BioLife Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BioLife Solutions Bundle

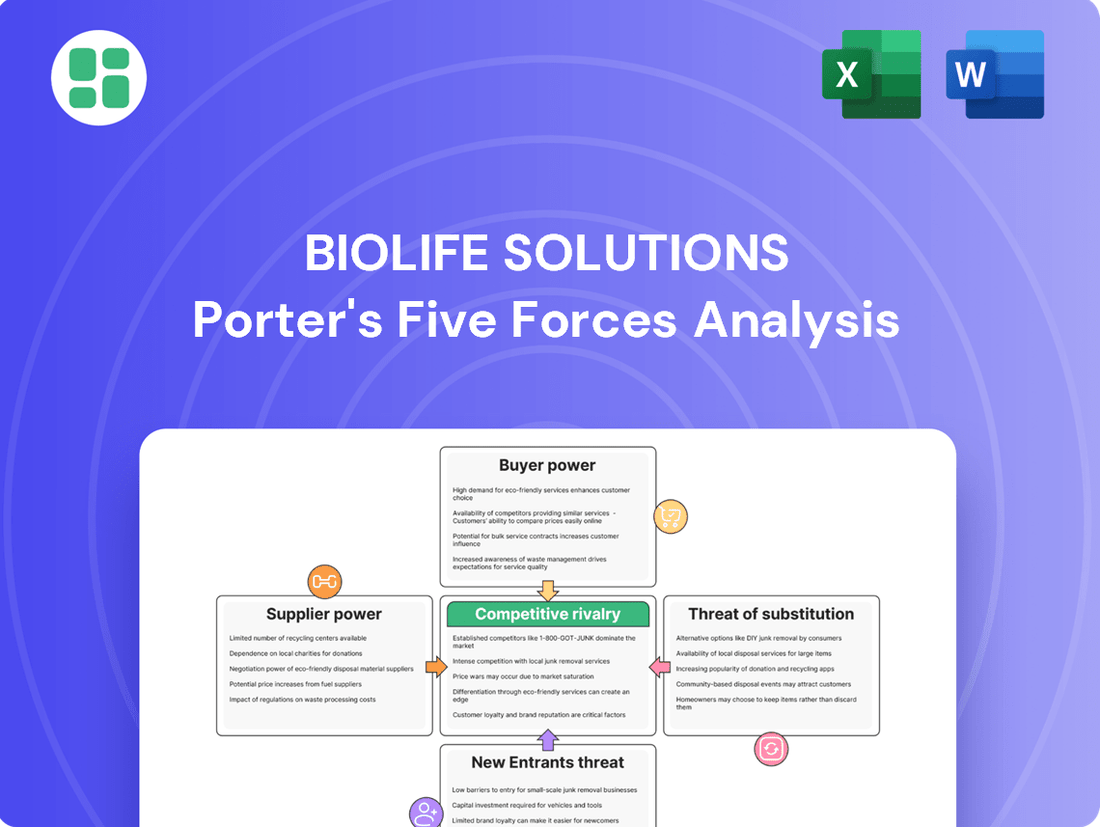

BioLife Solutions operates in a dynamic market shaped by moderate buyer power and the potential for new entrants, while supplier power and the threat of substitutes present distinct challenges. Understanding these forces is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping BioLife Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BioLife Solutions' reliance on specialized raw materials for its biopreservation media, essential for cell viability, highlights a key area of supplier bargaining power. The uniqueness of these inputs, potentially involving proprietary formulations, can give suppliers considerable leverage, particularly if alternative sources are scarce.

This dependency means that any supply disruptions or price hikes from these specialized material providers can directly impact BioLife's cost of goods sold and overall production stability. For instance, in 2023, BioLife Solutions reported a gross profit margin of 48.4%, indicating that the cost of raw materials is a significant factor in their profitability.

For BioLife Solutions, the bargaining power of suppliers is significantly influenced by high switching costs. When customers in the biopreservation and cell therapy sectors need to change their supplier for critical components like media, they often face extensive re-validation processes. This can involve rigorous testing and navigating complex regulatory pathways, making the transition costly and time-consuming.

This necessity to maintain stringent product quality and adhere to strict regulatory compliance within the sensitive cell and gene therapy market further solidifies customer reliance on their current, validated suppliers. For instance, a disruption in a validated media supply chain could delay critical clinical trials or product launches, representing substantial financial and reputational risk for the customer. This entrenched dependence naturally amplifies the leverage held by BioLife's suppliers.

The biopreservation market can exhibit supplier concentration, especially for highly specialized reagents or components. For instance, in 2024, companies relying on novel cryoprotectants or specific cell culture media might find only a handful of qualified vendors available, increasing supplier leverage.

When these specialized suppliers possess significant intellectual property or proprietary technologies, their bargaining power is substantially amplified. This dominance allows them to influence pricing structures and dictate supply chain terms, potentially impacting BioLife Solutions' cost of goods sold.

Impact of Input Cost on BioLife's Products

The bargaining power of suppliers is a key consideration for BioLife Solutions. While BioLife's cryopreservation media and services are vital for its customers in the cell and gene therapy sector, the cost of acquiring essential raw materials can significantly impact BioLife's bottom line and its ability to set competitive prices. Suppliers who can dictate higher prices for critical inputs can put pressure on BioLife's profit margins, especially if the company faces challenges in passing these increased costs along to its price-sensitive clientele.

This dynamic is particularly relevant given the specialized nature of BioLife's offerings. For instance, the market for specialized cell culture media components can be consolidated, giving certain suppliers more leverage. If BioLife cannot easily substitute these inputs or absorb the cost increases, its profitability could be directly affected.

- Input Cost Sensitivity: BioLife's profitability is directly linked to the cost of raw materials used in its proprietary media formulations.

- Supplier Leverage: A concentrated supplier base for key chemical components or biological materials can grant suppliers significant pricing power.

- Pricing Strategy Impact: Increased input costs may force BioLife to raise prices, potentially impacting its competitive position in the price-sensitive cell and gene therapy market.

- Margin Squeeze: If BioLife cannot fully pass on higher input costs, its operating margins could be compressed, affecting overall financial performance.

Forward Integration Threat by Suppliers

While BioLife Solutions primarily sources raw materials and specialized components, a theoretical threat of forward integration by highly specialized suppliers exists. This means a supplier could potentially move into producing biopreservation media or related services themselves, leveraging their deep market knowledge.

This potential, however remote, would significantly bolster a supplier's bargaining power. It signals their capability to become a direct competitor, forcing BioLife Solutions to consider this possibility in its supplier relationships.

Several factors make this threat less probable for BioLife Solutions. The biopreservation market is characterized by stringent regulatory requirements, such as FDA approvals for cell and gene therapy products, which are costly and time-consuming to navigate. Furthermore, the specialized nature of the market and the need for extensive research and development create significant barriers to entry for potential integrating suppliers.

For instance, in 2024, the biopharmaceutical industry continued to see significant investment in cell and gene therapies, a key market for BioLife Solutions. Companies developing these therapies often rely on highly specific, custom-formulated media. While a supplier might possess the chemical expertise, replicating BioLife Solutions' established quality control, regulatory compliance, and customer-specific formulation capabilities would be a substantial undertaking.

- Forward Integration Threat: Suppliers could theoretically enter BioLife Solutions' biopreservation media production.

- Increased Bargaining Power: This threat enhances supplier leverage due to their market insight and potential to compete directly.

- Deterrents: High regulatory hurdles and market specificities in biopreservation act as significant barriers to supplier integration.

- Market Context (2024): Continued growth in cell and gene therapies underscores the need for specialized, compliant media, making supplier integration challenging.

The bargaining power of BioLife Solutions' suppliers is heightened by the specialized nature of raw materials required for biopreservation media. Suppliers of unique chemical components or proprietary biological materials often hold significant leverage due to limited alternatives and high switching costs for BioLife's customers, which include rigorous re-validation processes in the cell and gene therapy sector.

This supplier concentration, particularly for novel cryoprotectants or specific cell culture media components, grants vendors considerable influence over pricing and supply terms. For instance, in 2024, the biopharmaceutical industry's continued investment in cell and gene therapies amplifies the demand for specialized, compliant media, reinforcing supplier strength.

The threat of forward integration by suppliers, while mitigated by regulatory complexities and market specificities, remains a theoretical factor that bolsters their bargaining power. BioLife's gross profit margin of 48.4% in 2023 underscores the direct impact of raw material costs on its profitability, making supplier leverage a critical consideration.

| Factor | Impact on BioLife Solutions | Supporting Data/Context |

|---|---|---|

| Specialized Inputs | Increases supplier leverage due to scarcity of alternatives. | Critical for biopreservation media, essential for cell viability. |

| Customer Switching Costs | Amplifies supplier power through high re-validation and regulatory hurdles. | Cell and gene therapy market demands stringent quality and compliance. |

| Supplier Concentration | Grants pricing power to a limited number of qualified vendors. | Prevalent for novel cryoprotectants or specific cell culture media components in 2024. |

| Intellectual Property | Further strengthens supplier influence on pricing and terms. | Proprietary technologies in specialized components. |

| Forward Integration Threat | Theoretically enhances supplier bargaining power. | Mitigated by high regulatory barriers and market specificities. |

What is included in the product

This analysis uncovers the competitive forces shaping BioLife Solutions' market, detailing the intensity of rivalry, buyer and supplier power, threat of substitutes, and barriers to entry.

Instantly visualize competitive pressures with a dynamic five forces model, enabling swift identification of strategic advantages and potential threats.

Customers Bargaining Power

BioLife Solutions' biopreservation media are deeply integrated into their customers' approved cell and gene therapies. This integration means that switching to a different supplier requires extensive re-validation and regulatory approval, creating significant hurdles for customers. The fact that BioLife's solutions are currently embedded in 17 approved therapies highlights the substantial switching costs, effectively locking in customers and reducing their bargaining power.

BioLife's biopreservation media are essential for the successful development and commercialization of cell and gene therapies. These solutions are critical for extending the viability and transportability of sensitive biological materials, directly impacting the success and safety of their customers' advanced therapies.

The indispensable nature of BioLife's products, particularly their CryoSeal™ cryopreservation media which saw significant adoption in 2023 and continued growth into 2024, significantly curtails the bargaining power of customers. When the quality and reliability of a supplier's offerings are directly tied to the efficacy and safety of a customer's high-value therapeutic products, customers have less leverage to demand lower prices or more favorable terms.

While the cell and gene therapy market is experiencing significant growth, the number of companies with commercially approved therapies that rely on BioLife Solutions' specialized preservation media and devices might still be somewhat concentrated. This concentration means a smaller group of major customers could potentially wield more influence over pricing and contract terms, particularly for substantial orders.

For instance, if a few large pharmaceutical companies dominate the market for therapies using BioLife's products, they could leverage their purchasing power. However, BioLife Solutions has been actively broadening its customer base, with an increasing number of companies achieving regulatory approval for their therapies. This expansion, as evidenced by BioLife's reported revenue growth in recent quarters, helps to dilute the bargaining power of any single customer.

Price Sensitivity vs. Performance

Customers in the cell and gene therapy sector often prioritize product performance and reliability above minor cost differences. This is because the biological materials they handle are incredibly valuable and sensitive, making product failure a potentially catastrophic event.

This inherent focus on quality significantly lowers customer price sensitivity for proven biopreservation solutions, such as those offered by BioLife Solutions. The risk of losing a high-value cell therapy outweighs the savings from a cheaper, less reliable alternative.

- High Stakes: Cell and gene therapies represent significant research and development investments, making product integrity paramount.

- Reliability Over Cost: For instance, a single batch of CAR-T cells can be worth hundreds of thousands of dollars, meaning the cost of the preservation media is a small fraction of the overall value.

- Reduced Price Sensitivity: This dynamic means customers are less likely to switch based on price alone, favoring suppliers with a strong track record of performance and quality assurance.

Limited Backward Integration by Customers

The bargaining power of customers for BioLife Solutions is somewhat limited by their inability to easily develop proprietary biopreservation media and thaw devices internally. This is because creating these solutions demands substantial scientific knowledge, considerable investment in research and development, and a deep understanding of regulatory requirements. Most companies in the cell and gene therapy sector either do not possess these capabilities or choose not to divert their valuable resources towards such endeavors.

This significant hurdle to backward integration means customers are largely reliant on external providers like BioLife for these critical components. Consequently, BioLife maintains a stronger negotiating position, as customers face substantial barriers to producing their own biopreservation solutions.

- High Barriers to Entry: Developing in-house biopreservation media and thaw devices requires specialized scientific expertise, significant R&D funding, and regulatory compliance knowledge, which most cell and gene therapy companies lack.

- Resource Allocation: Many potential customers prefer to focus their financial and human resources on their core therapeutic development rather than investing in the complex infrastructure needed for biopreservation solution manufacturing.

- Limited Alternatives: The specialized nature of BioLife's offerings means that readily available, high-quality alternatives for customers seeking to integrate backward are scarce, further enhancing BioLife's market position.

BioLife Solutions' customers have limited bargaining power due to high switching costs and the critical nature of their products. The integration of BioLife's biopreservation media into 17 approved cell and gene therapies means regulatory re-validation is a significant barrier, effectively locking in customers. This reliance on BioLife's proven quality, especially for high-value therapies where product failure is catastrophic, reduces customer price sensitivity.

Customers are unlikely to switch for minor cost savings when the integrity of their valuable biological materials is at stake. For example, a batch of CAR-T cells can be worth hundreds of thousands of dollars, making the cost of preservation media a small percentage of the overall value. This prioritization of reliability over cost significantly curtails customer leverage.

Furthermore, the specialized scientific knowledge, R&D investment, and regulatory expertise required to develop in-house biopreservation solutions create high barriers to backward integration for most cell and gene therapy companies. This dependency on external providers like BioLife strengthens BioLife's negotiating position.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Reasoning |

|---|---|---|

| Switching Costs | Lowers | Integration into 17 approved therapies requires extensive re-validation and regulatory approval. |

| Product Value/Importance | Lowers | Media is critical for viability and safety of high-value cell and gene therapies. |

| Price Sensitivity | Low | Reliability and performance are prioritized over minor cost differences due to high stakes (e.g., CAR-T cell value). |

| Internal Capabilities (Backward Integration) | Lowers | High barriers to entry (scientific expertise, R&D, regulatory knowledge) limit customers' ability to produce solutions internally. |

What You See Is What You Get

BioLife Solutions Porter's Five Forces Analysis

This preview showcases the complete BioLife Solutions Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the cell and gene therapy preservation market. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for immediate use.

Rivalry Among Competitors

The biopreservation market, a crucial segment for BioLife Solutions, is characterized by its rapid growth and a diverse competitive landscape. It includes highly specialized companies alongside established life science giants, all vying for dominance. This dynamic environment means that innovation and focusing on specific market niches are vital for gaining an edge.

BioLife Solutions faces stiff competition from a range of players, from small, agile startups to large, well-funded corporations. Success often hinges on mastering specific areas within biopreservation, leading to concentrated battles for market share in particular product categories or therapeutic areas. For instance, companies offering advanced cryopreservation media or specialized thawing devices often find themselves in direct competition.

Despite the intense rivalry, the overall cell and gene therapy market, which BioLife Solutions serves, is on a strong upward trajectory. Projections indicate substantial growth, with some estimates suggesting the global cell and gene therapy market could reach over $40 billion by 2029. This expanding market size offers the potential to absorb competitive pressures by increasing demand and creating new opportunities for all participants.

BioLife Solutions distinguishes itself through its patented biopreservation media, notably CryoStor and HypoThermosol. These products are engineered for superior cell viability preservation, a critical factor in regenerative medicine and cell therapy. This strong product differentiation, backed by intellectual property, creates a substantial barrier for rivals seeking to replicate their performance without significant research and development expenditure.

BioLife Solutions operates in a competitive landscape with significant players such as Lonza Group, Azenta Life Sciences, WuXi AppTec, Thermo Fisher Scientific, and Brooks Automation. These companies often possess broader product portfolios or offer more integrated solutions, presenting a challenge to BioLife Solutions' market position.

The competitive intensity is further amplified by the varied strategies of these rivals. Some competitors concentrate on specialized equipment, while others may offer overlapping product lines or a more comprehensive suite of services. This diversity in approaches creates complex competitive dynamics, requiring BioLife Solutions to constantly adapt its offerings and market strategy.

High Stakes in Cell and Gene Therapy

The cell and gene therapy sector is intensely competitive, driven by massive research and development expenses, protracted development timelines, and significant capital requirements. This high-stakes environment necessitates companies like BioLife Solutions to forge strategic, long-term alliances and vie for market leadership.

Players are compelled to pursue relentless innovation and employ assertive tactics to solidify their roles as critical infrastructure providers in this rapidly evolving field. For instance, the global cell and gene therapy market was valued at approximately $13.7 billion in 2023 and is projected to reach over $50 billion by 2030, underscoring the immense growth and competitive pressures.

- High R&D Investment: Companies in this space often invest billions annually in research and development, creating high barriers to entry and intense rivalry.

- Long Development Cycles: The lengthy process from discovery to market approval for cell and gene therapies means companies are competing for future market share, requiring sustained commitment and resources.

- Strategic Partnerships: Securing partnerships with leading biopharmaceutical companies is crucial for growth, leading to aggressive competition for these valuable collaborations.

- Market Dominance Aspirations: The potential for blockbuster therapies fuels a fierce race among established players and emerging biotechs to capture significant market share.

Strategic Partnerships and Acquisitions

Competitive rivalry in the biopreservation industry is intensified by strategic partnerships and acquisitions, as companies aim to enhance their offerings and market presence. BioLife Solutions, for instance, acquired PanTHERA CryoSolutions in April 2025, a move that underscores the industry's drive to consolidate specialized technologies. This acquisition allows BioLife Solutions to integrate advanced cryopreservation media and expand its product portfolio.

These consolidations are crucial for companies to build more comprehensive solutions and solidify their competitive standing. By acquiring companies with unique technologies, BioLife Solutions strengthens its ability to serve a broader range of clients in the cell and gene therapy markets. This strategy directly impacts the competitive landscape by raising the bar for specialized capabilities.

- Strategic Consolidation: BioLife Solutions' acquisition of PanTHERA CryoSolutions in April 2025 exemplifies the trend of industry players consolidating specialized cryopreservation technologies.

- Enhanced Capabilities: This acquisition allows BioLife Solutions to integrate advanced cryopreservation media, thereby strengthening its product portfolio and service offerings.

- Market Reach Expansion: By combining technologies, companies like BioLife Solutions aim to broaden their market reach and cater to a wider segment of the biopreservation market.

- Competitive Positioning: Such strategic moves are critical for companies to differentiate themselves and fortify their competitive positions in a dynamic market.

The competitive rivalry within BioLife Solutions' market is intense, driven by a mix of large, established life science companies and agile, specialized firms. This dynamic means companies must constantly innovate and focus on niche areas to gain an advantage.

BioLife Solutions faces formidable competition from giants like Lonza Group and Thermo Fisher Scientific, who often offer broader product portfolios. These larger players can leverage their scale and resources, creating a challenging environment for BioLife Solutions to maintain its market position.

The cell and gene therapy market, where BioLife Solutions is a key player, is experiencing substantial growth, with projections indicating it could exceed $50 billion by 2030. This expansion, however, also fuels aggressive competition as companies vie for dominance in this lucrative sector.

BioLife Solutions differentiates itself with patented biopreservation media like CryoStor and HypoThermosol, which offer superior cell viability. This strong product differentiation, supported by intellectual property, serves as a barrier for competitors attempting to replicate their performance.

SSubstitutes Threaten

While BioLife Solutions provides advanced biopreservation media, traditional cryopreservation methods, such as those using standard DMSO-based media, represent a significant threat of substitutes. These established techniques are often employed for less sensitive biological materials and may be perceived as a more cost-effective option, despite potentially compromising cell viability and long-term function compared to BioLife's specialized formulations.

Large biopharmaceutical companies with substantial research and development budgets, such as Pfizer and Moderna, possess the capability to develop their own proprietary biopreservation solutions. This in-house development, though demanding in terms of resources and investment, poses a threat, particularly for organizations prioritizing complete control over their supply chains and intellectual property, potentially reducing reliance on external providers like BioLife Solutions.

Future advancements in preservation technologies, such as novel vitrification techniques or supercooling, could offer alternatives to current methods. Research into nanoparticle infusion and laser rewarming aims to pause biological time more effectively, potentially disrupting existing biopreservation approaches. For instance, advancements in machine learning are accelerating the discovery of new cryoprotectants, a key component in many preservation solutions.

Decentralized Manufacturing Models

The rise of decentralized manufacturing models in cell and gene therapy presents a potential threat of substitutes for BioLife Solutions. As these therapies move towards production closer to the patient, the reliance on traditional, large-scale biopreservation solutions for long-distance transport could decrease. This shift might reduce the demand for BioLife's core preservation media and devices if localized manufacturing hubs adopt alternative, perhaps integrated, preservation methods.

For instance, if a hospital system establishes its own cell therapy manufacturing unit, it might develop or source preservation solutions specifically tailored for its internal, shorter-range logistics. This could bypass the need for BioLife's established cold chain solutions, which are optimized for broader distribution networks. The market for cell and gene therapy manufacturing is projected to reach over $40 billion by 2030, indicating a significant area where alternative approaches could emerge.

- Decentralized Manufacturing Impact: A move towards localized cell and gene therapy production could lessen reliance on BioLife's current preservation and transport solutions.

- Reduced Long-Distance Transport Needs: If therapies are made near patients, the demand for extensive cold chain logistics, a key market for BioLife, may shrink.

- Emergence of Alternative Preservation: Localized manufacturing might foster the development or adoption of preservation methods integrated into the production process, acting as substitutes.

Cost vs. Performance Trade-offs

Customers might choose less effective but cheaper substitutes if their needs are less stringent regarding cell viability or if cost becomes a major concern. For instance, while a research lab might tolerate a lower preservation rate for routine cell culturing, a company developing a life-saving gene therapy cannot afford such compromises.

However, for high-stakes applications like cell and gene therapies, where maintaining cell integrity and viability is absolutely critical, the superior performance of BioLife Solutions' products generally justifies their cost. In 2024, the increasing complexity and value of advanced therapies mean that even minor losses in cell viability can have significant financial and clinical repercussions, making the premium for reliable preservation solutions a necessary investment.

- Cost Sensitivity: While some customers may prioritize lower costs, the critical nature of cell and gene therapies often necessitates higher-quality preservation.

- Performance Requirements: Applications demanding high cell viability, such as advanced therapeutic development, limit the appeal of inferior substitutes.

- Value Proposition: BioLife's solutions offer a strong value proposition by minimizing cell loss, which is crucial for the success of expensive and complex treatments.

- Market Trends: The growing market for cell and gene therapies, projected to reach tens of billions of dollars by the late 2020s, underscores the demand for high-performance preservation.

Traditional cryopreservation methods using standard DMSO-based media are a significant substitute threat, especially for less sensitive biological materials where cost may outweigh the need for optimal cell viability. While BioLife Solutions offers advanced formulations, the established nature and lower perceived cost of older methods present a competitive challenge.

The threat of substitutes is also amplified by the potential for large biopharmaceutical companies to develop proprietary in-house preservation solutions. This strategy, driven by a desire for supply chain control and IP protection, could reduce reliance on external providers like BioLife, particularly as the cell and gene therapy market continues its rapid expansion, projected to exceed $40 billion by 2030.

Emerging preservation technologies, such as advanced vitrification or supercooling techniques, along with AI-driven cryoprotectant discovery, represent future substitute threats. These innovations aim to improve biological time-pausing capabilities, potentially disrupting current biopreservation standards.

Decentralized manufacturing models in cell and gene therapy could also diminish the need for BioLife's solutions. As production shifts closer to patients, the demand for long-distance cold chain logistics may decrease, favoring integrated or localized preservation methods.

| Threat of Substitute | Description | Impact on BioLife | Example/Data Point |

|---|---|---|---|

| Traditional Cryopreservation | Standard DMSO-based media | Lower cost alternative for less sensitive materials | Perceived as more cost-effective despite potential viability compromise |

| In-house Development | Large biopharma creating own solutions | Reduced reliance on external providers | Companies like Pfizer and Moderna have R&D budgets to support this |

| Novel Preservation Technologies | Vitrification, supercooling, AI-driven cryoprotectants | Potential disruption of current methods | Research into nanoparticle infusion and laser rewarming |

| Decentralized Manufacturing | Localized cell/gene therapy production | Decreased demand for long-distance cold chain | Market for cell and gene therapy manufacturing projected over $40 billion by 2030 |

Entrants Threaten

The biopreservation and cell and gene therapy sectors present formidable regulatory challenges for potential new entrants. Companies must navigate complex validation and approval pathways, often involving extensive documentation and adherence to strict quality standards, such as those exemplified by FDA Master File cross-references.

Establishing robust quality control systems and successfully completing these rigorous processes demands considerable time and financial resources, acting as a significant deterrent to newcomers. BioLife Solutions' track record, including processing 782 Master File cross-references, underscores the substantial investment and expertise required to operate within this regulated environment.

Developing advanced biopreservation media and thaw devices demands significant scientific knowledge, ongoing research, and considerable financial backing for specialized production. For instance, BioLife Solutions' commitment to innovation in cryopreservation technology, as evidenced by their product pipeline and manufacturing capabilities, represents a substantial barrier.

The high initial costs and lengthy validation periods for new products in this sector deter many potential competitors. This means that companies like BioLife Solutions, with established infrastructure and proven product lines, benefit from a protected market position.

Established players like BioLife Solutions possess substantial intellectual property, notably patents covering their specialized biopreservation media such as CryoStor and HypoThermosol. Newcomers would face a significant hurdle, needing to innovate entirely new formulations that bypass these existing patents or incur substantial costs for licensing, thereby limiting the threat of new entrants.

Brand Reputation and Customer Trust

In the highly specialized and sensitive cell and gene therapy sector, brand reputation and customer trust are incredibly difficult for new entrants to replicate. Companies like BioLife Solutions have cultivated deep relationships built on years of delivering high-quality, reliable products essential for life-saving treatments. For instance, BioLife's CryoSeal™ products are critical for preserving biological materials, and any perceived risk in their supply chain due to an unproven new entrant can be a significant deterrent for customers. This established trust acts as a substantial barrier.

New companies face the daunting task of demonstrating consistent performance and unwavering quality to customers who are often navigating complex regulatory pathways and investing heavily in research and development. The financial commitment required to build this level of trust, coupled with the lengthy validation processes in the biopharmaceutical industry, makes it challenging for newcomers to gain a foothold. For example, the rigorous testing and qualification periods for cryopreservation media can take years, during which existing suppliers like BioLife continue to strengthen their market position.

- Established Reputation: BioLife Solutions benefits from a long-standing reputation for reliability in supplying critical reagents for cell and gene therapies.

- Customer Trust: Clients in this sector prioritize proven suppliers due to the sensitive nature of their work, making it hard for new entrants to gain immediate confidence.

- High Switching Costs: The extensive validation and qualification processes required for biological reagents mean that customers are reluctant to switch from trusted suppliers.

- Regulatory Hurdles: New entrants must navigate stringent regulatory requirements and extensive testing, which adds significant time and cost to market entry.

Access to Supply Chains and Distribution Networks

The biopharmaceutical sector, where BioLife Solutions operates, demands highly specialized raw materials and intricate global distribution channels. Building these capabilities from scratch is a significant hurdle for newcomers, requiring substantial investment and time to establish reliable sourcing and efficient delivery systems. For instance, companies like BioLife Solutions have spent years cultivating relationships with suppliers and optimizing their cold chain logistics to ensure product integrity for sensitive biological materials.

New entrants would find it exceptionally difficult to match the established scale and operational efficiency of existing players in managing these complex supply chains. The capital expenditure required to build out comparable infrastructure, including specialized warehousing and transportation fleets, is prohibitive. Furthermore, navigating the regulatory landscape for transporting biological products across different countries adds another layer of complexity that established firms have already mastered.

- Capital Intensity: Establishing a global cold chain logistics network for biopharmaceutical products can require hundreds of millions of dollars in infrastructure and technology investment.

- Supplier Relationships: Securing consistent access to specialized raw materials, like the proprietary cell culture media components BioLife Solutions utilizes, often depends on long-standing, trusted supplier partnerships.

- Regulatory Expertise: Navigating the diverse and stringent international regulations for shipping biological materials is a significant barrier that takes considerable time and resources to develop.

The threat of new entrants into the biopreservation and cell and gene therapy markets, where BioLife Solutions operates, is significantly mitigated by high barriers to entry. These barriers include substantial regulatory hurdles, the need for deep scientific expertise, considerable capital investment, and the critical importance of established brand reputation and customer trust. For instance, navigating FDA regulations and securing Master File cross-references, a process BioLife has mastered with 782 such references, is time-consuming and costly.

New companies must also overcome the challenge of replicating BioLife's intellectual property, particularly patents on its proprietary media like CryoStor and HypoThermosol, which requires significant innovation or licensing fees. Furthermore, building the necessary global cold chain logistics and securing reliable supplier relationships for specialized raw materials demands extensive capital and time, estimated to require hundreds of millions of dollars for infrastructure alone.

| Barrier Type | Description | Impact on New Entrants | Example for BioLife Solutions |

|---|---|---|---|

| Regulatory Hurdles | Complex validation and approval pathways, strict quality standards. | High cost and time to market entry. | 782 FDA Master File cross-references processed. |

| Intellectual Property | Patents on proprietary biopreservation media. | Requires costly licensing or development of alternative formulations. | Patents on CryoStor and HypoThermosol. |

| Capital Investment | Establishing advanced manufacturing, R&D, and global cold chain logistics. | Prohibitive initial costs for infrastructure and technology. | Hundreds of millions required for global cold chain infrastructure. |

| Brand Reputation & Trust | Cultivated deep relationships based on proven product reliability. | Difficult to gain immediate customer confidence in a sensitive sector. | Trusted supplier for critical reagents in life-saving treatments. |

Porter's Five Forces Analysis Data Sources

Our BioLife Solutions Porter's Five Forces analysis is built upon a foundation of robust data, including company annual reports, SEC filings, industry-specific market research reports, and trade publications.

We leverage insights from financial databases, competitor press releases, and relevant scientific journals to comprehensively assess the competitive landscape for BioLife Solutions.