BioLife Solutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BioLife Solutions Bundle

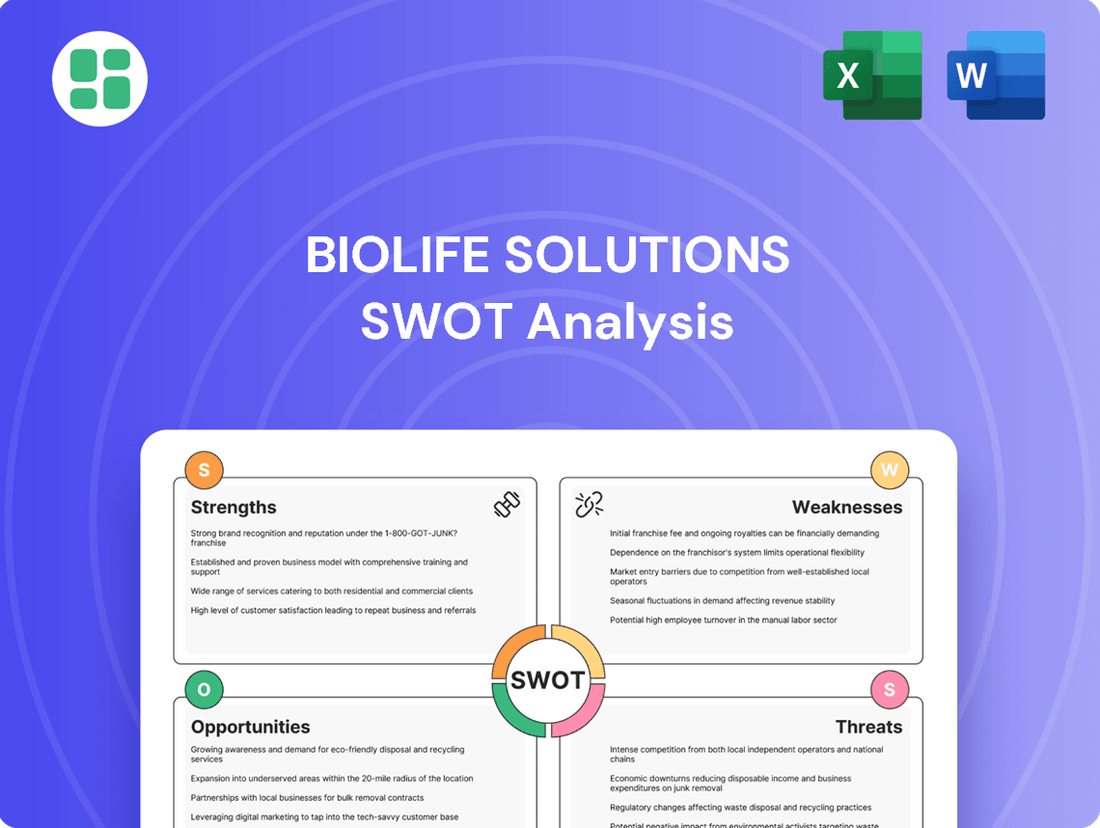

BioLife Solutions is positioned for growth with its innovative preservation media and biopreservation tools, but faces challenges in market adoption and competition. Our comprehensive SWOT analysis dives deep into these factors, providing a clear roadmap for strategic advantage.

Want the full story behind BioLife Solutions' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BioLife Solutions stands out as a premier developer and provider of biopreservation tools and services, a critical component for the burgeoning cell and gene therapy (CGT) sector. Their offerings, such as specialized biopreservation media and innovative thaw devices, are integral to the successful development and commercialization of cell-based treatments.

The company's solutions are actively utilized in a significant number of approved therapies and ongoing clinical trials, underscoring their vital role in bringing advanced medical treatments to market. This deep integration showcases BioLife Solutions' established expertise and trust within the CGT ecosystem.

This focused specialization grants BioLife Solutions a substantial competitive edge within a highly specialized and rapidly growing segment of the life sciences industry. Their leadership position is further solidified by their ability to support therapies that have reached commercialization, a testament to the reliability and efficacy of their products.

BioLife Solutions has shown impressive financial strength, with its Cell Processing segment consistently growing year-over-year and quarter-over-quarter. For instance, Q1 2025 saw a significant 33% jump in cell processing revenue compared to Q1 2024.

The company has also reaffirmed its full-year 2025 revenue projections, anticipating growth between 16% and 20%, translating to an estimated revenue of $95.5 million to $99.0 million. This strong financial outlook is further bolstered by a solid balance sheet, including over $100 million in cash reserves.

BioLife Solutions has strategically optimized its portfolio throughout 2024, a key strength. They divested less profitable segments, such as their freezer and biostorage operations, including the SciSafe business which was sold for $73 million. This move allows for a concentrated effort on their more lucrative, proprietary cell processing technologies.

This portfolio reshaping has demonstrably boosted BioLife's financial performance. Gross margins and adjusted EBITDA margins have seen improvements, signaling enhanced operational efficiency and a clearer strategic direction. The company is now positioned as a more focused enabler within the rapidly growing cell and gene therapy (CGT) market.

Critical Role in High-Growth Industries

BioLife Solutions plays a critical role in high-growth industries, particularly regenerative medicine and cell and gene therapy. Its products are essential for preserving cells, tissues, and organs, which is crucial for the development and delivery of these advanced therapies. This positions BioLife as a key enabler in a sector experiencing significant expansion.

The demand for BioLife's solutions is directly tied to the burgeoning pipeline of cell and gene therapies. With more than 1,200 CGT therapies currently in clinical trials worldwide, the need for reliable preservation and transport media is substantial and growing. This robust clinical trial activity indicates a strong future market for BioLife's specialized offerings.

- Indispensable for CGT: BioLife's media extend the viability and transportability of cells and tissues, critical for CGT development.

- Market Growth Driver: Over 1,200 CGT therapies in global clinical trials underscore the increasing demand for BioLife's preservation solutions.

- Enabling Innovation: The company's products facilitate the advancement of life-saving regenerative medicine treatments.

Innovation through Acquisitions

BioLife Solutions leverages strategic acquisitions to bolster its biopreservation media and scientific expertise. A prime instance is the April 2025 acquisition of PanTHERA CryoSolutions, integrating cutting-edge Ice Recrystallization Inhibitor (IRI) technology into its offerings.

This acquisition-driven approach enables BioLife Solutions to:

- Expand its product portfolio with advanced cryopreservation solutions.

- Address the dynamic needs of its customer base in the cell and gene therapy markets.

- Reinforce its market leadership by incorporating novel technologies.

BioLife Solutions' core strength lies in its specialized focus on the high-growth cell and gene therapy (CGT) market, where its biopreservation media and thaw devices are essential for product development and commercialization. The company's deep integration into numerous approved therapies and ongoing clinical trials, exceeding 1,200 globally, highlights its critical role and established trust within this sector. This specialization, coupled with strategic portfolio optimization in 2024, including the $73 million divestiture of its SciSafe business, has sharpened its focus on profitable, proprietary technologies and improved its financial performance, as evidenced by a 33% year-over-year revenue increase in its Cell Processing segment for Q1 2025.

What is included in the product

Delivers a strategic overview of BioLife Solutions’s internal and external business factors, highlighting its strengths in cell preservation media and opportunities in the growing cell and gene therapy market, while also addressing potential weaknesses in manufacturing scale and threats from competition.

Offers a clear, actionable framework for identifying and mitigating risks in the cell and gene therapy supply chain.

Weaknesses

BioLife Solutions' significant reliance on the niche cell and gene therapy (CGT) market presents a notable weakness. While this sector is experiencing robust expansion, BioLife's growth is intrinsically tied to the pace of new CGT therapy commercialization and regulatory approvals.

Any deceleration in the development pipeline, funding challenges for emerging therapies, or unexpected regulatory hurdles could directly dampen demand for BioLife's essential biopreservation solutions. For instance, if the anticipated ramp-up of CAR-T therapy production, a key driver for biopreservation needs, faces unforeseen delays in 2024 or 2025, BioLife's revenue projections could be negatively impacted.

BioLife Solutions' revenue is intrinsically linked to the success and funding of its clients in the burgeoning cell and gene therapy (CGT) sector. When biotech companies face economic headwinds or funding challenges, their research and development budgets often shrink. This directly impacts BioLife, as reduced client R&D activity can translate into lower demand for its critical biopreservation media and services. For instance, a slowdown in clinical trial funding for CGT therapies could mean fewer patients being treated, and consequently, less need for BioLife's cryopreservation solutions.

While strategic, BioLife Solutions' divestiture of non-core assets, such as its freezer and biostorage businesses, has undeniably impacted its total reported revenue. This move, aimed at enhancing margins and sharpening focus, resulted in a noticeable reduction in top-line figures when compared to prior periods. For example, the Evo and Thaw platform revenue experienced an 8% decrease in the fourth quarter of 2024 relative to the same quarter in 2023.

This reduction in revenue, even with improved profitability, can create a perception of shrinking overall business size. Investors and analysts often scrutinize top-line growth, and a decline, even if strategically driven, may require careful explanation to maintain confidence in the company's trajectory. It's a classic trade-off between immediate revenue scale and long-term profitability and strategic alignment.

Operational Expense Increases

BioLife Solutions has faced challenges with rising operational expenses. In the first quarter of 2025, GAAP operating expenses saw an increase compared to the same period in 2024. This rise was largely driven by higher costs associated with sales and fees related to acquisitions.

While some of these increased costs can be attributed to the company's expansion and strategic acquisitions, such as the integration of new businesses, sustained upward pressure on operating expenditures could impact profitability. Effective cost management will be crucial to ensure that these investments translate into long-term financial health.

Key factors contributing to the increase in operational expenses in Q1 2025 included:

- Increased Cost of Sales: Higher expenses incurred in producing and delivering goods or services.

- Acquisition-Related Fees: Costs associated with integrating newly acquired companies, including legal, accounting, and integration expenses.

- Potential Impact on Profitability: If not offset by revenue growth or efficiency gains, these rising costs could narrow profit margins.

Competition from Larger Players

BioLife Solutions operates in markets populated by much larger, more diversified companies. These giants possess significantly greater financial resources, enabling them to pour more into research and development, expand manufacturing capabilities, and build more robust distribution networks. This disparity in scale means BioLife faces an uphill battle against entities that can absorb costs and innovate at a faster pace.

While BioLife has carved out a strong position in its specific biopreservation niche, the threat of larger players entering or increasing their focus on this area is a significant weakness. For instance, a major medical device company with substantial R&D budgets could develop competing technologies. Such a move could erode BioLife's market share and put downward pressure on its pricing power, impacting revenue growth. As of Q1 2024, BioLife reported revenue of $42.2 million, a testament to its current success, but the potential for larger competitors to disrupt this could be substantial.

- Resource Disparity: Larger competitors in the broader medical equipment and biopharma sectors have access to far greater capital for R&D, manufacturing, and distribution compared to BioLife.

- Market Share Erosion Risk: A significant investment by a larger, diversified company into biopreservation technologies could directly challenge BioLife's existing market share.

- Pricing Pressure: Increased competition from well-funded players may force BioLife to lower prices, impacting its profitability and pricing power.

BioLife Solutions' concentrated focus on the cell and gene therapy (CGT) market, while a strength, also represents a weakness due to its dependency on the sector's growth and regulatory approvals. Delays in CGT commercialization or funding issues for emerging therapies could directly impact BioLife's demand for its biopreservation solutions, as seen in potential slowdowns in CAR-T therapy production impacting revenue projections for 2024-2025.

The company's revenue is closely tied to the financial health and R&D spending of its CGT clients. Economic headwinds affecting biotech companies can lead to reduced budgets, directly decreasing demand for BioLife's products, a risk highlighted by potential impacts from clinical trial funding slowdowns.

Divesting non-core assets, while strategic for margins, has reduced BioLife's reported revenue. For example, the Evo and Thaw platform revenue saw an 8% decrease in Q4 2024 compared to Q4 2023, potentially creating a perception of shrinking scale despite improved profitability.

Rising operational expenses, particularly in Q1 2025, driven by increased cost of sales and acquisition-related fees, could pressure profit margins if not offset by revenue growth or efficiency gains.

BioLife faces significant competition from larger, more diversified companies with greater financial resources, which can hinder its R&D, manufacturing, and distribution capabilities. This resource disparity, coupled with the risk of market share erosion from larger players entering the biopreservation niche, poses a substantial challenge, especially considering BioLife's Q1 2024 revenue of $42.2 million against potentially massive competitor investments.

Full Version Awaits

BioLife Solutions SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of BioLife Solutions' strategic positioning.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You'll gain immediate access to a detailed breakdown of BioLife Solutions' Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing actionable insights for BioLife Solutions' future strategies.

Opportunities

The growing pipeline of cell and gene therapies entering clinical trials and securing regulatory approvals is a major growth avenue for BioLife Solutions. As of early 2024, the FDA has approved over 50 cell and gene therapies, with hundreds more in various stages of development, indicating a robust market expansion.

This surge in therapeutic development directly translates to increased demand for BioLife's specialized biopreservation media and thawing solutions. As these advanced treatments transition from research to commercial scale, the need for consistent, high-quality preservation throughout the supply chain will escalate, providing BioLife with significant opportunities for increased sales and market share.

BioLife Solutions can tap into growing cell and gene therapy markets in regions like Asia-Pacific, where investments in biotech are surging, potentially mirroring the growth seen in North America. For instance, South Korea's biotech sector saw significant investment in 2024, creating new opportunities.

Expanding into adjacent life science segments, such as advanced biopreservation for regenerative medicine or even specialized diagnostic sample handling, could open up substantial new revenue channels. The global regenerative medicine market is projected to reach over $100 billion by 2030, indicating a vast untapped potential.

BioLife Solutions has a proven track record of successful inorganic growth, exemplified by its acquisition of PanTHERA CryoSolutions. This strategic move not only expanded their cryopreservation media portfolio but also integrated a significant player in the cell and gene therapy market.

Further strategic acquisitions of companies with complementary technologies or innovative solutions are a key opportunity. For instance, acquiring businesses that enhance their cold chain logistics or expand their cell processing capabilities could significantly bolster their market position.

Partnerships with leading academic institutions or biotech firms can also drive innovation and market penetration. Such collaborations, potentially announced in late 2024 or early 2025, could lead to the co-development of next-generation bioproduction tools, further solidifying BioLife's leadership.

Technological Advancements in Biopreservation

Ongoing advancements in cryopreservation and biopreservation technologies, such as novel formulations and devices, offer BioLife Solutions a significant opportunity to drive innovation and launch next-generation products. Staying at the forefront of these developments is crucial for maintaining a competitive edge in the rapidly evolving cell and gene therapy market.

BioLife Solutions can capitalize on these technological leaps by strategically investing in research and development or through targeted acquisitions of companies possessing cutting-edge capabilities. For instance, integrating technologies like PanTHERA's IRI technology could enhance their product offerings and provide superior solutions to their clients.

- Innovation Potential: New biopreservation methods can lead to improved cell viability and functionality post-thaw.

- Market Expansion: Advanced technologies can attract new customer segments within the regenerative medicine sector.

- Competitive Advantage: Early adoption and integration of novel technologies, like those acquired through strategic partnerships or M&A, can differentiate BioLife Solutions from competitors.

Increased Revenue per Dose from Commercial Therapies

As more of BioLife Solutions' biopreservation media becomes integral to approved commercial cell and gene therapies (CGTs), the company is positioned for higher revenue generation per dose. This trend is already evident, with commercial therapy clients now forming a substantial part of their biopreservation media revenue. This indicates a robust and scalable business model that grows in tandem with the success of their clients' products.

For instance, BioLife Solutions reported that its commercial biopreservation media revenue saw significant growth in 2023, driven by an expanding base of commercial CGT customers. This growth trajectory suggests a strong demand for their specialized media as therapies move from clinical trials to widespread market availability.

- Growing Commercial Adoption: BioLife's media is increasingly used in therapies approved for commercial sale, directly translating to more consistent and higher-value sales.

- Revenue Scalability: The business model inherently scales with the success and patient volume of the CGT products utilizing their media.

- Resilient Revenue Streams: Commercial sales offer a more predictable and durable revenue stream compared to early-stage clinical trial supply.

BioLife Solutions is well-positioned to benefit from the increasing number of cell and gene therapies (CGTs) moving into commercial production. As these advanced treatments gain regulatory approval and market traction, the demand for BioLife's critical biopreservation media and thawing solutions will naturally rise, offering a direct path to increased revenue. This trend is already being observed, with commercial CGT clients contributing a growing portion of BioLife's biopreservation media revenue, demonstrating the scalability of their business model.

The company's strategic acquisitions, such as the integration of PanTHERA CryoSolutions, have broadened its product portfolio and strengthened its market presence. Continued pursuit of similar strategic acquisitions that offer complementary technologies or expand their service offerings, like cold chain logistics or cell processing capabilities, presents a significant opportunity for further growth and market leadership. Partnerships with key research institutions and biotech firms also offer a pathway to co-develop next-generation bioproduction tools, fostering innovation and expanding market reach.

Furthermore, BioLife Solutions can leverage ongoing technological advancements in biopreservation and cryopreservation. By investing in research and development or acquiring companies with cutting-edge capabilities, BioLife can introduce innovative, next-generation products. This focus on innovation is crucial for maintaining a competitive edge in the rapidly evolving CGT landscape and capturing new market segments, such as regenerative medicine.

| Opportunity Area | Description | Potential Impact | Supporting Data (2024/2025 Focus) |

|---|---|---|---|

| Expanding CGT Market | Increasing regulatory approvals and commercialization of cell and gene therapies. | Higher demand for biopreservation media and thawing solutions. | Over 50 FDA-approved CGTs as of early 2024, with hundreds in development. |

| Strategic Acquisitions & Partnerships | Acquiring complementary technologies and collaborating with research institutions. | Enhanced product portfolio, market penetration, and innovation. | Acquisition of PanTHERA CryoSolutions; growing biotech investments in Asia-Pacific (e.g., South Korea). |

| Technological Advancement | Developing and integrating novel biopreservation and cryopreservation methods. | Improved product offerings, competitive advantage, and new revenue streams. | Global regenerative medicine market projected to exceed $100 billion by 2030. |

| Commercial Adoption Growth | Increasing use of BioLife's media in commercially approved therapies. | Scalable revenue growth tied to therapy success and patient volume. | Significant growth in commercial biopreservation media revenue reported in 2023. |

Threats

The biotech industry moves incredibly fast, meaning new and better ways to preserve biological materials could pop up. If a competitor creates a technology that preserves samples much more effectively, costs less to use, or is easier to handle, BioLife Solutions' existing products might become outdated or less popular. For instance, a breakthrough in cryopreservation techniques could directly challenge BioLife's current offerings.

As the cell and gene therapy market continues to grow and attract new entrants, BioLife Solutions faces the threat of intensified competition in the biopreservation tools and services space. This maturing market could see more companies vying for market share, potentially leading to significant pricing pressures.

This increased competition may force BioLife Solutions to either accept lower profit margins or significantly boost its investment in sales and marketing efforts to defend its current market position. For instance, as of early 2024, the cell and gene therapy market is projected to reach over $30 billion by 2030, indicating substantial growth but also a magnet for new competitors.

The cell and gene therapy sector, a core market for BioLife Solutions, operates under strict regulatory oversight. Any shifts in these guidelines or prolonged delays in securing approvals for novel therapies can directly affect BioLife's clientele, potentially impacting its revenue streams. For instance, the FDA's Center for Biologics Evaluation and Research (CBER) has been actively refining pathways for advanced therapies, but the inherent complexity can lead to extended review periods, as seen with some gene therapy applications facing multi-year development and approval timelines.

Economic Downturns Affecting Biotech Funding

Broader economic instability, particularly a downturn in venture capital and public funding markets, poses a significant threat to the biotech sector. This could directly impact BioLife Solutions by reducing investment in research and development and clinical trials for cell and gene therapies. For instance, a significant contraction in biotech venture funding, as seen in periods of economic uncertainty, could lead to fewer companies advancing therapies, thereby decreasing demand for BioLife's critical preservation media and thawing solutions. The biotech industry's reliance on external capital makes it particularly vulnerable to macroeconomic shifts, with funding rounds becoming more challenging to secure during economic contractions.

Specifically, a slowdown in the life sciences sector, driven by inflation or recessionary pressures, could translate to delayed or canceled clinical programs. This directly impacts BioLife Solutions' revenue streams, as their products are integral to the manufacturing and transport of cell and gene therapies throughout their lifecycle. In 2023, while venture capital funding for biotech saw some recovery from 2022 lows, it remained below the peak levels of prior years, highlighting the sensitivity of the sector to broader economic conditions.

- Reduced R&D Investment: Economic downturns can cause biotech companies to cut back on research and development, slowing the pace of innovation and the need for BioLife's products.

- Decreased Funding Rounds: A contraction in venture capital and IPO markets makes it harder for cell and gene therapy developers to raise capital, potentially stalling their progress and demand for BioLife's solutions.

- Impact on Clinical Trials: Economic pressures can lead to delays or cancellations of clinical trials, directly reducing the volume of cell and gene therapies being manufactured and transported, thus affecting BioLife's sales.

Supply Chain Disruptions and Manufacturing Challenges

BioLife Solutions, like many in the life sciences, faces risks from global supply chain issues. Disruptions in obtaining critical raw materials or manufacturing parts could hinder production and delivery. For instance, in the first quarter of 2024, the company reported that while they managed inventory effectively, ongoing global logistics challenges remained a point of vigilance.

These potential interruptions can directly impact BioLife's capacity to meet demand. Such delays could translate into lost revenue and strain vital customer relationships, particularly for clients relying on timely delivery of cryopreservation media and related products. The company's Q1 2024 earnings call highlighted a focus on diversifying supplier options to mitigate these very risks.

- Supply Chain Vulnerability: Susceptible to global disruptions affecting raw materials and manufacturing components.

- Production & Delivery Impact: Interruptions can impede the ability to produce and deliver essential products.

- Financial & Reputational Risk: Potential for revenue loss and damage to customer trust due to delivery failures.

- Mitigation Efforts: Company actively explores supplier diversification as a strategy to counter these threats.

BioLife Solutions faces the threat of rapid technological advancements in biopreservation, potentially making its current offerings obsolete if competitors develop superior or more cost-effective solutions. Increased competition in the growing cell and gene therapy market also presents a risk of pricing pressures, potentially impacting profit margins.

Economic downturns and instability in funding markets can significantly reduce investment in research and development, thereby slowing the progress of cell and gene therapies and reducing demand for BioLife's preservation products. Furthermore, global supply chain disruptions pose a risk to BioLife's ability to procure raw materials and deliver products on time, potentially leading to lost revenue and damaged customer relationships.

| Threat Category | Specific Threat | Potential Impact on BioLife Solutions | Example/Data Point (2023-2025) |

|---|---|---|---|

| Technological Obsolescence | Emergence of superior biopreservation methods | Reduced market share, decreased demand for existing products | Breakthroughs in cryopreservation techniques could challenge current offerings. |

| Market Competition | Intensified competition in cell and gene therapy market | Pricing pressure, reduced profit margins, increased sales/marketing costs | Cell and gene therapy market projected to exceed $30 billion by 2030 (as of early 2024). |

| Economic Factors | Biotech funding market contraction (VC, IPO) | Delayed/canceled clinical programs, reduced demand for preservation solutions | Biotech venture funding in 2023 remained below peak levels, indicating sector sensitivity to economic shifts. |

| Supply Chain Disruptions | Global logistics and raw material availability issues | Production delays, inability to meet demand, revenue loss, damaged customer relationships | Company actively diversifying suppliers to mitigate ongoing global logistics challenges (Q1 2024 focus). |

SWOT Analysis Data Sources

This BioLife Solutions SWOT analysis is built upon a foundation of robust data, incorporating official financial filings, comprehensive market research reports, and expert industry commentary to provide a clear and actionable strategic overview.