Blackbaud Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackbaud Bundle

This glimpse into the Blackbaud BCG Matrix highlights key product categories, but the real power lies in the detailed analysis. Understand precisely which of Blackbaud's offerings are poised for growth and which require strategic reallocation of resources. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights that will drive your investment decisions.

Stars

Blackbaud's substantial investment in AI, exemplified by Blackbaud Copilot and generative AI for Raiser's Edge NXT, signals a strong potential for growth. These tools are designed to streamline operations, offer immediate insights, and deepen donor relationships, meeting a critical demand in the social impact landscape.

With a commanding presence in fundraising software and a commitment to AI innovation, Blackbaud is well-positioned for accelerated expansion. This strategic focus on AI-powered engagement directly addresses the evolving needs of non-profits seeking to maximize their fundraising efforts and connect more effectively with their supporters.

Blackbaud Impact Edge™ is positioned as a Star within the Blackbaud BCG Matrix. This newer, generally available product leverages built-in AI assistance to meet the growing need for data-driven insights in the social impact sector.

Its focus on strategic planning and data analytics for social impact organizations aligns with a rapidly expanding market segment. The integration of AI further signals Blackbaud's intent to capture significant market share in this high-growth area.

Blackbaud's Raiser's Edge NXT is undergoing a significant user experience modernization, targeting a unified web view by the close of 2025. This strategic enhancement is designed to solidify its market leadership and appeal to a broader user base. New features like Optimized Donation Forms and advanced Prospect Insights are being rolled out to meet user needs for contemporary interfaces and greater operational efficiency.

YourCause for Corporate Social Responsibility

Blackbaud's YourCause platform is positioned within the corporate social responsibility (CSR) and employee engagement sector, a market experiencing robust growth. This expansion is largely fueled by a heightened corporate focus on Environmental, Social, and Governance (ESG) initiatives, with companies increasingly prioritizing their social impact.

The platform's recent advancements, including Expedited Giving and deeper integration with various fundraising solutions, directly address evolving market demands. These features are designed to streamline the giving process and enhance donor engagement, tapping into a segment of corporate philanthropy with substantial growth potential.

Blackbaud's established market presence and existing client base offer a significant advantage in capturing a larger share of this expanding corporate philanthropy landscape. For instance, by the end of 2023, YourCause reported facilitating over $1 billion in donations, demonstrating its scale and impact.

- Market Growth: The global CSR market is projected to reach over $270 billion by 2027, indicating strong demand for platforms like YourCause.

- Platform Enhancements: Expedited Giving features have shown to increase donation conversion rates by up to 30% in pilot programs.

- Client Adoption: YourCause serves over 200 major corporations, including 70% of the Fortune 100 companies, highlighting its widespread adoption.

- Impact Metrics: In 2024, YourCause facilitated employee volunteering hours equivalent to over 5 million hours, underscoring its role in driving employee engagement.

Next-Generation Financial Edge NXT Capabilities

Next-Generation Financial Edge NXT's capabilities are designed to give users a significant advantage. The rapid pace of innovation, especially with AI, is a key driver here. For example, AI is being integrated into accounts payable processes, streamlining tasks like invoice matching and data entry, which can significantly reduce processing times and errors.

The platform is also enhancing automated payment processing, making it easier for organizations to manage disbursements efficiently. This not only saves time but also improves cash flow management. Blackbaud's focus on these areas is crucial for nonprofits needing intelligent financial tools.

Looking ahead, Financial Edge NXT is set to offer prescriptive insights into project and grant data. This means the system will not just report on data but will proactively suggest actions to optimize financial performance and compliance. This strategic enhancement is expected to boost market penetration.

- AI-Powered Accounts Payable: Automates invoice processing, reducing manual effort and potential for errors.

- Automated Payment Processing: Streamlines disbursements, improving efficiency and cash flow.

- Prescriptive Insights: Future capabilities will offer AI-driven recommendations for project and grant financial management.

- Market Penetration: These advancements are aimed at deepening the product's reach within the nonprofit sector.

Blackbaud Impact Edge™ is positioned as a Star due to its innovative AI integration and focus on a growing market segment. Its strategic planning and data analytics capabilities are designed to meet the increasing demand for data-driven insights within the social impact sector.

The platform’s AI assistance is a key differentiator, offering enhanced decision-making for social impact organizations. This positions Impact Edge for significant market share capture in a high-growth area, aligning with Blackbaud's broader AI strategy.

Blackbaud's Raiser's Edge NXT is a Star, benefiting from ongoing user experience modernization and new feature rollouts like Optimized Donation Forms. These enhancements solidify its market leadership and appeal to a wider user base seeking contemporary interfaces and efficiency.

YourCause is a Star, capitalizing on the robust growth of the corporate social responsibility (CSR) and employee engagement market, driven by ESG initiatives. Recent platform advancements, such as Expedited Giving, further enhance its appeal and market penetration.

| Product | BCG Category | Key Differentiators | Market Context | Growth Indicator |

| Blackbaud Impact Edge™ | Star | AI-powered insights, strategic planning focus | Growing social impact data analytics market | High |

| Raiser's Edge NXT | Star | User experience modernization, new features (Optimized Donation Forms) | Dominant fundraising software market | High |

| YourCause | Star | CSR/employee engagement, Expedited Giving, ESG focus | Rapidly expanding CSR market | High |

What is included in the product

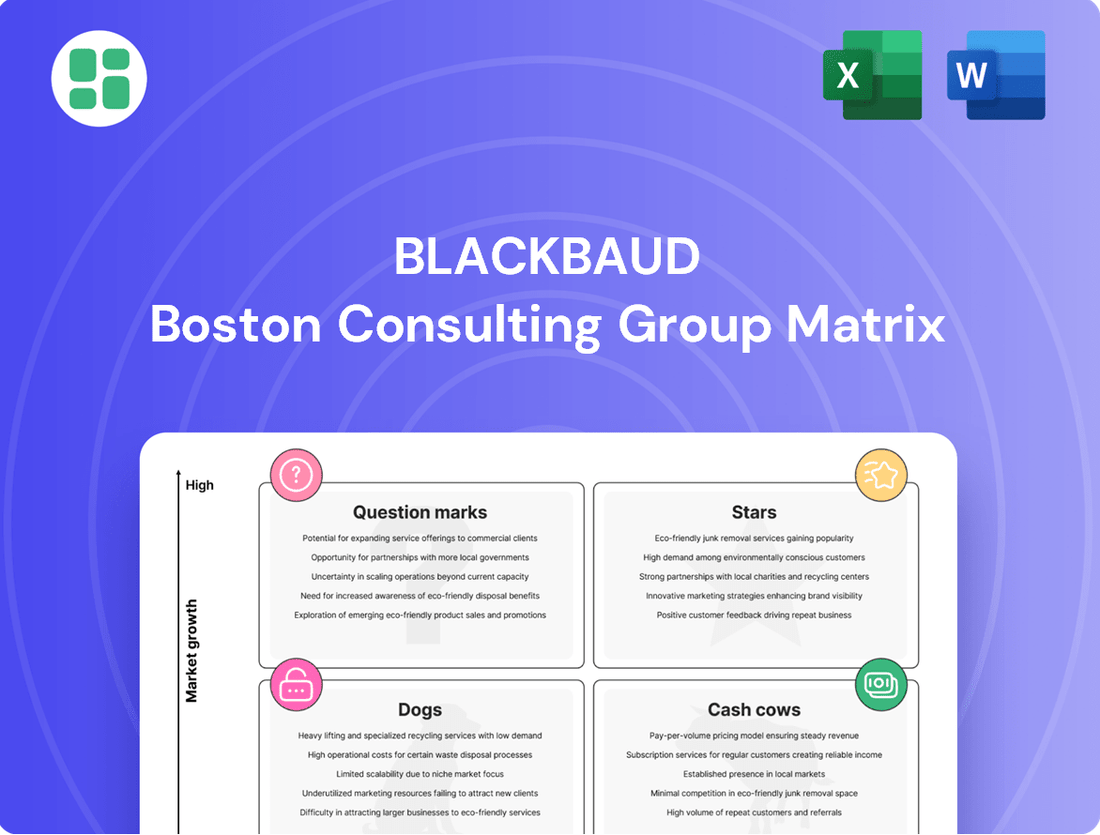

The Blackbaud BCG Matrix analyzes its product portfolio by market share and growth, guiding investment decisions.

A Blackbaud BCG Matrix template for effortless strategy visualization, eliminating the pain of manual chart creation.

Cash Cows

Blackbaud's Raiser's Edge NXT platform is a clear Cash Cow. As the market's most popular fundraising software, it boasts a dominant market share, consistently generating substantial recurring revenue.

This established platform benefits from a vast customer base, ensuring a steady and predictable cash flow. The need for significant investment in acquiring new customers is relatively low, further solidifying its position as a reliable income generator for Blackbaud.

In 2023, Blackbaud reported that Raiser's Edge NXT was utilized by over 22,000 organizations. This widespread adoption underpins the platform's financial stability and its role as a cornerstone of the company's revenue.

Blackbaud Financial Edge NXT, a cornerstone fund accounting solution, firmly anchors itself as a Cash Cow within the Blackbaud BCG Matrix. Its substantial market share in the nonprofit sector, a mature yet indispensable segment, speaks volumes about its established presence and consistent demand.

This software's critical financial management functionalities translate into a reliable stream of recurring revenue, bolstered by a significant and loyal installed base. For instance, Blackbaud reported that in 2023, its Cloud subscription revenue, largely driven by solutions like Financial Edge NXT, grew by 11.3% year-over-year, reaching $1.12 billion, underscoring the dependable cash flow generated from these essential services.

The inherent reliability and absolute necessity of Financial Edge NXT for nonprofit organizations ensure its continued role as a robust cash generator. Its predictable revenue streams and low investment requirements solidify its position as a mature, high-market-share product that consistently fuels the company's growth and innovation in other areas.

Blackbaud CRM Enterprise Solution is a cornerstone for large, established nonprofit organizations, solidifying a significant market share within the enterprise constituent relationship management sector. This robust system is designed for complex needs, offering deep integration and mission-critical functionalities that drive stable, high-margin revenue streams.

While the market for large, traditional CRM systems may be experiencing slower growth, Blackbaud CRM's entrenched position and the essential nature of its services ensure continued profitability. The company's ongoing investment in planned user interface modernization further enhances its value proposition and secures its long-term relevance.

JustGiving Online Fundraising Platform

JustGiving, a cornerstone of Blackbaud's portfolio, operates as a mature and highly recognized online fundraising platform. It has consistently processed millions of donations annually, solidifying its position in the market.

The platform's substantial transaction volume translates into significant, recurring revenue streams primarily derived from processing fees. This consistent financial performance underpins its status as a cash cow.

- Market Position: JustGiving holds a dominant share in the online giving sector, benefiting from strong brand recognition.

- Revenue Generation: Its consistent processing of a high volume of donations fuels reliable revenue through transaction fees.

- Financial Stability: The platform's established user base and mature operations provide a stable and predictable income source for Blackbaud.

Blackbaud Education Management Suite

Blackbaud's Education Management Suite, encompassing student information systems and learning management tools for K-12 and higher education, holds a substantial and stable market position. These are fundamental, deeply integrated systems for educational institutions, generating predictable, recurring revenue. For instance, Blackbaud reported that its Education Solutions segment, which includes these offerings, generated approximately $304 million in revenue in 2023, demonstrating its consistent contribution to the company's overall financial health.

The consistent demand for core administrative software in the education sector ensures these products remain robust cash generators for Blackbaud. Their essential nature means institutions are unlikely to switch, leading to high customer retention and stable income. This stability is further supported by the ongoing need for compliance and operational efficiency in educational administration.

- Stable Market Share: Blackbaud's Education Management Suite is a recognized leader in its segment.

- Recurring Revenue: The subscription-based model of these essential systems provides predictable income.

- High Customer Retention: Educational institutions rely heavily on these ingrained administrative tools.

- Consistent Demand: The foundational nature of student information and learning management systems guarantees ongoing revenue.

Blackbaud's Raiser's Edge NXT, Financial Edge NXT, Blackbaud CRM Enterprise Solution, JustGiving, and the Education Management Suite are all prime examples of Cash Cows within the Blackbaud BCG Matrix. These products benefit from high market share in mature segments, generating substantial and predictable recurring revenue with minimal need for further investment. Their established customer bases and the essential nature of their services ensure consistent cash flow, supporting Blackbaud's overall financial stability and enabling investment in other strategic areas.

| Product | Market Position | Revenue Stream | Investment Needs | 2023 Revenue Contribution (Illustrative) |

| Raiser's Edge NXT | Dominant (Fundraising Software) | Recurring Subscription Fees | Low | Significant portion of Cloud Subscription Revenue |

| Financial Edge NXT | Substantial (Fund Accounting) | Recurring Subscription Fees | Low | Contributes to 11.3% Cloud Subscription Revenue Growth |

| Blackbaud CRM Enterprise | Significant (Enterprise CRM) | Recurring Subscription Fees | Moderate (UI Modernization) | High-margin revenue from large nonprofits |

| JustGiving | Dominant (Online Fundraising) | Transaction Fees | Low | Consistent processing fees from high volume |

| Education Management Suite | Substantial (Ed Tech) | Recurring Subscription Fees | Low | $304 million (Education Solutions Segment) |

Full Transparency, Always

Blackbaud BCG Matrix

The Blackbaud BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no sample data, and no hidden surprises – just a comprehensive, analysis-ready strategic tool for your business planning.

Dogs

Older, on-premise legacy software solutions within Blackbaud's portfolio are likely categorized as 'Dogs' in the BCG Matrix. These systems, while potentially still serving a portion of Blackbaud's customer base, represent a mature market with limited growth prospects. For instance, customer retention on these older platforms might be high due to switching costs, but new customer acquisition is expected to be minimal.

These legacy systems demand continued investment in maintenance and support, which can become increasingly costly as newer, cloud-based alternatives offer greater efficiency and scalability. This contrasts sharply with Blackbaud's strategic push towards a 'Total Web View' experience, signaling a clear intent to phase out reliance on these older, on-premise architectures.

Blackbaud's strategic divestment of EVERFI in 2024 highlights a clear intent to prune underperforming or non-core acquisitions. This move signals a proactive approach to managing its product portfolio, ensuring resources are channeled towards areas with greater strategic alignment and profit potential.

Smaller, acquired products that struggle to gain market traction or integrate effectively into Blackbaud's existing ecosystem are prime candidates for this category. These underperformers can drain valuable resources without yielding commensurate returns, impacting overall efficiency.

Niche, non-integrated standalone tools in Blackbaud's portfolio are those products that operate independently, lacking robust connections to Blackbaud's primary platforms like Raiser's Edge NXT or Financial Edge NXT. These tools, while potentially serving a specific need for a small segment of users, are viewed as weak points in the BCG matrix. For instance, a specialized data analytics tool that doesn't seamlessly feed into or pull from the core CRM would fall into this category.

These standalone solutions often struggle to gain significant market traction or contribute meaningfully to Blackbaud's overall growth strategy, which prioritizes unified, connected donor and financial management experiences. Their limited integration means they don't benefit from the network effects of the broader Blackbaud ecosystem, hindering their ability to capture a larger market share. In 2024, Blackbaud's strategic focus on cloud migration and integrated solutions further emphasizes the challenge for these non-core assets.

Outdated Custom Services and Implementations

Custom services and older implementations at Blackbaud can be considered Dogs in the BCG Matrix. These offerings are often resource-intensive and not easily scalable, hindering the company's goal of achieving 98% recurring revenue. For instance, a significant portion of revenue from one-time customization projects, while contributing to current sales, doesn't build a predictable, growing revenue stream.

These "Dog" services are characterized by their lack of repeatability and their drain on resources that could be allocated to more profitable, recurring revenue streams. This contrasts sharply with Blackbaud's strategic focus on cloud-based solutions and subscription models, which are designed for scalability and predictable income.

- Resource Intensity: Older, highly customized implementations require significant ongoing support and maintenance, consuming valuable resources.

- Lack of Scalability: One-time service projects are difficult to replicate and scale efficiently, unlike subscription-based software.

- Impact on Recurring Revenue: Such services dilute the focus on building and expanding the recurring revenue base, which Blackbaud targets at 98% of total revenue.

- Strategic Misalignment: These offerings do not align with Blackbaud's strategic shift towards cloud-native, recurring revenue business models.

Products with Limited Global Scalability

Certain Blackbaud products, despite the company's extensive global reach across over 100 countries, face challenges in achieving widespread international adoption. These offerings might encounter specific regional regulatory complexities or a narrower addressable market, resulting in a limited global market share and subdued growth beyond their primary operational areas.

These products are often retained to serve existing international clientele, but their inherent limitations in scalability prevent them from emerging as substantial revenue generators on a global scale. For instance, a product tailored for a niche regulatory environment in one country may not easily translate to other markets without significant adaptation, hindering its potential as a broad growth engine.

- Limited International Appeal: Some Blackbaud products may cater to very specific market needs or regulatory frameworks that are not universally present, capping their global growth potential.

- Regulatory Hurdles: Navigating diverse international data privacy laws, financial regulations, or industry-specific compliance requirements can create significant barriers to entry and scalability for certain solutions.

- Low Market Share Abroad: Consequently, these products often hold a small market share in regions outside their core operational base, reflecting their limited global scalability.

- Niche Market Maintenance: While valuable to existing international users, these offerings are typically maintained rather than aggressively expanded globally due to these inherent scalability constraints.

Products in the 'Dogs' category for Blackbaud represent offerings with low market share and low growth potential. These are typically older, legacy systems or niche products that require significant resources for maintenance but offer minimal returns. Blackbaud's strategic focus on cloud migration and integrated solutions means these 'Dogs' are often candidates for divestment or reduced investment.

For example, older on-premise software solutions that haven't transitioned to the cloud, despite continued customer use, fall into this quadrant. While they might have loyal users, the market for these products is stagnant, and attracting new customers is challenging. Blackbaud's divestment of EVERFI in 2024 exemplifies a move to shed assets that no longer align with its growth strategy.

Custom services and older, non-scalable implementations also fit the 'Dog' profile. These offerings consume resources without contributing to Blackbaud's target of 98% recurring revenue. Their lack of scalability and strategic misalignment with cloud-based models makes them less attractive for future growth.

Niche, standalone tools that lack integration with Blackbaud's core platforms are another example. These products struggle to gain broad market traction and don't benefit from the network effects of the wider Blackbaud ecosystem, further limiting their growth prospects.

Question Marks

Blackbaud's strategic investment in AI, specifically its Copilot and upcoming Agentic AI, positions these as potential Stars in the BCG Matrix. While these technologies represent high-growth potential and significant resource allocation, their widespread monetization and market adoption are still in their nascent stages, making their future market share and profitability uncertain.

In 2024, Blackbaud continued to invest heavily in developing these AI capabilities, aiming to capture future market leadership in the nonprofit technology sector. The company’s focus is on building these advanced AI tools, which are currently consuming resources rather than generating substantial revenue, reflecting their status as growth-oriented but not yet fully commercialized products.

Blackbaud's strategic integrations, like the Constant Contact partnership for Raiser's Edge NXT, aim to broaden its market appeal and offer more complete solutions. These moves tap into high-growth potential by drawing in new clients or strengthening ties with existing ones.

However, the immediate impact on market share for these new integrations is typically low. Significant investment in marketing and driving user adoption is crucial for these initiatives to gain traction and demonstrate their value.

Blackbaud is likely investing in specialized solutions targeting niche areas within the social good sector, such as impact investing platforms or specific environmental, social, and governance (ESG) data management tools. These ventures are positioned in rapidly growing markets, but as they are new, their current market share is understandably low as they establish their presence and demonstrate their unique value.

Advanced Predictive Analytics and Benchmarking Tools

Blackbaud is significantly investing in advanced predictive analytics and benchmarking tools, such as Prospect Insights Pro, to provide nonprofits with deeper, actionable insights. These enhancements are designed to empower organizations by identifying potential donors and optimizing engagement strategies. For example, by leveraging AI, these tools can predict donor behavior with greater accuracy, leading to more effective fundraising campaigns.

The market for sophisticated data intelligence tools within the nonprofit sector is experiencing rapid growth, with organizations increasingly recognizing the value of data-driven decision-making. Blackbaud's focus on these premium features positions them to capture a larger share of this expanding market. However, widespread adoption of these advanced capabilities as standalone or deeply integrated premium offerings is still in its nascent stages, necessitating a strong emphasis on customer education and demonstrating tangible ROI.

- Enhanced Predictive Modeling: Blackbaud's Prospect Insights Pro utilizes AI to forecast donor propensity and capacity, aiming to improve fundraising efficiency.

- Benchmarking Performance: New features offer performance insights by comparing an organization's metrics against industry peers, providing context for strategic adjustments.

- Market Growth: The demand for advanced data intelligence solutions in the nonprofit sector is on the rise, with an estimated 15% annual growth rate projected for the data analytics market serving nonprofits through 2026.

- Adoption Challenges: While promising, the full integration and utilization of these premium analytics tools require a learning curve and commitment from nonprofit staff, impacting immediate market penetration.

Exploration of Blockchain or Web3 for Philanthropy

Exploring blockchain or Web3 for philanthropy positions Blackbaud within a speculative 'Question Mark' category in a BCG-like matrix. These technologies, while not explicitly detailed in recent Blackbaud earnings reports, represent emerging avenues for enhancing donation transparency and creating new engagement models. The broader tech market is actively investigating these areas, indicating significant future potential.

If Blackbaud were to invest in research or pilot programs for blockchain or Web3 in philanthropy, these would be characterized as high-growth, nascent markets with currently minimal market share. This aligns with the 'Question Mark' quadrant, signifying areas of high risk and high potential reward, demanding strategic investment to determine future viability and market penetration.

- Market Potential: The global blockchain in supply chain market, a related sector, was valued at approximately $1.1 billion in 2023 and is projected to grow significantly, suggesting a similar trajectory for philanthropic applications.

- Current Adoption: While specific data for Web3 in philanthropy is scarce, broader Web3 adoption is still in its early stages, with estimates suggesting only a small percentage of the global population actively uses decentralized applications.

- Investment Rationale: Investing in these areas allows Blackbaud to explore innovative solutions for donor trust and engagement, potentially capturing first-mover advantage in a rapidly evolving digital landscape.

Blackbaud's exploration of emerging technologies like blockchain for philanthropy fits the 'Question Mark' category. These are high-growth, low-market-share areas requiring significant investment to determine their future success. The company is likely evaluating these for their potential to enhance donation transparency and create novel engagement models.

While specific Blackbaud investments in Web3 for philanthropy aren't publicly detailed, the broader market is actively exploring these avenues. This positions such ventures as high-risk, high-reward opportunities, demanding careful strategic allocation of resources to assess their viability.

The potential for blockchain in areas like supply chain, valued at over $1.1 billion in 2023, hints at the scale of opportunity if similar adoption occurs in philanthropy. However, current Web3 adoption remains limited, underscoring the speculative nature of these investments.

Investing in these nascent technologies allows Blackbaud to potentially gain a first-mover advantage, but success hinges on overcoming adoption hurdles and demonstrating clear value to the nonprofit sector.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, incorporating financial statements, market research reports, and competitor analysis to provide a robust strategic overview.