Bank of Montreal Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Montreal Bundle

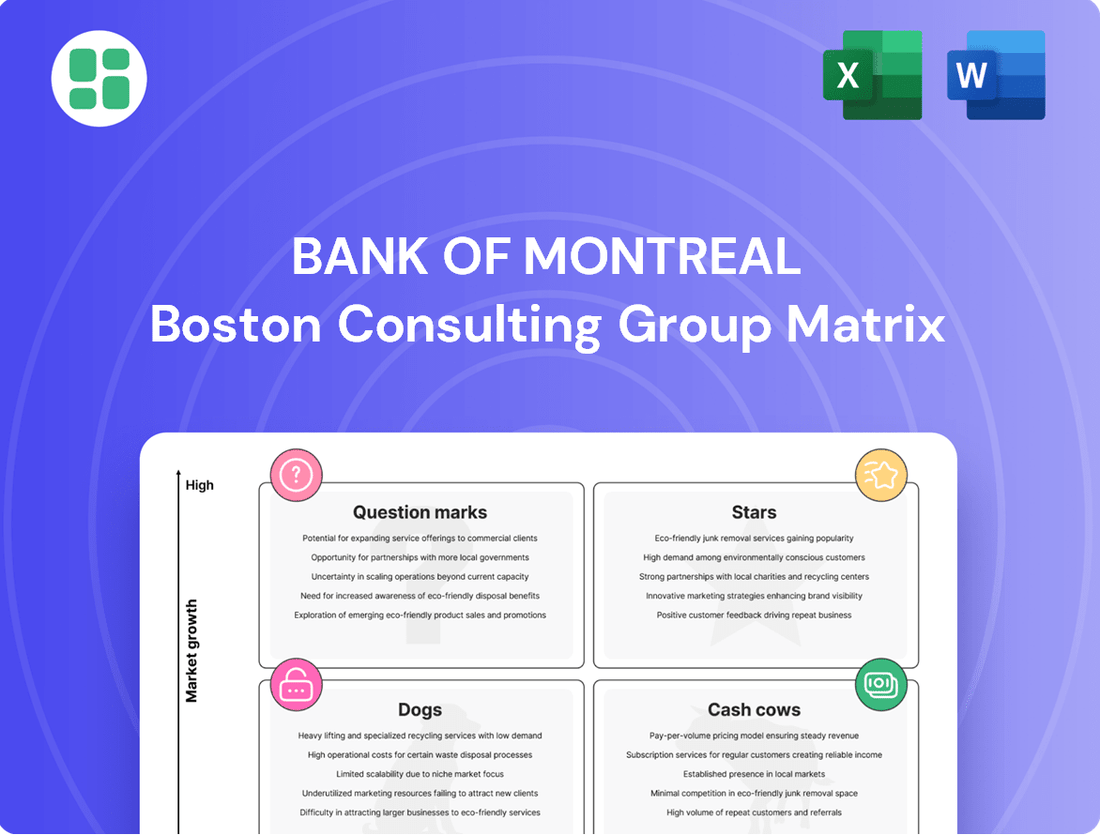

Curious about the Bank of Montreal's strategic positioning? Our BCG Matrix analysis reveals which of their offerings are market leaders (Stars), reliable income generators (Cash Cows), potential underperformers (Dogs), or require further investment (Question Marks).

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for BMO.

Stars

BMO is making significant strides in digital banking, evident in its investment in solutions like BMO Sync, which embeds banking services directly into business software. This focus on seamless integration, alongside features like digital card controls, is driving higher customer engagement and boosting product application volumes.

These digital initiatives are positioning BMO as a frontrunner in customer experience within the digital banking space. The bank’s commitment to innovation has been recognized with awards for payments and digital solutions, underscoring a strong market reception and a promising growth outlook for these offerings.

BMO's Canadian Personal & Commercial Banking segment is experiencing robust growth, largely propelled by its innovative digital acquisition strategies. A prime example is their outreach to newcomers, offering pre-arrival digital tools that streamline banking setup, fostering early engagement and loyalty. This focus on digital onboarding is a key driver for market share expansion in this vital segment.

The bank's commitment to digital enhancement is evident in features like the Savings Amplifier accounts, designed to attract and retain customers through user-friendly digital interfaces and compelling savings tools. This digital-first approach is crucial for capturing new clients and deepening relationships within Canada's evolving banking landscape, contributing to significant revenue increases.

BMO's commitment to sustainable finance is evident in its 2024 update to its Sustainable Bond Framework, broadening its scope to include green, social, and transition financing. This strategic move positions BMO to capitalize on the burgeoning sustainable finance market, aiming to be a key player in the global shift towards net-zero emissions.

The bank's development of ESG-focused investment products and advisory services reflects a recognition of the escalating demand from both investors and corporations for sustainable solutions. This area represents a significant growth opportunity for BMO, driven by increasing global awareness and regulatory impetus for environmental, social, and governance (ESG) principles.

U.S. Commercial Banking (Post-Bank of the West Integration)

Following its acquisition of Bank of the West, BMO significantly bolstered its U.S. presence, positioning itself among the top 10 diversified U.S. banks. This strategic move aims to capture greater market share by leveraging its expanded platform, particularly within commercial banking.

BMO's strategy in the U.S. commercial banking sector is built on a proven growth model. The bank intends to capitalize on the opportunities presented by this segment, which is expected to be a major contributor to overall earnings due to its considerable growth potential within a highly competitive market.

- U.S. Commercial Banking Footprint: Post-acquisition, BMO is now a top 10 U.S. bank, with a substantial increase in its U.S. operational scale.

- Strategic Growth Focus: The primary objective is to expand market share, with commercial banking identified as a key area for leveraging the enlarged platform.

- Earnings Contribution: This segment is anticipated to drive significant earnings growth for BMO, reflecting its high potential in the U.S. market.

- Market Position: BMO's U.S. commercial banking operations are now a cornerstone of its diversified U.S. strategy, aiming for sustained growth.

Wealth Management (Growth in Client Assets)

BMO Wealth Management is a strong performer, showing robust growth in client assets. This upward trend is fueled by favorable market conditions and BMO's diverse offerings, including digital solutions and tailored financial advice. The segment is successfully attracting new clients and strengthening relationships with existing ones, highlighting its significant growth potential.

In the first quarter of 2024, BMO Wealth Management reported a net income of $290 million, a notable increase from the previous year. Client assets under management reached $1.3 trillion by the end of the first quarter of 2024, reflecting substantial growth. This expansion is attributed to organic growth and strategic acquisitions.

- Client Asset Growth: BMO Wealth Management saw client assets under management climb to $1.3 trillion in Q1 2024.

- Net Income Increase: The segment's net income rose to $290 million in Q1 2024.

- Growth Drivers: Key drivers include strong market performance, expanded digital platforms, and personalized advisory services.

- Client Acquisition: BMO continues to attract new clients while deepening relationships with its existing customer base.

Stars in the BCG Matrix represent high-growth, high-market-share business units. For BMO, this would typically encompass segments experiencing rapid expansion and holding a dominant position.

BMO's digital banking initiatives, particularly its focus on seamless integration and enhanced customer experience, are positioning it for star status. The bank's investment in solutions like BMO Sync and digital card controls are driving customer engagement and product adoption, indicating strong growth potential in a rapidly evolving market.

Furthermore, BMO's strategic expansion in U.S. commercial banking, following the Bank of the West acquisition, places this segment firmly in the star category. With a significantly enhanced U.S. footprint and a clear strategy to leverage this for market share growth, this segment is poised to be a major contributor to BMO's earnings.

What is included in the product

This BCG Matrix overview details BMO's product portfolio, classifying each unit as Star, Cash Cow, Question Mark, or Dog.

Clear visualization of Bank of Montreal's portfolio, easing strategic decision-making.

Simplifies complex business unit analysis for immediate strategic focus.

Cash Cows

BMO's traditional Canadian retail banking, encompassing mortgages and deposits, is a classic cash cow. As a cornerstone of the Canadian financial landscape, these mature products benefit from BMO's significant market share among the Big Five banks, ensuring a stable and predictable revenue stream. In 2023, Canadian banks collectively saw substantial growth in mortgage lending, with total residential mortgage debt increasing by approximately 7.5%, highlighting the ongoing demand for these core services.

BMO's established Canadian Commercial Lending operations are a prime example of a Cash Cow within the BCG Matrix. Its extensive network and long-standing relationships in the Canadian market generate a stable, profitable revenue stream from business loans and credit facilities.

This segment benefits from a dominant market share in a mature market, with consistent client relationships and a diversified business mix ensuring steady cash generation and efficient capital deployment. As of Q1 2024, BMO reported strong performance in its Canadian Commercial Banking segment, underscoring the segment's maturity and consistent profitability.

Bank of Montreal's core payment processing and transactional services are a classic cash cow. These operations, handling everything from interbank transfers to basic retail transactions, are the bedrock of the bank's daily activities. In 2023, BMO reported total revenue of $13.0 billion, with a significant portion derived from these essential, high-volume services.

These services, while not experiencing rapid expansion, consistently deliver substantial and predictable fee income. This stability is crucial, as they form the backbone of client relationships for both businesses and individuals. The sheer volume ensures a steady stream of revenue, underpinning the bank's financial strength.

Institutional Investment Services (Custody & Fund Administration)

BMO's Institutional Investment Services, encompassing custody and fund administration, represent a strong Cash Cow within its BCG Matrix. These are established, high-volume offerings with a loyal institutional client base.

These services provide a steady stream of recurring revenue, largely driven by BMO's significant market presence and enduring client relationships in the institutional sector. This stability is a hallmark of a Cash Cow, requiring minimal investment for continued high returns.

- Market Share: BMO holds a notable position in the Canadian custody market, a sector characterized by high barriers to entry and substantial AUM.

- Revenue Generation: Fee-based income from custody and fund administration contributes significantly to BMO Capital Markets and Wealth Management's overall profitability.

- Client Retention: Long-term contracts and deep integration with institutional clients ensure a predictable revenue flow, minimizing churn.

- 2024 Outlook: Continued demand for secure and efficient asset servicing is expected to sustain the strong performance of these mature business lines.

Dividend Yield and Capital Returns

Bank of Montreal (BMO) demonstrates strong shareholder returns through its consistent dividend policy and share repurchase initiatives, highlighting the robust cash flow generated by its established operations.

These actions underscore the bank's financial stability and its capacity to convert profitable business lines into tangible shareholder value. For instance, in fiscal 2023, BMO returned approximately $5.7 billion to shareholders through dividends and share buybacks, reflecting the dependable cash generation from its mature businesses.

- Dividend Consistency: BMO has a long history of paying and increasing its quarterly dividends, signaling a reliable income stream for investors.

- Share Buybacks: Ongoing share repurchase programs further enhance shareholder value by reducing the number of outstanding shares, thereby increasing earnings per share.

- Financial Health Indicator: These capital return strategies are direct indicators of the bank's strong underlying financial performance and its ability to generate substantial excess cash from its core banking and wealth management segments.

BMO's Canadian Personal Banking, specifically its credit card portfolio, functions as a significant Cash Cow. These are mature products with a substantial customer base, generating consistent interest income and fee revenue.

The bank's strong brand recognition and extensive branch network in Canada support the sustained profitability of its credit card operations. This segment benefits from economies of scale, allowing for efficient management and consistent cash generation.

In 2023, Canadian banks generally saw continued growth in credit card spending, with BMO's operations reflecting this trend, contributing reliably to its overall revenue.

| Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Canadian Personal Banking (Credit Cards) | Cash Cow | Mature market, high customer loyalty, stable fee income | Credit card spending remained robust through 2023, a key driver for this segment. |

What You’re Viewing Is Included

Bank of Montreal BCG Matrix

The preview you're currently viewing is the identical, fully formatted Bank of Montreal BCG Matrix report you will receive immediately after purchase. This means no watermarks or placeholder content; you'll get the complete, analysis-ready document. The strategic insights and graphical representations are precisely as they will be delivered, ensuring you have the exact tool needed for your business planning. You can confidently assess the Bank of Montreal's portfolio based on this preview, knowing the purchased version offers the same professional quality and actionable data.

Dogs

Bank of Montreal's underperforming legacy IT systems and infrastructure are a clear example of their 'Cash Cows' in the BCG Matrix context, though not in a positive growth sense. These are the older systems, like legacy general ledgers, that BMO is actively working to replace with modern finance technology such as SAP S/4HANA as part of a multi-year digital transformation. While they still perform essential functions, they represent significant 'money tied up' that doesn't drive new growth or substantially boost operational efficiency.

These aging systems are essentially low-value assets within a declining operational paradigm. Their ongoing replacement signifies that BMO views them as hindrances rather than contributors to future success. For instance, the cost of maintaining these outdated systems can be substantial, diverting resources that could otherwise be invested in more innovative and growth-oriented initiatives.

Certain non-strategic credit card portfolios, often categorized as Dogs in the BCG Matrix, represent a divestment area for BMO as part of its balance sheet optimization. These portfolios typically exhibit low growth and low market share, making them less attractive for continued investment.

BMO's sale of these non-relationship credit card portfolios indicates a strategic move to shed assets that do not align with its core business. In 2024, the banking sector has seen a trend of financial institutions streamlining operations by divesting underperforming or non-core assets to focus on higher-return areas.

Certain older investment funds or niche products that haven't kept pace with market shifts or investor tastes can see declining interest and money leaving them. These would likely be in the Dogs category of BMO's BCG Matrix, characterized by low growth and shrinking market share.

For instance, a fund focused on legacy industries that are now experiencing secular decline, like certain types of traditional print media or fossil fuel extraction without a clear transition strategy, would fit this description. Such products generate minimal new business and might be phased out or de-emphasized within BMO's wealth management offerings as they don't align with current growth opportunities.

Traditional Paper-based Banking Services

Traditional paper-based banking services, while still a part of BMO's offerings, are increasingly being phased out due to declining demand and the bank's strategic shift towards digital solutions. Services like extensive physical check processing or exclusive paper statement delivery are examples of these. In 2024, the trend of digital transformation in banking continued to accelerate, with a significant portion of transactions moving online. For instance, mobile banking adoption rates have steadily climbed, with many customers preferring digital channels for their banking needs.

BMO's market share in these legacy paper-based services is likely to be low. This is because the bank is actively promoting digital alternatives to enhance operational efficiency and improve the overall customer experience. In 2024, financial institutions across the board reported a substantial decrease in the volume of paper transactions compared to previous years. BMO, like its peers, has invested heavily in digital platforms to cater to evolving customer preferences and reduce the costs associated with manual processing.

- Declining Market Share: Paper-based services face shrinking demand as digital banking gains prominence.

- Focus on Digitalization: BMO prioritizes digital channels for efficiency and customer satisfaction.

- Operational Efficiency: Moving away from paper reduces manual processing costs and errors.

- Customer Preference: The majority of customers now prefer digital banking solutions for convenience.

Small, Non-Core International Banking Operations (Outside North American Focus)

BMO's international operations, while present, are largely secondary to its North American core. Small, non-core banking units outside the U.S. and Canada, especially those with limited market share and growth prospects, fit the 'dog' category in the BCG matrix. These operations may not contribute significantly to BMO's overall strategic objectives or profitability.

- Limited Growth Potential: International operations outside North America often exhibit lower growth rates compared to BMO's domestic markets.

- Low Market Share: These units typically hold a small percentage of their local banking markets, making it difficult to achieve economies of scale.

- Strategic Misalignment: They may not align with BMO's primary focus on expanding its footprint and services within North America.

- Rationalization Candidates: Such 'dog' units could be considered for divestiture or restructuring to free up capital and management attention for more promising ventures.

Certain non-strategic credit card portfolios, characterized by low growth and low market share, represent 'Dogs' in BMO's BCG Matrix, often targeted for divestment. For example, BMO has been streamlining its balance sheet by selling off non-relationship credit card portfolios. This trend aligns with a broader banking sector strategy in 2024 to shed underperforming assets and concentrate on core, higher-return business lines.

Traditional paper-based banking services, like extensive check processing, are also considered 'Dogs' due to declining demand and BMO's strategic push towards digital solutions. In 2024, the shift to digital banking continued, with a significant decrease in paper transactions as customers increasingly favor mobile and online channels. BMO's market share in these legacy services is low, reflecting their investment in digital platforms to improve efficiency and meet customer preferences.

Small, non-core international banking units outside of BMO's primary North American focus, particularly those with limited growth prospects and market share, also fall into the 'Dog' category. These operations may not align with BMO's strategic objectives and could be candidates for restructuring or divestiture to redirect resources toward more promising ventures.

Question Marks

BMO is heavily investing in AI, exemplified by its internal Lumi Assistant, signaling a strategic push into advanced customer interaction technologies. This positions these emerging solutions in a high-growth sector, aligning with the potential for future market leadership.

While BMO's AI initiatives are innovative, their current external market share is minimal, reflecting their nascent stage. Significant investment is still needed to scale these solutions, a characteristic of Question Marks in the BCG Matrix that could evolve into Stars.

Bank of Montreal's strategic approach to early-stage fintech investments, exemplified by programs like WMNfintech, positions it to capture future market growth. These initiatives focus on fostering innovation in areas like embedded finance and AI, aligning with the bank's long-term vision. For instance, their partnership with FISPAN for BMO Sync demonstrates a commitment to integrating cutting-edge solutions.

Startups nurtured through these accelerators, while possessing high growth potential, typically command a low current market share. This profile aligns them with the question mark category in the BCG Matrix, signifying strategic investments aimed at future market leadership rather than immediate returns. BMO's 2024 investments are geared towards cultivating these nascent ventures.

Bank of Montreal's (BMO) expansion into specific new U.S. geographic sub-markets, following its acquisition of Bank of the West, can be viewed through the BCG matrix as a strategic move into potential Stars. While BMO is a strong player overall in the U.S. market post-acquisition, these new, unpenetrated local markets represent areas where BMO is initially entering with a low market share.

These targeted expansions are situated in markets identified for their growth potential. However, achieving significant market share in these localized areas necessitates substantial upfront investment. This includes building out physical infrastructure, implementing targeted marketing campaigns, and hiring local talent to understand and cater to the specific needs of these new communities. For instance, BMO's 2023 U.S. retail deposit base saw growth, and this strategy aims to further diversify and deepen that penetration in underserved regions.

Specialized Sustainable/Climate Finance Products for Nascent Industries

BMO's expansion into specialized sustainable finance products for nascent industries, such as green bonds for advanced clean energy or transition finance for emerging circular economy segments, positions it to capture high-growth, albeit currently niche, markets. These offerings represent a strategic move into areas with low initial market share but significant future potential.

Developing these targeted financial instruments requires focused investment to build scale and market penetration. For instance, the global green bond market reached an estimated $1.2 trillion in issuance by the end of 2023, with a growing segment dedicated to innovative technologies.

- Targeted Green Bonds: Issuing bonds specifically for novel climate solutions like direct air capture or advanced battery recycling.

- Transition Finance: Creating financial products that support the scaling of businesses in sectors like sustainable aviation fuel or green hydrogen production.

- Advisory Services: Offering expertise to help emerging sustainable companies structure their financing and navigate regulatory landscapes.

- Market Development: Investing in research and partnerships to foster liquidity and investor confidence in these specialized green markets.

Advanced Data Analytics & Hyper-Personalized Financial Insights Products

BMO is significantly investing in advanced data analytics to deliver hyper-personalized financial insights. This includes enriching transaction data to provide clients with a clearer understanding of their spending habits, a key step in improving financial management. For instance, BMO's digital tools in 2024 are offering more granular transaction categorization, allowing users to see exactly where their money is going, beyond just merchant names.

The bank is actively developing highly specialized, data-driven products. These offerings aim to provide hyper-personalized advice and tailored financial solutions for emerging customer segments identified through sophisticated analytics. This focus on niche markets represents a high-growth potential area for BMO, tapping into unmet needs.

- Targeted Digital Tools: BMO's 2024 digital enhancements provide personalized spending insights, with over 60% of active digital users engaging with budgeting and spending analysis features.

- Emerging Segment Focus: Development of AI-driven advisory services for specific demographics, such as young entrepreneurs or gig economy workers, is underway.

- Adoption Challenges: Initial adoption rates for these niche, data-intensive products are projected to be low, necessitating substantial investment in marketing and client education to drive awareness and usage.

- Growth Potential: Despite initial hurdles, these hyper-personalized offerings are expected to capture significant market share in their respective niches as client understanding and trust grow.

BMO's investment in AI initiatives like Lumi Assistant places them in a high-growth sector, aiming for future market leadership despite minimal current external market share. These nascent solutions require significant investment to scale, characteristic of Question Marks that could transition into Stars.

Early-stage fintech investments, such as through WMNfintech and partnerships like BMO Sync, position BMO to capture future market growth in areas like embedded finance and AI. Startups nurtured here have high growth potential but low current market share, aligning them with the question mark category and requiring substantial 2024 investment.

BMO's expansion into new U.S. sub-markets post-Bank of the West acquisition represents entry into potential Stars with initially low market share but identified growth potential. These localized efforts, aiming to deepen penetration beyond BMO's 2023 U.S. retail deposit base growth, necessitate significant upfront investment.

BMO's specialized sustainable finance products, like green bonds for advanced clean energy, target high-growth niche markets with low initial market share. The global green bond market's estimated $1.2 trillion issuance by end-2023 highlights the potential for these focused financial instruments, which require investment to build scale.

| Initiative | BCG Category | Market Share (Current) | Growth Potential | Investment Focus (2024) |

|---|---|---|---|---|

| AI/Lumi Assistant | Question Mark | Minimal | High | Scaling & Market Penetration |

| Fintech Accelerators (e.g., WMNfintech) | Question Mark | Low | High | Nurturing Ventures |

| New U.S. Geographic Markets | Question Mark | Low (in new sub-markets) | Moderate to High | Infrastructure & Marketing |

| Sustainable Finance Products | Question Mark | Low (in niche segments) | High | Market Development & Scale |

BCG Matrix Data Sources

Our BMO BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.