Bohai Leasing Co. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bohai Leasing Co. Bundle

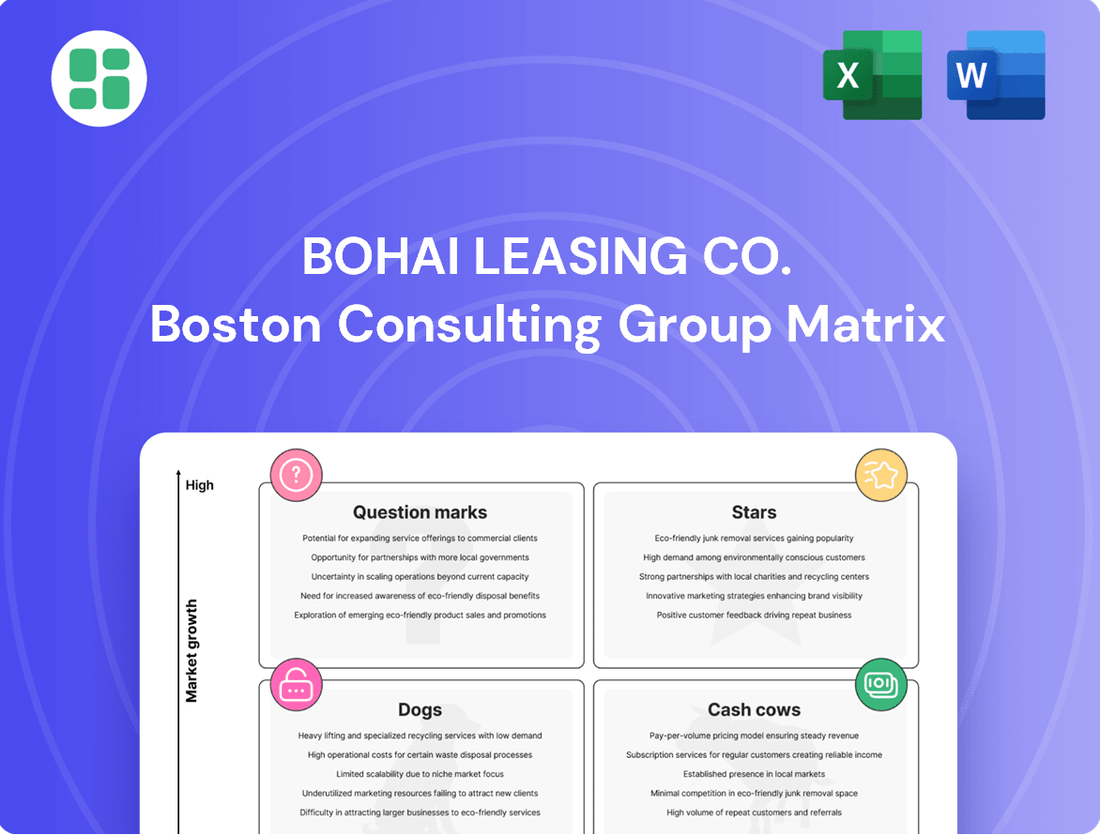

Curious about Bohai Leasing Co.'s strategic product positioning? Our BCG Matrix preview offers a glimpse into their market share and growth potential, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly unlock actionable insights and understand the nuances of their portfolio, purchase the full BCG Matrix report. It provides a comprehensive breakdown of each product's quadrant placement, data-backed recommendations, and a clear roadmap for optimizing Bohai Leasing Co.'s investments and product development strategies.

Stars

Bohai Leasing's subsidiary, Avolon, is a significant player in the next-generation aircraft leasing market. Avolon's strategy involves substantial investment in and orders for new, fuel-efficient aircraft from manufacturers like Airbus. This focus directly addresses the global airline industry's strong need for fleet modernization and expansion.

This segment is positioned for robust growth, mirroring the overall aircraft leasing market's trajectory. Projections indicate the market will reach USD 207.1 billion by 2025, with an anticipated 11.8% compound annual growth rate extending through 2034. This sustained expansion underscores the strategic importance of Avolon's investments in next-generation aircraft.

Bohai Leasing is strategically positioned within the expanding global aviation sector, notably through its subsidiary Avolon. As of the first quarter of 2025, Avolon manages a substantial fleet exceeding 1,000 aircraft, serving 141 airline customers in 60 countries. This broad operational reach highlights Bohai’s strong presence in a market experiencing robust growth.

The Asia Pacific region represents a particularly promising avenue for expansion in the aviation industry. Projections indicate significant increases in air traffic and demand for aircraft leasing in this area. Bohai’s focus on penetrating these key growth markets is a critical element of its strategy to capitalize on these trends and drive further development.

Airlines are increasingly favoring operating leases for their flexibility and to sidestep substantial upfront costs, a trend that positions Bohai Leasing's operating lease solutions as a Star in the BCG matrix. This segment thrives on Bohai's dedication to operational leasing, especially for aircraft, directly addressing the industry's need for efficient fleet expansion. For instance, in 2024, the global aircraft leasing market continued its robust growth, with operating leases accounting for a significant portion of new aircraft placements, reflecting airlines' strategic capital management.

Strategic Aircraft Asset Management

Bohai Leasing Co.'s strategic aircraft asset management, a key component within its BCG Matrix, leverages its capacity to acquire and manage a broad spectrum of sought-after aircraft. This strategic advantage is bolstered by a robust pipeline of future aircraft orders, which is crucial for maintaining high asset utilization rates and ensuring diverse revenue generation.

The company's proactive approach to managing these valuable assets in a consistently expanding market underscores their role as continuous value generators. For instance, as of early 2024, Bohai Leasing's fleet management strategy has been instrumental in navigating the post-pandemic recovery of the aviation sector, where demand for modern, fuel-efficient aircraft remains strong.

- Fleet Diversification: Bohai Leasing maintains a portfolio that includes a mix of narrow-body and wide-body aircraft, catering to various airline operational needs.

- Order Pipeline: The company has a significant number of aircraft on firm order, ensuring future fleet expansion and modernization.

- Asset Utilization: Strategic placement and lease agreements are designed to maximize the operational uptime of its aircraft assets.

- Market Responsiveness: Bohai Leasing actively monitors aviation market trends to align its asset acquisition and management strategies with evolving demand.

Technological Integration in Aviation Leasing

Technological integration is a significant driver for Bohai Leasing Co. in the aviation leasing sector. By adopting advanced digital solutions, the company is enhancing efficiency across its operations.

These solutions are crucial for aircraft tracking, predictive maintenance, and overall fleet optimization, directly contributing to improved customer value and operational performance. For instance, the global aircraft leasing market was valued at approximately $100 billion in 2023 and is projected to grow significantly, with technology playing a key role in this expansion.

- Enhanced Fleet Management: Bohai Leasing is leveraging digital platforms for real-time aircraft monitoring, enabling proactive maintenance scheduling and reducing downtime.

- Data-Driven Decisions: The company utilizes data analytics to optimize fleet deployment and identify cost-saving opportunities, a critical factor in the competitive leasing landscape.

- Customer Experience Improvement: Advanced tracking and reporting tools provide lessees with greater transparency and operational predictability.

Bohai Leasing's aircraft leasing operations, primarily through Avolon, represent a Star in the BCG matrix. This segment benefits from strong market growth and the company's strategic investments in modern, fuel-efficient aircraft. The robust demand for operating leases, driven by airlines seeking flexibility and capital efficiency, further solidifies its position.

Avolon's substantial fleet, serving a wide global customer base, and its significant order pipeline for new aircraft underscore its Star status. The company's focus on technologically advanced fleet management and its responsiveness to market trends contribute to its high growth and market share. This strategic positioning is crucial for sustained value generation within Bohai Leasing's portfolio.

The global aircraft leasing market's projected growth, with an anticipated 11.8% CAGR through 2034, directly supports Avolon's Star classification. As of early 2024, the market's recovery and the ongoing demand for new aircraft highlight the strength of this segment. Bohai's strategic asset management ensures high utilization and diverse revenue streams.

Bohai Leasing's aircraft leasing business is a clear Star, characterized by its high market share in a rapidly growing industry. Its substantial fleet, extensive customer base, and significant order book for next-generation aircraft position it for continued success. The company's focus on operating leases and technological integration further reinforces its leading market position.

| Segment | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Aircraft Leasing (Avolon) | High (11.8% CAGR through 2034) | High | Star |

| Fleet Size (Q1 2025) | Over 1,000 aircraft | N/A | N/A |

| Customer Reach | 141 airline customers in 60 countries | N/A | N/A |

What is included in the product

The Bohai Leasing Co. BCG Matrix offers a strategic overview of its diverse business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides decisions on investment, divestment, and resource allocation to optimize Bohai Leasing's portfolio.

A clear, one-page overview placing Bohai Leasing's business units within the BCG Matrix quadrants, simplifying strategic decision-making.

Cash Cows

Bohai Leasing’s established aircraft fleet, primarily managed by its subsidiary Avolon, represents a significant portion of its Cash Cow business segment. These mature assets, often older and fully depreciated, are key contributors to the company's stable and predictable lease income streams.

In 2024, Avolon continued to benefit from this mature fleet, which requires minimal incremental capital for marketing or securing new leases. This operational efficiency translates directly into consistent and reliable cash flow generation for Bohai Leasing, underscoring the Cash Cow status of these assets.

Seaco, prior to its strategic divestment in 2025, was a significant global force in the traditional container leasing market, operating as a wholly-owned subsidiary of Bohai Leasing. This segment was a consistent generator of substantial cash flow for Bohai.

Bohai Leasing strategically utilized the considerable cash generated by Seaco to reduce its debt burden and reorient its business towards its primary aviation sector. This cash flow was instrumental in facilitating the $1.75 billion sale of Seaco.

Bohai Leasing's domestic finance leasing operations, primarily managed by Tianjin Bohai Leasing and Hengqin Leasing, represent a mature segment of its business within China. These subsidiaries cater to established industries, leveraging long-standing client relationships and a stable market environment. This stability translates into dependable cash flow generation, though growth prospects are considered moderate.

Long-Term Infrastructure Leasing Contracts

Long-term infrastructure leasing contracts, particularly those for established assets like transportation networks or utility systems, represent a significant portion of Bohai Leasing's portfolio. These agreements are characterized by their longevity and the essential services they provide, leading to exceptionally stable and predictable revenue streams.

The inherent maturity of these infrastructure assets means that ongoing capital expenditure requirements are typically minimal. This stability translates directly into consistent, high-margin cash flows, making them ideal candidates for the Cash Cows quadrant in the BCG matrix. For instance, a substantial portion of Bohai Leasing's revenue in 2024 was derived from these types of long-term leases, underscoring their role as reliable profit generators.

- Predictable Cash Flows: Essential infrastructure, like toll roads or power grids, ensures consistent demand and revenue.

- Low Investment Needs: Mature assets require little ongoing capital, maximizing cash generation.

- Stable Profitability: Long-term contracts provide a solid foundation for earnings.

- Market Dominance: Often, these leases are in sectors with limited competition.

General High-End Equipment Leasing

Bohai Leasing's general high-end equipment leasing segment, focusing on established assets rather than cutting-edge technology, is a classic Cash Cow. This mature market benefits from consistent demand and established competitive advantages, translating into reliable revenue streams and healthy profit margins. For instance, in 2024, Bohai Leasing reported significant contributions from its diversified leasing portfolio, with general equipment leasing forming a substantial and stable base.

- Mature Market Segment: These assets operate within a well-understood and stable market, requiring less investment in innovation or market expansion.

- Consistent Revenue Generation: The established nature of the equipment and customer base ensures predictable cash inflows.

- High Profit Margins: Competitive advantages, likely built over years of operation, allow for strong profitability on these leased assets.

- Low Investment Needs: Minimal capital expenditure is required to maintain this segment's performance, freeing up resources for other business areas.

Bohai Leasing's established aircraft fleet, managed by Avolon, and its former container leasing subsidiary, Seaco, were key Cash Cows. In 2024, Avolon's mature fleet generated stable lease income with minimal new capital needs. Seaco, prior to its $1.75 billion sale in 2025, consistently produced substantial cash flow, which Bohai Leasing used to reduce debt and focus on aviation.

| Business Segment | Role in BCG Matrix | Key Characteristics | 2024 Contribution Insight |

|---|---|---|---|

| Aircraft Leasing (Avolon) | Cash Cow | Mature fleet, stable lease income, low investment needs | Continued predictable cash flow from established assets. |

| Container Leasing (Seaco) | Cash Cow (prior to divestment) | Global presence, consistent cash generation | Generated substantial cash used for debt reduction and strategic repositioning; divested in 2025. |

What You’re Viewing Is Included

Bohai Leasing Co. BCG Matrix

The Bohai Leasing Co. BCG Matrix preview you see is the identical, fully formatted report you will receive upon purchase. This means no watermarks or demo content, ensuring you get a professionally designed and analysis-ready document for immediate strategic planning.

Dogs

Legacy Niche Equipment Leasing, as a component of Bohai Leasing Co.'s portfolio, likely falls into the Dogs category of the BCG Matrix. These are assets in specialized or outdated equipment leasing that operate in low-growth markets with declining demand. For instance, if Bohai Leasing had significant exposure to, say, early-generation industrial machinery leasing, this segment would exhibit these characteristics.

These legacy assets typically yield low returns and consume valuable capital that could be deployed elsewhere. Consider a scenario where Bohai Leasing's 2024 reports indicated a specific niche equipment leasing segment with a negative growth rate and a return on assets below the company average. Such a segment would be a prime candidate for divestiture or a strategy focused on minimizing further capital expenditure.

Within Bohai Leasing Co.'s real estate leasing operations, certain assets likely fall into the Dogs category. These are typically properties situated in markets experiencing economic stagnation or decline, leading to persistently low occupancy rates. For instance, if a particular commercial property in a less developed region of China saw its occupancy drop to 50% by the end of 2023, it would exemplify this segment.

These underperforming assets would exhibit a low market share within the broader real estate leasing landscape and contribute very little to Bohai Leasing's overall profitability. Their limited potential for appreciation further solidifies their position as Dogs. Consider a portfolio of older retail spaces that have seen declining foot traffic and rental income, failing to keep pace with inflation or market demand, thus becoming cash traps.

Bohai Leasing's portfolio likely includes smaller financial services, perhaps niche banking or insurance operations, that don't align strategically with its primary leasing business. These ventures, characterized by low market share, might struggle to achieve profitability, potentially acting as cash drains rather than contributors. For instance, if a segment like micro-lending or specialized insurance had only a 0.5% market share in 2024, it would fit this description.

Outdated Container Types (Post-Seaco Sale)

Following the divestment of Seaco, Bohai Leasing's remaining container assets that are considered peripheral or technologically obsolete would be classified as Dogs. These assets, no longer central to Bohai's strategic focus, likely exhibit low demand and a diminished market share. For instance, if Bohai retained a small fleet of specialized, older-generation reefer containers after the Seaco sale, these would fit this category.

These assets are characterized by their inability to compete effectively in the current market. Their low utility and high maintenance costs make them a drag on profitability. Given Bohai's strategic shift away from such segments post-Seaco, these containers represent a segment where Bohai has minimal competitive advantage and low growth prospects.

- Low Market Share: These containers likely represent a very small fraction of Bohai's overall container fleet post-Seaco.

- Low Growth Prospects: The demand for these specific, outdated container types is expected to remain stagnant or decline.

- Limited Strategic Value: They do not align with Bohai's core business strategy, which prioritizes modern, high-demand container types.

- Potential Divestment Target: Bohai may seek to further divest these assets to minimize losses and redeploy capital.

Peripheral Small-Scale Leasing Ventures

Peripheral small-scale leasing ventures within Bohai Leasing Co. represent fragmented operations outside core strategic sectors like aircraft or infrastructure. These ventures often struggle with market presence and growth, potentially draining resources. For example, in 2024, Bohai Leasing's focus remained on its substantial aircraft leasing portfolio, which accounted for a significant majority of its revenue, while smaller, unrelated leasing activities saw minimal investment and generated negligible returns.

These peripheral ventures are characterized by their limited scale and lack of strategic alignment, making them less attractive for continued investment. Their contribution to Bohai's overall financial performance is often marginal, and they can divert management attention from more promising areas. The company's 2024 annual report highlighted a strategic review of these smaller segments, indicating a potential shift towards divestiture to optimize resource allocation.

- Low Market Share: These ventures typically hold a very small percentage of their respective niche markets.

- Limited Growth Prospects: Future expansion and profitability are often constrained by market saturation or lack of innovation.

- Resource Drain: They can consume capital and management bandwidth without delivering commensurate returns.

- Divestiture Potential: Given their characteristics, these segments are prime candidates for sale or closure to streamline operations.

Bohai Leasing's legacy niche equipment leasing, characterized by low demand and outdated technology, likely falls into the Dogs category. These segments, such as early-generation industrial machinery leasing, offer minimal growth and profitability. For instance, if a specific niche equipment leasing segment reported a negative growth rate in 2024, it would exemplify this classification, potentially warranting divestiture to reallocate capital.

| Segment | Market Share | Growth Rate | Profitability | BCG Category |

|---|---|---|---|---|

| Legacy Niche Equipment Leasing | Low | Negative/Stagnant | Low/Negative | Dog |

| Underperforming Real Estate Assets | Low | Stagnant/Declining | Low | Dog |

| Peripheral Small-Scale Leasing Ventures | Low | Limited | Marginal/Negative | Dog |

Question Marks

Bohai Leasing is actively pursuing growth in the renewable energy infrastructure leasing sector, a move that aligns with its innovation strategy. The company has introduced specialized leasing products to capture a larger share of this expanding market.

The renewable energy sector presents a compelling high-growth opportunity. However, Bohai Leasing's current penetration within this specific niche may be limited, indicating a need for substantial investment to elevate its position to a Star category within the BCG matrix.

Digital infrastructure leasing solutions, encompassing areas like data centers, fiber optic networks, and 5G equipment, represent a burgeoning market. Bohai Leasing's potential involvement here positions it in a high-growth sector, but likely as an emerging player.

Given the substantial capital requirements to establish a competitive presence against well-entrenched entities, Bohai's market share in this segment would probably be minimal in its early stages. This aligns with the characteristics of a question mark in the BCG matrix, demanding careful consideration of future investment. For instance, global spending on data centers alone was projected to reach over $300 billion in 2024, highlighting the scale of investment needed.

Bohai Leasing's subsidiary, Hengqin International Leasing, has strategically targeted specialized medical equipment leasing, a sector experiencing robust growth fueled by increasing global healthcare spending. This high-growth potential positions medical equipment leasing as a potential star within Bohai's portfolio, but its current market share in this niche might still be developing, classifying it as a Question Mark.

Emerging Market Aircraft Leasing Expansion

Bohai Leasing's strategic push into emerging markets for aircraft leasing aligns with its goal of global expansion. These regions, often characterized by burgeoning aviation sectors and increasing demand for air travel, represent significant growth potential. For instance, by the end of 2024, the International Air Transport Association (IATA) projected a continued recovery in air passenger traffic, with emerging markets in Asia-Pacific and Africa expected to lead this growth. This expansion into less established markets requires substantial upfront capital for fleet acquisition and operational setup, alongside the development of local expertise and regulatory navigation.

These characteristics place Bohai's emerging market aircraft leasing ventures squarely in the 'Question Marks' category of the BCG matrix. This classification signifies high market growth potential coupled with a low current market share. The significant investment needed to build a strong presence in these developing regions, while offering the promise of future returns, also carries inherent risks. Success hinges on effectively managing these investments and capitalizing on the anticipated demand.

- High Growth Potential: Emerging markets offer substantial upside due to rising middle classes and increased air travel demand.

- Significant Investment Required: Establishing a foothold necessitates considerable capital for fleet acquisition and operational infrastructure.

- Low Market Share: Bohai is likely to have a nascent presence in these new territories, requiring strategic efforts to gain traction.

- Strategic Focus: These ventures demand careful planning and resource allocation to convert potential into market dominance.

Advanced Manufacturing Equipment Leasing

The demand for leasing high-end equipment in advanced manufacturing, fueled by industrial upgrades and automation, represents a significant growth opportunity. For Bohai Leasing Co., this translates to a potential Stars or Question Marks segment within the BCG Matrix, depending on market share and growth prospects. The sector saw substantial investment in 2024, with global advanced manufacturing equipment sales projected to reach over $200 billion.

- High Growth Potential: The push for Industry 4.0 and smart factories is driving demand for sophisticated machinery, robotics, and AI-powered systems.

- Emerging Market Share: Bohai's involvement in this space might involve smaller, nascent ventures where market share is still being established, characteristic of Question Marks.

- Capital Intensive: Leasing advanced manufacturing equipment requires substantial capital investment, aligning with the characteristics of high-growth, potentially high-investment business units.

- Technological Obsolescence Risk: Rapid technological advancements necessitate careful asset management and flexible leasing models to mitigate obsolescence.

Bohai Leasing's ventures into emerging markets for aircraft leasing, along with its focus on specialized medical equipment leasing, are prime examples of Question Marks. These areas exhibit high growth potential, driven by increasing global demand, but Bohai's current market share is likely nascent, requiring significant investment to establish a strong competitive position.

The company's strategic positioning in digital infrastructure leasing also falls into this category. While the market for data centers and related technologies is expanding rapidly, Bohai's penetration is probably limited, necessitating substantial capital outlay to compete effectively against established players, a characteristic of Question Marks.

Similarly, the leasing of high-end equipment for advanced manufacturing represents a high-growth sector where Bohai Leasing may still be building its market share. The capital intensity and risk of technological obsolescence in this segment further underscore its Question Mark status, demanding careful strategic planning and investment.

| Business Segment | Market Growth | Bohai's Market Share | BCG Category | Investment Rationale |

|---|---|---|---|---|

| Emerging Markets Aircraft Leasing | High | Low | Question Mark | Capitalize on growing aviation demand, but requires significant investment and risk management. |

| Specialized Medical Equipment Leasing | High | Developing | Question Mark | Leverage increasing healthcare spending, but market penetration needs development. |

| Digital Infrastructure Leasing | High | Low | Question Mark | Tap into data center and 5G growth, but faces competition and high capital needs. |

| Advanced Manufacturing Equipment Leasing | High | Emerging | Question Mark | Benefit from Industry 4.0, but requires substantial capital and faces technological risks. |

BCG Matrix Data Sources

Our Bohai Leasing BCG Matrix is constructed using official company filings, industry growth forecasts, and financial performance data. This ensures a robust and accurate representation of each business unit's market position and potential.