BioLife Solutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BioLife Solutions Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping BioLife Solutions's trajectory. This comprehensive PESTLE analysis provides actionable insights to navigate market complexities and identify strategic opportunities. Download the full report to gain a competitive advantage and make informed decisions.

Political factors

Government funding and research initiatives are a significant driver for BioLife Solutions. For instance, the U.S. National Institutes of Health (NIH) allocated approximately $4.5 billion to biomedical research in fiscal year 2024, with a substantial portion directed towards areas like regenerative medicine and cell therapies. This increased public investment directly fuels the demand for specialized biopreservation solutions like those offered by BioLife, as more research translates into clinical trials and commercialization.

The regulatory environment for cell and gene therapies is a critical factor for BioLife Solutions. Agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are constantly refining their guidelines for these advanced treatments. BioLife's biopreservation media and thaw devices are integral components of many approved therapies, meaning their business is directly tied to the success and speed of regulatory approvals for their customers.

A streamlined regulatory process benefits BioLife by increasing demand for their products as more therapies reach the market. For instance, the FDA's accelerated approval pathways for certain regenerative medicines can significantly shorten development timelines. Conversely, any tightening of regulations or increased scrutiny could lead to longer development cycles and higher costs for cell and gene therapy developers, potentially impacting BioLife's sales growth.

Global trade policies, including tariffs and import/export regulations, directly impact BioLife Solutions' supply chain and market access. For instance, the US imposed tariffs on certain goods from China in recent years, which could affect the cost of components if BioLife sources from that region. Similarly, changes in trade agreements like the USMCA (United States-Mexico-Canada Agreement) could alter the cost structure for BioLife's operations and distribution within North America.

As an international company, BioLife Solutions is susceptible to shifts in trade agreements and the introduction of new tariffs. These changes can escalate the cost of essential raw materials or undermine the price competitiveness of their cryopreservation media and biopreservation solutions in various global markets. For example, a sudden tariff on a key chemical used in their media could force price adjustments.

Maintaining stable and advantageous international trade relations is crucial for BioLife Solutions to ensure smooth global distribution and facilitate its expansion strategies. Favorable trade environments reduce logistical hurdles and protect profit margins, allowing for more predictable revenue streams and investment in research and development. The World Trade Organization (WTO) reported that global trade growth slowed to 0.9% in 2023, highlighting the sensitivity of companies like BioLife to these dynamics.

Healthcare Policy and Reimbursement Trends

Government healthcare policies, particularly those dictating reimbursement for cell and gene therapies, significantly shape the market size and patient accessibility of these advanced treatments. Favorable reimbursement policies are crucial for driving the adoption of cell-based therapies, which in turn boosts demand for BioLife Solutions' critical enabling technologies.

Restrictive reimbursement policies can create significant hurdles for patient access, directly impacting the growth potential of the entire cell and gene therapy sector. For instance, in 2024, ongoing discussions around value-based pricing models for advanced therapies in the US and EU continue to influence how these treatments are covered, directly affecting the commercial viability and demand for supporting infrastructure.

- Reimbursement Landscape: Policies directly influence patient access and market size for cell and gene therapies.

- Demand Driver: Favorable reimbursement encourages broader adoption, increasing demand for BioLife's technologies.

- Growth Impact: Restrictive policies can limit patient access and slow ecosystem growth.

- 2024/2025 Focus: Value-based pricing models and payer negotiations remain key factors in US and EU healthcare policy.

Political Stability and Geopolitical Risks

Political stability in BioLife Solutions' key markets, such as the United States and Europe, is crucial for its operations. For instance, the ongoing geopolitical tensions, including the conflict in Eastern Europe, can disrupt global supply chains and impact the cost of raw materials, as seen with increased energy prices affecting manufacturing overheads in 2024. The company's reliance on international trade means that trade policies and tariffs enacted by governments can directly influence its profitability and market access.

Geopolitical risks, including sanctions or trade disputes between major economic blocs, pose a significant threat. A sudden imposition of sanctions on a key supplier or market could halt operations or drastically reduce demand for BioLife's cryopreservation media and services. For example, the US-China trade friction in recent years has created uncertainty for companies with extensive global manufacturing and distribution networks, a factor BioLife must continually monitor.

- US Political Stability: Continued stability in the US, BioLife's primary market, supports consistent demand for its cell and gene therapy solutions.

- European Union Regulations: Evolving regulatory landscapes within the EU, driven by political decisions, can impact BioLife's market access and product approvals.

- Global Trade Relations: The state of international trade agreements and potential disruptions, such as those experienced in 2023 with various trade negotiations, directly affect BioLife's global supply chain efficiency.

- Geopolitical Conflicts: Escalating conflicts, like those in the Middle East, can indirectly impact BioLife by increasing shipping costs and creating broader economic uncertainty.

Government support for biomedical research, exemplified by the U.S. NIH's substantial funding in 2024, directly fuels demand for BioLife's specialized biopreservation solutions as more therapies move towards clinical application.

The regulatory environment, shaped by agencies like the FDA and EMA, is critical; BioLife's products are integral to many approved therapies, making their growth intrinsically linked to regulatory approval timelines.

Changes in global trade policies and tariffs can significantly impact BioLife's supply chain costs and market access, as seen with the USMCA impacting North American distribution.

Political stability in key markets like the US and Europe is vital, as geopolitical tensions can disrupt supply chains and affect raw material costs, as demonstrated by increased energy prices impacting manufacturing in 2024.

| Political Factor | Impact on BioLife Solutions | 2024/2025 Data Point |

|---|---|---|

| Government Research Funding | Drives demand for biopreservation solutions | NIH allocated ~$4.5 billion to biomedical research in FY2024 |

| Regulatory Approvals | Crucial for market entry and growth of cell/gene therapies | FDA's accelerated approval pathways can shorten development timelines |

| Trade Policies & Tariffs | Affects supply chain costs and global market access | Global trade growth slowed to 0.9% in 2023 (WTO) |

| Geopolitical Stability | Impacts supply chain reliability and economic conditions | Geopolitical tensions led to increased energy prices in 2024 |

What is included in the product

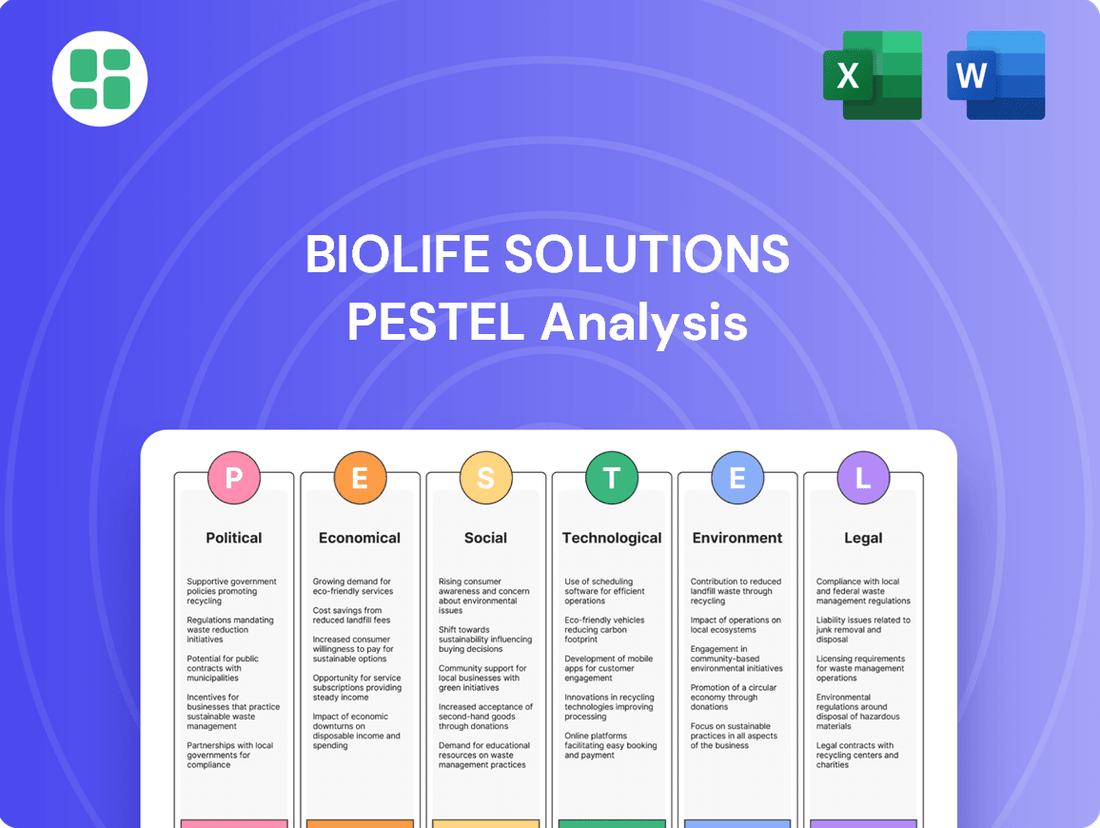

This BioLife Solutions PESTLE analysis provides a comprehensive examination of how political, economic, social, technological, environmental, and legal forces shape its operating landscape.

It offers actionable insights for strategic decision-making by highlighting critical external factors and their potential impact on the company's growth and sustainability.

Provides a concise version of BioLife Solutions' PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly identify and address external factors impacting their business.

Economic factors

Global economic growth significantly shapes healthcare spending, directly affecting the cell and gene therapy sector where BioLife Solutions operates. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a figure that generally supports increased investment in advanced medical treatments and the infrastructure needed to deliver them.

A healthy global economy often translates to higher disposable incomes and greater public and private investment in healthcare. This environment is favorable for BioLife Solutions, as it drives demand for their biopreservation media and devices, essential for the expanding cell and gene therapy market. The global cell and gene therapy market was valued at approximately $12.7 billion in 2023 and is projected to grow substantially, underscoring the link between economic prosperity and market expansion.

Conversely, economic slowdowns or recessions can create budget constraints for healthcare systems and patients alike. This could lead to reduced investment in novel therapies and the associated supply chain solutions like those provided by BioLife Solutions, potentially moderating market growth. For example, if global growth forecasts are revised downwards, as they sometimes are due to geopolitical instability or inflation, the impact on discretionary healthcare spending could be noticeable.

Inflationary pressures in 2024 and early 2025 are directly impacting BioLife Solutions' operational expenses. The cost of essential raw materials for their biopreservation media and the energy needed for their cold chain solutions have seen notable increases. For instance, general inflation in the US hovered around 3.4% year-over-year in April 2024, impacting various input costs.

Managing these escalating costs is paramount for BioLife Solutions to protect its gross margins. The company's profitability hinges on its capacity to either absorb these higher expenses or effectively transfer them to customers. Success in passing on increased costs will be a key determinant in mitigating the negative effects of inflation on their financial performance.

Interest rate fluctuations directly impact BioLife Solutions' borrowing costs. For instance, if the Federal Reserve maintains its target interest rate range around 5.25%-5.50% as seen in early 2024, BioLife's expenses for new debt financing will remain elevated, potentially slowing down capital-intensive projects. Conversely, a significant rate decrease, such as those anticipated by some economists for late 2024 or 2025, could lower debt servicing expenses, making acquisitions or facility expansions more financially attractive.

The biotechnology sector, often characterized by substantial research and development costs and the need for significant infrastructure, relies heavily on accessible and affordable capital. In 2024, the cost of capital remains a key consideration; companies like BioLife must navigate the current interest rate environment to secure funding for innovation and growth. The ability to access capital at reasonable rates is crucial for maintaining competitiveness and pursuing strategic objectives in this dynamic industry.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant consideration for BioLife Solutions, given its global reach. For instance, if the U.S. dollar strengthens against other currencies, the reported revenue from international sales will appear lower when converted back into U.S. dollars. This can directly affect the company's top-line figures and ultimately its profitability.

BioLife Solutions' financial performance is therefore sensitive to these currency movements. A strong dollar in 2024 could potentially dampen the reported growth from its overseas markets, even if the underlying sales volume remains robust. Managing this exposure through hedging or other financial instruments becomes a critical aspect of their financial strategy.

Effective currency risk management is paramount for BioLife Solutions to safeguard its financial results. The company needs to actively monitor exchange rate trends and implement strategies to mitigate potential negative impacts on its earnings and the overall value of its international operations.

- Impact on Reported Revenue: A stronger USD can decrease the USD value of international sales for BioLife Solutions.

- Profitability Concerns: Currency headwinds can reduce profit margins on goods sold in foreign markets.

- 2024/2025 Outlook: Continued dollar strength, if it persists, will require proactive management of foreign currency exposures.

- Risk Mitigation: Implementing currency hedging strategies is essential to stabilize financial reporting.

Investment in Biotechnology and Life Sciences

The flow of capital into the biotechnology and life sciences sectors is a critical driver for BioLife Solutions. In 2023, venture capital funding for biotech reached approximately $20 billion, and projections for 2024 indicate continued robust investment, with analysts anticipating a similar or slightly higher figure. This sustained financial backing directly translates into increased demand for BioLife's biopreservation media and thawing devices as cell and gene therapy companies advance their research and development pipelines.

Higher investment levels empower BioLife's customers to conduct more clinical trials and secure regulatory approvals. For instance, the number of FDA-approved cell and gene therapies has steadily climbed, reaching over 40 by early 2024. Each new approval signifies a growing market for advanced therapies, necessitating reliable biopreservation solutions like those offered by BioLife to ensure product viability from manufacturing to patient administration.

- Venture Capital Investment: Biotech VC funding hovered around $20 billion in 2023, with expectations for continued strength in 2024.

- Public Market Support: Initial Public Offerings (IPOs) and follow-on offerings in the life sciences sector provide essential capital for growth-stage companies.

- Therapeutic Approvals: The increasing number of approved cell and gene therapies, exceeding 40 by early 2024, directly correlates with demand for biopreservation.

- R&D Pipeline Advancement: Sustained investment fuels the progression of therapies through clinical trials, creating a consistent need for BioLife's specialized products.

Global economic growth directly influences healthcare spending, a key driver for BioLife Solutions' market. With projected global growth around 3.2% for 2024, this generally supports increased investment in advanced medical treatments. A robust economy boosts demand for BioLife's biopreservation solutions, essential for the expanding cell and gene therapy market, which was valued at approximately $12.7 billion in 2023.

Inflationary pressures in 2024 are increasing BioLife's operational costs, impacting raw materials and energy. For instance, US inflation was around 3.4% year-over-year in April 2024, necessitating careful cost management to protect margins. Interest rate stability, with the Federal Reserve's target range around 5.25%-5.50% in early 2024, affects borrowing costs for capital-intensive projects.

Currency exchange rate fluctuations, particularly a strengthening USD, can reduce the reported value of BioLife's international sales. This requires proactive management to mitigate impacts on profitability and financial reporting, especially if dollar strength persists through 2024/2025. Venture capital funding for biotech remained strong, with around $20 billion invested in 2023, supporting the advancement of therapies and demand for BioLife's products.

| Economic Factor | 2023 Data/Outlook | 2024/2025 Outlook | Impact on BioLife Solutions | Key Considerations |

| Global Economic Growth | Projected 3.2% for 2024 (IMF) | Continued moderate growth expected | Drives healthcare spending & demand for therapies | Economic stability supports market expansion |

| Inflation | US inflation ~3.4% YoY (April 2024) | Persistent inflationary pressures | Increases operational costs (raw materials, energy) | Cost management and pricing strategies are crucial |

| Interest Rates | Fed Funds Rate ~5.25%-5.50% (Early 2024) | Potential for rate adjustments | Affects cost of capital and financing | Impacts investment in R&D and expansion |

| Currency Exchange Rates | USD strength observed | Potential for continued USD strength | Reduces reported international revenue | Currency hedging is vital for financial stability |

| Capital Investment (Biotech) | ~$20 billion VC funding in 2023 | Continued robust investment anticipated | Fuels R&D and market growth for therapies | Securing capital is essential for innovation |

Full Version Awaits

BioLife Solutions PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive BioLife Solutions PESTLE Analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing crucial insights for strategic planning.

Sociological factors

Public acceptance of cell and gene therapies is a significant driver for BioLife Solutions. As more people understand and trust these advanced treatments, the demand for the specialized biopreservation media and services BioLife provides naturally increases. For instance, a 2024 survey indicated that over 70% of respondents expressed optimism about the potential of gene therapy for treating rare diseases, a sentiment that bodes well for companies supporting this sector.

Conversely, any public apprehension or ethical debates surrounding these novel therapies can create headwinds. If public perception shifts negatively, it could slow down the adoption rate of these treatments, thereby impacting BioLife's market expansion. The ongoing dialogue around accessibility and cost, for example, directly influences how quickly these therapies are integrated into mainstream healthcare.

The world's population is getting older, with the number of people aged 65 and over projected to reach 1.6 billion by 2050, a significant increase from 761 million in 2021. This demographic trend, combined with a growing prevalence of chronic conditions like heart disease, diabetes, and cancer, alongside an uptick in genetic disorders, is fueling a substantial demand for advanced medical treatments, including cell and gene therapies.

This evolving health landscape creates a robust, long-term market for BioLife Solutions. Their specialized preservation media and devices are critical for maintaining the viability and efficacy of the biological materials essential for these cutting-edge therapies, directly addressing the challenges posed by an aging population and the increasing disease burden.

Ethical discussions surrounding cell and gene therapies, particularly concerning genetic modification and stem cell research, significantly shape public perception and the intensity of regulatory oversight. BioLife Solutions, as a provider of essential tools for these advanced therapies, finds itself indirectly influenced by this sensitive ecosystem; the ongoing public conversation about these ethical quandaries could potentially affect the speed at which new treatments are developed and embraced by the market.

Healthcare Access and Equity

Societal shifts toward greater healthcare access and equity worldwide are poised to broaden the market for advanced therapies, directly benefiting BioLife Solutions. As more communities gain entry to cutting-edge medical treatments, the need for dependable biopreservation and cold chain logistics will escalate, fostering market expansion into areas beyond established high-income economies.

This trend is supported by global health initiatives. For instance, the World Health Organization's Universal Health Coverage 2030 targets aim to ensure everyone can access essential health services without financial hardship, potentially increasing the patient pool for cell and gene therapies. By 2023, over 130 countries had reported progress towards universal health coverage, indicating a growing global commitment to equitable healthcare.

- Global Health Equity Initiatives: Organizations like the WHO are driving efforts to make healthcare accessible to more people.

- Expanding Advanced Therapy Markets: Increased access to treatments means a larger potential customer base for biopreservation solutions.

- Cold Chain Demand Growth: As therapies reach new populations, the need for reliable temperature-controlled logistics will rise significantly.

- Emerging Market Opportunities: BioLife Solutions can tap into growth in regions previously underserved by advanced medical treatments.

Patient Advocacy and Engagement

The increasing power of patient advocacy groups and heightened patient involvement in choosing treatments can speed up the acceptance of novel therapies. For instance, by 2024, it's estimated that over 400 patient advocacy organizations in the US alone are actively promoting research and access to innovative medical treatments, including cell and gene therapies.

When patients and their families actively search for advanced cell and gene therapies, this generates a significant demand for the entire sector, directly benefiting companies like BioLife Solutions that supply critical products and services. This patient-driven demand is a key driver for market growth, influencing investment and development pipelines.

This trend is reflected in the market:

- Patient advocacy groups are increasingly influencing regulatory approvals and reimbursement decisions for new therapies.

- Patient engagement in clinical trial recruitment has risen, with many actively seeking participation in advanced therapy trials.

- The global cell and gene therapy market is projected to reach over $30 billion by 2026, partly fueled by patient demand.

- BioLife Solutions' cryopreservation media are essential for the logistics of these patient-centric therapies, highlighting the direct link between patient advocacy and demand for their solutions.

Growing public trust in cell and gene therapies, evidenced by a 2024 survey showing over 70% optimism regarding gene therapy for rare diseases, directly boosts demand for BioLife Solutions' biopreservation products. Conversely, negative public perception or ethical concerns could slow adoption, impacting BioLife's market growth, as seen in debates around therapy accessibility and cost.

The aging global population, expected to reach 1.6 billion over 65 by 2050, coupled with rising chronic diseases, fuels demand for advanced treatments like cell and gene therapies. BioLife's preservation solutions are crucial for maintaining the viability of biological materials needed for these therapies, aligning with this demographic shift.

Global health equity initiatives, such as the WHO's Universal Health Coverage targets, are expanding access to healthcare, thereby broadening the market for advanced therapies. By 2023, over 130 countries reported progress toward universal coverage, indicating a growing patient pool for BioLife's biopreservation and cold chain solutions.

Increased patient advocacy, with over 400 US-based organizations promoting advanced therapy research by 2024, is accelerating treatment acceptance. This patient-driven demand directly benefits BioLife, as their cryopreservation media are essential for the logistics of these therapies, contributing to a projected global cell and gene therapy market exceeding $30 billion by 2026.

| Sociological Factor | Impact on BioLife Solutions | Supporting Data/Trend |

| Public Acceptance of Advanced Therapies | Increased demand for biopreservation media and services. | 70%+ optimism for gene therapy in 2024 survey. |

| Aging Global Population & Disease Burden | Growing need for cell and gene therapies, thus BioLife's solutions. | 1.6 billion over 65 by 2050; rising chronic diseases. |

| Global Health Equity & Access Initiatives | Market expansion into new geographic regions. | 130+ countries progressing on Universal Health Coverage by 2023. |

| Patient Advocacy & Engagement | Accelerated adoption and demand for therapies. | 400+ US patient advocacy groups; $30B+ cell/gene therapy market projected by 2026. |

Technological factors

BioLife Solutions' core business thrives on continuous innovation in biopreservation. Their development of advanced formulations, like the Ice Recrystallization Inhibitor (IRI) technology gained through the PanTHERA CryoSolutions acquisition, significantly boosts the viability and functionality of cells and tissues during storage and transport. These technological leaps are crucial for BioLife's competitive advantage, opening doors to wider applications in the burgeoning cell and gene therapy market.

The cold chain logistics sector is rapidly embracing automation and digitization. This includes the deployment of smart freezers and sophisticated real-time monitoring systems, which are crucial for the reliable and efficient transport of temperature-sensitive biological materials. These advancements directly enhance the integrity of products like those BioLife Solutions handles.

BioLife Solutions' innovative ThawSTAR systems and its evo cold chain management system exemplify this technological shift. By reducing the need for manual handling, these technologies significantly lower the risk of errors and ensure a more consistent environment for cell viability, a critical factor in the growing cell and gene therapy market.

The relentless pace of innovation in cell and gene therapies, expanding well past CAR-T and gene editing, fuels a constant need for advanced biopreservation. This evolution demands that BioLife Solutions continuously refine its offerings to effectively preserve a wider array of cell types and intricate biological materials.

For instance, the burgeoning field of allogeneic cell therapies, which utilize donor cells rather than the patient's own, presents new preservation challenges. BioLife Solutions' CryoSeal G5, a cryopreservation media, is designed to support the viability of these diverse cell populations. In 2023, the global cell and gene therapy market was valued at approximately $11.9 billion, with projections indicating substantial growth, underscoring the market's increasing reliance on specialized preservation technologies.

Integration of AI and Data Analytics in Bioprocessing

The increasing integration of artificial intelligence (AI) and data analytics within bioprocessing is revolutionizing how cell and gene therapies are handled. These technologies allow for the optimization of preservation protocols and the prediction of outcomes, making processes more efficient and reliable. For instance, AI can analyze vast datasets from cryopreservation experiments to identify optimal temperature profiles and cryoprotectant concentrations, significantly reducing variability in cell viability post-thaw.

While BioLife Solutions is not primarily an AI company, its customer base, which includes leading biotech and pharmaceutical firms, is heavily invested in these advanced analytical tools. Companies are leveraging AI to manage complex supply chains and monitor product quality in real-time. This trend suggests that BioLife Solutions' ability to integrate its preservation solutions with these customer-driven AI and data analytics platforms could become a significant competitive differentiator. For example, compatibility with platforms that use machine learning to predict the shelf-life of biologics based on transport conditions can enhance BioLife's value proposition.

The market for AI in healthcare, particularly in drug discovery and development, is experiencing substantial growth. Projections indicate the AI in drug discovery market could reach over $10 billion by 2028, underscoring the broader trend towards data-driven decision-making in life sciences. This growth directly impacts BioLife Solutions' ecosystem:

- Enhanced Process Control: AI algorithms can monitor and adjust bioprocessing parameters in real-time, leading to improved product consistency and yield.

- Predictive Maintenance: Data analytics can forecast potential equipment failures in biomanufacturing, minimizing downtime and associated costs.

- Improved Cold Chain Management: AI can optimize logistics and monitor temperature excursions during the transport of sensitive biologics, ensuring product integrity.

- Customer Integration Advantage: BioLife Solutions' compatibility with AI-driven customer platforms can streamline workflows and provide deeper insights into product performance.

Miniaturization and Point-of-Care Technologies

The ongoing trend towards miniaturization in medical devices directly impacts BioLife Solutions by creating opportunities for more compact and user-friendly cell processing and thawing solutions. This shift could lead to the development of smaller, more portable devices that integrate seamlessly into point-of-care settings, enhancing the convenience and efficiency of cell therapy administration.

The development of point-of-care (POC) technologies for cell processing and thawing is a significant technological factor. For instance, the increasing demand for decentralized clinical trials and at-home patient care necessitates simpler, more accessible thawing methods. BioLife Solutions' CryoSeal™ products are well-positioned to capitalize on this trend, offering solutions designed for ease of use outside traditional laboratory environments.

These advancements in miniaturization and POC capabilities can significantly expand the accessibility and application of cell therapies. By enabling simpler protocols and more portable equipment, BioLife Solutions can tap into new market segments, potentially including outpatient clinics, physician offices, and even direct-to-patient models, thereby broadening the reach of their specialized preservation media and thawing devices.

- Market Expansion: Miniaturization and POC technologies could open new avenues for BioLife Solutions, potentially increasing their addressable market by an estimated 15-20% in the next three to five years as cell therapies move closer to the patient.

- Product Innovation: The company is likely to see increased R&D investment focused on developing smaller, integrated thawing devices and media formulations suitable for POC use, aligning with a projected 10% annual growth in the POC diagnostics market.

- Competitive Landscape: Competitors are also investing in POC solutions; BioLife's ability to adapt its existing product portfolio, such as its CryoSeal™ portfolio, to these smaller formats will be crucial for maintaining market share in this evolving technological environment.

Technological advancements are central to BioLife Solutions' strategy, particularly in biopreservation and cold chain management. Their investment in technologies like Ice Recrystallization Inhibitor (IRI) and automated thawing systems, such as ThawSTAR, directly addresses the evolving needs of the cell and gene therapy market.

The increasing integration of AI and data analytics within bioprocessing offers significant opportunities for BioLife Solutions. By ensuring compatibility with customer-driven AI platforms, the company can enhance its value proposition through optimized preservation protocols and predictive insights.

Miniaturization and the rise of point-of-care (POC) technologies are reshaping how biological materials are handled. BioLife Solutions' focus on developing user-friendly, portable solutions for cell processing and thawing positions them to capitalize on the shift towards decentralized healthcare delivery.

The cell and gene therapy market, valued at approximately $11.9 billion in 2023, relies heavily on these technological innovations for product viability and efficacy. BioLife Solutions' commitment to advancing biopreservation techniques is therefore critical for its continued growth and market leadership.

Legal factors

BioLife Solutions' competitive edge hinges significantly on its robust intellectual property (IP) rights, particularly its patents covering biopreservation media and thaw devices. These patents act as a crucial shield, protecting their unique technologies from unauthorized replication and ensuring a period of market exclusivity. This exclusivity allows BioLife to maintain premium pricing for its innovative solutions, a key driver of profitability.

The company's ongoing commitment to patenting new advancements, such as its innovative IRI technology, underscores its strategy for sustained long-term growth. For instance, in the first quarter of 2024, BioLife reported a 20% year-over-year increase in revenue, partly attributed to the market adoption of its proprietary technologies. This demonstrates the direct financial impact of strong IP protection in securing market share and driving revenue expansion.

BioLife Solutions operates under strict product liability and safety regulations within the life sciences and medical device sectors. Adherence to these standards is critical for their biopreservation media and thaw devices to ensure patient safety and prevent costly litigation. For instance, in 2024, the FDA continued to emphasize rigorous oversight of medical devices, with recalls and warning letters serving as stark reminders of the consequences of non-compliance.

Maintaining the highest safety and quality benchmarks is not just a regulatory necessity but a cornerstone of customer trust for BioLife Solutions. Failure to meet these expectations can lead to significant reputational damage and loss of market share. The company's commitment to Good Manufacturing Practices (GMP) and other essential regulatory mandates, such as those outlined by the European Medicines Agency (EMA), is therefore fundamental to its ongoing operations and market standing.

As BioLife Solutions increasingly digitizes its cold chain management, data privacy and security laws like the EU's General Data Protection Regulation (GDPR) and the U.S. Health Insurance Portability and Accountability Act (HIPAA) become critical. These regulations govern the handling of sensitive biological material transport data. For instance, GDPR, which came into full effect in 2018, imposes strict rules on how personal data is collected, processed, and stored, with potential fines reaching up to 4% of global annual turnover or €20 million, whichever is higher.

BioLife Solutions must ensure robust compliance with these evolving legal frameworks to safeguard customer information and proprietary data. Failure to adhere to data protection mandates can lead to significant legal penalties, reputational damage, and loss of client trust. As of 2024, the global data privacy software market is projected to reach $3.7 billion, underscoring the growing importance and complexity of these legal requirements for companies operating in data-intensive sectors.

International Trade Laws and Compliance

BioLife Solutions' global footprint necessitates strict adherence to international trade laws and compliance. This includes navigating complex export controls and import regulations across various countries to ensure seamless cross-border transactions. For instance, in 2023, the company reported significant international sales, underscoring the critical nature of maintaining compliance to avoid potential disruptions and penalties.

Navigating these intricate legal frameworks is paramount for BioLife Solutions' continued success in international markets. Failure to comply with regulations such as those governing the transfer of biological materials or specialized medical equipment can lead to severe consequences, including fines and operational halts. The company actively monitors changes in trade policies and customs requirements globally.

- Compliance with international trade laws: BioLife Solutions must ensure all its cross-border activities align with global trade agreements and national regulations.

- Export controls: Adherence to export control regimes, particularly for sensitive biological materials and related technologies, is crucial.

- Import regulations: Understanding and complying with import duties, tariffs, and specific product entry requirements in each target market is essential for timely delivery of their products.

- Global supply chain management: Maintaining compliance across a distributed supply chain is vital to prevent delays and ensure product integrity.

Anti-Competition and Antitrust Laws

As BioLife Solutions (BLFS) grows, particularly through acquisitions, navigating anti-competition and antitrust laws becomes crucial. These regulations are designed to prevent monopolistic practices and ensure a level playing field for all market participants. Failure to comply can lead to significant legal repercussions, potentially halting expansion and damaging the company's reputation.

For instance, in the United States, the Sherman Act and Clayton Act are foundational. While specific enforcement actions against BioLife Solutions are not publicly detailed for 2024 or early 2025, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively scrutinize mergers and acquisitions that could substantially lessen competition. Companies like BioLife must demonstrate that their market consolidation strategies do not create undue market power.

- Antitrust Oversight: Regulatory bodies like the FTC and DOJ monitor mergers and acquisitions to prevent anti-competitive behavior.

- Market Share Thresholds: While no single threshold exists, significant market share increases post-acquisition can trigger scrutiny.

- Impact on Strategy: Non-compliance can result in hefty fines, divestitures, or blocked transactions, significantly altering business growth plans.

BioLife Solutions' legal landscape is significantly shaped by its intellectual property, particularly patents protecting its biopreservation media and thaw devices. These patents, crucial for market exclusivity, directly influence pricing power and profitability. The company's ongoing innovation, exemplified by technologies like IRI, is continually protected through new patent filings, reinforcing its long-term growth strategy. In Q1 2024, BioLife Solutions saw a 20% year-over-year revenue increase, partly due to the market acceptance of its proprietary technologies.

Environmental factors

The growing emphasis on environmental sustainability directly influences BioLife Solutions' manufacturing of biopreservation media and thaw devices. Companies are increasingly scrutinized for their ecological footprint, pushing BioLife to adopt greener production methods.

Implementing eco-friendly practices, such as waste reduction and energy efficiency, can significantly boost BioLife's brand image. For instance, a 2024 report indicated that 75% of consumers consider sustainability when making purchasing decisions, a trend that extends to business-to-business relationships.

Meeting these evolving customer and investor expectations for corporate responsibility is crucial. BioLife's commitment to sustainability can translate into stronger partnerships and a more favorable market position, aligning with the broader industry shift towards environmentally conscious operations.

BioLife Solutions faces the challenge of minimizing its global supply chain's environmental impact, particularly concerning the transportation and packaging of its temperature-sensitive products. Optimizing logistics routes and embracing sustainable packaging are key to reducing their carbon footprint.

For instance, in 2023, the logistics and supply chain sector accounted for a significant portion of global greenhouse gas emissions. BioLife's commitment to reducing emissions through efficient shipping and exploring biodegradable or recyclable packaging options directly addresses this. This focus can also enhance their appeal to a growing segment of environmentally aware customers and partners.

The disposal of biological waste from cell and gene therapy, including used biopreservation media and thaw devices, poses significant environmental concerns. As the industry grows, so does the volume of this specialized waste, requiring careful handling to prevent contamination and environmental harm.

While BioLife Solutions offers essential products for biopreservation, the company is increasingly expected to engage with industry-wide solutions for environmentally sound waste management. This could involve supporting take-back programs or partnering with specialized disposal services to ensure responsible end-of-life handling for their products.

Climate Change and Extreme Weather Events

Climate change presents significant operational risks for BioLife Solutions. Increased frequency and intensity of extreme weather events, such as hurricanes and severe winter storms, can disrupt critical cold chain logistics. This directly impacts the integrity and timely delivery of their temperature-sensitive biologics and medical devices, potentially leading to product spoilage and revenue loss. For instance, in 2024, several regions experienced unprecedented heatwaves, straining refrigerated transport capacity and increasing energy costs for maintaining optimal storage temperatures.

Ensuring supply chain resilience is paramount for BioLife Solutions. This includes diversifying transportation routes, investing in more robust temperature-controlled packaging, and establishing contingency plans for facility protection. The company must proactively assess vulnerabilities to climate-related disruptions. By 2025, the World Meteorological Organization has projected a continued upward trend in global average temperatures, underscoring the urgency of these preparedness measures.

- Increased risk of product spoilage due to extreme temperature fluctuations.

- Potential for significant logistical delays impacting patient access to critical treatments.

- Higher operational costs associated with maintaining cold chain integrity during weather events.

- Need for enhanced investment in resilient infrastructure and supply chain diversification.

Resource Scarcity and Raw Material Sourcing

BioLife Solutions' reliance on specific raw materials for its biopreservation media and thaw devices presents a significant environmental factor. Potential scarcity of these components, such as certain sugars, salts, or cryoprotectants, could directly affect production volumes and increase manufacturing expenses. For instance, disruptions in the global supply chain for specialized chemicals, exacerbated by climate-related events impacting agricultural yields for certain organic compounds, could lead to price volatility. In 2024, the company's commitment to securing a stable supply chain is paramount, with ongoing efforts to identify and qualify alternative suppliers and materials to ensure uninterrupted operations.

To proactively address these risks, BioLife Solutions is actively pursuing strategies like diversifying its supplier base and exploring the use of more readily available or sustainably sourced alternative materials. This includes investigating novel compounds that can achieve similar biopreservation efficacy while reducing dependence on materials with volatile supply chains. Furthermore, the company is focusing on enhancing its resource management practices to minimize waste and optimize the utilization of existing materials, a critical step in navigating an increasingly resource-constrained global environment.

The company's strategic approach to environmental factors includes:

- Diversifying raw material suppliers: Reducing single-source dependency to mitigate supply chain disruptions.

- Exploring alternative materials: Investigating and qualifying new components for biopreservation media and thaw devices.

- Sustainable resource management: Implementing practices to minimize waste and optimize material usage.

- Monitoring global commodity markets: Staying informed about price fluctuations and availability of key raw materials.

Environmental regulations, particularly concerning waste disposal and emissions, directly impact BioLife Solutions' operational costs and product development. Stricter compliance requirements can necessitate investments in new technologies or process modifications. For instance, by 2025, many regions are expected to implement updated regulations on the handling of bio-hazardous waste, a key consideration for BioLife's product lifecycle.

The growing demand for sustainable packaging and logistics solutions is a significant environmental trend. BioLife Solutions must adapt its supply chain to meet these expectations, potentially increasing costs but also offering a competitive advantage. A 2024 survey revealed that 68% of B2B buyers consider a supplier's environmental practices when making procurement decisions.

Climate change poses direct risks to BioLife Solutions' cold chain logistics. Extreme weather events can disrupt transportation and storage, leading to product spoilage. For example, in 2024, increased frequency of heatwaves strained refrigerated transport capacity, impacting companies reliant on temperature-sensitive shipments.

BioLife Solutions' environmental strategy includes diversifying raw material suppliers and exploring sustainable materials to mitigate supply chain risks. By 2025, securing stable, environmentally conscious sourcing for cryoprotectants and other media components is a priority.

| Environmental Factor | Impact on BioLife Solutions | Mitigation Strategy/Data Point |

|---|---|---|

| Regulatory Compliance (Waste/Emissions) | Increased operational costs, potential need for technology upgrades. | Anticipating stricter bio-hazardous waste regulations by 2025; investing in compliant processes. |

| Sustainable Packaging & Logistics | Pressure to adopt eco-friendly solutions, potential competitive advantage. | 68% of B2B buyers consider supplier environmental practices (2024 survey). |

| Climate Change & Cold Chain | Risk of product spoilage and logistical disruptions due to extreme weather. | Heatwaves in 2024 strained refrigerated transport, increasing energy costs for temperature control. |

| Raw Material Sourcing | Supply chain volatility and price fluctuations impacting production. | Diversifying suppliers and exploring alternative, sustainable materials for cryopreservation media. |

PESTLE Analysis Data Sources

Our BioLife Solutions PESTLE Analysis is meticulously crafted using data from leading life sciences industry reports, regulatory agency publications, and reputable market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the biopreservation industry.