Blackbaud SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackbaud Bundle

Blackbaud's market position is defined by its strong brand recognition and established customer base within the nonprofit sector. However, understanding the full scope of its competitive advantages and potential vulnerabilities requires a deeper dive.

Want the full story behind Blackbaud's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Blackbaud's market leadership in social good software is a significant strength. They are the go-to provider for nonprofits, foundations, and educational institutions, boasting deep industry expertise. This specialization allows them to offer tailored solutions that meet the unique demands of this sector, solidifying their competitive edge.

Blackbaud's strength lies in its comprehensive and integrated suite of cloud-based solutions tailored for the social good sector. This end-to-end platform covers critical areas like fundraising, financial management, marketing, and operational support, offering a holistic approach that few competitors can match.

The company's offerings, including robust CRM, fund accounting, and ERP functionalities, are deeply interconnected. This integration creates a powerful ecosystem that significantly enhances customer loyalty and operational efficiency for non-profits and other social good organizations, as evidenced by their strong retention rates.

Blackbaud's strength lies in its robust recurring revenue model. In the first quarter of 2025, a remarkable 97.6% of its total revenue came from recurring subscriptions. This trend continued in fiscal year 2024, where recurring revenue represented 98% of total revenue.

This Software-as-a-Service (SaaS) approach creates a highly predictable and stable income stream for the company. Such a model is a significant advantage, as it underpins consistent organic revenue growth and provides the financial foundation for continuous investment in enhancing its product offerings.

Commitment to Innovation and AI Integration

Blackbaud's commitment to innovation is evident in its substantial investments in artificial intelligence (AI) and data intelligence. The company is actively integrating these technologies across its product suite, aiming to streamline operations for its clients in the nonprofit and education sectors. This focus on AI is designed to enhance customer capabilities and maintain a competitive edge.

Recent developments highlight this strategy, with Blackbaud rolling out AI-powered tools. These tools are specifically crafted to assist with fundraising efforts, automate financial processes, and provide deeper insights within educational institutions. For instance, their AI-driven solutions are projected to help organizations reduce manual administrative tasks, freeing up valuable resources for core mission activities.

- AI-powered fundraising tools are being deployed to optimize donor engagement and campaign effectiveness.

- Financial automation features leverage AI to streamline accounting and reporting, improving efficiency.

- Data intelligence enhancements are providing deeper insights for strategic decision-making in educational settings.

Solid Financial Performance and Shareholder Value Focus

Blackbaud has shown robust financial health, with Q1 2025 non-GAAP organic revenue increasing by 5.8%. This growth is complemented by enhanced profitability, evidenced by a non-GAAP adjusted EBITDA margin of 34.3% during the same period.

The company's dedication to shareholder returns is clear through its active share repurchase program. In Q1 2025 alone, Blackbaud repurchased approximately 4% of its outstanding shares, demonstrating a strategic focus on increasing shareholder value alongside strong operational performance.

- Strong Revenue Growth: 5.8% non-GAAP organic revenue growth in Q1 2025.

- Improved Profitability: 34.3% non-GAAP adjusted EBITDA margin in Q1 2025.

- Shareholder Returns: Approximately 4% of outstanding shares repurchased in Q1 2025.

Blackbaud's dominant position in the social good software market is a key strength, serving as the primary technology partner for a vast array of nonprofits, foundations, and educational institutions. Their deep understanding of this specialized sector allows them to develop and deliver highly tailored solutions, fostering strong client relationships and significant market share.

The company's integrated, cloud-based platform offers a comprehensive suite of tools covering fundraising, constituent relationship management (CRM), financial management, and marketing automation. This end-to-end approach streamlines operations for social good organizations, enhancing efficiency and effectiveness.

Blackbaud benefits from a highly predictable revenue stream, with approximately 98% of its revenue derived from recurring subscriptions in fiscal year 2024. This Software-as-a-Service (SaaS) model ensures financial stability and supports ongoing investment in product development and innovation.

Strategic investments in artificial intelligence (AI) and data intelligence are enhancing Blackbaud's offerings. The company is actively integrating AI across its solutions to automate tasks, improve fundraising outcomes, and provide deeper insights for its clients, reinforcing its competitive advantage.

Financially, Blackbaud demonstrated strong performance in Q1 2025, with non-GAAP organic revenue growth of 5.8% and a non-GAAP adjusted EBITDA margin of 34.3%. The company also actively returned capital to shareholders, repurchasing approximately 4% of its outstanding shares in the same quarter.

| Metric | Q1 2025 | FY 2024 |

|---|---|---|

| Non-GAAP Organic Revenue Growth | 5.8% | N/A |

| Non-GAAP Adjusted EBITDA Margin | 34.3% | N/A |

| Recurring Revenue % | 97.6% | 98% |

| Share Repurchases (Q1 2025) | ~4% of outstanding shares | N/A |

What is included in the product

Analyzes Blackbaud’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address Blackbaud's strategic challenges and opportunities.

Weaknesses

Blackbaud's history includes a significant 2020 data breach, leading to substantial financial penalties, including multi-million dollar settlements. Regulatory bodies mandated extensive security upgrades, underscoring the severity of the compliance challenges.

Despite ongoing efforts to rectify these issues, the lingering impact of past incidents continues to affect customer trust. This necessitates ongoing, considerable investment in cybersecurity infrastructure and adherence to evolving compliance standards, including data deletion protocols and enhanced safeguards.

Blackbaud's reliance on the social good sector, while a strength, also presents a significant weakness. This niche focus means the company is highly susceptible to economic downturns that directly impact charitable donations and the budgets of non-profits and educational institutions. For example, during periods of economic uncertainty, these organizations often face tighter financial constraints, which can lead to delayed purchasing decisions or reduced spending on software solutions. This sensitivity limits Blackbaud's growth potential and pricing power compared to software companies serving more diverse and robust commercial markets.

Blackbaud's growth strategy, heavily reliant on acquisitions, has resulted in a broad product suite that can feel disjointed. This fragmentation often means customers are dealing with systems that don't seamlessly communicate, leading to a less unified user experience. For instance, while Blackbaud acquired numerous companies in the early 2020s to bolster its cloud offerings, the challenge remains in harmonizing these diverse technologies.

Competition from Broader Software Platforms

Blackbaud, while a leader in its specific niche, faces growing competition from larger, more general software providers. Companies like Salesforce are increasingly developing specialized solutions for the nonprofit market, challenging Blackbaud's established position. This broader competition can impact Blackbaud's market share and its ability to stand out.

These larger platforms often boast extensive ecosystems and potentially more attractive pricing structures, or offer different integration advantages that could appeal to nonprofits. For instance, Salesforce's extensive partner network and app marketplace provide a wide array of complementary solutions. This intensified rivalry necessitates continuous innovation and clear value proposition for Blackbaud to maintain its competitive edge.

- Increased Competition: Broad software platforms like Salesforce are expanding into the nonprofit sector.

- Ecosystem Advantage: Competitors offer extensive app ecosystems and integration capabilities.

- Pricing Pressure: General software vendors may leverage economies of scale for more competitive pricing.

- Market Share Risk: This intensified competition could erode Blackbaud's market share and differentiation.

Perceived Complexity and Implementation Challenges

Some clients perceive Blackbaud's extensive software offerings as intricate, potentially necessitating substantial customization or the engagement of third-party consultants for complete setup and enhancement. This perceived complexity, coupled with the requirement for thorough training, could present adoption obstacles and affect general client contentment.

For instance, while Blackbaud reported a 6% increase in total revenue to $1.10 billion for the fiscal year ending December 31, 2023, the integration and user-friendliness of its diverse product suite remain key areas for improvement to ensure seamless adoption and maximize value for all users.

- Complexity Concerns: A significant portion of Blackbaud's customer base may find the breadth of its solutions daunting, leading to extended implementation timelines.

- Reliance on Consultants: The need for external expertise to fully leverage Blackbaud's platforms can add to project costs and complexity.

- Training Demands: Extensive user training is often required, which can be a barrier for organizations with limited resources or time.

- User Experience Gaps: Ensuring a consistent and intuitive user experience across all Blackbaud products is crucial for driving adoption and satisfaction.

Blackbaud's historical data breach in 2020, resulting in multi-million dollar settlements and mandated security upgrades, continues to impact customer trust and necessitates ongoing cybersecurity investments. The company's niche focus on the social good sector makes it vulnerable to economic downturns, potentially delaying non-profit spending on software. Furthermore, its acquisition-driven growth has led to a fragmented product suite, creating integration challenges and a less unified user experience for clients.

The perceived complexity of Blackbaud's extensive offerings can also be a weakness, potentially requiring significant customization or third-party consultants for full implementation, which adds to costs and can hinder user adoption. For instance, while Blackbaud reported a 6% increase in total revenue to $1.10 billion for the fiscal year ending December 31, 2023, ensuring a seamless user experience across its diverse product suite remains a key area for improvement.

What You See Is What You Get

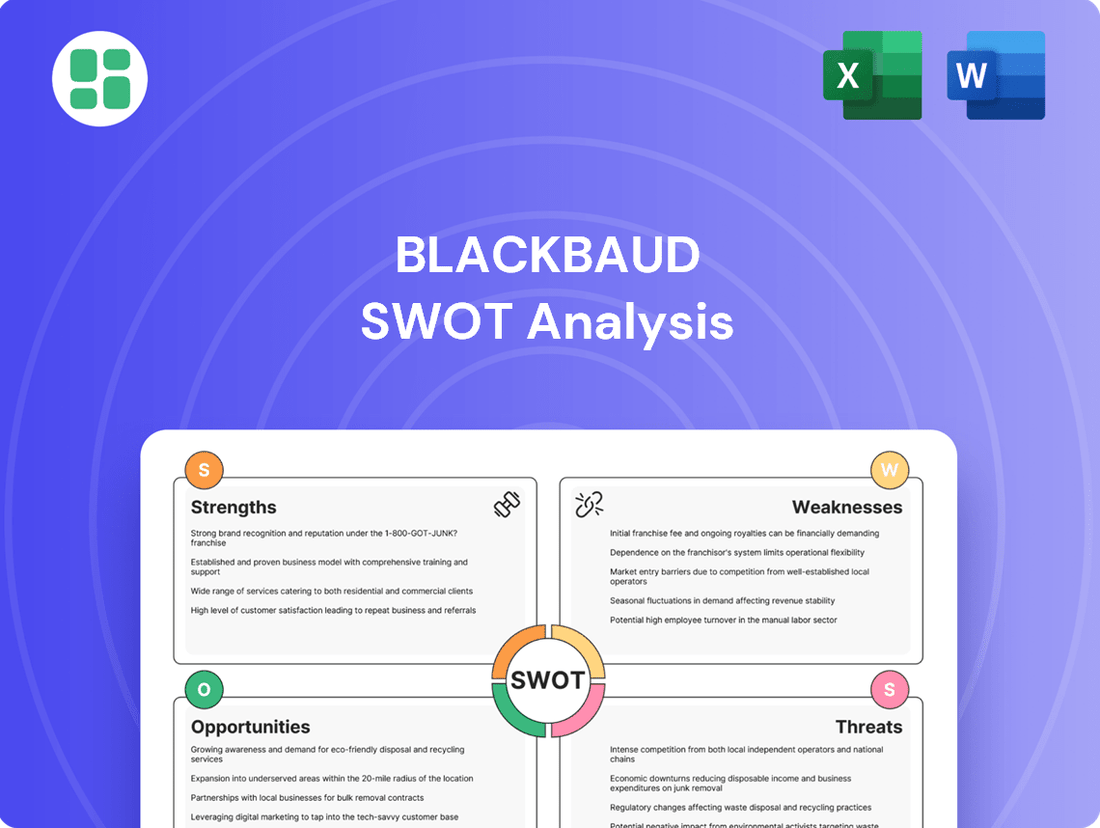

Blackbaud SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The swift uptake of AI by social impact organizations creates a prime chance for Blackbaud to integrate more sophisticated AI into its offerings. This aligns perfectly with their Intelligence for Good® approach, enabling them to deliver predictive fundraising analytics and automate tasks, thereby boosting customer efficiency and outcomes.

Blackbaud's established presence across numerous countries with a global user base presents a significant chance to deepen its reach within the social impact space. By tailoring product features for local markets, forging international alliances, and implementing focused marketing campaigns, the company can secure a greater portion of the expanding global philanthropy and corporate social responsibility sectors. This strategic international expansion is poised to diversify Blackbaud's revenue sources and spur faster overall growth.

The social good sector is actively adopting digital tools to boost efficiency and connect better with supporters. This shift represents a significant opportunity for Blackbaud, given its specialized cloud solutions designed for this market.

Blackbaud's platform is crucial for helping non-profits modernize, strengthen donor relationships, and ultimately advance their missions. The company's focus on purpose-built software aligns perfectly with this growing demand for digital advancement.

Evidence suggests technology is directly tied to fundraising success, with digital fundraising channels showing robust growth. For instance, online giving in the US saw substantial increases in recent years, highlighting the importance of digital transformation for non-profits.

Strategic Partnerships and Ecosystem Development

Blackbaud can significantly boost its market position by forging strategic alliances with technology firms offering complementary services. For instance, partnering with leaders in identity resolution or advanced digital marketing platforms can enrich Blackbaud's integrated ecosystem. This expansion not only broadens its customer appeal but also creates more fluid operational experiences for existing users.

These collaborations are crucial for developing a more robust and differentiated value proposition. By seamlessly integrating with other leading solutions, Blackbaud can offer a comprehensive suite that stands out against competitors offering only siloed software. This strategy is particularly relevant as the demand for end-to-end solutions in the nonprofit tech space continues to grow.

- Enhanced Ecosystem: Partnerships with identity resolution and digital marketing firms can strengthen Blackbaud's integrated offering.

- Broader Appeal: Collaborations expand the potential customer base by offering more comprehensive solutions.

- Customer Workflow Improvement: Seamless integration with partner technologies streamlines operations for nonprofits.

- Competitive Differentiation: A robust ecosystem built through partnerships sets Blackbaud apart from single-solution providers.

Addressing AI Governance and Policy Gaps for Customers

Many nonprofits are embracing AI technologies, yet a significant portion, potentially over 60% according to recent sector surveys in late 2024, are operating without formal AI governance policies. This presents a clear opportunity for Blackbaud to step in.

Blackbaud can position itself as a crucial partner by providing tailored guidance, best practices, and potentially embedding tools that assist nonprofits in developing ethical frameworks and robust data governance for their AI initiatives. This proactive approach can foster greater client trust.

- Guidance on AI Ethics: Offer resources and frameworks for ethical AI deployment, addressing bias and transparency concerns prevalent in AI adoption by nonprofits.

- Data Governance Solutions: Develop or highlight features within Blackbaud's platform that support secure and compliant data handling for AI applications, crucial given increasing data privacy regulations.

- Thought Leadership: Publish white papers and host webinars in 2025 detailing AI governance best practices specifically for the nonprofit sector, solidifying Blackbaud's role as a responsible technology leader.

The increasing adoption of AI by social impact organizations presents a significant opportunity for Blackbaud to integrate advanced AI features, aligning with its Intelligence for Good® strategy. This allows for enhanced predictive fundraising analytics and task automation, improving client efficiency. Furthermore, the growing digital transformation within the social good sector, evidenced by robust growth in online giving channels, underscores the demand for Blackbaud's specialized cloud solutions.

Blackbaud can capitalize on the trend of nonprofits seeking to modernize and strengthen donor relationships by offering purpose-built software that facilitates these goals. Strategic partnerships with technology firms in areas like identity resolution and digital marketing can further enrich Blackbaud's ecosystem, expanding its customer appeal and improving user workflows. The company is well-positioned to address the significant gap in AI governance among nonprofits, offering guidance and tools to build trust and ensure responsible AI deployment.

| Opportunity Area | Description | Potential Impact |

|---|---|---|

| AI Integration | Leveraging AI for predictive fundraising and task automation. | Increased client efficiency and improved outcomes. |

| Digital Transformation | Supporting nonprofits' shift to digital tools for engagement and fundraising. | Strengthened donor relationships and mission advancement. |

| Strategic Partnerships | Collaborating with complementary tech firms. | Enhanced ecosystem, broader customer appeal, and workflow improvement. |

| AI Governance Solutions | Providing guidance and tools for ethical AI deployment. | Building client trust and establishing thought leadership in responsible AI. |

Threats

The social good software sector is seeing a surge in competition. Startups focused on niche areas, alongside giants like Salesforce with their expanding nonprofit offerings, are intensifying the market. This means Blackbaud faces pressure on pricing and higher costs for marketing and sales.

For instance, Salesforce's continued investment in its nonprofit cloud solutions directly challenges Blackbaud's established position. This competitive pressure could impact Blackbaud's market share if they don't innovate and adapt quickly. In 2023, the global nonprofit software market was valued at approximately $10 billion and is projected to grow, making it an attractive space for new entrants.

Blackbaud continues to grapple with sophisticated, evolving cybersecurity threats, including advanced ransomware and data breaches, despite ongoing security investments. For instance, the company reported a significant data breach in 2019 that impacted many of its customers, highlighting the persistent nature of these risks.

The expanding landscape of global data privacy regulations, such as GDPR and CCPA, presents substantial compliance burdens and potential liabilities for Blackbaud. Failure to adhere to these complex rules can lead to hefty fines; for example, GDPR penalties can reach up to 4% of annual global turnover.

Any future security lapses or instances of regulatory non-compliance could severely damage Blackbaud's reputation, erode customer trust, and result in considerable financial penalties, impacting its market position and revenue streams.

Economic downturns pose a significant threat to Blackbaud. The company's revenue is closely tied to the financial capacity of its clients, primarily nonprofits and educational institutions. For instance, during the initial phases of the COVID-19 pandemic in 2020, many charities saw donation levels fluctuate, directly impacting their ability to invest in new technologies or upgrade existing systems, which could slow Blackbaud's sales cycle.

Rapid Technological Disruption and Innovation Cycles

The relentless pace of technological advancement, especially in areas like cloud computing, artificial intelligence, and sophisticated data analytics, presents a significant challenge. Blackbaud needs to consistently allocate resources to research and development to keep its offerings at the forefront of the market and maintain a competitive edge.

Failure to swiftly adapt to emerging technologies or evolving client demands could diminish the appeal of Blackbaud's current solutions. This could also pave the way for new competitors to capture market share by introducing more advanced or efficient alternatives.

- Cloud Computing Advancements: Continued innovation in cloud infrastructure and services by major providers could create new competitive pressures or opportunities for integration.

- AI and Machine Learning Integration: Competitors leveraging AI for enhanced donor engagement, predictive analytics, or operational efficiency could outpace Blackbaud if its own AI capabilities lag.

- Data Security and Privacy Regulations: Evolving global data privacy laws (e.g., GDPR, CCPA) require continuous investment in compliance and security, adding to R&D costs and potentially limiting certain data utilization strategies.

Customer Churn and Retention Challenges

Blackbaud faces the ongoing threat of customer churn, particularly if clients perceive the costs as too high or encounter difficulties integrating Blackbaud's solutions with their existing systems. Lingering concerns from past data security incidents could also fuel dissatisfaction and lead to attrition.

For instance, while Blackbaud's customer base is generally sticky, a proactive approach to demonstrating ongoing value and swiftly resolving service issues is paramount. This is especially critical in a competitive market where alternative solutions might appear more cost-effective or easier to implement.

- Customer Retention Focus: Blackbaud's ability to retain its existing customer base is crucial, especially given the investments clients make in its platforms.

- Value Proposition Reinforcement: Continuously proving the ROI and unique benefits of Blackbaud's offerings is key to combating churn.

- Addressing Past Concerns: Proactively managing and communicating resolutions to any past data security or integration challenges is vital for rebuilding and maintaining client trust.

Intensifying competition, particularly from giants like Salesforce expanding their nonprofit offerings, pressures Blackbaud on pricing and increases sales and marketing expenses. The global nonprofit software market, valued at approximately $10 billion in 2023, is a target for new entrants, amplifying this threat.

Evolving cybersecurity threats, including advanced ransomware and data breaches, persist despite security investments, as evidenced by the 2019 breach that affected numerous clients. Furthermore, expanding global data privacy regulations like GDPR and CCPA impose significant compliance burdens and potential liabilities, with GDPR fines potentially reaching 4% of annual global turnover.

Economic downturns directly impact Blackbaud's revenue, as its clients, primarily nonprofits and educational institutions, may reduce technology spending during financial strain. For example, the initial COVID-19 impact in 2020 saw fluctuating donation levels for charities, potentially slowing Blackbaud's sales cycles.

The rapid pace of technological advancement, especially in cloud computing and AI, necessitates continuous R&D investment to maintain a competitive edge. Failure to adapt swiftly could diminish solution appeal and allow competitors to capture market share with more advanced offerings.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, incorporating Blackbaud's official financial statements, comprehensive market research reports, and insights from industry analysts to provide a well-rounded perspective.