Bioventus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bioventus Bundle

Bioventus operates in a dynamic market shaped by intense competition and evolving customer demands. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for navigating its landscape.

The complete report reveals the real forces shaping Bioventus’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bioventus's reliance on specialized suppliers for critical biomaterials and components, especially for its orthobiologics and medical devices, can give those suppliers considerable leverage. When the number of suppliers capable of meeting the rigorous medical-grade quality, regulatory compliance, and specific intellectual property needs is limited, their bargaining power naturally grows.

This concentration is amplified if these suppliers provide unique or patented inputs that are essential for Bioventus's clinically differentiated product offerings. For instance, in 2024, Bioventus continued its focus on innovation in regenerative medicine, a sector where the availability of highly specialized and often proprietary raw materials is a key determinant of product efficacy and market positioning.

Bioventus faces considerable switching costs when changing suppliers for its critical biomaterials and device components. These costs aren't just monetary; they encompass the extensive time and resources required for re-validation of new materials, securing necessary regulatory approvals, and potential retraining of personnel.

For instance, the process of obtaining FDA clearance for a new component can take many months, if not longer, representing a significant hurdle. This investment in time and effort to qualify a new supplier means Bioventus is unlikely to switch providers frequently.

The high switching costs effectively bolster the bargaining power of Bioventus's existing suppliers. Any disruption or expense incurred by Bioventus in transitioning to a new supplier directly translates to increased leverage for the current ones, allowing them to potentially command higher prices or more favorable terms.

Bioventus's reliance on specialized biological materials for its orthobiologics, such as those derived from human tissue or advanced cell cultures, means suppliers of these unique inputs hold significant bargaining power. If these inputs are patented or involve proprietary manufacturing processes, Bioventus faces a limited pool of alternative suppliers, thereby increasing supplier leverage.

Threat of Forward Integration by Suppliers

If suppliers possess the capability and motivation to enter Bioventus's downstream markets, such as manufacturing or commercializing similar regenerative medicine products, their bargaining power significantly escalates. This potential shift represents a strategic threat that necessitates Bioventus maintaining robust and collaborative relationships with its key suppliers.

While this threat is less prevalent for highly specialized or proprietary components, it remains a crucial consideration for long-term strategic planning. For instance, if a supplier of a critical biologic material for Bioventus's joint injection therapies were to develop its own finished product, it could directly compete, thereby increasing its leverage.

The risk of forward integration by suppliers is a constant factor that Bioventus must actively manage. This involves not only securing supply but also understanding supplier motivations and capabilities. For example, in 2024, the global biopharmaceutical contract manufacturing market saw significant growth, indicating increased capacity and potential interest from suppliers to move up the value chain.

- Supplier Capability: Assess if suppliers have the technical expertise and capital to enter Bioventus's product segments.

- Market Incentives: Evaluate if the profitability and market demand in Bioventus's sectors would make forward integration attractive for suppliers.

- Strategic Threat: Recognize that supplier entry into Bioventus's markets could lead to increased competition and reduced margins.

- Relationship Management: Prioritize strong, mutually beneficial relationships with suppliers to mitigate this risk.

Importance of Bioventus to Suppliers

The bargaining power of suppliers is influenced by how crucial Bioventus is to their overall business. If Bioventus constitutes a substantial part of a supplier's revenue stream, that supplier is likely to be more flexible with pricing and terms. This is because losing Bioventus as a customer would significantly impact their financial performance.

Conversely, if Bioventus is a minor client for a supplier, the supplier holds more leverage. They can more easily impose their preferred prices, delivery schedules, and contract conditions, knowing that Bioventus’s business is not essential to their own profitability. This asymmetry in reliance grants the supplier greater power in negotiations.

- Supplier Dependence: Bioventus's significance to a supplier's revenue directly impacts supplier power. A larger share of Bioventus's business for a supplier means less supplier leverage.

- Client Size Matters: If Bioventus represents a small percentage of a supplier's total sales, the supplier has greater freedom to dictate terms.

- Negotiating Leverage: Suppliers with many other customers can afford to be less accommodating to Bioventus, especially if Bioventus is not a key account.

Bioventus's reliance on a concentrated supplier base for specialized biomaterials and medical device components significantly amplifies supplier bargaining power. This is particularly true when suppliers offer unique, patented inputs essential for Bioventus's innovative orthobiologics, as seen in its 2024 focus on regenerative medicine. High switching costs, encompassing lengthy re-validation and regulatory approval processes, further entrench this supplier leverage, making frequent changes impractical for Bioventus.

Suppliers capable of forward integration into Bioventus's markets, such as manufacturing similar regenerative medicine products, pose a strategic threat and increase their negotiating power. This risk is underscored by the growth in the global biopharmaceutical contract manufacturing market observed in 2024. Conversely, supplier leverage is diminished if Bioventus represents a substantial portion of their revenue, making them more amenable to favorable terms.

| Factor | Impact on Bioventus | Example/Data Point |

|---|---|---|

| Supplier Concentration | High | Limited suppliers for specialized, medical-grade biomaterials. |

| Switching Costs | High | Months-long regulatory approval for new components (e.g., FDA clearance). |

| Supplier Forward Integration Risk | Moderate to High | Growth in contract manufacturing (2024) signals potential for suppliers to move up the value chain. |

| Bioventus's Importance to Supplier | Variable | If Bioventus is a minor client, supplier leverage increases significantly. |

What is included in the product

This analysis unpacks the competitive forces impacting Bioventus, detailing supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the musculoskeletal health market.

Effortlessly identify and address competitive threats with a dynamic, interactive Porter's Five Forces model tailored for Bioventus's pain management market.

Customers Bargaining Power

Bioventus's customer base is largely concentrated among healthcare providers, including hospitals, surgical centers, and clinics. These entities often procure medical devices and therapies in substantial quantities, directly impacting Bioventus's sales volume. For instance, in 2023, Bioventus reported that its largest customer accounted for approximately 10% of its total revenue, highlighting a degree of customer concentration.

Furthermore, many of these healthcare providers are members of Group Purchasing Organizations (GPOs). GPOs aggregate the purchasing power of multiple healthcare facilities, enabling them to negotiate better prices and terms with suppliers like Bioventus. This collective bargaining strength can significantly influence Bioventus's pricing strategies and profit margins.

Bioventus strives to offer clinically differentiated products, but customers' perception of this differentiation and the presence of competing orthobiologics or alternative treatments significantly influence their bargaining power. If customers see Bioventus's offerings as interchangeable with those of rivals, or if a wide array of substitutes is readily available, they gain leverage to negotiate for reduced prices or enhanced service terms.

Customer switching costs for Bioventus can vary significantly depending on the product category. For instance, adopting new surgical solutions or fracture healing technologies often requires healthcare providers to invest in staff retraining, revise existing clinical protocols, and manage new inventory systems. These factors create a degree of stickiness, making it less appealing for providers to switch to a competitor.

However, for Bioventus's less complex or more commoditized product lines, the barriers to switching are considerably lower. In these segments, customers may face minimal retraining or integration challenges, thereby increasing their bargaining power and making them more sensitive to price or alternative offerings.

Price Sensitivity of Customers and Reimbursement Pressures

Healthcare providers, including hospitals and surgical centers, face substantial budget limitations, often dictated by reimbursement rates from payers like Medicare and private insurance companies. This financial pressure makes them acutely sensitive to the prices of medical devices and treatments, thereby amplifying their bargaining power. For instance, in 2024, many healthcare systems are scrutinizing capital expenditures, prioritizing solutions that offer clear return on investment and avoid out-of-pocket costs for patients or providers.

Bioventus, offering minimally invasive treatments, must therefore present a compelling case for the cost-effectiveness of its products. This involves demonstrating not only clinical efficacy but also potential long-term savings, such as reduced hospital stays or fewer revision procedures, to justify its pricing structure in a reimbursement-constrained environment.

- Price Sensitivity: Healthcare providers are highly sensitive to price due to budget constraints and reimbursement policies.

- Reimbursement Pressure: Insurer and government reimbursement rates directly influence provider purchasing decisions.

- Cost-Effectiveness Demonstration: Bioventus needs to prove the economic benefits of its treatments to overcome price sensitivity.

- 2024 Focus: Budgetary scrutiny and ROI analysis are key considerations for providers in the current economic climate.

Customer Information and Transparency

In the medical technology sector, customers, particularly hospitals and large healthcare systems, often have access to a wealth of product information. This includes detailed efficacy studies, clinical trial results, and comparative performance data against rival products. For instance, by mid-2024, many procurement departments actively utilized third-party analytics platforms that provided side-by-side comparisons of surgical implant performance and associated patient outcomes.

This increased transparency regarding product efficacy, real-world outcomes, and pricing benchmarks significantly shifts the bargaining power towards the customer. Armed with this data, healthcare providers can negotiate more effectively with suppliers like Bioventus, demanding better pricing or more favorable contract terms based on demonstrable value and competitive offerings. For example, a hospital system might leverage data showing a competitor's device achieving a 5% higher success rate in a specific procedure to negotiate a discount on Bioventus's comparable product.

- Informed Decision-Making: Access to detailed product information and comparative data allows customers to make more informed purchasing choices.

- Price Benchmarking: Transparency in pricing across competitors enables customers to benchmark costs and negotiate aggressively.

- Outcome-Based Negotiations: Data on product efficacy and patient outcomes empowers customers to negotiate based on demonstrable value.

- Supplier Competition: Increased customer knowledge intensifies competition among suppliers, driving down prices and improving terms.

The bargaining power of Bioventus's customers, primarily healthcare providers, is substantial due to their concentrated purchasing power and increasing price sensitivity. These entities, often part of Group Purchasing Organizations (GPOs), leverage collective volume to negotiate favorable terms. For instance, in 2023, Bioventus noted its largest customer represented about 10% of its revenue, indicating the influence of major buyers.

Healthcare providers in 2024 are under immense budget pressure, making them highly sensitive to the cost-effectiveness of medical technologies. This financial scrutiny means Bioventus must clearly demonstrate the economic benefits and return on investment of its products to justify pricing, especially given the influence of reimbursement rates from payers.

Furthermore, the availability of detailed product information and comparative performance data empowers customers. By mid-2024, many procurement departments utilize analytics platforms to assess rival products, enabling them to negotiate more effectively with suppliers like Bioventus based on demonstrable value and competitive pricing.

| Factor | Impact on Bioventus | Supporting Data/Observation |

| Customer Concentration | High | Largest customer accounted for ~10% of revenue in 2023. |

| Purchasing Power (GPOs) | High | Healthcare providers aggregate demand through GPOs for better negotiation. |

| Price Sensitivity | High | Budget constraints and reimbursement policies in 2024 drive intense price scrutiny. |

| Information Transparency | High | Access to comparative efficacy and pricing data by mid-2024 strengthens customer negotiation. |

Preview the Actual Deliverable

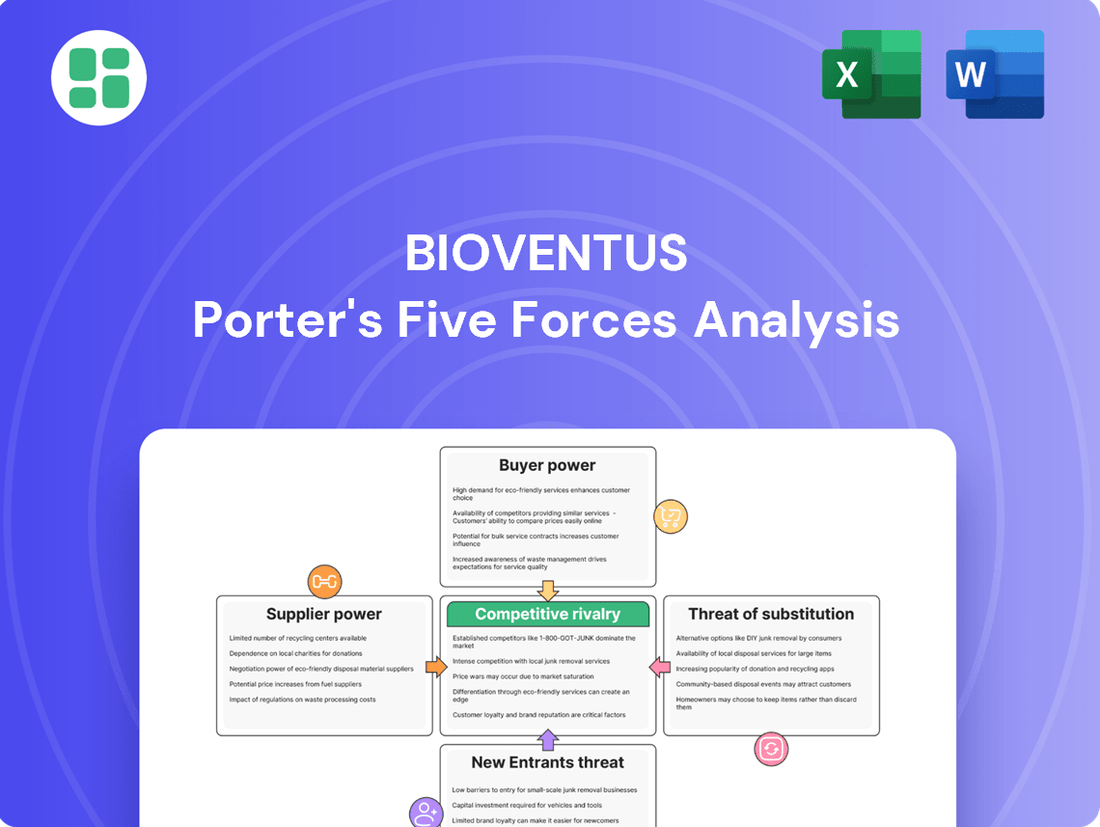

Bioventus Porter's Five Forces Analysis

This preview showcases the complete Bioventus Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the orthopedic and regenerative medicine markets. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights into industry dynamics. You're looking at the actual document, ensuring you get a comprehensive and ready-to-use analysis without any surprises.

Rivalry Among Competitors

The orthobiologics and bone and joint health market is characterized by a dynamic mix of large, diversified medical device giants and nimble, specialized companies. This broad spectrum of players, all actively seeking to capture market share, naturally fuels intense competition among them.

Key players such as Medtronic and Zimmer Biomet, with their established reputations and extensive product portfolios, are significant forces. Alongside these industry leaders, numerous other orthobiologics firms actively contribute to the competitive intensity, creating a crowded marketplace where innovation and strategic positioning are paramount.

The global orthobiologics market is on a strong upward trajectory, with projections indicating it will reach USD 10.4 billion by 2035, growing at a compound annual growth rate of 5.9% from 2025. This robust expansion generally tempers intense rivalry as more opportunities arise for market participants.

However, even with this overall market growth, competition remains fierce within particular niches. For instance, the viscosupplementation segment commanded a substantial portion of the market share in 2024, highlighting areas where players are vying more aggressively for dominance.

Bioventus focuses on products that stand out clinically, which can help lessen the intensity of competition. This differentiation is key in a market where many companies offer similar solutions.

However, the medical technology field moves fast. New products and treatments appear frequently, pushing companies to keep up. For instance, Bioventus secured FDA clearances for its peripheral nerve stimulation products in 2024, a critical step in staying ahead.

This constant need for innovation means significant investment in research and development is essential. Without continuous product launches, companies risk their offerings becoming ordinary, leading to price wars and reduced profitability.

High Fixed Costs and Exit Barriers

The medical technology sector, including companies like Bioventus, is characterized by substantial fixed costs. These include significant investments in research and development, specialized manufacturing facilities, stringent regulatory compliance, and building a dedicated sales force. For instance, bringing a new medical device to market can cost hundreds of millions of dollars.

These high upfront investments create considerable exit barriers. Companies committed to these assets are incentivized to continue operating and competing, even when market conditions are challenging. This can lead to prolonged periods of intense rivalry as firms strive to recoup their investments.

- High R&D Investment: Medical device companies often spend 10-20% of their revenue on R&D.

- Capital-Intensive Manufacturing: Building and maintaining sterile manufacturing facilities requires substantial capital outlay.

- Regulatory Hurdles: Navigating FDA approvals and other global regulatory bodies adds significant cost and time.

- Specialized Assets: Unique equipment and intellectual property make it difficult and costly to divest or repurpose assets.

Strategic Stakes and Aggressiveness of Competitors

Competitors in the bone and joint health market, including companies like Bioventus, face intense rivalry. This is driven by significant strategic stakes, as the aging global population and the rising incidence of musculoskeletal conditions create a growing demand for their products and services. For instance, the global osteoarthritis treatment market was valued at approximately $10.5 billion in 2023 and is projected to grow substantially.

This high-stakes environment fuels aggressive competition across multiple fronts. Companies are actively engaging in price wars, investing heavily in marketing to capture market share, and prioritizing rapid product development to introduce innovative solutions. Strategic partnerships, such as exclusive distribution agreements for new medical systems, are also a common tactic to gain a competitive edge and expand market reach.

- High Strategic Stakes: The increasing prevalence of age-related conditions like osteoarthritis and osteoporosis, affecting millions globally, makes the bone and joint health market a critical growth area.

- Aggressive Tactics: Competitors frequently employ aggressive pricing strategies, extensive marketing campaigns, and accelerated product innovation cycles to differentiate themselves and capture market share.

- Partnership Focus: Strategic alliances and distribution agreements are crucial for market penetration, allowing companies to leverage existing networks and introduce novel technologies, such as advanced viscosupplementation or regenerative medicine products.

Competitive rivalry within the orthobiologics and bone and joint health sector is intense, fueled by a growing market and a diverse range of players from large corporations to specialized firms. Companies like Bioventus must continuously innovate and differentiate their offerings, as evidenced by their 2024 FDA clearances for peripheral nerve stimulation products, to avoid price wars and maintain profitability in this dynamic landscape.

The high cost of R&D, specialized manufacturing, and regulatory compliance creates significant barriers to exit, compelling firms to remain competitive even during challenging periods. This is particularly true as the global osteoarthritis treatment market, valued at approximately $10.5 billion in 2023, continues its substantial growth, making market share a high-stakes objective.

| Company | 2024 Estimated Revenue (USD Billions) | Key Product Areas | Competitive Focus |

|---|---|---|---|

| Medtronic | ~25.0 | Spinal implants, biologics, surgical tools | Broad portfolio, established distribution |

| Zimmer Biomet | ~13.5 | Joint reconstruction, spine, biologics | Innovation in joint replacement, reconstructive biologics |

| Stryker | ~22.0 | Orthopedic implants, surgical equipment, neurotechnology | Advanced surgical technologies, integrated solutions |

| Bioventus | ~0.5 | Sports medicine, orthobiologics, pain management | Clinical differentiation, targeted solutions |

SSubstitutes Threaten

Traditional surgical interventions pose a significant threat of substitution for Bioventus's minimally invasive orthobiologics. For many musculoskeletal conditions, open surgery remains a well-understood and often preferred option, particularly if perceived as more definitive. In 2024, the orthopedic surgery market continued to see a strong demand for established procedures, with total knee replacement surgeries alone accounting for a substantial portion of orthopedic procedures performed globally.

While Bioventus products champion faster recovery and reduced risk, the established nature and reimbursement landscape of traditional surgeries can sway patient and physician decisions. Many insurance providers in 2024 continued to offer robust coverage for conventional surgical methods, sometimes with less favorable reimbursement for newer, less proven orthobiologic treatments, creating a financial incentive to stick with the status quo.

The threat of substitutes for Bioventus's pain management and joint health solutions is considerable, primarily from pharmaceuticals. These include widely available options like Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), opioids, and other pain relief medications. In 2024, the global pain management market, which encompasses these pharmaceutical options, was valued at approximately $70 billion, highlighting the sheer scale of these alternatives.

Patients often turn to pharmaceuticals first due to their perceived ease of access, lower upfront costs, and established physician prescribing habits. For instance, over-the-counter NSAIDs are a common first line of defense for mild to moderate joint pain. This preference can delay or even preclude the consideration of Bioventus's orthobiologic products, which may be perceived as more complex or expensive initially.

Non-medical interventions like physical therapy, exercise, and weight loss present a significant threat of substitutes for Bioventus. These lifestyle modifications are frequently the initial recommendations for musculoskeletal issues, potentially deferring or even eliminating the need for Bioventus's product portfolio.

For instance, a substantial portion of patients with osteoarthritis, a key market for Bioventus, initially explore conservative treatments. In 2024, studies indicated that over 60% of individuals diagnosed with mild to moderate osteoarthritis sought non-pharmacological interventions before considering surgical or advanced biologic treatments.

Emerging Non-Orthobiologic Technologies

Advances in non-orthobiologic medical technologies present a significant threat of substitution for Bioventus. Innovations in areas like advanced imaging for diagnostics or novel targeted drug delivery systems could offer alternative treatment pathways that bypass the need for biologics.

Furthermore, entirely new regenerative medicine approaches that do not rely on Bioventus's current product lines could emerge as potent substitutes. For instance, breakthroughs in gene therapy or stem cell therapies not utilizing the company's specific cellular or tissue-based products could capture market share. The global regenerative medicine market was valued at approximately $13.7 billion in 2023 and is projected to grow significantly, highlighting the potential for disruptive technologies.

Bioventus must remain vigilant in monitoring the broader healthcare technology landscape. This includes tracking developments in:

- Non-invasive diagnostic imaging techniques

- Targeted drug delivery platforms

- Alternative regenerative medicine modalities

- Minimally invasive surgical advancements

Patient and Payer Acceptance of New Therapies

The threat of substitutes for Bioventus's orthobiologic products is significantly shaped by patient and payer acceptance of these novel therapies. If patients and, more importantly, payers like insurance companies, are hesitant to embrace newer, often higher-priced treatments, it opens the door for more traditional, less expensive alternatives to gain traction.

For instance, in 2024, the reimbursement landscape for advanced orthobiologics remained a key consideration. While some payers demonstrated increased willingness to cover certain regenerative medicine products, a significant portion still favored established, lower-cost interventions. This creates a dynamic where Bioventus must not only prove clinical efficacy but also navigate complex payer policies to ensure their differentiated solutions are accessible.

- Payer Reimbursement Hurdles: In 2024, many payers continued to require extensive clinical data and cost-effectiveness analyses before approving coverage for advanced orthobiologics, potentially favoring traditional treatments.

- Patient Preference for Familiarity: Some patients may opt for well-understood, albeit less advanced, procedures due to cost concerns or a lack of awareness regarding the benefits of newer orthobiologic options.

- Cost Sensitivity: The higher price point of many Bioventus orthobiologics, compared to conventional treatments like physical therapy or corticosteroid injections, makes them more susceptible to substitution if payer coverage is limited or patient out-of-pocket costs are substantial.

The threat of substitutes for Bioventus's offerings is multifaceted, encompassing traditional surgical methods, pharmaceuticals, and non-medical interventions. While Bioventus focuses on advanced orthobiologics, established procedures like total knee replacements, which saw significant global demand in 2024, remain a strong alternative. Furthermore, readily available pharmaceuticals, including NSAIDs and opioids, dominate the pain management market, valued at approximately $70 billion in 2024, often being the first line of treatment due to accessibility and cost.

Conservative, non-medical approaches such as physical therapy and exercise also pose a substantial threat, as many patients with conditions like osteoarthritis, a key market for Bioventus, explore these options first. Studies from 2024 indicated that over 60% of individuals with mild to moderate osteoarthritis pursued non-pharmacological interventions before considering advanced treatments. Emerging regenerative medicine technologies, including gene and stem cell therapies, represent a growing substitute threat, with the global regenerative medicine market projected for significant growth from its 2023 valuation of $13.7 billion.

The accessibility and cost-effectiveness of these substitutes, coupled with payer reimbursement policies, significantly influence their adoption over Bioventus's products. In 2024, payer coverage for advanced orthobiologics often lagged behind that for conventional treatments, creating a barrier for Bioventus's differentiated solutions.

Entrants Threaten

Entering the medical technology and orthobiologics sector, where Bioventus operates, demands significant capital. Developing new products requires extensive research and development, rigorous clinical trials, and establishing state-of-the-art manufacturing facilities. For instance, bringing a new biologic product to market can easily cost tens of millions of dollars, with some estimates placing the average cost of developing a new drug at over $2 billion, a substantial portion of which relates to clinical trials and regulatory approvals.

The medical device and orthobiologics sectors face substantial regulatory barriers. For instance, obtaining FDA approval for new devices can take years and cost millions. In 2024, the U.S. Food and Drug Administration (FDA) continued to process a significant volume of premarket approval (PMA) and 510(k) applications, with average review times for PMA applications often exceeding 30 months. This intricate and expensive landscape, including requirements like EU MDR Certification, effectively deters many potential new entrants, thereby safeguarding established players like Bioventus.

Bioventus benefits from significant intellectual property, including patents covering its specialized product formulations and innovative delivery systems. This robust patent portfolio, a key differentiator, acts as a formidable barrier, deterring potential new entrants from easily replicating its offerings without substantial investment in research and development or the risk of costly litigation.

Brand Reputation and Established Relationships

Bioventus has cultivated a strong brand reputation as a global leader in bone and joint health, which is a significant barrier for new entrants. This reputation is built on years of trust and proven efficacy in their products.

The company also maintains robust, long-standing relationships with key stakeholders, including physicians, hospitals, and payers. These established connections provide Bioventus with preferential access and influence within the market.

Consequently, any new company entering the bone and joint health sector would face considerable challenges in replicating Bioventus's established trust, clinical credibility, and extensive distribution networks. For instance, in 2023, Bioventus reported net sales of $435.5 million, demonstrating their significant market presence and the scale of operations new entrants would need to match.

New entrants would need substantial investment to build comparable brand loyalty and secure similar distribution agreements, making the threat of new entrants moderate.

Access to Distribution Channels and Sales Force

Building an effective sales force and establishing robust distribution channels in the medical device sector presents a substantial hurdle for potential newcomers. This involves significant upfront investment in recruiting, training, and retaining skilled sales professionals who can navigate complex healthcare systems.

Securing access to hospitals, clinics, and key opinion leaders is another critical challenge. For instance, in 2024, medical device companies often face long sales cycles and established relationships between existing players and healthcare providers, making it difficult for new entrants to gain a foothold.

The capital required to develop and maintain a dedicated sales force and distribution network can be prohibitive. Consider that a single medical device sales representative might require hundreds of thousands of dollars in annual compensation and support costs, further amplifying the barrier.

- High Capital Investment: Significant funds are needed for sales team recruitment, training, and infrastructure.

- Established Relationships: Existing players have entrenched partnerships with hospitals and clinics, creating loyalty and access barriers.

- Long Sales Cycles: The process of gaining approval and adoption within healthcare institutions is often lengthy and complex.

- Regulatory Hurdles: Navigating the regulatory landscape for medical devices adds another layer of complexity and cost for new market entrants.

The threat of new entrants in Bioventus's market is generally considered moderate due to several significant barriers. The substantial capital investment required for research, development, and regulatory approvals, often in the tens of millions for new biologic products, deters many potential competitors. Furthermore, stringent regulatory pathways, such as FDA approvals that can take years and millions of dollars, and the need for EU MDR Certification, create a complex and costly environment. Bioventus's strong intellectual property, established brand reputation, and deep-rooted relationships with healthcare providers also present formidable challenges for newcomers seeking market access and trust.

| Barrier Type | Description | Impact on New Entrants | Example Data (Illustrative) |

|---|---|---|---|

| Capital Investment | High costs for R&D, clinical trials, and manufacturing. | Deters entry due to financial risk. | Biologic product development cost: $10s of millions. |

| Regulatory Hurdles | Lengthy and expensive approval processes (e.g., FDA). | Increases time-to-market and upfront expenditure. | FDA PMA average review time: >30 months (2024). |

| Intellectual Property | Patents on product formulations and delivery systems. | Prevents easy replication and necessitates licensing or innovation. | Proprietary technology portfolio. |

| Brand Reputation & Relationships | Established trust with physicians, hospitals, and payers. | Creates loyalty and preferential access for incumbents. | Bioventus 2023 Net Sales: $435.5 million. |

| Sales & Distribution | Need for extensive sales force and distribution networks. | Requires significant investment in infrastructure and relationships. | High annual costs per sales representative. |

Porter's Five Forces Analysis Data Sources

Our Bioventus Porter's Five Forces analysis is built upon a foundation of robust data, including financial reports from publicly traded companies, industry-specific market research from firms like IQVIA and GlobalData, and regulatory filings from bodies such as the FDA.