Boeing Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boeing Bundle

Explore the intricate workings of Boeing's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates how Boeing builds and delivers value, from its key partners to its revenue streams. Discover the strategic architecture that underpins its global aviation leadership.

Partnerships

Boeing's strategic supplier relationships are foundational to its operations, with companies like ATI providing essential titanium products, crucial for both commercial and defense aircraft. These long-standing partnerships are critical for maintaining a consistent supply of high-quality materials, directly impacting production timelines and the overall integrity of Boeing's aircraft. In 2023, Boeing's supply chain costs represented a significant portion of its overall expenses, underscoring the financial importance of these supplier agreements.

Boeing's Defense, Space & Security segment thrives on deep collaborations with government agencies such as the U.S. Department of Defense, NASA, and various international defense ministries. These partnerships are the bedrock for securing substantial, multi-year contracts for critical assets like military aircraft, advanced space systems, and essential support services.

These government relationships are not merely transactional; they often involve intricate co-development programs and extensive technology sharing, fostering innovation and mutual advancement. For instance, in 2023, Boeing's defense segment revenue reached $33.3 billion, underscoring the immense scale of these government-driven collaborations.

Such alliances are indispensable for national security objectives, enabling the development and deployment of cutting-edge defense capabilities, and are equally vital for spearheading ambitious space exploration endeavors, pushing the boundaries of human discovery.

Boeing actively collaborates with universities and research institutions worldwide, fostering advancements in aerospace technology and sustainability. For instance, in 2024, Boeing continued its significant investment in research partnerships aimed at developing next-generation aircraft and sustainable aviation solutions. These collaborations are crucial for driving innovation in areas like advanced materials, propulsion systems, and digital engineering, ensuring Boeing remains at the forefront of the aerospace industry.

Commercial Airlines and Leasing Companies

Boeing's Commercial Airplanes segment relies heavily on its deep-rooted relationships with major commercial airlines and aircraft leasing companies. These partnerships are the bedrock for direct aircraft sales, crucial for fleet renewal and expansion initiatives. In 2023, Boeing delivered 528 commercial aircraft, a significant increase from 2022, reflecting the ongoing demand from these key customers.

These collaborations extend beyond initial purchases to encompass long-term support services, including maintenance, spare parts, and training. The health of these relationships is particularly vital as Boeing navigates recent quality control and delivery schedule issues. For instance, the company has been working to address production bottlenecks that impacted its delivery targets throughout 2023 and into early 2024.

- Fleet Modernization: Airlines continuously update their fleets to improve fuel efficiency and passenger experience, driving demand for new Boeing aircraft.

- Leasing Market Influence: Leasing companies are major buyers, influencing aircraft demand and often acting as intermediaries for airline fleet needs.

- Support Services Revenue: Long-term service agreements contribute a substantial and recurring revenue stream for Boeing.

- Customer Trust: Maintaining strong customer relationships is paramount for securing future orders amidst competitive pressures and production challenges.

Industry Associations and Advocacy Groups

Boeing collaborates with key industry bodies, including the Aerospace Industries Association (AIA) and the Association for Uncrewed Vehicle Systems International (AUVSI). These relationships are crucial for shaping regulatory landscapes and championing the aerospace sector's needs. For instance, in 2024, AIA advocated for policies supporting advanced manufacturing and workforce training, directly impacting companies like Boeing.

Through these partnerships, Boeing actively participates in addressing critical sector-wide challenges. This includes efforts to bolster the aerospace workforce and strengthen the complex global supply chain. In 2023, the AIA reported a projected need for over 1.9 million new aerospace professionals by 2042, highlighting the urgency of these joint initiatives.

Furthermore, these associations foster vital collaboration among industry players. The focus is often on advancing safety protocols and promoting sustainable practices across the aerospace industry. Boeing's involvement in these groups ensures alignment with evolving environmental standards and shared commitments to operational excellence.

- Industry Association Engagement: Boeing's active participation in groups like AIA and AUVSI allows for direct input into policy development.

- Advocacy for Sector Interests: These partnerships enable Boeing to collectively address issues such as workforce shortages and supply chain resilience.

- Collaboration on Standards: Boeing contributes to industry-wide efforts on safety enhancements and the adoption of sustainable aviation technologies.

Boeing's key partnerships are diverse, spanning suppliers, government entities, commercial clients, and industry organizations. These collaborations are vital for material sourcing, contract acquisition, product sales, and shaping the regulatory environment. For example, in 2023, Boeing's defense segment revenue was $33.3 billion, illustrating the scale of government partnerships.

| Partner Type | Examples | Significance |

| Suppliers | ATI (titanium), Spirit AeroSystems | Ensures consistent supply of critical materials and components, impacting production costs and timelines. |

| Government Agencies | U.S. Department of Defense, NASA | Secures large, long-term contracts for defense systems and space exploration projects. |

| Commercial Airlines & Lessors | United Airlines, AerCap | Drives aircraft sales, fleet modernization, and provides recurring revenue through support services. |

| Research Institutions | Universities globally | Drives innovation in aerospace technology, materials, and sustainability initiatives. |

| Industry Associations | Aerospace Industries Association (AIA) | Influences policy, advocates for sector interests, and promotes industry-wide safety and sustainability standards. |

What is included in the product

A structured framework detailing Boeing's approach to creating, delivering, and capturing value, focusing on its diverse customer segments, extensive product/service offerings, and complex global supply chain.

This model outlines Boeing's core activities, key resources, and revenue streams, highlighting its strategic partnerships and cost structure in the aerospace industry.

Provides a structured framework to identify and address key operational inefficiencies and market challenges.

Helps to pinpoint areas of risk and inefficiency, enabling targeted solutions for improved performance.

Activities

Boeing's central focus is the intricate process of designing, developing, and engineering a wide array of aircraft, from commercial airliners that connect the globe to advanced military jets and vital space systems. This core activity demands continuous innovation and a deep commitment to technical excellence.

The company dedicates substantial resources to research and development, consistently investing over $3 billion annually. This significant financial commitment fuels the creation of cutting-edge technologies and the enhancement of current aircraft models, ensuring Boeing remains at the forefront of aerospace engineering.

Innovation, paramount safety standards, and superior performance are the guiding principles that drive Boeing's engineering efforts. These principles are applied across its entire diverse product range, from the latest commercial jets to specialized defense platforms.

Boeing's manufacturing and assembly is a core activity, involving the complex production of aircraft and defense systems across its global facilities. This intricate process demands rigorous supply chain management and stringent quality control to ensure product safety and operational efficiency.

In 2024, Boeing continued its focus on stabilizing production for critical programs such as the 737 MAX and 787 Dreamliner. For instance, the company aimed to increase 737 MAX production to around 50 aircraft per month during 2024, a significant ramp-up from previous years.

Boeing actively pursues global sales and marketing to secure contracts with airlines, governments, and space organizations across more than 150 nations. This involves direct sales discussions, presence at major international air shows, and cultivating key customer relationships.

The company's substantial order backlog, exceeding 5,600 commercial aircraft as of early 2024, underscores robust ongoing demand for its products and services.

Post-Delivery Support and Services (Global Services)

A significant and growing part of Boeing's operations involves providing comprehensive global services. This includes essential activities like aircraft maintenance, modifications, and upgrades. They also manage the distribution of spare parts and offer crucial training programs for both commercial and defense clients.

This services segment is vital for generating recurring revenue. It plays a critical role in ensuring that customer fleets remain operationally ready and efficient. Boeing Global Services has demonstrated a pattern of consistent revenue growth and profitability, underscoring its importance to the company's overall financial health.

- Aircraft Maintenance & Modifications: Ongoing support to keep fleets airworthy and updated.

- Spare Parts Distribution: Ensuring timely availability of critical components worldwide.

- Training Services: Providing pilots, mechanics, and other personnel with necessary skills.

- Fleet Operational Readiness: Guaranteeing high uptime and efficiency for customer aircraft.

Supply Chain Management and Optimization

Boeing's key activities heavily involve managing its extensive global supply chain to ensure the timely and efficient procurement of thousands of parts and materials needed for aircraft production. This complex network requires constant oversight and strategic partnerships to maintain quality and control costs. In 2023, Boeing reported that its supply chain faced significant challenges, impacting delivery schedules, a situation it actively worked to resolve through intensified supplier collaboration and quality improvement initiatives.

Optimization efforts focus on streamlining processes, reducing lead times, and enhancing collaboration with over 2,000 suppliers worldwide. Boeing actively engages with these partners to implement best practices, drive innovation, and ensure compliance with rigorous quality standards. For instance, the company has invested in digital tools to improve supply chain visibility and predictability.

Strategic moves, like the potential re-acquisition of Spirit AeroSystems, underscore Boeing's commitment to gaining greater control over critical parts of its supply chain. This move, if completed, would allow for more direct management of key component production, aiming to mitigate disruptions and improve overall production flow. Such vertical integration is a significant strategic lever for managing supply chain resilience and performance.

- Global Supply Chain Management: Overseeing a network of over 2,000 suppliers globally to source critical aircraft components and materials.

- Supplier Collaboration and Quality Improvement: Working closely with suppliers to enhance efficiency, reduce costs, and maintain high-quality standards across the production process.

- Strategic Re-acquisitions: Exploring and executing strategic acquisitions, such as potential moves involving Spirit AeroSystems, to strengthen control over key supply chain elements and mitigate risks.

Boeing's key activities encompass the entire lifecycle of aircraft and aerospace system development, production, and support. This includes designing, engineering, manufacturing, and servicing a diverse range of products for commercial and defense markets. A significant focus is placed on stabilizing production rates and enhancing quality across its programs.

In 2024, Boeing continued its efforts to ramp up production for key commercial aircraft like the 737 MAX, targeting approximately 50 aircraft per month. The company also actively manages its extensive global supply chain, working with over 2,000 suppliers to ensure timely delivery of parts and materials, while exploring strategic acquisitions to bolster control over critical components.

Furthermore, Boeing provides comprehensive global services, including maintenance, modifications, spare parts distribution, and training, which are vital for generating recurring revenue and ensuring fleet operational readiness for its customers.

| Activity Area | Description | 2024 Focus/Data Points |

|---|---|---|

| Design & Engineering | Developing new aircraft and aerospace systems, emphasizing innovation and safety. | Continued investment in R&D, exceeding $3 billion annually. |

| Manufacturing & Production | Complex assembly of aircraft and defense systems globally. | Targeting 737 MAX production of ~50 aircraft/month; addressing 787 Dreamliner production challenges. |

| Sales & Marketing | Securing contracts with airlines, governments, and organizations worldwide. | Maintaining a substantial order backlog exceeding 5,600 commercial aircraft (early 2024). |

| Global Services | Providing maintenance, modifications, spare parts, and training. | Focus on recurring revenue generation and fleet operational readiness. |

| Supply Chain Management | Managing a global network of over 2,000 suppliers for parts and materials. | Intensified supplier collaboration and quality initiatives; exploring vertical integration (e.g., Spirit AeroSystems). |

What You See Is What You Get

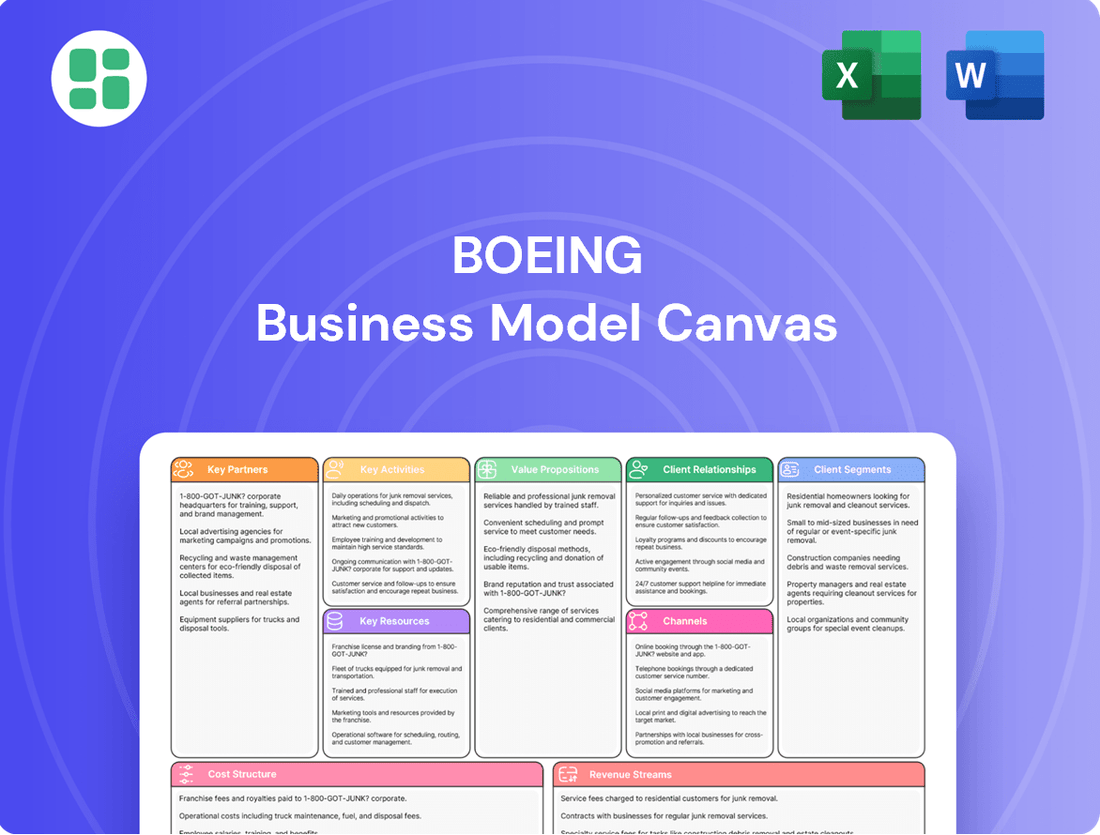

Business Model Canvas

The Boeing Business Model Canvas preview you are viewing is an authentic representation of the final product. This means that upon purchase, you will receive the exact same comprehensive document, meticulously structured and populated with all the essential components of Boeing's strategic framework. Rest assured, what you see is precisely what you will get, ensuring full transparency and immediate usability for your analysis or presentation needs.

Resources

Boeing's intellectual property, including thousands of patents and proprietary technologies, forms a cornerstone of its competitive edge. This vast portfolio covers everything from advanced aerodynamic designs to critical software systems, safeguarding its dominance in the aerospace and defense markets.

In 2023, Boeing reported research and development expenses of $4.1 billion, underscoring its commitment to innovation and the continuous protection of its technological assets. This investment fuels the creation of next-generation aircraft and defense systems, ensuring sustained leadership.

Boeing's extensive manufacturing and assembly facilities are the backbone of its operations, featuring large-scale, specialized plants and assembly lines strategically located across the globe. These state-of-the-art facilities are outfitted with advanced machinery and sophisticated processes essential for building complex aircraft and defense systems. In 2024, Boeing continued to leverage these critical assets to meet global demand and maintain its production capabilities.

Boeing's highly skilled workforce, encompassing engineers, technicians, and program managers, is a cornerstone of its operations. This deep well of expertise in aerospace design, manufacturing, and maintenance is absolutely critical for developing cutting-edge aircraft and ensuring top-notch quality and customer support.

In 2023, Boeing reported approximately 171,000 employees globally, a significant portion of whom possess specialized technical skills. The company's commitment to continuous training and development ensures this talent pool remains at the forefront of aerospace innovation, a vital asset for maintaining its competitive edge.

Financial Capital and Liquidity

Financial Capital and Liquidity are the lifeblood of Boeing’s operations. These resources are absolutely critical for funding everything from cutting-edge research and development to the massive undertaking of large-scale aircraft production and significant strategic investments. Without robust financial backing, these essential activities would simply stall.

Boeing’s capacity to secure capital and effectively manage its debt obligations is paramount. This financial dexterity allows the company to not only weather the inherent cyclical nature of the aerospace industry but also to confidently finance ambitious, long-term projects that define its future. This management of financial health is a core component of its business model.

To illustrate this point, consider Boeing’s financial standing. As of the end of 2024, the company reported substantial liquidity, holding $26.3 billion in cash and marketable securities. This significant reserve provides a strong foundation for ongoing operations and future growth initiatives.

- Cash Reserves: $26.3 billion in cash and marketable securities as of year-end 2024.

- Access to Capital Markets: Ability to issue debt and equity to fund operations and investments.

- Credit Facilities: Availability of committed lines of credit to manage short-term liquidity needs.

- Debt Management: Strategic approach to managing leverage to maintain financial flexibility.

Strong Brand Reputation and Customer Trust

Boeing's century-long legacy in aerospace has cultivated a powerful global brand, synonymous with innovation and reliability. This strong reputation, even after facing recent scrutiny, remains a cornerstone for securing new aircraft orders and fostering enduring customer loyalty. For instance, in 2023, Boeing delivered 528 commercial aircraft, a significant increase from 2022, demonstrating continued demand underpinned by its brand equity.

Despite recent challenges impacting public perception, Boeing's brand reputation and customer trust are actively being rebuilt. The company's strategic focus is squarely on enhancing safety and quality across its operations. This commitment is vital for restoring confidence among airlines and regulators, which is essential for long-term market position.

- Brand Recognition: Globally recognized for aerospace innovation and reliability.

- Customer Loyalty: A critical asset for securing new orders and maintaining relationships.

- Strategic Priority: Rebuilding trust through an intensified focus on safety and quality.

- Market Impact: Continued deliveries in 2023 (528 commercial aircraft) reflect underlying demand, despite challenges.

Boeing's intellectual property, including thousands of patents and proprietary technologies, forms a cornerstone of its competitive edge. This vast portfolio covers everything from advanced aerodynamic designs to critical software systems, safeguarding its dominance in the aerospace and defense markets. In 2023, Boeing reported research and development expenses of $4.1 billion, underscoring its commitment to innovation and the continuous protection of its technological assets.

Boeing's extensive manufacturing and assembly facilities are the backbone of its operations, featuring large-scale, specialized plants and assembly lines strategically located across the globe. These state-of-the-art facilities are outfitted with advanced machinery and sophisticated processes essential for building complex aircraft and defense systems. In 2024, Boeing continued to leverage these critical assets to meet global demand and maintain its production capabilities.

Boeing's highly skilled workforce, encompassing engineers, technicians, and program managers, is a cornerstone of its operations. This deep well of expertise in aerospace design, manufacturing, and maintenance is absolutely critical for developing cutting-edge aircraft and ensuring top-notch quality and customer support. In 2023, Boeing reported approximately 171,000 employees globally, a significant portion of whom possess specialized technical skills.

Financial Capital and Liquidity are the lifeblood of Boeing’s operations. These resources are absolutely critical for funding everything from cutting-edge research and development to the massive undertaking of large-scale aircraft production and significant strategic investments. As of the end of 2024, the company reported substantial liquidity, holding $26.3 billion in cash and marketable securities.

| Key Resource | Description | 2023/2024 Data Point |

| Intellectual Property | Patents and proprietary technologies in aerospace design and software. | $4.1 billion in R&D expenses in 2023. |

| Manufacturing Facilities | Global network of specialized plants for aircraft and defense systems. | Continued operations and production capacity in 2024. |

| Skilled Workforce | Expertise in aerospace design, manufacturing, and maintenance. | Approx. 171,000 employees globally in 2023. |

| Financial Capital | Cash reserves and access to capital markets for operations and investment. | $26.3 billion in cash and marketable securities at year-end 2024. |

Value Propositions

Boeing's value proposition centers on its advanced and innovative aerospace products, encompassing a wide range of commercial jetliners, military aircraft, and space systems. These offerings are distinguished by their integration of cutting-edge design, sophisticated engineering, and digital solutions. This technological prowess translates into superior performance, enhanced fuel efficiency, and improved operational capabilities for customers.

The company's commitment to continuous innovation is a cornerstone of its strategy, designed to anticipate and address evolving customer needs. For instance, in 2024, Boeing continued its development of next-generation aircraft, focusing on sustainability and advanced avionics. This forward-looking approach positions Boeing to not only meet current market demands but also to shape the future trajectory of the aerospace industry.

Boeing's foundational value proposition centers on uncompromised safety and quality, a commitment that has been intensely scrutinized and reinforced in recent years. The company is undertaking significant cultural and operational shifts to embed these principles throughout its entire value chain, from design to delivery.

This dedication is not merely a statement but a strategic imperative aimed at rebuilding confidence among customers, regulators, and the flying public. For instance, in 2023, Boeing reported delivering 528 commercial aircraft, a notable increase from 2022, underscoring its operational efforts while safety remains paramount.

Boeing offers extensive global support, ensuring aircraft and systems remain operational throughout their entire lifespan. This includes crucial services like maintenance, necessary modifications, and readily available spare parts, alongside comprehensive training programs. In 2023, Boeing's Services segment generated approximately $37 billion in revenue, highlighting the significant value customers place on these lifecycle offerings.

Customized Defense and Security Solutions

Boeing's value proposition centers on delivering highly customized defense and security solutions to government and defense clients worldwide. These offerings are meticulously designed to address specific national security requirements, integrating advanced capabilities across various domains. The company's commitment is to provide platforms that ensure air dominance, enhance intelligence gathering, and bolster strategic defense postures, all while prioritizing peak performance and unwavering reliability for critical operations.

In 2024, Boeing continued to be a cornerstone supplier for numerous global defense initiatives. For instance, the U.S. Department of Defense awarded Boeing significant contracts, including a notable $2.7 billion contract for the production of T-7A Red Hawk trainer aircraft, highlighting the demand for advanced training platforms. Furthermore, international sales of its defense systems, such as the F-15EX Eagle II and P-8A Poseidon maritime patrol aircraft, underscore the global reliance on Boeing's specialized security solutions.

- Tailored National Security Capabilities: Boeing provides solutions specifically engineered to meet the unique defense needs of individual nations, ranging from aerial warfare to intelligence surveillance and reconnaissance (ISR).

- Advanced Platform Integration: The company excels at integrating complex systems into high-performance platforms, ensuring seamless operation and maximum effectiveness in demanding security environments.

- Focus on Reliability and Performance: Boeing's value proposition emphasizes the delivery of robust and dependable systems, critical for mission success in high-stakes defense scenarios.

- Strategic Defense Enhancements: Solutions are geared towards strengthening a nation's strategic defense capabilities, offering an edge in deterrence and response.

Commitment to Sustainability and Environmental Performance

Boeing is actively championing sustainability, focusing on creating aerospace products and solutions that significantly lessen aviation's environmental impact. This commitment is demonstrated through substantial investments in technologies that support sustainable aviation fuels (SAF) and the development of more fuel-efficient aircraft designs, incorporating advanced lightweight materials.

This strategic direction directly responds to the increasing market and customer demand for aerospace solutions that prioritize environmental responsibility. For instance, Boeing has set goals to support the widespread adoption of SAF, aiming for 100% SAF compatibility for all its commercial aircraft by 2030. This aligns with the broader industry push to achieve net-zero carbon emissions from aviation by 2050.

- Sustainable Aviation Fuel (SAF) Integration: Boeing is working to ensure all its commercial aircraft can fly on 100% SAF blends, a critical step for reducing lifecycle carbon emissions.

- Fuel-Efficient Aircraft Design: Continued investment in aerodynamic improvements, advanced engine technologies, and lighter composite materials leads to reduced fuel burn per flight.

- Environmental Footprint Reduction: Boeing's commitment extends to its own operations, with targets for reducing greenhouse gas emissions, waste, and water usage across its global facilities.

- Industry Collaboration: Boeing actively partners with airlines, fuel producers, and governments to accelerate the development and availability of SAF and other sustainable aviation technologies.

Boeing's value proposition for its customers is built on delivering advanced, reliable, and safe aerospace products and services. This includes a comprehensive portfolio of commercial aircraft, defense systems, and space solutions, all underpinned by cutting-edge technology and a commitment to operational excellence.

The company is focused on enhancing fuel efficiency and performance through continuous innovation, such as the development of new aircraft designs and the integration of advanced materials. In 2024, Boeing continued its efforts to improve production processes and product quality, aiming to rebuild customer trust and ensure the highest safety standards.

Boeing provides extensive global support, encompassing maintenance, spare parts, and training, ensuring customers maximize the operational lifespan and effectiveness of their investments. The company's Services segment revenue in 2023 reached approximately $37 billion, underscoring the significant value placed on these lifecycle support offerings.

Boeing is also a key player in advancing sustainable aviation, investing in technologies like sustainable aviation fuels (SAF) and more fuel-efficient aircraft designs. The company aims for 100% SAF compatibility for its commercial aircraft by 2030, contributing to the industry's goal of net-zero emissions by 2050.

Customer Relationships

Boeing fosters enduring relationships with major commercial airlines and government entities, viewing them as strategic partners rather than just clients. These collaborations extend beyond simple sales, encompassing joint planning for future fleet requirements and ongoing technical and operational support. For instance, in 2024, Boeing continued its long-standing partnerships with carriers like United Airlines, which operates a significant fleet of Boeing aircraft, underscoring the decades-long trust and shared development that characterize these critical customer ties.

Boeing leverages dedicated account management and sales teams to foster deep customer relationships. These specialized teams engage directly with clients, understanding their unique operational needs and offering customized aircraft and service solutions. This personalized approach is crucial for securing large, complex orders and ensuring long-term satisfaction.

This direct engagement is particularly vital in the commercial aviation sector, where aircraft purchases represent significant, multi-year investments. Boeing's sales force acts as a primary point of contact, guiding customers through the entire lifecycle, from configuring new aircraft to arranging financing and aftermarket support. For example, in 2023, Boeing secured substantial orders, including a significant deal with Singapore Airlines for 23 787 Dreamliners, highlighting the effectiveness of these dedicated teams in navigating complex sales cycles.

Boeing fosters deep customer relationships through its Global Services segment, offering comprehensive aftermarket support. This includes vital maintenance, repair, and overhaul (MRO) services, ensuring aircraft remain operational and safe. In 2024, Boeing's Global Services division continued to be a significant revenue driver, reflecting the ongoing demand for these critical support functions.

Beyond MRO, Boeing provides essential spare parts supply and extensive pilot and technician training programs. These offerings are crucial for maximizing aircraft uptime and operational efficiency for their airline customers. The company's commitment to continuous value delivery through these services solidifies its partnerships and customer loyalty.

Direct Engagement and Feedback Mechanisms

Boeing actively cultivates direct engagement with its customers, employing various channels to solicit feedback and address concerns. This approach is crucial for refining product development and enhancing service offerings, with a particular emphasis on transparency and prompt responsiveness to foster trust.

- Direct Communication: Boeing utilizes direct lines of communication with airline operators and other clients to facilitate ongoing dialogue.

- Customer Advisory Boards: The establishment of customer advisory boards allows for structured feedback sessions and strategic alignment.

- Proactive Outreach: Following operational incidents, Boeing engages proactively with affected customers to provide support and gather insights for improvement.

- Feedback Integration: Customer feedback is systematically incorporated into the design, manufacturing, and service processes to drive continuous enhancement.

Government Relations and Advocacy

Boeing actively cultivates strong ties with government entities and regulatory bodies globally. This is paramount due to the stringent regulations governing aerospace and defense. For instance, in 2023, Boeing secured significant defense contracts, such as the multi-billion dollar award for the T-7A Red Hawk trainer aircraft, underscoring the importance of these government relationships.

Maintaining this engagement involves ongoing communication, adherence to certification standards, and proactive advocacy for favorable industry policies. These efforts are vital for securing new contracts and ensuring the continued operational licensing of Boeing's diverse product lines.

- Government Contracts: Boeing's 2023 revenue included substantial contributions from government contracts, particularly in defense.

- Regulatory Compliance: Continuous dialogue ensures compliance with aviation safety and defense regulations worldwide.

- Policy Advocacy: Boeing engages in advocacy to support policies beneficial to aerospace innovation and manufacturing.

- Licensing and Approvals: Government relations are crucial for obtaining and maintaining essential operational licenses and product certifications.

Boeing's customer relationships are built on long-term partnerships, especially with major airlines and governments, extending beyond simple transactions to include joint planning and extensive support. This deep engagement is managed by dedicated account teams who tailor solutions to client needs, crucial for securing large, multi-year aircraft orders. For example, in 2023, Boeing's significant deal with Singapore Airlines for 23 787 Dreamliners exemplifies this personalized approach.

The Global Services segment is key to solidifying these ties, offering essential aftermarket support like maintenance, repair, and overhaul (MRO), spare parts, and training, which are vital for aircraft uptime and operational efficiency. In 2024, this segment continued to be a significant revenue contributor, demonstrating the ongoing value airlines derive from Boeing's comprehensive support network.

Boeing also prioritizes direct customer feedback through advisory boards and proactive outreach, integrating insights into product development and service enhancements for continuous improvement. This commitment to transparency and responsiveness is fundamental to maintaining trust and loyalty.

| Customer Type | Relationship Focus | 2023/2024 Highlight |

| Commercial Airlines | Long-term partnerships, fleet planning, customized solutions, aftermarket support | Secured major orders like Singapore Airlines' 23 787 Dreamliners in 2023. Global Services drove significant revenue in 2024. |

| Government Entities | Contract fulfillment, regulatory compliance, policy advocacy, defense partnerships | Awarded multi-billion dollar contracts for defense programs like the T-7A Red Hawk trainer in 2023. |

| Key Support Functions | Maintenance, Repair, Overhaul (MRO), spare parts, pilot/technician training | Integral to customer retention and operational efficiency, contributing significantly to Global Services' revenue. |

Channels

Boeing's direct sales force is the backbone for selling its commercial aircraft, engaging directly with airlines and private buyers. This specialized team manages the intricate process of customizing aircraft configurations, negotiating complex, multi-year contracts, and building enduring customer relationships for high-value transactions.

In 2024, Boeing continued to leverage this direct channel, which is crucial for its core business of delivering new airplanes. The company's order backlog, a key indicator of its direct sales success, remained substantial, reflecting ongoing demand for its commercial fleet.

Boeing's Defense, Space & Security segment heavily relies on formal government procurement channels. This involves submitting detailed bids and proposals, often following rigorous evaluation criteria set by defense ministries and space agencies. For instance, in 2024, the U.S. Department of Defense continued to award substantial contracts for aircraft and weapon systems, reflecting the ongoing demand and complex acquisition cycles.

These government procurement processes are characterized by strict regulatory compliance, ensuring fairness and accountability. Boeing navigates these complex frameworks, which can lead to multi-year contract awards for major programs like military aircraft, advanced weapon systems, and crucial space exploration vehicles. The lengthy nature of these awards underscores the strategic importance and long-term commitment involved in these government partnerships.

Boeing's Global Services segment leverages a vast worldwide network of service centers, field offices, and parts distribution hubs. This infrastructure is crucial for delivering localized maintenance, repair, and overhaul (MRO) services, along with essential technical support and spare parts, directly to their global customer base.

These strategically located channels are designed to ensure swift response times and maintain the continuous operational readiness of the installed aircraft fleet. In 2024, Boeing's Global Services reported significant revenue contributions, underscoring the importance of this extensive support network in maintaining customer satisfaction and fleet availability.

Training Academies and Simulation Centers

Boeing's Training Academies and Simulation Centers act as a crucial channel for delivering specialized training services to pilots, maintenance technicians, and cabin crew. These state-of-the-art facilities are instrumental in equipping the global aviation workforce with the necessary skills and certifications for safe and efficient aircraft operations.

These centers are vital for maintaining operational readiness and ensuring compliance with evolving aviation standards. For instance, in 2024, Boeing continued to invest in advanced simulator technology, including full-flight simulators and virtual reality training modules, to enhance the realism and effectiveness of its training programs. The demand for qualified aviation personnel remains high, underscoring the importance of these training channels.

- Pilot Training: Offering type-specific recurrent and initial training for Boeing aircraft.

- Maintenance Training: Providing hands-on and theoretical instruction for aircraft maintenance personnel.

- Cabin Crew Training: Focusing on safety, emergency procedures, and customer service.

- Simulation Technology: Utilizing advanced simulators to replicate real-world flight and operational scenarios.

Digital Platforms and Online Portals

Boeing utilizes digital platforms and online portals as crucial channels to directly engage with its customer base. These platforms serve as a central hub for accessing essential resources like technical documentation, service bulletins, and comprehensive parts catalogs. By offering these resources online, Boeing significantly enhances customer efficiency and promotes self-service support, streamlining operations for airlines and other operators.

These digital channels are designed to provide valuable data analytics tools, empowering customers with insights for effective fleet management and optimization. For instance, in 2024, Boeing continued to invest in its digital offerings, aiming to improve predictive maintenance capabilities and reduce aircraft downtime. The seamless exchange of information facilitated through these portals is vital for robust operational planning and ensuring the highest levels of safety and performance across the global aviation sector.

- Access to Technical Documentation: Customers can readily access up-to-date manuals and guides.

- Service Bulletins and Parts Catalogs: Essential information for maintenance and parts procurement is available digitally.

- Data Analytics Tools: Boeing provides insights for fleet management and operational efficiency.

- Enhanced Efficiency and Self-Service: These platforms empower customers to manage their needs independently.

Boeing's channels are diverse, encompassing direct sales for commercial aircraft, formal government procurement for defense, and a global service network for maintenance and support. Digital platforms and training academies further extend its reach, ensuring customer engagement and operational readiness across all segments.

In 2024, Boeing's direct sales continued to be a primary channel, supported by a robust order backlog. The Defense segment relied on established government procurement processes, securing significant contracts. Global Services' extensive network ensured efficient MRO delivery, while Training Academies provided essential pilot and technician skills, bolstered by investments in advanced simulation technology.

| Channel | Description | 2024 Relevance/Data Point |

|---|---|---|

| Direct Sales (Commercial) | Engaging directly with airlines for aircraft sales and customization. | Crucial for managing a substantial order backlog, reflecting ongoing new aircraft demand. |

| Government Procurement (Defense) | Formal bidding and proposal processes for defense contracts. | U.S. Department of Defense awarded substantial contracts in 2024 for aircraft and weapon systems. |

| Global Service Network | Service centers, field offices, and parts hubs for MRO and support. | Contributed significantly to revenue in 2024, vital for fleet availability. |

| Training Academies/Simulation Centers | Specialized training for pilots and maintenance personnel. | Investments in advanced simulators in 2024 enhanced training effectiveness. |

| Digital Platforms/Online Portals | Online access to technical data, service bulletins, and parts catalogs. | Continued investment in 2024 to improve predictive maintenance and reduce aircraft downtime. |

Customer Segments

Commercial airlines, encompassing major flag carriers, low-cost carriers, and regional operators worldwide, represent a core customer segment for Boeing. These entities are the primary purchasers of Boeing's diverse commercial jetliner portfolio, including popular models like the 737 MAX, 787 Dreamliner, and the upcoming 777X, utilizing them for both passenger and cargo transportation.

The purchasing decisions of these airlines are fundamentally driven by several key factors. Fleet modernization programs, aimed at replacing older, less efficient aircraft with newer models that offer improved fuel economy and passenger comfort, are a significant demand generator. Furthermore, airlines' strategies for expanding their route networks and the overall growth in global passenger traffic directly influence their need for new aircraft, as seen in the robust order books Boeing typically maintains.

For instance, in 2024, the commercial aviation industry continued its recovery and expansion, with passenger traffic levels approaching or exceeding pre-pandemic figures in many regions. This resurgence directly translates into increased demand for new aircraft. Boeing's 2024 order backlog, a crucial indicator of future revenue, reflects this sustained demand from airlines eager to upgrade and expand their fleets to meet growing passenger volumes and operational efficiencies.

Boeing's government defense agencies segment includes national defense ministries and armed forces globally, with the U.S. Department of Defense being a significant customer. This segment procures advanced military aircraft like the F-15 and KC-46A, alongside sophisticated defense systems and ongoing support services crucial for national security. In 2023, Boeing's defense, space, and security segment generated $33.7 billion in revenue, underscoring the substantial reliance on these government contracts.

Boeing's space agency and satellite operator customer segment encompasses entities like NASA and commercial providers. These clients require sophisticated spacecraft, reliable launch systems, and ongoing support for a range of missions, from scientific discovery to vital communication and national security surveillance.

In 2024, the global space economy was projected to reach $647 billion, with government spending on space programs remaining a significant driver. NASA, for instance, has a substantial budget allocation for exploration and research, creating a consistent demand for Boeing's advanced space technologies and services.

Cargo Airlines and Freight Operators

Dedicated cargo airlines and the freight divisions of passenger carriers represent a crucial customer base for Boeing's freighter aircraft. These operators rely on robust, long-haul capabilities, making models like the 747 Freighter and 767 Freighter essential for their global logistics networks. The demand from this segment is intrinsically tied to the health of international trade and the burgeoning e-commerce sector.

In 2024, the air cargo market continues to show resilience, with global air freight traffic expected to grow. For instance, the International Air Transport Association (IATA) projected a significant increase in cargo volumes for the year, driven by factors such as supply chain adjustments and increased consumer spending on goods. This directly translates to a sustained need for efficient and high-capacity freighters.

- Key Customer Needs: High payload capacity, long-range capabilities, operational efficiency, and reliability for global distribution.

- Market Drivers: Growth in e-commerce, cross-border trade, and the need for expedited shipping of high-value goods.

- Boeing's Offering: Freighter variants of popular wide-body aircraft, designed for maximum cargo volume and efficient long-distance transport.

- 2024 Outlook: Air cargo demand is anticipated to remain strong, supporting the market for new and used freighter aircraft.

Aircraft Leasing Companies

Aircraft leasing companies are crucial financial partners for Boeing, functioning as major purchasers of new aircraft. These entities acquire planes and subsequently lease them to airlines globally, acting as intermediaries that enable fleet growth and modernization for carriers. For instance, in 2024, companies like AerCap, Avolon, and SMBC Aviation Capital continued to be significant buyers of Boeing's commercial jets, reflecting their ongoing demand for versatile and efficient aircraft.

Their primary interest lies in acquiring reliable aircraft models that promise strong residual values and favorable leasing agreements. This focus on long-term asset performance is paramount for their business model. The global aircraft leasing market is substantial, with lease agreements accounting for a significant portion of airline fleets; by the end of 2023, it was estimated that over 40% of the world's commercial aircraft were leased.

- Key Motivations: Leasing companies prioritize aircraft with proven operational efficiency and high market demand to ensure consistent lease revenue and strong resale value.

- Market Influence: They facilitate fleet expansion for airlines, often enabling carriers to acquire new technology without the upfront capital expenditure of direct purchase.

- Financial Strategy: Their business hinges on managing aircraft assets effectively, securing competitive financing, and optimizing lease terms to generate returns.

Boeing's customer segments are diverse, ranging from commercial airlines and government defense agencies to space operators and cargo carriers. Each segment has distinct needs, from fleet modernization and national security to space exploration and efficient global logistics. Aircraft leasing companies also play a vital role as purchasers, facilitating access to new aircraft for airlines worldwide.

Cost Structure

Boeing's commitment to innovation is evident in its substantial Research and Development (R&D) expenses. These costs are fundamental to developing new aircraft, advanced defense systems, and cutting-edge technologies that keep Boeing at the forefront of the aerospace industry.

In 2024, Boeing allocated $3.812 billion to R&D. This significant investment underscores the company's dedication to future product development and maintaining its competitive advantage in a rapidly evolving market.

Manufacturing and production costs represent a substantial segment of Boeing's expense base, driven by the direct costs of raw materials like titanium, essential components, and the skilled labor involved in assembly. These expenditures are inherently volatile, reacting to shifts in supply chain reliability, fluctuating material prices, and the ongoing pursuit of production efficiency. For instance, in 2023, Boeing reported significant production challenges impacting its delivery targets, directly influencing the per-unit cost of its aircraft.

Boeing's cost structure heavily relies on its extensive global workforce, encompassing salaries, wages, and comprehensive benefits for its highly skilled engineers, technicians, and support staff. In 2024, the company continued to manage these significant labor expenses, which are crucial for its complex manufacturing and design processes.

The aerospace giant's operational stability and cost management are intrinsically linked to its labor agreements and the potential for industrial action. For instance, past labor disputes have highlighted the direct financial impact of strikes on production schedules and overall expenditures.

Boeing has also employed workforce adjustments as a strategic element of its cost-reduction initiatives. These measures, including reductions in force, are implemented to streamline operations and improve financial efficiency in a competitive market.

Supply Chain and Logistics Costs

Managing Boeing's extensive global supply chain incurs significant costs related to sourcing parts, moving goods, and holding inventory. In 2024, the company continued its strategy of optimizing these expenses through efficiency drives and fostering deeper relationships with its key suppliers. These efforts are crucial for maintaining competitive pricing and ensuring timely delivery of aircraft to customers worldwide.

Boeing's commitment to cost reduction within its supply chain is a continuous process. For instance, the company has been working to streamline its logistics networks and implement advanced inventory management systems to minimize waste and holding costs. These initiatives are vital, especially given the potential for supply chain disruptions to escalate expenses and cause production setbacks, impacting delivery schedules.

- Procurement Expenses: Costs associated with acquiring raw materials and components from a global network of suppliers.

- Logistics and Transportation: Expenses for shipping, freight, and warehousing of parts and finished aircraft.

- Inventory Management: Costs related to holding and managing stock of components and work-in-progress.

- Supplier Partnerships: Investment in building and maintaining long-term relationships to ensure reliability and cost-effectiveness.

Fixed-Price Development Program Charges

Boeing's Defense, Space & Security segment frequently incurs substantial charges and losses on fixed-price development contracts. These financial hits stem from persistent cost overruns and unforeseen technical hurdles inherent in complex aerospace projects.

For instance, in 2023, Boeing reported significant charges related to its fixed-price development programs, impacting overall profitability. These charges underscore the high-risk nature of these contracts and the ongoing efforts to mitigate them.

- 2023 Charges: Boeing's defense segment faced billions in charges, notably impacting programs like the T-7 trainer and Starliner.

- Impact on Profitability: These charges directly reduced operating income, highlighting the financial strain of development cost overruns.

- Risk Mitigation: The company actively pursues contract restructuring and improved program management to reduce future charges.

- Focus Area: Fixed-price development contracts remain a critical area for operational improvement and financial risk management.

Boeing's cost structure is significantly influenced by its substantial investments in Research and Development (R&D), aiming to maintain technological leadership. Manufacturing and production costs, driven by raw materials and skilled labor, form another major expense. The company also manages considerable labor costs for its global workforce and faces expenses related to its extensive supply chain operations.

| Cost Category | 2024 Data/Focus | Impact |

|---|---|---|

| Research & Development (R&D) | $3.812 billion allocated | Drives innovation and future product development |

| Manufacturing & Production | Volatile due to material prices and supply chain | Direct costs of aircraft assembly, impacts per-unit cost |

| Labor Costs | Management of salaries, wages, and benefits for a skilled workforce | Essential for complex design and manufacturing processes |

| Supply Chain Management | Optimizing sourcing, logistics, and inventory | Ensures competitive pricing and timely delivery |

Revenue Streams

Boeing's core revenue generation hinges on the sale of commercial aircraft, with popular models such as the 737 MAX, 787 Dreamliner, and the upcoming 777X forming the backbone of these transactions. These sophisticated machines are sold to a global clientele of airlines and aircraft leasing companies.

This segment, despite facing challenges like production slowdowns, historically accounts for the most significant share of Boeing's overall revenue. For instance, in 2023, commercial airplanes accounted for approximately 63% of Boeing's total revenue, reaching $82.4 billion, underscoring its critical importance.

The sales cycle for these large capital assets is lengthy, with airlines and leasing firms often placing orders years ahead of delivery. This forward-looking order book provides a degree of revenue visibility, though it remains subject to economic cycles and specific program execution.

Boeing's Defense, Space & Security segment generates revenue primarily through the sale of sophisticated military aircraft, advanced weapon systems, and vital satellites to governmental and defense organizations worldwide. This stream is characterized by its stability, often secured through multi-year government contracts, which provides a predictable income unlike the more cyclical commercial aviation market.

Key revenue drivers within this segment include iconic platforms such as fighter jets, aerial refueling tankers, and critical surveillance aircraft. For instance, in 2024, Boeing continued to deliver its F-15EX Eagle II fighter jets to the U.S. Air Force and its P-8A Poseidon maritime patrol aircraft to various international customers, underscoring the ongoing demand for its advanced defense capabilities.

Boeing's Global Services segment is a substantial and increasingly important revenue generator, offering a wide array of aftermarket support. This encompasses everything from essential aircraft maintenance and crucial modifications to performance-enhancing upgrades. The segment also profits from the sale of spare parts, advanced digital solutions, and comprehensive training programs tailored for both commercial airlines and defense clients.

In 2024, this segment demonstrated its robust profitability, significantly bolstering Boeing's overall operating income. For instance, Boeing reported that its Global Services segment generated over $15 billion in revenue for the fiscal year 2023, with expectations for continued growth in 2024, highlighting its critical role in the company's financial health.

Government Contracts and Support Services

Boeing secures substantial revenue through government contracts that extend beyond initial product sales. These agreements encompass vital research, development, and engineering services for sophisticated defense programs. For instance, in 2024, Boeing's defense segment, which heavily relies on these contracts, continued to be a cornerstone of its financial performance, reflecting the ongoing demand for advanced military capabilities.

These contracts often translate into long-term commitments for sustainment, crucial upgrades, and essential technical assistance for existing defense platforms. This structure creates a reliable and predictable revenue stream, insulating a portion of Boeing's business from the more cyclical nature of commercial aviation markets. The company's ability to secure and manage these complex, multi-year agreements is a key driver of its financial stability.

- Long-Term Sustainment: Boeing generates revenue by providing ongoing maintenance, repair, and operational support for delivered defense systems, ensuring their readiness and effectiveness over extended periods.

- Research and Development: Significant portions of government contracts are allocated to the research and development of next-generation defense technologies and platforms, fostering innovation and future revenue opportunities.

- Engineering and Technical Services: Boeing offers specialized engineering expertise and technical support throughout the lifecycle of defense programs, from initial design to operational deployment and upgrades.

- Program Upgrades and Modernization: Revenue is also derived from contracts focused on modernizing and upgrading existing military aircraft and systems to meet evolving threat landscapes and technological advancements.

Training and Simulation Services

Boeing also generates revenue by offering specialized training and simulation services to aviation professionals worldwide. These offerings are crucial for ensuring safe operations and regulatory compliance.

These services form a consistent revenue stream within Boeing's Global Services segment. The demand for such training is anticipated to see substantial growth in the coming years.

- Pilot Training: Comprehensive programs for commercial and military pilots.

- Maintenance Training: Technical instruction for aircraft maintenance personnel.

- Simulation Services: Advanced flight simulators and virtual reality training tools.

- Air Traffic Control Training: Specialized courses for air traffic management professionals.

Boeing's revenue streams are multifaceted, primarily driven by the sale of commercial aircraft and defense systems. The Global Services segment, offering aftermarket support and training, is also a significant contributor, showing robust growth. Government contracts for research, development, and sustainment of defense platforms provide a stable, long-term income base.

| Revenue Stream | Description | 2023 Revenue (Approx.) | Key Drivers |

|---|---|---|---|

| Commercial Aircraft Sales | Sale of new commercial airplanes to airlines and leasing companies. | $82.4 billion | 737 MAX, 787 Dreamliner, 777X |

| Defense, Space & Security | Sale of military aircraft, weapon systems, and satellites to governments. | (Segment total not directly comparable to Commercial Aircraft Sales) | Fighter jets (F-15EX), P-8A Poseidon, surveillance aircraft |

| Global Services | Aftermarket support, maintenance, upgrades, spare parts, training. | Over $15 billion | Aftermarket services, digital solutions, pilot and maintenance training |

| Government Contracts (R&D/Sustainment) | Research, development, engineering, and sustainment services for defense programs. | (Integrated within Defense segment reporting) | Long-term government commitments, program upgrades |

Business Model Canvas Data Sources

The Boeing Business Model Canvas is constructed using a blend of internal financial reports, extensive market research, and competitive analysis. These diverse data sources ensure a comprehensive and accurate representation of Boeing's strategic framework.