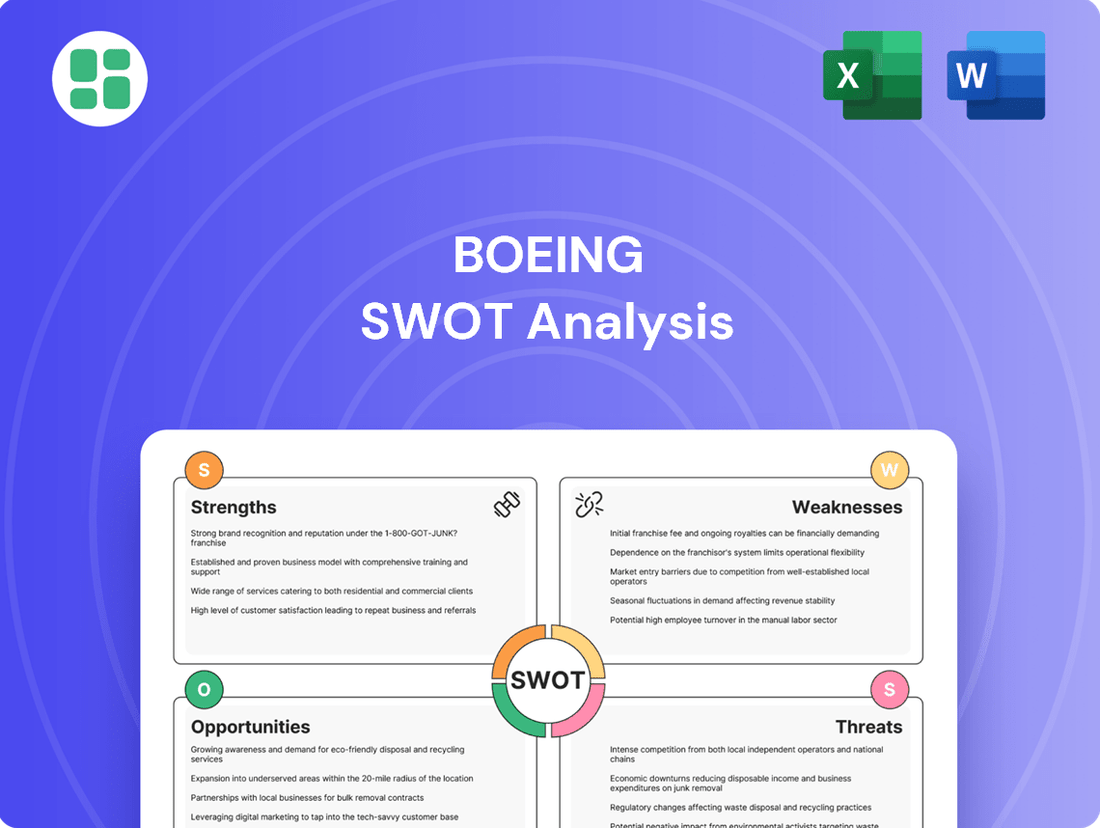

Boeing SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boeing Bundle

Boeing, a titan of aerospace, faces a complex landscape of strengths like its established brand and technological prowess, yet grapples with weaknesses such as production challenges and regulatory scrutiny. Understanding these dynamics is crucial for navigating the competitive aviation industry.

Want the full story behind Boeing’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Boeing commands a leading position in the global aerospace sector, a status underscored by its widespread brand recognition and a rich heritage in aviation innovation. This strong reputation is a cornerstone of its business, fostering trust among a diverse customer base that spans commercial airlines and government defense agencies in over 150 nations. For instance, in 2023, Boeing secured significant orders, including a substantial deal with United Airlines for 737 MAX aircraft, reflecting continued market confidence.

Boeing's strength lies in its exceptionally diverse product portfolio, spanning commercial airplanes, defense systems, space exploration, and security solutions. This broad business model, which also includes a rapidly expanding Global Services division, provides significant resilience against market downturns in any single sector. For instance, in 2023, Boeing Defense, Space & Security (BDS) reported revenues of $28.1 billion, while Commercial Airplanes (BCA) generated $93.1 billion, showcasing the balance across its operations.

Boeing's substantial order backlog, valued at an impressive $619 billion as of the second quarter of 2025, is a significant strength. This backlog includes more than 5,900 commercial aircraft, indicating a strong pipeline of future business.

This robust order book provides a stable foundation for revenue generation and allows for more predictable operational planning over the coming years. It demonstrates sustained demand for Boeing's products, even amidst recent operational hurdles.

Advanced Technological Capabilities and R&D Investment

Boeing's advanced technological capabilities are a significant strength, underpinned by substantial investments in research and development. In 2024 alone, the company allocated $4.5 billion to R&D, demonstrating a long-standing commitment to innovation.

This continuous investment fuels the development of cutting-edge technologies, next-generation aircraft designs, and enhancements to current product lines. Such a focus on technological leadership is vital for maintaining a competitive advantage and addressing the dynamic needs of the aerospace industry.

- Significant R&D Investment: Boeing's $4.5 billion R&D expenditure in 2024 highlights its dedication to technological advancement.

- Innovation Pipeline: This investment supports the creation of advanced aircraft designs and new aerospace technologies.

- Competitive Edge: Technological prowess is key to Boeing's ability to compete effectively and meet evolving market demands.

Strong Global Presence and Aftermarket Services

Boeing's extensive global footprint, reaching over 150 countries, is a significant strength, bolstered by a dedicated Global Services segment. This segment provides essential aircraft maintenance, modifications, and training, ensuring operational continuity for its diverse customer base.

The company's robust aftermarket services are not just a revenue stream but also a critical factor in fostering strong customer loyalty and long-term relationships. These services are vital for keeping aircraft flying safely and efficiently worldwide.

The financial performance of the Global Services segment underscores its importance, with revenues reaching $5.3 billion in the second quarter of 2025. This demonstrates the segment's consistent contribution to Boeing's overall financial health and market position.

- Global Reach: Operations and customer base in over 150 countries.

- Comprehensive Services: Aircraft maintenance, modifications, and training offered through Global Services.

- Revenue Generation: Aftermarket services contribute significantly to overall revenue.

- Customer Loyalty: Strong relationships built through reliable support and services.

Boeing's substantial order backlog, valued at $619 billion as of Q2 2025, represents a significant strength, securing future revenue streams. This backlog includes over 5,900 commercial aircraft, demonstrating sustained demand and providing a stable foundation for operations and planning.

The company's commitment to innovation is evident in its $4.5 billion R&D investment in 2024, fueling the development of advanced aerospace technologies and next-generation aircraft. This focus on technological leadership is crucial for maintaining a competitive edge in the rapidly evolving aerospace industry.

Boeing's Global Services segment generated $5.3 billion in revenue in Q2 2025, highlighting the strength of its aftermarket support, including maintenance and training. This segment not only contributes to financial stability but also fosters strong customer loyalty across its extensive global network spanning over 150 countries.

What is included in the product

Analyzes Boeing’s competitive position through key internal and external factors, detailing its strengths in aerospace leadership, weaknesses in production, opportunities in emerging markets, and threats from competition and regulatory scrutiny.

Offers a clear, actionable framework to address Boeing's complex challenges by identifying key internal and external factors.

Helps pinpoint and prioritize strategic responses to mitigate risks and leverage opportunities within Boeing's operational landscape.

Weaknesses

Boeing's persistent quality control and safety issues, notably the 737 MAX accidents and the January 2024 Alaska Airlines door plug incident, have severely damaged its reputation. These recurring problems have resulted in heightened scrutiny from the Federal Aviation Administration (FAA), leading to production limitations and even a criminal fraud conspiracy charge against the company.

Boeing has faced significant production delays, particularly with the 737 MAX and 787 Dreamliner. These issues stem from supply chain problems, labor challenges, and rigorous quality control measures, causing the company to miss its output targets. For instance, in 2023, Boeing delivered 528 commercial aircraft, falling short of its goal to reach 400-450 deliveries for the 737 MAX program alone, highlighting the persistent production challenges.

These persistent production setbacks have directly affected delivery timelines for airline customers, leading to considerable frustration and potential financial penalties for Boeing. The backlog of undelivered aircraft has grown, impacting cash flow and the company's ability to meet market demand effectively. This inefficiency in scaling production is a major hurdle for Boeing's financial recovery and its competitive standing.

Boeing faced significant financial headwinds, reporting a substantial $11.83 billion net loss for 2024. This downturn marked its most challenging financial period since 2020, underscoring deep-seated operational issues.

The company continued to post GAAP losses in the first two quarters of 2025, a direct consequence of persistent operational inefficiencies and production delays. These ongoing challenges have severely hampered its cash flow, creating a critical concern for financial sustainability.

While some positive trends emerged in 2025, suggesting potential for recovery, the overall financial stability of Boeing remains a significant point of apprehension for investors and stakeholders.

High Reliance on Key Commercial Aircraft Programs

Boeing's commercial aircraft segment shows a significant concentration in revenue generation from a limited number of core programs, with the 737 MAX family being a prime example. This reliance exposes the company to substantial risk if these particular aircraft models encounter operational disruptions or regulatory scrutiny.

For instance, the 737 MAX program, while a significant revenue driver, also represents a critical vulnerability. Any production challenges or further regulatory hurdles for this model directly impact Boeing's financial performance. This dependence highlights a persistent challenge in achieving broader diversification within its commercial aviation offerings.

- Revenue Concentration: A large percentage of Boeing's commercial airplane revenue is derived from a few key aircraft programs.

- 737 MAX Vulnerability: The 737 MAX program's issues, such as past groundings and production challenges, directly impact Boeing's financial health.

- Diversification Challenge: Boeing faces ongoing difficulties in diversifying its revenue streams within the commercial aircraft sector.

Damaged Reputation and Eroding Trust

Boeing's reputation has taken a significant hit due to a string of safety issues, including the 737 MAX incidents and recent quality control problems. This has eroded trust not only with passengers but also with airlines and aviation authorities worldwide. For instance, in early 2024, the Federal Aviation Administration (FAA) increased its oversight of Boeing, limiting production of the 737 MAX.

Rebuilding this trust is a monumental task. It requires Boeing to consistently prove a commitment to enhanced quality and safety standards. This ongoing challenge directly impacts its ability to secure new orders and maintain its standing in the competitive aerospace market, with delays in deliveries becoming a common occurrence throughout 2024.

- Damaged Public Perception: Post-737 MAX crashes and ongoing quality concerns have led to a noticeable dip in consumer confidence.

- Airline Scrutiny: Major airline customers are exerting more pressure on Boeing for improved quality and on-time delivery.

- Regulatory Hurdles: Increased scrutiny from bodies like the FAA has led to production caps and slower certification processes.

- Eroding Investor Confidence: Stock performance has reflected these challenges, with significant volatility tied to safety and production news.

Boeing's persistent quality control and safety issues, exemplified by the 737 MAX groundings and the January 2024 Alaska Airlines incident, have severely damaged its reputation and led to increased regulatory scrutiny. These recurring problems have resulted in production limitations, including FAA-imposed caps on 737 MAX output, and have contributed to significant delivery delays throughout 2024.

The company's financial performance has been heavily impacted, with a substantial net loss reported for 2024, underscoring deep-seated operational inefficiencies. Ongoing GAAP losses in the first half of 2025 further highlight these challenges, creating critical concerns for cash flow and overall financial sustainability.

A significant weakness lies in Boeing's revenue concentration, with a large portion of its commercial aircraft income tied to a few key programs, most notably the 737 MAX family. This reliance makes the company highly vulnerable to disruptions or regulatory actions affecting these specific models, hindering diversification efforts.

The company's ability to meet production targets has been consistently hampered by supply chain issues, labor challenges, and rigorous quality control measures. In 2023, Boeing delivered 528 commercial aircraft, falling short of its ambitious goals, a trend that continued to impact delivery timelines and customer satisfaction into 2024.

| Weakness | Description | Impact | Supporting Data |

|---|---|---|---|

| Quality & Safety Issues | Recurring problems with aircraft manufacturing and safety protocols. | Damaged reputation, increased regulatory oversight, production slowdowns. | January 2024 Alaska Airlines door plug incident; FAA production limits on 737 MAX. |

| Production Delays | Inability to meet delivery targets due to supply chain, labor, and quality control issues. | Missed revenue targets, customer dissatisfaction, financial penalties. | 2023 commercial aircraft deliveries (528) fell short of goals; persistent delays in 737 MAX and 787 programs. |

| Financial Performance | Significant net losses and ongoing operational inefficiencies. | Strained cash flow, investor apprehension, reduced financial flexibility. | $11.83 billion net loss in 2024; continued GAAP losses in Q1-Q2 2025. |

| Revenue Concentration | Heavy reliance on a few core aircraft programs, particularly the 737 MAX. | Vulnerability to program-specific issues, limited diversification. | The 737 MAX family is a critical revenue driver, making it a key point of financial risk. |

Full Version Awaits

Boeing SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final Boeing SWOT analysis. Unlock the full report when you purchase.

You’re previewing the actual analysis document. Buy now to access the full, detailed report, providing comprehensive insights into Boeing's strategic position.

Opportunities

The global aerospace market is on a strong upswing, with passenger air traffic projected to nearly double by 2044. This robust recovery, especially driven by growth in Asian markets, creates a significant opportunity for Boeing to boost its commercial aircraft sales and deliveries.

Airlines worldwide are actively upgrading their fleets to more fuel-efficient models, directly fueling demand for Boeing's latest jetliners. For instance, Boeing secured a significant order for 150 737 MAX aircraft from Ryanair in mid-2023, highlighting this fleet modernization trend.

Global defense spending is on the rise, driven by escalating geopolitical tensions and a worldwide push for military modernization. This upward trend presents a substantial opportunity for Boeing's Defense, Space & Security division.

Governments are allocating more resources to defense, creating a fertile ground for Boeing to win significant contracts. These contracts are expected to cover a range of advanced products, including fighter jets, unmanned aerial vehicles (drones), sophisticated space-based systems, and crucial support services.

For instance, in 2023, the global defense market was valued at approximately $2.2 trillion, with projections indicating continued growth. Boeing's recent contract awards, such as the multi-billion dollar deals for F-15EX fighter jets and various satellite programs, underscore its strong position to capitalize on this expanding market.

The aftermarket services market in aerospace is a significant growth area, presenting a prime opportunity for Boeing to bolster its Global Services division. This segment is projected to reach substantial figures, with some analysts forecasting its value to exceed $1 trillion by the early 2030s.

By offering robust maintenance, repair, overhaul (MRO), and training solutions, Boeing can cultivate recurring revenue streams and deepen customer relationships across the entire lifespan of its aircraft. In 2023, Boeing's Global Services segment reported significant revenue, demonstrating its current strength and substantial potential for continued expansion.

Advancements in Sustainable Aviation Technology

The growing emphasis on environmental sustainability within the aviation sector presents a significant opportunity for Boeing to spearhead the development of eco-friendly aircraft, such as electric, hybrid, and hydrogen-powered planes. This shift aligns with increasing global demand for reduced carbon emissions.

Boeing's investment in green technologies and advanced lightweight materials can solidify its position as a frontrunner in sustainable aviation. This strategic focus will not only help meet upcoming regulatory mandates but also cater to evolving customer preferences for environmentally conscious travel solutions.

- Industry Shift: The global aviation industry is projected to invest billions in sustainable technologies through 2030, with a significant portion allocated to new aircraft designs and propulsion systems.

- Boeing's Commitment: Boeing has committed substantial resources to research and development in areas like SAF (Sustainable Aviation Fuel) compatibility and advanced aerodynamic designs, aiming to reduce fuel burn by up to 20% for new aircraft models.

- Market Demand: Airlines are increasingly prioritizing aircraft with lower operating costs and reduced environmental impact, creating a strong market pull for Boeing’s sustainable innovations.

Strategic Acquisitions and Partnerships

Boeing can significantly bolster its operational control and efficiency through strategic acquisitions, notably its pursuit of Spirit AeroSystems. This move aims to integrate a key supplier directly, potentially streamlining production and quality management. For instance, the Spirit AeroSystems deal, valued around $4.75 billion in early 2024, underscores Boeing's commitment to supply chain resilience.

Forming strategic alliances with technology leaders and other aerospace innovators presents another avenue for growth. These partnerships can accelerate the development of next-generation aircraft and propulsion systems, driving innovation in areas like sustainable aviation fuel integration and advanced materials. Collaborations can also unlock new market segments, such as the burgeoning urban air mobility sector, where companies are exploring electric vertical takeoff and landing (eVTOL) aircraft.

- Supply Chain Integration: Acquiring Spirit AeroSystems aims to bring approximately 80% of its current work in-house, enhancing control over a critical segment of its manufacturing process.

- Innovation Acceleration: Partnerships can speed up the adoption of new technologies, such as advanced composite materials and AI-driven design tools, as seen in collaborations with firms like Woven Planet for autonomous driving technology integration in future mobility concepts.

- Market Expansion: Strategic alliances can facilitate entry into emerging markets, including the anticipated growth in electric and autonomous flight solutions, with potential market sizes for urban air mobility projected to reach tens of billions of dollars by 2030.

The ongoing recovery and projected growth in global air travel present a substantial opportunity for Boeing to increase its commercial aircraft sales, particularly with strong demand from Asian markets. Airlines are actively modernizing their fleets, evidenced by significant orders like Ryanair's 150 737 MAX aircraft in mid-2023, signaling a robust demand for fuel-efficient planes.

Rising global defense spending, driven by geopolitical shifts, offers a significant boost to Boeing's Defense, Space & Security division. The market, valued at approximately $2.2 trillion in 2023, is expected to continue its upward trajectory, creating opportunities for contracts in fighter jets, drones, and space systems.

The expanding aerospace aftermarket services sector, projected to exceed $1 trillion by the early 2030s, provides Boeing's Global Services division with a clear path for recurring revenue and deeper customer engagement through maintenance, repair, and training solutions.

Boeing can lead in the development of sustainable aviation technologies, such as electric and hydrogen-powered aircraft, aligning with global environmental goals and increasing airline demand for reduced emissions. The industry's planned investment of billions in sustainable tech through 2030, coupled with Boeing's R&D in SAF compatibility and efficiency improvements, positions it for market leadership.

Threats

Boeing faces relentless competition from Airbus, its sole major rival in the large commercial aircraft market. In 2023, Airbus delivered 735 aircraft, exceeding Boeing's 528 deliveries, and secured 2,296 net orders compared to Boeing's 1,751, highlighting Airbus's current market advantage.

This intense rivalry directly impacts Boeing's pricing power and market share. Airbus's consistent order book strength and production ramp-up capabilities exert significant pressure, potentially affecting Boeing's profitability and ability to regain its historical market leadership.

Boeing faces intensified scrutiny from the FAA and international aviation authorities following recent safety events, impacting production rates and financial recovery. This heightened oversight translates to stricter inspections and potential production caps, directly hindering the company's ability to ramp up output.

The financial implications are significant, with substantial fines already levied and the prospect of further compliance costs and production delays looming. For instance, the FAA imposed a 7% reduction in Boeing's 737 MAX production rate in early 2024 as part of its oversight. These regulatory hurdles directly challenge Boeing's operational efficiency and its path to financial stability.

Boeing faces ongoing challenges from global supply chain disruptions. Shortages of essential parts and increasing material prices, like aluminum and titanium, directly impact its ability to meet production targets and deliver aircraft on time. For instance, in early 2024, the company continued to grapple with delays stemming from supplier issues, particularly affecting the 737 MAX program.

Geopolitical tensions and trade disputes present significant threats. These can lead to the cancellation or delay of international orders, the imposition of tariffs on aircraft and parts, and restricted access to vital markets. The ongoing trade friction between the United States and China, a major customer for Boeing, remains a persistent concern for future revenue streams and operational stability.

Economic Downturns and Volatile Fuel Prices

Global economic instability, including the potential for recessions and persistent inflation, poses a significant threat by directly impacting airlines' ability to finance new aircraft purchases and dampening overall demand. For instance, as of early 2024, many economies are still navigating inflationary pressures and concerns about growth slowdowns, which can reduce airline capital expenditure budgets.

Volatile fuel prices represent another critical challenge. When fuel costs surge, airlines face increased operational expenses, squeezing their profit margins and potentially leading them to postpone or cancel aircraft orders. This directly impacts Boeing's commercial airplane segment, as seen in historical patterns where high oil prices have correlated with reduced new aircraft demand.

- Economic Slowdown Impact: A projected global GDP growth of 2.7% for 2024, down from 3.0% in 2023 according to the IMF, signals a weaker economic environment that could curb airline expansion plans.

- Fuel Price Volatility: Brent crude oil prices, while fluctuating, have remained a significant operational cost for airlines, with average prices in early 2024 hovering around $80-$85 per barrel, impacting airline profitability and fleet modernization decisions.

- Deferred Orders: Historically, periods of economic contraction and high energy costs have led to order deferrals, directly affecting Boeing's delivery schedules and revenue forecasts for its commercial division.

Risk of Further Labor Disputes and Workforce Challenges

Boeing's reliance on a unionized workforce presents a persistent threat. The machinist strike in late 2024, for instance, directly impacted production schedules, highlighting the financial repercussions of labor unrest.

The ongoing risk of further labor disputes, coupled with potential workforce morale issues and existing talent shortages, could continue to hinder Boeing's operational efficiency and delay its recovery.

- Labor Disputes: Past strikes have led to significant production delays, impacting delivery commitments.

- Workforce Morale: Maintaining high morale is crucial for productivity, especially during challenging periods.

- Talent Shortages: The aerospace industry faces a general shortage of skilled labor, which can affect Boeing's ability to scale production.

- Union Negotiations: Future contract negotiations could lead to disruptions if agreements are not reached amicably.

Boeing faces significant threats from its primary competitor, Airbus, which has consistently outperformed Boeing in aircraft deliveries and net orders, as evidenced by Airbus's 2023 figures of 735 deliveries versus Boeing's 528, and 2,296 net orders compared to Boeing's 1,751. This competitive pressure directly impacts Boeing's market share and pricing power, hindering its ability to regain market leadership. Furthermore, heightened scrutiny from aviation authorities like the FAA, which mandated a 7% production rate reduction for the 737 MAX in early 2024, imposes operational constraints and financial penalties. Persistent global supply chain disruptions, including shortages of critical parts and rising material costs, continue to impede Boeing's production targets and delivery timelines, as seen with ongoing issues affecting the 737 MAX program in early 2024. Geopolitical tensions and trade disputes, particularly with major markets like China, pose risks to future revenue streams and market access, while global economic instability, characterized by a projected 2.7% global GDP growth for 2024 according to the IMF, could dampen airline demand and financing capabilities. Volatile fuel prices, with Brent crude averaging around $80-$85 per barrel in early 2024, also impact airline profitability and their willingness to invest in new aircraft. Finally, the threat of labor disputes, exemplified by a machinist strike in late 2024, can disrupt production and negatively affect operational efficiency and recovery efforts.

| Threat Category | Specific Threat | Impact/Data Point (Early 2024) |

| Competition | Airbus Market Dominance | Airbus 2023 Deliveries: 735; Boeing Deliveries: 528. Airbus 2023 Net Orders: 2,296; Boeing Net Orders: 1,751. |

| Regulatory Oversight | FAA Production Rate Reduction | FAA mandated 7% 737 MAX production rate cut in early 2024. |

| Supply Chain | Part Shortages & Material Costs | Ongoing delays affecting 737 MAX program due to supplier issues. |

| Economic Factors | Global Economic Slowdown | IMF projects 2.7% global GDP growth for 2024 (down from 3.0% in 2023). |

| Economic Factors | Fuel Price Volatility | Brent crude oil prices averaged $80-$85/barrel in early 2024. |

| Geopolitical Factors | Trade Disputes | Ongoing US-China trade friction impacts potential orders. |

| Labor Relations | Labor Disputes/Strikes | Late 2024 machinist strike impacted production schedules. |

SWOT Analysis Data Sources

This analysis leverages a robust blend of data, drawing from Boeing's official financial reports, comprehensive market intelligence, and expert industry forecasts to provide a well-rounded strategic perspective.