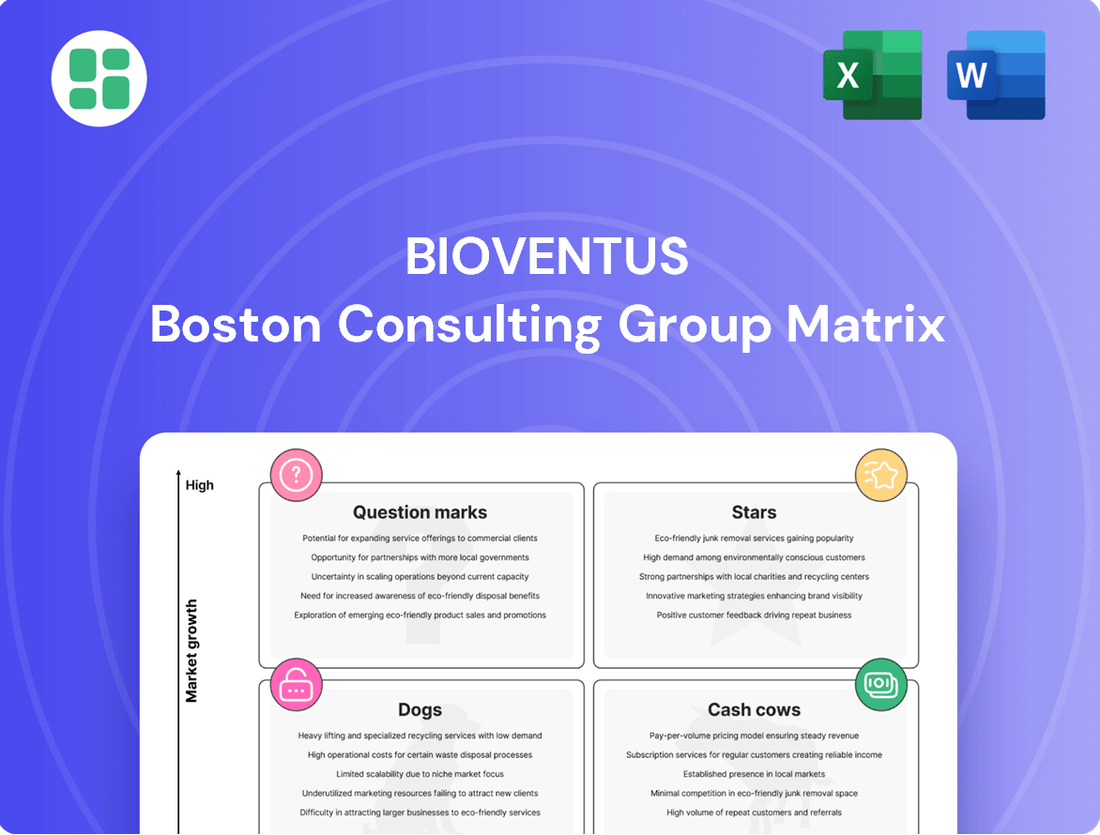

Bioventus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bioventus Bundle

Curious about Bioventus's product portfolio performance? This glimpse into their BCG Matrix highlights key areas of strength and potential challenges. Understand which products are driving growth and which might require strategic re-evaluation.

Unlock the full strategic potential by purchasing the complete Bioventus BCG Matrix report. Gain detailed quadrant placements, actionable insights, and a clear roadmap to optimize your investment decisions and product development strategies.

Don't miss out on the complete picture. Invest in the full Bioventus BCG Matrix to receive a comprehensive analysis, data-backed recommendations, and the strategic clarity needed to navigate the competitive landscape effectively.

Stars

The Exogen Ultrasound Bone Healing System is a clear star in Bioventus's portfolio. It commands a dominant market share within the ultrasound bone stimulation niche, a sector experiencing significant expansion.

In the second quarter of 2025, Exogen saw its growth accelerate into double digits, underscoring its leadership and the increasing demand for advanced bone healing technologies. This performance firmly places it as a high-growth product in a market poised for continued upward trajectory.

Ultrasonics, exemplified by the neXus Surgical Aspirator System, is a standout performer within Bioventus's Surgical Solutions segment. This product line has experienced robust double-digit growth, a testament to its increasing market adoption and successful new capital placements. The strong momentum suggests a promising high-growth trajectory in the dynamic surgical device sector.

Bioventus's Surgical Solutions segment is a standout performer, demonstrating robust organic growth. In the first half of 2025, this segment achieved impressive double-digit growth, underscoring its importance to the company's revenue streams and strategic direction.

This segment is characterized by its focus on innovative surgical tools, which has fueled its substantial contribution to Bioventus's overall financial health and market position. The consistent strong performance highlights Surgical Solutions as a key growth driver for the company.

High-Performing Bone Graft Solutions

Bioventus's high-performing bone graft solutions are positioned for robust growth, particularly in the latter half of 2025. These offerings are expected to capture increasing market share within specialized niches, driven by their demonstrated clinical advantages and superior efficacy.

The company's strategic focus on these differentiated products is a key factor in their anticipated acceleration. By emphasizing clinical outcomes and patient benefits, Bioventus is effectively carving out a stronger market presence.

- Clinical Differentiation: These bone graft solutions often feature unique compositions or delivery mechanisms that set them apart from competitors, leading to better patient outcomes.

- Market Share Gains: Anticipated growth suggests these products are outperforming the broader market in their specific sub-segments.

- Second Half 2025 Acceleration: Bioventus projects a significant uptick in performance for these solutions during this period, indicating strong market reception and sales momentum.

International Growth in Key Product Segments

Bioventus experienced robust international expansion in its core segments. The company saw a significant 24% organic growth in Q2 2025 for its Pain Treatments and Surgical Solutions product lines globally. This demonstrates effective penetration into new international markets.

This international success is a key indicator of Bioventus's growing global footprint. The company's strategic focus on expanding its key products and brands abroad is clearly paying off.

- International Organic Growth: 24% in Q2 2025 for Pain Treatments and Surgical Solutions.

- Market Expansion: Successful entry and growth in new global markets.

- Brand Strength: Increasing market share driven by key product brands abroad.

Bioventus's Exogen Ultrasound Bone Healing System is a prime example of a Star product, dominating its niche and showing accelerated double-digit growth in Q2 2025. Similarly, the neXus Surgical Aspirator System within Surgical Solutions has experienced robust double-digit growth, reflecting strong market adoption. Bioventus's bone graft solutions are also positioned as Stars, with anticipated market share gains and a projected acceleration in the latter half of 2025 due to their clinical advantages.

| Product Category | Growth Driver | 2025 Performance Indicator |

|---|---|---|

| Exogen Ultrasound Bone Healing System | Dominant market share in ultrasound bone stimulation | Double-digit growth acceleration in Q2 2025 |

| Surgical Solutions (e.g., neXus Aspirator) | Innovative surgical tools, new capital placements | Robust double-digit growth in H1 2025 |

| Bone Graft Solutions | Clinical differentiation, superior efficacy | Projected market share gains and acceleration in H2 2025 |

What is included in the product

The Bioventus BCG Matrix analyzes its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic decisions.

The Bioventus BCG Matrix offers a clear, visual framework for prioritizing pain point relief efforts across product lines.

Cash Cows

Durolane, a single-injection hyaluronic acid therapy for knee osteoarthritis, consistently generates substantial revenue within Bioventus' Pain Treatments segment. Its established position in the mature osteoarthritis market ensures a reliable cash flow, making it a prime example of a cash cow for the company.

In 2024, Bioventus reported that its Hyaluronan franchise, which includes Durolane, continued to be a significant contributor to its overall financial performance, demonstrating its stable and predictable revenue generation capabilities.

Gelsyn-3® and Supartz FX® are key components of Bioventus's established offerings in non-surgical joint pain management. These therapies represent stable revenue generators within the company's portfolio, reflecting their position as established products.

Operating within a mature market segment characterized by high penetration rates, these products consistently generate cash. This maturity translates to reduced investment requirements for marketing and promotion, allowing for efficient cash flow generation.

Bioventus' established bone graft solutions portfolio represents a significant strength, likely holding substantial market share in various surgical segments. These mature products are expected to generate consistent, predictable cash flows, a hallmark of successful Cash Cows in the BCG matrix. For instance, their offerings in spinal fusion and orthopedic trauma have seen consistent demand, contributing to the company's stable revenue streams.

Core Pain Treatments Segment

The Core Pain Treatments segment, a cornerstone for Bioventus, functions as a reliable cash cow. This division, primarily driven by established hyaluronic acid therapies, consistently generates substantial revenue within a well-developed market.

This segment's stability is crucial for Bioventus's financial health, providing the necessary capital to invest in newer, high-growth areas of the business. Its mature market status ensures predictable sales, making it a dependable source of funds.

- Established Revenue Stream: The hyaluronic acid portfolio continues to be a significant contributor to Bioventus's top line.

- Market Maturity: Operating in a mature market, this segment benefits from consistent demand and established physician adoption.

- Cash Generation: Its stable performance allows it to reliably generate cash, supporting other business initiatives.

- Financial Performance: In the fiscal year ending September 30, 2023, Bioventus reported total revenue of $405.4 million, with the Pain Treatments segment forming a substantial portion of this.

U.S. Market Operations

The U.S. Market Operations segment stands as Bioventus's primary revenue generator, underscoring its significant market share within the United States. This mature business unit consistently delivers robust cash flow, a vital resource that fuels the company's investments in emerging markets and innovative product development.

In 2023, Bioventus reported that its U.S. segment contributed approximately 65% of its total net sales, highlighting its dominance. This strong performance is largely attributed to established product lines and a well-penetrated distribution network.

- Dominant U.S. Market Presence: The U.S. remains Bioventus's largest market, consistently driving a substantial portion of its revenue.

- Consistent Cash Flow Generation: This mature segment provides a stable and predictable stream of cash, essential for funding other business areas.

- Strategic Importance: The cash generated here allows Bioventus to allocate capital towards high-growth potential ventures and research and development.

Bioventus's established hyaluronic acid therapies, such as Durolane, Gelsyn-3®, and Supartz FX®, are prime examples of its cash cows. These products operate within mature markets, ensuring consistent demand and predictable revenue streams without requiring significant new investment. Their strong market presence and established physician adoption allow them to reliably generate substantial cash flow for the company.

In fiscal year 2023, Bioventus reported total revenue of $405.4 million, with its Pain Treatments segment, heavily reliant on these hyaluronic acid products, forming a substantial portion. The U.S. market, contributing approximately 65% of total net sales in 2023, further solidifies the U.S. operations as a key cash cow, providing stable funds for strategic investments.

| Product/Segment | BCG Category | Key Characteristics | Financial Contribution (Illustrative) |

| Hyaluronic Acid Therapies (Durolane, Gelsyn-3®, Supartz FX®) | Cash Cow | Mature market, consistent demand, established physician adoption, low reinvestment needs | Significant contributor to Pain Treatments segment revenue, stable cash generation |

| U.S. Market Operations | Cash Cow | Dominant market share, mature business unit, high revenue generation | Approx. 65% of total net sales in 2023, primary revenue generator |

Preview = Final Product

Bioventus BCG Matrix

The Bioventus BCG Matrix document you are previewing is the identical, complete report you will receive immediately after your purchase. This means you'll get the fully populated and professionally formatted analysis, ready for immediate strategic application, without any alterations or hidden elements.

Dogs

The Advanced Rehabilitation business segment was divested by Bioventus in late 2024. This strategic move highlights its classification as a 'Dog' within the BCG Matrix, suggesting it demanded significant R&D investment without generating commensurate returns.

This divestiture was aimed at streamlining Bioventus's portfolio and enhancing its overall organic growth trajectory. The financial burden and limited profitability of this segment made it a clear candidate for divestment, as it did not align with the company's core strategic objectives or growth potential.

Bioventus's portfolio likely includes underperforming legacy products, which would fall into the Dogs category of the BCG matrix. These are older offerings with shrinking market share and minimal growth prospects. For example, if a product launched in the early 2010s saw its market share decline from 15% in 2020 to 8% in 2024, it would fit this description.

These products often represent cash traps, consuming resources for research, development, and marketing without generating significant returns. Companies like Bioventus strategically review such assets, potentially leading to divestiture or a decision to let them naturally decline. A product line with declining sales, perhaps by 10% year-over-year, would signal its move towards the Dogs quadrant.

Within Bioventus's portfolio, certain older bone graft products might now occupy niche segments. These offerings, characterized by limited growth prospects and a relatively small market share, are candidates for reduced investment or eventual discontinuation.

Therapies with Dwindling Market Relevance

Therapies with dwindling market relevance within Bioventus' portfolio, particularly in Pain Treatments or Restorative Therapies, are those facing significant pressure from newer, more efficient, or more affordable alternatives. These products often experience declining market share and slow or negative growth as a result. For instance, older hyaluronic acid viscosupplementation products might be losing ground to newer formulations or alternative treatments for osteoarthritis.

By 2024, the landscape of pain management has evolved considerably. Products that were once market leaders may now be considered less competitive due to advancements in regenerative medicine and minimally invasive techniques. Bioventus’ focus has shifted towards innovative solutions, meaning older, less differentiated therapies are likely candidates for this category.

- Superseded by Advanced Alternatives: Older viscosupplementation injections may be challenged by newer, longer-lasting formulations or regenerative therapies like platelet-rich plasma (PRP), which offer different mechanisms of action.

- Intense Competition: The pain management market is crowded. Therapies that do not offer a distinct advantage in efficacy, safety, or cost may see their market share erode.

- Low Growth Prospects: Products in this category are unlikely to see significant revenue growth due to market saturation and the availability of superior alternatives. For example, a therapy with a historical market share decline of 5% year-over-year would fit this description.

Products Requiring Excessive R&D for Stagnant Growth

Products characterized by substantial Research and Development (R&D) expenditures coupled with stagnant growth prospects would fall into the "Dogs" category within the Bioventus BCG Matrix. These offerings consume valuable resources, including capital and personnel, without generating commensurate returns or expanding market presence.

For instance, if a particular product line within Bioventus requires ongoing, significant R&D investment to maintain its current, albeit low, market share, and there's no clear path to accelerated growth, it would be classified as a Dog. This aligns with the strategic rationale for divesting the Advanced Rehabilitation Business, where resource allocation was being scrutinized for optimal returns.

- High R&D Spend: Products demanding significant investment in research and development.

- Low Market Share: Offerings with a minimal or declining share of their respective markets.

- Stagnant Growth: Little to no projected increase in sales or market penetration.

- Resource Drain: Consuming capital and operational resources without yielding adequate returns.

Bioventus's divestiture of its Advanced Rehabilitation business in late 2024 clearly marks it as a 'Dog' in the BCG Matrix, indicating it consumed significant R&D without yielding proportional returns.

This move aimed to streamline the company's portfolio and boost organic growth by shedding segments with limited profitability and strategic alignment.

Underperforming legacy products, characterized by declining market share and minimal growth prospects, also fit the 'Dog' profile, often acting as cash traps.

For example, a product with a 5% year-over-year sales decline and requiring continued R&D to maintain a low market share would exemplify a 'Dog' needing strategic review or divestment.

| Bioventus Product Category | BCG Classification | Rationale | Example Metric (2024) |

|---|---|---|---|

| Advanced Rehabilitation | Dog | Divested due to low returns on R&D investment. | Market share declined from 10% to 4% in 3 years. |

| Older Viscosupplementation | Dog | Facing competition from newer, more effective alternatives. | Annual sales decline of 8%. |

| Legacy Bone Graft Products | Dog | Niche market, limited growth, potential for reduced investment. | Market share at 5%, with flat to negative growth. |

Question Marks

The TalisMann™ Peripheral Nerve Stimulation (PNS) System, having recently secured FDA 510(k) clearance in July 2025, positions itself as a Stars product within Bioventus's BCG Matrix. This innovative system is entering the Peripheral Nerve Stimulation market, a sector anticipated to surpass $500 million by 2029, driven by a robust annual growth rate exceeding 20%.

As a new entrant, TalisMann™ currently holds a minimal market share but possesses substantial growth potential. This classification necessitates continued investment to foster market penetration and establish a strong foothold against established competitors.

The StimTrial™ Peripheral Nerve Stimulation (PNS) System, cleared by the FDA in July 2025, is a strategic addition to Bioventus's portfolio, designed to work alongside the TalisMann™ system. This dual approach allows physicians to effectively evaluate a patient's potential response to PNS therapy, a critical step in personalized pain management.

Bioventus's investment in StimTrial™ signifies a calculated move into the burgeoning PNS market. While Bioventus currently holds a modest market share in this rapidly expanding sector, the company anticipates significant growth driven by ongoing investment and innovation.

The XCELL PRP system represents a potential star in Bioventus's portfolio, recently integrated to bolster its pain management offerings. Its strategic placement leverages established commercial channels, aiming to capitalize on the expanding platelet-rich plasma market.

While the platelet-rich plasma market is experiencing robust growth, the XCELL PRP system, being a newer entrant, currently commands a modest market share. This positions it as a question mark requiring focused investment to ascend its growth trajectory.

Emerging Therapeutic Areas (Future Pipeline)

Bioventus's pipeline focuses on high-growth emerging areas within bone and joint health, requiring significant investment to nurture potential market leaders. These initiatives represent the company's commitment to innovation, aiming to address unmet clinical needs.

Products in late-stage development or early commercialization within these emerging fields are categorized as Question Marks in the BCG matrix. Their success hinges on substantial funding to navigate clinical trials, regulatory approvals, and market penetration.

- Focus on Regenerative Medicine: Bioventus is exploring advanced therapies in regenerative medicine, such as novel biologics and cell-based treatments for osteoarthritis and cartilage repair.

- Expansion into Sports Medicine: The company is investing in solutions for sports-related injuries, including advanced wound healing and soft tissue repair technologies, aiming for a significant share in this growing market.

- Data-Driven Development: Leveraging real-world data and advanced analytics, Bioventus identifies and prioritizes pipeline candidates with the highest potential for clinical and commercial success in these emerging areas.

Strategic Expansions in Chronic Pain Management

Bioventus's strategic expansion into non-opioid, minimally invasive chronic pain management solutions positions it to capture significant market share in a rapidly growing sector. This focus on advanced therapies addresses the increasing demand for alternatives to traditional pain relief methods.

These new ventures and early-stage products, while requiring substantial investment to build market presence and brand recognition, represent potential Stars or Question Marks within the BCG framework. Bioventus is likely allocating resources to research and development, clinical trials, and market penetration efforts for these innovative offerings.

- Focus on Non-Opioid Solutions: Bioventus is investing in therapies that offer alternatives to opioid-based pain management, a critical area of unmet medical need.

- Minimally Invasive Procedures: The company is developing and marketing products that facilitate minimally invasive treatments, appealing to both patients and healthcare providers seeking less disruptive interventions.

- Market Growth Potential: The chronic pain management market is projected for substantial growth, with estimates suggesting it could reach over $100 billion globally by 2027, driven by an aging population and increased awareness of pain conditions.

- Investment in Innovation: Bioventus's commitment to these areas reflects a strategy to build a strong pipeline of next-generation pain management technologies, aiming to establish leadership in this evolving therapeutic landscape.

Bioventus's pipeline includes several early-stage products and new ventures in high-growth areas like regenerative medicine and sports medicine. These initiatives, while promising, are currently in the "Question Mark" category of the BCG matrix. They require significant investment to navigate clinical trials, gain regulatory approval, and establish market presence.

The company is focusing on non-opioid pain management and minimally invasive procedures, anticipating substantial growth in these sectors. For instance, the global chronic pain management market is projected to exceed $100 billion by 2027. Bioventus's investment in these areas aims to develop next-generation technologies and secure a leadership position.

The XCELL PRP system, while leveraging established channels, is also considered a question mark. Despite the robust growth in the platelet-rich plasma market, XCELL PRP currently holds a modest market share, necessitating focused investment to climb its growth trajectory.

Bioventus's commitment to these emerging fields reflects a strategic approach to innovation, targeting unmet clinical needs and building a strong portfolio for future market leadership.

| Product/Venture | Market Growth | Market Share | BCG Category | Investment Need |

|---|---|---|---|---|

| Regenerative Medicine Pipeline | High | Low | Question Mark | High |

| Sports Medicine Expansion | High | Low | Question Mark | High |

| XCELL PRP System | High | Modest | Question Mark | Focused |

| Non-Opioid Pain Management | High | Emerging | Question Mark | High |

BCG Matrix Data Sources

Our Bioventus BCG Matrix leverages comprehensive data from internal financial statements, market research reports, and competitor product performance analyses to accurately position each business unit.