Boeing Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boeing Bundle

Boeing operates in a highly competitive aerospace industry, facing significant pressure from established rivals and the constant threat of new entrants. Understanding the intricate balance of power between suppliers, buyers, and substitute products is crucial for navigating this complex landscape. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Boeing’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Boeing's reliance on a concentrated group of highly specialized suppliers for critical components like engines, avionics, and aerostructures significantly amplifies supplier bargaining power. Companies such as GE Aviation, Honeywell Aerospace, and Raytheon Technologies dominate their respective niches, holding substantial market shares. This limited pool of qualified suppliers for complex aerospace parts grants them considerable leverage over Boeing concerning pricing and delivery timelines.

Switching suppliers for specialized aerospace components is an extremely costly and time-consuming endeavor for Boeing. The process involves extensive redesign, rigorous testing, and re-certification of aircraft systems, which can amount to millions of dollars per aircraft.

These high switching costs further tie Boeing to its existing suppliers, amplifying the latter's bargaining power. For instance, in 2023, Boeing continued to rely on a select group of key suppliers for critical systems, with contract renegotiations often reflecting the deep integration and certification hurdles involved.

Many of Boeing's critical suppliers, such as those providing advanced avionics or specialized composite materials, possess unique, proprietary technologies and extensive engineering know-how. This expertise is not easily replicated and is fundamental to the performance and cutting-edge innovation of Boeing's aircraft designs.

These suppliers often make substantial investments in research and development, driving technological progress within the aerospace sector. For instance, in 2024, leading aerospace suppliers continued to allocate significant portions of their revenue to R&D, focusing on areas like advanced propulsion and sustainable aviation fuels, directly benefiting Boeing's product evolution.

Boeing's dependence on this advanced, often patented, technology grants these suppliers considerable bargaining power. This leverage can translate into higher prices for components and a notable influence on Boeing's product development timelines and its overall innovation trajectory.

Supply Chain Disruptions and Constraints

Ongoing global supply chain disruptions, such as shortages of critical materials like titanium and specialized aerospace components, have notably amplified supplier leverage. These persistent issues translate directly into production bottlenecks and elevated costs for Boeing, as suppliers grapple with their own capacity and resource limitations.

Boeing's 2024 performance has been directly impacted by these supplier constraints, with reports indicating production setbacks and reduced aircraft delivery targets. For instance, the company has faced scrutiny over its 737 MAX production rates, with supplier quality issues contributing to these challenges.

- Increased Lead Times: Suppliers are dictating longer lead times for essential parts, forcing Boeing to plan further in advance and absorb potential delays.

- Price Hikes: Limited availability of specialized components has allowed suppliers to command higher prices, impacting Boeing's cost of goods sold.

- Production Halts: Shortages of specific parts have, at times, led to temporary suspensions of production lines, directly affecting output volume.

Long-Term Strategic Partnerships

Boeing's strategy of forging long-term strategic partnerships, often lasting 12-15 years with key suppliers, significantly influences supplier bargaining power. These deep relationships can involve exclusive supply agreements and collaborative technology development, creating a strong interdependence.

While these partnerships aim for stability, they also mean Boeing's operational success is closely tied to its suppliers' financial health and performance. This mutual reliance can amplify the suppliers' leverage, particularly when specialized components or critical materials are involved.

- Long-Term Commitments: Partnerships can extend for 12-15 years, locking Boeing into specific supplier relationships.

- Exclusive Agreements: Exclusive supply contracts further concentrate power with the supplier.

- Joint Development: Collaborative technology projects create shared risks and rewards, increasing supplier influence.

- Interdependence: Boeing's reliance on supplier performance for its own output solidifies supplier bargaining power.

Boeing's bargaining power with its suppliers is significantly weakened due to the highly concentrated nature of the aerospace supply chain, where a few specialized firms like GE Aviation and Raytheon Technologies dominate critical component markets. This concentration, coupled with the immense cost and complexity of switching suppliers—often involving millions in redesign and recertification—gives these suppliers considerable leverage over pricing and delivery schedules. Furthermore, suppliers' proprietary technologies and ongoing R&D investments, such as those focusing on sustainable aviation in 2024, solidify their influence, directly impacting Boeing's production and innovation timelines.

| Supplier Type | Key Suppliers | Impact on Boeing |

|---|---|---|

| Engines | GE Aviation, Rolls-Royce | High reliance, significant pricing power |

| Avionics | Honeywell Aerospace, Garmin | Proprietary technology, high switching costs |

| Aerostructures | Spirit AeroSystems, Triumph Group | Concentrated market, supply chain vulnerability |

What is included in the product

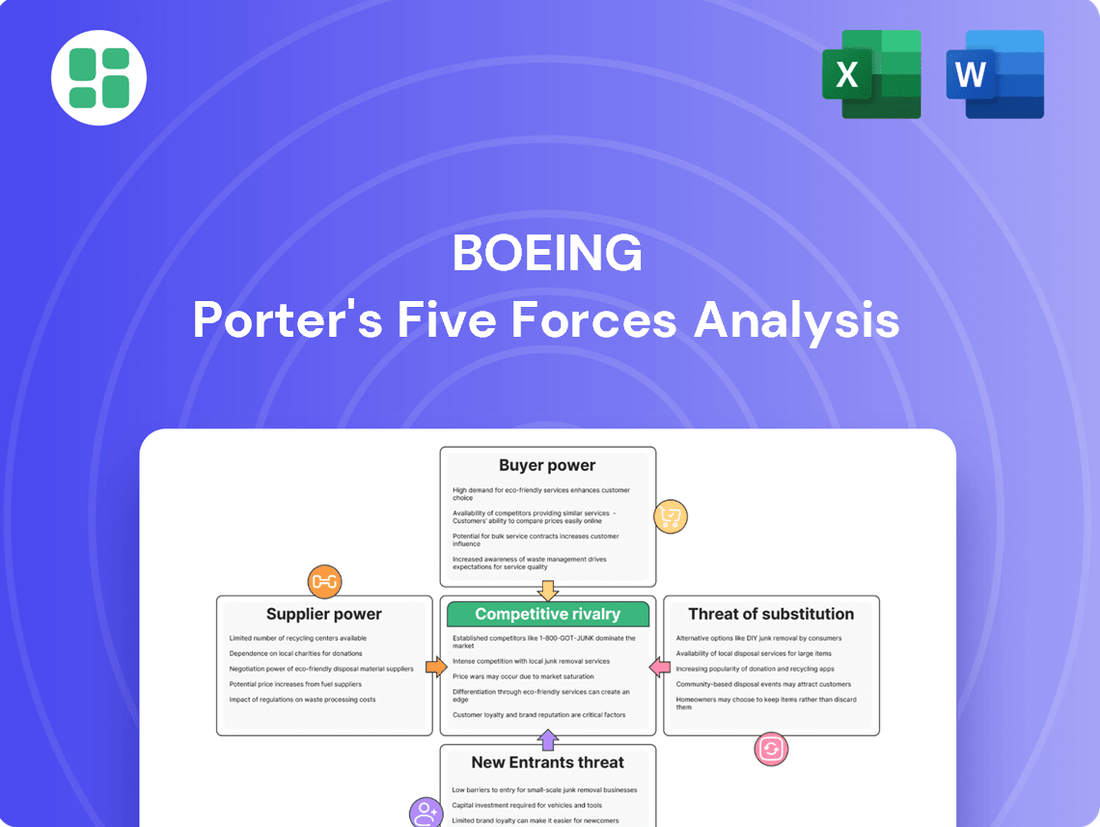

Boeing's Porter's Five Forces analysis examines the intense rivalry within the aerospace industry, the significant bargaining power of its airline customers and suppliers, and the high barriers to entry for new competitors.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces on an intuitive interactive dashboard.

Customers Bargaining Power

Boeing's customer base is concentrated, featuring a limited number of major commercial airlines, governments, and defense departments worldwide. These entities, like the top global carriers, represent significant order volumes, giving them considerable leverage.

The sheer scale of orders placed by these sophisticated buyers, such as the hundreds of aircraft ordered by airlines like American Airlines or United Airlines in a single transaction, amplifies their bargaining power. Their deep understanding of aircraft specifications, pricing, and market alternatives further strengthens their position.

In 2024, the airline industry continues to navigate fluctuating fuel costs and passenger demand, making cost-effective aircraft acquisition paramount. This economic environment further empowers large airline customers to negotiate favorable terms with manufacturers like Boeing.

The sheer scale of aircraft acquisition, often involving multi-billion dollar, multi-year commitments for airlines and governments, grants customers substantial bargaining power. This high purchase value means customers can negotiate aggressively on pricing, customization, and after-sales service, directly impacting Boeing's margins.

For instance, a single wide-body aircraft order can easily exceed $300 million, and airlines frequently secure deals for dozens of planes. The financial well-being of these carriers, therefore, becomes a critical factor in their purchasing decisions and their leverage with manufacturers like Boeing.

The commercial aircraft market is largely a duopoly, with Boeing and Airbus as the dominant players. This structure significantly increases the bargaining power of customers, primarily airlines. Airlines can leverage the competition between these two giants to negotiate more favorable pricing and terms for their aircraft orders.

Airlines have the ability to pit Boeing against Airbus, seeking the best deals available. This dynamic is particularly relevant as airlines make substantial capital investments in new fleets. For instance, in 2023, Airbus secured a significant order for 150 A320neo family aircraft from IndiGo, a major Indian carrier, highlighting the competitive landscape for new aircraft deliveries.

Recent production issues faced by Boeing have further amplified customer bargaining power. Airlines experiencing delays or quality concerns with Boeing aircraft may naturally lean towards Airbus for their immediate and future needs. This situation allows airlines to press for concessions and better delivery schedules from Boeing, knowing that alternatives exist and are actively seeking their business.

Impact of Production Delays and Quality Issues

Recent production delays and quality control issues, notably with the 737 MAX program, have significantly eroded Boeing's reputation, thereby strengthening the bargaining power of its customers. These persistent problems have compelled Boeing to offer more favorable contract terms and compensation to its airline clients to manage order backlogs and maintain crucial relationships.

The impact of these disruptions is substantial. For instance, by early 2024, Boeing faced scrutiny over manufacturing quality, leading to increased inspections and potential delivery slowdowns. This situation gives airlines more leverage, as they can potentially delay or even re-evaluate their orders.

- Increased Customer Leverage: Quality issues and delivery delays directly empower airlines to negotiate better pricing, more flexible payment terms, and enhanced support packages.

- Risk of Order Diversion: Airlines may increasingly consider or divert orders to competitors like Airbus, especially if Boeing's production and quality issues persist, impacting its market share.

- Financial Repercussions: Boeing has already incurred costs related to these issues, including compensation to airlines and potential penalties for delayed deliveries, affecting its profitability and cash flow.

Aftermarket Services and Support Requirements

Customers, particularly large airlines, often negotiate not just the initial aircraft purchase but also extensive long-term aftermarket services. This includes crucial maintenance, repair, and overhaul (MRO) operations, pilot and technician training, and a steady supply of spare parts. For instance, in 2024, airlines continue to scrutinize MRO contracts as a significant portion of their operating budget, often exceeding 15% of total fleet costs annually.

The persistent demand for these ongoing support services grants customers considerable leverage. They can, and do, use this to negotiate more competitive pricing and insist on high-quality service delivery. These aftermarket elements represent substantial operational expenses throughout an aircraft's lifecycle, making their cost and reliability paramount for airline profitability.

- Significant Operating Costs: Aftermarket services can account for over 15% of annual fleet operating expenses for airlines.

- Long-Term Dependency: Airlines require continuous MRO, training, and parts, creating a long-term reliance on suppliers.

- Negotiating Power: This dependency allows customers to negotiate favorable terms and service level agreements.

- Quality Imperative: Ensuring high-quality support is critical for operational efficiency and safety, further empowering customer demands.

Boeing's bargaining power with customers is significantly challenged by the concentrated nature of its buyer base, primarily large airlines and governments. These major clients, placing orders worth billions, wield considerable influence due to the sheer volume and value of their purchases. In 2024, economic pressures on airlines further amplify their negotiation strength, as cost-effectiveness remains a top priority.

The duopolistic market structure, with Airbus as the main competitor, allows airlines to strategically leverage competition for better pricing and terms. Recent production and quality issues at Boeing have further tipped the scales, empowering customers to demand concessions and explore alternatives. This dynamic is evident as airlines scrutinize long-term aftermarket services, which represent substantial operational costs, using this dependency to negotiate favorable contracts.

| Customer Type | Order Value (Approx.) | Key Negotiation Points | Impact on Boeing |

|---|---|---|---|

| Major Airlines (e.g., United, Delta) | $10B+ (for large fleet orders) | Pricing, delivery schedules, customization, aftermarket support | Reduced profit margins, potential order delays/cancellations |

| Governments/Defense Departments | Variable (significant for specialized aircraft) | Specifications, long-term support, pricing | Complex contract negotiations, geopolitical considerations |

| Leasing Companies | $1B+ (for portfolio acquisitions) | Bulk discounts, lease terms, residual value guarantees | Influences fleet availability and pricing for airlines |

Preview the Actual Deliverable

Boeing Porter's Five Forces Analysis

This preview showcases the complete Boeing Porter's Five Forces Analysis, offering an in-depth examination of industry competitiveness. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full accessibility to this professionally crafted report.

Rivalry Among Competitors

The commercial airplane market is essentially a tight race between two giants: Boeing and Airbus. This intense rivalry means they are constantly battling for every single order, making the competition incredibly direct.

Both manufacturers offer very similar planes across most categories, forcing them to compete fiercely on price, attractive financing deals, and cutting-edge technology to win over airlines. For instance, in 2023, Boeing delivered 771 aircraft, while Airbus delivered 735, highlighting their close competition for market dominance.

The aerospace sector, particularly for major players like Boeing, is defined by immense upfront investments. Think billions in research and development for new aircraft models, massive manufacturing plants, and the rigorous, lengthy process of getting planes certified. These aren't small sums; the development cost for Boeing's 787 Dreamliner, for instance, was estimated to be around $32 billion.

This financial reality creates a powerful drive for high production volumes. To spread those enormous fixed costs and achieve profitability, companies must sell a lot of aircraft. This pressure intensifies competition, as both Boeing and its primary rival, Airbus, are locked in a constant battle to secure substantial order backlogs, which are crucial for maintaining operational efficiency and financial stability.

In 2023, Boeing reported a backlog of over 5,600 aircraft, a testament to the ongoing demand but also the scale of production required to service it. Similarly, Airbus maintained a robust backlog, highlighting the intense rivalry driven by the need to achieve economies of scale in a capital-intensive industry.

Competitive rivalry in the commercial aircraft sector, particularly between Boeing and Airbus, is intensely driven by technological advancements and operational efficiency. Key differentiators include fuel efficiency, extended flight range, passenger capacity, robust safety records, and the incorporation of cutting-edge avionics and lightweight materials.

Both Boeing and Airbus are locked in a perpetual cycle of significant research and development investment. For instance, Boeing's 2023 annual report highlighted a substantial commitment to R&D, aiming to enhance aircraft performance and passenger experience. This ongoing innovation is crucial for maintaining a competitive edge and attracting airline customers who prioritize cost savings and operational flexibility.

Global Market Share Battles and Regional Focus

The rivalry between Boeing and Airbus is intense, with both manufacturers fiercely competing for global market share. This competition is particularly pronounced in rapidly growing regions such as Asia and the Middle East, where demand for new aircraft is high.

Recent production challenges for Boeing have provided an opening for Airbus. For instance, in 2023, Airbus secured a significant number of net orders, outpacing Boeing and demonstrating Airbus's ability to capitalize on Boeing's operational hurdles. This shift in momentum highlights the dynamic nature of their market share battles.

- Airbus's Net Order Growth: Airbus reported a substantial increase in net orders in 2023, further solidifying its position against Boeing.

- Boeing's Production Setbacks: Boeing has faced ongoing production issues, impacting its delivery schedules and market share in the short term.

- Regional Market Dynamics: Emerging markets in Asia and the Middle East are key battlegrounds for both manufacturers, influencing global order books.

- Competitive Landscape: The duopoly of Boeing and Airbus means intense direct competition, with each company striving to gain an edge through product development and customer relationships.

Competition in Defense, Space, and Security Segments

While Boeing's commercial aircraft business operates as a near duopoly, its Defense, Space & Security (BDS) segment encounters a more fragmented and intensely competitive landscape. Key rivals such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies vie aggressively for government contracts, particularly in areas like aerospace, defense systems, and intelligence. This rivalry is fueled by the critical need for technological innovation and is significantly influenced by evolving geopolitical situations and national security priorities.

The competition within these segments is characterized by a strong emphasis on securing lucrative government contracts. For instance, in 2024, the U.S. Department of Defense continued to award substantial multi-year contracts for aircraft, missile defense, and surveillance technologies. Boeing's BDS segment competes directly with these major players for these significant revenue streams, where technological prowess and established relationships with government agencies are paramount.

- Major Competitors: Lockheed Martin, Northrop Grumman, Raytheon Technologies are primary rivals in defense, space, and security.

- Drivers of Competition: Government contracts, technological superiority, and geopolitical developments shape the competitive environment.

- Market Dynamics: The sector is driven by significant R&D investments and the ability to deliver advanced, reliable solutions for national security needs.

The commercial aircraft market is a stark duopoly, with Boeing and Airbus locked in a constant, high-stakes competition for every order. This intense rivalry necessitates continuous innovation in fuel efficiency, range, and passenger capacity, with both manufacturers investing heavily in research and development. For example, in 2023, Boeing delivered 771 aircraft while Airbus delivered 735, illustrating their close battle for market dominance. The need to recoup massive R&D and production costs, often in the tens of billions of dollars like Boeing's 787 program, drives both companies to maximize production volumes and secure large order backlogs, which exceeded 5,600 aircraft for Boeing in 2023.

Boeing's defense segment faces a more diverse competitive field, including giants like Lockheed Martin, Northrop Grumman, and Raytheon Technologies. Competition here is driven by securing substantial government contracts, technological advancement, and responding to global geopolitical shifts. The U.S. Department of Defense's significant contract awards in 2024 for advanced aerospace and defense systems underscore the importance of innovation and established relationships in this arena.

| Manufacturer | 2023 Deliveries | 2023 Net Orders | 2023 Backlog (Approx.) |

|---|---|---|---|

| Boeing | 771 | 1,250 | 5,600+ |

| Airbus | 735 | 2,094 | 8,000+ |

SSubstitutes Threaten

Advancements in videoconferencing and telepresence technologies offer a growing substitute for business travel. For instance, in 2024, many companies continued to embrace hybrid work models, reducing the need for frequent in-person meetings. This trend directly impacts the demand for business class air travel, a key revenue stream for airlines.

The expansion of high-speed rail networks, especially in densely populated regions like Europe and Asia, presents a significant threat of substitution for short-to-medium haul air travel. For instance, the European Union has been actively investing in its Trans-European Transport Network, aiming to create seamless high-speed rail connections across member states. This growing infrastructure can draw passengers away from regional flights, impacting demand for aircraft like Boeing's smaller commercial jets.

Maritime shipping presents a significant threat to Boeing's cargo aircraft business, especially for non-time-sensitive and non-perishable goods. This alternative offers a substantially lower cost per ton-mile and a reduced environmental footprint compared to air freight. For instance, in 2024, ocean freight rates remained considerably lower than air cargo rates, making it an attractive option for many businesses looking to optimize their supply chain expenditures.

This cost advantage directly impacts Boeing's freighter sales and the operational utilization of its existing cargo aircraft fleet. Companies prioritizing cost savings over speed are increasingly opting for sea routes, thereby diminishing the demand for air cargo capacity and, consequently, new freighter orders. The ongoing growth in global maritime trade volumes further underscores the persistent nature of this substitute threat.

Unmanned Aerial Vehicles (UAVs) in Defense

The rise of Unmanned Aerial Vehicles (UAVs), or drones, presents a significant threat of substitution for certain traditional manned aircraft roles within the defense industry. These unmanned systems are increasingly capable of performing critical missions like intelligence, surveillance, and reconnaissance (ISR), as well as precision strike operations, directly competing with capabilities historically provided by Boeing's manned platforms.

This substitution trend is fueled by several factors, including the lower cost of acquisition and operation for UAVs compared to manned aircraft, reduced risk to human life, and enhanced endurance for prolonged missions. For instance, the global military drone market was valued at approximately $11.5 billion in 2023 and is projected to grow substantially, indicating a clear shift in defense spending towards unmanned solutions.

- Growing UAV Capabilities: Drones are now equipped with advanced sensors and weaponry, making them viable alternatives for ISR and tactical strike missions.

- Cost-Effectiveness: UAVs generally offer a lower total cost of ownership than manned aircraft, making them attractive for budget-conscious defense ministries.

- Reduced Risk: The deployment of unmanned systems eliminates the risk to pilots in dangerous combat zones, a significant advantage in modern warfare.

- Market Growth: Projections indicate continued robust growth in the military drone sector, underscoring the increasing reliance on these technologies.

Emerging Personal Air Mobility Solutions (Long-term)

While still in early development, emerging personal air mobility solutions like electric vertical takeoff and landing (eVTOL) aircraft represent a potential long-term threat of substitutes for certain travel segments. These advanced aerial vehicles could eventually offer alternative point-to-point transportation, particularly for niche urban or regional markets, bypassing traditional ground infrastructure. For instance, by 2024, significant investment continues to flow into UAM startups, with companies like Joby Aviation and Archer Aviation making strides in testing and certification processes.

Although eVTOLs are unlikely to replace large commercial jetliners for mass transit in the near to medium term, their ability to provide direct, on-demand travel could disrupt specific routes or high-value passenger segments. The perceived convenience and potential time savings offered by these solutions could draw demand away from conventional air travel for shorter, more specialized journeys. Market forecasts suggest a growing UAM sector, with some analyses projecting it to be a multi-billion dollar industry by the end of the decade, indicating a growing potential for substitution.

The threat of substitutes from personal air mobility is currently low for Boeing's core business, but its long-term trajectory warrants careful monitoring.

- Nascent Stage: UAM and eVTOL technologies are still in early development, limiting their immediate impact.

- Niche Market Potential: These solutions are more likely to serve specific, high-value point-to-point travel needs initially.

- Long-Term Disruption: Continued advancements and investment could lead to significant substitution possibilities in the future.

- Investment Growth: The UAM sector saw substantial investment in 2024, with key players progressing towards operationalization.

The threat of substitutes for Boeing is multifaceted, encompassing technological advancements and evolving consumer preferences. While direct substitutes for large commercial aircraft are limited, alternative modes of transport and new technologies pose indirect threats. For instance, the increasing sophistication of videoconferencing in 2024 continues to reduce the need for some business travel, impacting airline passenger volumes.

High-speed rail networks, particularly in Europe and Asia, offer a compelling substitute for short to medium-haul flights, diverting passengers from regional air routes. Furthermore, maritime shipping remains a cost-effective alternative for non-time-sensitive cargo, directly affecting Boeing's freighter business. The military sector also faces substitution threats from increasingly capable unmanned aerial vehicles (UAVs), which offer a lower-cost, lower-risk alternative to manned aircraft for certain missions.

Emerging personal air mobility solutions like eVTOLs, while still in early development as of 2024, represent a potential long-term disruptor for niche travel segments. These evolving alternatives highlight the need for Boeing to remain agile and innovative in its product development and market strategy.

Entrants Threaten

The aerospace manufacturing industry is characterized by exceptionally high capital requirements. Developing a new commercial aircraft program alone can cost tens of billions of dollars, encompassing extensive research and development, the establishment of state-of-the-art manufacturing facilities, and specialized tooling.

These colossal upfront investments create an almost insurmountable financial barrier for potential new entrants. For instance, Boeing's 787 Dreamliner program reportedly incurred development costs exceeding $30 billion, illustrating the immense scale of capital needed to compete in this sector.

New entrants into the aerospace manufacturing sector, like Boeing, confront formidable regulatory barriers. Obtaining certifications for aircraft safety, environmental compliance, and airworthiness from bodies such as the FAA and EASA is a protracted and exceptionally expensive undertaking. For instance, the development of a new commercial aircraft can easily cost tens of billions of dollars and take over a decade to certify, a significant deterrent to potential competitors.

Boeing and Airbus have cultivated decades-long, deeply entrenched relationships with major airlines, governments, and space agencies. This fosters formidable brand loyalty and trust, making it exceptionally difficult for newcomers to penetrate these established networks and gain the confidence needed for high-value, critical purchases.

Complex Global Supply Chain and Infrastructure

The sheer complexity of building and operating a global supply chain for aerospace components, which can involve tens of thousands of specialized parts, presents a massive hurdle for potential new entrants. Boeing, for instance, manages an intricate network of suppliers and logistics to ensure timely delivery and quality control for its aircraft. This complexity is amplified by the need for a worldwide infrastructure supporting maintenance, training, and customer service, making it incredibly difficult for newcomers to replicate.

Consider the vastness of the aerospace supply chain: in 2023, Boeing reported a total supply chain spend of over $30 billion, highlighting the scale of operations required. Establishing a comparable system, complete with the necessary certifications, supplier relationships, and logistical expertise, is a monumental and capital-intensive endeavor. This intricate web of dependencies and global reach acts as a significant deterrent to new companies attempting to enter the market.

- Global Supply Chain Complexity: Managing thousands of specialized aerospace parts across numerous countries requires sophisticated logistics and quality assurance, a significant barrier for new entrants.

- Infrastructure Investment: Establishing worldwide maintenance, training, and support networks demands substantial capital and time, deterring potential competitors.

- Supplier Relationships: Boeing's long-standing relationships with its extensive supplier base, built over decades, are difficult for new firms to replicate quickly.

- Regulatory Compliance: Navigating the stringent and varied regulatory environments across different aviation markets adds another layer of complexity and cost for new entrants.

Intellectual Property and Technological Expertise

The threat of new entrants for Boeing, particularly concerning intellectual property and technological expertise, remains relatively low. Established players like Boeing have cultivated extensive intellectual property portfolios, including numerous patents and proprietary designs, developed over decades of operation. For instance, Boeing's commitment to research and development is substantial, with R&D spending often in the billions annually, underscoring the deep technological foundation that is difficult for newcomers to match.

Replicating Boeing's accumulated engineering know-how, sophisticated design capabilities, and intricate manufacturing processes represents a significant hurdle. This depth of knowledge, honed through years of experience and innovation, requires immense capital investment and a considerable timeframe to develop, effectively deterring most potential new entrants from entering the commercial aircraft manufacturing sector.

- Vast Intellectual Property: Boeing holds thousands of patents covering aircraft design, materials, and manufacturing processes.

- Centuries of Expertise: Over 100 years of accumulated engineering and operational experience.

- High Barrier to Entry: Replicating this knowledge base requires massive, long-term investment in R&D and talent.

- Technological Sophistication: Advanced capabilities in areas like aerodynamics, materials science, and avionics are difficult to replicate quickly.

The threat of new entrants into the commercial aerospace manufacturing sector, where Boeing operates, is exceptionally low. The industry demands immense capital investment, with aircraft development costs easily reaching tens of billions of dollars, as seen with Boeing's $30+ billion 787 program. Regulatory hurdles are also substantial, requiring lengthy and costly certifications from agencies like the FAA and EASA, often taking over a decade and costing billions. Furthermore, established players like Boeing have built deep, long-standing relationships with airlines and governments, fostering brand loyalty that is difficult for newcomers to overcome.

The complexity of global supply chains and the need for extensive infrastructure for maintenance and support further solidify these barriers. For instance, Boeing's 2023 supply chain spend exceeded $30 billion, illustrating the scale required. Finally, Boeing's vast intellectual property and accumulated engineering expertise, backed by billions in annual R&D, create a formidable technological moat that deters potential competitors.

| Barrier Type | Description | Example/Data Point |

| Capital Requirements | Extremely high upfront investment for R&D, facilities, and tooling. | Boeing 787 development costs exceeded $30 billion. |

| Regulatory Hurdles | Protracted and expensive certification processes for safety and airworthiness. | New aircraft certification can take over a decade and cost billions. |

| Supplier Relationships | Decades-long, entrenched relationships with a vast network of specialized suppliers. | Boeing's 2023 supply chain spend was over $30 billion. |

| Intellectual Property & Expertise | Extensive patents, proprietary designs, and accumulated engineering know-how. | Billions spent annually on R&D by established players like Boeing. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Boeing is built upon a robust foundation of data, including Boeing's annual reports and SEC filings, alongside industry-specific reports from aviation consultancies and market research firms. We also incorporate data from government aviation authorities and macroeconomic indicators to provide a comprehensive competitive landscape.