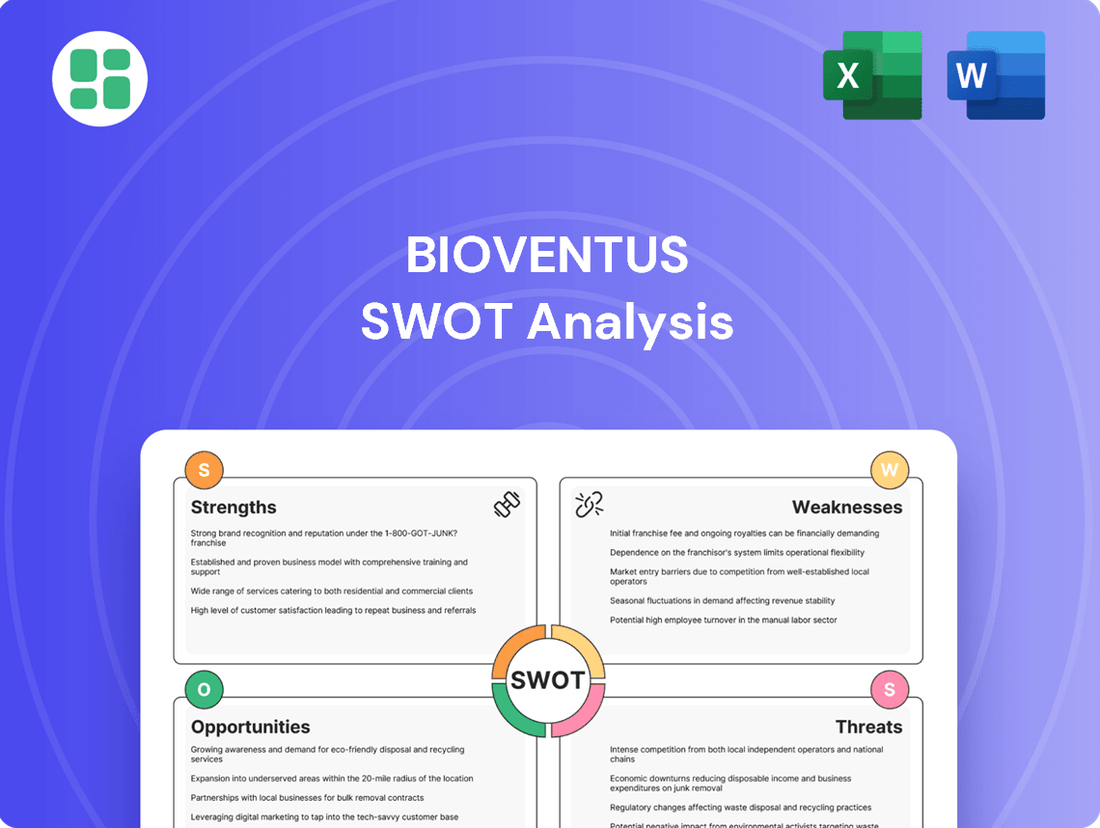

Bioventus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bioventus Bundle

Bioventus leverages strong product innovation and a growing global presence as key strengths, but faces challenges in regulatory hurdles and market competition. Understanding these dynamics is crucial for any investor or strategist looking to navigate the regenerative medicine landscape.

Want the full story behind Bioventus's competitive advantages, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

Bioventus boasts a diverse product portfolio centered on bone and joint health, featuring orthobiologics for osteoarthritis, fracture healing, and surgical applications. This breadth reduces reliance on any single offering and allows the company to target a wide array of musculoskeletal issues.

The company's strategic diversification is paying off, as evidenced by strong performance in its Pain Treatments and Surgical Solutions segments. In the first quarter of 2024, Bioventus reported double-digit organic growth in these key areas, underscoring the market's positive reception to its varied solutions.

Bioventus has shown impressive organic growth in its key business areas, even when overall revenue saw some ups and downs. This is a really positive sign for the company's core operations.

For instance, in the first quarter of 2025, organic growth reached 5%, and this momentum continued into the second quarter of 2025 with a 6% organic growth rate. These figures point to strong demand and a good reception for their main products in the market.

This steady organic performance, especially in segments like Pain Treatments and Surgical Solutions, underscores the fundamental strength and health of Bioventus's primary revenue streams.

Bioventus prioritizes clinically differentiated and cost-effective treatments, a strategy that resonates strongly in today's healthcare landscape. This focus on value-based care and less invasive options positions them favorably against competitors.

Their proprietary technologies, such as the LIPUS device EXOGEN for bone healing, offer unique, evidence-backed solutions. In 2023, Bioventus reported revenue of $408.7 million, demonstrating market traction for their differentiated offerings.

Improved Financial Performance and Debt Reduction

Bioventus has demonstrated a notable strengthening of its financial position. For the full year 2024, the company reported a reduced net loss from continuing operations and an increase in adjusted EBITDA, signaling improved operational efficiency and profitability. This financial turnaround is a key strength.

Further bolstering its financial health, Bioventus made significant strides in debt management. In the fourth quarter of 2024, the company successfully reduced its long-term debt by $48.3 million. Additionally, a new credit agreement finalized in August 2025 is set to decrease interest expenses and enhance overall liquidity, providing a more stable financial foundation.

- Reduced Net Loss: Improved financial performance in full-year 2024.

- Increased Adjusted EBITDA: Signifying enhanced operational profitability.

- Debt Reduction: $48.3 million decrease in long-term debt in Q4 2024.

- Improved Liquidity and Lower Interest: Through a new credit agreement in August 2025.

Established Market Presence and Distribution

Bioventus boasts a significant global footprint, supported by a robust distribution network that has cultivated strong brand recognition and customer loyalty, especially within the orthopedic specialist community. This widespread access facilitates efficient engagement with healthcare providers, giving the company a competitive edge in the orthobiologics sector.

The company's established market presence is a key strength, enabling it to effectively reach and serve its target customer base. For instance, in 2023, Bioventus reported that its products were utilized in over 1.5 million patient procedures globally, underscoring the breadth of its reach.

North America continues to be a pivotal market for orthobiologics, and Bioventus's deep penetration in this region, accounting for approximately 60% of its revenue in 2023, further solidifies its market leadership.

This established distribution infrastructure is crucial for the timely delivery of innovative orthobiologic solutions, ensuring that healthcare professionals have access to the tools they need. The company's commitment to expanding its international presence, with a focus on key European markets, also contributes to its overall market strength.

Bioventus's diverse product range in bone and joint health, including osteoarthritis treatments and fracture healing solutions, reduces reliance on single products and addresses a broad spectrum of musculoskeletal conditions.

The company's strategic focus on clinically differentiated and cost-effective treatments, such as the EXOGEN LIPUS device, resonates well in the value-based healthcare market. This focus on unique, evidence-backed solutions provides a competitive advantage.

Financially, Bioventus has shown a strengthening position, with a reduced net loss and increased adjusted EBITDA reported for the full year 2024. Significant debt reduction, including $48.3 million in Q4 2024, and a new credit agreement in August 2025 further enhance liquidity and financial stability.

Bioventus benefits from a strong global distribution network and established brand recognition, particularly among orthopedic specialists. In 2023, its products were used in over 1.5 million patient procedures worldwide, highlighting its extensive market reach.

What is included in the product

Delivers a strategic overview of Bioventus’s internal and external business factors, highlighting its market strengths and potential growth opportunities alongside operational weaknesses and competitive threats.

Offers a clear, actionable framework for identifying and addressing pain points in Bioventus' pain management solutions.

Weaknesses

Bioventus faced an overall revenue decrease in the first half of 2025. This dip, with Q1 revenue down 4% and Q2 revenue down 2.4% year-over-year, stems from the strategic decision to sell its Advanced Rehabilitation Business in late 2024. While this move sharpens focus on key growth areas, it has a direct, albeit temporary, impact on reported revenue totals.

Bioventus has been embroiled in significant legal battles, including a derivative lawsuit and a class action settlement stemming from alleged financial reporting missteps and accounting irregularities. A substantial $15.25 million settlement received approval in December 2024, aiming to resolve some of these claims.

Despite the settlement, the company faces continued legal scrutiny with a new derivative suit initiated in February 2025. This ongoing litigation presents persistent financial risks due to potential future legal costs and settlement payouts, alongside significant reputational damage.

Bioventus's financial position is still marked by substantial long-term debt, which stood at $297.9 million as of the second quarter of 2025, even after some debt reduction initiatives. This level of borrowing can create significant constraints on the company's ability to invest in new opportunities or respond to market shifts.

Furthermore, the company must diligently adhere to its debt covenants. Non-compliance could trigger demands for immediate repayment of outstanding loans, severely impacting Bioventus's cash flow and overall financial maneuverability.

Negative Operating Cash Flow in Certain Periods

Bioventus experienced negative operating cash flow in the first quarter of 2025, a situation that can strain a company's financial flexibility. This means that the cash generated from its core business operations wasn't enough to cover its expenses during that period.

While the company anticipates improvement in operating cash flow in the quarters following Q1 2025, the initial negative trend is a concern. This can affect the company's ability to self-fund expansion plans or meet its debt repayment schedules without needing to borrow additional funds.

- Q1 2025 Operating Cash Flow: Reported negative, indicating cash burn from core operations.

- Impact on Liquidity: Negative cash flow can reduce readily available funds for immediate needs.

- Funding Growth: Difficulty in funding new projects or acquisitions without external capital.

- Debt Management: Potential challenges in servicing existing debt obligations.

Competitive Market Intensity

The orthobiologics sector where Bioventus operates is intensely competitive. This market is populated by a multitude of large, established multinational corporations alongside agile smaller firms, all vying for market position.

To stand out and grow its market share, Bioventus must consistently invest in innovation, build robust clinical evidence for its products, and implement shrewd pricing strategies. The company faces formidable competition from major industry players.

- Zimmer Biomet: A significant competitor with a broad portfolio of orthopedic products.

- Medtronic: Another powerhouse in the medical device industry, offering a wide range of solutions.

- Stryker: Known for its advanced surgical technologies and implant systems.

Bioventus's financial health is impacted by its significant debt load, with long-term debt standing at $297.9 million as of Q2 2025. This debt level, along with strict debt covenants, limits financial flexibility and investment capacity. The company also reported negative operating cash flow in Q1 2025, indicating a cash burn from core operations that could hinder self-funding of growth initiatives and debt servicing.

| Financial Metric | Q1 2025 | Q2 2025 |

| Long-Term Debt | - | $297.9 million |

| Operating Cash Flow | Negative | Anticipated Improvement |

Preview the Actual Deliverable

Bioventus SWOT Analysis

The preview you see is the same Bioventus SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

This is a real excerpt from the complete Bioventus SWOT analysis. Once purchased, you’ll receive the full, editable version ready for strategic planning.

You’re viewing a live preview of the actual Bioventus SWOT analysis file. The complete, in-depth version becomes available after checkout.

Opportunities

The global orthobiologics market is a significant opportunity, forecasted to grow from USD 6.77 billion in 2024 to USD 10.34 billion by 2033, showing a compound annual growth rate of 4.74% between 2025 and 2033. This robust expansion is fueled by the rising prevalence of orthopedic conditions, a surge in sports-related injuries, and an aging global population, all of which create a strong demand for Bioventus's innovative product offerings.

The world's population is getting older, and this trend is a significant tailwind for Bioventus. By 2050, the United Nations projects that the number of people aged 65 and over will nearly double, reaching 1.6 billion. This demographic shift directly fuels demand for orthopedic solutions as age-related conditions such as osteoarthritis and osteoporosis become more prevalent.

This growing elderly demographic translates into a substantial increase in the need for orthopedic procedures and treatments. For instance, the global orthopedic devices market was valued at approximately $50 billion in 2023 and is expected to grow steadily. Bioventus's focus on pain management and fracture healing solutions positions it well to capitalize on this sustained and expanding market demand.

Bioventus can capitalize on ongoing advancements in regenerative medicine and orthobiologics to develop and launch innovative new products. This focus on R&D is crucial for staying competitive and meeting evolving patient needs in the musculoskeletal care market.

The company's recent FDA 510(k) clearance in July 2025 for its next-generation peripheral nerve stimulation products is a significant opportunity. This clearance unlocks potential new revenue streams by expanding its product portfolio into a promising area of pain management and recovery.

Expansion into High-Growth Market Segments

Bioventus is actively targeting high-growth areas, notably peripheral nerve stimulation (PNS). This segment is experiencing rapid expansion, with U.S. market growth projected to surpass 20% annually. The PNS market is anticipated to reach over $500 million by 2029, presenting a significant opportunity for increased market share and revenue.

By investing in dedicated direct sales forces for these burgeoning product lines, Bioventus can directly capitalize on this momentum. This strategic focus is designed to accelerate adoption and capture greater value in these promising segments.

- Targeting high-growth segments like PNS.

- U.S. PNS market growth exceeding 20% annually.

- PNS market projected to surpass $500 million by 2029.

- Investing in direct sales for new products to drive revenue.

Increasing Demand for Minimally Invasive Treatments

The healthcare landscape is seeing a significant shift towards minimally invasive treatments across various specialties, including orthopedics. This trend is driven by patient demand for quicker recovery periods and a desire to minimize surgical risks and complications.

Bioventus is well-positioned to capitalize on this growing preference. Their product portfolio, which includes solutions like the EXOGEN Ultrasound Bone Healing System and their viscosupplementation offerings, directly addresses the need for less invasive and more cost-effective orthopedic care. This alignment with market demand provides a distinct competitive edge, encouraging greater uptake of their innovative treatments.

For instance, the global minimally invasive surgery market was valued at approximately $25.6 billion in 2023 and is projected to grow significantly. Bioventus's focus on these procedures means they are tapping into a rapidly expanding segment of the healthcare industry.

- Growing Patient Preference: Patients increasingly favor procedures with shorter hospital stays and faster return to daily activities.

- Bioventus's Alignment: The company's core offerings are designed for minimally invasive application, fitting this evolving patient and physician preference.

- Market Growth: The demand for orthopedic solutions that reduce recovery time and risk is a major driver in the medical device sector.

- Competitive Advantage: Specializing in these areas allows Bioventus to differentiate itself and capture market share as minimally invasive techniques become standard.

Bioventus is strategically positioned to benefit from the expanding global orthobiologics market, which is projected to reach USD 10.34 billion by 2033. This growth is driven by an aging population and increased sports injuries, creating a sustained demand for their specialized treatments.

The company's recent FDA 510(k) clearance in July 2025 for its next-generation peripheral nerve stimulation (PNS) products represents a significant new revenue avenue. The U.S. PNS market alone is anticipated to grow by over 20% annually, exceeding $500 million by 2029, a segment Bioventus is actively investing in with dedicated sales forces.

Furthermore, Bioventus's product portfolio aligns perfectly with the growing preference for minimally invasive orthopedic procedures. This trend, supported by a global market valued at approximately $25.6 billion in 2023, offers Bioventus a competitive advantage as patients and physicians increasingly seek treatments with faster recovery times and reduced risks.

| Opportunity Area | Market Size (2024/2023) | Projected Growth | Bioventus Relevance |

|---|---|---|---|

| Global Orthobiologics | USD 6.77 billion (2024) | CAGR of 4.74% (2025-2033) | Addresses rising orthopedic conditions and sports injuries. |

| Peripheral Nerve Stimulation (PNS) - U.S. | N/A (Market projected >$500M by 2029) | >20% annually | New revenue stream from recent FDA clearance; direct sales investment. |

| Minimally Invasive Surgery | USD 25.6 billion (2023) | Significant growth | Product portfolio aligns with patient demand for faster recovery. |

Threats

Bioventus, like other medical device companies, navigates a dynamic regulatory environment. The upcoming EU AI Act, labeling AI-enabled medical devices as high-risk, alongside updated FDA cybersecurity directives, necessitates significant investment in compliance. These evolving standards, including strengthened post-market surveillance in Great Britain from June 2025, directly translate to increased operational costs and complexity for the company.

Bioventus faces significant threats from reimbursement challenges and ongoing pricing pressures within the healthcare industry. High costs associated with orthobiologics products and procedures, coupled with inadequate reimbursement rates, can indeed limit the company's ability to expand its market reach and profitability.

Past Medicare pricing adjustments have demonstrably affected Bioventus's financial performance, underscoring the vulnerability to policy shifts. For instance, in 2023, the company noted that changes in reimbursement policies, particularly concerning its EXOVATE™ product, could negatively impact revenue if not adequately addressed.

The broader healthcare sector continues to experience intense pricing pressures, driven by cost-containment efforts from payers and government entities. This environment poses a persistent threat to Bioventus's margins and its capacity to maintain competitive pricing while investing in innovation and market development.

The orthobiologics sector is fiercely competitive, with giants like Zimmer Biomet, Medtronic, and Stryker consistently introducing new products, acquiring rivals, and conducting clinical studies. This aggressive innovation landscape poses a significant threat to Bioventus, potentially leading to a decline in its market share.

Such intense rivalry can trigger price wars, directly impacting Bioventus's profit margins and overall financial health. For instance, the orthobiologics market, valued at approximately $5.5 billion in 2023, is projected to grow, but increased competition could dilute the gains for any single player.

Macroeconomic Uncertainty and Foreign Currency Fluctuations

Macroeconomic shifts and fluctuating exchange rates pose a significant threat to Bioventus. Increased global economic uncertainty, potentially exacerbated by trade policies like tariffs, can directly impact the company's revenue streams and operational costs. These external factors create a volatile landscape that makes financial forecasting more challenging.

Foreign currency fluctuations, in particular, have already demonstrated their potential to disrupt Bioventus's financial results. For instance, in the second quarter of 2025, the company reported unplanned foreign currency losses. This event underscores the vulnerability of Bioventus to adverse movements in exchange rates, which can erode profitability when international sales or expenses are translated back into the company's reporting currency.

- Macroeconomic Volatility: Global economic instability and potential trade disputes create an unpredictable operating environment for Bioventus.

- Foreign Currency Risk: Unfavorable shifts in exchange rates can negatively impact reported earnings and cash flows, as seen in Q2 2025.

- Impact on Financial Performance: Both macroeconomic uncertainty and currency fluctuations can lead to reduced revenue, increased costs, and lower overall profitability.

- Forecasting Challenges: The dynamic nature of these external factors makes it difficult for Bioventus to accurately predict future financial outcomes.

Dependence on Physician Adoption and Clinical Evidence

Bioventus's growth is significantly tied to how readily physicians embrace its innovative therapies. This adoption is directly influenced by the availability of compelling clinical evidence demonstrating product efficacy and safety. Without robust data, physicians may be hesitant to integrate new treatments into their practice, impacting sales volumes.

Furthermore, favorable reimbursement policies from payers are crucial for widespread physician adoption. If insurers do not adequately cover Bioventus's products, it creates a significant barrier for both physicians and patients, potentially limiting market penetration. For instance, changes in Medicare coverage decisions could directly affect product demand.

- Physician Adoption: Success hinges on healthcare providers integrating Bioventus's solutions into their standard care protocols.

- Clinical Evidence: Strong, peer-reviewed studies are essential to build physician confidence and support product claims.

- Reimbursement Landscape: Favorable coverage decisions from insurance providers are critical for patient access and physician uptake.

- Market Trends: Shifts in treatment preferences or the emergence of competing therapies can influence physician choice and product demand.

Intensifying competition within the orthobiologics market, valued at approximately $5.5 billion in 2023, presents a substantial threat to Bioventus. Major players like Zimmer Biomet, Medtronic, and Stryker are continuously innovating and expanding their offerings. This aggressive landscape could lead to price wars, directly impacting Bioventus's profit margins and potentially eroding its market share.

SWOT Analysis Data Sources

This Bioventus SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market research reports, and expert industry commentary to ensure a thorough and accurate strategic evaluation.