Bank of Montreal PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Montreal Bundle

Discover how political shifts, economic fluctuations, and evolving social trends are shaping Bank of Montreal's operational landscape. Our PESTLE analysis provides the critical external context needed to navigate these complexities and identify strategic opportunities. Gain a competitive advantage by understanding these forces—download the full report now for actionable intelligence.

Political factors

As a federally regulated entity, BMO's operations are deeply intertwined with the stability of the Canadian government and the directives from key regulators such as OSFI and the Bank of Canada. Shifts in government focus, particularly concerning fiscal measures or the supervision of the financial industry, directly shape BMO's operational landscape and strategic direction.

Regulatory updates significantly influence BMO's compliance and risk management. For example, OSFI's revised Supervisory Framework, effective April 1, 2024, introduced an expanded risk rating scale for earlier identification of supervisory concerns. Furthermore, new integrity and security guidelines from OSFI are set to take effect on January 31, 2025, requiring BMO to adapt its internal processes accordingly.

BMO's substantial North American footprint makes it sensitive to evolving international trade dynamics, especially concerning Canada-U.S. relations. The potential for U.S. tariffs and persistent trade negotiations introduce considerable unpredictability for Canadian financial institutions like BMO.

Geopolitical instability can disrupt global financial markets, affect cross-border financial flows, and erode investor sentiment, compelling BMO to implement robust and adaptable risk management frameworks.

Government decisions regarding financial flexibility measures, such as new mortgage regulations and anti-money laundering requirements, directly affect BMO's lending practices and compliance costs.

The Office of the Superintendent of Financial Institutions (OSFI) has announced a new loan-to-income (LTI) approach for uninsured mortgage portfolios, with banks expected to adhere to LTI limits beginning in their fiscal Q1 2025.

These interventions, while aimed at bolstering financial stability, can also constrain bank operations and profitability by introducing new compliance burdens and potentially limiting credit availability.

Consumer Protection and Open Banking Legislation

The Canadian government's commitment to enhanced consumer protection and the burgeoning open banking framework are significant political factors influencing BMO. The Retail Payment Activities Act (RPAA) is actively being implemented, with the Bank of Canada providing crucial guidance throughout 2024 to broaden the reach of payment system participants. This regulatory shift aims to create a more secure and competitive payments ecosystem.

Furthermore, the anticipated launch of open banking in Canada by early 2026 is poised to revolutionize how financial services are delivered. This initiative will facilitate secure data sharing between financial institutions and third-party providers, paving the way for innovative new service models and a more dynamic competitive environment for banks like BMO.

- Consumer Protection Focus: Legislation like the RPAA underscores a political drive to safeguard consumers in the evolving financial landscape.

- Open Banking Timeline: The early 2026 target for open banking implementation signals a proactive government stance on fostering innovation and competition.

- Regulatory Guidance: Ongoing guidance from the Bank of Canada on the RPAA in 2024 demonstrates a phased approach to regulatory adaptation.

- Impact on BMO: These political factors will necessitate BMO's adaptation in service delivery to comply with new regulations and leverage opportunities presented by open banking.

Taxation Policies and Corporate Tax Rates

Changes in corporate taxation policies at federal and provincial levels in Canada, alongside those in the United States where BMO has significant operations, directly impact the bank's profitability and investment strategies. For instance, the Canadian federal corporate income tax rate remains at 15% for general corporations, while provincial rates vary. In the US, the federal corporate tax rate is 21% as of 2024.

Future fiscal policies, including potential increases in defense spending, could influence government revenue requirements, potentially leading to adjustments in tax rates or the introduction of new levies. BMO's effective tax rate in 2023 was 24.3%, highlighting the sensitivity of its financial performance to these tax environments.

BMO must continually monitor these legislative shifts to optimize its tax strategy and financial planning, ensuring compliance and maximizing shareholder value amidst evolving fiscal landscapes.

- Canadian Federal Corporate Tax Rate: 15% (general).

- US Federal Corporate Tax Rate: 21% (as of 2024).

- BMO's Effective Tax Rate (2023): 24.3%.

- Impact of Fiscal Policy: Potential for tax adjustments due to government revenue needs, influenced by spending priorities like defense.

Government policies directly shape BMO's operational environment, with regulatory updates from bodies like OSFI significantly impacting compliance and risk management. For instance, OSFI's revised Supervisory Framework, effective April 1, 2024, and new integrity guidelines by January 31, 2025, necessitate ongoing adaptation by BMO.

The push for enhanced consumer protection, exemplified by the Retail Payment Activities Act (RPAA) and ongoing guidance from the Bank of Canada in 2024, alongside the anticipated early 2026 launch of open banking, will redefine BMO's service delivery and competitive landscape.

Changes in corporate taxation, with Canadian federal rates at 15% and US federal rates at 21% in 2024, alongside BMO's 2023 effective tax rate of 24.3%, directly influence profitability and strategic financial planning.

Government decisions on financial flexibility, such as new mortgage regulations like OSFI's loan-to-income approach for uninsured portfolios starting fiscal Q1 2025, can constrain lending practices and increase compliance costs for BMO.

What is included in the product

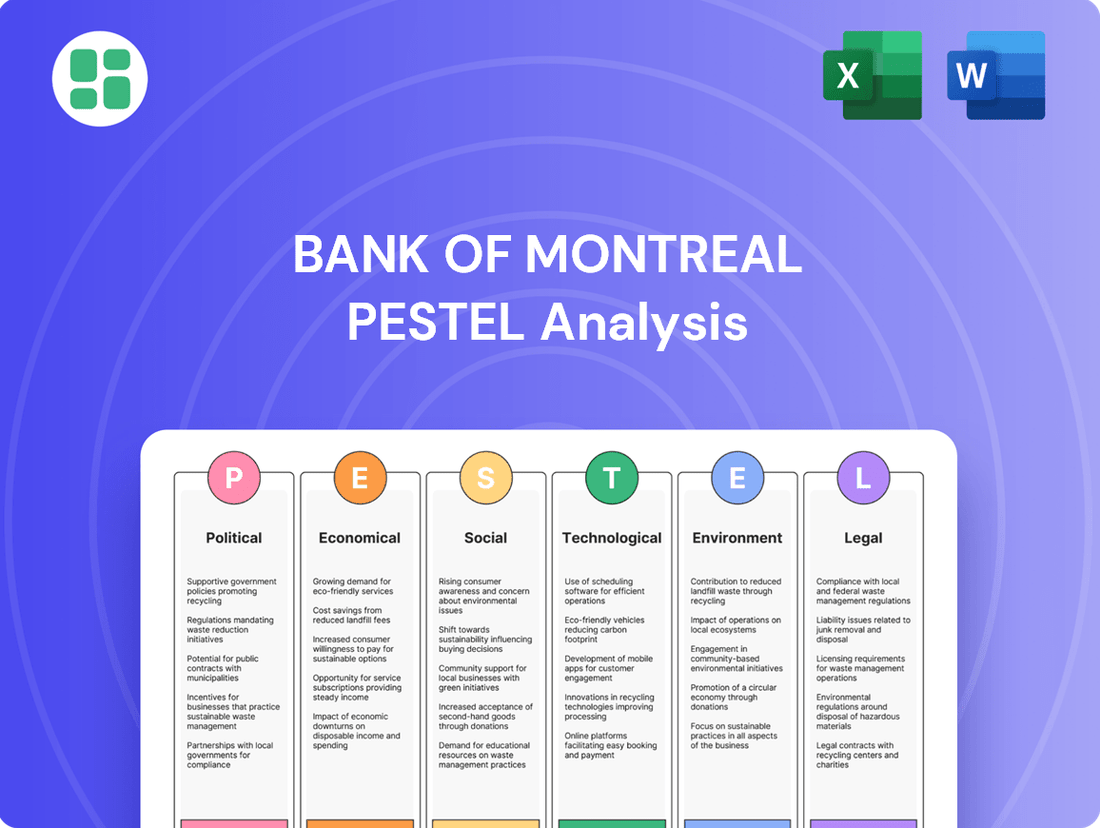

This PESTLE analysis of the Bank of Montreal examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations.

It provides a comprehensive understanding of the external forces shaping the bank's strategic landscape, identifying potential risks and opportunities.

A PESTLE analysis for BMO offers a clear roadmap to navigate external challenges, acting as a vital tool for proactive strategic planning and risk mitigation.

By dissecting political, economic, social, technological, environmental, and legal factors, BMO can identify opportunities and threats, ultimately strengthening its market position.

Economic factors

The Bank of Canada's monetary policy, particularly its interest rate decisions, significantly shapes BMO's net interest margin and overall lending operations. Recent aggressive rate cuts initiated in June 2024 are anticipated to continue, with projections suggesting the overnight rate could reach 2.5% by mid-2025.

This easing monetary stance in Canada, more pronounced than in the United States, is a response to observed economic weaknesses. For BMO, this translates into a lower cost of funds but also influences the demand for loans as borrowing becomes cheaper.

While Canada's overall inflation rate has been trending downwards, it's projected to hover around 3% through the second quarter of 2024 before ideally settling back to the Bank of Canada's 2% target in 2025. This persistent inflation, especially within shelter costs, directly erodes consumer purchasing power. This can translate into increased loan defaults and diminished savings capacity for individuals.

Bank of Montreal's financial results are inherently tied to these inflationary dynamics. Higher inflation can increase operating costs for BMO and impact the value of its assets. Furthermore, the Bank of Canada's monetary policy, which is heavily influenced by inflation levels, will continue to shape interest rate environments, affecting BMO's lending and borrowing activities.

The economic growth trajectory in Canada and the U.S. is a critical factor for BMO, directly influencing loan demand and credit quality. While Canada's economy has seen a slowdown, it's demonstrating resilience, with projections for 2025 anticipating consumer spending and residential investment to fuel GDP expansion.

A healthy economic environment underpins BMO's profitability by fostering business expansion and bolstering consumer confidence. For instance, Canada's GDP growth was estimated at 1.1% in 2024, with forecasts suggesting a pickup to 1.7% in 2025, according to the Bank of Canada's outlook.

Unemployment Rates and Consumer Spending

Unemployment rates significantly influence consumer spending, a key driver for BMO's retail and commercial banking operations. Rising unemployment, as seen in potential economic slowdowns, can lead to increased credit defaults and a general pullback in consumer spending. This directly impacts BMO's ability to generate revenue from loans and transaction fees.

Conversely, periods of low unemployment and robust consumer spending create a more favorable environment for banks like BMO. Stronger consumer confidence translates into higher demand for banking services, including mortgages, credit cards, and investment products. For instance, if unemployment in Canada remains low, hovering around the 6.0% mark as it did in early 2024, BMO can anticipate sustained demand for its retail lending products.

Monitoring labor market indicators is therefore crucial for BMO's strategic planning. By closely tracking unemployment figures and consumer spending trends, the bank can better assess credit risk across its portfolio and accurately forecast demand for its diverse range of financial products.

- Unemployment Impact: Rising joblessness can increase loan defaults and decrease consumer spending, directly affecting BMO's revenue streams.

- Favorable Conditions: Low unemployment and strong consumer spending boost demand for BMO's retail and commercial banking services.

- Data Monitoring: BMO must closely watch labor market data to manage credit risk and predict demand for its offerings.

- 2024/2025 Outlook: Continued low unemployment in Canada, potentially staying below 6.5% through 2025, would generally support BMO's business segments.

Foreign Exchange Rate Volatility

Foreign exchange rate volatility, especially between the Canadian and U.S. dollars, directly affects Bank of Montreal's (BMO) financial results due to its substantial cross-border operations. When BMO translates its U.S. dollar earnings and assets back into Canadian dollars, fluctuations in the CAD/USD exchange rate can significantly alter the reported figures. For instance, a stronger Canadian dollar would reduce the reported value of U.S. dollar earnings.

Monetary policy divergence between Canada and the United States is a key driver of this volatility. As of mid-2024, the Bank of Canada and the U.S. Federal Reserve have been navigating different inflation landscapes, potentially leading to differing interest rate paths. This can widen yield differentials, influencing currency markets and, consequently, BMO's international transactions and the valuation of its foreign holdings.

- CAD/USD Exchange Rate Impact: In Q2 2024, BMO reported that a 1% appreciation of the Canadian dollar against the U.S. dollar would have a negative impact on its net income by approximately CAD $20 million.

- Monetary Policy Influence: The Bank of Canada's policy rate stood at 5.00% in June 2024, while the U.S. Federal Reserve's target range was 5.25%-5.50%, indicating a narrow but present yield differential that can influence FX markets.

- Cross-Border Operations: BMO's U.S. P&C operations contributed approximately 30% of the bank's total revenue in fiscal year 2023, highlighting the material impact of FX fluctuations on its consolidated financial performance.

The Bank of Canada's monetary policy, particularly its interest rate decisions, significantly shapes BMO's net interest margin and overall lending operations. Recent aggressive rate cuts initiated in June 2024 are anticipated to continue, with projections suggesting the overnight rate could reach 2.5% by mid-2025.

This easing monetary stance in Canada, more pronounced than in the United States, is a response to observed economic weaknesses. For BMO, this translates into a lower cost of funds but also influences the demand for loans as borrowing becomes cheaper.

While Canada's overall inflation rate has been trending downwards, it's projected to hover around 3% through the second quarter of 2024 before ideally settling back to the Bank of Canada's 2% target in 2025. This persistent inflation, especially within shelter costs, directly erodes consumer purchasing power. This can translate into increased loan defaults and diminished savings capacity for individuals.

Bank of Montreal's financial results are inherently tied to these inflationary dynamics. Higher inflation can increase operating costs for BMO and impact the value of its assets. Furthermore, the Bank of Canada's monetary policy, which is heavily influenced by inflation levels, will continue to shape interest rate environments, affecting BMO's lending and borrowing activities.

The economic growth trajectory in Canada and the U.S. is a critical factor for BMO, directly influencing loan demand and credit quality. While Canada's economy has seen a slowdown, it's demonstrating resilience, with projections for 2025 anticipating consumer spending and residential investment to fuel GDP expansion.

A healthy economic environment underpins BMO's profitability by fostering business expansion and bolstering consumer confidence. For instance, Canada's GDP growth was estimated at 1.1% in 2024, with forecasts suggesting a pickup to 1.7% in 2025, according to the Bank of Canada's outlook.

Unemployment rates significantly influence consumer spending, a key driver for BMO's retail and commercial banking operations. Rising unemployment, as seen in potential economic slowdowns, can lead to increased credit defaults and a general pullback in consumer spending. This directly impacts BMO's ability to generate revenue from loans and transaction fees.

Conversely, periods of low unemployment and robust consumer spending create a more favorable environment for banks like BMO. Stronger consumer confidence translates into higher demand for banking services, including mortgages, credit cards, and investment products. For instance, if unemployment in Canada remains low, hovering around the 6.0% mark as it did in early 2024, BMO can anticipate sustained demand for its retail lending products.

Monitoring labor market indicators is therefore crucial for BMO's strategic planning. By closely tracking unemployment figures and consumer spending trends, the bank can better assess credit risk across its portfolio and accurately forecast demand for its diverse range of financial products.

- Unemployment Impact: Rising joblessness can increase loan defaults and decrease consumer spending, directly affecting BMO's revenue streams.

- Favorable Conditions: Low unemployment and strong consumer spending boost demand for BMO's retail and commercial banking services.

- Data Monitoring: BMO must closely watch labor market data to manage credit risk and predict demand for its offerings.

- 2024/2025 Outlook: Continued low unemployment in Canada, potentially staying below 6.5% through 2025, would generally support BMO's business segments.

Foreign exchange rate volatility, especially between the Canadian and U.S. dollars, directly affects Bank of Montreal's (BMO) financial results due to its substantial cross-border operations. When BMO translates its U.S. dollar earnings and assets back into Canadian dollars, fluctuations in the CAD/USD exchange rate can significantly alter the reported figures. For instance, a stronger Canadian dollar would reduce the reported value of U.S. dollar earnings.

Monetary policy divergence between Canada and the United States is a key driver of this volatility. As of mid-2024, the Bank of Canada and the U.S. Federal Reserve have been navigating different inflation landscapes, potentially leading to differing interest rate paths. This can widen yield differentials, influencing currency markets and, consequently, BMO's international transactions and the valuation of its foreign holdings.

- CAD/USD Exchange Rate Impact: In Q2 2024, BMO reported that a 1% appreciation of the Canadian dollar against the U.S. dollar would have a negative impact on its net income by approximately CAD $20 million.

- Monetary Policy Influence: The Bank of Canada's policy rate stood at 5.00% in June 2024, while the U.S. Federal Reserve's target range was 5.25%-5.50%, indicating a narrow but present yield differential that can influence FX markets.

- Cross-Border Operations: BMO's U.S. P&C operations contributed approximately 30% of the bank's total revenue in fiscal year 2023, highlighting the material impact of FX fluctuations on its consolidated financial performance.

| Economic Factor | 2024 Data/Outlook | 2025 Outlook | BMO Impact |

|---|---|---|---|

| Interest Rates (BOC Overnight) | ~4.75% (as of June 2024, trending down) | Projected 2.5% by mid-2025 | Lower cost of funds, potential decrease in lending margins, influences loan demand. |

| Inflation Rate (Canada) | ~3% (Q2 2024), aiming for 2% target | Targeting 2% | Impacts operating costs, asset values, and consumer purchasing power, potentially affecting loan defaults. |

| GDP Growth (Canada) | Estimated 1.1% | Forecasted 1.7% | Influences loan demand, credit quality, and overall business expansion opportunities. |

| Unemployment Rate (Canada) | ~6.0% (early 2024) | Expected to remain below 6.5% | Low unemployment supports consumer spending and demand for BMO's retail products; rising rates increase default risk. |

| CAD/USD Exchange Rate | Volatile, influenced by monetary policy divergence | Continued volatility expected | Affects translation of U.S. dollar earnings, impacting reported net income. A 1% CAD appreciation impacts net income by ~CAD $20 million (Q2 2024 data). |

Preview Before You Purchase

Bank of Montreal PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Bank of Montreal covers all critical political, economic, social, technological, legal, and environmental factors impacting its operations. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

Canada's demographic landscape is evolving, with an aging population and increasing immigration significantly impacting banking needs. For instance, in 2024, Canada's population growth was largely driven by immigration, with over 1.2 million new permanent residents welcomed by the end of 2023, a number expected to continue its upward trend. This necessitates tailored financial products for diverse groups, from retirement planning for seniors to specialized services for newcomers.

Bank of Montreal (BMO) actively adapts to these demographic shifts by introducing targeted programs. Their NewStart Program, for example, allows newcomers to Canada to establish banking relationships before arriving, simplifying their transition. This proactive approach acknowledges that evolving household structures and varying life stages create demand for a wider array of financial solutions, from mortgages for young families to wealth management for established individuals.

Canadians are increasingly favoring digital channels for banking, with mobile apps now preferred over traditional online platforms and brick-and-mortar branches. This shift is a permanent change in consumer behavior.

BMO is actively addressing this by improving its digital offerings. The bank was recognized for its digital banking experience revamp, highlighting its commitment to meeting evolving customer needs.

In 2023, over 70% of Canadian banking transactions occurred digitally, with mobile banking usage growing by 15% year-over-year, underscoring the critical need for BMO to maintain robust digital infrastructure and intuitive user interfaces.

Public trust is the bedrock of any financial institution, and for BMO, this is particularly true. Recent surveys in 2024 indicate that Canadians place a high value on transparency and ethical conduct when choosing a bank. BMO's stated commitment to its purpose, 'to Boldly Grow the Good in business and life,' coupled with its emphasis on integrity and responsibility, directly addresses these public expectations. Maintaining this trust is paramount, especially in light of evolving data privacy regulations and the increasing scrutiny of corporate social responsibility.

Financial Literacy and Demand for Advice

Financial literacy levels significantly influence how individuals engage with banking services and seek financial advice. In Canada, while efforts are ongoing, a notable portion of the population still reports lower levels of financial confidence, creating a clear demand for accessible guidance. This presents a substantial opportunity for BMO's wealth management and personal banking divisions to step in and provide the necessary support.

The ongoing intergenerational transfer of wealth is a critical dynamic for BMO. As an estimated CAD 1 trillion in assets is expected to pass between generations in Canada over the next decade, banks like BMO can capitalize by offering specialized financial planning and wealth management services. This demographic shift underscores the need for tailored advice to manage and grow these assets effectively.

BMO can strengthen client relationships and foster loyalty through proactive educational initiatives and easily accessible financial advice. Such programs not only empower customers but also position BMO as a trusted partner in their financial journey.

- Growing Demand: A 2023 survey indicated that 40% of Canadians felt they needed more financial advice, highlighting a significant market gap.

- Intergenerational Wealth Transfer: Projections estimate over CAD 1 trillion in wealth transfer in Canada by 2030, a key area for BMO's advisory services.

- Digital Engagement: BMO's investment in digital tools and platforms aims to make financial literacy resources more accessible, reaching a broader audience.

- Client Retention: Providing personalized financial guidance is a proven strategy for enhancing client retention and attracting new customers seeking expert advice.

Diversity, Equity, and Inclusion (DEI) Expectations

Societal pressure for greater diversity, equity, and inclusion (DEI) is significantly shaping corporate strategies. This translates to expectations for businesses, including financial institutions like BMO, to demonstrate tangible progress in their workforce composition and customer service inclusivity.

Canadian ESG regulations now mandate corporate diversity reporting for federally regulated entities. This means BMO must actively track and disclose data related to the diversity of its employees and leadership, a trend that is expected to intensify in the coming years.

BMO's commitment to inclusive economic growth, exemplified by programs such as the BMO EMpower initiative, directly addresses these evolving societal values. This focus not only helps attract a wider customer base but also appeals to a more diverse talent pool, crucial for long-term success.

- Increasing Societal Demand: A 2024 survey indicated that over 70% of Canadians believe companies should prioritize DEI in their operations.

- Regulatory Compliance: Federal regulations require financial institutions to report on board diversity metrics, with expectations for more granular data in future reporting cycles.

- Talent Attraction: BMO’s EMpower program aims to support underrepresented entrepreneurs, reflecting a strategic alignment with DEI principles that enhances brand reputation and market reach.

Canada's demographic shifts, including an aging population and increasing immigration, are reshaping banking needs, with immigration driving significant population growth in 2024. BMO's tailored programs, like the NewStart Program for newcomers, demonstrate an adaptation to these evolving needs. Furthermore, the strong preference for digital banking channels, with over 70% of transactions occurring digitally in 2023, necessitates continuous investment in BMO's digital infrastructure to meet customer expectations.

Technological factors

BMO is deeply invested in a digital-first approach, channeling significant resources into artificial intelligence, advanced cloud infrastructure, and real-time analytics. This strategic focus aims to elevate both customer experiences and operational efficiency, driving substantial business value.

The bank's commitment to innovation was recognized with the 2025 Celent Model Bank Award for Payments Innovation. This accolade highlights achievements in areas like Unified Push Provisioning and FundsNow, technologies designed to simplify transactions and ensure immediate fund availability for customers.

This ongoing digital transformation is paramount for BMO to deliver consistently smooth, personalized client interactions and to achieve greater optimization across all its business functions.

The financial sector, including BMO, is grappling with escalating cybersecurity threats. These range from sophisticated ransomware attacks and autonomous malware to increasingly advanced AI-driven assaults, all of which imperil sensitive data and essential banking infrastructure.

To counter these evolving risks, BMO is compelled to make ongoing, substantial investments in its cybersecurity defenses. This includes implementing advanced data encryption protocols and providing comprehensive training for its employees to safeguard customer information and ensure operational continuity.

The threat landscape is starkly illustrated by projections indicating a 25% increase in ransomware attacks by 2025, with the financial sector identified as a prime target for such malicious activities.

The Canadian FinTech landscape is rapidly evolving, presenting a dual challenge and opportunity for BMO. Record investments in Canadian fintech during the first half of 2024 highlight the accelerating pace of innovation and the growing demand for digital financial services.

BMO is actively navigating this dynamic by forging strategic technology partnerships. For instance, its collaboration with Google aims to expedite the development and rollout of new services, including advanced robo-advisors and potentially blockchain-enabled solutions, thereby enhancing its competitive edge.

Investment in Digital Infrastructure and Customer Experience

BMO is heavily investing in its digital infrastructure to elevate the customer experience. This includes developing robust online banking platforms and expanding its payment ecosystems, aiming to provide seamless financial interactions. For instance, in its fiscal year 2024 first quarter, BMO reported a 10% year-over-year increase in digital product applications, reflecting a growing customer preference for tech-driven services.

These digital enhancements are directly contributing to improved customer satisfaction metrics. The bank's focus on a user-friendly digital interface and accessible services has resulted in new highs in customer satisfaction scores. This commitment to digital transformation is crucial for meeting the evolving demands of consumers who expect convenience and efficiency in their banking activities.

- Digital Investment: BMO's ongoing commitment to digital infrastructure upgrades.

- Customer Experience: Focus on enhancing user satisfaction through digital channels.

- Growth in Digital Adoption: Increased application volumes for digital banking products.

- Market Demand: Responding to the rising consumer need for tech-enabled financial services.

Automation of Banking Processes

Automation, increasingly driven by artificial intelligence and machine learning, is fundamentally reshaping banking operations. This technological shift impacts everything from customer interactions, with AI-powered chatbots handling inquiries, to the efficiency of back-office functions. BMO, recognizing this, is actively investing in modernization, leveraging data, analytics, and AI to deliver enhanced value to both customers and the business. For instance, BMO launched an AI-powered digital assistant within its insurance division, demonstrating a commitment to integrating these advanced technologies.

The benefits of this automation are significant, promising greater operational efficiency, substantial cost reductions, and a marked improvement in accuracy across various banking tasks. These advancements are crucial for maintaining competitiveness in the evolving financial landscape. BMO's strategic focus on these areas is designed to yield tangible improvements. In 2024, the financial sector saw continued investment in AI, with reports indicating that banks were allocating significant resources to digital transformation initiatives aimed at improving customer experience and operational agility.

- AI Adoption: Banks are increasingly deploying AI for tasks like fraud detection, credit scoring, and personalized customer service.

- Efficiency Gains: Automation in areas like loan processing and account management can reduce processing times by up to 70%.

- Cost Savings: Implementing AI-driven solutions can lead to a projected 20-30% reduction in operational costs in the medium term.

- Customer Experience: AI-powered chatbots can handle a large volume of customer queries, improving response times and availability.

BMO's technological strategy centers on a digital-first approach, heavily investing in AI, cloud infrastructure, and real-time analytics to boost customer experience and operational efficiency. This focus is evident in their 2025 Celent Model Bank Award for Payments Innovation, recognizing advancements in areas like FundsNow for immediate fund availability.

Cybersecurity remains a critical technological factor, with BMO investing substantially to counter escalating threats like AI-driven attacks and ransomware, which are projected to increase by 25% by 2025, particularly targeting the financial sector.

The bank is actively navigating the evolving Canadian FinTech landscape through strategic partnerships, such as with Google, to accelerate new service development, including advanced robo-advisors.

BMO's digital transformation is yielding tangible results, with a 10% year-over-year increase in digital product applications in Q1 fiscal 2024, contributing to new highs in customer satisfaction scores.

| Area | BMO's Focus/Investment | Impact/Metric | Industry Trend |

|---|---|---|---|

| Digital Infrastructure | AI, Cloud, Real-time Analytics | Enhanced Customer Experience, Operational Efficiency | Digital-first banking models |

| Cybersecurity | Advanced Encryption, Training | Mitigation of AI-driven attacks, Ransomware | 25% projected increase in ransomware attacks by 2025 |

| FinTech Partnerships | Collaboration with Google | Accelerated service development (e.g., robo-advisors) | Growth in FinTech investment in Canada |

| Digital Adoption | Online platforms, Payment ecosystems | 10% YoY increase in digital product applications (Q1 FY24) | Rising consumer demand for tech-enabled services |

Legal factors

Bank of Montreal (BMO) navigates a landscape shaped by rigorous banking regulations, primarily overseen by the Office of the Superintendent of Financial Institutions (OSFI) in Canada. These regulations include critical capital adequacy requirements, such as those mandated by Basel III, which dictate the minimum capital banks must hold to absorb unexpected losses. For instance, BMO's Common Equity Tier 1 (CET1) ratio is a key metric closely monitored by regulators and investors alike, reflecting its financial resilience.

OSFI has been actively updating its regulatory framework, with significant developments anticipated in 2024 and 2025. A notable update includes revisions to its Supervisory Framework, aiming to enhance the oversight of financial institutions. Furthermore, OSFI has announced deferrals on certain capital requirement changes, specifically those related to aligning with the Basel III standardized capital floor, providing a period of regulatory stability for institutions like BMO as they adapt to evolving global standards.

Staying compliant with these dynamic regulatory changes is not merely a procedural necessity for BMO; it is fundamental to its ongoing financial stability and the preservation of its operational license. Failure to adhere to capital requirements or other OSFI mandates could lead to penalties, restrictions, or even the revocation of its banking charter, underscoring the critical importance of proactive compliance management.

Canada's anti-money laundering (AML) and know your customer (KYC) laws, primarily driven by the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and overseen by FINTRAC, are undergoing constant updates to counter financial illicit activities. These regulations are becoming more stringent, impacting how financial institutions like BMO operate.

A significant development is the upcoming requirement for federally incorporated companies to disclose beneficial ownership details by 2025, a move aimed at increasing transparency in corporate structures. BMO must ensure its internal processes align with these evolving transparency mandates.

BMO is obligated to maintain comprehensive AML programs, conduct thorough risk assessments, and promptly report any suspicious transactions to regulatory bodies. Failure to comply can result in substantial financial penalties; for instance, FINTRAC levied $1.8 million in fines for non-compliance issues in 2024, highlighting the critical importance of robust adherence.

BMO must navigate a complex web of consumer protection and privacy laws, including Canada's Personal Information Protection and Electronic Documents Act (PIPEDA). These regulations dictate the responsible collection, storage, and utilization of customer data, with a strong emphasis on obtaining consent and ensuring robust security measures. For instance, PIPEDA mandates that organizations must obtain consent for the collection, use, or disclosure of personal information, a cornerstone of customer trust.

The financial sector is witnessing a dynamic regulatory environment, with ongoing discussions and potential new legislation concerning consumer-driven banking. This evolving landscape will necessitate BMO to adapt its strategies for managing customer information and delivering innovative services, potentially impacting its digital offerings and data governance frameworks.

Competition Law and Market Conduct

Competition laws are crucial for maintaining a level playing field in Canada's financial services industry, preventing monopolies and ensuring fair practices for businesses and consumers alike. The Bank of Montreal (BMO) must operate within this framework, which governs everything from pricing strategies to mergers and acquisitions.

A significant development impacting market conduct is the Canadian government's ongoing exploration of legislation aimed at requiring payment processors to pass on savings from reduced credit card transaction fees to small businesses. This initiative, potentially coming into effect in 2024 or 2025, directly affects how financial institutions like BMO interact with merchants and their fee structures.

BMO's market strategies, particularly concerning its merchant services and credit card offerings, must be carefully aligned with these evolving regulatory expectations. Failure to adapt could lead to penalties and a loss of competitive advantage.

- Regulatory Scrutiny: Canadian regulators are increasingly focused on ensuring fair competition and consumer protection within the financial sector, impacting BMO's operational strategies.

- Payment Fee Legislation: Proposed legislation to mandate the passing of credit card fee savings to small businesses highlights a direct government intervention in market conduct.

- Compliance Imperative: BMO must proactively adjust its business models and fee structures to remain compliant with anticipated changes in competition law and market conduct regulations.

Litigation Risks and Legal Disputes

Bank of Montreal, like other major financial institutions, navigates a landscape of potential litigation. These risks can stem from a variety of sources, including disagreements over contracts, failures to comply with regulations, and the possibility of class-action lawsuits. For instance, in its fiscal year 2023, BMO reported ongoing legal proceedings and contingent liabilities, which are standard disclosures for a bank of its size and scope.

To manage these challenges, BMO places significant emphasis on adhering to all relevant laws and maintaining strong internal compliance systems. These measures are crucial for minimizing exposure to legal disputes and their potential financial impact.

- Contractual Disputes: BMO may face legal action related to its various financial agreements and service contracts.

- Regulatory Non-Compliance: Violations of financial regulations, such as those from OSFI or FINTRAC in Canada, can lead to penalties and lawsuits.

- Class-Action Lawsuits: These can arise from issues like data breaches, mis-selling of products, or alleged discriminatory practices.

- Disclosure of Liabilities: BMO's annual reports provide insights into significant legal matters, with contingent liabilities often detailed to inform stakeholders of potential future financial obligations.

The Bank of Montreal operates under a stringent regulatory environment in Canada, with key legislation like the Bank Act and oversight from bodies such as the Office of the Superintendent of Financial Institutions (OSFI) and FINTRAC shaping its operations. New beneficial ownership disclosure rules are set to take effect by 2025, increasing transparency requirements.

Anticipated changes in 2024 and 2025 from OSFI include updates to its Supervisory Framework and potential adjustments to capital requirement alignment with Basel III, impacting BMO's capital adequacy planning.

Furthermore, evolving competition laws, such as proposed mandates for payment processors to pass on credit card fee savings to small businesses, directly influence BMO's market strategies and fee structures, with potential implementation in 2024 or 2025.

Environmental factors

Climate change poses significant physical risks for BMO, such as potential damage to assets from increasingly severe weather events, and transition risks stemming from evolving regulations and market demand for a low-carbon economy. The bank is actively positioning itself as a partner for clients navigating this shift, aiming to finance green initiatives and capitalize on emerging opportunities.

BMO's commitment to supporting the net-zero transition is evident in its updated Sustainable Bond Framework, which now encompasses financing for nuclear energy and low-carbon fuels, demonstrating a strategic response to climate-related challenges and opportunities.

The burgeoning ESG investing trend significantly shapes BMO's product development and overall corporate direction, reflecting a clear market shift. This growing investor and stakeholder demand for transparent ESG disclosures is a critical factor, with federally regulated financial institutions like BMO facing increasing requirements to report on these vital factors.

BMO's commitment to sustainability and climate reporting demonstrates its alignment with evolving disclosure frameworks, offering investors greater insight into its environmental and social impact. For instance, by mid-2024, a significant portion of BMO's assets under management were integrated with ESG considerations, showcasing a tangible response to market pressures.

Canadian regulatory bodies, notably the Office of the Superintendent of Financial Institutions (OSFI), are significantly escalating demands for climate-related disclosures from federally regulated financial institutions. This means banks like BMO must prepare for more comprehensive reporting on environmental impacts.

Beginning with fiscal year-end 2024 for larger institutions and fiscal year-end 2025 for others, banks are mandated to report on climate-related risks, including their Scope 1 and Scope 2 greenhouse gas emissions. This is a critical shift towards greater transparency in the financial sector's environmental footprint.

Although the requirement for Scope 3 emissions reporting has been pushed back to fiscal year 2028, BMO is proactively strengthening its capabilities to assess these indirect impacts. This forward-looking approach ensures the bank can meet evolving and robust disclosure expectations, demonstrating a commitment to environmental accountability.

Reputational Risks Associated with Environmental Impact

BMO's reputation is closely tied to its environmental performance and sustainability efforts. Public perception regarding the bank's financing activities, particularly in carbon-intensive sectors, can directly impact its brand image and stakeholder trust. For instance, a perceived lack of robust climate action could lead to reputational damage.

BMO's stated purpose, to Boldly Grow the Good in business and life, underscores its commitment to mitigating environmental risks. The bank has achieved carbon neutrality in its own operations since 2010, a significant milestone in managing its direct environmental footprint.

- Reputational Impact: Stakeholder scrutiny on financing of fossil fuels or inadequate climate strategies poses a significant reputational threat.

- Sustainability Commitment: BMO's long-standing carbon neutrality in operations (since 2010) aims to bolster its environmental credentials.

- Public Perception: Negative press or activism related to environmental concerns can erode customer loyalty and investor confidence.

- ESG Integration: Increasingly, investors and customers evaluate banks on their Environmental, Social, and Governance (ESG) performance, making reputation management crucial.

Sustainable Finance Initiatives and Targets

BMO has established significant goals in sustainable finance, aiming to direct $300 billion towards sustainable lending and underwriting by 2025. This commitment supports businesses focused on achieving sustainable results.

The bank has enhanced its Sustainable Bond Framework, broadening its scope to encompass new categories like green, social, and transition financing. This includes financing for nuclear energy projects and initiatives focused on climate change adaptation.

- Sustainable Finance Commitment: $300 billion in sustainable lending and underwriting by 2025.

- Framework Enhancements: Inclusion of nuclear energy and climate adaptation financing.

- Strategic Alignment: Supporting the transition to a sustainable economy through financial solutions.

Environmental factors significantly influence BMO's operations and strategy, driven by climate change and the growing demand for ESG integration. Regulatory bodies like OSFI are mandating increased climate-related disclosures, with fiscal year-end 2024 for larger institutions and 2025 for others requiring reporting on Scope 1 and 2 emissions. BMO's proactive approach includes strengthening capabilities for Scope 3 emissions assessment by 2028, demonstrating a commitment to transparency and environmental accountability.

| Environmental Factor | BMO's Response/Impact | Key Data/Target |

|---|---|---|

| Climate Change Risks | Physical and transition risks; positioning as a partner for clients | |

| Sustainable Finance Goal | Directing capital towards sustainable initiatives | $300 billion by 2025 |

| Regulatory Disclosure | Mandatory reporting on climate risks | Scope 1 & 2: FY2024/FY2025; Scope 3: FY2028 |

| Operational Footprint | Commitment to carbon neutrality | Carbon neutral since 2010 |

PESTLE Analysis Data Sources

Our Bank of Montreal PESTLE Analysis is grounded in a comprehensive review of data from official government publications, financial regulatory bodies, and reputable economic research institutions. We integrate insights from market trend reports and industry-specific analyses to ensure a robust understanding of the macro-environment.