Bohai Leasing Co. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bohai Leasing Co. Bundle

Bohai Leasing Co. operates in an industry characterized by moderate bargaining power of buyers and suppliers, with a growing threat from new entrants due to capital intensity. The intensity of rivalry is significant, driven by a few dominant players, while the threat of substitutes is relatively low in the core leasing market.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bohai Leasing Co.’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers, particularly manufacturers of aircraft and high-end equipment, is a considerable factor for Bohai Leasing. Companies like Airbus and Boeing hold significant sway due to the limited number of global producers and the highly specialized, capital-intensive nature of aircraft manufacturing. This concentration means Bohai Leasing, and its subsidiary Avolon, must negotiate with a few dominant players for new fleet acquisitions.

In 2024, the ongoing demand for new aircraft, coupled with supply chain constraints that have affected production rates, further amplifies the bargaining power of these key asset manufacturers. For example, Avolon's recent large aircraft orders, such as those with Airbus, underscore the necessity of maintaining strong relationships with these suppliers, even if it means accepting terms dictated by the manufacturers' market position. This reliance directly impacts Bohai Leasing's cost of capital and fleet expansion strategies.

Financial institutions and capital markets are vital suppliers for Bohai Leasing, providing the necessary funds for acquiring assets and supporting daily operations. The company's reliance on these sources means their terms and availability significantly influence Bohai Leasing's cost of capital and growth potential.

Bohai Leasing's recent refinancing activities, such as managing its $2 billion senior unsecured notes maturing in September 2024, highlight the direct impact of capital providers. The willingness and terms offered by banks and private equity firms, including major players like Morgan Stanley, Deutsche Bank, RRJ Capital, and MBK Partners, are critical factors in its financial strategy.

Suppliers offering specialized maintenance, repair, and overhaul (MRO) services for Bohai Leasing's aircraft and containers possess a degree of bargaining power. These MRO services are highly technical and subject to stringent regulatory oversight, which naturally restricts the number of capable and certified providers. For instance, the global aviation MRO market was valued at approximately $77.5 billion in 2023 and is projected to grow, highlighting the specialized nature of these services.

Technology and Software Providers for Leasing Operations

The bargaining power of technology and software providers for leasing operations is significant for companies like Bohai Leasing. Their reliance on specialized IT systems for managing a vast and varied leasing portfolio means these providers hold considerable sway. Robust, integrated IT systems are crucial for Bohai's operational efficiency, risk mitigation, and customer service on a global scale.

The dependence on these advanced solutions can lead to high switching costs for Bohai Leasing. If comparable alternative systems are not easily accessible or require substantial investment to implement, the existing providers can leverage this situation. For instance, in 2024, the global market for fleet management software, a key component for leasing operations, was projected to reach over $25 billion, highlighting the specialized nature and value of these solutions.

- High Switching Costs: Implementing new leasing management software can involve significant data migration, system integration, and employee retraining, making it costly and time-consuming to switch providers.

- Dependence on Specialized Features: Leasing companies require highly specific functionalities, such as asset tracking, contract management, and regulatory compliance tools, which only a few specialized software vendors can effectively provide.

- Limited Vendor Pool: The market for advanced leasing software is often concentrated, with a few key players dominating, thereby increasing their bargaining power.

- Innovation and Updates: Continuous investment in R&D by software providers to offer cutting-edge features and security updates further entrenches their position and can justify premium pricing.

Input Costs and Raw Materials for Asset Production

While Bohai Leasing Co. doesn't directly purchase raw materials for its leasing assets, the cost of manufacturing these assets, such as aircraft or shipping containers, is influenced by input costs. For instance, global aluminum prices, a key component in aircraft manufacturing, saw volatility in 2024, impacting the production costs for aircraft lessors. This indirect effect on asset acquisition costs can ultimately shape the lease rates Bohai Leasing offers its clients.

Changes in the prices of metals like aluminum and steel, crucial for aircraft and container production respectively, can significantly alter the purchase price of new equipment. For example, if steel prices surge, the cost of new containers increases, which in turn could lead to higher lease payments for businesses relying on container leasing services from companies like Bohai Leasing. This dynamic means that global commodity market trends have a tangible, albeit indirect, bearing on Bohai's operational expenses and pricing strategies.

- Global Aluminum Price Trends: Fluctuations in aluminum prices, a primary material for aircraft, directly affect aircraft manufacturers' costs.

- Steel Market Impact: The price of steel, essential for shipping containers, influences the cost of acquiring new container assets.

- Indirect Cost Transmission: Increased raw material costs for manufacturers are often passed on to leasing companies like Bohai Leasing through higher asset purchase prices.

- Lease Rate Adjustments: Higher initial investment costs due to material price hikes can necessitate adjustments in subsequent lease rates offered by Bohai Leasing.

Suppliers of aircraft, like Boeing and Airbus, wield significant power due to the concentrated nature of the industry and high production costs. For Bohai Leasing, this translates to negotiating terms on new fleet acquisitions, as seen in its substantial orders. Financial institutions also act as critical suppliers, providing the capital essential for operations and growth, with their terms directly impacting Bohai's cost of capital and expansion plans.

Specialized MRO providers and software vendors for leasing operations also possess considerable bargaining power. The technical expertise and regulatory compliance required for aircraft maintenance, along with the specialized features of fleet management software, limit the available suppliers. This dependence, coupled with high switching costs for IT systems, allows these suppliers to influence pricing and terms for Bohai Leasing.

| Supplier Type | Key Considerations for Bohai Leasing | 2024 Market Context/Data |

| Aircraft Manufacturers (e.g., Boeing, Airbus) | Limited number of global producers, high capital intensity, ongoing demand, supply chain constraints | Avolon's significant aircraft orders highlight reliance on these manufacturers. Global aircraft demand remains robust. |

| Financial Institutions & Capital Markets | Availability and cost of funding, refinancing terms, relationships with major banks and PE firms | Bohai Leasing's $2 billion senior unsecured notes maturing in September 2024. Key providers include Morgan Stanley, Deutsche Bank, RRJ Capital, MBK Partners. |

| MRO Service Providers | Highly technical, regulatory requirements, limited certified providers | Global aviation MRO market valued at ~$77.5 billion in 2023. |

| IT & Software Vendors (Fleet Management) | Specialized features, high switching costs, limited vendor pool, continuous innovation | Global fleet management software market projected to exceed $25 billion in 2024. |

What is included in the product

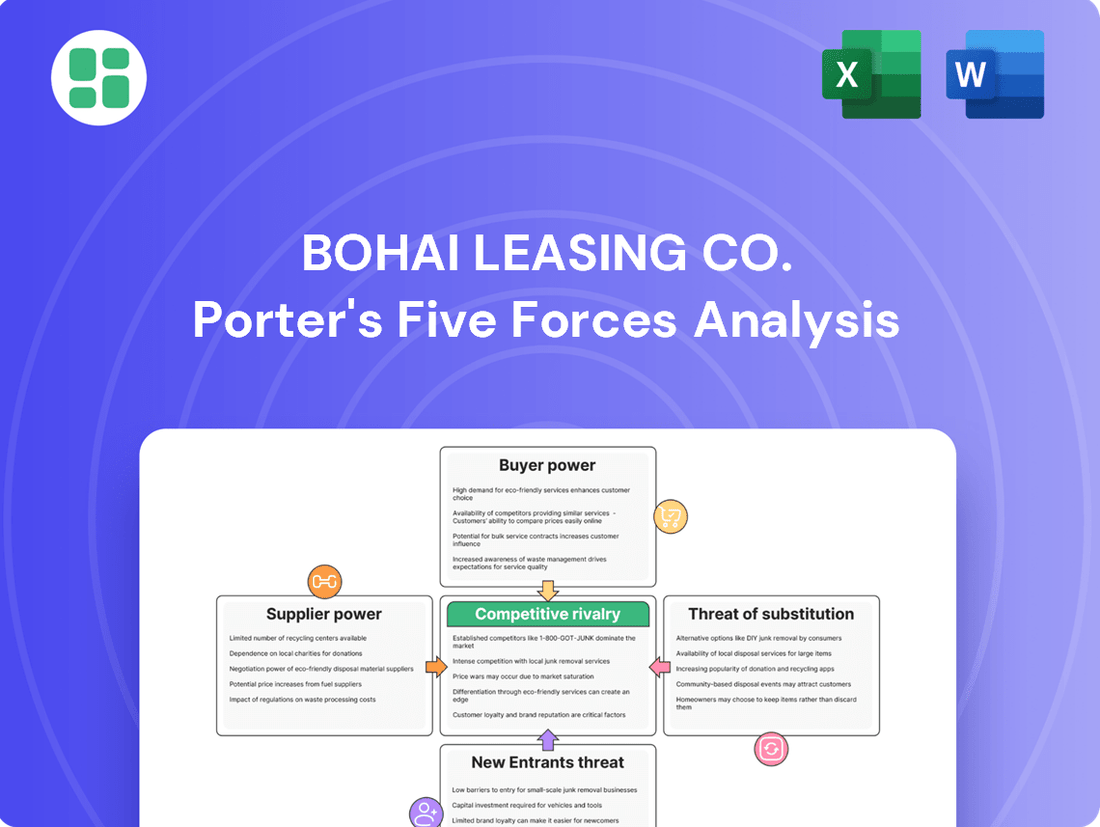

This analysis tailors Porter's Five Forces to Bohai Leasing Co., examining the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes within the leasing industry.

Bohai Leasing Co.'s Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making and understanding strategic pressures.

Customers Bargaining Power

Bohai Leasing's extensive customer network, exceeding 900 clients globally across aviation, shipping, infrastructure, and high-end equipment sectors, significantly dilutes individual customer bargaining power. This broad diversification means the loss of any single customer has a minimal impact on overall revenue.

The company's strategic aim to boost its international revenue share to 30% by 2025 further solidifies its global presence. This expanding international reach reduces reliance on any specific regional market, thereby diminishing the leverage of individual customers in price negotiations or demanding customized terms.

Customers, particularly large corporations like airlines, have significant bargaining power when they can easily access alternative financing and acquisition methods for assets such as aircraft. For instance, traditional bank loans or equity financing present viable options, allowing them to bypass leasing companies if terms are unfavorable. In 2024, the availability of competitive interest rates for corporate loans, influenced by central bank policies, directly impacts the attractiveness of these alternatives to leasing.

The cost-effectiveness and simplicity of these alternatives are key drivers of customer power. If securing a bank loan for an aircraft purchase is straightforward and less expensive than a lease, airlines will naturally lean towards ownership. This is especially true for major capital expenditures where financing costs can represent a substantial portion of the total outlay.

Bohai Leasing's strategic response to this threat involves offering a diverse range of financing structures, including both financial and operating leases. By providing flexible and customized solutions, Bohai Leasing aims to match or even surpass the appeal of traditional financing, thereby retaining its customer base and mitigating the bargaining power derived from alternative acquisition methods.

For existing customers, switching leasing providers can incur costs related to contract termination, new agreement negotiation, and potential operational disruptions. These switching costs, particularly for long-term leases of specialized equipment, tend to reduce customer bargaining power and encourage continued engagement with Bohai Leasing.

Customer Price Sensitivity and Market Conditions

In highly competitive markets, customer price sensitivity can significantly impact profitability, particularly for standardized offerings like shipping containers. During economic downturns or when the industry faces specific headwinds, this sensitivity often intensifies as customers seek cost savings. For instance, global trade slowdowns can put downward pressure on container leasing rates.

Bohai Leasing's strategic decision in 2024 to divest its container leasing subsidiary, Seaco, and concentrate on aircraft leasing highlights an adaptation to these market dynamics. Aircraft leasing is often perceived to offer more stable cash flows, suggesting a move towards segments where customer price sensitivity might be less pronounced or where value propositions extend beyond mere price. This strategic pivot underscores a recognition of varying customer demands and market conditions across different leasing sectors.

- Customer Price Sensitivity: In competitive leasing markets, especially for commoditized assets like standard shipping containers, customers often exhibit high price sensitivity.

- Impact of Market Conditions: Economic downturns or industry-specific challenges can amplify customer price sensitivity, leading to increased pressure on leasing rates.

- Bohai Leasing's Strategic Response: The company's 2024 sale of its container leasing subsidiary, Seaco, to focus on aircraft leasing demonstrates a strategic adjustment to mitigate risks associated with fluctuating customer price sensitivity in different market segments.

- Aircraft Leasing as a Focus: Aircraft leasing is often favored for its potentially more stable cash flows, suggesting a move towards assets where value is less solely determined by price.

Customization and Value-Added Services

Bohai Leasing's focus on customized leasing solutions, particularly for small and medium-sized enterprises (SMEs), directly addresses customer needs, thereby diminishing their inherent bargaining power. By offering tailored financing plans and risk management services, Bohai creates unique value propositions that generic lenders cannot easily replicate.

The company's commitment to supporting equipment upgrades and providing ancillary financial services further solidifies customer loyalty. This differentiation strategy, evident in Bohai Leasing's operational model, strengthens its position by making switching to competitors less attractive for clients.

- Customized Solutions: Bohai Leasing designs leasing packages to meet specific client requirements, reducing reliance on standardized offerings.

- Value-Added Services: Beyond basic leasing, the company provides financial advisory, risk assessment, and asset management, enhancing overall customer value.

- SME Focus: Catering to SMEs, often with unique financial needs, allows Bohai to build strong, personalized relationships.

- Competitive Differentiation: These tailored services set Bohai apart, making it a preferred partner and limiting customers' ability to negotiate heavily on price or terms.

Bohai Leasing's extensive client base, numbering over 900 globally across aviation, shipping, and infrastructure, dilutes the bargaining power of any single customer. The company's strategic goal to increase its international revenue share to 30% by 2025 further reduces its dependence on any one market, lessening individual customer leverage.

However, customers like major airlines can exert significant power if they have easy access to alternative financing, such as traditional bank loans, especially with competitive interest rates available in 2024. The cost and simplicity of these alternatives directly influence customer choices, making ownership more attractive if it's cheaper than leasing.

Bohai Leasing counters this by offering diverse leasing structures and customized solutions, aiming to be more appealing than alternative financing. Switching costs for existing customers, particularly for long-term, specialized leases, also serve to limit their bargaining power and encourage continued business.

While Bohai Leasing divested its container leasing arm, Seaco, in 2024 to focus on aircraft leasing, this move acknowledges varying customer price sensitivity. Aircraft leasing is often perceived to offer more stable cash flows, suggesting a strategic shift towards segments where price is not the sole determinant of value.

What You See Is What You Get

Bohai Leasing Co. Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Bohai Leasing Co., detailing the competitive landscape and strategic implications within the aviation and leasing industries. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing a thorough examination of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry as they pertain to Bohai Leasing.

Rivalry Among Competitors

The leasing sector, especially for aircraft and containers, is characterized by a mix of a few dominant global entities and many smaller, niche operators. Bohai Leasing, via its subsidiary Avolon, stands as a prominent global aircraft lessor, and previously held a significant position in container leasing before divesting Seaco.

The competitive landscape is shaped by the presence of large, financially robust competitors who actively compete for market share and clients. This dynamic intensifies rivalry, as these major players leverage their scale and resources to attract and retain business.

The leasing industry, while generally expanding, presents varied competitive dynamics. Container leasing, for instance, can be quite cyclical, with demand fluctuating based on global trade patterns. This volatility can intensify rivalry as companies vie for business during downturns.

In contrast, the aircraft leasing sector has demonstrated more stable cash flow generation, particularly with its post-pandemic recovery. By the end of 2024, the International Air Transport Association (IATA) projected global airline industry net profits to reach $25.7 billion, signaling a robust environment for aircraft lessors.

When market growth slows or segments mature, competitive rivalry typically escalates. Companies then focus on capturing a larger share of the existing, less rapidly expanding demand, leading to increased price competition and a greater emphasis on differentiation.

Competitive rivalry in the leasing sector, particularly for financial leasing, often devolves into price wars due to the commoditized nature of many offerings. Bohai Leasing actively counters this by diversifying its asset base to include aircraft, infrastructure projects, and specialized high-end equipment, alongside a significant global operational footprint.

This broad portfolio, coupled with the capacity to tailor financing structures, allows Bohai Leasing to move beyond simple price comparisons. By providing value-added services and adaptable leasing arrangements, the company effectively reduces direct exposure to intense price-based competition, thereby strengthening its market position.

High Fixed Costs and Exit Barriers

The leasing sector, including aircraft leasing where Bohai Leasing operates, is characterized by significant capital outlays for asset acquisition, resulting in high fixed costs. For instance, the average price of a new narrow-body aircraft can range from $90 million to $130 million, and wide-body aircraft can exceed $300 million. These substantial investments create formidable exit barriers.

Companies face considerable challenges in exiting the market due to these sunk costs and the complexity of liquidating large, specialized asset portfolios. This often compels lessors to remain active and compete fiercely, even in challenging economic conditions, to ensure their assets are utilized and generate revenue.

This dynamic intensifies competitive rivalry as firms strive to maintain high utilization rates. In 2023, the global aircraft leasing market was valued at approximately $200 billion, demonstrating the scale of assets involved and the pressure to keep them productive.

- High Capital Expenditure: Aircraft leasing requires massive upfront investment in aircraft, leading to substantial fixed costs for lessors.

- Significant Exit Barriers: Divesting large fleets of specialized assets is difficult and costly, trapping capital and discouraging market exits.

- Intensified Competition: High fixed costs and exit barriers force lessors to compete aggressively on pricing and service to maintain asset utilization and profitability.

Strategic Moves by Competitors

Competitors' strategic maneuvers, including mergers, acquisitions, and diversification into new asset classes, are actively reshaping the leasing industry. These actions can dramatically alter the competitive intensity and market share distribution.

Bohai Leasing's own divestment of its container leasing arm, Seaco, to Textainer Group in a deal valued at approximately $1 billion, underscores this dynamic. This strategic pivot allows Bohai Leasing to concentrate more resources on its aviation leasing segment.

- Seaco's Sale: Bohai Leasing's sale of Seaco to Textainer Group was a significant strategic move, impacting both the container and aviation leasing markets.

- Focus Shift: This transaction highlights Bohai Leasing's strategic decision to prioritize and expand its aviation leasing operations.

- Market Impact: Such strategic realignments by major players like Bohai Leasing directly influence the competitive landscape, creating opportunities and challenges for other participants in the aviation and container leasing sectors.

Competitive rivalry within the leasing sector, particularly in aircraft leasing where Bohai Leasing is a major player, is intense due to high capital requirements and significant exit barriers. Companies like Bohai Leasing must actively manage their asset utilization and offer competitive financing to thrive. The industry is dynamic, with strategic moves like divestitures and acquisitions by key players constantly reshaping the competitive landscape.

| Competitor | Primary Asset Class | Estimated Market Position (Aircraft Leasing) |

|---|---|---|

| AerCap | Aircraft | Largest global lessor |

| Avolon (Bohai Leasing Subsidiary) | Aircraft | Top 5 global lessor |

| SMBC Aviation Capital | Aircraft | Significant global presence |

| BOC Aviation | Aircraft | Major player with diverse fleet |

SSubstitutes Threaten

Companies can bypass leasing entirely by directly purchasing assets, using either their own funds or securing conventional bank loans. This outright ownership is a significant substitute for financial leasing. For instance, in 2024, the average interest rate for a commercial loan hovered around 7-10%, a key factor influencing the attractiveness of this alternative to leasing.

The appeal of outright purchase hinges on several crucial elements. These include prevailing interest rates, the ease of accessing capital, and the financial health of the acquiring company, often reflected in its debt-to-equity ratio, which for many industrial companies remained below 1.0 in early 2024, indicating a capacity for debt financing.

Companies can obtain debt financing from traditional banks or issue corporate bonds to fund asset purchases, effectively bypassing leasing companies like Bohai Leasing. The availability and cost of these alternatives, such as interest rates on bank loans and bond yields, directly impact the competitiveness of leasing services. For instance, if bank loan rates are significantly lower, it makes direct borrowing a more attractive option for asset acquisition.

The attractiveness of traditional bank lending and debt financing as substitutes for leasing is heavily influenced by prevailing interest rates and credit market conditions. In 2024, for example, the Federal Reserve's monetary policy decisions and the overall economic outlook played a crucial role in shaping borrowing costs. Bohai Leasing's own financial strategies, such as its reported debt refinancing activities, are a clear indicator of its sensitivity to these market dynamics.

For certain equipment or short-term needs, businesses might opt for rental agreements rather than long-term financial or operating leases. This presents a threat of substitutes for Bohai Leasing's services, especially when specialized rental companies offer flexible, on-demand solutions.

While Bohai Leasing provides operating leases, the availability of shorter-term rentals from competitors can siphon off customers seeking temporary access to assets like high-end equipment or shipping containers. For instance, the global equipment rental market was valued at approximately $100 billion in 2023 and is projected to grow, indicating a robust alternative for businesses needing assets for projects with uncertain durations.

Shared Economy Models and Asset Utilization Platforms

The rise of shared economy models and asset utilization platforms poses a growing threat of substitutes for traditional leasing. For instance, platforms enabling fractional ownership of aircraft or shared logistics networks for containers offer alternatives, particularly attractive to smaller enterprises or those needing flexible, on-demand access to assets. This trend could diminish the demand for conventional leasing arrangements as businesses seek more agile solutions.

These evolving models directly challenge the necessity of long-term leases by providing access to underutilized assets. Consider the logistics sector, where companies might opt for shared trucking capacity instead of leasing their own fleet. This shift is driven by cost efficiencies and the ability to scale operations dynamically.

- Shared Logistics: Platforms like Convoy have seen significant growth, facilitating efficient freight matching and potentially reducing the need for dedicated trucking leases.

- Fractional Aircraft Ownership: Services offering fractional ownership or jet card programs provide alternatives to full aircraft leasing for business travel.

- Container Sharing: While less mature, initiatives exploring shared container pools could impact the leasing market for shipping companies.

Internal Asset Management and Existing Inventory Utilization

Companies might opt to prolong the lifespan of their current assets or maximize the use of existing inventory instead of engaging in new leasing agreements. This strategic choice is often driven by considerations such as the cost of maintaining older assets, the pace of technological advancement that could render new leases obsolete, and the available capital expenditure budget for potential lessees.

For instance, a business facing tight capital constraints in 2024 might find it more economical to invest in refurbishing existing machinery rather than leasing newer, more advanced equipment. This approach can significantly reduce upfront costs and ongoing operational expenses, making it a compelling alternative to traditional leasing, especially for companies with stable operational needs.

- Cost Savings: Extending asset life can avoid new capital outlay and depreciation charges associated with leased assets.

- Reduced Obsolescence Risk: Utilizing existing, proven technology mitigates the risk of rapid technological depreciation inherent in new leases.

- Flexibility: Internal asset management offers greater control over asset usage and modification compared to lease terms.

- Inventory Optimization: Efficiently managing and repurposing existing inventory can fulfill demand without the need for new asset acquisition through leasing.

Direct asset purchase via bank loans or corporate bonds presents a significant substitute, especially with 2024 commercial loan rates around 7-10%. Companies with strong balance sheets, often indicated by debt-to-equity ratios below 1.0 in early 2024, find this a viable alternative to leasing. Rental agreements for shorter-term needs also divert customers, with the global equipment rental market valued at approximately $100 billion in 2023, highlighting its market presence.

The threat of substitutes for Bohai Leasing is multifaceted. Direct purchase, facilitated by bank loans or bond issuances, offers an alternative, with 2024 interest rates for commercial loans typically ranging from 7% to 10%. Companies with healthy financial standing, often demonstrated by debt-to-equity ratios below 1.0 in early 2024, can leverage these options. Furthermore, the growing equipment rental market, valued at around $100 billion in 2023, provides flexible, short-term asset access, directly competing with leasing services.

Beyond direct purchase and rentals, extending the life of existing assets is a key substitute. This strategy is particularly attractive when capital is constrained, as seen in 2024, where refurbishing older machinery might be more economical than leasing new equipment. This approach avoids new capital outlay and the risk of rapid technological obsolescence inherent in new leases, offering greater control and potential cost savings.

| Substitute | Mechanism | 2024 Relevance/Data |

|---|---|---|

| Direct Asset Purchase | Using own funds or bank loans/bonds | Commercial loan rates ~7-10%; Debt-to-equity ratios < 1.0 for many industrial firms |

| Equipment Rental | Short-term, flexible access to assets | Global equipment rental market ~$100 billion (2023) |

| Asset Life Extension | Refurbishing/optimizing existing assets | Cost savings, reduced obsolescence risk, greater control |

Entrants Threaten

The leasing industry, particularly for major assets like aircraft and infrastructure, presents a formidable barrier to entry due to exceptionally high capital requirements. Aspiring new companies must secure vast sums of money to acquire even a modest fleet or portfolio of assets. For context, Bohai Leasing's substantial asset base, reaching approximately RMB 267.94 billion by the end of September 2024, underscores the immense financial firepower needed to establish a competitive presence in this sector.

The financial leasing sector, especially for a global entity like Bohai Leasing, faces significant barriers due to stringent regulatory oversight. Obtaining the necessary licenses and continuously complying with complex, jurisdiction-specific regulations demands considerable resources and expertise, deterring many potential new entrants.

For instance, in 2024, many countries intensified their scrutiny of financial services, including leasing. This often translates to higher capital requirements and more rigorous operational standards for new companies seeking to enter the market. Navigating these evolving regulatory landscapes across multiple international markets presents a substantial challenge, effectively limiting the threat of new entrants.

Established players like Bohai Leasing Co. benefit significantly from economies of scale in asset procurement and financing. For instance, in 2023, Bohai Leasing managed a substantial fleet, allowing for more favorable terms on aircraft leases and acquisitions compared to a smaller, newer competitor. This scale translates directly into lower per-unit costs.

The experience curve also presents a formidable barrier. Bohai Leasing's years of operation have honed its expertise in asset valuation, risk management, and global client relations. This accumulated knowledge, solidified by navigating various market cycles, provides an efficiency and cost advantage that new entrants would struggle to match in the short to medium term.

Access to Funding and Established Relationships

New companies entering the leasing market, especially for significant assets like aircraft, face considerable hurdles in securing adequate funding. This is particularly true when seeking capital at rates competitive with established firms.

Bohai Leasing, for instance, benefits from deep-seated relationships with financial institutions and capital markets. These established connections facilitate easier access to a broader spectrum of funding options, crucial for its operations. In 2023, Bohai Leasing successfully completed several refinancing initiatives, demonstrating its continued ability to tap into diverse funding sources.

- Funding Access: New entrants often struggle to secure large-scale, long-term financing at favorable terms compared to incumbents.

- Established Relationships: Bohai Leasing leverages its extensive network with banks and capital markets for superior funding access.

- Refinancing Success: Bohai Leasing's 2023 refinancing activities highlight its established creditworthiness and funding capabilities.

Brand Reputation and Customer Trust

In the leasing sector, a strong brand reputation and deep customer trust are paramount, acting as significant deterrents to new players. Bohai Leasing, established in 2004, has cultivated a global clientele exceeding 900 customers, a testament to its reliability and service quality. This established trust, built over years of consistent performance, is a substantial hurdle for any emerging competitor looking to gain market share.

- Brand Reputation: Bohai Leasing's long operational history since 2004 underpins its market standing.

- Customer Trust: A global customer base of over 900 clients signifies established confidence.

- Barrier to Entry: The time and effort required to build similar trust and reputation create a significant challenge for new entrants.

The threat of new entrants in the leasing industry, particularly for Bohai Leasing, is considerably low due to immense capital requirements and stringent regulatory hurdles. For instance, securing the necessary licenses and complying with evolving financial regulations, especially in 2024, demands substantial resources and expertise, effectively deterring many potential new players.

Established players like Bohai Leasing benefit from significant economies of scale and a well-developed experience curve, providing cost advantages and operational efficiencies that new entrants struggle to replicate. Furthermore, Bohai Leasing's strong brand reputation, built since 2004 with over 900 global customers, fosters deep client trust, a critical barrier that takes considerable time and effort for newcomers to overcome.

Access to favorable financing is another key deterrent; Bohai Leasing's established relationships with financial institutions, evidenced by its successful refinancing activities in 2023, provide a distinct advantage over new entrants who often face challenges securing large-scale, long-term funding at competitive rates.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bohai Leasing Co. leverages publicly available financial statements, annual reports filed with regulatory bodies, and industry-specific market research from reputable firms. This data provides a comprehensive view of the competitive landscape, including market share, profitability, and key industry trends.