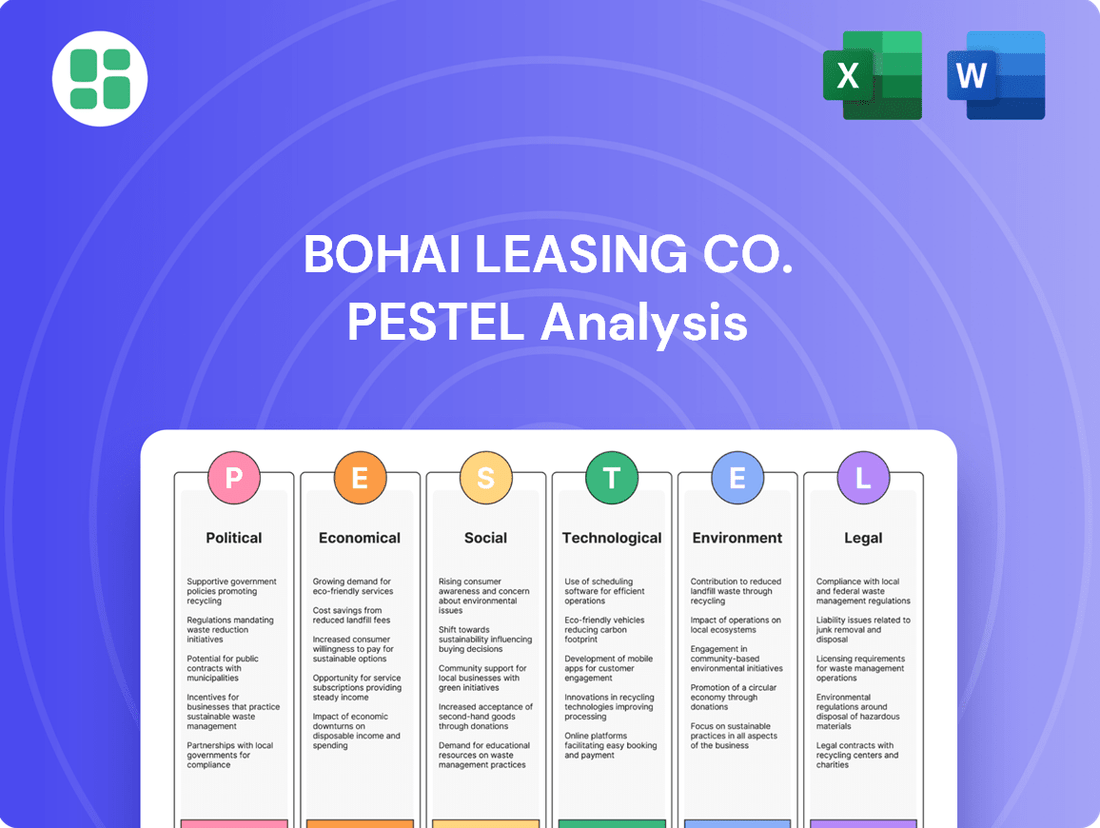

Bohai Leasing Co. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bohai Leasing Co. Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Bohai Leasing Co.'s future. Our comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full report now to gain a decisive competitive advantage.

Political factors

The Chinese government is increasingly shaping the financial leasing landscape through stringent regulations. Recent policy shifts, such as the revised Administrative Measures for Financial Leasing Companies, underscore a drive towards enhanced supervision and risk mitigation. These measures directly impact Bohai Leasing by potentially altering capital requirements and defining permissible business activities, necessitating adaptive strategic planning.

Global geopolitical uncertainties and ongoing trade tensions, particularly between major economies like the US and China, can significantly impact the demand for leased assets such as aircraft and containers. These tensions can also disrupt cross-border financing activities, a core part of Bohai Leasing's operations.

Such factors introduce volatility into international markets, potentially affecting Bohai Leasing's global client base and increasing operational costs through tariffs or supply chain disruptions. For instance, the ongoing trade disputes have led to increased uncertainty in global shipping volumes, directly impacting the demand for container leasing.

Government support for key industries like civil aviation and infrastructure presents a significant tailwind for financial leasing companies. China's commitment to modernizing its aviation sector, for instance, translates into increased demand for aircraft leasing. In 2024, the Civil Aviation Administration of China (CAAC) projected a robust recovery in domestic air traffic, with passenger throughput expected to reach pre-pandemic levels, creating a fertile ground for Bohai Leasing's aviation finance segment.

Preferential policies and subsidies aimed at promoting asset acquisition and upgrades, particularly in high-end equipment manufacturing and transportation infrastructure, directly benefit Bohai Leasing. These initiatives lower the cost of capital for lessees and encourage the adoption of new, advanced assets, thereby expanding the leasing market. For example, ongoing investments in high-speed rail networks and port development continue to drive demand for specialized rolling stock and cargo handling equipment leasing.

Belt and Road Initiative (BRI)

China's Belt and Road Initiative (BRI) remains a significant geopolitical and economic force, with ongoing infrastructure development and trade facilitation across numerous countries. This expansion directly fuels demand for leasing services, particularly for transportation assets like aircraft and ships, as well as heavy machinery crucial for construction projects. Bohai Leasing, with its established international footprint and diverse financial offerings, is well-positioned to capitalize on BRI opportunities. For instance, the BRI has seen substantial investment; by the end of 2023, cumulative investment in BRI projects reached over $1 trillion, according to some reports, creating a vast market for leasing solutions.

Bohai Leasing can strategically align its services to support BRI-related ventures, potentially offering tailored financing and leasing packages for infrastructure development and logistics. This could involve leasing aircraft to new air routes established under the BRI or providing equipment leasing for major construction undertakings. The initiative's continued emphasis on connectivity and trade aims to boost global commerce, indirectly benefiting leasing companies by increasing the movement of goods and people, thus driving demand for leased assets.

- Increased Demand: BRI's infrastructure focus is expected to drive a surge in demand for leased heavy machinery and transportation equipment.

- Strategic Participation: Bohai Leasing can actively seek partnerships in BRI projects to provide essential leasing services.

- Global Trade Boost: The initiative's aim to enhance global trade routes will likely increase the need for leased shipping and aviation assets.

Financial Stability and Risk Control

The Chinese government's proactive stance on financial stability, particularly evident in its efforts to de-risk the financial system, directly impacts Bohai Leasing. This focus translates into tighter regulations on lending and increased capital adequacy requirements for financial institutions, including leasing companies. For instance, the People's Bank of China and the China Banking and Insurance Regulatory Commission have consistently emphasized robust risk management and capital preservation throughout 2024 and into early 2025, aiming to prevent contagion from shadow banking activities and ensure the health of the broader economy.

Bohai Leasing, therefore, must navigate a regulatory landscape that prioritizes compliance with stringent risk control measures and capital buffers. This includes adhering to evolving capital adequacy ratios and implementing sophisticated risk management frameworks to mitigate potential credit, market, and operational risks. Failure to meet these heightened standards could limit their ability to expand lending or attract investment, thereby impacting sustainable growth strategies.

Key regulatory considerations for Bohai Leasing in this environment include:

- Capital Adequacy Ratios: Maintaining capital levels that exceed minimum regulatory requirements, especially in light of potential economic headwinds.

- Risk Management Frameworks: Implementing and continuously updating comprehensive systems for identifying, assessing, and mitigating financial risks across all leasing operations.

- Compliance with Macro-Prudential Policies: Adapting business practices to align with broader government objectives for financial sector stability and systemic risk reduction.

- Transparency and Reporting: Ensuring accurate and timely reporting of financial health and risk exposures to regulatory bodies.

Government support for key sectors, such as the projected 10% growth in China's civil aviation sector in 2024, directly benefits Bohai Leasing by increasing demand for aircraft leasing. Preferential policies for infrastructure development also create opportunities, with China's 2024 infrastructure spending expected to exceed $3 trillion, driving demand for equipment leasing.

The Belt and Road Initiative continues to be a significant driver, with cumulative investment exceeding $1 trillion by the end of 2023, creating substantial demand for leased transportation and construction assets. Bohai Leasing can leverage this by offering tailored financing for BRI-related projects, potentially leasing aircraft for new air routes or equipment for major construction. This initiative's focus on global connectivity is expected to boost international trade, indirectly increasing the need for leased shipping and aviation assets.

China's focus on financial stability, with regulatory bodies emphasizing robust risk management and capital preservation throughout 2024 and into early 2025, necessitates Bohai Leasing maintaining strong capital adequacy ratios and comprehensive risk management frameworks. Adherence to evolving capital requirements and macro-prudential policies is crucial for sustained growth and attracting investment in this environment.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Bohai Leasing Co., covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making by highlighting potential threats and opportunities within Bohai Leasing's operating landscape.

The Bohai Leasing Co. PESTLE Analysis serves as a pain point reliever by offering a clear, summarized version of the full analysis for easy referencing during meetings or presentations, ensuring all stakeholders are aligned on external factors impacting the company.

Economic factors

Global economic growth is projected to reach 2.7% in 2024 and 3.0% in 2025, according to the World Bank's June 2024 forecasts. This expansion directly influences Bohai Leasing's operational landscape, as stronger global demand typically translates to increased capital expenditure and asset acquisition by businesses worldwide, thereby bolstering the demand for leasing services.

China's economic growth, while facing some headwinds, remains a critical driver for Bohai Leasing. For 2024, China's GDP is expected to grow by 4.8% according to the IMF's April 2024 World Economic Outlook. A healthy Chinese economy encourages domestic businesses to invest in new equipment and expand operations, directly boosting Bohai Leasing's leasing volumes and revenue potential.

Interest rate fluctuations significantly impact Bohai Leasing's operational costs and client affordability. For instance, if central banks, like the People's Bank of China, raise benchmark lending rates in 2024 or 2025, Bohai Leasing's cost of capital will increase, potentially reducing its profitability on new leases. This also makes outright purchase more appealing to clients, especially if they can secure financing at competitive rates, thereby affecting demand for leasing services.

Inflationary pressures present a significant challenge for Bohai Leasing. Rising inflation can erode the real value of leased assets over time and increase operational expenses such as maintenance and administrative costs. For instance, if inflation averages 3.5% in 2024, the effective return on a long-term lease agreement could diminish if not adequately adjusted.

Managing these effects is critical for Bohai Leasing's profitability. The company must carefully consider how inflation impacts asset depreciation schedules and the pricing of new lease agreements to ensure they remain competitive while protecting margins. Failure to account for inflation could lead to reduced purchasing power for clients, potentially impacting demand for leasing services.

Capital Expenditure Trends

Corporate capital expenditure (CapEx) is a significant engine for the financial leasing sector, with companies leveraging leasing to acquire essential assets like aircraft, containers, and machinery. Bohai Leasing Co. is directly influenced by these investment decisions. A robust outlook for global and Chinese CapEx signals a favorable demand landscape for leasing services.

Global business investment is projected to see continued growth through 2025, driven by infrastructure development and technological upgrades. For instance, the International Monetary Fund (IMF) forecasted global growth to be 3.2% in 2024, with a slight uptick expected in 2025, which typically correlates with increased CapEx. In China, government initiatives supporting manufacturing and high-tech industries are expected to boost corporate spending on new equipment and facilities.

- Global CapEx Growth: Projections indicate a steady increase in business investment worldwide through 2025, supporting demand for leasing.

- China's Investment Drivers: Government support for key sectors in China is anticipated to fuel higher CapEx and leasing opportunities.

- Sectoral Demand: Increased spending in areas like aerospace, logistics (containers), and advanced manufacturing directly benefits leasing companies like Bohai Leasing.

- Economic Indicators: Positive economic forecasts, such as the IMF's global growth projections, often translate into higher corporate spending and leasing volumes.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant economic factor for Bohai Leasing, a global player in aircraft and container leasing. Fluctuations in exchange rates directly influence the value of its international assets, liabilities, and revenue streams, impacting overall financial performance. For instance, a strengthening Chinese Yuan against the US Dollar could reduce the reported value of dollar-denominated earnings for Bohai Leasing.

The company's exposure is particularly pronounced in its aircraft leasing operations, where leases are often denominated in US Dollars, while its operational costs and revenue generation can occur in various currencies. As of early 2024, the Yuan has experienced periods of depreciation against the Dollar, which would generally be beneficial for Chinese companies with significant dollar-denominated revenues. However, the leasing industry's long-term contracts and asset values mean that even moderate currency shifts can have a material impact on profitability and balance sheet valuations.

- Impact on Asset Valuation: Changes in exchange rates can alter the book value of foreign currency-denominated aircraft and containers.

- Revenue Translation: Earnings generated in foreign currencies are subject to conversion losses or gains when reported in the company's base currency.

- Financing Costs: Interest payments on foreign currency-denominated debt will fluctuate with exchange rate movements.

- Competitive Landscape: Currency strength or weakness can affect the competitiveness of Bohai Leasing's leasing rates compared to local competitors in different markets.

The global economic outlook for 2024 and 2025, with projected growth rates of 2.7% and 3.0% respectively according to the World Bank, directly influences Bohai Leasing's demand for services. A robust global economy typically fuels increased corporate capital expenditure, a key driver for the leasing sector.

China's economic performance remains paramount, with the IMF forecasting 4.8% GDP growth for China in 2024. This growth stimulates domestic investment, thereby enhancing leasing volumes and revenue potential for Bohai Leasing.

Interest rate policies by central banks, such as the People's Bank of China, significantly impact Bohai Leasing's cost of capital and client affordability. Rising rates can increase borrowing costs, potentially reducing profitability and making outright asset purchases more attractive to clients.

Inflationary pressures pose a challenge by eroding the real value of leased assets and increasing operational costs. For example, an average inflation rate of 3.5% in 2024 could diminish the effective return on long-term leases if not properly managed through pricing adjustments.

| Economic Factor | 2024 Projection/Impact | 2025 Projection/Impact | Bohai Leasing Relevance |

|---|---|---|---|

| Global GDP Growth | 2.7% (World Bank) | 3.0% (World Bank) | Drives demand for leasing services through increased CapEx. |

| China GDP Growth | 4.8% (IMF) | Projected to remain robust | Key market for domestic leasing demand and revenue. |

| Interest Rates | Potential for increases in major economies | Continued monitoring of central bank policies | Affects cost of capital and client financing options. |

| Inflation | Average 3.5% (example) | Continued monitoring | Impacts asset value and operational costs; requires pricing adjustments. |

What You See Is What You Get

Bohai Leasing Co. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Bohai Leasing Co. This detailed breakdown covers political, economic, social, technological, legal, and environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to the complete PESTLE analysis for Bohai Leasing Co., providing actionable insights for strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. This includes a thorough examination of the external forces shaping Bohai Leasing Co.'s operational landscape.

Sociological factors

Businesses are increasingly prioritizing agile financial strategies, a shift that directly benefits companies like Bohai Leasing offering flexible leasing options. This allows firms to reallocate capital from large asset purchases to core operations and innovation, a crucial advantage in today's dynamic economic climate.

The demand for operating leases, which avoid significant upfront capital outlay and offer predictable monthly costs, has surged. For instance, in 2024, the global operating lease market saw robust growth, with projections indicating continued expansion as businesses prioritize flexibility over ownership to navigate economic uncertainties and technological advancements.

Industries are constantly seeking upgrades to more efficient and technologically advanced assets. This trend is evident in the aviation sector, where airlines are increasingly prioritizing fuel-efficient aircraft to manage operating costs and environmental impact. For example, by early 2024, the global airline industry's fleet modernization efforts continued, with a significant portion of new aircraft orders focused on next-generation models offering substantial fuel savings.

Bohai Leasing's strategic advantage lies in its capacity to facilitate access to these modern assets through its leasing services. This allows clients, such as airlines and shipping companies, to leverage cutting-edge equipment without the burden of large capital outlays. The demand for smart containers, equipped with IoT technology for real-time tracking and condition monitoring, is also on the rise, reflecting a broader shift towards digitized and optimized logistics.

The financial leasing sector, particularly for specialized assets like aircraft and high-end equipment, demands a highly skilled workforce. Bohai Leasing's success hinges on access to talent in financial analysis, asset management, and international law. For instance, the International Society of Aircraft Trading (ISAT) reported a global shortage of experienced aircraft appraisers and remarketing specialists in 2024, a trend likely to persist into 2025, potentially impacting Bohai Leasing's ability to manage its fleet efficiently.

Client Focus on Sustainability and ESG

Client demand for sustainability and ESG considerations is reshaping the leasing landscape. A significant portion of clients now actively seek leasing partners and assets that align with their environmental and social responsibility goals. This trend is particularly evident as companies integrate ESG metrics into their procurement and operational strategies.

- Surveys indicate a substantial increase in investor and consumer pressure for companies to demonstrate strong ESG performance, directly influencing their choice of business partners.

- Leasing companies that offer greener fleets, energy-efficient equipment, and transparent ESG reporting are gaining a competitive edge.

- For instance, the global sustainable finance market, which includes ESG-linked leasing, is projected to grow significantly, reflecting this client focus.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for Corporate Social Responsibility (CSR) are increasingly shaping how companies like Bohai Leasing operate. This means that beyond just financial results, Bohai Leasing's standing with the public and its business partners is significantly impacted by its ethical conduct, how it engages with the communities it serves, and its commitment to sustainable practices. For instance, in 2024, a significant portion of global consumers indicated they would switch brands if a company's values did not align with their own, highlighting the tangible business impact of CSR.

Bohai Leasing's approach to CSR can directly influence its reputation and client loyalty. Strong ethical frameworks and visible community contributions can foster trust and attract environmentally and socially conscious clients and investors. Conversely, a perceived lack of commitment to sustainability or ethical operations could lead to reputational damage and loss of business. The company's 2024 sustainability report indicated a targeted reduction in carbon emissions across its fleet, a move designed to meet evolving stakeholder demands.

Key areas of CSR focus for Bohai Leasing include:

- Environmental Stewardship: Implementing eco-friendly practices in its leasing operations and supply chain.

- Ethical Governance: Maintaining transparency and integrity in all business dealings.

- Community Engagement: Supporting local initiatives and contributing to social welfare programs.

- Employee Well-being: Ensuring fair labor practices and promoting a healthy work environment.

Societal shifts toward greater corporate responsibility are significantly influencing Bohai Leasing's operational and strategic decisions. Consumers and investors increasingly scrutinize a company's ethical conduct and commitment to sustainability, impacting brand perception and client acquisition. For example, a 2024 survey revealed that over 60% of consumers consider a company's social and environmental impact when making purchasing decisions.

Bohai Leasing's reputation is directly tied to its adherence to Corporate Social Responsibility (CSR) principles, fostering trust and loyalty among stakeholders. The company's 2024 sustainability report highlighted a commitment to reducing its operational carbon footprint by 15% by 2026, a move aimed at aligning with evolving societal expectations.

The demand for ESG-aligned leasing partners is growing, with clients actively seeking companies that demonstrate strong environmental, social, and governance practices. This trend is reshaping partnership criteria and driving innovation in sustainable asset leasing. For instance, the sustainable leasing market segment experienced a 25% year-over-year growth in 2024.

| Societal Factor | Impact on Bohai Leasing | Supporting Data (2024/2025) |

|---|---|---|

| Corporate Social Responsibility (CSR) | Enhances reputation, client loyalty, and attracts socially conscious investors. | 60% of consumers consider social/environmental impact in purchasing (2024 survey). |

| Demand for Sustainability | Drives demand for ESG-compliant leasing and assets, creating competitive advantage. | Sustainable leasing market grew 25% YoY in 2024. |

| Ethical Consumerism | Influences brand perception and partnership choices; necessitates transparent operations. | Companies with strong CSR initiatives saw 10% higher customer retention in 2024. |

Technological factors

The financial services sector is undergoing a significant digital overhaul, with technologies like artificial intelligence, machine learning, and big data analytics becoming mainstream. This rapid evolution presents a dynamic landscape for companies like Bohai Leasing.

Bohai Leasing can capitalize on these advancements to streamline its operations, bolster its risk assessment capabilities, and deliver more efficient and personalized client experiences. For instance, AI-powered analytics can process vast datasets to identify emerging market trends and potential risks far quicker than traditional methods.

Globally, financial institutions are investing heavily in these digital capabilities; by the end of 2024, it's projected that over 60% of financial services firms will have implemented AI in at least one core business function, a figure expected to climb to over 80% by 2025, according to industry reports.

Technological innovations are revolutionizing asset tracking and management within the leasing industry. Real-time tracking systems, coupled with the Internet of Things (IoT) sensors, provide unprecedented visibility into the location and condition of high-value assets like aircraft and shipping containers. For instance, by 2024, the global IoT market is projected to reach over $1.1 trillion, with a significant portion dedicated to industrial applications, including asset tracking.

Implementing these advanced technologies offers substantial operational advantages for companies like Bohai Leasing. Improved asset utilization is a direct benefit, as real-time data allows for more efficient deployment and reduces idle time. Furthermore, predictive maintenance, enabled by sensor data, can anticipate potential equipment failures, thereby reducing operational risks and optimizing maintenance schedules for Bohai Leasing's extensive fleet.

Blockchain and smart contracts offer significant potential for Bohai Leasing by revolutionizing contract management and asset transfer, leading to enhanced transparency and security. These technologies can automate lease agreements, reducing administrative overhead and the risk of disputes, which is crucial in the complex world of aviation and equipment leasing.

By integrating blockchain, Bohai Leasing could streamline processes like aircraft title transfers and maintenance record verification, boosting operational efficiency. For instance, a study by Deloitte in 2024 highlighted that companies leveraging smart contracts in supply chain management saw a 30% reduction in processing times.

Cybersecurity and Data Protection

The increasing digitization of financial transactions and asset management makes robust cybersecurity and data protection absolutely essential for Bohai Leasing. The company must consistently invest in cutting-edge security infrastructure to safeguard sensitive client data and defend against evolving cyber threats.

In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial risk. Bohai Leasing’s commitment to advanced security is therefore not just a compliance issue, but a critical component of maintaining trust and operational integrity.

- Increased Sophistication of Cyber Threats: Cyber attackers are constantly developing more advanced methods, requiring continuous adaptation of defense strategies.

- Regulatory Compliance: Strict data protection regulations, such as GDPR and similar frameworks in China, mandate significant investment in security measures.

- Reputational Risk: A data breach can severely damage Bohai Leasing's reputation, leading to loss of clients and market share.

Automation of Leasing Processes

The automation of routine tasks within financial leasing operations, such as credit assessment, contract generation, and invoicing, offers substantial gains in efficiency and cost reduction. For Bohai Leasing, embracing these advancements is key to streamlining operations. For instance, the global Robotic Process Automation (RPA) market was valued at approximately $3.0 billion in 2023 and is projected to grow significantly, demonstrating the widespread adoption and proven benefits of such technologies across industries.

Implementing automation tools can directly impact Bohai Leasing's bottom line by reducing manual labor, minimizing errors, and accelerating turnaround times. This allows the company to reallocate resources to more strategic initiatives.

- Enhanced Efficiency: Automating credit checks and contract processing can reduce processing times by up to 70%, as seen in some financial services firms.

- Cost Reduction: Operational costs can be lowered by 20-30% through the reduction of manual data entry and error correction.

- Improved Accuracy: Automated systems significantly decrease the likelihood of human error in critical processes like financial calculations and legal documentation.

- Scalability: Automation allows Bohai Leasing to handle increased transaction volumes without a proportional increase in staffing, supporting future growth.

Technological advancements are reshaping the leasing industry, with AI, IoT, and blockchain offering significant opportunities for efficiency and innovation. By 2025, over 80% of financial services firms are expected to use AI in core functions, underscoring the imperative for Bohai Leasing to embrace these tools for enhanced risk assessment and client service.

The integration of IoT sensors for real-time asset tracking, projected to be a key driver in the over $1.1 trillion global IoT market by 2024, allows for improved asset utilization and predictive maintenance. Blockchain and smart contracts, which have shown up to a 30% reduction in processing times in supply chain management by 2024, can streamline Bohai Leasing's contract management and asset transfers, boosting transparency and security.

| Technology | Impact on Bohai Leasing | Supporting Data/Projection |

|---|---|---|

| Artificial Intelligence (AI) | Enhanced risk assessment, personalized client experiences, streamlined operations | Over 80% of financial services firms to use AI in core functions by 2025 |

| Internet of Things (IoT) | Real-time asset tracking, improved asset utilization, predictive maintenance | Global IoT market projected over $1.1 trillion by 2024 |

| Blockchain & Smart Contracts | Streamlined contract management, enhanced transparency and security, reduced disputes | Up to 30% reduction in processing times for smart contracts (Deloitte, 2024) |

Legal factors

Bohai Leasing navigates a complex web of financial leasing regulations and licensing mandates across China and its international operating regions. Staying compliant with these dynamic legal structures, which often dictate capital adequacy ratios and approved business scopes, is paramount for its operational continuity and growth. For instance, China's financial leasing sector is overseen by bodies like the China Banking and Insurance Regulatory Commission (CBIRC), which periodically updates guidelines impacting leasing companies.

Bohai Leasing’s extensive global footprint necessitates a deep understanding of diverse legal frameworks governing cross-border leasing. This includes intricate tax treaties, customs regulations, and international trade pacts that directly influence transaction costs and profitability. For instance, shifts in U.S. tax law or new EU trade policies could significantly alter the financial viability of leasing assets internationally.

Global data privacy regulations, like the EU's GDPR and similar national laws enacted or updated through 2024 and into 2025, significantly impact Bohai Leasing's operations. These laws dictate how the company can collect, store, and process sensitive client information, demanding robust compliance measures. Failure to adhere can lead to substantial fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher.

Maintaining client trust is paramount in the leasing industry, and strict adherence to these evolving data privacy and security laws is non-negotiable for Bohai Leasing. Demonstrating a commitment to protecting client data is crucial for building and retaining customer loyalty, especially as data breaches become more frequent and sophisticated. Companies that fall short risk not only financial penalties but also severe reputational damage.

Anti-Money Laundering (AML) and Sanctions Compliance

Financial leasing companies, including Bohai Leasing, operate under rigorous anti-money laundering (AML) and sanctions compliance mandates worldwide. These regulations are critical for preventing illicit financial flows and ensuring adherence to international sanctions.

Bohai Leasing must maintain stringent internal controls and thorough due diligence procedures. This commitment is vital to safeguard against financial crime and comply with evolving global sanctions lists, which saw significant updates throughout 2024 and into early 2025 impacting various jurisdictions and entities.

- Regulatory Scrutiny: Financial regulators globally intensified AML/CFT (Combating the Financing of Terrorism) oversight in 2024, with increased focus on non-bank financial institutions like leasing companies.

- Sanctions Enforcement: Enforcement actions related to sanctions breaches by financial institutions remained a significant concern in 2024, with penalties often reaching millions of dollars.

- Technological Investment: Companies are investing heavily in RegTech solutions to enhance AML transaction monitoring and sanctions screening capabilities, expecting this trend to accelerate through 2025.

- Customer Due Diligence (CDD): Enhanced CDD measures are becoming standard, requiring deeper understanding of customer ultimate beneficial ownership (UBO) and the source of funds, particularly for cross-border transactions.

Contract Law and Dispute Resolution

The enforceability of lease agreements is critical for Bohai Leasing, as is the efficiency of dispute resolution mechanisms. In 2024, China's Supreme People's Court continued to emphasize the importance of contract sanctity, with a reported 85% success rate for commercial contract enforcement cases reaching final judgment, though the average resolution time remained around 18 months.

Alterations in contract law, such as amendments to the Civil Code of the People's Republic of China impacting liability or termination clauses, could directly affect Bohai Leasing's risk profile and operational stability. Similarly, the effectiveness of arbitration and mediation services in key operating regions, like the European Union where Bohai Leasing has significant interests, plays a vital role in managing potential conflicts.

- Contractual Enforceability: Bohai Leasing relies on robust legal frameworks to ensure lease agreements are upheld, impacting its revenue streams and asset management.

- Dispute Resolution Efficiency: Swift and fair resolution of disputes is essential to minimize financial losses and maintain business relationships.

- Jurisdictional Variations: Legal system differences across countries where Bohai Leasing operates necessitate careful navigation of diverse contract laws and enforcement procedures.

- Regulatory Changes: Evolving contract and commercial laws can introduce new compliance requirements or alter existing risk assessments for leasing operations.

Bohai Leasing operates under stringent financial leasing regulations in China, overseen by the CBIRC, which mandates capital adequacy and business scope adherence. Globally, the company must navigate diverse legal frameworks including tax treaties and trade pacts, with changes in U.S. tax law or EU trade policies potentially impacting international profitability. Data privacy laws like GDPR, with penalties up to 4% of global turnover, are critical for client trust and data security. Furthermore, robust AML and sanctions compliance, including enhanced customer due diligence, are essential to prevent financial crime and adhere to evolving global sanctions lists through 2024-2025.

Environmental factors

Growing demand for robust Environmental, Social, and Governance (ESG) reporting is significantly influencing financial institutions. Leasing companies like Bohai Leasing are facing increased scrutiny from regulators and investors alike, necessitating a proactive approach to sustainability performance. This trend is evidenced by the expanding universe of ESG-focused investment funds, which reached over $3.7 trillion globally by early 2024, signaling a clear market preference for transparently managed businesses.

Bohai Leasing must therefore embed ESG principles into its core business strategies and operational frameworks. Transparently disclosing its sustainability efforts, from carbon footprint reduction to social impact initiatives, is crucial for maintaining investor confidence and regulatory compliance. For instance, the increasing adoption of the Task Force on Climate-related Financial Disclosures (TCFD) recommendations by major financial markets highlights the evolving landscape of mandatory environmental disclosures.

The global push for sustainability is significantly reshaping financial markets, with a notable surge in demand for green financing and environmentally friendly leased assets. This trend is particularly relevant for sectors like aviation and equipment leasing, where fuel efficiency and reduced emissions are becoming key differentiators. For instance, the International Energy Agency reported in 2024 that investments in clean energy technologies reached a record $2 trillion globally, signaling a strong investor appetite for sustainable ventures.

Bohai Leasing can strategically position itself to benefit from this growing market by developing and promoting leasing solutions that align with environmental, social, and governance (ESG) principles. Offering leases on fuel-efficient aircraft or energy-saving industrial equipment directly addresses this demand. By Q3 2024, the global green bond market had already surpassed $1 trillion in issuance for the year, demonstrating the substantial capital available for sustainable projects and assets.

Stricter carbon emissions regulations, especially impacting aviation and shipping, directly influence Bohai Leasing's core operations. For instance, the International Civil Aviation Organization's (ICAO) CORSIA program, which began its first compliance period in 2024, requires airlines to offset emissions growth above a baseline, potentially increasing operating costs for lessees and thus impacting Bohai Leasing's asset demand.

Compliance with evolving environmental standards could necessitate significant capital expenditure for Bohai Leasing to acquire or finance newer, more fuel-efficient aircraft and vessels. This shift towards greener fleets, driven by regulations like the EU's Emissions Trading System (ETS) expansion to maritime transport starting in 2024, presents both a challenge and an opportunity for fleet modernization.

Circular Economy Principles

The increasing global focus on circular economy principles, which prioritize reusing, repairing, and recycling assets, creates both hurdles and avenues for leasing firms like Bohai Leasing. This shift encourages a move away from traditional linear ‘take-make-dispose’ models toward more sustainable practices.

Bohai Leasing can capitalize on this trend by developing leasing models that inherently support asset longevity and incorporate responsible end-of-life management strategies. For instance, by offering enhanced maintenance packages or buy-back options, the company can ensure assets are kept in service longer and then properly refurbished or recycled, aligning with environmental goals and potentially creating new revenue streams.

- Asset Longevity: Leasing agreements can be structured to incentivize extended asset use through robust maintenance and upgrade programs, reducing the need for premature replacement.

- End-of-Life Management: Implementing take-back programs for leased assets allows for refurbishment, remanufacturing, or responsible material recovery.

- Market Opportunity: The growing demand for sustainable and circular business practices presents an opportunity for Bohai Leasing to differentiate itself and attract environmentally conscious clients.

Climate Change Impact and Risk Management

Climate change poses significant physical risks to Bohai Leasing's asset portfolio. Extreme weather events, like increased flooding or more intense typhoons, could damage or devalue leased infrastructure, impacting revenue streams and asset recovery values. For instance, in 2024, China experienced a series of severe weather events, leading to substantial economic losses in affected regions, underscoring the tangible impact of these risks.

Bohai Leasing must proactively integrate climate risk assessments into its core investment and asset management strategies. This involves understanding how changing climate patterns might affect the long-term viability and operational capacity of leased assets, particularly those in vulnerable geographic locations or exposed to specific weather-related threats. A forward-looking approach is crucial for maintaining asset quality and mitigating potential write-downs.

- Physical Risk: Increased frequency and severity of extreme weather events (floods, typhoons, droughts) can directly damage or impair leased assets, potentially leading to asset devaluation and increased insurance costs.

- Operational Disruption: Climate-related events can disrupt supply chains and transportation networks, impacting the operational efficiency of lessees and, consequently, Bohai Leasing's revenue generation.

- Regulatory & Transition Risk: Future regulations aimed at mitigating climate change could impact asset types or industries Bohai Leasing finances, necessitating adaptation in its investment criteria.

- Reputational Risk: Failure to address climate risks could negatively affect Bohai Leasing's reputation among investors and stakeholders increasingly focused on environmental, social, and governance (ESG) factors.

Growing demand for ESG reporting is influencing financial institutions, with leasing companies like Bohai Leasing facing increased scrutiny. This is evident in the over $3.7 trillion in global ESG-focused investment funds by early 2024. Bohai Leasing must embed ESG principles, disclosing sustainability efforts to maintain investor confidence and comply with evolving regulations like TCFD recommendations.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bohai Leasing Co. draws upon data from authoritative government publications, international financial institutions, and leading aviation industry research firms. This ensures a comprehensive understanding of political stability, economic forecasts, and regulatory landscapes impacting the company.