Bank of Montreal Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Montreal Bundle

Unlock the strategic blueprint behind Bank of Montreal's success with our comprehensive Business Model Canvas. Discover how they engage diverse customer segments, forge key partnerships, and deliver compelling value propositions in the financial sector. This detailed analysis is your key to understanding their competitive edge.

Ready to dissect the operational engine of a financial giant? Our full Business Model Canvas for Bank of Montreal lays bare their revenue streams, cost structures, and critical resources. Gain actionable insights to refine your own business strategy or investment approach.

See how Bank of Montreal structures its operations for sustained growth. This downloadable canvas provides a clear, section-by-section breakdown of their key activities and channels, offering invaluable lessons for aspiring entrepreneurs and seasoned professionals alike.

Partnerships

BMO actively partners with fintech innovators, notably through its WMNfintech program, a collaboration with 1871. This initiative helps BMO discover and implement cutting-edge financial solutions for its diverse client base.

These strategic alliances accelerate BMO's digital transformation journey, allowing it to integrate advanced technologies and enhance its service offerings for both retail and commercial customers.

BMO strategically partners with major technology providers like Google, Microsoft, and Amazon Web Services. These collaborations are crucial for integrating cutting-edge digital solutions, including AI tools designed to improve customer interactions and streamline operations. For instance, BMO's investment in cloud infrastructure with AWS supports its digital transformation initiatives, aiming for greater agility and scalability in its services.

BMO's strategic alliance with Canal Road Group (CRG) is a cornerstone of its direct lending strategy, specifically targeting the upper middle-market. This partnership is designed to enhance BMO's capacity to serve a broader range of clients by leveraging CRG's specialized investment management expertise.

This collaboration is particularly impactful as it merges BMO's vast client network and deep capital markets knowledge with CRG's proven success in managing investments. Such synergy allows for more efficient and effective deployment of capital, directly benefiting sponsor and corporate clients. For instance, in 2024, the direct lending market saw significant activity, with private credit funds playing an increasingly vital role in financing middle-market companies, a trend BMO's partnership is well-positioned to capitalize on.

The integration of CRG's capabilities broadens BMO's access to private lending capital, a crucial element for facilitating significant transactions. This expanded access is vital for supporting the complex financial needs of clients, especially in an environment where traditional bank lending may be more constrained. The ability to offer diverse private lending solutions is a key differentiator for BMO in the competitive financial landscape.

Financial Planning Software Firms

BMO actively collaborates with financial planning software firms to bolster its digital offerings. A prime example is their partnership with Conquest Planning, which led to the creation of the My Financial Progress portal. This integration enables BMO clients to develop customized financial plans directly within the bank's online environment.

These strategic alliances are crucial for BMO's value proposition, providing clients with sophisticated tools designed to improve financial literacy and facilitate the achievement of personal financial objectives. In 2024, BMO continued to emphasize digital client solutions, recognizing the growing demand for accessible and user-friendly financial management tools.

- Conquest Planning Integration: Launched the My Financial Progress portal, allowing clients to create personalized financial plans.

- Enhanced Value Proposition: Offers advanced tools for financial literacy and goal achievement through digital platforms.

- Digital Client Solutions: Reflects BMO's 2024 focus on providing accessible and user-friendly financial management tools.

Industry Associations and Regulators

BMO actively cultivates strong ties with industry associations and regulatory bodies, a cornerstone for navigating the dynamic financial landscape. This ensures ongoing compliance with evolving standards and fosters BMO's contribution to the broader financial ecosystem.

Key to these relationships is adherence to guidelines set forth by entities like Canada's Office of the Superintendent of Financial Institutions (OSFI). For instance, in 2023, BMO reported significant progress in meeting regulatory capital requirements, with its Common Equity Tier 1 (CET1) ratio consistently exceeding stipulated minimums, demonstrating a robust foundation for operations.

Furthermore, BMO's engagement with sustainability reporting frameworks, such as those promoted by the Task Force on Climate-related Financial Disclosures (TCFD), highlights a commitment to transparency and responsible business practices. This proactive approach is vital for maintaining stakeholder trust and operating effectively within a well-regulated environment.

- Regulatory Adherence: Maintaining compliance with OSFI guidelines and other financial regulations is paramount.

- Industry Engagement: Participation in industry associations allows BMO to contribute to and stay informed about evolving best practices.

- Sustainability Focus: Alignment with frameworks like TCFD demonstrates a commitment to responsible and transparent operations.

BMO's key partnerships extend to fintech innovators like those engaged through its WMNfintech program, fostering the adoption of cutting-edge financial solutions. Strategic alliances with major technology providers such as Google and Microsoft are vital for integrating AI and cloud infrastructure, enhancing customer interactions and operational efficiency. Furthermore, collaborations with financial planning software firms, exemplified by the Conquest Planning partnership, enrich BMO's digital offerings and client financial literacy tools.

| Partner Type | Example Partner(s) | Strategic Impact | 2024 Focus/Data Point |

|---|---|---|---|

| Fintech Innovators | 1871 (WMNfintech) | Accelerates digital transformation and service enhancement. | Continued investment in discovering and implementing new financial technologies. |

| Technology Providers | Google, Microsoft, AWS | Integrates AI, cloud infrastructure for improved customer experience and operations. | AWS cloud migration supports BMO's agility and scalability initiatives. |

| Financial Planning Software | Conquest Planning | Enables personalized financial planning through digital portals. | My Financial Progress portal adoption aimed at boosting client financial literacy. |

| Direct Lending Specialists | Canal Road Group (CRG) | Expands direct lending capacity for the upper middle-market. | Capitalizing on 2024 growth in private credit for middle-market financing. |

What is included in the product

A strategic overview of the Bank of Montreal's operations, detailing its diverse customer segments, extensive distribution channels, and multifaceted value propositions.

This canvas outlines key resources, activities, and partnerships, supported by a robust cost structure and revenue streams, offering a holistic view of their banking services.

The Bank of Montreal's Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of their complex operations, allowing for streamlined understanding and problem-solving.

Activities

BMO's personal and commercial banking segments are central to its operations, offering a wide array of financial products and services. These include essential services like checking and savings accounts, mortgages, and personal loans for individuals, alongside tailored solutions for businesses such as commercial loans, treasury management, and capital markets access.

The bank's strategy in this area focuses on enabling customers to achieve financial progress through convenient and integrated digital and in-branch experiences. For instance, as of Q1 2024, BMO reported a reported diluted earnings per share of $3.04, reflecting the strength of its diversified business, including its robust banking operations.

Bank of Montreal's wealth and asset management divisions are central to their operations, focusing on comprehensive financial solutions for a broad client base. This includes individuals, families, business owners, and institutional investors, offering a suite of products designed to manage and grow assets.

Key activities within this segment involve meticulous financial planning, expert investment management, and the development of cutting-edge financial products. For instance, in Q1 2024, BMO's Personal & Canadian Commercial Banking segment, which encompasses wealth management, reported a net income of $1.1 billion, demonstrating the significant contribution of these services.

The overarching goal is to provide clients with the tools and strategies needed to effectively grow, safeguard, and transfer their wealth across generations. This client-centric approach, coupled with a robust product offering, positions BMO as a key player in the financial services landscape, aiming to foster long-term client relationships and financial well-being.

BMO Capital Markets is a key player, offering a comprehensive range of investment banking, global markets trading, and advisory services to a worldwide client base of corporations, institutions, and governments. This robust offering is designed to support client expansion and is a major contributor to the bank's financial performance.

In fiscal year 2023, BMO Capital Markets generated $4.3 billion in revenue, showcasing its significant contribution to the bank's bottom line. The segment's success is driven by its ability to provide tailored solutions, from underwriting debt and equity offerings to facilitating complex derivatives and foreign exchange transactions.

Digital Innovation and Transformation

BMO’s key activities heavily lean into its digital innovation and transformation efforts, a critical component of its business model. This involves a significant commitment to a digital-first strategy, leveraging artificial intelligence, robust data analytics, and ongoing technology modernization to stay competitive and meet evolving customer expectations.

The bank actively develops and enhances digital products and services. Examples include features like Savings Goals, which help customers manage their finances more effectively, and Digital Card Controls, offering users greater security and convenience. Furthermore, services such as FundsNow streamline payment processes, demonstrating BMO's focus on practical digital solutions.

These digital advancements are not just about offering new tools; they are designed to create tangible customer value and drive operational efficiencies across the organization. By improving the mobile banking experience and introducing user-friendly digital interfaces, BMO aims to deepen customer relationships and streamline internal processes.

- Digital Investment: BMO's strategy prioritizes AI, data, and technology modernization to fuel digital innovation.

- Product Development: Key digital offerings include Savings Goals, Digital Card Controls, and FundsNow.

- Customer Experience: Enhancements to mobile banking aim to deliver superior customer value and convenience.

- Efficiency Gains: Digital transformation is a core driver for improving operational efficiency within the bank.

Risk Management and Compliance

BMO's key activities include robust risk management and strict compliance. This means actively monitoring and mitigating credit risk, a core function for any financial institution. For instance, in fiscal year 2024, BMO maintained a strong focus on its credit portfolio, demonstrating a commitment to financial stability.

The bank also prioritizes adherence to all relevant regulations and ethical guidelines. This commitment extends to transparent reporting, including disclosures related to sustainability and climate-related risks, ensuring accountability to stakeholders.

Key activities in this area involve:

- Proactive Credit Risk Management: Implementing strategies to identify, assess, and control potential credit losses.

- Regulatory Adherence: Ensuring full compliance with all applicable laws, regulations, and supervisory expectations.

- Ethical Conduct: Upholding the highest ethical standards in all business operations and interactions.

- Transparent Disclosure: Providing clear and comprehensive information on financial performance, risk exposures, and sustainability initiatives.

BMO's key activities revolve around providing a comprehensive suite of financial services across its Personal & Canadian Commercial Banking, BMO Wealth Management, and BMO Capital Markets segments. This includes developing and enhancing digital products, managing client relationships, and offering expert financial advice. The bank also prioritizes robust risk management and strict regulatory compliance to ensure stability and ethical operations.

Preview Before You Purchase

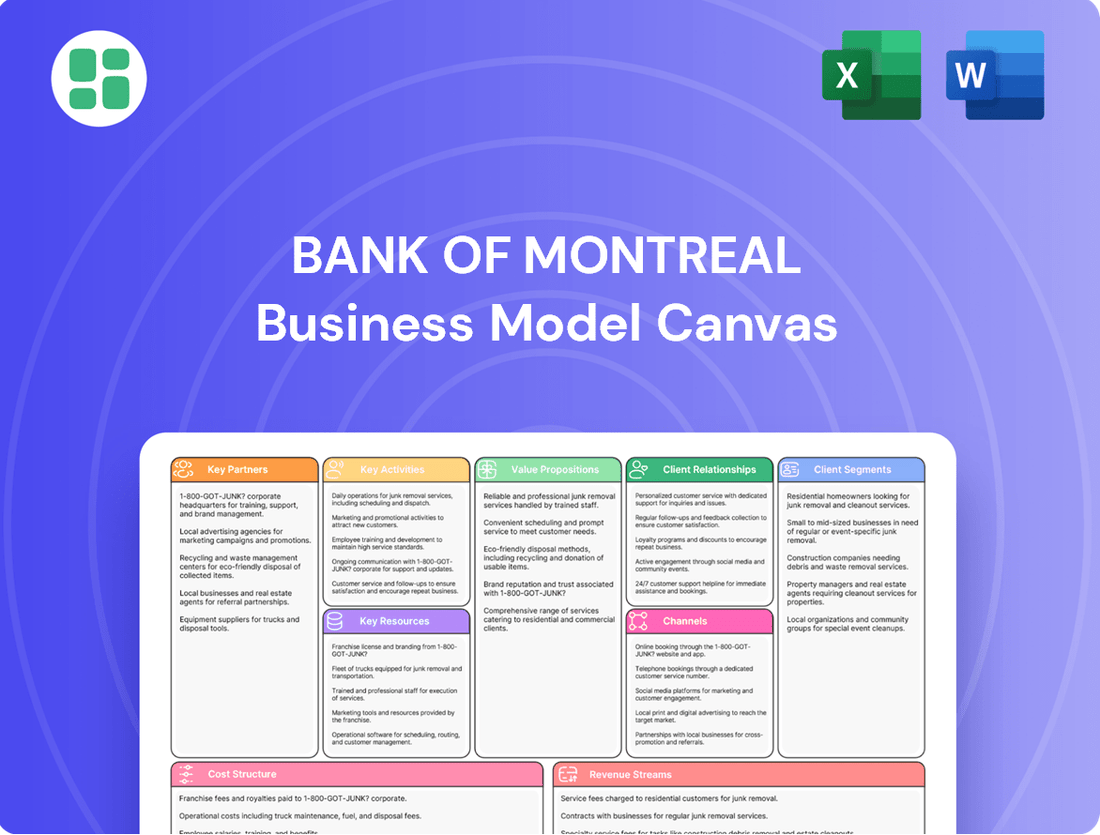

Business Model Canvas

The Bank of Montreal Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the finalized file, ensuring you know exactly what you're getting. Once your order is processed, you'll have full access to this comprehensive Business Model Canvas, ready for immediate use and analysis.

Resources

BMO's financial capital is a cornerstone of its business model, enabling extensive client support and strategic investment. As of October 31, 2024, the bank reported total assets amounting to approximately $1.41 trillion. This substantial financial backing is further reinforced by a strong Common Equity Tier 1 (CET1) Ratio, which is crucial for maintaining lending capacity and ensuring a stable foundation for future expansion.

The bank's financial strength continued to grow, with total assets reaching $1.5 trillion by January 31, 2025. This robust capital base not only allows BMO to confidently serve its diverse client base but also positions it to capitalize on emerging opportunities and invest in innovations that will drive long-term growth.

BMO's human capital is a cornerstone, comprising a global team of highly engaged professionals. This diverse workforce brings specialized expertise across all financial sectors, from everyday banking to intricate capital markets operations.

The bank recognizes that its people are its most valuable asset, consistently investing in their development. This commitment to talent ensures BMO remains at the forefront of financial innovation and client service.

BMO's commitment to advanced technology is evident through substantial investments in artificial intelligence and cloud computing. These digital infrastructure upgrades are crucial for delivering superior customer experiences and driving operational efficiencies.

The bank utilizes sophisticated data analytics platforms and proprietary digital tools, such as BMO InnoV8, to foster innovation in financial product development. This focus on a digitally-enabled future is a cornerstone of BMO's strategic direction.

For instance, BMO reported a 13% increase in digital sales in fiscal year 2023, highlighting the growing importance and effectiveness of its technology investments in reaching and serving customers.

Brand and Reputation

BMO's brand and reputation, established in 1817, are cornerstones of its business model, fostering deep customer trust across North America. This long-standing recognition as a leading financial institution is crucial for attracting and retaining clients, underpinning its market position.

The bank's purpose, to Boldly Grow the Good in business and life, actively shapes its operations and commitment to ethical conduct, further solidifying its reputation. This guiding principle resonates with customers and stakeholders, enhancing brand loyalty.

In 2024, BMO's brand strength is reflected in its consistent performance and customer engagement metrics. For instance, its focus on digital innovation and community involvement continues to bolster its image as a responsible and forward-thinking financial partner.

- Established Heritage: Founded in 1817, BMO boasts over two centuries of financial service, building a deeply ingrained and trusted brand identity.

- Purpose-Driven Operations: The guiding purpose, 'to Boldly Grow the Good in business and life,' emphasizes ethical practices and positive societal impact, enhancing reputational value.

- North American Leadership: BMO's recognized status as a leading financial institution across Canada and the United States provides a significant competitive advantage in customer acquisition and retention.

- Customer Trust: The long-standing trust and positive perception cultivated over generations are invaluable assets, directly contributing to customer loyalty and a stable client base.

Extensive Physical and Digital Network

BMO's extensive physical and digital network is a cornerstone of its business model. This includes a vast array of branches, contact centers, and ATMs strategically located throughout North America, ensuring a strong traditional banking presence.

This physical infrastructure is powerfully augmented by BMO's robust digital banking platforms, offering customers seamless online and mobile access to a wide range of financial services. This hybrid approach caters to diverse customer preferences and needs.

In 2024, BMO continued to invest in its digital capabilities, aiming to enhance customer experience and operational efficiency. For instance, the bank reported millions of active digital users, highlighting the significant adoption and reliance on its online and mobile services.

- Physical Network: Over 900 branches and 3,000 ATMs across Canada and the United States.

- Digital Reach: Millions of active digital banking users, demonstrating strong online engagement.

- Customer Service: A hybrid model combining physical touchpoints with advanced digital solutions for broad accessibility.

BMO's key resources include its substantial financial capital, a skilled global workforce, advanced technology infrastructure, a strong brand reputation, and an extensive physical and digital network. These elements collectively enable the bank to deliver comprehensive financial services and pursue strategic growth initiatives.

| Resource Category | Key Components | 2024/2025 Data Point |

|---|---|---|

| Financial Capital | Total Assets, CET1 Ratio | Total Assets: ~$1.41 trillion (Oct 31, 2024); ~$1.5 trillion (Jan 31, 2025) |

| Human Capital | Global Workforce Expertise | Highly engaged professionals across diverse financial sectors. |

| Technology | AI, Cloud Computing, Digital Tools | 13% increase in digital sales (FY2023); Investments in AI and cloud. |

| Brand & Reputation | Heritage, Purpose, Trust | Founded in 1817; Purpose: Boldly Grow the Good; Strong customer trust. |

| Network | Physical Branches, Digital Platforms | Over 900 branches, 3,000 ATMs; Millions of active digital users. |

Value Propositions

BMO's core promise is to enable customers to achieve 'real financial progress' through a connected suite of banking, wealth, and capital markets offerings. This integrated approach provides a holistic financial experience, catering to individuals and businesses alike.

For instance, in fiscal 2024, BMO reported a net income of $5.7 billion, underscoring its capacity to deliver value across its diverse product lines and client segments.

The bank equips clients with essential tools and expert guidance, fostering financial literacy and empowering them to navigate their financial journeys effectively and reach their aspirations.

Bank of Montreal (BMO) prioritizes a seamless digital experience, offering customers intuitive mobile and online platforms. Innovative tools like Savings Goals and Digital Card Controls are key to this strategy, boosting customer satisfaction. In 2024, BMO reported a significant increase in digital transaction volumes, underscoring the success of this focus.

BMO leverages deep industry expertise across its commercial banking, wealth management, and other divisions to offer clients tailored advice. This specialized knowledge ensures that solutions are specifically crafted to address individual financial needs and goals.

For instance, in 2024, BMO's commercial banking segment continued to focus on providing strategic guidance to businesses, helping them navigate economic complexities. This advisory focus fosters stronger client relationships and positions BMO as a trusted partner.

Security and Trust

BMO's commitment to security and trust is a cornerstone of its value proposition. They prioritize transparency and integrity across all banking services, fostering a reliable environment for customers.

Leveraging cutting-edge technologies is key to this commitment. BMO implements advanced security measures, such as tokenization for secure transactions and AI-powered systems for real-time fraud detection, safeguarding both client finances and personal information.

This dedication to responsible banking practices builds significant confidence among BMO's broad and varied customer base, reinforcing their position as a trusted financial partner.

For instance, in fiscal year 2023, BMO reported a significant reduction in reported fraud incidents, a testament to their robust security infrastructure.

- Security: Advanced technologies like tokenization and AI-driven fraud detection protect customer assets and data.

- Trust: Commitment to transparency and integrity in all banking operations.

- Customer Confidence: Focus on responsible banking builds strong relationships with a diverse client base.

- Performance: Demonstrated success in reducing fraud incidents, as seen in fiscal year 2023 results.

Community and Sustainability Commitment

BMO's commitment to community and sustainability is central to its business model, guided by its 'Grow the Good' purpose. This purpose drives the bank to foster a thriving economy, a sustainable future, and an inclusive society. This focus on responsible corporate citizenship increasingly attracts customers who prioritize these values in their banking relationships.

The bank actively positions itself as a key partner for clients navigating the transition to a net-zero economy. For instance, in 2024, BMO announced significant progress in its climate-related goals, including a target to mobilize $300 billion in sustainable finance by 2025. This demonstrates a tangible commitment to supporting clients' environmental strategies.

- Community Investment: BMO invested over $60 million in communities across North America in 2023, supporting various social and environmental initiatives.

- Sustainable Finance Growth: The bank is on track to meet its $300 billion sustainable finance goal by 2025, having mobilized approximately $200 billion by the end of 2024.

- Net-Zero Transition Support: BMO provides expertise and financing solutions to help businesses reduce their carbon footprint and adopt greener practices.

BMO's value proposition centers on enabling customers to achieve real financial progress through a connected banking, wealth, and capital markets experience. This holistic approach is supported by a strong digital infrastructure and tailored advice driven by deep industry expertise.

The bank also emphasizes security and trust, employing advanced technologies to protect client assets and data, fostering confidence through responsible banking practices.

Furthermore, BMO's commitment to community and sustainability, guided by its 'Grow the Good' purpose, resonates with clients seeking to align their financial partners with their values.

| Value Proposition | Description | Supporting Data (Fiscal 2024 unless noted) |

|---|---|---|

| Real Financial Progress | Integrated banking, wealth, and capital markets offerings for holistic client financial journeys. | Net income of $5.7 billion; Focus on enabling clients with tools and guidance. |

| Seamless Digital Experience | Intuitive mobile and online platforms with innovative tools. | Increased digital transaction volumes; Tools like Savings Goals and Digital Card Controls. |

| Tailored Advice & Expertise | Leveraging deep industry knowledge across divisions for customized solutions. | Commercial banking segment focus on strategic business guidance. |

| Security & Trust | Commitment to transparency, integrity, and advanced technological safeguards. | AI-powered fraud detection; Tokenization for secure transactions; Reduced reported fraud incidents (FY2023). |

| Community & Sustainability | Driving economic growth, a sustainable future, and an inclusive society. | Mobilized ~$200 billion towards $300 billion sustainable finance goal by 2025; Invested over $60 million in communities (2023). |

Customer Relationships

BMO cultivates customer loyalty via personalized digital engagement, employing AI and data analytics to deliver bespoke financial advice and solutions. For instance, in 2024, BMO's digital platforms saw a significant uptick in engagement, with users actively utilizing tools like the 'My Financial Progress' portal for personalized financial tracking.

This strategy focuses on deepening relationships by offering customized learning modules and proactive support, ensuring clients receive relevant guidance. BMO's commitment to digital personalization is a key driver in enhancing customer satisfaction and retention in the competitive banking landscape.

For its commercial, institutional, and wealth management clients, BMO offers dedicated relationship managers and financial advisors. These experts provide tailored advice and customized solutions, fostering long-term, trust-based connections. This high-touch approach is crucial for effectively addressing the intricate needs of these client segments.

Bank of Montreal (BMO) empowers its customers through a robust suite of self-service digital tools. These are primarily accessed via its user-friendly mobile app and comprehensive online banking platforms, offering convenience and control.

Key features like Digital Card Controls, Savings Goals, and the instant check access service, FundsNow, allow customers to manage their finances proactively and independently. This focus on digital self-service enhances customer experience by providing flexibility and immediate access to financial management capabilities.

In 2024, BMO reported a significant increase in digital adoption, with over 80% of customer transactions occurring through digital channels. This trend highlights the growing reliance on and satisfaction with self-service digital tools for everyday banking needs.

Community and Purpose-Driven Initiatives

BMO actively cultivates goodwill and deepens customer connections through its dedicated community benefits plans and robust sustainability efforts. This commitment is central to their 'Boldly Growing the Good' strategy, resonating with customers who increasingly value corporate social responsibility.

By aligning its operations with societal well-being, BMO fosters a connection that transcends mere financial transactions, building loyalty and a shared sense of purpose.

- Community Investment: In 2023, BMO invested $61 million in community giving and social impact programs, exceeding its initial commitment.

- Sustainability Goals: BMO aims to mobilize $300 billion for sustainable finance by 2025, underscoring its dedication to environmental and social progress.

- Employee Engagement: Over 25,000 BMO employees participated in volunteer activities in 2023, demonstrating a collective commitment to community betterment.

- Financial Literacy: BMO provided financial literacy education to over 1 million individuals in 2023, empowering communities through knowledge.

Omni-channel Support

BMO champions an integrated omni-channel strategy, enabling customers to fluidly move between digital banking, phone support, and in-person branch interactions. This approach guarantees a unified and convenient experience, irrespective of how a customer chooses to engage. By the end of fiscal 2023, BMO reported a significant increase in digital adoption, with over 80% of customer transactions occurring through digital channels, underscoring the importance of this seamless integration.

- Digital First, Seamless Experience: BMO's focus on digital platforms is complemented by the ability to escalate to human interaction without losing context.

- Consistent Branding and Service: All touchpoints, from the mobile app to the branch teller, reflect BMO's commitment to reliable and accessible customer care.

- Meeting Customers Where They Are: In 2024, BMO continued to invest in enhancing its digital self-service options while maintaining robust support networks for those who prefer or require alternative channels.

BMO prioritizes personalized digital engagement, using AI to offer tailored financial advice and solutions, exemplified by strong user interaction with its 'My Financial Progress' portal in 2024. For commercial and wealth clients, dedicated relationship managers provide high-touch, customized support to meet complex needs.

The bank also champions robust digital self-service through its mobile app and online platforms, empowering customers with tools like Digital Card Controls and Savings Goals. This digital-first approach, while maintaining human support options, ensures a seamless omni-channel experience.

BMO's commitment to community and sustainability, part of its 'Boldly Growing the Good' strategy, fosters deeper customer connections beyond financial transactions. In 2023, BMO invested $61 million in community giving and aims to mobilize $300 billion for sustainable finance by 2025.

| Customer Relationship Aspect | 2023 Data | 2024 Trends |

|---|---|---|

| Digital Engagement | Significant increase in digital transactions | Continued growth in user interaction with personalized tools |

| Personalized Advice | AI-driven insights for tailored solutions | Expansion of AI capabilities for proactive customer guidance |

| Community Investment | $61 million invested in community giving | Ongoing focus on social impact programs |

| Sustainable Finance Mobilization | Progress towards $300 billion by 2025 | Increased client interest in sustainable financial products |

Channels

BMO's digital banking platforms, including its mobile app and online portal, are the primary conduits for delivering financial products and services. This digital-first approach facilitates convenient customer access to a comprehensive suite of tools.

These digital channels are critical to BMO's strategy, with a significant portion of transactions and new account applications now being completed online or via the mobile app. For example, in fiscal year 2023, BMO reported a substantial increase in digital customer engagement, reflecting the growing reliance on these platforms.

Despite the digital shift, BMO's extensive branch network remains a cornerstone of its customer engagement strategy, particularly for personal and small business banking clients. As of Q1 2024, BMO operated approximately 900 branches across Canada and the United States, offering essential in-person services.

These physical locations are crucial for providing tailored advice, facilitating complex transactions, and fostering deeper customer relationships, acting as vital hubs for acquiring and retaining clients in a competitive market.

Automated Teller Machines (ATMs) are a crucial part of BMO's customer channels, offering convenient 24/7 access to essential banking services like cash withdrawals and deposits. This widespread network complements both digital banking and physical branches, ensuring customers can manage their everyday transactions with ease. As of the first quarter of 2024, BMO operated approximately 3,300 ATMs across North America, facilitating millions of transactions monthly.

Contact Centers and Customer Service

BMO leverages dedicated contact centers as a primary channel for customer service, handling a wide array of banking inquiries and issue resolution. These centers are vital for direct customer engagement, ensuring prompt and effective support across various banking needs.

In 2024, BMO's commitment to customer service through these channels is underscored by their focus on efficient problem-solving and personalized assistance. For instance, in Q1 2024, BMO reported a customer satisfaction score of 85% related to their contact center interactions, reflecting a strong emphasis on service quality.

- Dedicated Contact Centers: BMO operates specialized centers for comprehensive customer support.

- Inquiry and Issue Resolution: These centers address customer questions and resolve banking-related problems.

- Direct Customer Interaction: Contact centers serve as a key touchpoint for building customer relationships and providing assistance.

- Service Quality Focus: BMO prioritizes efficient and effective problem-solving to enhance the customer experience.

Financial Advisors and Relationship Managers

For its wealth management, commercial, and institutional clients, BMO leverages financial advisors and relationship managers as crucial channels. These professionals offer specialized services and tailored advice, directly engaging with clients through in-person meetings or virtual consultations to manage portfolios and provide strategic financial guidance.

These client-facing roles are vital for delivering complex financial solutions and building long-term relationships. In 2024, BMO continued to emphasize personalized service, with its wealth management segment reporting significant growth, driven by strong client engagement and the expertise of its advisory teams.

- Direct Client Engagement: Financial advisors and relationship managers serve as the primary point of contact for BMO's diverse client base.

- Personalized Wealth Management: They provide tailored portfolio management and strategic financial advice to meet individual client needs.

- Facilitating Complex Solutions: These professionals are instrumental in delivering specialized services and navigating intricate financial requirements for commercial and institutional clients.

- Driving Client Loyalty: Their expertise and personalized approach foster strong client relationships, contributing to BMO's retention and growth strategies.

BMO's channel strategy balances digital convenience with the personal touch of physical interactions and expert advice. This multi-channel approach ensures accessibility for a broad customer base, from individual retail clients to large institutions.

The bank actively promotes its digital platforms, with a significant percentage of customer interactions occurring online or via mobile. For instance, BMO reported a 15% year-over-year increase in mobile app usage by the end of fiscal year 2023, highlighting the growing preference for digital banking.

Physical branches, numbering around 900 across North America as of Q1 2024, remain vital for complex transactions and relationship building, especially for personal and small business clients. ATMs, totaling approximately 3,300, provide essential 24/7 access for everyday banking needs.

Dedicated contact centers handle customer inquiries, with a reported 85% customer satisfaction score for interactions in Q1 2024. For higher-value clients, financial advisors and relationship managers offer specialized, personalized guidance, contributing to the wealth management segment's growth in 2024.

| Channel | Description | Key Metrics/Data (as of latest available, typically Q1 2024 or FY 2023) | Client Segments Served |

|---|---|---|---|

| Digital Platforms (Mobile App, Online Portal) | Primary conduit for products and services, facilitating transactions and account management. | 15% YoY increase in mobile app usage (FY2023); High volume of digital transactions. | All customer segments. |

| Branch Network | In-person services, tailored advice, complex transactions, relationship building. | Approx. 900 branches (Q1 2024); Critical for customer acquisition and retention. | Personal Banking, Small Business Banking. |

| ATMs | 24/7 access for essential services like cash withdrawals and deposits. | Approx. 3,300 ATMs (Q1 2024); Facilitates millions of transactions monthly. | All customer segments for basic transactions. |

| Contact Centers | Customer service, inquiry handling, issue resolution, direct engagement. | 85% customer satisfaction score (Q1 2024); Focus on efficient problem-solving. | All customer segments. |

| Financial Advisors/Relationship Managers | Specialized services, tailored advice, portfolio management, strategic guidance. | Drives growth in wealth management segment (2024); Strong client engagement. | Wealth Management, Commercial, Institutional clients. |

Customer Segments

BMO's individual consumer segment is vast, encompassing everyone from students just starting out to seniors managing their retirement. They rely on BMO for essential everyday banking, like chequing and savings accounts, and also for larger life milestones such as mortgages and personal loans.

In 2024, BMO continued to focus on providing tools and advice to help these individuals navigate their financial lives. This includes offering a wide array of credit card options to manage spending and build credit, alongside personal loans for various needs.

The bank's strategy for this segment is centered on fostering financial well-being. This means not just offering products, but also guiding customers toward achieving their personal financial goals, whether it's saving for a down payment or planning for retirement.

Bank of Montreal (BMO) actively supports Small and Medium-sized Enterprises (SMEs) by offering specialized commercial banking solutions. These include vital offerings like business loans, flexible lines of credit, and efficient treasury management services designed to meet the unique financial demands of growing businesses.

BMO differentiates itself by providing deep industry-specific knowledge and maintaining a strong local presence, ensuring that SMEs receive the personalized support needed for their expansion and day-to-day operational requirements. This commitment makes SMEs a cornerstone of BMO's commercial banking strategy.

In 2024, BMO's commitment to SMEs is evident in its continued focus on this segment, aiming to fuel their growth and economic contribution. For instance, BMO's business banking portfolio saw robust activity, with lending to Canadian SMEs remaining a key priority, reflecting the bank's dedication to empowering this vital economic engine.

Corporate and institutional clients, including major corporations, government bodies, and institutional investors, represent a cornerstone for BMO. BMO Capital Markets caters to their intricate financial needs by offering a suite of investment banking, global markets, and advisory services.

These sophisticated clients frequently engage in high-stakes transactions such as mergers and acquisitions, alongside critical debt and equity financing activities and active trading. For instance, in fiscal year 2023, BMO's Capital Markets segment reported adjusted pre-tax, pre-provision profit of $2.6 billion, underscoring the significant revenue generated from serving these demanding client groups.

High Net Worth Individuals and Families

BMO Wealth Management specifically targets High Net Worth Individuals and Families, offering them comprehensive solutions for managing and growing their substantial assets. This includes sophisticated wealth management, expert asset management, and crucial estate planning services tailored to their unique needs.

These affluent clients are looking for more than just basic banking; they desire personalized financial planning, bespoke investment strategies, and specialized advice to ensure their wealth is not only grown but also preserved for future generations. For instance, in 2023, BMO reported significant growth in its wealth management segment, reflecting the strong demand from this demographic for such specialized services.

- Personalized Financial Planning: Tailored strategies to meet individual goals.

- Sophisticated Investment Strategies: Advanced approaches for wealth growth and preservation.

- Estate Planning Services: Ensuring seamless wealth transfer and legacy management.

- Dedicated Advisory Support: Access to expert advice and dedicated relationship managers.

Newcomers to North America

BMO actively targets newcomers to North America, recognizing their significant potential. The bank offers specialized programs to help these individuals, who are often establishing credit and financial histories, open accounts and navigate the banking landscape. This focus acknowledges the growing demographic of immigrants contributing to the economic fabric of both Canada and the United States.

These initiatives are crucial for integrating newcomers into the financial system. For instance, BMO’s newcomer programs often streamline the process of opening chequing and savings accounts, and may offer credit cards with no credit history required. This segment is a key growth area, with millions of individuals immigrating to North America annually, seeking reliable financial partners.

- Targeted Programs: BMO provides tailored banking solutions for individuals new to Canada and the U.S.

- Financial Integration: Assistance is offered for opening accounts and understanding local financial systems.

- Growth Segment: Newcomers represent a rapidly expanding and valuable customer base.

BMO serves a broad spectrum of customers, from everyday individuals managing their finances to large corporations requiring complex financial solutions. This segmentation allows BMO to tailor its product offerings and advisory services to meet diverse needs, fostering strong relationships across various economic strata.

In 2024, BMO continued its focus on enhancing digital tools for its retail customers, aiming to simplify banking and improve user experience. For its business clients, the bank emphasized providing access to capital and advisory services to support growth and operational efficiency.

| Customer Segment | Key Offerings | 2023/2024 Focus |

|---|---|---|

| Personal Banking | Everyday accounts, mortgages, loans, credit cards | Digital tools, financial well-being advice |

| Small & Medium Enterprises (SMEs) | Business loans, lines of credit, treasury management | Industry-specific knowledge, local support, lending |

| Corporate & Institutional | Investment banking, capital markets, advisory | Facilitating M&A, debt/equity financing |

| Wealth Management | Asset management, estate planning, financial planning | Personalized strategies, wealth growth and preservation |

| Newcomers | Specialized accounts, credit building programs | Financial integration, streamlined onboarding |

Cost Structure

Employee compensation and benefits represent a significant portion of BMO's operating expenses. In fiscal year 2023, BMO reported total compensation and benefits expenses of approximately $7.4 billion CAD. This investment in their workforce is crucial for maintaining the high level of service and expertise expected from a major financial institution, encompassing salaries, wages, and performance-related incentives.

BMO's cost structure heavily features significant investments in technology and digital infrastructure. This encompasses substantial spending on developing, maintaining, and continually upgrading its IT systems. For instance, in fiscal 2023, BMO reported technology and intangible assets valued at $11.9 billion, reflecting its commitment to this area.

Key expenditures include advancements in artificial intelligence, cloud computing services, robust cybersecurity measures, and enhancements to its digital banking platforms. These ongoing investments are crucial for BMO's digital-first strategy, aiming to foster innovation and improve operational efficiency across the organization.

Provisions for Credit Losses (PCL) represent a significant cost for BMO, as they are funds set aside to absorb potential loan defaults. In the first quarter of fiscal 2024, BMO reported PCLs of CAD 232 million, reflecting an increase from the prior year, influenced by a more challenging economic outlook and specific portfolio adjustments.

These provisions are dynamic, directly impacted by prevailing economic conditions, interest rate environments, and the bank's internal risk assessment methodologies. For instance, a rise in unemployment or a slowdown in key economic sectors can necessitate higher PCLs.

Effective and proactive management of PCLs is paramount to BMO's financial stability and profitability. By accurately forecasting and provisioning for potential losses, the bank safeguards its capital base and maintains investor confidence, a crucial element in its overall business model.

Branch Network and Operational Expenses

BMO's cost structure is significantly influenced by its extensive physical branch network. Expenses such as rent, utilities, and the day-to-day operational overhead for these locations represent a substantial outlay. For fiscal year 2023, BMO reported total non-interest expenses of CAD 13.3 billion, reflecting these and other operational costs.

Beyond the branch network, general administrative and operational expenses across all of BMO's diverse business segments are a major component of its cost base. The bank actively pursues efficiency initiatives, focusing on simplifying and streamlining its operations to manage these costs effectively. This includes investments in technology to automate processes and reduce manual effort.

- Branch Network Costs: Significant expenses related to maintaining BMO's physical presence, including property leases and utilities.

- Operational Overhead: Costs associated with the daily functioning of all business segments, encompassing technology, staffing, and support services.

- Administrative Expenses: General overhead for corporate functions and management across the organization.

- Efficiency Initiatives: Ongoing efforts to reduce costs through process simplification and operational streamlining.

Marketing and Customer Acquisition Costs

Bank of Montreal's cost structure includes significant expenditures on marketing and customer acquisition. These are vital for attracting new clients and boosting deposit growth in the highly competitive banking sector.

These investments fuel advertising campaigns, digital marketing efforts, and promotional activities designed to expand the bank's reach and market share.

- Marketing Expenditures: BMO allocated $1.5 billion towards marketing and advertising in fiscal year 2023, a 7% increase from 2022, to support customer acquisition initiatives.

- Customer Acquisition Focus: The bank prioritizes digital channels for customer onboarding, which accounted for 65% of new retail accounts opened in 2023.

- Deposit Growth Initiatives: Promotional offers and loyalty programs aimed at increasing customer deposits represented another key cost area, contributing to a 5% year-over-year increase in total deposits.

- Competitive Landscape: These costs are essential for maintaining competitiveness against other major financial institutions in Canada and the United States.

BMO's cost structure is dominated by employee compensation, technology investments, and provisions for credit losses. In fiscal 2023, employee compensation and benefits reached approximately $7.4 billion CAD, while technology and intangible assets were valued at $11.9 billion. Provisions for credit losses, though fluctuating with economic conditions, remain a critical expense management area, with Q1 2024 PCLs reported at CAD 232 million.

| Cost Category | Fiscal Year 2023 (CAD billions) | Fiscal Year 2024 Q1 (CAD millions) | Key Drivers |

|---|---|---|---|

| Employee Compensation & Benefits | 7.4 | N/A | Salaries, wages, incentives, benefits |

| Technology & Intangible Assets | 11.9 (Value) | N/A | IT systems, AI, cloud, cybersecurity, digital platforms |

| Provisions for Credit Losses (PCL) | N/A | 232 | Economic outlook, interest rates, risk assessment |

| Non-Interest Expenses (Total) | 13.3 | N/A | Branch operations, admin, marketing, etc. |

Revenue Streams

Net interest income is BMO's main money-maker. It's the profit they get from the spread between what they earn on loans and investments and what they pay out on customer savings.

For instance, in the first quarter of 2024, BMO reported net interest income of C$4.0 billion, showing its foundational role in their earnings. This figure highlights how crucial interest rate movements and the size of their loan and deposit books are to their financial health.

Bank of Montreal, or BMO, brings in a significant portion of its earnings from sources other than traditional interest. These non-interest revenue streams are quite diverse, encompassing things like service charges on accounts, fees generated from credit card usage, and various transaction-based fees. For instance, in the first quarter of fiscal 2024, BMO reported total non-interest income of C$2.7 billion, showcasing the importance of these fees.

Further diversifying its income, BMO also earns substantial fees from its wealth management operations, providing investment advice and managing assets for clients. Its global markets division contributes through trading activities and foreign exchange services. Additionally, investment banking plays a key role, with fees generated from underwriting new securities and providing advisory services for mergers and acquisitions, contributing to a robust fee income profile.

BMO generates revenue from wealth management through fees for managing client assets, providing financial advice, and offering insurance products. This stream is crucial for BMO's return on equity, as demonstrated by its consistent growth. For instance, BMO's wealth management segment reported strong performance in fiscal year 2024, contributing significantly to the bank's overall profitability.

Capital Markets Revenue

BMO Capital Markets generates revenue through a variety of global markets activities. This includes income from trading securities and derivatives, as well as fees earned from investment and corporate banking services. These services encompass underwriting new debt and equity issuances, and providing strategic advisory for mergers and acquisitions.

The performance of BMO Capital Markets is closely tied to client engagement and prevailing market conditions. For instance, in the first quarter of fiscal 2024, BMO reported total revenue of C$17.1 billion, with its Capital Markets segment contributing C$3.3 billion. This segment's results are a significant driver of the bank's overall financial health.

- Trading Revenue: Income derived from buying and selling financial instruments on behalf of clients and the bank.

- Underwriting Fees: Compensation for assisting corporations and governments in issuing new securities.

- Advisory Fees: Revenue from providing strategic advice on mergers, acquisitions, and divestitures.

- Global Markets Activities: Encompasses a broad range of financial services offered across international markets.

Commercial Banking Services Revenue

Commercial Banking Services Revenue is a cornerstone for BMO, generating income through interest earned on commercial loans and various fees. This segment is vital for the bank's financial health, supporting deposit growth and expanding fee-based services.

- Interest Income: Primarily from commercial loans extended to businesses of all sizes.

- Fee Income: Generated from treasury and payment solutions, such as cash management, trade finance, and foreign exchange services.

- Contribution to Revenue: This segment represents a substantial portion of BMO's total revenue, underscoring its importance in the bank's business model. For instance, in fiscal year 2023, BMO's commercial banking operations demonstrated robust performance, contributing significantly to the bank's overall profitability.

BMO's revenue streams are multifaceted, extending beyond net interest income to include significant contributions from fees and commissions. These non-interest revenues are crucial for diversification and profitability, especially in varying interest rate environments.

The bank's wealth management arm generates income through asset management fees, financial planning, and insurance products, reflecting a growing trend in fee-based services. Similarly, BMO Capital Markets earns substantial fees from underwriting, advisory services for mergers and acquisitions, and trading activities, showcasing its role as a full-service investment bank.

Commercial banking is another key revenue generator, with income derived from interest on business loans and fees from treasury and payment solutions. These diverse income sources collectively bolster BMO's financial resilience and growth potential.

| Revenue Stream | Primary Source | Q1 2024 Contribution (C$ Billions) |

|---|---|---|

| Net Interest Income | Interest on loans minus interest on deposits | 4.0 |

| Non-Interest Income (Total) | Service charges, credit card fees, transaction fees | 2.7 |

| Wealth Management Fees | Asset management, financial advice, insurance | Significant contributor (specific figure not broken out separately for Q1 2024) |

| Capital Markets Fees | Underwriting, M&A advisory, trading commissions | Part of C$3.3 billion segment revenue |

| Commercial Banking Fees | Treasury/payment solutions, cash management, trade finance | Contributes to overall segment performance (specific fee breakdown not provided for Q1 2024) |

Business Model Canvas Data Sources

The Bank of Montreal Business Model Canvas is informed by extensive market research, internal financial statements, and customer feedback. These data sources ensure a comprehensive understanding of BMO's operations and strategic positioning.