Bank of Montreal Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Montreal Bundle

Bank of Montreal faces moderate rivalry from established banks and fintech disruptors, while customer switching costs, though present, are decreasing. The threat of new entrants is somewhat mitigated by significant capital requirements and regulatory hurdles. Understanding these dynamics is crucial for navigating the competitive landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bank of Montreal’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

BMO's reliance on technology and software providers is significant, as these vendors underpin its digital infrastructure, cybersecurity, and customer platforms. The bargaining power of these suppliers can range from moderate to high, particularly when they offer specialized or proprietary technologies essential for modern banking and innovation.

The bank's commitment to digital advancement, evidenced by its 2024 digital transformation initiatives and investments in AI-driven customer service, underscores its dependence on these tech partners. Maintaining a competitive edge and improving customer experience directly ties into the capabilities and pricing power of these critical software and technology vendors.

The banking industry, including BMO, relies heavily on professionals with expertise in finance, technology, risk management, and cybersecurity. The limited availability of specialized talent, especially in rapidly growing areas like artificial intelligence and data analytics, grants these individuals considerable leverage.

BMO's commitment to fostering a high-performing, digitally advanced, and future-ready institution highlights the critical need to attract and keep the best employees. In 2024, the demand for AI specialists in finance saw salaries increase by an average of 15-20% compared to the previous year, reflecting this scarcity.

Data and information service providers wield significant bargaining power over BMO, as access to accurate financial data, market intelligence, and credit ratings is fundamental to the bank's operations, risk management, and strategic planning. The essential nature of this data, often held under proprietary control, grants these suppliers leverage.

This power is further amplified by stringent regulatory demands for robust risk management and data integrity, making BMO reliant on high-quality, validated information. For instance, in 2023, the global financial data market was valued at over $30 billion, indicating the scale and importance of these services.

Regulatory Bodies and Compliance Services

Regulatory bodies, while not direct commercial suppliers, wield considerable influence over banks like BMO. The Office of the Superintendent of Financial Institutions (OSFI) in Canada, for example, sets strict operating and risk management standards. These regulations directly impact a bank's investment in compliance and technology, effectively acting as a powerful 'supplier' of operational mandates.

The escalating complexity and frequency of regulatory shifts, encompassing areas like operational resilience and capital adequacy, amplify this power. For instance, BMO, like its peers, must continually adapt to evolving capital requirements, such as the upcoming Basel III finalization, which significantly shapes strategic planning and operational costs. These changes necessitate substantial investments in risk management systems and reporting capabilities, directly influenced by regulatory directives.

- Regulatory Mandates: OSFI and similar bodies dictate operational frameworks, risk controls, and capital adequacy, influencing BMO's strategic direction and expenditure.

- Compliance Costs: Adapting to new regulations, such as those concerning operational resilience and third-party risk, incurs significant technology and personnel investments for BMO.

- Strategic Influence: The need to comply with evolving rules, like upcoming Basel III finalization rules, forces banks to prioritize regulatory adherence, impacting their competitive strategies and resource allocation.

Payment Network and Infrastructure Providers

Payment network and infrastructure providers, such as Visa and Mastercard, wield significant bargaining power over banks like BMO. These entities control the essential rails for transaction processing, and their fees and operational requirements directly impact BMO's costs and service offerings.

BMO, despite its size, remains dependent on these networks for seamless, widespread transaction capabilities. The reliance on third-party infrastructure means BMO has limited leverage in negotiating terms, especially as these networks are critical for customer convenience and operational efficiency.

The Canadian payment landscape is rapidly evolving, with initiatives like real-time payments (e.g., Payments Canada’s Lynx system) requiring significant investment and integration from all participants, including BMO. This ongoing technological shift further solidifies the power of infrastructure providers who set the standards and offer the necessary solutions.

- Interoperability Costs: BMO must invest in integrating with evolving payment standards, adding to operational expenses dictated by network providers.

- Transaction Fees: Fees charged by major card networks represent a direct cost to BMO for facilitating customer transactions.

- Technological Dependence: BMO's ability to offer modern payment services is contingent on the infrastructure and innovation roadmap of these external providers.

The bargaining power of suppliers for BMO is a key consideration, particularly concerning technology, data, and payment networks. Specialized software providers can command higher prices due to the critical nature of their offerings for BMO's digital transformation, as seen in the 2024 focus on AI-driven services. Similarly, data and information service providers hold significant leverage, as accurate financial data is indispensable for risk management and strategic planning, with the global financial data market exceeding $30 billion in 2023.

Payment network providers like Visa and Mastercard also exert considerable influence, setting transaction fees and dictating integration requirements that impact BMO's operational costs and customer service capabilities. The ongoing evolution of payment systems, such as real-time payments, further solidifies the power of these infrastructure providers.

| Supplier Type | BMO's Dependence | Supplier Bargaining Power Factors | Impact on BMO | 2024/Recent Data Point |

|---|---|---|---|---|

| Technology & Software Providers | High (digital infrastructure, AI) | Specialized/proprietary tech, innovation roadmap | Increased costs, reliance on vendor capabilities | 15-20% salary increase for AI specialists in finance |

| Data & Information Service Providers | High (market intelligence, credit ratings) | Essential data, proprietary control, regulatory demands | Operational costs, risk management effectiveness | Global financial data market > $30 billion (2023) |

| Payment Network Providers | High (transaction processing) | Control of payment rails, network effects | Transaction fees, integration costs | Ongoing investment in real-time payment integration |

What is included in the product

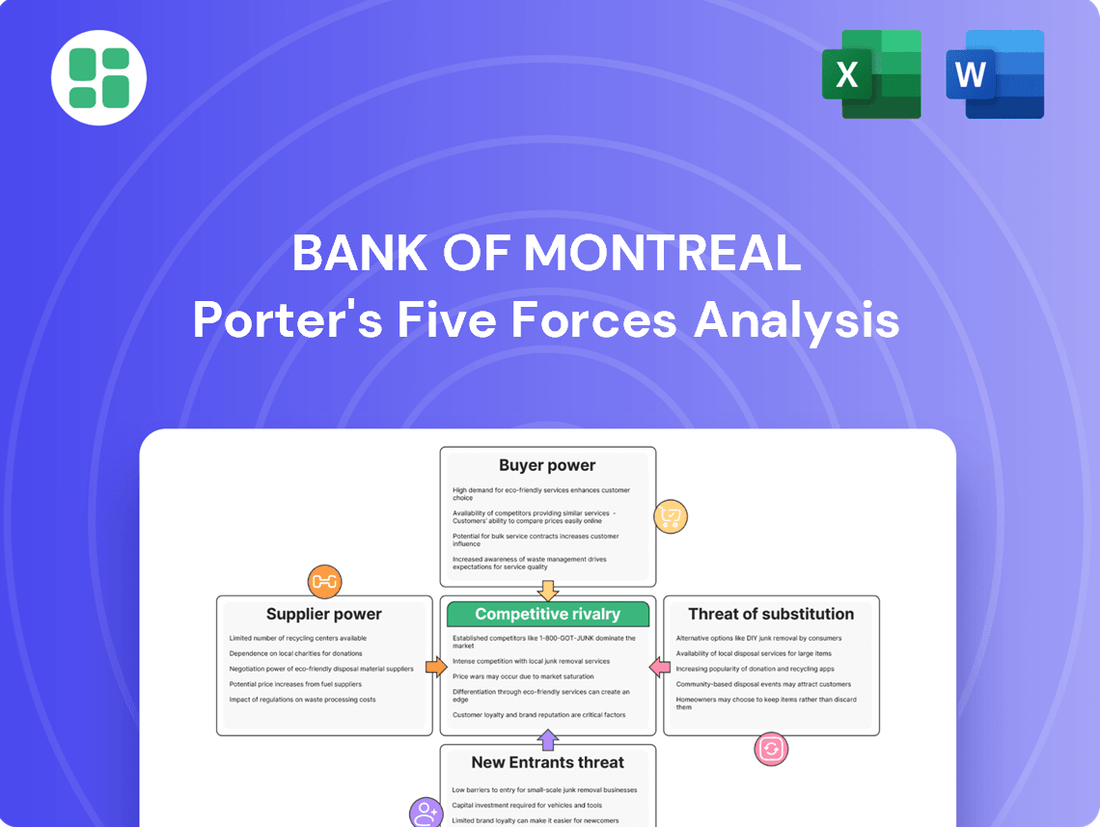

This Porter's Five Forces analysis for the Bank of Montreal dissects the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes within the Canadian banking sector.

Instantly visualize the competitive landscape for BMO, highlighting key threats and opportunities to inform strategic adjustments.

Customers Bargaining Power

Individual retail customers at BMO possess moderate bargaining power. The Canadian banking landscape is competitive, with options ranging from other major banks to credit unions and innovative fintech companies. This widespread availability means customers can readily switch providers if they find better terms or services elsewhere.

Switching costs for standard banking products, like checking or savings accounts, are generally low. Furthermore, the proliferation of digital banking platforms has made it simpler for consumers to compare offerings from various institutions, increasing their ability to negotiate or seek out more favorable deals. For instance, in 2024, the average interest rate on a high-interest savings account offered by major Canadian banks saw a slight increase, reflecting this competitive pressure.

BMO actively works to mitigate this customer power through strategic investments in digital innovation and customer experience. Platforms like BMO Savings Goals and SmartProgress are designed to foster greater customer loyalty and reduce the likelihood of them switching. By offering enhanced digital tools and personalized financial guidance, BMO aims to build stronger relationships that go beyond simple price comparisons.

Small and medium-sized businesses (SMBs) are experiencing a notable increase in their bargaining power within the financial services sector. This shift is largely driven by the proliferation of specialized financial service providers and agile fintech companies that are increasingly catering to the unique needs of this segment. For instance, by the end of 2024, the global fintech market was projected to reach over $1.1 trillion, indicating a significant competitive landscape for traditional banks like BMO.

While BMO provides a broad suite of commercial banking services, SMBs can readily source competitive alternatives for specific functions, such as payment processing or streamlined lending, from these non-traditional players. This access to niche solutions allows SMBs to negotiate more favorable terms or switch providers if their needs are not adequately met. The capacity of fintechs to innovate and address previously underserved areas further amplifies this trend, giving SMBs more options and leverage.

Large corporate and institutional clients wield considerable influence over BMO due to the sheer volume of business they represent and their intricate financial requirements. These entities frequently maintain relationships with multiple banks, enabling them to secure advantageous terms on services like capital markets, complex loans, and wealth management. In 2024, BMO's Capital Markets division, a key area serving these clients, navigated a landscape where securing and retaining such business hinges on competitive pricing and specialized offerings.

Digital-Savvy Customers and Fintech Adoption

Digital-savvy customers are increasingly wielding more power, expecting seamless, personalized financial experiences. This trend is amplified by the growing comfort with digital-first banking solutions. For instance, in 2023, over 70% of Canadian banking transactions were conducted digitally, highlighting this shift.

The proliferation of mobile banking apps, robo-advisors, and innovative digital payment systems provides customers with readily accessible alternatives. If traditional institutions like BMO fail to keep pace with these evolving digital expectations, customers can easily switch. This ease of switching directly impacts a bank's ability to retain customers and dictate terms.

BMO's strategic investments in digital transformation are a direct response to these customer demands. By enhancing its digital offerings, BMO aims to not only meet but exceed these expectations, thereby strengthening customer loyalty and mitigating the impact of this powerful customer force. Their commitment to digital innovation is crucial for maintaining a competitive edge.

- Digital Transaction Growth: In 2023, Canadian banks reported that over 70% of customer transactions occurred through digital channels.

- Customer Expectations: A significant portion of customers, particularly younger demographics, prioritize digital convenience and personalized services when choosing financial providers.

- Fintech Adoption: The adoption rate of fintech solutions, such as mobile payment apps, continues to rise, offering consumers more choices and increasing their bargaining power.

- BMO's Digital Investment: Bank of Montreal has allocated substantial resources to enhance its digital platforms and mobile banking capabilities to cater to these evolving customer needs.

Price Sensitivity for Commoditized Products

For commoditized banking products like mortgages and basic savings accounts, Bank of Montreal (BMO) faces significant customer price sensitivity. This is particularly evident in the mortgage market, where in 2024, Canadians continued to actively seek the best rates, often comparing offers from multiple institutions online. The widespread availability of online comparison tools means that customers can easily identify and switch to providers offering more attractive pricing, directly impacting BMO's ability to command premium rates on these core offerings.

The intense competition in these segments forces BMO to focus on factors beyond just price for differentiation. While competitive pricing remains crucial, BMO's strategy in 2024 emphasized enhancing customer experience through superior service, convenient digital platforms, and the introduction of value-added features. This approach aims to build customer loyalty and mitigate the direct impact of price-based competition on its market share for commoditized banking products.

- High Price Sensitivity: Customers are highly sensitive to price differences for commoditized banking products.

- Online Comparison Impact: Digital tools enable easy comparison of rates, increasing competitive pressure on BMO.

- Differentiation Strategy: BMO focuses on service, convenience, and value-added features to stand out from price-focused competitors.

The bargaining power of customers for Bank of Montreal (BMO) is substantial, particularly for individual retail clients and small to medium-sized businesses (SMBs). This stems from a highly competitive Canadian banking sector, where numerous alternatives exist, including other major banks, credit unions, and fintech firms. Low switching costs for standard accounts and the ease of comparing offerings online empower customers to seek better terms, as evidenced by the slight rise in high-interest savings account rates in 2024 due to competitive pressures.

Digital-savvy customers are also a significant force, expecting seamless, personalized experiences, with over 70% of Canadian banking transactions occurring digitally in 2023. The availability of mobile banking apps and other digital payment systems means customers can easily switch if traditional institutions like BMO don't meet their evolving digital expectations. BMO's substantial investments in digital transformation are a direct strategy to retain these customers and mitigate this powerful force.

For commoditized products like mortgages, customer price sensitivity is high, with online comparison tools in 2024 facilitating easy rate shopping. This forces BMO to differentiate through superior service and digital convenience rather than solely relying on price. Large corporate clients also hold considerable sway due to the volume of business they represent, often maintaining relationships with multiple banks to secure favorable terms on complex financial services.

| Customer Segment | Bargaining Power Level | Key Drivers | BMO's Mitigation Strategies |

|---|---|---|---|

| Individual Retail Customers | Moderate to High | Competitive landscape, low switching costs, digital comparison tools | Digital innovation, enhanced customer experience, loyalty programs |

| Small & Medium Businesses (SMBs) | Increasingly High | Proliferation of fintechs, niche financial solutions, competitive alternatives | Tailored commercial banking services, digital platforms for SMBs |

| Large Corporate & Institutional Clients | High | High transaction volumes, complex needs, multi-bank relationships | Competitive pricing, specialized capital markets and wealth management services |

| Digital-Savvy Customers | High | Expectation of seamless digital experience, availability of digital-first alternatives | Significant investment in digital transformation, mobile banking enhancements |

What You See Is What You Get

Bank of Montreal Porter's Five Forces Analysis

This preview shows the exact Bank of Montreal Porter's Five Forces analysis you'll receive immediately after purchase, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. You're looking at the actual document, which provides a comprehensive overview of the forces shaping the competitive landscape for BMO. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The Canadian banking landscape is a tight race, with the 'Big Six' banks, including BMO, fiercely vying for customers. This means BMO is constantly up against formidable rivals who are also strong players across personal banking, business services, wealth management, and investment banking. It’s a crowded field where gaining a significant edge in market share is a real challenge.

This intense rivalry compels BMO and its peers to push for innovation and find unique ways to stand out. For instance, in 2023, Canadian banks collectively reported significant net income growth, with BMO itself seeing a substantial increase, demonstrating their ability to compete effectively even within this concentrated market. This competitive pressure fuels efforts in digital transformation and personalized customer experiences.

Fintech companies are significantly intensifying competition for established players like BMO. These agile digital disruptors often specialize in specific financial services, offering streamlined, tech-driven solutions in areas such as payments, lending, and investment management. For instance, the global fintech market was projected to reach over $300 billion in 2024, highlighting its substantial growth and impact.

Banks, including BMO, face significant hurdles in differentiating their core products and services. Despite investments in digital tools like BMO's SmartProgress and Savings Goals, many fundamental banking offerings are perceived as similar by consumers. This commoditization intensifies competitive rivalry, as it becomes difficult to sustain unique advantages over the long term.

Geographic Expansion and U.S. Market Competition

BMO's substantial U.S. market footprint places it directly against a vast and diverse array of competitors. This includes not only major national players but also a multitude of regional and community banks, each vying for market share.

The competitive intensity is further amplified by a robust and rapidly evolving fintech sector, which introduces innovative solutions and pressures traditional banking models. This dynamic U.S. landscape presents ongoing challenges for BMO.

Key competitive pressures in the U.S. banking sector for BMO include the critical need to attract and retain customer deposits, especially amidst fluctuating interest rate environments, and the imperative to stimulate loan growth in a saturated market.

- Intense Competition: BMO faces formidable competition from national banks, regional institutions, and community banks within the U.S.

- Fintech Disruption: A well-developed fintech ecosystem adds another layer of competitive rivalry, challenging traditional banking services.

- Deposit and Loan Pressures: The U.S. market presents challenges in retaining deposits and driving loan growth, intensifying competitive dynamics.

High Exit Barriers

High exit barriers are a significant factor in the competitive rivalry for banks like BMO. The immense capital required to establish and maintain a banking operation, coupled with the stringent regulatory approvals needed to operate, makes exiting the market an incredibly difficult and costly endeavor. For instance, in 2024, the average capital requirement for a new chartered bank in Canada can run into hundreds of millions of dollars, making divestiture or closure financially prohibitive for many. This essentially locks existing players into the market, ensuring they must continue to compete vigorously for every customer and every dollar of profit.

The established infrastructure, including extensive branch networks, sophisticated IT systems, and deep customer relationships, further solidifies these exit barriers. BMO, like its peers, has invested billions over decades to build this infrastructure. In 2024, Canadian banks continue to spend significantly on technology upgrades, with investments often exceeding $1 billion annually per major institution, to remain competitive. This makes it challenging for underperforming banks to simply shut down operations without incurring massive losses, thus perpetuating intense competition among the remaining participants.

- Regulatory Hurdles: Obtaining and maintaining banking licenses involves extensive compliance with bodies like OSFI in Canada, creating a high barrier to entry and exit.

- Capital Intensity: Significant capital is required to operate, with major banks holding hundreds of billions in assets, making it difficult to recoup investments upon exit.

- Infrastructure Lock-in: Billions invested in physical branches, technology, and brand building create substantial sunk costs, discouraging market departure.

- Sustained Rivalry: These factors compel existing banks to continuously compete for market share, intensifying rivalry as no player can easily leave the field.

The competitive rivalry within the Canadian banking sector is exceptionally high, characterized by the dominance of the 'Big Six' banks, including BMO. This intense competition forces continuous innovation and differentiation, as evidenced by significant net income growth reported by Canadian banks in 2023. The rise of agile fintech companies further escalates this rivalry, as they offer specialized, tech-driven solutions in areas like payments and lending, contributing to a global fintech market projected to exceed $300 billion in 2024.

BMO's extensive U.S. operations place it in direct competition with a broad spectrum of financial institutions, from large national banks to numerous regional and community banks. This environment is further complicated by the dynamic fintech sector, which challenges traditional banking models with innovative offerings. Consequently, BMO faces significant pressures in attracting and retaining customer deposits and driving loan growth in a saturated market.

| Competitor Type | Key Characteristics | Impact on BMO |

|---|---|---|

| Big Six Canadian Banks | Dominant market share, comprehensive services | Intense pressure on market share, pricing, and innovation |

| U.S. National Banks | Vast reach, significant resources | Direct competition for customers and deposits in the U.S. |

| U.S. Regional/Community Banks | Local focus, strong customer relationships | Niche competition, particularly in specific geographic areas |

| Fintech Companies | Agile, digital-first, specialized services | Disruption of traditional services, pressure on fees and customer experience |

SSubstitutes Threaten

The most significant threat of substitutes for Bank of Montreal (BMO) stems from fintech companies. These firms unbundle traditional banking services, offering specialized and often more convenient digital solutions. For instance, digital payment platforms like PayPal, Square, and Stripe are increasingly handling transactions that might otherwise occur through a bank.

Online lending platforms and robo-advisors also present a considerable threat. These alternatives frequently boast lower fees and cater to specific customer needs, such as streamlined loan applications or automated investment management. In 2024, the global fintech market continued its robust growth, with digital payments alone projected to reach trillions in transaction value, highlighting the scale of this competitive pressure.

Credit unions and community banks pose a threat of substitution, especially for BMO's retail and small business clientele. These institutions often emphasize personalized service and local community ties, which can be attractive to customers. For instance, as of Q1 2024, credit unions in Canada reported a collective membership of over 5.7 million, demonstrating their significant reach and appeal as alternatives for core banking services.

Peer-to-peer (P2P) lending and crowdfunding platforms are emerging as viable substitutes for traditional bank financing, particularly for small businesses and individuals. These platforms offer alternative avenues for capital, often with more flexible terms or easier accessibility than conventional loans. For instance, the P2P lending market globally saw significant growth, with transaction volumes reaching hundreds of billions of dollars annually by 2023, indicating a clear shift in funding preferences for certain segments.

Direct Investment Platforms and Robo-Advisors

Direct investment platforms and robo-advisors present a significant threat of substitution for Bank of Montreal's wealth management offerings. These digital solutions empower individuals to manage their portfolios with less human guidance, often at a fraction of the cost of traditional advisory services. This appeals to a growing segment of investors prioritizing autonomy and cost savings.

For instance, the global robo-advisor market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially in the coming years. BMO's wealth management division must contend with this shift towards digital-first, lower-cost alternatives that directly compete for investor assets.

- Lower Fees: Robo-advisors typically charge annual management fees ranging from 0.25% to 0.75%, significantly less than the 1% or more often seen in traditional wealth management.

- Accessibility: Many platforms allow investors to start with very low minimum investment amounts, democratizing access to investment management.

- Digital Convenience: Investors can access and manage their accounts 24/7 through user-friendly online portals and mobile apps.

- Growing Market Share: The adoption of these platforms is increasing, with many traditional financial institutions also launching their own digital advisory services to remain competitive.

Cryptocurrencies and Blockchain-based Finance

Cryptocurrencies and blockchain-based finance present a growing threat of substitution for traditional banking services. While still developing, platforms like decentralized finance (DeFi) offer alternative avenues for transactions, investments, and lending, potentially bypassing established financial institutions.

The total value locked (TVL) in DeFi protocols reached over $100 billion in early 2024, indicating significant user adoption and capital allocation outside traditional banking systems. This growth suggests a tangible shift in how some consumers and businesses manage their finances.

- Decentralized Finance (DeFi) Growth: DeFi TVL surpassed $100 billion in early 2024, showcasing a substantial alternative to traditional financial services.

- Transaction Alternatives: Cryptocurrencies provide a means for cross-border payments and other transactions, often with lower fees and faster settlement times than traditional methods.

- Investment Diversification: Digital assets offer a new class of investment, attracting capital that might otherwise be allocated to traditional banking products like savings accounts or bonds.

- Regulatory Uncertainty: Evolving regulatory landscapes for cryptocurrencies and DeFi could either accelerate or temper their disruptive potential as substitutes.

The threat of substitutes for Bank of Montreal is substantial, driven by technological innovation and evolving consumer preferences. Fintech companies, offering specialized digital solutions, are a primary concern, with digital payment platforms handling significant transaction volumes. Furthermore, credit unions and community banks appeal to specific customer segments through personalized service, and P2P lending platforms provide alternative financing options.

The rise of robo-advisors and direct investment platforms directly challenges BMO's wealth management services, offering lower fees and greater accessibility. Cryptocurrencies and decentralized finance (DeFi) also represent a growing, albeit nascent, threat by providing alternative financial ecosystems. The total value locked in DeFi protocols exceeding $100 billion in early 2024 underscores the capital shifting outside traditional banking.

| Substitute Category | Key Characteristics | Impact on BMO | Market Data/Trends (as of early-mid 2024) |

|---|---|---|---|

| Fintech Payment Platforms | Specialized, convenient digital transactions | Reduced transaction fees and customer engagement | Global digital payments market projected to reach trillions in value. |

| Robo-Advisors/Direct Investment | Lower fees, accessibility, digital management | Loss of wealth management AUM, fee compression | Robo-advisor market valued around $2.5 billion in 2023, with strong growth expected. |

| Credit Unions/Community Banks | Personalized service, local focus | Competition for retail and small business deposits and loans | Credit unions in Canada had over 5.7 million members by Q1 2024. |

| P2P Lending/Crowdfunding | Alternative financing, flexible terms | Disintermediation of traditional lending | Global P2P lending market transacting hundreds of billions annually by 2023. |

| Cryptocurrencies/DeFi | Decentralized transactions, alternative investments | Potential disintermediation of core banking functions | DeFi total value locked (TVL) exceeded $100 billion in early 2024. |

Entrants Threaten

The banking sector faces substantial threats from new entrants, primarily due to high regulatory and capital barriers. Existing institutions like Bank of Montreal operate within a framework demanding significant financial reserves and adherence to complex compliance protocols.

Stringent licensing requirements and robust capital adequacy rules, such as those outlined by Basel III and Office of the Superintendent of Financial Institutions (OSFI) guidelines, create formidable obstacles. These established hurdles make it exceptionally challenging for aspiring entities to launch as full-service banks. In 2024, OSFI continued to emphasize its updated supervisory framework, reinforcing these entry barriers and protecting incumbent players.

Trust is absolutely critical in the banking sector, and established players like BMO have spent centuries cultivating a strong reputation and customer loyalty. New entrants must overcome the significant hurdle of building this same level of confidence and credibility to attract a substantial customer base.

This intangible asset, trust, is incredibly difficult and costly for newcomers to replicate, acting as a substantial barrier to entry. For instance, in 2024, consumer trust in financial institutions remains a key differentiator, with studies showing a strong preference for banks with a long-standing presence and positive public perception.

Existing large banks like BMO benefit from significant economies of scale in operations, technology, and marketing, giving them a substantial cost advantage. For instance, BMO's extensive branch network and digital infrastructure are costly to replicate. New entrants would find it difficult to achieve similar cost efficiencies without a massive initial investment and rapid customer acquisition, making it challenging to compete on price for a wide array of financial services.

Access to Distribution Channels and Customer Data

New entrants face significant hurdles in accessing established distribution channels and crucial customer data, which are vital for effective market penetration. BMO, for instance, benefits from its extensive network of physical branches, ATMs, and robust digital platforms. This infrastructure, combined with a wealth of proprietary customer data, provides a substantial competitive advantage.

The absence of such established networks and data insights makes customer acquisition for new players both costly and challenging. While digital channels offer a more accessible entry point, achieving a comprehensive reach comparable to incumbents like BMO remains a considerable obstacle. For example, in 2023, BMO reported over 1,200 branches across North America, underscoring the scale of physical reach new entrants must contend with.

- Established Infrastructure: BMO's extensive branch and ATM network (over 1,200 locations as of 2023) creates a significant barrier for new entrants.

- Data Advantage: Access to and utilization of vast amounts of proprietary customer data provides BMO with deep insights into customer behavior and preferences, which new entrants lack.

- Customer Acquisition Costs: Without established channels and data, new entrants face higher costs to attract and onboard customers.

- Digital Reach Challenge: While digital platforms are easier to build, replicating the comprehensive market reach of an incumbent like BMO is a long and expensive process.

Technological Complexity and Infrastructure Investment

The sheer technological complexity and the massive infrastructure investment required present a significant barrier for new entrants looking to compete with established banks like BMO. Building and maintaining the sophisticated, secure, and scalable systems essential for modern banking operations, from core banking platforms to advanced payment processing and robust cybersecurity, demands enormous capital outlay. For instance, in 2023, major banks continued to invest billions in digital transformation and cybersecurity, with industry estimates suggesting global spending on financial technology (FinTech) reached over $120 billion.

Replicating BMO's established technological capabilities would necessitate a comparable, if not greater, level of investment. This includes not only the initial setup but also ongoing maintenance, upgrades, and the recruitment of highly specialized talent. The ongoing evolution of financial technology, including AI-driven analytics and blockchain solutions, further escalates these requirements, making it exceedingly difficult for newcomers to achieve parity without substantial financial backing and a long-term commitment.

- High Capital Expenditure: Significant upfront investment is needed for core banking systems, payment infrastructure, and cybersecurity.

- Technological Sophistication: Developing and maintaining advanced digital capabilities, including AI and data analytics, is a complex undertaking.

- Ongoing Investment: Continuous spending is required for system upgrades, maintenance, and staying ahead of technological advancements.

The threat of new entrants in the banking sector, impacting institutions like Bank of Montreal, is considerably low due to high barriers to entry. These include stringent regulatory requirements, substantial capital needs, and the immense difficulty in building customer trust and brand loyalty.

New players also struggle to match the economies of scale and established technological infrastructure of incumbents, making it hard to compete on cost or service breadth. For instance, in 2023, BMO's extensive North American branch network of over 1,200 locations represented a significant physical advantage that newcomers would find costly to replicate.

The financial technology sector, while innovative, often partners with or is acquired by established banks rather than directly challenging them as full-service entities. In 2024, the ongoing investments by major banks in digital transformation, estimated in the billions globally, further solidify their technological lead.

| Barrier Type | Description | Impact on New Entrants | Example for BMO (2023-2024) |

|---|---|---|---|

| Regulatory & Capital | High capital adequacy ratios and complex compliance rules | Requires significant upfront investment and ongoing adherence to strict standards | OSFI's reinforced supervisory framework in 2024 |

| Brand & Trust | Established reputation and customer loyalty | Difficult and time-consuming to build credibility and attract customers | Consumer preference for long-standing institutions in 2024 |

| Economies of Scale | Cost advantages from large-scale operations | Newcomers struggle to achieve similar cost efficiencies | BMO's extensive branch and digital infrastructure |

| Technology & Infrastructure | Sophisticated and secure IT systems | Massive investment needed for development, maintenance, and upgrades | Billions invested globally in FinTech and digital transformation in 2023 |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bank of Montreal is built upon a foundation of publicly available financial reports, investor presentations, and regulatory filings. We supplement this with data from reputable financial news outlets, industry-specific research reports, and market intelligence platforms to capture current competitive dynamics.