Boeing PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boeing Bundle

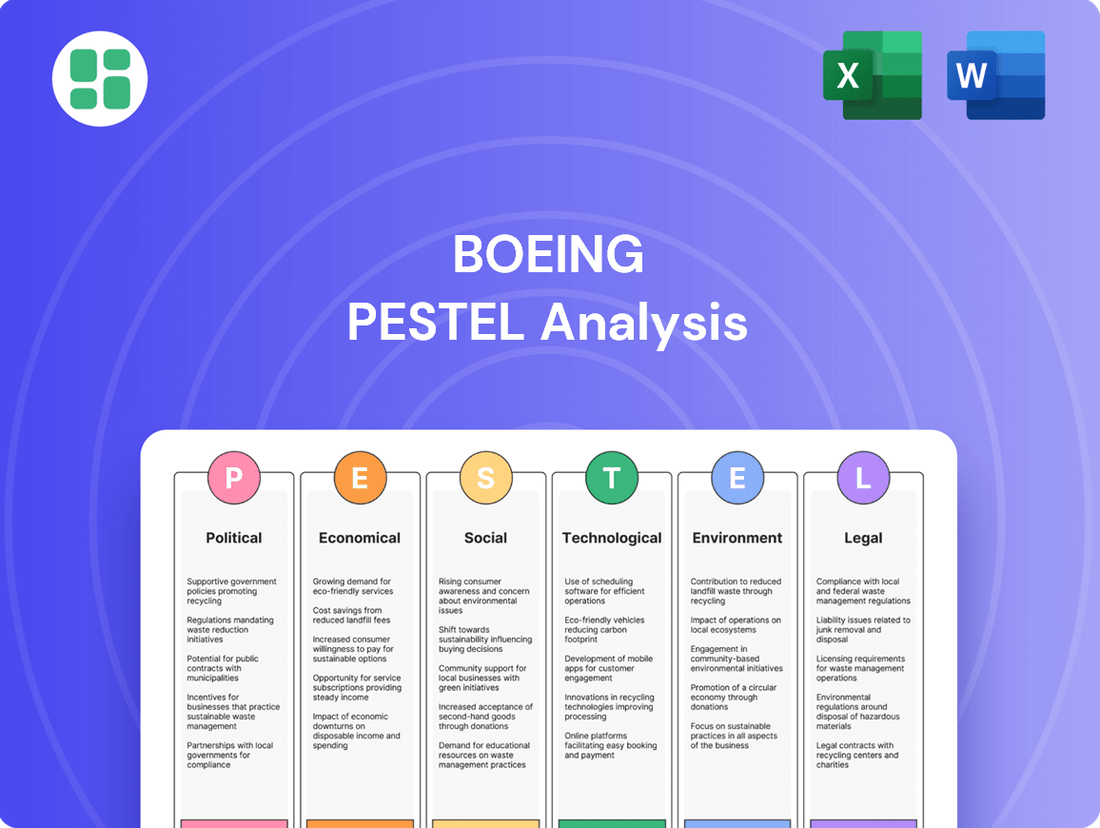

Uncover the intricate web of political, economic, social, technological, legal, and environmental factors influencing Boeing's trajectory. Our comprehensive PESTLE analysis provides the critical intelligence you need to anticipate market shifts and identify strategic opportunities. Download the full version now to gain a competitive advantage and make informed decisions.

Political factors

Boeing's operations are heavily influenced by government regulations, with the Federal Aviation Administration (FAA) playing a critical role. Following a series of safety concerns, particularly involving the 737 MAX, the FAA has intensified its oversight. This increased scrutiny has directly impacted Boeing's production rates and the certification timelines for new aircraft.

The FAA's heightened attention means Boeing must rigorously adhere to stringent safety and quality control measures to maintain its operating licenses. For instance, the FAA's ongoing review of Boeing's manufacturing processes and quality management systems, which began in earnest in 2024, continues to shape production schedules and the pace of new aircraft deliveries.

Boeing's Defense, Space & Security segment is significantly shaped by government defense budgets and global geopolitical events. In fiscal year 2023, the U.S. Department of Defense budget was approximately $886 billion, a key indicator of potential contract volumes for major suppliers like Boeing.

Shifts in military priorities, such as increased investment in cybersecurity or next-generation fighter jets, directly affect the demand for Boeing's specific product lines. For instance, ongoing international conflicts in 2024 and projected global defense spending increases, estimated by some analysts to reach over $2 trillion annually by 2025, underscore the importance of these contracts for Boeing's revenue.

Boeing's global operations are significantly influenced by international trade policies and tariffs, with China representing a crucial market. Trade disputes can directly impact the cost of components and the smooth delivery of aircraft, affecting Boeing's bottom line and its standing against competitors.

For instance, the ongoing trade friction between the US and China has previously led to significant order cancellations and delivery delays for Boeing aircraft. In 2023, China remained a vital customer, and any imposition of new tariffs on aerospace parts or finished aircraft could add substantial costs, potentially impacting Boeing's projected revenues for 2024 and beyond.

Geopolitical tensions can also cause abrupt shifts in demand, forcing Boeing to adjust its production schedules and market focus. The company must remain agile, ready to reconfigure its supply chains and sales strategies in response to evolving international relations and potential restrictions on sales to certain countries.

Geopolitical Tensions and Global Stability

Global geopolitical tensions significantly impact Boeing's operations, particularly its defense sector. For instance, ongoing conflicts in regions like Eastern Europe and the Middle East can bolster demand for military aircraft and defense systems, a key revenue stream for Boeing. In 2023, the defense segment accounted for roughly 40% of Boeing's total revenue, highlighting its sensitivity to international security dynamics. This instability also poses risks to commercial aviation, as travel advisories and reduced consumer confidence can dampen demand for new aircraft and services.

Supply chain disruptions are another critical consequence of geopolitical instability. Boeing relies on a vast global network of suppliers, and conflicts or trade disputes can impede the flow of essential components, leading to production delays and increased costs. The company's ability to secure raw materials and specialized parts is directly tied to international trade relations and the stability of manufacturing hubs. Navigating these complexities is crucial for maintaining production schedules and meeting customer delivery commitments.

- Defense Sales Impact: Geopolitical events directly influence government defense budgets and procurement decisions, affecting Boeing's military aircraft and defense system orders.

- Commercial Aviation Demand: Global instability can lead to reduced international travel and lower demand for commercial aircraft due to safety concerns and economic downturns.

- Supply Chain Vulnerability: Tensions can disrupt the flow of critical components from international suppliers, impacting Boeing's manufacturing and delivery timelines.

- Operational Risks: Increased security risks and regulatory changes in volatile regions can add complexity and cost to Boeing's global operations and customer support.

Government Support and Industrial Policy

Boeing frequently benefits from government backing as a key player in the aerospace sector. This support often includes funding for research and development, crucial for advancing aviation technology. For instance, in 2023, the U.S. government continued to invest heavily in aerospace R&D, with a significant portion allocated to defense and next-generation aircraft projects that directly or indirectly benefit Boeing.

Industrial policies play a vital role in shaping Boeing's competitive landscape. These policies can foster domestic manufacturing, which is particularly important for national security interests. Boeing's role as a primary supplier to the U.S. military means it's often a direct beneficiary of government initiatives designed to maintain and enhance domestic defense industrial bases. This support helps offset some of the competitive pressures from international manufacturers.

Export credit guarantees are another form of government support that can significantly impact Boeing's international sales. These guarantees reduce the financial risk for foreign buyers, making Boeing aircraft more accessible. While specific figures for 2024 and 2025 are still emerging, historically, these guarantees have been instrumental in securing large aircraft orders, especially in developing markets.

- Government R&D Funding: Continued investment in aerospace R&D by governments worldwide supports technological advancements crucial for Boeing's future product development.

- National Security Imperatives: Boeing's strategic importance to national defense ensures ongoing government interest and support for its manufacturing capabilities.

- Export Support Mechanisms: Government-backed export financing and guarantees remain vital tools for bolstering Boeing's global sales competitiveness.

Government regulations, particularly from the FAA, continue to shape Boeing's operations, with intensified scrutiny following past safety incidents. This oversight directly impacts production rates and certification timelines, demanding rigorous adherence to safety and quality standards. For instance, the FAA's ongoing review of Boeing's processes, which intensified in 2024, is a critical factor in delivery schedules.

Defense budgets and geopolitical shifts significantly influence Boeing's Defense, Space & Security segment. The U.S. defense budget, approximately $886 billion in fiscal year 2023, indicates the scale of potential contracts. Global defense spending is projected to exceed $2 trillion annually by 2025, underscoring the importance of these military orders for Boeing's revenue streams, especially amidst ongoing international conflicts in 2024.

International trade policies and geopolitical tensions create both opportunities and risks for Boeing. Trade disputes can affect component costs and aircraft deliveries, impacting profitability and market position. China remains a vital market, and any new tariffs on aerospace components in 2024 or 2025 could add significant costs, potentially affecting Boeing's projected revenues.

Boeing benefits from government support through R&D funding and industrial policies that bolster domestic manufacturing and national security interests. Export credit guarantees also remain crucial for international sales, making aircraft more accessible to foreign buyers. While specific 2024/2025 figures are emerging, these guarantees have historically been instrumental in securing large orders.

| Factor | Impact on Boeing | 2023/2024/2025 Data/Context |

|---|---|---|

| Regulatory Oversight (FAA) | Production rates, certification timelines, safety compliance | Intensified scrutiny post-737 MAX incidents, ongoing process reviews in 2024 |

| Defense Spending | Demand for military aircraft and defense systems | U.S. FY23 Defense Budget: ~$886 billion; Global defense spending projected >$2 trillion annually by 2025 |

| International Trade Policy | Component costs, delivery schedules, market access | China as a key market; potential tariffs on aerospace parts in 2024/2025 |

| Government R&D & Support | Technological advancement, manufacturing base, export sales | Continued government investment in aerospace R&D; export credit guarantees vital for international competitiveness |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Boeing, providing a comprehensive understanding of its external operating environment.

A clear, actionable summary of Boeing's PESTLE analysis, highlighting key external factors impacting the aerospace industry, to streamline strategic decision-making and mitigate potential disruptions.

Economic factors

The global economic outlook is a critical driver for Boeing's commercial airplane business. Strong economic growth translates directly into increased passenger and cargo traffic, boosting airline revenues and their capacity to invest in new aircraft. For instance, the International Monetary Fund (IMF) projected global GDP growth of 3.2% for both 2024 and 2025, signaling a stable environment for air travel demand.

Boeing's commercial segment thrives when airlines are profitable and have the confidence to expand or update their fleets. Higher disposable incomes and increased business travel, fueled by economic expansion, lead to greater demand for flights. This, in turn, creates a positive feedback loop for aircraft manufacturers like Boeing, as airlines seek to meet this rising demand with modern, efficient planes.

Emerging markets are particularly important. As these economies grow, so does their middle class, leading to a surge in air travel. This trend is already evident, with many developing nations experiencing passenger traffic growth rates significantly above the global average, directly benefiting Boeing's order books for new aircraft.

Global fuel prices are a major driver of airline operating expenses. For instance, in early 2024, jet fuel prices hovered around $2.50 per gallon, a significant factor for carriers. These costs directly influence an airline's ability to invest in new aircraft, with higher prices often leading to a preference for more fuel-efficient models.

This dynamic creates a clear demand signal for manufacturers like Boeing. Airlines facing elevated fuel costs are more likely to prioritize aircraft with superior fuel economy, such as Boeing's 737 MAX or 787 Dreamliner families. This trend shapes Boeing's product development pipeline and sales focus, pushing for innovations that reduce fuel burn.

Boeing's intricate global supply chain is a significant vulnerability, susceptible to disruptions that directly impact production timelines and inflate costs. These issues, such as persistent personnel shortages and logistical bottlenecks, have notably hampered the manufacturing of critical aircraft, including the 737 MAX, pushing back delivery schedules.

For instance, in early 2024, Boeing reported further delays in its 737 MAX program, partly attributed to ongoing supply chain challenges. These disruptions not only strain Boeing's financial performance but also place considerable pressure on its numerous suppliers, some of whom are experiencing their own financial difficulties.

Addressing these vulnerabilities requires a strategic shift towards enhancing supply chain resilience. This includes exploring options like nearshoring certain manufacturing processes and diversifying sourcing to reduce reliance on single points of failure, a strategy becoming increasingly vital in the current economic climate.

Exchange Rates and International Competitiveness

Boeing, as a major global exporter, is significantly impacted by fluctuations in exchange rates. A strong US dollar, for instance, can increase the cost of its aircraft for international customers, potentially diminishing its competitive edge against rivals like Airbus, which may price in other currencies.

The strength of the US dollar against major currencies like the Euro and the Pound Sterling directly influences Boeing's pricing power and order volume. For example, in late 2023 and early 2024, the dollar's relative strength presented a headwind.

- Impact on Competitiveness: A stronger dollar makes Boeing's products more expensive for buyers using weaker currencies.

- Revenue Exposure: A significant portion of Boeing's revenue is generated in foreign currencies, exposing it to translation risk.

- Cost Management: Conversely, a weaker dollar can make imported components more costly for Boeing, impacting its manufacturing expenses.

- Strategic Hedging: Boeing actively employs financial instruments to hedge against adverse currency movements, aiming to stabilize its financial performance.

Inflation and Interest Rates

Rising inflation presents a significant challenge for Boeing, directly impacting its operational costs. For instance, the Producer Price Index for manufactured goods saw a notable increase throughout 2023 and into early 2024, signaling higher expenses for raw materials like aluminum and titanium, as well as labor. This cost pressure can erode Boeing's profit margins if not effectively passed on to customers or offset through efficiencies.

Furthermore, the prevailing interest rate environment, with central banks maintaining higher rates to combat inflation, affects Boeing's financial strategy. Higher borrowing costs can make it more expensive for Boeing to finance its extensive research and development projects and capital expenditures. Simultaneously, airline customers face increased financing costs for new aircraft, potentially dampening demand for new orders or leading to renegotiated payment terms.

These macroeconomic forces necessitate careful financial planning and risk management for Boeing.

- Inflationary Pressures: The US CPI rose 3.4% year-over-year in April 2024, indicating continued cost increases for inputs.

- Interest Rate Impact: The Federal Reserve kept its benchmark interest rate steady in the 5.25%-5.50% range as of May 2024, making borrowing more expensive.

- Customer Financing: Higher rates increase the cost of capital for airlines, potentially slowing aircraft order cycles.

- Margin Management: Boeing must navigate cost increases while managing pricing to protect profitability.

Economic stability directly fuels demand for commercial aircraft. As global GDP growth, projected at 3.2% for 2024 and 2025 by the IMF, expands passenger and cargo traffic, airlines are more inclined to invest in new fleets. This creates a favorable environment for Boeing, as increased travel translates to higher airline revenues and a greater capacity for fleet modernization.

Inflation and interest rates pose significant challenges. With the US CPI at 3.4% year-over-year in April 2024 and the Federal Reserve maintaining rates at 5.25%-5.50% as of May 2024, Boeing faces higher operational costs and increased borrowing expenses. These factors also raise financing costs for airline customers, potentially impacting new aircraft orders.

Fluctuations in exchange rates, particularly the strength of the US dollar, affect Boeing's global competitiveness. A stronger dollar makes its aircraft more expensive for international buyers, impacting order volumes and revenue generated in foreign currencies. Boeing utilizes financial hedging to mitigate these currency risks.

| Economic Factor | 2024/2025 Projection/Data | Impact on Boeing |

| Global GDP Growth | IMF: 3.2% (2024 & 2025) | Drives air travel demand, boosting aircraft orders. |

| US Inflation (CPI) | 3.4% YoY (April 2024) | Increases operational costs for raw materials and labor. |

| Federal Funds Rate | 5.25%-5.50% (May 2024) | Raises borrowing costs for Boeing and its airline customers. |

| Jet Fuel Price | ~$2.50/gallon (Early 2024) | Influences airline operating expenses and demand for fuel-efficient aircraft. |

What You See Is What You Get

Boeing PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Boeing PESTLE analysis breaks down the political, economic, social, technological, legal, and environmental factors impacting the aerospace giant.

What you’re previewing here is the actual file—fully formatted and professionally structured. It offers a deep dive into the external forces shaping Boeing's strategic landscape, providing valuable insights for informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis is your key to understanding the complex environment in which Boeing operates.

Sociological factors

Recent safety incidents, including the January 2024 Alaska Airlines 737 MAX door plug incident, have severely eroded public perception of Boeing's commitment to quality and safety. This has directly translated into a decline in brand trust, with surveys indicating a noticeable drop in consumer confidence in the company's aircraft.

Rebuilding this trust is paramount for Boeing's future. A transparent approach to addressing manufacturing flaws and a demonstrable commitment to enhanced quality control are essential to regain customer confidence and secure future orders. For instance, the FAA's intensified scrutiny and production limits imposed in early 2024 reflect this loss of trust and directly impact Boeing's output and financial performance.

Boeing's workforce relations, particularly the specter of labor strikes by its unionized employees, represent a substantial risk to its operational continuity and financial health. Recent labor disputes have already highlighted this vulnerability, with a significant strike by Machinists at a key defense facility in 2023 impacting production schedules for vital military programs. Maintaining harmonious labor relations is paramount to preventing costly work stoppages that can delay critical aircraft deliveries and damage Boeing's reputation for reliability.

Boeing's internal safety culture has faced scrutiny, with reports indicating areas needing improvement. A key sociological factor is fostering an environment where employees feel secure reporting safety and quality concerns without retribution. This is essential for identifying and rectifying potential issues proactively.

To address these concerns, Boeing has been investing in initiatives aimed at enhancing its safety culture. These include comprehensive workforce training programs designed to reinforce safety protocols and empower employees. Furthermore, efforts to simplify processes and eliminate defects are underway, with the goal of improving overall safety and quality performance across its operations.

Demographic Shifts and Talent Acquisition

The aerospace sector, including giants like Boeing, is grappling with an aging workforce. Many experienced engineers and skilled manufacturing professionals are nearing retirement, creating a knowledge gap. This demographic reality means a critical need to bring in fresh talent.

To counter this, strategic workforce development is paramount. Boeing, for instance, needs robust training programs and innovative recruitment strategies to cultivate a new generation of aerospace experts. This ensures a consistent supply of essential skills to meet production demands and future innovation.

- Aging Workforce: A significant portion of the skilled aerospace workforce is approaching retirement age, posing a risk to institutional knowledge and operational capacity.

- Talent Gap: There's a pronounced shortage of engineers, particularly in specialized fields like avionics and materials science, as well as skilled manufacturing technicians.

- Recruitment Challenges: Attracting younger talent to the demanding and often complex aerospace industry requires competitive compensation, appealing work environments, and clear career progression paths.

- Workforce Development: Investments in apprenticeships, university partnerships, and continuous learning programs are crucial for building a sustainable talent pipeline.

Air Travel Trends and Consumer Preferences

Consumer preferences are significantly reshaping air travel. There's a noticeable surge in demand for shorter flights, often driven by increased domestic travel and regional connectivity. This trend directly impacts aircraft manufacturing, favoring efficient single-aisle models. For instance, Boeing's 737 MAX family is designed to meet this growing need.

The proliferation of low-cost carriers (LCCs) is another major sociological factor. LCCs often focus on high-frequency, short-to-medium haul routes, further boosting the demand for narrow-body aircraft. In 2023, LCCs accounted for a substantial portion of global air traffic growth, particularly in Asia and Europe, influencing Boeing's production priorities.

Emerging markets are becoming increasingly important travel hubs, contributing to evolving consumer preferences. As disposable incomes rise in these regions, air travel becomes more accessible, leading to a greater demand for both short-haul and medium-haul aircraft. Boeing's long-term forecasts, such as their 2024 market outlook, highlight the significant growth expected from these developing economies, underscoring the need for versatile aircraft solutions.

- Rising Demand for Short-Haul: A significant portion of air travel growth in 2024 is attributed to domestic and regional routes.

- Low-Cost Carrier Expansion: LCCs continue to capture market share, driving demand for fuel-efficient, single-aisle aircraft.

- Emerging Market Growth: Developing economies are projected to be key drivers of future air travel demand, influencing aircraft fleet planning.

- Boeing's Focus: The company's product strategy emphasizes single-aisle aircraft like the 737 MAX to align with these evolving consumer preferences and market dynamics.

Recent safety incidents, such as the January 2024 Alaska Airlines 737 MAX door plug failure, have significantly damaged public trust in Boeing's quality and safety standards. This erosion of confidence directly impacts brand perception, with consumer surveys showing a marked decrease in trust in the company's aircraft. Rebuilding this trust requires transparency regarding manufacturing defects and a clear commitment to improved quality control, as evidenced by the FAA's intensified oversight and production limits implemented in early 2024, which directly affect Boeing's output.

Boeing faces a critical challenge with its aging workforce, as many experienced engineers and skilled manufacturing personnel are nearing retirement, leading to a potential knowledge gap. This demographic trend necessitates a proactive approach to talent acquisition and development. To address this, Boeing must implement robust training programs and innovative recruitment strategies to cultivate a new generation of aerospace professionals, ensuring a continuous supply of essential skills for current production needs and future innovation.

Shifting consumer preferences are reshaping air travel, with a growing demand for shorter flights and increased domestic and regional travel. This trend favors the production of efficient single-aisle aircraft, such as Boeing's 737 MAX family. The expansion of low-cost carriers (LCCs) further fuels this demand, as they often operate high-frequency, short-to-medium haul routes, influencing Boeing's production priorities and product development strategies.

Technological factors

Boeing's commitment to research and development is a cornerstone of its long-term competitiveness, with substantial investments aimed at pioneering next-generation aircraft and aerospace technologies. This focus is critical for maintaining an edge in the fiercely competitive aerospace sector.

In 2023, Boeing reported R&D expenses of $3.9 billion, underscoring its dedication to innovation. These investments are channeled into crucial areas like advanced aerodynamics, more efficient propulsion systems, and cutting-edge materials science, all designed to boost fuel efficiency and reduce environmental impact.

The aviation industry is pushing hard towards decarbonization, with sustainable aviation technologies like Sustainable Aviation Fuel (SAF) and electric/hybrid propulsion leading the charge. Boeing is a major player in this shift, aiming for its entire commercial fleet to be capable of running on 100% SAF by 2030. This commitment is fueled by growing environmental awareness and increasingly stringent regulations.

Automation and advanced manufacturing are critical for Boeing's operational success. The company is actively integrating robotics and digital tools to boost production efficiency and precision, especially as it navigates labor market challenges. For instance, Boeing's Charleston facility utilizes advanced automation in its 787 Dreamliner production to enhance quality and speed.

These technological advancements are key to improving quality control and reducing manufacturing costs. By leveraging automation, Boeing can achieve higher levels of precision in complex assembly processes, which is vital for aircraft safety and performance. This focus on digital design and production capabilities is a strategic move to streamline operations and ensure product integrity in a competitive aerospace landscape.

Digitalization and Cybersecurity

The increasing digitalization of aircraft systems, manufacturing, and supply chains presents significant cybersecurity challenges for Boeing. Protecting intellectual property, sensitive data, and operational systems from evolving cyber threats is a critical priority. For instance, the aerospace and defense sector experienced a 47% increase in cyberattacks in 2023 compared to the previous year, highlighting the urgency of robust defenses.

Boeing must implement strong cybersecurity measures to safeguard the integrity of its products and operations. This is essential for maintaining the trust of its defense and commercial clients, who rely on the security and reliability of Boeing's aircraft and systems. In 2024, Boeing reported investing over $2 billion in cybersecurity initiatives to bolster its defenses against sophisticated threats.

- Digitalization Risks: Increased connectivity in aircraft and manufacturing processes expands the attack surface for cyber threats.

- Intellectual Property Protection: Safeguarding proprietary designs and sensitive data from espionage is crucial for competitive advantage.

- Operational Integrity: Ensuring the continuous and secure operation of flight systems and manufacturing lines is paramount.

- Client Trust: Demonstrating strong cybersecurity capabilities is vital for maintaining confidence with government and commercial customers.

Space and Security System Advancements

Technological advancements in defense, space, and security systems are critical for Boeing's expansion beyond commercial aviation. The company is actively developing next-generation military aircraft, sophisticated satellite constellations, and robust cybersecurity solutions to meet the evolving needs of government clients worldwide. For instance, Boeing's investment in autonomous systems and advanced sensor technology for its defense platforms is a key differentiator.

Continued innovation in these specialized sectors is paramount for securing substantial, long-term defense contracts and solidifying Boeing's leadership in increasingly complex global security environments. In 2024, the U.S. Department of Defense awarded Boeing significant contracts, including those for advanced fighter jet upgrades and satellite communication systems, underscoring the importance of these technological investments.

- Advanced Military Aircraft Development: Focus on next-generation fighter jets and unmanned aerial systems (UAS) with enhanced capabilities.

- Satellite Systems Innovation: Continued development of secure, high-bandwidth satellite communication and Earth observation platforms.

- Cybersecurity Solutions: Investing in AI-driven cybersecurity to protect critical infrastructure and sensitive data for government and commercial clients.

- Space Exploration Technologies: Contributing to space exploration through advanced propulsion systems and spacecraft design, aligning with NASA's Artemis program goals.

Boeing's technological trajectory is heavily influenced by the push for sustainable aviation, with significant R&D allocated to Sustainable Aviation Fuel (SAF) compatibility and next-generation propulsion systems. The company aims for its commercial fleet to be SAF-ready by 2030, reflecting a broader industry commitment to decarbonization driven by environmental concerns and regulatory pressures.

Automation and advanced manufacturing are key to Boeing's operational efficiency, with investments in robotics and digital tools aimed at improving production quality and speed amidst labor market dynamics. This focus on digital integration enhances precision in complex assembly, crucial for aircraft safety and cost management.

Cybersecurity remains a critical technological factor, with Boeing investing over $2 billion in 2024 to protect its intellectual property and operational systems from escalating cyber threats, which saw a 47% increase in the aerospace sector in 2023.

Technological advancements in defense and space systems are vital for Boeing's diversification, with ongoing development in autonomous systems and satellite technology securing substantial government contracts, such as those for fighter jet upgrades and satellite communications in 2024.

Legal factors

Boeing operates under rigorous aviation safety regulations from bodies like the Federal Aviation Administration (FAA). Adherence to these standards for aircraft certification, manufacturing quality, and ongoing airworthiness is paramount, directly impacting operational continuity and market trust.

Recent safety concerns have significantly heightened regulatory oversight. For instance, the FAA imposed production limits on the 737 MAX program in early 2024, restricting Boeing's output until specific quality improvements are demonstrated, a move that directly affects delivery schedules and financial projections.

Boeing's operations are heavily influenced by product liability, with significant legal exposure arising from past and potential future aircraft incidents. These lawsuits can lead to substantial financial settlements and considerable damage to the company's reputation, impacting investor confidence and customer relationships.

In recent times, Boeing has grappled with and settled legal challenges, including those related to allegations of misleading regulators and claims of negligence. For instance, in January 2024, Boeing reached a settlement with the families of victims of a 2018 Lion Air crash, a case that underscored the intense scrutiny and legal ramifications of its product safety record.

The financial impact of these legal battles is significant. While specific settlement figures are often confidential, the cumulative cost of legal defense, settlements, and potential fines can run into billions of dollars, directly affecting Boeing's bottom line and its ability to invest in future innovation.

Antitrust laws are a significant legal consideration for Boeing, given its position as one of only two major global aircraft manufacturers. Regulatory bodies, such as the U.S. Department of Justice and the European Commission, closely scrutinize Boeing's competitive practices to prevent monopolistic behavior and ensure a level playing field in the aerospace sector. For instance, past investigations into potential anti-competitive mergers and acquisitions highlight the ongoing vigilance.

Intellectual Property Rights and Patents

Intellectual property rights are the bedrock of Boeing's competitive advantage. Protecting its vast portfolio, which includes thousands of patents covering everything from advanced aerodynamics to intricate manufacturing techniques, is paramount. This legal shield allows Boeing to safeguard its innovations and maintain its technological lead in the aerospace industry.

The legal frameworks surrounding patents are actively utilized by Boeing to prevent competitors from infringing on its designs and processes. For instance, in 2023, Boeing continued its robust patent filing strategy, securing new patents related to sustainable aviation technologies and advanced manufacturing methods, reinforcing its commitment to innovation and market exclusivity.

- Patent Portfolio Growth: Boeing consistently invests in R&D, leading to a growing number of patents filed annually, crucial for protecting innovations in areas like electric propulsion and advanced materials.

- Global Enforcement: The company actively monitors and enforces its intellectual property rights across major global markets to prevent unauthorized replication of its technologies.

- Licensing Opportunities: While primarily defensive, Boeing's IP portfolio also presents opportunities for strategic licensing, generating revenue and fostering industry collaboration.

- Competitive Differentiation: Patents allow Boeing to differentiate its products and services, commanding premium pricing and securing long-term customer contracts based on technological superiority.

International Trade Laws and Sanctions

Boeing's extensive global footprint means its operations are deeply intertwined with international trade laws, export controls, and economic sanctions. Navigating this complex legal landscape is critical for avoiding significant penalties and ensuring continued access to vital international markets. For instance, the ongoing geopolitical tensions in Eastern Europe and the Middle East continue to shape trade regulations, potentially impacting Boeing's supply chain and sales strategies as new restrictions emerge.

The dynamic nature of international relations necessitates constant vigilance and adaptability. Boeing must continuously monitor and adjust its compliance frameworks to align with evolving sanctions regimes and trade agreements. Failure to do so can result in severe financial repercussions and reputational damage, affecting its ability to conduct business worldwide.

- Export Control Compliance: Boeing adheres to stringent U.S. export control regulations, such as the International Traffic in Arms Regulations (ITAR) and the Export Administration Regulations (EAR), which govern the transfer of defense articles and dual-use technologies.

- Sanctions Evasion: The company must ensure its transactions and supply chains do not violate economic sanctions imposed by governments and international bodies on specific countries, entities, or individuals.

- Geopolitical Impact: In 2023, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) continued to enforce export controls on Russia, impacting various industries, including aerospace, requiring companies like Boeing to implement robust compliance measures.

Boeing's legal landscape is dominated by stringent aviation safety regulations, with bodies like the FAA imposing significant oversight. Recent events, such as the FAA's 2024 production limit on the 737 MAX, highlight the direct impact of regulatory actions on production and financial forecasts.

Product liability remains a critical legal factor, with past incidents leading to substantial settlements and ongoing scrutiny. Boeing's January 2024 settlement with families of a Lion Air crash victim underscores the financial and reputational risks associated with safety concerns.

Antitrust laws are also crucial, given Boeing's duopoly in the commercial aircraft market. Regulatory bodies actively monitor competitive practices to prevent monopolistic behavior, impacting potential mergers and market strategies.

Intellectual property protection is vital for Boeing's technological edge, with a robust patent portfolio safeguarding innovations in areas like sustainable aviation. The company's continued patent filings in 2023 reinforce its commitment to maintaining market exclusivity.

Environmental factors

The aerospace sector faces mounting pressure to curb carbon emissions, spurred by evolving climate change regulations and international accords. Boeing is actively pursuing the industry's 2050 net-zero emissions target, with specific 2025 goals to slash greenhouse gas output from its own operations.

These efforts include significant investments in renewable energy sources and the adoption of more sustainable manufacturing processes. For instance, Boeing aims to reduce emissions intensity from its facilities by 25% by 2025 compared to a 2017 baseline.

The push for Sustainable Aviation Fuel (SAF) is a critical environmental factor for the aviation industry. Boeing is actively investing in and purchasing SAF, aiming to boost its availability and reduce costs for airlines. The company's commitment to having its entire commercial aircraft fleet capable of using 100% SAF by 2030 underscores its dedication to decarbonization.

Boeing is actively integrating circular economy principles, aiming to minimize waste across its operations. This involves reducing waste during manufacturing processes and planning for aircraft end-of-life, promoting recycling and material reuse. For example, in 2023, Boeing reported a 10% reduction in manufacturing waste intensity compared to 2022, driven by these initiatives.

Noise Pollution Regulations

Aircraft noise pollution continues to be a major environmental issue, especially for those living near airports. Boeing faces the challenge of creating aircraft that meet ever-tightening noise standards worldwide. For instance, the European Union's Stage 4 noise limits, implemented in 2017, set stringent requirements for aircraft emissions, influencing future design considerations.

To address this, Boeing actively invests in research and development for quieter engine technologies and improved aerodynamic designs. Their commitment to reducing noise levels is evident in ongoing projects aimed at minimizing the environmental footprint of their aircraft. This focus on innovation is crucial for maintaining market access and meeting regulatory compliance across different regions.

- Global Noise Standards: Boeing must adhere to international noise regulations, such as those set by the International Civil Aviation Organization (ICAO), which are periodically updated.

- Technological Advancements: Continuous investment in engine noise reduction technologies, like geared turbofans and advanced nacelle designs, is essential for compliance and competitive advantage.

- Community Impact: Designing aircraft with lower noise profiles directly benefits communities surrounding airports, enhancing Boeing's social license to operate.

- Regulatory Evolution: Staying ahead of evolving noise regulations, including potential future "Stage 5" standards, requires proactive engineering and design strategies.

Resource Consumption and Conservation

Boeing's commitment to resource consumption and conservation is a significant environmental factor. The company prioritizes the efficient use and conservation of natural resources like water and energy across its global operations. For instance, Boeing has publicly stated goals to reduce its water withdrawal by 25% by 2025 compared to a 2017 baseline, and aims to procure 100% renewable electricity for its U.S. facilities by 2030.

These conservation efforts are integrated through best practices at manufacturing sites. Such initiatives are crucial for minimizing the company's environmental footprint and aligning with growing global expectations for corporate sustainability.

- Water Withdrawal Reduction: Target of 25% reduction by 2025 (vs. 2017 baseline).

- Renewable Electricity Procurement: Goal of 100% renewable electricity for U.S. facilities by 2030.

- Operational Efficiency: Implementing conservation best practices across manufacturing to minimize environmental impact.

Environmental pressures are significantly reshaping the aerospace industry, pushing companies like Boeing towards ambitious sustainability goals. The drive for net-zero emissions by 2050 is a central theme, with Boeing actively working to reduce its operational greenhouse gas output. Key initiatives include investing in renewable energy and optimizing manufacturing processes, targeting a 25% reduction in emissions intensity from its facilities by 2025 (compared to a 2017 baseline).

Sustainable Aviation Fuel (SAF) is a critical component of this environmental strategy, with Boeing committed to ensuring its entire commercial fleet can use 100% SAF by 2030. This focus extends to waste reduction, with the company aiming to decrease manufacturing waste intensity by 10% in 2023 compared to the previous year. Furthermore, Boeing is addressing aircraft noise pollution by developing quieter engine technologies and aerodynamic designs to meet evolving global noise standards.

Resource conservation is also paramount, demonstrated by Boeing's goal to reduce water withdrawal by 25% by 2025 (vs. 2017 baseline) and its objective to source 100% renewable electricity for its U.S. facilities by 2030. These environmental factors are not just about compliance but are increasingly integrated into core business strategy and innovation.

| Environmental Focus | Boeing's Target/Goal | Baseline/Year | Status/Progress |

| Greenhouse Gas Emissions Intensity Reduction | 25% reduction | 2017 | Ongoing progress towards 2025 goal |

| Sustainable Aviation Fuel (SAF) Capability | 100% SAF capable fleet | N/A | Target by 2030 |

| Manufacturing Waste Intensity Reduction | 10% reduction | 2022 | Achieved in 2023 |

| Water Withdrawal Reduction | 25% reduction | 2017 | Ongoing progress towards 2025 goal |

| Renewable Electricity Procurement (U.S. Facilities) | 100% renewable | N/A | Target by 2030 |

PESTLE Analysis Data Sources

Our Boeing PESTLE Analysis is grounded in comprehensive data from aviation industry regulators, global economic forums, and leading aerospace research institutions. We incorporate insights from government policy databases, market intelligence reports, and technological innovation forecasts to ensure a robust understanding of the macro-environment.