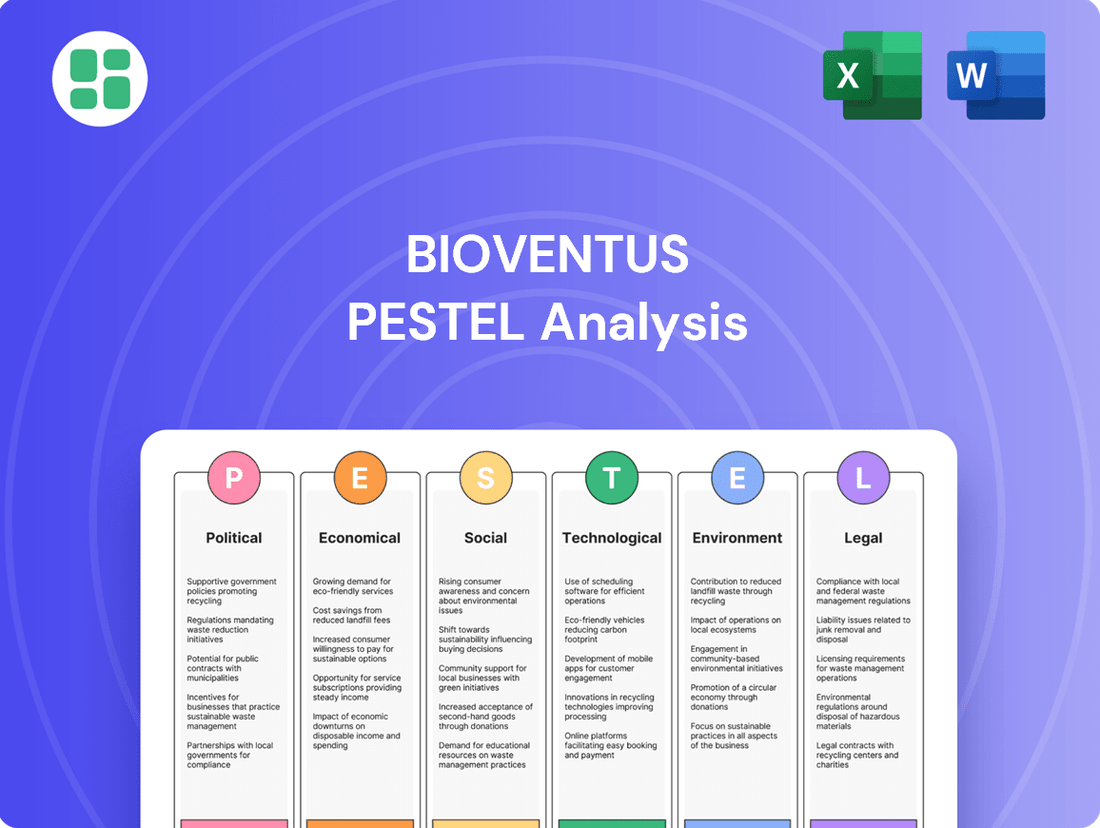

Bioventus PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bioventus Bundle

Navigate the dynamic external landscape impacting Bioventus with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its strategic direction and market opportunities. Gain a critical edge by leveraging these expert-level insights to inform your own business planning and investment decisions. Download the full version now for actionable intelligence.

Political factors

Government healthcare spending and reimbursement policies are a critical factor for Bioventus. For instance, proposed changes to Medicare payment rates for certain durable medical equipment in 2025 could affect the profitability of Bioventus's product lines. These policies directly influence how much healthcare providers are reimbursed for using Bioventus's orthobiologics and surgical products, impacting market adoption.

Bioventus's reliance on regulatory bodies like the FDA for its orthobiologics and medical devices means that approval processes are paramount. Any shifts or slowdowns in these pathways, particularly for innovative products, can directly affect when new treatments reach patients and the market.

For instance, the FDA's 510(k) clearance process is a key hurdle. Successfully navigating these requirements, as seen with recent clearances for Bioventus's peripheral nerve stimulation technologies, is essential for timely market entry and revenue generation.

Global trade policies and potential tariffs represent a significant political factor for Bioventus, influencing its international supply chain and pricing. Changes in these policies can impact the cost of raw materials and finished goods, directly affecting profitability and competitive positioning in various markets.

While Bioventus's 2025 financial guidance suggests that the immediate impact of tariffs may be immaterial, ongoing vigilance is essential. For instance, the United States International Trade Commission reported that tariffs imposed in 2018-2019 led to increased costs for many businesses, a trend that could resurface depending on future trade agreements and geopolitical shifts.

Political Stability in Key Markets

Political stability in Bioventus’ key markets, including the United States and Europe, is crucial for maintaining predictable operations and fostering growth. Instability can disrupt supply chains and impact market access, as seen with trade policy shifts affecting medical device imports and exports.

Geopolitical tensions can introduce regulatory uncertainty and economic volatility, directly influencing Bioventus’ ability to secure market approvals and manage pricing. For instance, ongoing trade disputes between major economic blocs could lead to tariffs or restrictions on medical technologies.

- US Regulatory Environment: The FDA's evolving regulations for medical devices directly impact Bioventus' product development and market entry strategies in its largest market.

- European Union Medical Device Regulation (MDR): Compliance with the MDR, which became fully applicable in May 2021, presents ongoing challenges and opportunities for Bioventus' European operations.

- Global Trade Relations: Bioventus, like many medical technology companies, is sensitive to changes in international trade agreements and tariffs that could affect the cost of goods and market accessibility.

Healthcare Reform Initiatives

Ongoing healthcare reform initiatives, particularly those emphasizing value-based care and cost-effectiveness, significantly shape the perception and adoption of medical technologies. Bioventus's strategic focus on clinically differentiated and cost-effective solutions positions it favorably within these evolving trends.

The company's product portfolio, which includes regenerative medicine and orthobiologics, is designed to improve patient outcomes while potentially reducing overall healthcare expenditures. This alignment is crucial as payers and providers increasingly scrutinize the economic value of medical interventions.

- Value-Based Purchasing: In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to expand its value-based purchasing programs, rewarding providers for quality and efficiency.

- Cost Containment Measures: Many health systems are implementing stricter cost containment protocols, favoring technologies demonstrating clear return on investment.

- Bioventus's Alignment: Bioventus's emphasis on products that can reduce hospital stays or the need for more expensive procedures directly addresses these cost-containment pressures.

Government healthcare spending and reimbursement policies remain a pivotal factor for Bioventus. For example, proposed adjustments to Medicare payment rates for specific durable medical equipment in 2025 could impact Bioventus's product line profitability, directly influencing market adoption.

Navigating regulatory landscapes, such as the FDA's 510(k) clearance process, is critical for Bioventus's market entry. The successful clearance of technologies, like its peripheral nerve stimulation devices, underscores the importance of these pathways for revenue generation.

Global trade policies and potential tariffs present ongoing considerations for Bioventus's international supply chain and pricing strategies. While the immediate impact may be minimal, as indicated by 2025 guidance, historical data from 2018-2019 shows tariffs can increase business costs.

Political stability in key markets like the US and Europe is essential for Bioventus's predictable operations and growth. Geopolitical tensions can introduce regulatory uncertainty and economic volatility, affecting market access and pricing.

| Political Factor | Impact on Bioventus | Example/Data Point |

|---|---|---|

| Healthcare Reimbursement | Affects product adoption and profitability | Proposed Medicare payment changes for DME in 2025 |

| Regulatory Approvals | Determines time-to-market for new products | FDA 510(k) clearance for peripheral nerve stimulation |

| Trade Policies & Tariffs | Influences supply chain costs and pricing | Historical tariff impact on business costs (2018-2019) |

| Political Stability | Ensures predictable operations and market access | Geopolitical tensions can create regulatory uncertainty |

What is included in the product

This Bioventus PESTLE analysis meticulously examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

It provides actionable insights for identifying market opportunities and potential risks, empowering informed decision-making for stakeholders.

Bioventus's PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, acting as a pain point reliver by simplifying complex external factors.

Economic factors

Global economic growth is a significant driver for healthcare spending, directly affecting patient capacity and demand for Bioventus's orthobiologic solutions. As economies strengthen, disposable income rises, allowing for greater investment in elective procedures and advanced medical treatments.

The orthobiologics market, a key area for Bioventus, is anticipated to experience robust expansion. Projections indicate the global orthobiologics market could reach approximately $15.6 billion by 2027, growing at a compound annual growth rate of around 7.6% from 2020 to 2027, according to some market analyses.

In 2024 and looking into 2025, economic recovery trends are varied across regions. For instance, the IMF projected global growth at 3.2% for 2024, with a slight uptick expected for 2025. This general economic stability or improvement supports increased healthcare budgets and patient out-of-pocket spending, which are crucial for Bioventus's revenue streams.

Inflationary pressures directly impact Bioventus by increasing the cost of essential raw materials, manufacturing processes, and global logistics. This can squeeze profit margins if these higher costs cannot be fully passed on to consumers. For example, rising energy prices in 2024 and 2025 are a significant factor in transportation and production expenses across the medical device industry.

To combat these challenges, Bioventus must prioritize supply chain efficiencies and explore diverse sourcing strategies. This proactive approach is crucial for mitigating the impact of rising input costs and ensuring consistent product availability. The company's ongoing efforts to optimize its operational footprint are a testament to this focus.

Fluctuations in interest rates directly affect Bioventus's cost of capital, influencing decisions on investments, research and development, and managing its debt portfolio. For instance, a rising rate environment would increase the expense associated with any new borrowings, potentially impacting profitability.

Bioventus has actively managed its financial leverage, as seen in its 2023 financial reports where it entered into new credit agreements aimed at reducing its overall interest expense. This proactive approach is crucial for maintaining financial flexibility and optimizing its balance sheet in a dynamic economic climate.

Healthcare Insurance Coverage & Payer Mix

The landscape of healthcare insurance coverage directly shapes Bioventus's market access and revenue potential. A high prevalence of insured individuals, particularly those with private insurance, generally translates to greater patient affordability and uptake of Bioventus's innovative therapies. Conversely, a payer mix heavily skewed towards public programs with stricter reimbursement policies can present hurdles.

Bioventus's success is intrinsically linked to its ability to secure favorable reimbursement from key payers. For instance, obtaining coverage from major private Medicare Advantage plans, like Aetna Medicare Advantage, is a critical step in ensuring broad patient access to their products. These agreements validate the clinical and economic value of their offerings.

- Payer Mix Impact: In 2024, the Centers for Medicare & Medicaid Services (CMS) projected that Medicare Advantage enrollment would exceed 31 million beneficiaries, highlighting the significance of this segment for companies like Bioventus.

- Reimbursement Negotiations: Successful negotiations with private payers are essential for Bioventus to achieve widespread adoption of its orthopedic and regenerative medicine solutions.

- Coverage Gaps: Uninsured or underinsured populations represent a significant challenge, limiting the addressable market for treatments that require out-of-pocket payment or extensive pre-authorization.

Disposable Income & Patient Out-of-Pocket Costs

While Bioventus products often have insurance coverage, patient disposable income and out-of-pocket expenses remain crucial. For treatments considered elective or as supplementary therapies, a patient's available funds directly influence demand. This highlights the importance of cost-effectiveness in their product strategy.

The economic climate directly impacts consumer spending power. As of early 2024, inflation has tempered somewhat, but the cumulative effect on household budgets continues to influence discretionary spending on healthcare. For instance, a rise in the Consumer Price Index (CPI) can erode disposable income, making patients more sensitive to co-pays and deductibles for non-essential medical treatments.

- Disposable Income Trends: In the U.S., real disposable personal income saw a modest increase in late 2023 and early 2024, but growth rates varied by demographic.

- Healthcare Cost Sensitivity: Studies in 2023 indicated that a significant percentage of Americans delayed or forwent medical care due to cost concerns, a trend likely to persist.

- Out-of-Pocket Maximums: Understanding the average out-of-pocket maximums for health insurance plans in key markets is critical for assessing patient affordability for Bioventus's offerings.

Economic stability and growth are foundational for Bioventus, directly influencing healthcare expenditure and patient access to its orthobiologic solutions. The global economy's trajectory in 2024 and into 2025, with projected growth around 3.2% for 2024 according to the IMF, supports increased healthcare budgets and patient spending on elective procedures.

Inflationary pressures remain a key concern, impacting Bioventus through higher raw material, manufacturing, and logistics costs. For example, rising energy prices in 2024 and 2025 significantly affect transportation and production expenses across the medical device sector.

Interest rate fluctuations directly influence Bioventus's cost of capital, affecting investment and debt management strategies. The company has actively managed its financial leverage, as evidenced by credit agreements in 2023 aimed at reducing interest expenses.

The payer mix, particularly the growing Medicare Advantage enrollment exceeding 31 million beneficiaries in 2024, is critical for Bioventus's market access and revenue. Securing favorable reimbursement from private payers is paramount for broad product adoption.

| Economic Factor | 2024/2025 Trend | Impact on Bioventus |

|---|---|---|

| Global Economic Growth | Projected 3.2% in 2024 (IMF) | Supports healthcare spending and patient affordability |

| Inflation | Persistent pressure on energy and raw materials | Increases operating costs, potentially squeezing margins |

| Interest Rates | Variable, impacting cost of capital | Influences investment and debt management decisions |

| Medicare Advantage Enrollment | Over 31 million beneficiaries (CMS projection) | Highlights importance of securing coverage from this segment |

What You See Is What You Get

Bioventus PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bioventus PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a complete understanding of the external forces shaping Bioventus's strategic landscape.

Sociological factors

The world's population is getting older. By 2050, the United Nations projects that nearly 1 in 6 people globally will be over 65, up from 1 in 11 in 2015. This demographic shift directly fuels demand for orthopedic solutions as age-related conditions like osteoarthritis and osteoporosis become more prevalent.

Bioventus, with its focus on bone and joint health, is well-positioned to capitalize on this trend. Their product portfolio, including treatments for osteoarthritis pain and fracture healing, directly addresses the needs of an aging demographic. For instance, the global orthobiologics market was valued at approximately $10.5 billion in 2023 and is projected to reach over $20 billion by 2030, demonstrating the significant growth driven by an aging population.

Societal shifts towards less active lifestyles and rising obesity rates are directly contributing to an increase in joint-related issues. For instance, in the US, the Centers for Disease Control and Prevention (CDC) reported that in 2021-2022, approximately 42.4% of adults were considered obese, a significant factor in joint stress and pain.

This growing patient demographic facing conditions like osteoarthritis, often exacerbated by these lifestyle factors, naturally expands the market for orthopedic solutions. Bioventus, with its focus on pain management and restorative therapies, is well-positioned to address this escalating demand, as evidenced by the continued growth in the global orthopedic devices market, projected to reach over $60 billion by 2027.

Patients increasingly favor minimally invasive procedures, a trend driven by desires for quicker recovery and reduced health risks. This societal shift directly benefits Bioventus, whose product portfolio is centered on exactly these types of less intrusive medical solutions.

For instance, the global market for minimally invasive surgical devices was valued at approximately $35 billion in 2023 and is projected to grow significantly, reflecting this strong patient preference. Bioventus's focus on areas like viscosupplementation and bone graft substitutes positions it to capitalize on this expanding demand for outpatient and less invasive care options.

Awareness & Acceptance of Orthobiologics

Growing patient and physician understanding of orthobiologics is a key driver for Bioventus' market growth. As more people learn about these regenerative therapies, demand naturally increases. This shift is fueled by ongoing research and educational efforts highlighting their effectiveness.

Clinical studies are vital in building trust and encouraging the adoption of orthobiologics. For instance, a 2024 survey indicated that over 60% of orthopedic surgeons were more likely to consider orthobiologics for patient treatment compared to just 40% in 2022. This demonstrates a clear upward trend in acceptance.

Bioventus actively participates in these educational initiatives, aiming to further solidify the role of orthobiologics in musculoskeletal care. The company's investment in clinical trials and physician training programs directly supports this rising awareness.

Key factors influencing this trend include:

- Increased media coverage: Positive patient stories and expert interviews in health publications are raising general awareness.

- Physician education programs: Bioventus and other industry leaders are hosting webinars and workshops to educate healthcare providers.

- Demonstrated clinical outcomes: Data from ongoing studies showing improved patient recovery times and reduced pain are crucial for acceptance.

- Patient advocacy groups: Organizations dedicated to specific orthopedic conditions are increasingly highlighting orthobiologics as viable treatment options.

Health & Wellness Trends Driving Proactive Care

Societal shifts towards proactive health management are significantly influencing the demand for Bioventus's offerings. People are increasingly investing in their well-being, seeking ways to prevent ailments and maintain active lifestyles. This trend directly supports Bioventus's core mission of enabling patients to lead pain-free, active lives.

The growing emphasis on wellness means consumers are more open to adopting solutions that aid in recovery and pain management. This proactive approach to health is a powerful driver for the musculoskeletal health market. For instance, the global sports medicine market, a key area for Bioventus, was valued at approximately $14.5 billion in 2023 and is projected to grow substantially in the coming years, reflecting this societal focus.

- Increased consumer spending on preventative health measures.

- Growing preference for non-invasive and regenerative treatment options.

- Higher participation in sports and fitness activities, leading to greater demand for recovery solutions.

Societal trends like an aging global population and increasing rates of obesity directly fuel demand for Bioventus's orthopedic solutions. For example, by 2050, nearly 1 in 6 people globally are projected to be over 65, a demographic highly susceptible to joint issues.

Furthermore, a growing preference for minimally invasive procedures, driven by desires for faster recovery, aligns perfectly with Bioventus's product offerings. The global market for these devices was approximately $35 billion in 2023, highlighting this patient-centric shift.

Bioventus also benefits from increased patient and physician understanding of orthobiologics, supported by ongoing research and educational initiatives. A 2024 survey indicated over 60% of orthopedic surgeons were more inclined to consider orthobiologics, up from 40% in 2022.

Finally, a societal move towards proactive health management and wellness increases demand for recovery and pain management solutions, as seen in the growing sports medicine market, valued at $14.5 billion in 2023.

Technological factors

Bioventus's core strategy is deeply intertwined with the rapid evolution of orthobiologics and regenerative medicine. These advancements directly fuel the company's product development pipeline and expand its market reach. For instance, the increasing sophistication of stem cell therapies and novel bone graft substitutes presents substantial avenues for growth and innovation.

The increasing adoption of digital health and telemedicine is transforming patient care. These technologies improve remote monitoring and boost treatment adherence, expanding access to healthcare services. For Bioventus, a company focused on physical products, this presents an opportunity to develop digital platforms that enhance patient engagement and post-treatment follow-up, potentially creating new revenue streams. The global telemedicine market was valued at approximately $110 billion in 2023 and is projected to grow significantly, indicating a strong demand for such integrated solutions.

Artificial intelligence and data analytics are revolutionizing diagnostics and treatment planning, promising more effective patient care. For instance, AI algorithms are demonstrating high accuracy in identifying diseases from medical images, with some studies showing performance comparable to or exceeding human radiologists in detecting certain cancers. This advancement directly impacts companies like Bioventus by potentially increasing the demand for data-driven treatment solutions and influencing physician adoption of AI-assisted diagnostic tools.

While direct regulation of AI in medical devices is still developing, its indirect influence on physician decision-making is significant. As AI tools become more integrated into diagnostic workflows, they can subtly guide physicians toward specific treatment modalities or products. This evolving landscape necessitates that Bioventus stay abreast of AI advancements to ensure its product offerings align with or are enhanced by these new technological capabilities, potentially impacting market share and product development priorities for 2024 and 2025.

Innovations in Medical Device Manufacturing

Innovations in medical device manufacturing are rapidly reshaping the landscape, with advancements like 3D printing enabling highly customized implants and the development of novel biomaterials enhancing product performance. These technological leaps can significantly improve product design, functionality, and ultimately, cost-effectiveness for companies like Bioventus. By embracing these innovations, Bioventus can strengthen its existing product lines and streamline its production methods.

For instance, the global 3D printing in healthcare market was valued at approximately $2.6 billion in 2023 and is projected to reach over $6.9 billion by 2028, demonstrating substantial growth potential. Bioventus can capitalize on this trend by exploring 3D printing for patient-specific surgical guides or implants, thereby offering more tailored solutions. This could lead to improved patient outcomes and a competitive edge in specialized orthopedic and spine markets.

- 3D Printing Adoption: Increased use of additive manufacturing for custom surgical implants and devices.

- Advanced Materials: Integration of new biocompatible and biodegradable materials to enhance device longevity and efficacy.

- Process Optimization: Streamlining manufacturing through automation and digital technologies for greater efficiency and reduced waste.

Emerging Therapies & Competitive Technologies

The landscape of bone and joint health is rapidly evolving, with new therapies and competitive technologies constantly emerging. For Bioventus, staying ahead means a relentless focus on research and development, alongside forging strategic partnerships. This commitment is crucial for maintaining its market leadership in a dynamic sector.

Bioventus's dedication to innovation is clearly demonstrated by its recent FDA clearances for next-generation peripheral nerve stimulation products. These advancements underscore the company's proactive approach to addressing unmet clinical needs and expanding its therapeutic offerings.

- Innovation Pipeline: Bioventus is actively developing new solutions in areas like regenerative medicine and advanced wound care, aiming to capture growing market segments.

- Competitive Landscape: The company faces competition from both established players introducing novel treatments and emerging biotech firms with disruptive technologies.

- R&D Investment: Continued investment in R&D is essential for Bioventus to bring differentiated products to market and counter competitive advancements.

Technological advancements are reshaping Bioventus's operational and product strategies. The increasing sophistication of orthobiologics and regenerative medicine, coupled with the rise of digital health and AI in diagnostics, presents significant growth opportunities. Innovations in manufacturing, such as 3D printing, also allow for more customized and efficient production of medical devices.

Bioventus's commitment to innovation is evident in its pursuit of next-generation peripheral nerve stimulation products, reflecting a proactive approach to market needs. The company's R&D investments are crucial for developing differentiated offerings and maintaining a competitive edge against emerging technologies and established players in the bone and joint health sector.

The global telemedicine market was valued at approximately $110 billion in 2023, highlighting the potential for Bioventus to integrate digital platforms for enhanced patient engagement. Similarly, the 3D printing in healthcare market, projected to reach over $6.9 billion by 2028, offers avenues for patient-specific solutions.

| Technology Area | Market Value (2023 Approx.) | Projected Growth Driver | Bioventus Opportunity |

|---|---|---|---|

| Telemedicine | $110 Billion | Increased remote patient care demand | Digital platforms for patient engagement |

| 3D Printing in Healthcare | $2.6 Billion | Demand for customized medical devices | Patient-specific surgical guides/implants |

| AI in Diagnostics | N/A (Growing Integration) | Improved diagnostic accuracy and efficiency | Data-driven treatment solutions |

Legal factors

Bioventus must navigate stringent medical device regulations, such as FDA approvals in the United States and CE Mark certifications in Europe, to successfully introduce and sell its products. For instance, the FDA's 510(k) clearance pathway remains a critical hurdle for many of Bioventus's innovative offerings, ensuring they meet safety and effectiveness standards before reaching the market.

Intellectual property protection is paramount for Bioventus, especially concerning its innovative orthobiologics and advanced wound care technologies. Patents are the bedrock for safeguarding these advancements against market imitation, ensuring a competitive edge. In 2024, the company's focus on R&D, which historically represents a significant portion of its operational spending, directly translates to a need for strong patent portfolios.

The threat of patent disputes presents considerable legal and financial risks for Bioventus. Such challenges can lead to costly litigation, potential revenue loss, and delays in product commercialization. Therefore, a proactive and robust intellectual property strategy, including thorough patent landscaping and enforcement, is critical for mitigating these vulnerabilities and maintaining market leadership in the orthobiologics sector.

Bioventus operates under strict product liability and safety regulations designed to protect patients. Compliance with these mandates is crucial for minimizing legal exposure stemming from any adverse events linked to their medical devices and therapies. For instance, in 2023, the U.S. Food and Drug Administration (FDA) continued its focus on post-market surveillance, a key area for companies like Bioventus to demonstrate ongoing product safety.

Maintaining high quality standards and adhering to evidence-based medicine principles are core to Bioventus's business model. This commitment is vital not only for regulatory adherence but also for building trust with healthcare professionals and patients. The company's investment in clinical trials and post-market studies, such as those supporting their hyaluronic acid viscosupplementation products, underscores this dedication to validated efficacy and safety.

Data Privacy & Cybersecurity Laws

Compliance with stringent data privacy regulations like HIPAA in the U.S. and GDPR in Europe presents a significant legal hurdle for Bioventus, particularly as digital health solutions become more prevalent. Failure to adhere to these laws can result in substantial fines and reputational damage. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Protecting sensitive patient information and maintaining robust cybersecurity measures are not just best practices but legal mandates for Bioventus. The increasing sophistication of cyber threats requires continuous investment in security infrastructure and protocols. In 2023, the healthcare sector experienced a significant rise in data breaches, underscoring the critical nature of these legal obligations.

- HIPAA and GDPR Compliance: Bioventus must navigate complex international data privacy frameworks.

- Cybersecurity Imperative: Legal obligations demand strong defenses against data breaches.

- Financial Penalties: Non-compliance can lead to severe financial penalties, impacting profitability.

- Reputational Risk: Data security failures can erode patient trust and brand value.

Anti-Kickback & Fraud and Abuse Laws

Bioventus, like all medical device companies, must meticulously adhere to anti-kickback and fraud and abuse laws. These regulations, such as the Anti-Kickback Statute and the False Claims Act, are designed to prevent illicit payments or inducements that could influence purchasing decisions or lead to fraudulent billing. For instance, in 2024, the Department of Justice continued to emphasize enforcement in healthcare fraud, with significant settlements reached across the industry for violations related to improper physician payments and kickbacks, underscoring the high stakes for compliance.

Navigating this complex legal landscape demands a robust compliance program focused on transparency and ethical conduct. This includes ensuring all marketing practices, physician relationships, and billing procedures are free from any suggestion of improper influence. Failure to comply can result in severe penalties, including substantial fines, exclusion from federal healthcare programs, and reputational damage. For example, in 2023, numerous healthcare providers and companies faced significant financial penalties for alleged kickback schemes, highlighting the ongoing scrutiny.

- Strict adherence to Anti-Kickback Statute and False Claims Act is paramount for Bioventus.

- U.S. healthcare fraud enforcement remained a priority in 2024, with significant settlements impacting the industry.

- Transparency in physician relationships and marketing practices is crucial for avoiding legal pitfalls.

- Non-compliance can lead to severe financial penalties and exclusion from federal healthcare programs.

Bioventus faces stringent regulatory oversight, including FDA approvals and CE Mark certifications, essential for market access. The company's innovation pipeline relies heavily on pathways like the 510(k) clearance in 2024, ensuring product safety and efficacy. This regulatory environment directly impacts product launch timelines and market penetration strategies.

Intellectual property is a cornerstone for Bioventus, safeguarding its orthobiologics and wound care technologies. Strong patent portfolios, a focus of R&D investment in 2024, are critical for maintaining a competitive edge against imitation. The company's patent strategy is vital for protecting its market position.

Product liability and safety regulations are critical legal considerations for Bioventus. Adherence to these standards minimizes legal exposure from adverse events, with post-market surveillance by agencies like the FDA in 2023 being a key focus. The company's commitment to evidence-based medicine, demonstrated through clinical trials, reinforces its dedication to patient safety.

Data privacy laws, such as HIPAA and GDPR, present significant legal challenges, particularly with the rise of digital health solutions. Non-compliance can result in substantial financial penalties, with GDPR fines capable of reaching 4% of global turnover. Robust cybersecurity measures are therefore a legal imperative, especially given the rise in healthcare data breaches observed in 2023.

Bioventus must also navigate anti-kickback and fraud and abuse laws, such as the Anti-Kickback Statute and False Claims Act. These regulations aim to prevent improper payments influencing healthcare decisions. Continued enforcement by the Department of Justice in 2024, with significant industry settlements, highlights the critical need for transparency and ethical conduct in physician relationships and marketing practices.

Environmental factors

Bioventus is actively working to reduce its environmental impact through sustainable manufacturing and supply chain practices, aiming to lower its carbon footprint. For instance, in 2023, the company reported a 5% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to its 2021 baseline, reflecting a tangible commitment to environmental stewardship.

Adopting these greener approaches not only bolsters Bioventus's corporate image among environmentally conscious stakeholders but also presents opportunities for long-term cost savings. By optimizing energy consumption and minimizing waste, the company can achieve greater operational efficiency, a trend mirrored across the healthcare sector where sustainable initiatives are increasingly linked to improved financial performance.

Bioventus faces stringent environmental regulations concerning the disposal of medical products, encompassing packaging and biological materials. These rules are designed to prevent contamination and protect ecosystems, directly impacting operational procedures.

Compliance with waste management protocols is critical for Bioventus to mitigate environmental harm and avoid significant penalties. For instance, the Resource Conservation and Recovery Act (RCRA) in the U.S. governs hazardous waste, which can include certain medical byproducts, with potential fines for non-compliance reaching tens of thousands of dollars per day.

Climate change poses indirect operational risks for Bioventus, potentially disrupting global supply chains and increasing transportation expenses. For instance, extreme weather events, which are becoming more frequent, can delay shipments of essential raw materials or finished products, impacting inventory levels and delivery timelines. The company must actively assess and develop strategies to mitigate these evolving logistical challenges.

Corporate Social Responsibility (CSR) & ESG Initiatives

Bioventus's commitment to Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) initiatives is crucial for its long-term success. By actively participating in these programs, the company can bolster its brand reputation, attract investors focused on sustainable practices, and cultivate a more engaged workforce. For instance, their efforts in donating disused IT equipment and championing healthier lifestyle choices directly support their sustainability goals.

The growing emphasis on ESG principles is reshaping investment landscapes. In 2023, global ESG assets were projected to reach $33.9 trillion, highlighting the significant financial incentive for companies like Bioventus to integrate these values into their core operations. This trend suggests that robust CSR and ESG performance will increasingly be a differentiator in securing capital and building stakeholder trust.

- Brand Enhancement: Strong CSR/ESG programs can improve public perception and brand loyalty.

- Investor Attraction: Socially conscious investors increasingly prioritize companies with solid ESG credentials, potentially leading to better access to capital.

- Employee Engagement: Initiatives that align with employee values can boost morale and retention.

- Sustainability Focus: Actions like IT equipment donation and health promotion contribute to a more sustainable operational footprint.

Resource Scarcity & Material Sourcing

Bioventus faces potential disruptions from resource scarcity, particularly concerning specialized materials vital for its orthobiologics and medical devices. For instance, the increasing demand for rare earth elements, crucial in some advanced medical technologies, could lead to price volatility and supply chain constraints. In 2024, global supply chain disruptions, including those affecting critical minerals, continued to pose challenges for various manufacturing sectors.

To mitigate these risks and ensure long-term supply chain resilience, Bioventus must actively pursue diversified sourcing strategies. This involves identifying and qualifying multiple suppliers for key raw materials, reducing reliance on any single source. Furthermore, exploring and investing in the development of alternative, sustainable materials is paramount. This proactive approach not only addresses potential scarcity but also aligns with growing environmental, social, and governance (ESG) expectations within the healthcare industry.

- Diversified Sourcing: Identifying and partnering with multiple suppliers for critical components to reduce dependency on single-source providers.

- Material Innovation: Investing in research and development for alternative, sustainable materials that can replace or supplement current resource-intensive options.

- Supply Chain Transparency: Enhancing visibility into the upstream supply chain to better anticipate and manage potential resource availability issues.

- Geopolitical Risk Assessment: Monitoring geopolitical stability in regions that are primary sources for key raw materials used in medical device manufacturing.

Bioventus is actively reducing its environmental impact, achieving a 5% decrease in Scope 1 and 2 greenhouse gas emissions in 2023 compared to 2021. This focus on sustainability not only enhances its corporate image but also drives operational efficiency and potential cost savings, aligning with broader healthcare sector trends.

The company must navigate strict regulations regarding medical product disposal, including packaging and biological materials, to prevent contamination and protect ecosystems. Compliance with waste management protocols, such as those under the U.S. Resource Conservation and Recovery Act (RCRA), is essential to avoid significant financial penalties, which can reach tens of thousands of dollars daily for violations.

Climate change presents indirect risks, potentially disrupting Bioventus's global supply chains and increasing transportation costs due to more frequent extreme weather events. The company is also addressing potential resource scarcity for specialized materials, a challenge highlighted by continued global supply chain disruptions impacting critical minerals in 2024.

| Environmental Factor | Bioventus's Action/Impact | Data/Example |

|---|---|---|

| Greenhouse Gas Emissions | Reduction efforts in manufacturing and supply chain | 5% reduction in Scope 1 & 2 emissions (2023 vs. 2021) |

| Waste Management | Compliance with disposal regulations for medical products | Potential fines under RCRA for non-compliance can be substantial |

| Climate Change Impact | Risk to supply chains and transportation costs | Increased frequency of extreme weather events |

| Resource Scarcity | Addressing potential shortages of specialized materials | Continued global supply chain disruptions affecting critical minerals (2024) |

PESTLE Analysis Data Sources

Our Bioventus PESTLE Analysis is built on a robust foundation of data from reputable sources, including government health agencies, leading medical journals, and industry-specific market research reports. We ensure every insight into political, economic, social, technological, legal, and environmental factors is grounded in credible, up-to-date information.