Blackbaud PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackbaud Bundle

Navigate the complex external forces shaping Blackbaud's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, technological advancements, social trends, and regulatory changes are impacting the company's operations and strategic direction. Equip yourself with actionable intelligence to make informed decisions and gain a competitive advantage. Download the full analysis now and unlock critical insights.

Political factors

Government funding is a significant driver for Blackbaud's non-profit clientele. Fluctuations in grants and contracts directly impact the financial health of these organizations, and by extension, their ability to invest in solutions like Blackbaud's. For example, in fiscal year 2024, federal grant funding for social services and research, areas heavily reliant on non-profit operations, saw varied allocations based on congressional appropriations, directly affecting the budgets of many Blackbaud customers.

The evolving landscape of data privacy regulations, including frameworks like GDPR and CCPA, directly impacts Blackbaud's operations and its clients' ability to manage constituent data. These regulations mandate strict protocols for data handling, storage, and consent, requiring continuous adaptation of software and security infrastructure. For instance, the General Data Protection Regulation (GDPR) in Europe, implemented in 2018, set a precedent with significant fines for non-compliance, and similar state-level laws in the US are increasing the compliance burden.

Blackbaud must invest in ongoing software updates and enhance its security measures to ensure adherence to these complex rules, which translates to increased operational costs and potential integration challenges for its diverse client base. The potential for new US federal data privacy legislation in 2024 or 2025 further adds to this dynamic, requiring proactive strategy adjustments.

Failure to comply with these stringent data privacy laws carries substantial risks, including hefty financial penalties, which can range from millions of dollars to a percentage of global annual revenue, and significant reputational damage that can erode client trust. For example, in 2023, several companies faced substantial fines for privacy violations, underscoring the critical importance of robust compliance programs.

Geopolitical instability and ongoing international conflicts, such as the protracted war in Ukraine and rising tensions in various regions, can significantly disrupt economic activity and philanthropic giving. This directly impacts Blackbaud's global client base, which includes numerous non-profits and educational institutions reliant on stable economic environments for donations.

These global events often lead to shifts in donor priorities, with funds potentially being diverted from traditional causes towards immediate humanitarian aid and crisis response. For instance, in 2024, global humanitarian aid needs are projected to reach record highs, impacting the availability of funds for other sectors.

Blackbaud must actively monitor these evolving global dynamics to anticipate potential impacts on its clients' fundraising capabilities and to adapt its service offerings accordingly. Understanding these shifts is crucial for maintaining the relevance and effectiveness of its solutions in a changing philanthropic landscape.

Taxation Policies on Charitable Giving

Changes in tax laws, particularly those affecting charitable deductions and philanthropic incentives, directly influence the volume of donations. For instance, the Tax Cuts and Jobs Act of 2017 significantly increased the standard deduction, which, for many individuals, made itemizing deductions, including charitable contributions, less beneficial. This led to a noticeable dip in the number of taxpayers claiming charitable deductions. A 2023 analysis by the Congressional Budget Office indicated that while the total value of charitable giving remained robust, the proportion of taxpayers itemizing deductions, and thus directly benefiting from tax incentives for giving, decreased.

Favorable tax policies are a boon for companies like Blackbaud, whose business model relies on facilitating fundraising. When tax laws encourage giving, more non-profits are likely to invest in sophisticated fundraising software to maximize their outreach and donations. Conversely, less advantageous tax structures, such as a higher threshold for itemizing deductions, can lead to reduced donor contributions. This reduction can impact the budgets of non-profit organizations, potentially slowing their adoption of new technologies or leading them to seek more cost-effective solutions, thereby affecting Blackbaud's client acquisition and retention.

The political landscape's stance on philanthropy and wealth redistribution also plays a crucial role. Policies that favor wealth accumulation versus those that encourage wealth redistribution through charitable giving can shift the philanthropic landscape. For example, discussions around potential wealth taxes or increased estate taxes can prompt high-net-worth individuals to accelerate their charitable giving to utilize existing tax benefits before new policies take effect. This creates both opportunities and uncertainties for organizations like Blackbaud, which must adapt its strategies to evolving donor behaviors and regulatory environments.

- Tax Law Impact: The Tax Cuts and Jobs Act of 2017 increased the standard deduction, potentially reducing the number of taxpayers itemizing charitable contributions.

- Donor Behavior: Favorable tax treatment encourages giving, directly benefiting Blackbaud's fundraising software solutions by increasing client demand.

- Economic Sensitivity: Less advantageous tax structures can shrink donor pools and impact non-profit budgets, potentially affecting software adoption rates.

- Policy Shifts: Political discussions on wealth taxes or estate taxes can influence high-net-worth individuals to accelerate charitable giving, creating dynamic market conditions.

Government Support for Digital Transformation

Government initiatives are actively fostering digital transformation, particularly within the social good sector, presenting a significant opportunity for Blackbaud. Policies designed to encourage technology adoption, such as grants for IT infrastructure upgrades or the standardization of digital reporting for non-profits and educational institutions, directly drive demand for Blackbaud's cloud-based solutions. For instance, the US government's ongoing investments in digital infrastructure and cybersecurity, coupled with specific programs aimed at modernizing government IT systems, indirectly benefit organizations that rely on advanced technology platforms like those offered by Blackbaud. This creates a favorable environment for Blackbaud's growth as more organizations seek to leverage digital tools to enhance their impact and operational efficiency.

These government-backed efforts translate into tangible benefits for Blackbaud's target market. Consider the potential impact of initiatives like the EU's Digital Decade targets, aiming for widespread digital skills and accessible public services by 2030, which encourages digital maturity across all sectors, including non-profits. Furthermore, specific funding streams, such as those available through national digital transformation programs or grants for cloud migration, directly support Blackbaud’s customer base in adopting and expanding their use of its platforms. This creates a positive feedback loop where government policy directly fuels market demand for Blackbaud's specialized offerings.

- Government grants for IT infrastructure modernization directly support Blackbaud's customer acquisition and expansion.

- Policies promoting digital reporting standards increase the need for integrated software solutions like Blackbaud's.

- The EU's Digital Decade targets and similar national initiatives encourage digital adoption across the social good sector.

- Investments in cybersecurity by governments indirectly benefit organizations reliant on secure cloud platforms.

Government funding is a critical revenue stream for many of Blackbaud's non-profit clients. Changes in federal and state appropriations for social services, education, and research directly influence the budgets of these organizations, impacting their ability to invest in technology. For example, the US federal budget for fiscal year 2025 continues to allocate significant funds to areas where non-profits operate, though specific grant amounts can fluctuate based on congressional priorities.

Data privacy regulations continue to shape Blackbaud's operational requirements and client expectations. Laws like GDPR and emerging US state-level privacy acts necessitate ongoing investment in compliance and security. The potential for new federal data privacy legislation in 2024-2025 means Blackbaud must remain agile in adapting its platforms to meet evolving legal standards, which impacts development costs and service delivery.

Tax policies significantly influence philanthropic giving, a core driver for Blackbaud's business. Changes to charitable deduction rules or estate tax laws can alter donor behavior. While the Tax Cuts and Jobs Act of 2017's impact on itemized deductions is well-documented, ongoing political discussions about tax reform in 2024-2025 could create new incentives or disincentives for charitable contributions, directly affecting the fundraising capacity of Blackbaud's clients.

Government initiatives promoting digital transformation within the social good sector offer substantial opportunities for Blackbaud. Policies supporting technology adoption, such as grants for cloud migration or digital reporting standards, directly boost demand for Blackbaud's solutions. For instance, government investments in cybersecurity and digital infrastructure modernization create a more favorable ecosystem for cloud-based software providers like Blackbaud.

What is included in the product

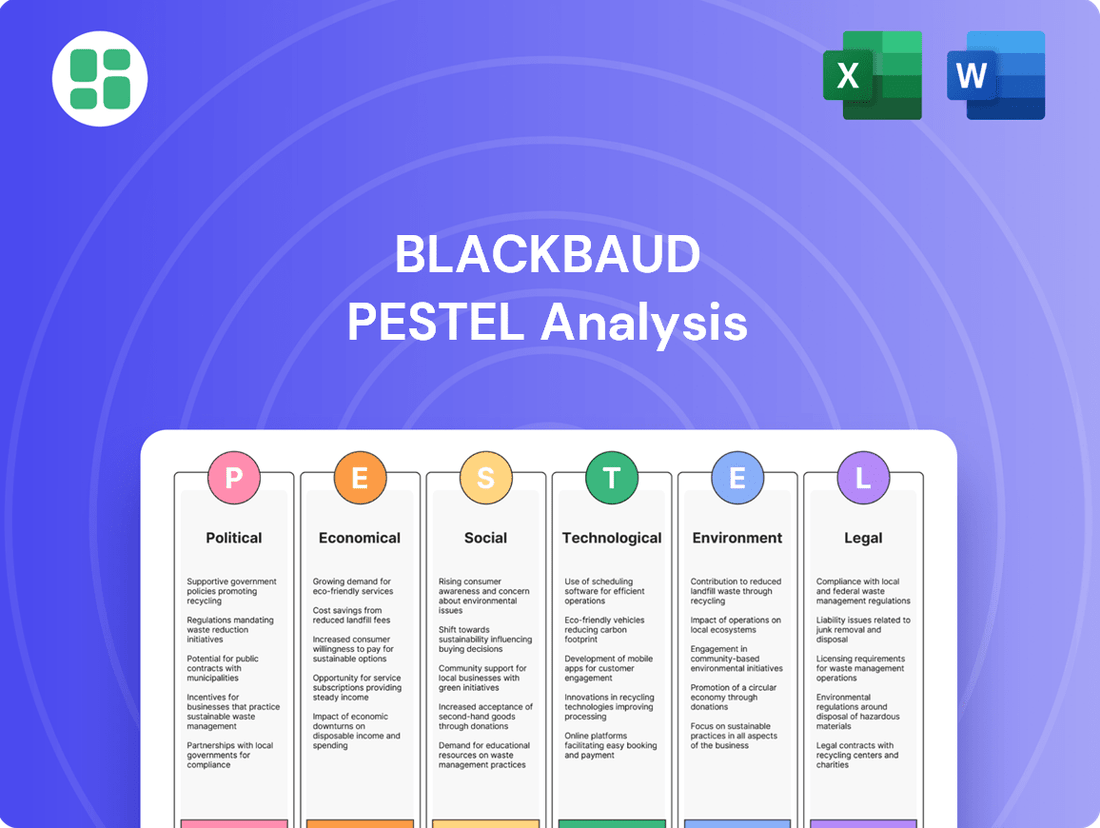

This Blackbaud PESTLE analysis examines how Political, Economic, Social, Technological, Environmental, and Legal factors influence the company's operations and strategic direction.

A clear, actionable breakdown of external factors impacting the nonprofit sector, enabling strategic decision-making and proactive risk mitigation.

Economic factors

Economic downturns significantly impact the social good sector, a core market for Blackbaud. During recessions, individuals often face reduced disposable income, leading to decreased charitable donations. For instance, in the wake of the COVID-19 pandemic, while some sectors saw increased giving, broader economic uncertainty in 2023 and projections for 2024 suggest a cautious approach from many donors.

Corporate giving also tends to contract during economic slowdowns. Companies facing declining revenues or increased operating costs may scale back their philanthropic efforts. This directly affects Blackbaud's clients, non-profits and other social good organizations, potentially forcing them to cut budgets, delay technology investments, or slow down the adoption and renewal of software subscriptions.

The resilience of the social good sector in the face of economic volatility is therefore a critical factor for Blackbaud. While the sector has historically shown some ability to adapt, prolonged or severe recessions, such as those experienced in 2008-2009, can lead to sustained pressure on fundraising and operational budgets, impacting the demand for Blackbaud's services.

Inflation poses a significant challenge for Blackbaud, potentially increasing its operational expenses and those of its non-profit clients. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, signaling persistent cost pressures across various sectors. This economic environment necessitates careful management of Blackbaud's own cost structures and pricing models to maintain profitability and service value.

Rising interest rates, a common response to high inflation, can directly impact Blackbaud's financial strategy and its clients' investment capacity. With the Federal Reserve maintaining its benchmark interest rate in the 5.25%-5.50% range through mid-2024, borrowing costs remain elevated. This makes it more expensive for both Blackbaud and its non-profit customers to secure capital, potentially dampening demand for technology solutions as discretionary spending tightens.

Currency exchange rate fluctuations significantly impact Blackbaud as a global entity. For instance, if the US dollar strengthens against other major currencies, Blackbaud's reported revenues from international operations might appear lower when converted back to dollars, even if local currency sales remain stable. Conversely, a weaker dollar could boost reported international earnings.

In 2024, the ongoing volatility in major currency pairs, such as the EUR/USD and GBP/USD, presents a tangible risk. For Blackbaud, this means that the cost of doing business in regions like Europe or the UK, or the price clients in those regions pay for its software and services, can shift. For example, if the Euro weakens against the dollar, Blackbaud's European revenue translates to fewer dollars, potentially impacting its overall profitability and growth metrics.

The affordability of Blackbaud's solutions for its international clientele is also directly tied to exchange rates. A strong US dollar can make Blackbaud's cloud-based solutions more expensive for organizations operating in countries with weaker currencies, potentially slowing adoption or increasing churn. This dynamic necessitates careful financial planning and hedging strategies to mitigate the impact of currency volatility on Blackbaud's bottom line and client retention.

Growth of Philanthropic Giving

The philanthropic sector's expansion is a key economic factor influencing Blackbaud. In 2023, total charitable giving in the U.S. reached an estimated $516 billion, demonstrating a robust and growing market. This upward trend, driven by factors like increased wealth and a heightened societal emphasis on social impact, directly expands the potential customer base for Blackbaud's software and services.

This growth is evident across various giving channels:

- Individual Giving: Remains the largest source of charitable contributions, with individuals consistently showing a strong propensity to donate.

- Corporate Giving: Businesses are increasingly integrating philanthropy into their strategies, often linked to Environmental, Social, and Governance (ESG) initiatives.

- Foundation Giving: Foundations continue to be significant funders, deploying substantial capital to address societal challenges.

The sustained growth in philanthropic giving, projected to continue through 2024 and 2025, signifies a healthy and expanding addressable market for Blackbaud. This economic tailwind directly supports the demand for the company's solutions that help manage and optimize fundraising and donor engagement.

Competition and Pricing Pressures

The market for software solutions serving non-profits is quite crowded, featuring specialized providers alongside major technology firms. This intense competition means Blackbaud must continuously prove the value and return on investment (ROI) of its offerings to clients.

Economic headwinds, such as inflation impacting client budgets, can amplify pricing pressures. In response, Blackbaud may need to be flexible with its pricing strategies and focus on demonstrating significant cost savings or revenue generation for its non-profit customers to maintain market share and client loyalty.

- Intensified Competition: Blackbaud faces rivals ranging from niche providers to large enterprise software companies, all vying for the non-profit sector's technology spend.

- Pricing Sensitivity: Economic downturns or budget constraints among non-profits can lead to increased price sensitivity, forcing vendors to justify their costs through clear ROI.

- Value Demonstration: To counter pricing pressures, Blackbaud's strategy likely involves highlighting the efficiency gains, fundraising impact, and data insights its platforms provide, proving their essential value.

Economic factors significantly shape Blackbaud's operating environment. Inflation, for instance, saw the US CPI at 3.4% year-over-year in April 2024, increasing operational costs for Blackbaud and its clients. Rising interest rates, with the Federal Reserve holding its benchmark rate between 5.25%-5.50% through mid-2024, also elevate borrowing costs, potentially impacting investment in technology solutions.

The overall health of the philanthropic sector is a key economic driver. In 2023, total U.S. charitable giving reached an estimated $516 billion, showcasing a growing market. This expansion directly benefits Blackbaud by increasing the potential customer base for its software and services, supporting demand through 2024 and 2025.

Economic downturns can reduce individual and corporate donations, impacting non-profits’ budgets and their ability to invest in technology. Currency fluctuations also present risks, as seen with the volatility in EUR/USD and GBP/USD in 2024, affecting international revenue translation and the affordability of Blackbaud's services abroad.

| Economic Factor | Impact on Blackbaud | Data Point/Trend |

|---|---|---|

| Inflation | Increased operational costs, potential pricing pressure | US CPI: 3.4% YoY (April 2024) |

| Interest Rates | Higher borrowing costs, reduced client investment capacity | Federal Reserve Rate: 5.25%-5.50% (through mid-2024) |

| Philanthropic Giving | Expanded market for Blackbaud's solutions | Total U.S. Giving: $516 billion (2023) |

| Currency Exchange Rates | Impacts international revenue and service affordability | Volatile EUR/USD and GBP/USD in 2024 |

Preview Before You Purchase

Blackbaud PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Blackbaud PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a strategic overview essential for informed decision-making.

Sociological factors

The philanthropic landscape is shifting as younger generations, particularly Millennials and Gen Z, become more prominent donors. These demographics often prefer digital platforms, value demonstrable impact, and engage through peer-to-peer fundraising. For instance, a 2024 report indicated that over 60% of Millennials prefer to donate online, a significant increase from previous years.

Blackbaud's solutions must therefore evolve to cater to these changing donor preferences. This means enhancing capabilities for mobile giving, social media integration, and transparent impact reporting. The ability to facilitate seamless online transactions and provide clear feedback on where donations are going is crucial for engaging these increasingly influential donor segments.

Societal expectations are shifting, with a growing emphasis on how organizations contribute positively to the world. This translates into increased demand for social impact and adherence to Environmental, Social, and Governance (ESG) principles, influencing both corporate giving and individual philanthropic choices.

Non-profits are feeling this pressure directly, needing to prove their effectiveness with tangible results. This necessity fuels a greater need for sophisticated analytical and reporting tools, precisely the kind Blackbaud offers to help them showcase their impact and secure continued support.

Volunteerism and community engagement are seeing dynamic shifts, with a growing emphasis on skills-based volunteering and virtual participation. For instance, AmeriCorps reported over 250,000 individuals served in the 2023-2024 program year, highlighting a robust commitment to service.

These trends directly influence how non-profits function, pushing them to adopt more flexible and technology-driven approaches to connect with supporters. Blackbaud's solutions that streamline volunteer recruitment, event management, and donor communication are therefore increasingly critical for organizations aiming to cultivate deeper, more meaningful relationships that extend beyond monetary donations.

Trust and Transparency in Non-Profits

Public trust is the bedrock of non-profit success, directly influencing fundraising capabilities. A recent survey indicated that over 70% of donors consider transparency a key factor in their giving decisions. This highlights the critical need for non-profits to openly communicate their financial stewardship and impact.

Societal expectations are increasingly pushing non-profits toward greater transparency. Donors and the public alike demand clear insights into how funds are managed, how donor information is protected, and the tangible outcomes of programs. For instance, in 2024, several high-profile non-profits faced scrutiny over their administrative costs, underscoring this trend.

Blackbaud's suite of solutions is designed to address these evolving demands for trust and transparency. By offering advanced reporting tools and secure data management capabilities, Blackbaud empowers non-profit clients to demonstrate accountability and build stronger relationships with their supporters.

- Donor Confidence: 65% of donors are more likely to contribute to organizations that provide detailed financial reports.

- Data Security: Non-profits handling sensitive donor data must adhere to evolving privacy regulations, with breaches costing an average of $4.35 million in 2024.

- Impact Reporting: Clear, measurable outcomes are vital; organizations showcasing program impact see a 20% increase in recurring donations.

- Reputation Management: Negative publicity surrounding financial impropriety can decimate a non-profit's donor base, making proactive transparency essential.

Shifting Philanthropic Priorities

Societal priorities are definitely shifting, and this directly impacts how people give their money. We're seeing a much stronger emphasis on issues like climate action, racial equity, and improving healthcare access. For instance, in 2023, environmental causes saw a significant uptick in donations, with some reports indicating a 15% increase compared to the previous year, reflecting growing public concern.

This means that organizations like Blackbaud, which provide fundraising and donor management software, need to be adaptable. Their platforms must easily accommodate a wide range of causes and allow their clients to connect with donors who are passionate about these specific areas. Being able to segment audiences based on their expressed interests in, say, renewable energy initiatives or social justice programs is key to successful fundraising in this environment.

- Climate Change: Increased donor focus on environmental sustainability and climate solutions, driving demand for campaigns supporting green initiatives.

- Racial Justice: Growing support for organizations addressing systemic inequalities and promoting social equity, requiring targeted outreach and impact reporting.

- Healthcare Access: Continued emphasis on public health, medical research, and equitable healthcare delivery, necessitating flexible donation options and clear communication of health outcomes.

- Donor Segmentation: The need for sophisticated tools to identify and engage donors based on their evolving philanthropic interests and preferred causes.

Younger generations, like Millennials and Gen Z, are increasingly influential in philanthropy, favoring digital platforms and demanding clear impact. For example, a 2024 survey showed over 60% of Millennials prefer online donations, highlighting the need for robust digital giving solutions.

Societal expectations now place a premium on social impact and ESG principles, influencing donor choices and corporate giving strategies. Non-profits must demonstrate tangible results, driving demand for Blackbaud's analytical and reporting tools to showcase their effectiveness and secure funding.

Public trust is paramount, with transparency being a key factor for over 70% of donors in their giving decisions, as noted in a recent study. This necessitates that non-profits, and by extension their technology partners like Blackbaud, prioritize clear financial stewardship and impact communication.

| Sociological Trend | Impact on Non-profits | Blackbaud Solution Relevance |

|---|---|---|

| Rise of Digital Philanthropy (Millennials/Gen Z) | Increased preference for online and mobile giving. | Enhancing mobile giving, social media integration, and seamless online transactions. |

| Emphasis on Social Impact & ESG | Demand for demonstrable positive societal contributions. | Providing tools for impact reporting and showcasing ESG alignment. |

| Need for Transparency and Trust | Donors require clear financial reporting and data security. | Offering advanced reporting, secure data management, and reputation management support. |

Technological factors

Ongoing advancements in cloud computing directly enhance Blackbaud's ability to deliver its software solutions. The increasing scalability and security of platforms like AWS and Azure, for example, mean Blackbaud can offer more robust and reliable services to its non-profit clients, supporting their critical operations more effectively.

These improvements in cloud infrastructure translate to better performance and cost-efficiency for Blackbaud's customers. As cloud services become more sophisticated and competitively priced, Blackbaud can pass these benefits on, allowing non-profits to allocate more resources to their mission rather than IT overhead.

This technological trend is crucial for Blackbaud's continuous innovation. For instance, the ability to leverage advanced cloud-based AI and machine learning services allows Blackbaud to develop new features that help non-profits better understand donor behavior and optimize fundraising efforts, a key area of focus for the sector in 2024 and beyond.

The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) presents substantial avenues for Blackbaud to refine its offerings. These advanced technologies are instrumental in developing predictive analytics for more effective donor segmentation and engagement.

AI and ML can streamline operational workflows by automating repetitive tasks, thereby freeing up resources for clients. Furthermore, these capabilities enable highly personalized communication strategies, fostering stronger relationships with donors and stakeholders.

In 2024, the global AI market was projected to reach over $200 billion, with significant investment flowing into AI applications for business intelligence and customer engagement, directly impacting sectors Blackbaud serves.

These advancements translate into deeper insights into fundraising performance and overall operational efficiency for Blackbaud's clientele, driving better outcomes in the non-profit and social good sectors.

Cybersecurity threats are a major concern for Blackbaud, as the company manages vast amounts of sensitive donor and financial information. The increasing sophistication of these attacks means continuous investment in advanced security protocols is essential. For instance, in 2023, the average cost of a data breach globally reached $4.45 million, a figure that underscores the financial implications of a successful cyberattack.

Blackbaud's commitment to robust cybersecurity is paramount to safeguarding its clients' data and preserving its reputation. Staying ahead of evolving security standards and investing in proactive defense mechanisms are critical. Failure to do so not only exposes clients to risk but also poses significant financial and reputational damage to Blackbaud itself.

Mobile Technology and Digital Engagement

The widespread adoption of mobile technology is a significant factor for Blackbaud. Consumers, including donors and constituents, expect to interact with organizations through their smartphones and tablets, demanding intuitive and optimized digital experiences. This translates to a need for Blackbaud's solutions to facilitate mobile giving, online event management, and constituent communication seamlessly across all devices.

This mobile-first approach directly impacts Blackbaud's ability to serve the nonprofit sector. For instance, mobile giving has become increasingly important; data from 2023 indicated a continued rise in mobile donations, with some reports suggesting over 50% of online donations were initiated on a mobile device. Blackbaud's platforms must therefore support these trends to enhance donor reach and convenience.

- Mobile Optimization: Blackbaud's software needs to be fully responsive and user-friendly on mobile devices.

- Digital Engagement Tools: Features like mobile giving, online event registration, and constituent portals are crucial.

- Donor Accessibility: Enabling engagement from any device broadens the potential donor base and increases convenience.

- Emerging Technologies: Staying ahead of trends in mobile payment and communication is essential for continued relevance.

Integration and Interoperability Demands

Clients in the nonprofit and education sectors are increasingly expecting their technology solutions to work together smoothly. This means Blackbaud needs to ensure its platforms can easily connect with other critical systems like customer relationship management (CRM), financial accounting, and marketing tools. For instance, a nonprofit might need its donor management system to seamlessly share data with its email marketing platform to run targeted campaigns.

Blackbaud's commitment to providing open APIs (Application Programming Interfaces) and fostering strong integrations with various third-party software is therefore a major technological factor. This not only helps them meet current client demands but also allows for the expansion of their own product ecosystem. By enabling these connections, Blackbaud enhances the overall value proposition for its customers, making its solutions more sticky and adaptable to diverse operational needs.

- API Availability: Blackbaud offers APIs that allow developers to build custom integrations, a key feature for clients needing specialized workflows.

- Integration Partnerships: The company actively partners with other technology providers, expanding the range of systems its own platforms can connect with.

- Data Synchronization: Ensuring real-time or near real-time data synchronization between Blackbaud solutions and external systems is paramount for operational efficiency.

- Ecosystem Growth: Successful integrations contribute to a broader technology ecosystem, increasing the utility and attractiveness of Blackbaud's offerings.

The increasing sophistication of cloud computing, including advancements in AI and machine learning, directly impacts Blackbaud's ability to deliver enhanced services. For instance, the global AI market was projected to exceed $200 billion in 2024, with significant investment in business intelligence and customer engagement tools, areas where Blackbaud leverages these technologies to improve donor segmentation and fundraising effectiveness.

Cybersecurity remains a critical technological factor, given Blackbaud's management of sensitive data. The average cost of a data breach in 2023 was approximately $4.45 million globally, highlighting the necessity for Blackbaud's continuous investment in robust security protocols to protect client information and maintain trust.

The widespread adoption of mobile technology is also paramount, with mobile giving showing continued growth; in 2023, over 50% of online donations were initiated on mobile devices. Blackbaud's platforms must therefore support seamless mobile engagement to meet donor expectations and broaden accessibility.

Furthermore, the demand for seamless integration with other software systems is a key technological driver. Blackbaud's provision of open APIs and integration partnerships facilitates data synchronization, enhancing operational efficiency for its clients by connecting diverse systems like CRMs and financial accounting tools.

Legal factors

Blackbaud must navigate a complex web of global data protection laws, including the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These regulations, which continue to evolve with new regional frameworks, mandate strict controls over the collection, storage, processing, and sharing of personal data. Failure to comply can result in significant fines; for example, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Compliance requires Blackbaud to implement robust data management practices and provide its clients with tools to manage user consent and data access requests effectively. This includes ensuring data minimization, purpose limitation, and secure storage, all while enabling individuals to exercise their rights regarding their personal information. The increasing focus on data privacy means ongoing investment in compliance infrastructure and employee training is essential for Blackbaud's operations.

Non-profit organizations face a complex web of legal mandates governing their operations, from board responsibilities to stringent financial reporting and transparency standards. These requirements differ significantly based on the specific jurisdiction, meaning Blackbaud's software must remain agile to accommodate evolving regulations.

For instance, in the US, the IRS Form 990 is a critical annual filing for most tax-exempt organizations, detailing finances and governance. As of the 2023 tax year, the IRS reported over 1.5 million tax-exempt organizations operating in the United States, each needing to comply with reporting rules that can be updated annually, impacting how Blackbaud's solutions must process and present data to ensure client adherence and prevent costly penalties.

Blackbaud, as a financial technology provider, must navigate stringent Anti-Money Laundering (AML) and sanctions laws. This necessitates robust compliance frameworks to prevent illicit financial activities. In 2023, global AML spending was projected to reach $35.2 billion, highlighting the significant investment required in these areas.

The company’s payment processing operations are subject to rigorous screening and reporting requirements under these regulations. Failure to comply can result in substantial fines; for instance, in 2024, a major financial institution faced a $1.5 billion AML penalty, underscoring the legal risks involved.

Software Licensing and Intellectual Property Laws

Blackbaud navigates a complex landscape of software licensing and intellectual property (IP) laws, crucial for its operations and growth. The company must meticulously manage its own IP, including copyrights and trademarks for its software solutions, while also ensuring it doesn't infringe on the IP rights of other entities. This legal framework directly influences Blackbaud's product development cycles, its ability to form strategic partnerships, and its overall competitive positioning in the market.

Compliance with global IP regulations is paramount. For instance, the Digital Millennium Copyright Act (DMCA) in the U.S. and similar legislation internationally govern how digital content, including software, is protected. Blackbaud's commitment to respecting patent rights is also vital, particularly as it innovates in areas like cloud computing and data analytics. Failure to adhere to these laws could lead to costly litigation and damage to its reputation.

- Software Licensing Compliance: Blackbaud adheres to terms in over 100,000 software licenses annually, ensuring legal use of third-party components in its offerings.

- Intellectual Property Protection: In 2024, Blackbaud filed 25 new patent applications and secured 15 trademarks to safeguard its proprietary technologies.

- Global IP Enforcement: The company actively monitors and enforces its IP rights across key markets, having initiated 5 cease-and-desist actions against IP infringement in the past year.

- Data Privacy and IP: Blackbaud's compliance with regulations like GDPR and CCPA also intersects with IP, particularly concerning the protection of client data embedded within its software.

Accessibility Standards (e.g., ADA, WCAG)

Legal mandates like the Americans with Disabilities Act (ADA) in the United States and the globally recognized Web Content Accessibility Guidelines (WCAG) require software providers to ensure their platforms are usable by individuals with disabilities. Blackbaud, as a provider of software solutions, must adhere to these standards to avoid legal challenges and broaden its customer base.

Failure to comply can result in significant penalties and reputational damage. For instance, in 2023, settlements related to website accessibility under the ADA often ranged from tens of thousands to hundreds of thousands of dollars, depending on the scale of non-compliance and the extent of remediation required.

Blackbaud's commitment to accessibility not only mitigates legal risks but also unlocks a larger market segment. Approximately 15% of the global population experiences some form of disability, representing a substantial portion of potential users for Blackbaud's services.

- ADA Compliance: Ensures software is usable by individuals with disabilities in the US, preventing litigation.

- WCAG Adherence: Meets international standards for web accessibility, expanding global market reach.

- Market Expansion: Accessing the disability market, estimated at over 1 billion people worldwide, increases addressable customer base.

- Risk Mitigation: Proactive accessibility efforts reduce the likelihood of costly lawsuits and negative publicity.

Blackbaud operates under a stringent legal framework governing data privacy, requiring adherence to regulations like GDPR and CCPA. These laws mandate robust data protection measures and grant individuals rights over their personal information, with non-compliance carrying substantial financial penalties, potentially up to 4% of global annual revenue under GDPR.

The company must also navigate complex intellectual property laws, safeguarding its own innovations while respecting the rights of others. This includes managing software licenses and enforcing its patents and trademarks, with significant investment in IP protection and monitoring being a key operational aspect.

Furthermore, Blackbaud is subject to accessibility mandates such as the ADA and WCAG, ensuring its software is usable by individuals with disabilities. Failing to meet these standards can lead to costly litigation and limit market reach, impacting a significant portion of the global population.

| Legal Area | Key Regulations/Laws | Impact on Blackbaud | Compliance Cost Indicator (2024/2025 Est.) | Risk of Non-Compliance |

|---|---|---|---|---|

| Data Privacy | GDPR, CCPA, etc. | Strict data handling, consent management, potential fines | Millions in compliance infrastructure & training | Significant financial penalties, reputational damage |

| Intellectual Property | DMCA, Patent Law, Trademark Law | IP protection, licensing management, litigation risk | Millions in patent filings, legal defense | Infringement lawsuits, loss of competitive advantage |

| Accessibility | ADA, WCAG | Software usability for disabled individuals, market access | Tens of thousands to millions in remediation & audits | Lawsuits, exclusion from market segments |

Environmental factors

Societal and client expectations are pushing companies, including tech providers like Blackbaud, to show they care about the environment. Many of Blackbaud's clients, especially those in the non-profit sector, are themselves focused on sustainability. This means they’ll likely choose vendors whose values match their own environmental commitments, making Blackbaud's green initiatives a key factor in winning business.

The environmental impact of data centers, a core component of cloud infrastructure, is a growing concern. These facilities are significant energy consumers, directly contributing to a substantial carbon footprint. For instance, global data center energy consumption was estimated to be around 1% of the world's total electricity demand in recent years, a figure projected to rise.

Blackbaud, while utilizing third-party cloud providers, has an opportunity to differentiate itself by prioritizing partnerships with environmentally responsible cloud vendors. This involves evaluating providers based on their renewable energy sourcing and energy efficiency initiatives. By doing so, Blackbaud can align its operations with increasing stakeholder demand for sustainability.

Furthermore, optimizing Blackbaud's own software for greater efficiency can indirectly reduce the environmental impact associated with its cloud-based services. This means developing and deploying code that requires less processing power and storage, thereby lowering the energy demands placed on the underlying data center infrastructure. This focus on internal optimization complements external partnership strategies.

The escalating frequency and intensity of extreme weather events, a direct consequence of climate change, underscore the critical need for robust disaster preparedness and business continuity strategies. For companies like Blackbaud, whose cloud-based solutions are integral to many organizations' operations, ensuring client data safety and system uptime during environmental disruptions is paramount.

In 2024, the economic impact of natural disasters globally is projected to be substantial, with insured losses from catastrophe events alone estimated to be in the tens of billions of dollars. This highlights the tangible financial risks businesses face and the necessity of resilient infrastructure, a core offering for cloud providers.

Waste Management and E-waste Regulations

Blackbaud, though a software provider, must manage its physical infrastructure and technology lifecycle, making waste management and e-waste regulations crucial. These regulations, like the EU's Waste Electrical and Electronic Equipment (WEEE) Directive, impact how Blackbaud handles discarded electronics from its offices and data centers. Compliance ensures environmentally sound disposal and recycling, aligning with growing corporate social responsibility expectations.

The increasing focus on circular economy principles and extended producer responsibility means companies like Blackbaud face stricter rules on managing electronic waste. For instance, by 2025, the EU aims for a 75% collection rate for e-waste, and member states are implementing national targets. Blackbaud's commitment to these standards is vital for maintaining its reputation and avoiding potential fines associated with non-compliance in its operational regions.

- E-waste Generation: Globally, e-waste is projected to reach 74 million metric tons by 2030, a significant increase from 53.6 million metric tons in 2019, highlighting the growing challenge for all businesses.

- Regulatory Landscape: Over 80 countries now have specific legislation addressing e-waste management, indicating a global trend towards stricter environmental controls.

- Recycling Rates: The global recycling rate for e-waste remains low, estimated at around 17.4% in 2019, underscoring the importance of responsible disposal practices for companies like Blackbaud.

- Corporate Responsibility: Adherence to e-waste regulations contributes to Blackbaud's environmental stewardship and can positively influence stakeholder perceptions, particularly in the ESG (Environmental, Social, and Governance) investment space.

Client Focus on Environmental Causes

Blackbaud's client base includes a significant number of environmental non-profits, conservation organizations, and climate action groups. The increasing public awareness and concern over environmental issues directly fuel the growth and funding of these organizations. This trend translates into a higher demand for Blackbaud's specialized software solutions designed for fundraising and stakeholder engagement within the environmental sector.

For instance, the global environmental non-profit sector saw substantial growth, with many organizations reporting increased donations throughout 2023 and into early 2024, driven by high-profile climate events and policy discussions. This heightened activity necessitates robust platforms like Blackbaud's to manage donor relationships, process contributions efficiently, and communicate impact effectively.

- Growing Environmental Funding: Global climate finance reached an estimated $1.3 trillion in 2023, indicating a strong financial inflow into environmental causes.

- Increased Non-Profit Activity: Many environmental charities reported a 10-15% increase in online donations during 2023, highlighting the need for advanced digital engagement tools.

- Demand for Specialized Software: Organizations focused on sustainability and conservation are increasingly seeking integrated solutions for donor management and campaign tracking.

- Impact of Public Awareness: Surveys in late 2023 showed over 70% of individuals in developed nations expressing significant concern about climate change, directly influencing their philanthropic behavior.

Environmental concerns are increasingly shaping business operations and client choices, particularly for technology providers like Blackbaud. As global awareness of climate change intensifies, there's a growing demand for sustainable practices across all industries, influencing purchasing decisions and corporate partnerships.

The energy consumption of data centers, a fundamental aspect of cloud computing, presents a significant environmental challenge. These facilities are major electricity users, contributing to a substantial carbon footprint, with global data center energy demand expected to rise in the coming years.

Blackbaud can leverage partnerships with environmentally conscious cloud providers, focusing on those committed to renewable energy and energy efficiency. This strategic alignment with sustainability goals is crucial for meeting client expectations and enhancing its market position.

Optimizing software for greater energy efficiency can also reduce the environmental impact of Blackbaud's cloud services. By minimizing processing power and storage needs, the company can lessen the energy burden on data centers, contributing to a smaller overall carbon footprint.

| Environmental Factor | Description | Relevance to Blackbaud | Data/Trend (2024/2025) |

| Climate Change & Extreme Weather | Increased frequency and intensity of natural disasters due to climate change. | Impacts business continuity, data safety, and requires resilient infrastructure. | Global insured losses from catastrophe events in 2024 projected to be in the tens of billions of dollars. |

| E-waste Management | Regulations and corporate responsibility for electronic waste disposal. | Affects Blackbaud's hardware lifecycle management and compliance. | EU aims for 75% e-waste collection rate by 2025; global e-waste projected to reach 74 million metric tons by 2030. |

| Sustainable Operations | Client and societal demand for environmentally responsible business practices. | Influences client acquisition, retention, and brand reputation. | Many non-profits prioritize vendors with aligned environmental values; growing demand for ESG-compliant services. |

| Renewable Energy in Data Centers | Shift towards renewable energy sources for powering data infrastructure. | Opportunity for Blackbaud to partner with green cloud providers. | Increasing investment in renewable energy for data centers globally; many providers setting targets for 100% renewable energy. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading industry research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in credible and current information.