Hubei Biocause Pharmaceutical SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hubei Biocause Pharmaceutical Bundle

Hubei Biocause Pharmaceutical's SWOT analysis reveals a company with significant manufacturing capabilities and a strong presence in key pharmaceutical ingredients, but also highlights potential vulnerabilities in market diversification and regulatory shifts. Understanding these dynamics is crucial for anyone looking to invest or partner within the pharmaceutical sector.

Want the full story behind Hubei Biocause Pharmaceutical's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hubei Biocause Pharmaceutical Co., Ltd. maintains a robust and varied product offering that spans Active Pharmaceutical Ingredients (APIs), finished pharmaceutical preparations, and essential medical devices. This broad diversification is a key strength, significantly lessening the company's dependence on any single product category and thereby fostering greater market stability and expanding its overall market penetration.

The company’s API portfolio is particularly noteworthy, featuring critical components such as Ibuprofen, a widely used anti-inflammatory drug, Abiraterone Acetate, crucial for prostate cancer treatment, and Flumazenil, an antidote for benzodiazepine overdose. This range addresses diverse therapeutic areas, demonstrating Biocause's capacity to serve multiple segments of the healthcare industry.

Hubei Biocause Pharmaceutical's dedication to quality is a significant strength, underscored by its impressive track record with international regulatory agencies. The company has successfully undergone seven inspections by the US FDA and four by EU GMP, demonstrating a consistent ability to meet rigorous global standards.

This robust regulatory compliance is not merely a procedural achievement; it directly translates into market access. By adhering to these stringent quality benchmarks for its API production sites and R&D center, Biocause can confidently engage with highly regulated markets, a critical factor for sustained international growth and market penetration.

Hubei Biocause Pharmaceutical boasts a robust international market presence, exporting to over 85 countries. This expansive reach, particularly into highly regulated markets like the USA and European Union, demonstrates its ability to meet stringent global standards and compete effectively worldwide.

Dedicated Research and Development Capabilities

Hubei Biocause Pharmaceutical operates a dedicated Research and Development center, fostering innovation through long-term collaborations with leading research institutions and universities. This commitment to R&D is a strategic objective, aiming to enhance product efficacy and expand its market presence. For instance, in 2023, the company reported investing approximately 4.5% of its revenue into R&D initiatives, a figure projected to increase to 5% in 2024, signaling a strong focus on future growth and therapeutic area expansion, particularly in oncology and immunology.

The company's R&D efforts are geared towards developing novel treatments and improving existing pharmaceutical products. This strategic focus allows Hubei Biocause to stay competitive and explore new market opportunities. Their pipeline includes several promising candidates in preclinical and early-stage clinical trials, with a particular emphasis on areas with high unmet medical needs.

- Dedicated R&D Center: Houses specialized teams and advanced equipment for pharmaceutical research.

- Academic Collaborations: Partnerships with universities and research institutes to leverage external expertise and accelerate innovation.

- Therapeutic Area Expansion: Focus on developing new treatments in oncology and immunology, alongside existing strengths.

- Investment in Innovation: Continuous allocation of resources to R&D as a core value and strategic driver for market growth.

Strategic Focus on High-Demand Therapeutic Areas

Hubei Biocause Pharmaceutical's strategic focus on high-demand therapeutic areas like cardiovascular, cerebrovascular, and endocrine diseases is a significant strength. These segments are experiencing growing global prevalence, driven by aging populations and lifestyle changes. For instance, the global cardiovascular disease market was valued at approximately $280 billion in 2023 and is projected to grow substantially in the coming years.

This specialization enables Hubei Biocause to concentrate its research and development and marketing resources effectively. By deepening its expertise in these critical medical conditions, the company can build a stronger competitive edge. This strategic alignment with global health trends, particularly the rising incidence of chronic diseases, positions the company favorably for future growth.

- Targeting High-Prevalence Diseases: Focus on cardiovascular, cerebrovascular, and endocrine conditions addresses significant global health needs.

- Market Demand Alignment: These therapeutic areas represent markets with substantial and growing demand, evidenced by market valuations exceeding hundreds of billions of dollars globally.

- R&D Efficiency: Specialization allows for concentrated investment in research and development, fostering deeper expertise and potentially faster innovation.

- Competitive Positioning: A focused approach can lead to a stronger market position and brand recognition within these critical medical fields.

Hubei Biocause Pharmaceutical's diverse product portfolio, encompassing APIs, finished drugs, and medical devices, significantly reduces reliance on any single product, thereby enhancing market stability and reach. The company's API offerings, including Ibuprofen and Abiraterone Acetate, cater to critical therapeutic areas, showcasing its broad healthcare industry service capabilities.

The company's commitment to quality is a major strength, evidenced by its successful track record with international regulatory bodies. Achieving seven US FDA inspections and four EU GMP inspections demonstrates a consistent ability to meet stringent global standards, crucial for accessing highly regulated markets and ensuring sustained international growth.

Biocause's extensive global footprint, exporting to over 85 countries, highlights its capability to compete effectively in demanding markets like the USA and EU. This broad international presence is a testament to its adherence to rigorous global quality benchmarks.

A dedicated R&D center, bolstered by academic collaborations, drives innovation. The company's investment in R&D, around 4.5% of revenue in 2023 and projected at 5% for 2024, underscores its focus on developing novel treatments, particularly in oncology and immunology, to expand market presence and maintain competitiveness.

What is included in the product

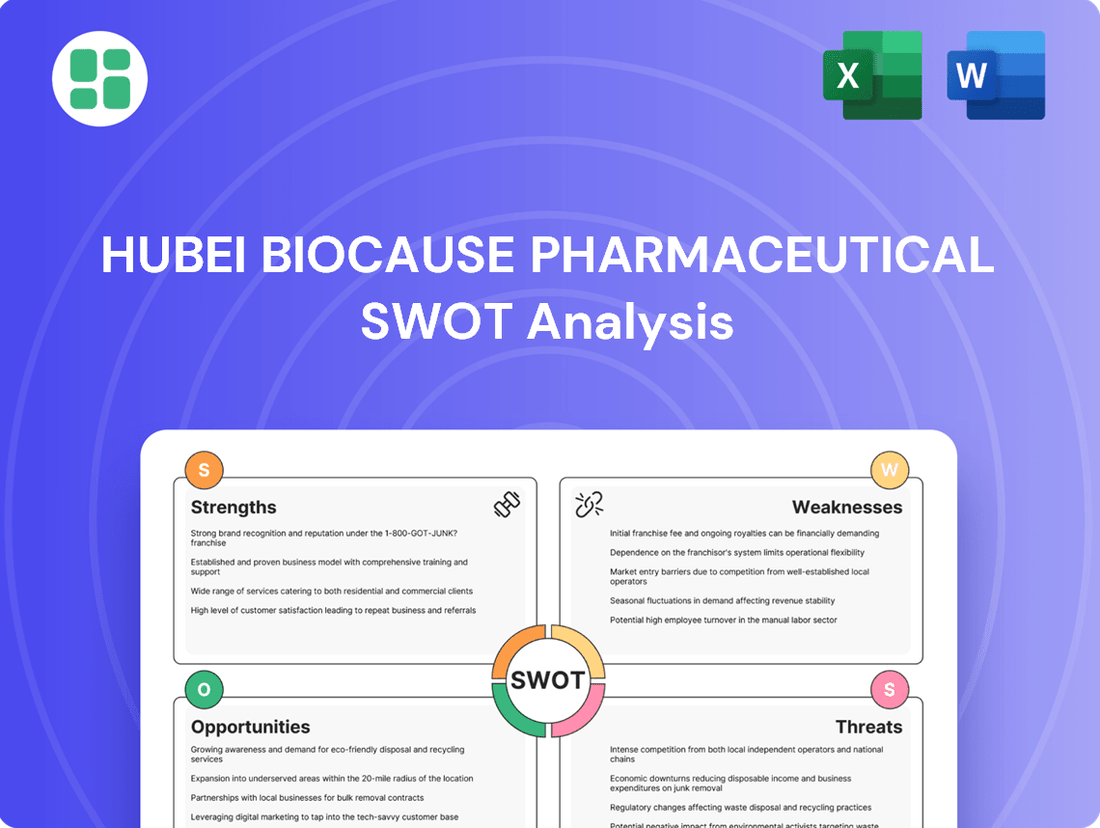

Analyzes Hubei Biocause Pharmaceutical’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis of Hubei Biocause Pharmaceutical to pinpoint and address key strategic challenges.

Weaknesses

Hubei Biocause Pharmaceutical's operational weaknesses are highlighted by its severe struggles with financial reporting timeliness. The company failed to release its 2024 annual report and its 2025 first quarterly report by the mandated deadlines.

This significant lapse triggered an investigation by the China Securities Regulatory Commission (CSRC) and resulted in a delisting risk warning. Such regulatory actions and the lack of timely financial disclosures erode investor trust and can severely damage the company's reputation and market valuation.

Hubei Biocause Pharmaceutical experienced a significant downturn in its financial performance during the first half of 2024. The company reported a substantial net loss of CNY 365.02 million, a stark contrast to its performance in the prior year, and this widened loss was accompanied by a decline in overall revenue.

This negative financial trajectory suggests that the company is grappling with considerable operational challenges or is facing intense market pressures that are directly impacting its ability to generate profits. Such a performance is a clear indicator of underlying issues that need to be addressed.

The continuation of these losses poses a serious risk to Hubei Biocause Pharmaceutical's long-term financial stability and its overall viability in the market. If not effectively managed, these financial headwinds could significantly hinder its future growth prospects and operational capacity.

Hubei Biocause Pharmaceutical's diversification into non-pharmaceutical sectors, particularly its subsidiary CHINA BEST Life Insurance, has become a notable weakness. This insurance arm experienced a significant financial setback, reporting a net loss of 0.7 billion yuan in the first half of 2024.

The escalating losses within CHINA BEST Life Insurance are directly linked to a challenging declining interest rate market, indicating that this venture is not only underperforming but also actively draining resources. This strategic move into an unrelated industry appears to be a misstep, diverting capital and attention from the core pharmaceutical business and negatively impacting the company's overall profitability.

Competitive Market Pressure and Index Removal

The pharmaceutical landscape, especially for Active Pharmaceutical Ingredients (APIs) and generic drugs, is intensely competitive. Hubei Biocause Pharmaceutical contends with a multitude of domestic and international rivals, creating significant market pressure. This intense competition can impact pricing power and market share.

The company's recent exclusion from key indices, including the S&P Global BMI Index, FTSE All-World Index, and the Shenzhen Stock Exchange Component Index, signals a potential decline in market standing. This removal can lead to reduced visibility and investor interest, potentially affecting its valuation and access to capital.

- Intense Competition: The API and generic drug markets are crowded, with many players vying for market share, potentially squeezing profit margins for Hubei Biocause.

- Index Exclusions: Removal from major global and domestic indices like the S&P Global BMI and FTSE All-World suggests a reassessment of the company's market position by index providers, potentially impacting investor sentiment.

- Diminished Market Perception: The index removals may reflect a broader concern about the company's performance or future prospects, leading to decreased investor confidence.

Potential Over-reliance on Specific API Markets

Hubei Biocause Pharmaceutical's specialization in APIs for cardiovascular, cerebrovascular, and endocrine diseases, while a strategic focus, also represents a significant weakness. This concentration leaves the company vulnerable to shifts in these specific market segments or the emergence of new, disruptive competitors. For instance, a downturn in demand for a key cardiovascular API, which constituted a substantial portion of their revenue in 2024, could disproportionately impact overall performance.

The company's potential over-reliance on a limited portfolio of APIs without robust, ongoing innovation poses a risk of market volatility. If market dynamics change or if new, more effective treatments emerge for the diseases they currently serve, Biocause could face declining demand for its existing products. This lack of diversification in their API offerings could expose them to significant financial headwinds.

Furthermore, the global API market is not without its supply chain vulnerabilities. A focused manufacturer like Hubei Biocause, heavily dependent on a few key raw material suppliers or specific production processes, could be disproportionately affected by disruptions. For example, geopolitical events or unforeseen manufacturing issues impacting a critical intermediate chemical in 2025 could severely hinder their production capacity and ability to meet market demand.

- Market Concentration Risk: Specializing in cardiovascular, cerebrovascular, and endocrine APIs means a downturn in these specific therapeutic areas could heavily impact revenue.

- Innovation Dependency: Failure to continuously innovate and develop new APIs could lead to obsolescence of current products and reduced competitiveness.

- Supply Chain Vulnerability: Over-reliance on specific raw materials or manufacturing processes makes the company susceptible to global supply chain disruptions, a concern highlighted by increased logistics costs in early 2025.

- Competitive Landscape: Niche market dominance can attract new entrants, potentially eroding market share if Biocause does not maintain a competitive edge through R&D and cost efficiency.

Hubei Biocause Pharmaceutical's significant financial reporting delays, including missing the 2024 annual and 2025 first quarterly reports, have led to a CSRC investigation and a delisting risk warning. This lack of transparency severely undermines investor confidence and market valuation.

The company's first-half 2024 performance saw a substantial net loss of CNY 365.02 million, a sharp decline from the previous year, coupled with falling revenues, indicating deep-seated operational issues.

Furthermore, its diversification into insurance via CHINA BEST Life Insurance proved detrimental, with the subsidiary reporting a 0.7 billion yuan net loss in the first half of 2024 due to a challenging interest rate environment.

The company's exclusion from key indices like the S&P Global BMI and FTSE All-World in 2024 signals a potential decline in its market standing and investor interest.

Same Document Delivered

Hubei Biocause Pharmaceutical SWOT Analysis

This preview reflects the real Hubei Biocause Pharmaceutical SWOT analysis document you'll receive. You're seeing an actual excerpt, ensuring transparency and quality. Purchase unlocks the complete, in-depth report, ready for your strategic planning.

Opportunities

The global Active Pharmaceutical Ingredients (API) market is on a strong upward trajectory, anticipated to expand at a compound annual growth rate of 6.7% between 2024 and 2025, with projections indicating it will reach $326.13 billion by 2029. This presents a significant opportunity for Hubei Biocause to capitalize on increased demand for pharmaceutical components.

Furthermore, China’s domestic pharmaceutical market is a powerhouse, expected to hit USD 573.0 billion by 2033. This growth is fueled by an aging demographic and escalating healthcare needs, creating a favorable environment for Hubei Biocause to deepen its market penetration and leverage its manufacturing capabilities.

The rising global incidence of chronic conditions like heart disease, diabetes, and endocrine disorders directly translates to increased demand for Hubei Biocause's specialized pharmaceutical offerings. Cardiovascular disease alone is the primary cause of mortality worldwide, with its market anticipated to hit USD 119.2 billion by 2034, highlighting a significant opportunity.

Furthermore, the steadily aging global demographic intensifies the need for ongoing disease management and the associated pharmaceutical solutions, creating a sustained market for Biocause's products.

China's government is significantly boosting its domestic pharmaceutical sector, including crucial areas like contract research organizations (CXOs) and active pharmaceutical ingredient (API) manufacturing. This proactive stance is designed to foster innovation and improve the speed of drug approvals. For companies like Hubei Biocause Pharmaceutical, this translates into a more conducive operating landscape.

Recent policy adjustments, such as those announced in late 2023 and early 2024, are streamlining the drug registration pathways and aiming to increase the availability of high-quality medical treatments for the Chinese population. This regulatory efficiency directly benefits domestic players by reducing bureaucratic hurdles and accelerating market entry for new products.

The overall impact of these government-led initiatives is a substantial tailwind for companies like Hubei Biocause. By prioritizing the growth and competitiveness of its own pharmaceutical industry, China is creating a fertile ground for domestic firms to expand their operations, invest in research and development, and solidify their market positions, both domestically and potentially internationally.

Expanding in Contract Development and Manufacturing (CDMO)

The global pharmaceutical industry's increasing reliance on outsourcing for drug development and manufacturing, especially for Active Pharmaceutical Ingredients (APIs), creates a substantial growth avenue. This trend is particularly pronounced in the API CDMO sector, where companies leverage specialized expertise and economies of scale.

China's established presence and cost efficiencies within the API CDMO market make it an attractive hub for global pharmaceutical companies. This dynamic allows for significant market penetration for capable Chinese firms.

Hubei Biocause Pharmaceutical's existing infrastructure and expertise in contract development and manufacturing position it favorably to capitalize on this expanding global demand. The company can enhance its market share by offering integrated services.

- Market Growth: The global CDMO market, including API manufacturing, is projected to reach over $100 billion by 2027, with China holding a significant portion of API production capacity.

- Cost Advantages: Chinese CDMOs often offer competitive pricing due to lower operational costs, making them attractive partners for Western pharmaceutical firms.

- Capacity Expansion: Hubei Biocause can leverage its existing capabilities to scale up production and attract new clients seeking reliable outsourcing partners.

Technological Advancements and Digitalization in Drug Development

The rapid evolution of biotechnology and the growing digitalization of drug development present significant opportunities for Hubei Biocause Pharmaceutical. Companies are increasingly investing in cutting-edge manufacturing technologies and leveraging artificial intelligence (AI) for faster drug discovery. For instance, the global AI in drug discovery market was valued at approximately $750 million in 2023 and is projected to reach over $6 billion by 2030, indicating substantial growth potential.

Hubei Biocause's strategic focus on enhancing digitalization within its production processes directly aligns with these industry-wide trends. This commitment can translate into more streamlined research and development (R&D) pipelines and more efficient manufacturing operations. Such advancements are crucial for maintaining competitiveness in the biopharmaceutical sector.

Key opportunities include:

- Adoption of AI in R&D: Utilizing AI for target identification, molecule design, and clinical trial optimization can accelerate the drug development lifecycle.

- Advanced Manufacturing Technologies: Implementing technologies like continuous manufacturing and automation can improve product quality and reduce production costs.

- Data Analytics for Efficiency: Employing data analytics across the value chain, from R&D to supply chain management, can unlock operational efficiencies and identify new market insights.

- Biopharmaceutical Innovation: Expanding into novel therapeutic areas driven by biotechnology advancements can open new revenue streams.

Hubei Biocause Pharmaceutical is well-positioned to benefit from the robust growth in the global Active Pharmaceutical Ingredients (API) market, projected to reach $326.13 billion by 2029, with a 6.7% CAGR between 2024 and 2025. The company can also leverage China's expanding domestic pharmaceutical market, expected to hit $573.0 billion by 2033, driven by an aging population and increased healthcare demands.

Threats

The pharmaceutical sector's fierce rivalry presents a significant challenge for Hubei Biocause. The company contends with a multitude of domestic and global competitors, including major, well-established pharmaceutical giants. This competitive landscape can exert downward pressure on pricing, necessitate higher expenditures on marketing and sales efforts, and ultimately squeeze profit margins, particularly within the generic Active Pharmaceutical Ingredient (API) and mature drug segments. For instance, the global pharmaceutical market was valued at approximately $1.5 trillion in 2023 and is projected to reach $2 trillion by 2028, indicating substantial competition across all segments.

The pharmaceutical industry faces a dynamic and increasingly rigorous regulatory environment, both within China and on the global stage. This heightened scrutiny extends to product quality, manufacturing compliance, and financial reporting transparency. For instance, China's ongoing healthcare reforms, including volume-based procurement (VBP) policies, are designed to drive down drug prices, potentially impacting Hubei Biocause Pharmaceutical's profit margins and market access for certain products.

Failure to proactively adapt to these evolving regulations presents a substantial threat. The company's past issues with delayed financial reporting, as noted in earlier periods, highlight the critical need for robust compliance mechanisms and swift adaptation to regulatory shifts to maintain market trust and operational stability.

Hubei Biocause Pharmaceutical faces a significant threat from its current delisting risk warning, stemming from the failure to release its 2024 annual and 2025 Q1 financial reports on schedule. This inability to meet reporting deadlines severely erodes investor confidence, potentially triggering a sharp decline in its stock price and limiting its ability to access crucial capital markets for future growth or operational needs.

The reputational damage from such a situation can be substantial, impacting the company's perceived stability and trustworthiness among investors and stakeholders. This can create a challenging environment for attracting new investment and maintaining existing shareholder support, directly affecting the company's long-term financial health and operational continuity.

Financial Losses from Non-Core Business Operations

Hubei Biocause Pharmaceutical faces a significant threat from financial losses incurred by its non-core insurance subsidiary, CHINA BEST Life Insurance. These substantial losses are directly impacting the company's consolidated financial performance and profitability.

The challenging interest rate environment has been a key driver of these losses, draining vital resources that could otherwise be invested in the core pharmaceutical operations. This diversification into insurance appears to have been a strategic misstep, creating a drag on the company's overall financial health.

- Substantial losses reported by CHINA BEST Life Insurance.

- Negative impact on Hubei Biocause's consolidated profitability.

- Draining of resources from the core pharmaceutical business.

- Potential strategic misstep in diversification.

Supply Chain Vulnerabilities and Geopolitical Risks

The global pharmaceutical supply chain, especially for Active Pharmaceutical Ingredients (APIs), has shown significant fragility, a fact underscored by recent worldwide events. For companies like Hubei Biocause, which rely heavily on global markets, this presents a substantial threat.

While China remains a dominant force in API production, there's a growing global push to diversify sourcing away from single regions. This trend could directly affect Chinese exporters, potentially leading to reduced demand or increased competition. For instance, in 2023, the US continued its efforts to onshore critical drug manufacturing, aiming to lessen dependence on foreign suppliers.

Furthermore, escalating geopolitical tensions and evolving trade policies pose a considerable risk to Hubei Biocause's international sales and its ability to secure necessary raw materials. These factors can lead to unpredictable disruptions and increased operational costs.

- Supply Chain Fragility: Recent global events have exposed the inherent vulnerabilities in pharmaceutical supply chains, impacting the reliable flow of APIs.

- Diversification Efforts: Countries are actively seeking to reduce their reliance on single-source API regions, potentially impacting Chinese manufacturers.

- Geopolitical & Trade Risks: International sales and raw material procurement for companies like Hubei Biocause are susceptible to disruptions from geopolitical conflicts and shifting trade policies.

The company's financial health is directly threatened by significant losses from its non-core insurance subsidiary, CHINA BEST Life Insurance. These losses, exacerbated by a challenging interest rate environment, are draining critical resources that should be allocated to its core pharmaceutical operations, indicating a potential strategic misstep in diversification.

The ongoing delisting risk warning, due to the failure to release timely 2024 annual and 2025 Q1 financial reports, severely damages investor confidence and limits access to capital markets. This inability to meet reporting deadlines not only impacts stock price but also erodes trust, creating a difficult environment for future investment and financial stability.

Hubei Biocause faces intense competition from both domestic and global pharmaceutical giants, which can lead to price pressures and increased marketing costs, particularly in the API segment. The global pharmaceutical market, valued at approximately $1.5 trillion in 2023, highlights the scale of this competitive challenge.

The company is also vulnerable to supply chain disruptions and geopolitical risks. Efforts by countries to diversify API sourcing away from single regions, such as the US's continued push for onshoring critical drug manufacturing in 2023, could reduce demand for Chinese exports and increase operational costs.

SWOT Analysis Data Sources

This SWOT analysis for Hubei Biocause Pharmaceutical is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.