Blackbaud Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackbaud Bundle

Blackbaud operates in a dynamic sector, facing pressures from rivals, suppliers, buyers, new entrants, and substitutes. Understanding these forces is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping Blackbaud’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Blackbaud's dependence on a handful of major cloud infrastructure providers like AWS, Azure, and Google Cloud is a significant factor in its supplier bargaining power. The limited number of these essential service providers means they hold considerable sway, particularly concerning the uptime and storage crucial for Blackbaud's operations.

This concentration translates into substantial leverage for these cloud giants. For instance, in 2024, the cloud computing market continued to be dominated by these three providers, with AWS, Azure, and Google Cloud collectively holding over 65% of the global market share. Any price adjustments or service interruptions from these suppliers can directly affect Blackbaud's operational expenses and its ability to deliver reliable services to its clients.

Blackbaud's reliance on specialized software components and development tools from third-party vendors presents a significant factor in supplier bargaining power. If these critical inputs are proprietary or lack readily available substitutes, the suppliers can leverage their position to dictate terms, potentially increasing licensing fees and support costs. For instance, a key cybersecurity solution provider with a dominant market share could significantly impact Blackbaud's operational expenses and product release schedules.

The availability of highly skilled software developers, cybersecurity experts, and data scientists is absolutely critical for Blackbaud's ability to innovate and deliver its services effectively. In 2024, the demand for these specialized roles continued to outstrip supply in many regions. This scarcity directly translates into increased wage demands and higher recruitment expenses, effectively granting these skilled professionals significant bargaining power.

Blackbaud, like many tech companies, must actively invest in competitive compensation packages and robust talent retention programs to mitigate the impact of this bargaining power. For instance, reports in late 2023 and early 2024 indicated average salaries for senior software engineers in major tech hubs often exceeded $150,000 annually, a figure that can significantly impact operational costs if not managed strategically.

Payment Processing Partners

Blackbaud, a company offering solutions for fundraising and financial management, relies on payment processing partners to handle transactions securely. The bargaining power of these suppliers can be influenced by the need for robust, secure, and integrated payment systems. In 2024, the global digital payment market was valued at over $10 trillion, indicating a significant scale and the presence of major players who can exert influence.

The necessity for reliable and compliant payment gateways gives established providers some leverage. Blackbaud's transaction-based revenue streams or the costs passed to its customers are directly impacted by the fees these partners charge. For instance, a slight increase in processing fees from a dominant provider could noticeably affect Blackbaud's profitability on a large volume of transactions.

- Dependency on Specialized Services: Blackbaud needs payment processors with specific security certifications and integration capabilities, which limits the pool of suitable partners.

- Market Concentration: A few large payment processing companies often dominate the market, giving them pricing power.

- Impact on Customer Pricing: Higher processing fees from suppliers can either squeeze Blackbaud's margins or lead to increased costs for its end-users.

Data and Analytics Service Providers

Blackbaud's reliance on data and analytics service providers, particularly those offering unique datasets or advanced AI/ML models, can grant these suppliers significant bargaining power. If Blackbaud's core value proposition, such as donor prospecting and predictive fundraising, heavily depends on proprietary algorithms or specialized data sources that are not easily replicable, these suppliers can command higher prices or dictate terms. For instance, a provider of highly accurate demographic data or a unique predictive modeling framework could leverage its indispensability. In 2023, the global data analytics market was valued at approximately $27.9 billion, with significant growth driven by AI and machine learning integration, indicating the increasing importance and potential leverage of specialized providers within this sector.

- Supplier Dependence: Blackbaud's ability to innovate and deliver enhanced offerings, like improved donor prospecting, is tied to the quality and uniqueness of data and analytics services it procures.

- Cost Implications: A strong supplier position can translate to increased operational costs for Blackbaud if essential data or analytical tools become more expensive or if access is restricted.

- Market Dynamics: The competitive landscape for data analytics services, especially those incorporating AI, is evolving rapidly, potentially shifting bargaining power towards providers with cutting-edge capabilities.

Blackbaud's bargaining power with its suppliers is influenced by the concentration in critical technology markets. The dominance of a few cloud providers, specialized software vendors, and data analytics firms means these suppliers often have considerable leverage. This is particularly true for essential services like cloud infrastructure, where AWS, Azure, and Google Cloud held over 65% of the global market share in 2024, allowing them to influence pricing and service terms.

The scarcity of specialized talent, such as senior software engineers, also shifts power towards employees, driving up labor costs. For instance, average salaries for these roles in major tech hubs exceeded $150,000 annually in early 2024. Similarly, in the rapidly growing data analytics sector, valued at approximately $27.9 billion in 2023, providers with cutting-edge AI capabilities can command premium pricing.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Blackbaud | Relevant Market Data (2023-2024) |

|---|---|---|---|

| Cloud Infrastructure Providers | Market concentration, essential service nature | Potential for increased operational costs, service dependency | AWS, Azure, Google Cloud held >65% global market share in 2024 |

| Specialized Software Vendors | Proprietary nature of inputs, lack of substitutes | Higher licensing fees, impact on product release schedules | N/A (specific vendor data not publicly available) |

| Skilled Labor (Tech Talent) | High demand, limited supply | Increased recruitment and retention costs, wage inflation | Senior software engineer salaries >$150k annually in tech hubs (early 2024) |

| Data & Analytics Service Providers | Uniqueness of data/algorithms, AI/ML capabilities | Increased costs for essential insights, potential for restricted access | Data analytics market valued at ~$27.9 billion in 2023 |

What is included in the product

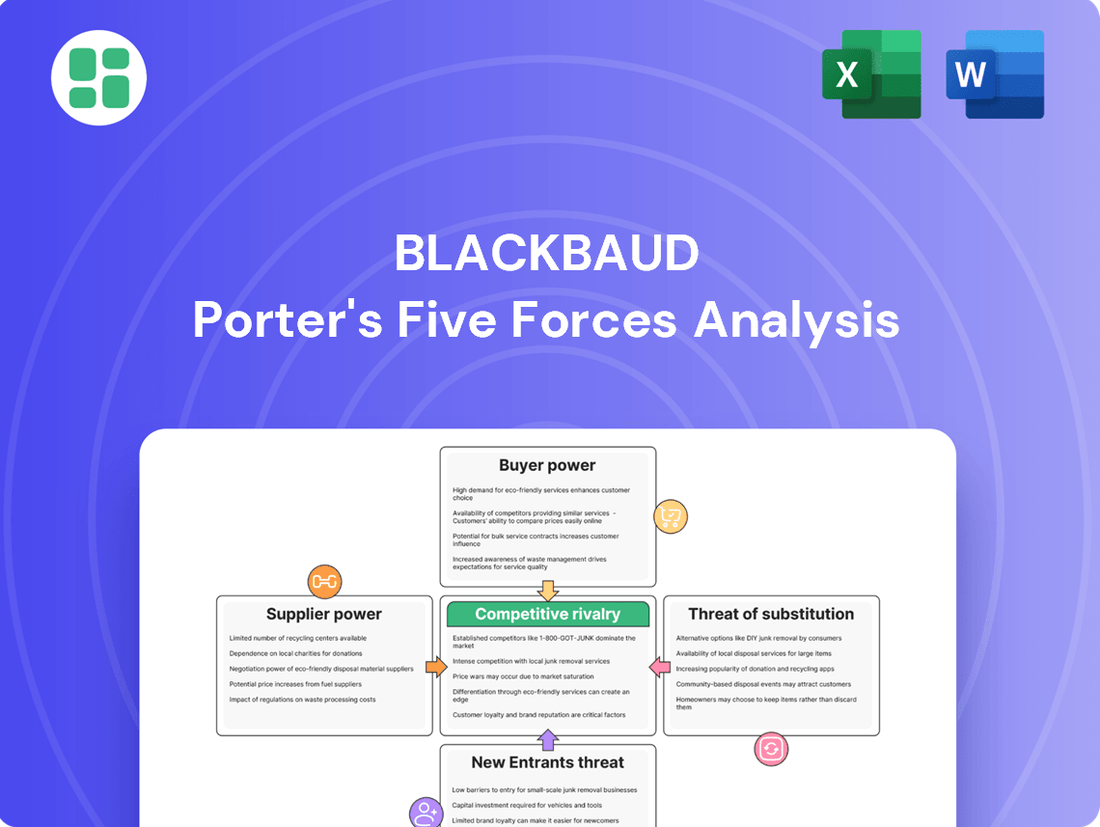

This Blackbaud Porter's Five Forces Analysis dissects the competitive landscape, evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the software industry.

Instantly visualize competitive intensity with a dynamic, interactive dashboard, allowing for rapid identification of key threats and opportunities.

Customers Bargaining Power

Blackbaud's customer base is quite varied, featuring many smaller nonprofit organizations, foundations, and schools. Individually, these smaller clients don't wield much influence, but together, their collective demand can impact Blackbaud's pricing strategies and the features it prioritizes.

Conversely, larger clients, often referred to as enterprise-level customers, hold more sway. Their substantial contract values and specific customization needs give them greater leverage to negotiate better terms and pricing.

Customers deeply embedded in Blackbaud's integrated cloud solutions for fundraising, financial management, and CRM experience significant switching costs. The sheer volume of donor data, intricate financial records, and established operational workflows makes transitioning to a competitor a daunting and resource-intensive undertaking.

For instance, migrating years of detailed donor engagement history and complex financial reporting structures can easily take months and incur substantial professional services fees, often running into tens of thousands of dollars or more, depending on the organization's size and data complexity. This inherent lock-in effect significantly diminishes a customer's ability to negotiate favorable terms or switch providers readily, thereby reducing their overall bargaining power.

Nonprofit organizations are often very budget-conscious, making them highly sensitive to the price of software solutions. This means Blackbaud faces significant pressure to keep its pricing competitive; a sharp price increase could easily lead to customers looking elsewhere. For instance, many nonprofits rely on grants and donations, which are not always predictable, further amplifying their need for cost-effective tools.

Demand for Specialized Features and Customization

The social good sector often requires highly specific functionalities that off-the-shelf software struggles to provide. Customers in this space frequently demand specialized features for intricate donor management, detailed grant tracking, and rigorous compliance adherence. Blackbaud's strength lies in its capacity to deliver these purpose-built solutions, thereby increasing its perceived value. However, a failure to adapt to or meet these evolving, niche demands could significantly shift bargaining power towards customers, prompting them to explore more agile competitors or insist on extensive customizations.

The increasing demand for specialized features, particularly in areas like impact measurement and regulatory reporting, directly influences customer leverage. For instance, a nonprofit organization needing to meticulously track grant expenditures against specific programmatic outcomes might find a generic CRM inadequate. In 2024, the complexity of ESG (Environmental, Social, and Governance) reporting requirements further amplified the need for tailored software. Blackbaud's ability to integrate these specialized reporting modules is a key differentiator, but if competitors emerge with more streamlined or cost-effective customization options, customers gain more negotiating power.

- Specialized Needs: Social good organizations require unique functionalities for donor relations, grant lifecycle management, and regulatory compliance that generic software often lacks.

- Customer Expectations: There is a growing demand for tailored solutions that can precisely meet the intricate operational and reporting needs of nonprofits and foundations.

- Competitive Pressure: If Blackbaud fails to keep pace with evolving specialized demands, customers may seek out more responsive or customizable alternatives, increasing their bargaining power.

Customer Access to Alternatives and Open-Source Solutions

Customers have a significant bargaining power due to the availability of numerous alternatives to Blackbaud's solutions. Competitors like Salesforce Nonprofit Cloud, Bloomerang, and Neon CRM offer comparable or specialized functionalities, giving clients a wider array of choices. This competitive landscape, amplified by the growing capabilities of adaptable CRM systems and open-source options, empowers customers to negotiate better terms or switch providers if dissatisfied.

The increasing accessibility of these alternatives means that even smaller organizations can find cost-effective solutions. For instance, while Blackbaud's comprehensive offerings cater to large enterprises, the rise of more agile and niche-focused CRMs provides a direct challenge. This proliferation of choice directly impacts Blackbaud's pricing power and customer retention strategies.

- Increased Choice: A wide range of CRM providers, including Salesforce Nonprofit Cloud and Bloomerang, offer similar functionalities.

- Open-Source Availability: The growth of adaptable and open-source CRM systems further expands customer options.

- Negotiating Power: Customers can leverage these alternatives to negotiate better pricing and service agreements with Blackbaud.

- Market Dynamics: The competitive environment allows customers to switch providers if Blackbaud's offerings do not meet their evolving needs or budget.

Blackbaud's customers, particularly smaller nonprofits, have moderate bargaining power due to budget constraints and the availability of alternative solutions. While larger clients with complex needs and significant data migration costs have less power, the overall market offers choices. Blackbaud's ability to meet specialized demands, such as ESG reporting in 2024, is crucial in mitigating this power.

Preview the Actual Deliverable

Blackbaud Porter's Five Forces Analysis

This preview showcases the comprehensive Blackbaud Porter's Five Forces Analysis, demonstrating the exact document you will receive immediately after purchase. You are viewing the complete, professionally formatted report, ensuring no surprises or placeholder content. What you see is precisely what you get, ready for your immediate use and strategic planning.

Rivalry Among Competitors

Blackbaud commands a substantial portion of the nonprofit CRM software market, demonstrating its robust standing. However, the competitive landscape is fierce, with specialized nonprofit software providers and broader software companies entering the fray with adapted solutions.

The company's strategic focus on the social good sector offers a distinct advantage, leveraging its profound industry knowledge. For instance, in 2023, Blackbaud reported revenue of $1.13 billion, underscoring its significant presence and ability to navigate this competitive environment.

Major tech giants such as Salesforce, with its dedicated Nonprofit Cloud, and Microsoft, offering Dynamics 365, are making significant inroads into the nonprofit technology market. These companies leverage their substantial financial resources, extensive cloud infrastructure, and wide-ranging product ecosystems to provide integrated solutions. For instance, Salesforce reported total revenue of $31.4 billion for fiscal year 2024, showcasing its capacity to invest heavily in sector-specific offerings.

The presence of these large, diversified tech companies intensifies competitive rivalry within the nonprofit sector. Their ability to bundle services, offer robust enterprise-level solutions, and potentially undercut smaller competitors on price puts pressure on existing providers. This is particularly true for larger nonprofit organizations that require comprehensive, scalable software for donor management, fundraising, and operational efficiency.

The nonprofit technology landscape is increasingly populated by nimble, specialized players. Companies like Bloomerang, Neon CRM, DonorPerfect, and Virtuous are carving out significant market share by offering solutions tailored to specific organizational needs or by presenting more budget-friendly options. For instance, Bloomerang, known for its user-friendly interface and focus on donor retention, has seen substantial growth, attracting organizations that may find Blackbaud's broader suite overwhelming or cost-prohibitive.

These smaller competitors often focus on ease of use and affordability, directly challenging Blackbaud's market position, especially among smaller to mid-sized nonprofits. DonorPerfect, for example, has a long-standing reputation for its robust features at a competitive price point, making it a strong contender for organizations prioritizing value. This competitive pressure compels Blackbaud to continually innovate and ensure its offerings remain attractive across the entire spectrum of nonprofit sizes and budgets.

Product Differentiation and Innovation Pace

Competitive rivalry in the nonprofit technology sector is intense, fueled by a relentless drive for innovation. Companies are actively integrating artificial intelligence, machine learning, and advanced analytics to offer deeper donor insights, optimize fundraising efforts, and streamline operations. For instance, in 2024, many platforms introduced AI-powered tools for more precise donor prospecting and predictive modeling to forecast fundraising success.

Blackbaud faces significant pressure to maintain a rapid pace of product development and introduce compelling feature enhancements. This is crucial for retaining its market position and attracting new clients. Competitors are continuously rolling out new capabilities, making it essential for Blackbaud to keep pace with advancements like AI-driven donor segmentation and automated communication workflows.

- AI-Driven Donor Prospecting: Competitors are enhancing their AI capabilities to identify and engage potential donors more effectively.

- Predictive Fundraising: Advanced analytics are being used to forecast donation trends and optimize campaign strategies.

- Operational Efficiency Tools: Integration of automation and AI aims to reduce administrative burdens for nonprofits.

- Data Integration and Insights: Platforms are focusing on providing more comprehensive and actionable insights from constituent data.

Customer Retention and Switching Costs Dynamics

Blackbaud enjoys a strong position due to the significant switching costs associated with its cloud-based software solutions for the nonprofit sector. However, competitors are actively targeting these high switching costs, often promoting easier migration paths and offering incentives to lure Blackbaud's customers. For instance, in 2024, several smaller, agile competitors have introduced simplified data import tools and dedicated migration support teams, aiming to reduce the perceived burden for organizations looking to switch. This competitive pressure means Blackbaud must continually demonstrate value to retain its customer base.

The ability of rivals to attract Blackbaud's customers hinges on their success in highlighting perceived pain points related to switching costs and offering compelling alternatives. Competitors are increasingly emphasizing superior user experience, seamless integration capabilities with other essential nonprofit tools, and more adaptable pricing models. For example, a report from early 2024 indicated that a key competitor saw a 15% increase in new customer acquisition directly attributed to their streamlined onboarding process and transparent pricing, directly challenging Blackbaud's entrenched market share and growth potential.

- High Switching Costs: Blackbaud's integrated suite of solutions, which often involves significant data migration and staff retraining, creates high barriers for customers to move to a competitor.

- Competitive Counter-Strategies: Rivals are actively marketing lower switching costs through simplified migration tools, dedicated support, and attractive introductory offers.

- Impact of User Experience and Integration: Competitors focusing on intuitive design and better integration with other software platforms are gaining traction, directly impacting Blackbaud's ability to retain clients.

- Pricing Flexibility as a Lever: More flexible and transparent pricing structures offered by competitors are proving to be a significant draw for organizations seeking cost-effective solutions, potentially eroding Blackbaud's market share.

Competitive rivalry in the nonprofit software sector is intense, with Blackbaud facing pressure from both large tech companies and specialized providers. Major players like Salesforce, with its $31.4 billion revenue in fiscal year 2024, and Microsoft are leveraging their vast resources to offer integrated solutions. Meanwhile, nimble competitors such as Bloomerang and DonorPerfect are attracting clients with user-friendly interfaces and more affordable options, particularly for smaller nonprofits.

The market is characterized by a rapid pace of innovation, with companies integrating AI for donor prospecting and predictive fundraising, a trend evident in 2024 platform updates. Blackbaud must continuously enhance its offerings to maintain its leading position. High switching costs for Blackbaud’s integrated cloud solutions are a key retention factor, but competitors are actively mitigating these barriers with simplified migration tools and incentives, as seen in early 2024 customer acquisition trends.

| Competitor | Key Offering | 2024 Market Focus |

| Salesforce | Nonprofit Cloud | Integrated solutions, AI features |

| Microsoft | Dynamics 365 | Enterprise-level, cloud infrastructure |

| Bloomerang | Donor management | User-friendliness, donor retention |

| DonorPerfect | CRM software | Affordability, robust features |

SSubstitutes Threaten

Nonprofits, particularly those with tighter budgets, may turn to readily available general business software. Solutions like Microsoft Excel for data management, or free CRM tools such as HubSpot CRM, can fulfill fundamental requirements. These alternatives offer a more economical path compared to specialized nonprofit software, posing a threat of substitution.

Larger, highly specialized organizations might opt to build their own software solutions. This is because they have unique operational needs that off-the-shelf products might not fully address. For instance, a major university with complex alumni relations and fundraising workflows could find developing an in-house system more efficient than adapting a general platform.

While developing in-house solutions is expensive and requires significant internal resources, it offers complete control over functionality and data. This tailored approach can be a direct substitute for Blackbaud's offerings, especially for organizations prioritizing bespoke features over immediate, broader platform availability. Such custom systems can directly compete by offering specialized capabilities that Blackbaud might not provide out-of-the-box.

For very small organizations or specific, niche functions, manual processes like paper-based record-keeping or direct mail for fundraising can still act as substitutes for Blackbaud's software solutions. This is especially true in environments with low technology adoption rates or severely limited budgets, where the immediate cost savings from avoiding subscription fees are paramount.

Hybrid Solutions and Modular Approaches

The threat of substitutes for integrated software suites like Blackbaud's is growing, particularly with the rise of modular approaches. Nonprofits are increasingly opting to assemble best-of-breed solutions for specific functions, such as separate platforms for fundraising, accounting, and constituent relationship management. This shift allows organizations to select the most effective tool for each task, potentially bypassing the need for a single, all-encompassing provider.

The increasing ease of integration between disparate cloud services through APIs is a key enabler of this modular strategy. For instance, a nonprofit might use a specialized donation platform that integrates seamlessly with its accounting software, substituting for a single vendor's bundled offering. This flexibility can lead to cost savings and better functionality tailored to specific needs.

- Modular adoption: Many nonprofits are building custom tech stacks by integrating specialized software for different operational areas.

- API-driven integration: The widespread availability and improving capabilities of APIs make it easier to connect various cloud-based solutions.

- Cost-effectiveness: Organizations can potentially achieve better value by paying only for the specific functionalities they require, rather than a comprehensive suite.

- Specialized functionality: Best-of-breed solutions often offer deeper features and more advanced capabilities within their niche compared to modules within a larger suite.

Consulting Services and Outsourcing

The threat of substitutes for Blackbaud's comprehensive software solutions is significant, particularly from specialized consulting services and outsourcing firms. Organizations can choose to outsource functions like fundraising, financial management, or event planning to these external providers. This approach offers a viable alternative, delivering the desired outcomes without the need for Blackbaud's integrated software. For instance, a non-profit might engage a fundraising consultancy rather than investing in Blackbaud's Raiser's Edge NXT for donor management.

These consulting services can effectively substitute for software by providing expertise and execution for specific business needs. This bypasses the client's requirement to purchase, implement, and maintain complex software platforms. The trend towards outsourcing non-core functions further amplifies this threat.

Consider these points regarding consulting services as substitutes:

- Specialized Expertise: Consulting firms offer deep expertise in niche areas such as grant writing or impact measurement, which may be more cost-effective than replicating this in-house with software.

- Outcome-Based Solutions: Many outsourcing providers focus on delivering specific results, like increasing donation revenue or improving operational efficiency, directly addressing a client's goals.

- Reduced IT Burden: By outsourcing, organizations offload the IT management, training, and maintenance associated with software, a significant appeal for many businesses.

- Market Growth: The global outsourcing market is substantial and growing, with projections indicating continued expansion, underscoring the competitive pressure from these alternative service models. For example, the global IT outsourcing market was valued at over $300 billion in 2023 and is expected to grow further.

The threat of substitutes for Blackbaud's offerings is substantial, driven by the availability of general business software and the increasing trend of modular adoption. Nonprofits, especially those with budget constraints, can leverage tools like Microsoft Excel for data management or free CRM platforms such as HubSpot CRM, which fulfill basic needs more affordably. Furthermore, the rise of best-of-breed solutions, where organizations assemble specialized software for distinct functions like fundraising or accounting, presents a significant alternative to integrated suites.

The increasing ease of integrating disparate cloud services via APIs facilitates this modular approach, allowing organizations to select optimal tools for each task. This strategy can lead to cost savings and better-tailored functionality, directly substituting for a single, all-encompassing provider. For instance, a nonprofit might use a specialized donation platform that seamlessly connects with its accounting software, bypassing the need for a bundled Blackbaud offering.

Specialized consulting services and outsourcing firms also pose a considerable threat. These providers offer expertise and execution for functions like fundraising or financial management, delivering desired outcomes without requiring clients to invest in and maintain complex software. This trend towards outsourcing non-core functions is amplified by the significant growth in the global outsourcing market, which was valued at over $300 billion in 2023.

| Substitute Category | Examples | Key Advantages | Impact on Blackbaud |

| General Business Software | Microsoft Excel, HubSpot CRM (Free Tier) | Lower cost, ease of use for basic functions | Attracts budget-conscious or smaller organizations |

| Modular Software Stacks | Separate platforms for CRM, accounting, fundraising | Specialized functionality, flexibility, potential cost savings | Reduces demand for integrated suites |

| In-house Development | Custom-built solutions for unique needs | Complete control, tailored features | Threatens larger organizations with specific requirements |

| Manual Processes | Paper-based records, direct mail | Zero software cost, simplicity for very small operations | Relevant in low-tech adoption environments |

| Consulting & Outsourcing | Fundraising consultancies, outsourced accounting | Expertise, outcome-based solutions, reduced IT burden | Bypasses software need by providing services |

Entrants Threaten

Developing and maintaining a comprehensive cloud software suite, akin to Blackbaud's offerings in fundraising, financial management, and CRM, demands substantial capital. This includes hefty investments in robust infrastructure, continuous research and development, and acquiring specialized talent.

The sheer scale of this financial commitment creates a formidable barrier for any new player looking to enter the market. For instance, in 2023, major cloud infrastructure providers saw significant capital expenditure, with companies like Amazon Web Services (AWS) investing billions, reflecting the ongoing cost of building and scaling these platforms.

This high upfront cost effectively deters many potential competitors, as they would need to secure considerable funding to even begin competing on a similar technological and service level.

The social good sector demands specialized knowledge, particularly in areas like fund accounting, grant management, and donor privacy. New companies entering this market must possess deep domain expertise to create software that effectively meets these intricate requirements. This necessity for specialized understanding acts as a substantial barrier, deterring many potential new entrants from successfully competing with established players like Blackbaud.

Blackbaud benefits from a deeply entrenched brand reputation and a loyal customer base, particularly within the nonprofit sector. This loyalty is a significant barrier for newcomers, as establishing trust and demonstrating reliability in this sensitive market requires sustained effort and a proven track record.

New entrants face the considerable challenge of replicating Blackbaud's established relationships and the confidence that nonprofits place in its solutions. The time and investment needed to build comparable brand equity and customer loyalty are substantial, effectively deterring rapid market entry and share acquisition.

Data Network Effects and Integration Complexity

Blackbaud benefits significantly from data network effects, where its vast repository of donor behavior and fundraising trends directly improves its product's predictive accuracy and overall value proposition. For instance, by analyzing millions of past transactions, Blackbaud can offer more precise insights into donor engagement strategies, a capability difficult for newcomers to match without comparable historical data. This deep well of information acts as a substantial moat, making it challenging for new entrants to quickly build a competitive dataset.

Furthermore, the intricate nature of integrating Blackbaud's platform with a wide array of existing third-party systems, such as diverse payment processors and external data analytics tools, presents a significant hurdle for potential competitors. The effort and expertise required to achieve seamless interoperability with the complex ecosystem of nonprofit technology stacks mean that new entrants face considerable integration complexity and cost.

- Data Network Effects: Blackbaud's extensive historical data on donor interactions and fundraising outcomes enhances predictive analytics, a key differentiator.

- Integration Complexity: The requirement to integrate with numerous disparate third-party systems (e.g., CRM, payment gateways) creates a high barrier to entry.

- Replication Difficulty: New entrants would find it extremely challenging and time-consuming to amass a comparable dataset to Blackbaud's.

Regulatory and Compliance Hurdles

The social good sector faces significant regulatory and compliance hurdles that act as a barrier to new entrants. These include stringent data privacy laws like GDPR and CCPA, which require robust data protection measures for donor and constituent information. For instance, a 2024 report indicated that over 60% of non-profits identified regulatory compliance as a major operational challenge.

New software providers must invest heavily in ensuring their platforms meet these complex requirements, from financial reporting standards to charitable solicitation regulations. Failure to comply can result in substantial fines and reputational damage, making the cost and effort of market entry considerably higher.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA is mandatory, impacting how sensitive constituent data is handled and stored.

- Financial Reporting Standards: New entrants must align their software with established accounting and reporting frameworks for non-profits.

- Charitable Solicitation Laws: Navigating varying state and national laws governing fundraising activities adds another layer of complexity.

- Increased Entry Costs: The need for specialized legal counsel and compliance technology significantly raises the initial investment for new companies.

The threat of new entrants for Blackbaud is relatively low due to several significant barriers. High capital requirements for developing sophisticated cloud software, estimated in the billions for robust infrastructure and R&D, deter many. Furthermore, the need for deep domain expertise in the social good sector, coupled with the difficulty of replicating Blackbaud's established brand loyalty and data network effects, creates substantial hurdles. Regulatory complexities, such as data privacy laws, also add to the cost and effort of market entry.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Developing comprehensive cloud software requires billions in investment for infrastructure and R&D. | High; deters potential competitors needing substantial funding. |

| Domain Expertise | Specialized knowledge in fund accounting, grant management, and donor privacy is essential. | Substantial; new companies must possess deep expertise to meet intricate requirements. |

| Brand Loyalty & Data Network Effects | Blackbaud benefits from established trust and millions of data points enhancing product value. | Significant; difficult for newcomers to build comparable trust and data assets. |

| Integration Complexity | Seamlessly integrating with diverse third-party systems is a major challenge. | High; requires considerable expertise and investment for interoperability. |

| Regulatory Compliance | Adherence to data privacy and financial reporting standards is mandatory. | Increases costs and complexity, with significant penalties for non-compliance. |

Porter's Five Forces Analysis Data Sources

Our Blackbaud Porter's Five Forces analysis leverages a comprehensive dataset including Blackbaud's financial reports, industry-specific market research from firms like Gartner and Forrester, and competitor disclosures to accurately gauge competitive intensity.