BioLife Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BioLife Solutions Bundle

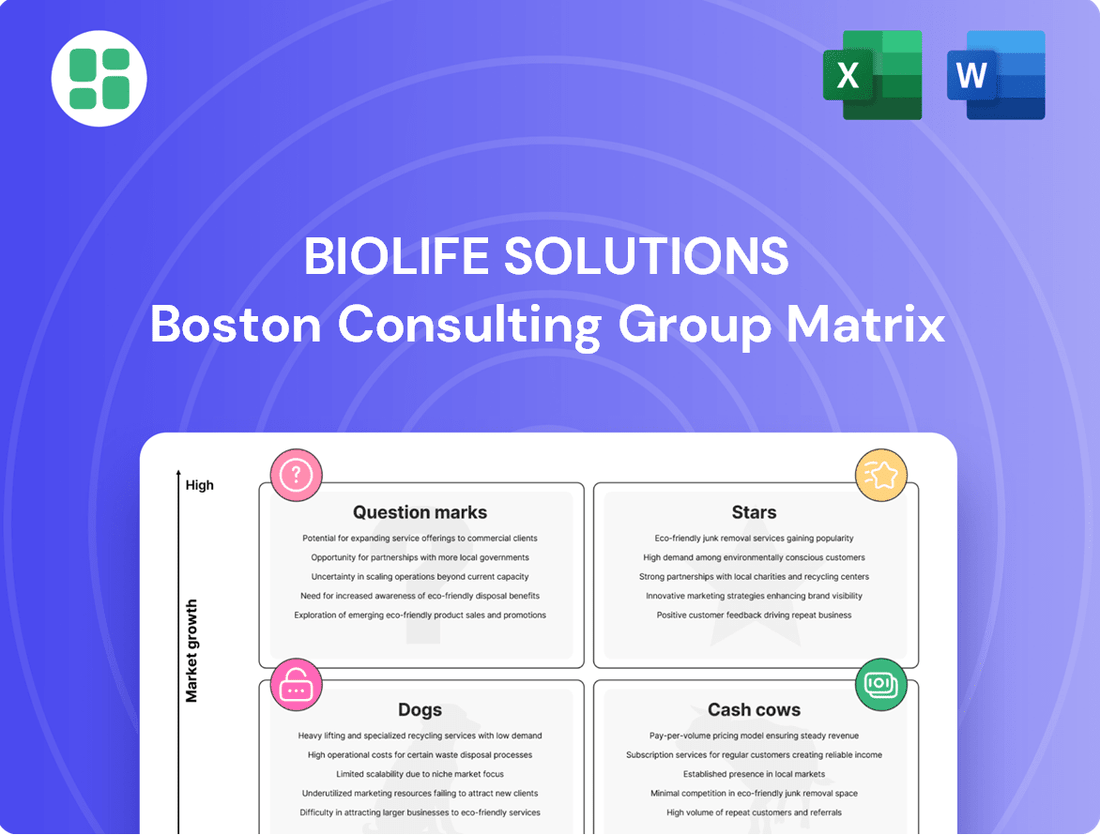

Understand the strategic positioning of BioLife Solutions' product portfolio at a glance. This preview highlights key areas, but to truly unlock actionable insights and guide your investment decisions, the full BCG Matrix is essential. Discover where your capital should flow for maximum growth and efficiency.

Gain a competitive edge by understanding BioLife Solutions' market share and growth potential across its offerings. This glimpse into their BCG Matrix is just the start; purchase the complete report for detailed quadrant analysis and strategic recommendations that will empower your business planning.

See where BioLife Solutions' products shine as Stars, sustain as Cash Cows, falter as Dogs, or present opportunities as Question Marks. For a comprehensive understanding and the strategic roadmap to capitalize on these positions, invest in the full BCG Matrix today.

Stars

BioLife Solutions' CryoStor and HypoThermosol are crucial for the booming cell and gene therapy (CGT) sector. This market is set for impressive growth, with Compound Annual Growth Rates (CAGRs) estimated between 17.1% and 22.7% from 2029 through 2033, highlighting a dynamic, high-growth landscape.

These biopreservation media are already part of many approved CGT treatments, and more approvals are anticipated. This suggests BioLife Solutions holds a strong position and significant market share within this vital specialized area.

The company anticipates these products will be key revenue drivers for its Cell Processing segment in 2025, reflecting their foundational role in BioLife's business strategy.

CryoStor's role in supporting commercial-stage cell and gene therapies positions it firmly in a high-growth, high-market-share quadrant. BioLife Solutions has indicated that roughly 40% of its biopreservation media revenue is derived from customers with approved commercial therapies, underscoring a substantial and stable income source.

This strong reliance on commercial applications suggests that as the cell and gene therapy market matures and more products gain regulatory approval, CryoStor is poised for continued market share expansion within this vital and expanding sector.

BioLife Solutions is strategically positioned to capitalize on the burgeoning allogeneic cell therapy market by offering manufacturing solutions designed for high-volume production. This focus addresses a key industry need for scalable processes as these advanced therapies transition from development to commercialization.

The company's recent advancements, such as their new high-capacity controlled rate freezers and sophisticated thaw systems, directly tackle critical bottlenecks in cell therapy manufacturing. These innovations are vital for achieving the necessary throughput for widespread patient access, reinforcing BioLife's role as a key enabler in this rapidly expanding sector.

PanTHERA CryoSolutions' Ice Recrystallization Inhibitor (IRI) Technology

The acquisition of PanTHERA CryoSolutions in April 2025 significantly bolsters BioLife Solutions' biopreservation media offerings. This move integrates PanTHERA's cutting-edge Ice Recrystallization Inhibitor (IRI) technology, a key differentiator in the biopreservation space.

This IRI technology is poised to be a star performer for BioLife, tapping into the rapidly expanding biopreservation market. The demand for advanced solutions is high, and this acquisition positions BioLife to capture a larger share of this lucrative segment.

- Innovation Driver: PanTHERA's IRI technology represents a significant technological advancement in preventing ice crystal damage during cryopreservation.

- Market Expansion: This acquisition enhances BioLife's product portfolio, enabling them to address a broader range of biopreservation needs and potentially attract new customer segments.

- Growth Potential: The biopreservation market, a critical component of cell and gene therapy development, is experiencing robust growth, with projections indicating continued expansion in the coming years.

- Competitive Advantage: By integrating novel IRI technology, BioLife Solutions gains a competitive edge, offering superior cryopreservation solutions compared to existing market offerings.

Biopreservation Media for Clinical Trials (Late-Stage)

BioLife Solutions' biopreservation media for late-stage clinical trials is a strong contender in the BCG matrix. It's estimated to be utilized in a substantial portion of relevant U.S. cell and gene therapy (CGT) clinical trials, with penetration in late-stage trials surpassing 75%.

This high penetration in late-stage trials is a key indicator. As these therapies move towards commercial approval, BioLife's media is positioned to transition from trial use to widespread commercial application. This secures a significant future market share and a steady revenue stream.

- Late-Stage Trial Penetration: Over 75% of U.S. CGT clinical trials in late stages utilize BioLife's biopreservation media.

- Transition to Commercial Use: High late-stage trial penetration positions products for commercial adoption as therapies gain approval.

- Future Market Share: The product's established presence in trials is a strong predictor of future market share in commercialized therapies.

- Revenue Growth Potential: The anticipated shift from clinical to commercial use signifies robust future revenue growth opportunities.

BioLife Solutions' biopreservation media, particularly CryoStor and HypoThermosol, are critical components in the rapidly expanding cell and gene therapy (CGT) market. The company's strong market share in this sector, evidenced by their media being used in a significant portion of late-stage CGT clinical trials, positions these products as Stars in the BCG matrix. This high penetration, exceeding 75% in late-stage U.S. trials, suggests a strong likelihood of these products becoming foundational for commercialized therapies, driving future revenue growth.

| Product/Segment | BCG Quadrant | Key Differentiator | Market Growth | Market Share |

|---|---|---|---|---|

| CryoStor/HypoThermosol (Commercial CGT) | Star | Established use in approved therapies, high customer adoption | High (CGT market CAGR 17.1%-22.7% from 2029-2033) | High (approx. 40% of media revenue from commercial-stage customers) |

| Biopreservation Media (IRI Technology) | Star | Innovative Ice Recrystallization Inhibitor (IRI) technology | High (growing biopreservation market) | Growing (acquisition of PanTHERA CryoSolutions enhances offerings) |

| Biopreservation Media (Late-Stage Clinical Trials) | Star | Penetration >75% in late-stage U.S. CGT trials | High (transition to commercial use) | High (predictor of future commercial market share) |

What is included in the product

BioLife Solutions' BCG Matrix analyzes its product portfolio, guiding strategic decisions on investment, divestment, or growth.

The BioLife Solutions BCG Matrix visually clarifies product portfolio performance, easing the pain of resource allocation decisions.

Cash Cows

Certain mature biopreservation media formulations from BioLife Solutions, especially those utilized in established life science areas beyond cutting-edge cell and gene therapies, can be viewed as cash cows. These products likely command a significant market share, built on years of industry adoption and proven reliability.

While the broader biopreservation market continues to expand, these specific, mature formulations might be experiencing a more moderate growth trajectory. Their strength lies in generating steady, predictable cash flow, often requiring limited incremental investment in marketing or development to maintain their position.

BioLife's proprietary freezing media, HypoThermosol and CryoStor, have found a strong footing in regenerative medicine, biobanking, and drug discovery beyond their advanced cell and gene therapy uses. These established markets represent a significant portion of BioLife's revenue, acting as dependable cash cows.

These established applications likely hold a high market share within their respective mature segments, generating consistent revenue. For example, in 2023, BioLife Solutions reported total revenue of $77.4 million, with a substantial portion attributed to these foundational product lines, underscoring their role as reliable income generators.

The earlier generations of ThawSTAR automated thawing systems, especially those geared towards routine lab use, likely represent cash cows for BioLife Solutions. These systems offer a reliable, water-free thawing process that has secured a solid market share in established laboratory settings. Their consistent performance and mature product lifecycle suggest stable revenue generation with minimal ongoing research and development needs.

Biopreservation Solutions for Biobanking

Biopreservation solutions for biobanking represent a stable, mature market segment for BioLife Solutions. These products are crucial for maintaining the integrity of biological samples stored long-term, a necessity for research and clinical applications.

BioLife's offerings in this area likely command a significant market share. This is due to established customer relationships within the biobanking sector and the proven reliability of their biopreservation media, which are vital for sample viability over extended durations.

- Market Maturity: The biobanking sector is a well-established, albeit low-growth, market.

- High Market Share: BioLife's established presence and effective solutions likely secure a strong position.

- Consistent Revenue: This segment provides a predictable and steady income stream.

- Sample Integrity: Products are essential for preserving biological samples over long periods.

Maintenance and Support Services for Installed Base

For BioLife Solutions, the maintenance, calibration, and support services tied to their established ThawSTAR systems likely function as cash cows. This segment generates a consistent and high-margin revenue stream from existing installations, requiring minimal new capital investment compared to pioneering new product development. In 2023, BioLife Solutions reported revenue from their Cryoport Systems segment, which includes these types of services, growing to $149.1 million, indicating a strong and stable income base.

These service contracts offer a predictable revenue flow, contributing significantly to the company's overall profitability. The installed base of ThawSTAR systems creates a recurring revenue model that is less susceptible to market fluctuations than new product sales. This stability allows BioLife Solutions to allocate resources efficiently, leveraging existing infrastructure for ongoing customer support.

- Predictable Revenue: Service contracts for ThawSTAR systems provide a consistent income stream.

- High Margins: Support services typically carry higher profit margins than initial product sales.

- Low Investment: Requires less capital expenditure compared to R&D for new products.

- Installed Base Leverage: Capitalizes on existing customer deployments for ongoing revenue.

BioLife Solutions' established biopreservation media, particularly HypoThermosol and CryoStor, serve as significant cash cows. These products, essential for regenerative medicine and biobanking, hold substantial market share due to their proven reliability in mature applications.

The earlier generations of ThawSTAR automated thawing systems also fit the cash cow profile. Their consistent performance in routine lab settings generates stable revenue, requiring minimal new investment. Support and maintenance services for these installed systems further bolster this dependable income stream.

| Product/Service Category | BCG Matrix Classification | Key Characteristics | Supporting Data (2023) |

|---|---|---|---|

| Established Biopreservation Media (HypoThermosol, CryoStor) | Cash Cow | High market share in mature segments (regenerative medicine, biobanking), steady revenue generation. | Contributed significantly to BioLife's $77.4 million total revenue. |

| Mature ThawSTAR Systems & Services | Cash Cow | Strong market share in established lab settings, recurring revenue from maintenance and support. | Cryoport Systems segment (including services) grew to $149.1 million, indicating a stable income base. |

Delivered as Shown

BioLife Solutions BCG Matrix

The BioLife Solutions BCG Matrix you are currently previewing is the exact, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and no hidden surprises – just a comprehensive, analysis-ready strategic tool. You can confidently use this preview as a direct representation of the professional-grade report that will be yours to edit, present, or integrate into your business planning. It's designed for immediate application, providing you with the insights needed for informed decision-making.

Dogs

In 2024, BioLife Solutions strategically divested its freezer and biostorage businesses, including Global Cooling, Arctic Solutions/Custom Biogenics Systems, and SciSafe. This move signals these segments were likely classified as 'Dogs' in the BCG matrix, potentially due to lower profit margins, high capital requirements, or a divergence from the company's primary focus on high-growth cell processing solutions.

These divestitures are part of BioLife Solutions' plan to sharpen its strategic direction and enhance its financial performance. By exiting these less dynamic or lower-margin operations, the company aims to concentrate resources on its core, high-potential product lines, thereby streamlining its business model for improved efficiency and profitability.

Prior to recent divestitures, certain niche or older cryogenic freezer models from BioLife Solutions likely represented their 'Dogs' in a BCG matrix analysis. These products typically held a low market share within a mature and competitive capital equipment sector, facing limited growth prospects and struggling to contribute meaningfully to overall revenue or profit.

For instance, if BioLife Solutions had legacy freezer lines that were superseded by newer, more efficient technology, these would fall into the Dog category. Such a strategic divestiture, as seen in their 2023 actions where they sold their CryoStore freezing systems business, is a common tactic to shed underperforming assets and redirect capital towards more promising ventures.

Legacy hypothermic storage solutions with limited adoption fall into the 'Dogs' category of the BCG Matrix. These are older technologies that haven't captured significant market share in the biopharmaceutical sector. For instance, a hypothetical older cell and tissue preservation solution might have seen its market share dwindle to less than 1% by mid-2024 amidst the rise of more advanced, automated systems.

These products typically operate in a growing market but struggle to compete due to lower efficiency or lack of advanced features. Their revenue generation is minimal, often failing to cover the costs associated with their continued development or support. Companies holding such products might consider divesting them or phasing them out to reallocate resources to more promising innovations.

Non-Core, Low-Margin Capital Equipment

Before BioLife Solutions' strategic portfolio adjustments, certain capital equipment lines, such as specific freezers and storage units, existed outside their primary biopreservation media business. These were likely lower-margin, slower-growing segments compared to their core offerings.

These non-core, low-margin capital equipment lines were considered drains on resources. Their divestment aligns with a strategy to focus on higher-margin, recurring revenue streams, enhancing overall profitability and operational efficiency.

- Non-Core Equipment: Freezers and storage units not directly linked to biopreservation media.

- Low Margin: Characterized by lower profit margins compared to core products.

- Resource Drain: Identified as segments that consumed resources without commensurate returns.

- Strategic Divestment: Removed to sharpen focus on high-growth, high-margin biopreservation solutions.

Products with High Customization Needs and Low Scalability

Products or services that require extensive customization for individual clients but lack the potential for broad, scalable adoption could be considered Dogs in the BCG Matrix. For BioLife Solutions, this might include highly specialized, one-off biopreservation solutions for niche research projects or unique patient needs that demand significant manual intervention. If the effort and cost of customization outweigh the potential for significant market share or recurring revenue, these offerings would tie up resources without yielding high returns in a rapidly industrializing biopreservation market. For example, a bespoke cryopreservation protocol developed for a single rare cell line, requiring extensive protocol adaptation and specialized equipment for each instance, would fit this description. Such products often have limited growth potential and low market share, generating insufficient profits to justify continued investment.

These offerings typically exhibit low growth and low market share, meaning they are not attractive investment opportunities. In 2023, BioLife Solutions reported revenue of $74.6 million, with a focus on expanding its existing product lines like CryoSeal and CryoStore. Products falling into the Dog category would likely represent a very small fraction of this revenue, perhaps even a net cost if not managed carefully. The company’s strategy emphasizes scaling its core technologies, making highly customized, low-volume solutions less of a priority for resource allocation.

Consider the following characteristics of BioLife Solutions' potential Dog products:

- High labor and material costs per unit due to bespoke development and production.

- Limited market demand driven by highly specific, individual client requirements.

- Low profit margins as customization costs eat into revenue.

- Minimal opportunities for process optimization or economies of scale, hindering scalability.

BioLife Solutions' divestment of its freezer and biostorage segments in 2024, including entities like Global Cooling, suggests these were likely classified as 'Dogs' within the BCG matrix. These businesses likely faced challenges such as low market share in mature markets, high capital expenditure needs, or a strategic misalignment with the company's core focus on high-growth cell processing solutions.

The company's decision to exit these operations underscores a strategic pivot towards its more promising, high-potential product lines. This streamlining aims to optimize resource allocation and enhance overall financial performance by shedding underperforming or non-core assets.

Legacy cryogenic equipment or highly specialized, low-volume biopreservation solutions with limited scalability and profitability would also fit the 'Dog' profile. For instance, a bespoke cryopreservation protocol for a rare cell line, requiring significant custom development for each instance, would likely yield minimal returns and tie up valuable resources.

These 'Dog' segments typically operate in markets with low growth and hold a small market share, making them unattractive for further investment. BioLife Solutions' reported revenue of $74.6 million in 2023 highlights a strategic emphasis on scaling core technologies, such as CryoSeal and CryoStore, further deprioritizing these low-return segments.

| BCG Category | BioLife Solutions Example | Market Growth | Relative Market Share | Strategic Implication |

| Dogs | Divested Freezer & Biostorage Businesses (e.g., Global Cooling) | Low | Low | Divestment to focus on core growth areas. |

| Dogs | Legacy Cryogenic Equipment | Low | Low | Potential phase-out or divestment to reallocate resources. |

| Dogs | Highly Customized, Low-Volume Solutions | Low | Low | Resource drain; limited scalability and profitability. |

Question Marks

Beyond its notable IRI technology, PanTHERA CryoSolutions brought other promising, though less mature, technologies into BioLife Solutions' portfolio. These could be classified as Question Marks within the BCG Matrix.

These newly acquired technologies are in a high-growth segment of the biopreservation market. However, they currently hold a very small market share, meaning BioLife Solutions will need to invest heavily to help them grow and become successful.

BioLife Solutions' advanced ThawSTAR systems, like the IntelliRate i67C CRF introduced in early 2025, are designed for the increasing demands of emerging cell and gene therapies. These sophisticated thawing solutions are crucial for the successful scaling of these innovative treatments.

The market for these advanced therapies is experiencing robust growth, indicating significant future potential. However, the market share for BioLife's newer, high-capacity ThawSTAR devices is still in its nascent stages, reflecting their recent market entry.

Significant investment in marketing and sales efforts will be necessary to drive adoption and transition these advanced thawing systems from question marks to stars within the BCG matrix. This strategic push is vital for capturing a larger portion of this expanding market.

BioLife Solutions is exploring biopreservation for emerging therapeutic areas like tissue engineering and regenerative medicine. These represent future growth frontiers, but currently, BioLife's presence is minimal, classifying them as question marks requiring substantial investment in research and market penetration.

The company's strategy likely involves targeting these nascent markets with tailored preservation solutions, anticipating significant future demand. For instance, the global regenerative medicine market was valued at approximately $13.7 billion in 2023 and is projected to grow substantially, presenting a prime opportunity for BioLife's innovative approaches.

Integration of AI-enabled Biopreservation Systems

The increasing integration of AI-enabled biopreservation systems is a significant emerging trend. If BioLife Solutions is actively developing or incorporating AI into its future offerings, these products would likely be classified as Question Marks in the BCG matrix. This is because they operate in a high-growth technological space but currently possess a low market share, necessitating substantial investment to demonstrate value and achieve market penetration.

- AI in Biopreservation: AI's role in optimizing temperature control, monitoring sample integrity, and predicting potential degradation in biopreservation is a rapidly advancing area.

- BioLife's Potential Position: New AI-driven biopreservation solutions from BioLife would fit the Question Mark quadrant due to their presence in a burgeoning market with uncertain future dominance.

- Investment Needs: Companies in this category, like BioLife with its AI initiatives, require significant R&D and market development funding to compete effectively.

- Market Growth: The global biopreservation market is projected to reach over $12 billion by 2028, indicating substantial growth potential for innovative solutions.

Partnerships for Next-Generation Bioproduction Workflows

BioLife Solutions is actively exploring partnerships to embed its biopreservation technologies into advanced bioproduction workflows. These collaborations aim to create more efficient and integrated manufacturing processes for cell and gene therapies, a sector projected for substantial growth. For instance, the global cell and gene therapy market was valued at approximately $10.5 billion in 2023 and is anticipated to reach over $40 billion by 2030, highlighting the immense potential for streamlined production solutions.

These strategic alliances, while targeting a high-growth future market, currently represent a nascent stage for BioLife Solutions, likely holding a low market share due to their developmental or pilot nature. The company's focus on integrating its solutions into these next-generation workflows positions it for future market leadership, but requires substantial upfront investment to scale these integrated offerings effectively. The bioproduction market itself is seeing significant investment, with venture capital funding in biotech manufacturing reaching record levels in recent years, demonstrating the broader industry's commitment to innovation in this space.

- Targeting Future Growth: Partnerships focus on integrating biopreservation into next-generation bioproduction, a sector with projected strong growth.

- Low Current Market Share: These initiatives are in developmental or pilot phases, indicating a low current market share for integrated workflow solutions.

- Investment Needs: Significant capital investment is required to scale these advanced, integrated bioproduction solutions.

- Market Potential: The cell and gene therapy market's rapid expansion underscores the strategic importance of efficient bioproduction workflows.

BioLife Solutions’ emerging technologies, such as novel cryopreservation media and advanced thawing systems targeting niche applications within regenerative medicine, are prime examples of Question Marks. These innovations operate within high-growth sectors, but currently represent a small fraction of BioLife's overall market presence.

The company's investment in these areas, like the development of specialized cryopreservation solutions for complex cell therapies, requires significant capital to drive market penetration and establish a strong foothold. For instance, the global cell therapy market was projected to grow significantly, creating a demand for specialized preservation methods.

Success hinges on BioLife's ability to effectively market and scale these nascent technologies, transforming them from potential future stars into current revenue drivers. This strategic focus is essential to capitalize on the expanding biopharmaceutical landscape.

| Technology Area | Market Growth Potential | Current Market Share | Investment Need |

|---|---|---|---|

| Novel Cryopreservation Media | High | Low | High |

| Advanced Thawing Systems (Niche) | High | Low | High |

| Regenerative Medicine Solutions | Very High | Very Low | Very High |

BCG Matrix Data Sources

Our BioLife Solutions BCG Matrix leverages comprehensive data, including company financial reports, market research, and industry growth projections, to accurately map product portfolio performance.