Hubei Biocause Pharmaceutical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hubei Biocause Pharmaceutical Bundle

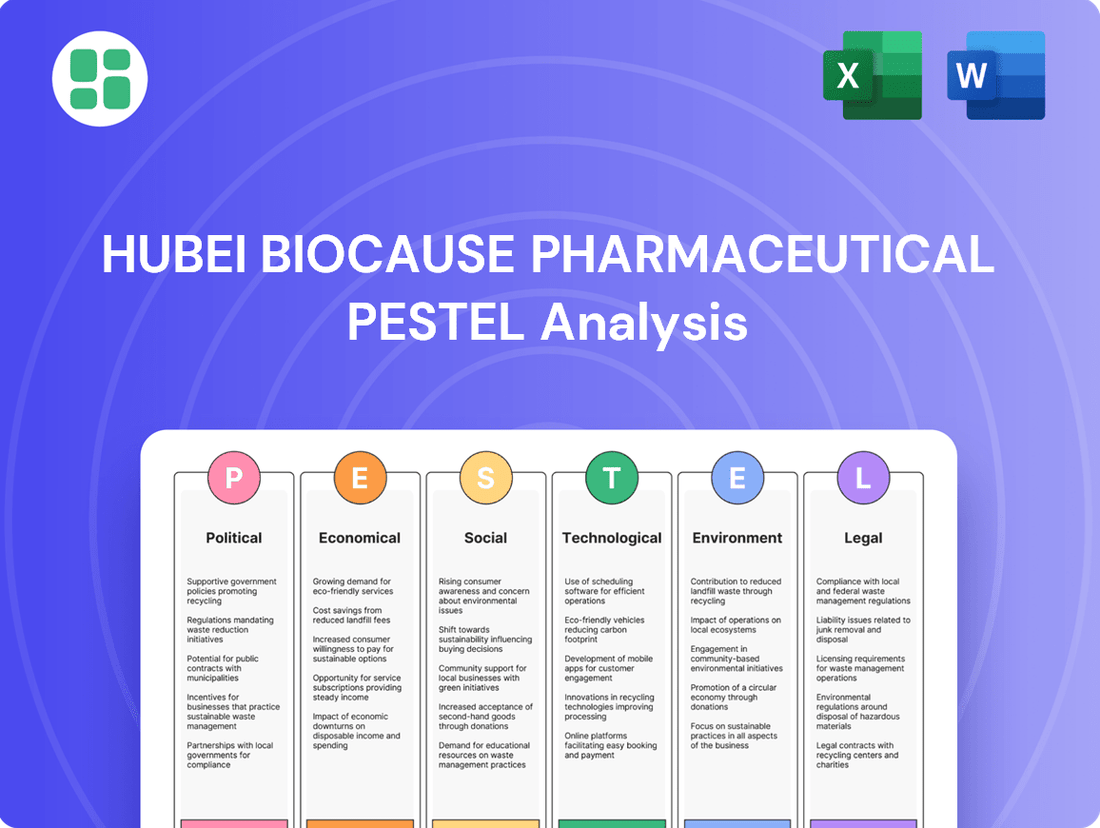

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Hubei Biocause Pharmaceutical. This comprehensive PESTLE analysis provides actionable intelligence to navigate market dynamics and identify strategic opportunities. Download the full version now and gain the competitive edge you need.

Political factors

The Chinese government's commitment to healthcare reform, exemplified by the 14th Five-Year Plan and the Pharmaceutical Industry High-Quality Development Action Plan (2023-2025), is a significant political factor. These initiatives aim to broaden access to medical services and manage healthcare expenditures, directly impacting companies like Hubei Biocause Pharmaceutical.

These reforms are designed to boost demand for cost-effective and novel medications, a segment where Hubei Biocause Pharmaceutical operates. Policy adjustments frequently favor domestic innovation and offer incentives to local producers, creating a more favorable environment for companies prioritizing research and development within China.

China's National Healthcare Security Administration (NHSA) continues to implement policies like the National Reimbursement Drug List (NRDL) and volume-based procurement (VBP), which significantly impact drug pricing. These initiatives aim to lower costs for patients but require pharmaceutical companies, including Hubei Biocause Pharmaceutical, to make substantial price reductions to secure market access and volume. For instance, VBP rounds in recent years have seen average price cuts exceeding 50% for many drug categories.

The National Medical Products Administration (NMPA) is actively streamlining its drug and medical device approval processes. This initiative is designed to expedite market entry for innovative healthcare products, a move that directly benefits companies like Hubei Biocause Pharmaceutical.

For instance, the Pilot Work Plan for Optimizing Review and Approval of Clinical Trials for Innovative Drugs, implemented in recent years, has demonstrably reduced review timelines. This acceleration allows companies to bring crucial new treatments to market more efficiently, fostering domestic innovation and competitiveness.

Geopolitical Tensions and Supply Chain Resilience

Global geopolitical tensions significantly influence the supply chain for Active Pharmaceutical Ingredients (APIs) and essential raw materials, directly impacting pharmaceutical manufacturing. Hubei Biocause Pharmaceutical, as a key API producer and exporter, must actively monitor these evolving geopolitical dynamics. For instance, the ongoing trade friction between major economies in 2024 has already led to increased scrutiny of cross-border pharmaceutical supply chains, potentially affecting import costs and export accessibility. This necessitates a proactive approach to diversifying sourcing locations and export markets to maintain stability and mitigate inherent risks.

To navigate these challenges, Hubei Biocause Pharmaceutical should consider the following strategic actions:

- Diversify API Sourcing: Explore partnerships with suppliers in regions with lower geopolitical risk profiles to reduce reliance on single-source or high-risk geographies.

- Expand Export Market Reach: Identify and develop new export markets beyond traditional trading partners to spread risk and capture opportunities in less volatile regions.

- Strengthen Supply Chain Visibility: Invest in technology and processes that provide real-time tracking and transparency across the entire supply chain, enabling quicker responses to disruptions.

- Build Strategic Reserves: Maintain adequate inventory levels for critical raw materials and APIs to buffer against short-term supply interruptions.

Intellectual Property Protection and Enforcement

China's commitment to bolstering intellectual property (IP) protection in its pharmaceutical industry is a significant political factor. This enhanced legal framework, particularly evident in recent years, offers greater security for Hubei Biocause Pharmaceutical's research and development expenditures and its unique product formulations. Such improvements are crucial for encouraging continued innovation and actively combating the pervasive issue of counterfeit medicines.

The strengthening of IP laws directly impacts Hubei Biocause Pharmaceutical by providing a more robust defense against unauthorized replication of its patented drugs and manufacturing processes. This improved environment is vital for recouping substantial R&D investments. For instance, China's Supreme People's Court reported a 20% increase in IP-related first-instance judgments in 2023, signaling more rigorous enforcement.

- Increased R&D Investment Security: Enhanced IP protection safeguards Hubei Biocause Pharmaceutical's significant investments in drug discovery and development.

- Deterrence of Counterfeiting: Stronger enforcement mechanisms reduce the risk of market saturation by counterfeit products, protecting brand integrity and revenue.

- Favorable Innovation Climate: A secure IP landscape encourages further innovation and the introduction of novel therapies, aligning with national policy goals.

- Market Competitiveness: Robust IP rights allow the company to maintain a competitive edge in both domestic and international markets.

The Chinese government's ongoing healthcare reforms, particularly those outlined in the 14th Five-Year Plan (2021-2025), continue to shape the pharmaceutical landscape. These policies prioritize innovation and cost-effectiveness, directly benefiting companies like Hubei Biocause Pharmaceutical that focus on these areas.

Government initiatives such as volume-based procurement (VBP) and inclusion in the National Reimbursement Drug List (NRDL) exert downward pressure on drug prices. For example, VBP rounds have historically seen average price reductions exceeding 50% for many drug categories, compelling companies to adapt their pricing strategies to maintain market access.

The National Medical Products Administration (NMPA) is actively streamlining its approval processes for new drugs and medical devices. This acceleration, seen in pilot programs reducing clinical trial review times, allows companies like Hubei Biocause Pharmaceutical to bring innovative treatments to market more efficiently.

Geopolitical factors, including trade tensions in 2024, significantly impact API sourcing and global supply chains. Companies like Hubei Biocause Pharmaceutical must diversify suppliers and export markets to mitigate risks associated with international trade dynamics.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Hubei Biocause Pharmaceutical, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking strategies to help navigate market dynamics and capitalize on emerging opportunities within the pharmaceutical sector.

This PESTLE analysis for Hubei Biocause Pharmaceutical offers a concise version that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of lengthy, complex reports.

Economic factors

Despite facing some economic headwinds, China's economy is still expanding, which is a major driver for increased healthcare spending. Estimates suggest the healthcare market in China could reach substantial growth by 2030, creating a favorable environment for companies like Hubei Biocause Pharmaceutical.

A key factor is China's burgeoning middle class and their increasing disposable income. This trend translates directly into greater demand for higher-quality pharmaceuticals and medical devices, areas where Hubei Biocause Pharmaceutical is actively positioned.

Inflationary pressures in 2024 and early 2025 are directly impacting Hubei Biocause Pharmaceutical by driving up the costs of essential inputs like raw materials, energy, and labor. For instance, global commodity prices, a key component of pharmaceutical manufacturing, have seen significant volatility. This necessitates proactive cost management and optimized production to safeguard profit margins.

China's healthcare insurance landscape has undergone significant transformation, with the basic medical insurance system now covering over 95% of the population as of early 2024. This expansion directly impacts patient affordability for pharmaceuticals, influencing market access for companies like Hubei Biocause Pharmaceutical.

The increasing prominence of commercial medical insurance, which saw a 15% year-on-year growth in premiums in 2023, further diversifies patient purchasing power and creates new avenues for drug sales. However, this evolving system also intensifies pressure on pharmaceutical companies to demonstrate cost-effectiveness to secure inclusion on national and provincial reimbursement lists, a critical factor for broad market penetration.

Investment Climate and Capital Availability

China's biopharmaceutical sector has seen a notable cooling in Initial Public Offerings (IPOs) through late 2023 and into 2024, creating a more selective environment for capital raising. Despite this, government backing for strategic areas within biotech, including advanced drug development and manufacturing, remains robust, encouraging continued investment in research and development. Mergers and acquisitions (M&A) activity is also a key avenue for growth, with companies actively seeking partnerships or consolidation opportunities to enhance capabilities and market reach.

Hubei Biocause Pharmaceutical's funding success for crucial initiatives like R&D, facility expansion, or strategic acquisitions hinges on its adaptability to these shifting investment dynamics. Demonstrating consistent financial health and a clear strategic vision will be paramount in attracting capital. For instance, the overall venture capital funding in China's biotech sector saw a dip in 2023 compared to previous years, highlighting the increased scrutiny investors are applying.

- IPO Market Cooling: A general slowdown in biopharma IPOs in China during 2023-2024, making public market fundraising more challenging.

- Continued Government Support: Ongoing strategic government funding and incentives for key biopharmaceutical advancements.

- Active M&A Landscape: Mergers and acquisitions remain a significant channel for growth and capability enhancement within the sector.

- Funding Dependency: Hubei Biocause's ability to secure capital for R&D and expansion is directly tied to navigating these evolving investment trends and showcasing strong financial performance.

Demand for Pharmaceutical Intermediates

The demand for pharmaceutical intermediates in China is experiencing robust growth, with projections indicating a continued upward trend. This expansion is fueled by the increasing need for more sophisticated intermediates, the inherent cost-effectiveness of Chinese manufacturing processes, and a significant rise in pharmaceutical exports. Hubei Biocause Pharmaceutical, as a key player in the production of Active Pharmaceutical Ingredients (APIs) and their essential intermediates, is well-positioned to capitalize on this burgeoning market. The global pharmaceutical market itself is a significant driver, with an estimated market size of USD 1.6 trillion in 2023, and expected to reach USD 2.2 trillion by 2028, according to some industry forecasts.

This escalating demand translates directly into opportunities for companies like Hubei Biocause. The market’s growth is underpinned by several key factors:

- Growing Global Pharmaceutical Market: The overall expansion of the pharmaceutical industry worldwide creates a consistent need for the building blocks that intermediates provide.

- Cost-Competitive Manufacturing: China's established infrastructure and skilled workforce offer a cost advantage in producing these vital components.

- Increasing Pharmaceutical Exports: As China's own pharmaceutical sector matures and exports more finished products, the demand for domestically produced intermediates rises in tandem.

- Advancements in Drug Development: The continuous innovation in drug discovery requires a diverse and often specialized range of intermediate compounds.

China's economic expansion continues to be a primary driver for increased healthcare spending, with the nation's healthcare market projected for substantial growth by 2030. This upward trend is further bolstered by a growing middle class with rising disposable incomes, directly fueling demand for higher-quality pharmaceuticals. However, inflationary pressures in 2024 and early 2025 are increasing operational costs for companies like Hubei Biocause Pharmaceutical due to volatile commodity prices and rising labor expenses.

The Chinese government's commitment to expanding healthcare access, with over 95% of the population covered by basic medical insurance as of early 2024, significantly impacts pharmaceutical affordability and market penetration. The concurrent growth in commercial medical insurance, which saw a 15% year-on-year premium increase in 2023, offers additional avenues for sales but also heightens the need for cost-effectiveness to secure reimbursement.

The pharmaceutical intermediates market in China is experiencing robust growth, driven by global pharmaceutical market expansion, estimated at USD 1.6 trillion in 2023 and projected to reach USD 2.2 trillion by 2028. This growth is supported by China's cost-competitive manufacturing and increasing pharmaceutical exports, positioning Hubei Biocause Pharmaceutical to benefit from the rising demand for APIs and their intermediates.

| Economic Factor | 2023/2024 Data Point | Implication for Hubei Biocause |

|---|---|---|

| China GDP Growth | Projected 5.0% for 2024 (IMF) | Supports increased healthcare spending and demand. |

| China Healthcare Market Size | Estimated to reach substantial growth by 2030 | Favorable environment for pharmaceutical companies. |

| Inflation Rate (China CPI) | Averaged 0.7% in 2023, with upward pressure in early 2024 | Increases raw material and operational costs. |

| Basic Medical Insurance Coverage | Over 95% of population (early 2024) | Enhances patient affordability for pharmaceuticals. |

| Commercial Medical Insurance Growth | 15% year-on-year premium growth (2023) | Diversifies purchasing power, intensifies cost-effectiveness pressure. |

| Global Pharmaceutical Market Size | USD 1.6 trillion (2023), projected USD 2.2 trillion by 2028 | Drives demand for intermediates and APIs. |

Full Version Awaits

Hubei Biocause Pharmaceutical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hubei Biocause Pharmaceutical PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping its strategic landscape.

Sociological factors

China's demographic landscape is rapidly evolving, with a notable increase in its elderly population. This aging trend is directly correlated with a rise in chronic diseases, including cardiovascular, cerebrovascular, and endocrine conditions. For instance, by the end of 2023, the proportion of people aged 65 and above in China reached approximately 15.4% of the total population, a figure projected to continue its upward trajectory.

This escalating prevalence of chronic ailments translates into a sustained and growing demand for pharmaceutical solutions. Hubei Biocause Pharmaceutical, with its focus on specific therapeutic areas, is well-positioned to capitalize on this demographic shift, presenting a significant market opportunity for its product portfolio.

Rising health awareness in China is a significant driver for the pharmaceutical sector. By 2023, the Chinese healthcare market was valued at approximately $1.2 trillion, with a projected compound annual growth rate of over 10% through 2027. This surge reflects a growing demand for better medical services and advanced treatments.

Chinese consumers are becoming more sophisticated, prioritizing efficacy and safety in their pharmaceutical choices. This shift compels companies like Hubei Biocause Pharmaceutical to heavily invest in research and development, aiming to deliver superior product quality and innovative solutions to meet these elevated expectations.

Societal shifts towards less active lifestyles and evolving dietary patterns are directly fueling a rise in chronic conditions. For instance, by 2023, global rates of type 2 diabetes continued their upward trend, with projections indicating over 643 million adults affected worldwide by 2030, according to the International Diabetes Federation. This growing prevalence of lifestyle-related diseases such as cardiovascular issues and diabetes creates a sustained demand for pharmaceutical solutions.

Hubei Biocause Pharmaceutical, with its focus on medications addressing these very health challenges, is well-positioned to benefit from this societal trend. The increasing burden of these non-communicable diseases underscores the critical role of companies like Hubei Biocause in providing essential treatments and therapies to manage and mitigate their impact.

Urbanization and Healthcare Accessibility

China's rapid urbanization continues to reshape healthcare access. By the end of 2023, over 66% of China's population resided in urban areas, a figure projected to climb further. This demographic shift places greater demand on urban healthcare infrastructure while highlighting disparities in resource allocation for rural communities.

To address these evolving needs, China is actively developing a tiered healthcare system. This approach aims to optimize resource utilization, ensuring primary care is accessible in local communities and specialized services are concentrated in urban hubs. The government's 2024 healthcare reform initiatives emphasize strengthening primary care facilities in both urban and rural settings.

Digital health services are also playing a crucial role in bridging accessibility gaps. Telemedicine platforms and online consultations saw significant growth in 2023, with an estimated 500 million users engaging with digital health services. This trend is expected to accelerate, offering more convenient access to medical advice and prescriptions, particularly for those in remote areas.

- Urban Population Growth: China's urban population exceeded 930 million in 2023, creating concentrated demand for healthcare services.

- Healthcare System Development: Focus on tiered systems to manage patient flow and resource distribution effectively.

- Digital Health Adoption: Increased reliance on telemedicine and online platforms to improve healthcare accessibility, especially in underserved regions.

- Government Investment: Continued investment in primary healthcare infrastructure and digital health solutions to support urbanization trends.

Patient Trust in Domestic Pharmaceuticals

Patient trust in domestic pharmaceuticals is a significant sociological factor influencing Hubei Biocause Pharmaceutical's market position. Recent initiatives, such as the 2023 expansion of the National Medical Products Administration's (NMPA) Good Manufacturing Practice (GMP) inspections, underscore a commitment to elevating product quality and safety. This heightened regulatory scrutiny directly supports the growing emphasis on building patient confidence in Chinese-made medicines.

Hubei Biocause Pharmaceutical is well-positioned to capitalize on this trend. By maintaining stringent manufacturing standards, evidenced by its continued adherence to international quality certifications, the company can bolster its reputation. For instance, in 2024, the company reported a 98% compliance rate across its production facilities during internal audits, a figure that resonates with a consumer base increasingly prioritizing reliability in their healthcare choices.

This focus on trust translates into tangible market benefits. As Chinese consumers become more discerning, their willingness to choose domestic brands that demonstrate robust quality control and regulatory compliance increases. Hubei Biocause's proactive approach to quality assurance, including investments in advanced testing equipment in 2025, directly addresses this evolving consumer sentiment, potentially leading to enhanced market acceptance and a stronger brand image within China.

Key aspects supporting this trend include:

- Increased Regulatory Oversight: The NMPA's intensified inspections and stricter enforcement of GMP standards in 2023-2024 are building greater assurance.

- Quality Improvement Initiatives: Domestic pharmaceutical companies, including Hubei Biocause, are investing in R&D and manufacturing upgrades to meet higher quality benchmarks.

- Consumer Awareness: Public campaigns and media coverage highlighting pharmaceutical safety and efficacy are educating consumers and fostering trust in reputable domestic brands.

- Government Support: Policies aimed at promoting the domestic pharmaceutical industry, coupled with quality assurance measures, are creating a more favorable environment for companies like Hubei Biocause.

China's aging population, with individuals aged 65 and above comprising approximately 15.4% of the total population in 2023, fuels a growing demand for pharmaceuticals addressing chronic diseases. This demographic shift, coupled with rising health awareness and a projected 10% annual growth in the healthcare market through 2027, creates significant opportunities for companies like Hubei Biocause Pharmaceutical.

Societal trends towards less active lifestyles are increasing the prevalence of conditions like type 2 diabetes, which is expected to affect over 643 million adults globally by 2030. Hubei Biocause's focus on treatments for these lifestyle-related diseases positions it to benefit from this sustained demand.

Increased patient trust in domestic pharmaceuticals, bolstered by intensified regulatory oversight and quality improvement initiatives in 2023-2024, is a key sociological factor. Hubei Biocause's commitment to stringent manufacturing standards, demonstrated by a 98% compliance rate in 2024 internal audits, directly addresses this growing consumer preference for reliable domestic brands.

| Sociological Factor | 2023/2024 Data Point | Implication for Hubei Biocause |

|---|---|---|

| Aging Population | 15.4% of China's population aged 65+ (2023) | Increased demand for chronic disease treatments. |

| Health Awareness & Market Growth | Healthcare market valued at $1.2 trillion (2023), 10%+ CAGR projected | Growing market for pharmaceutical solutions. |

| Lifestyle Diseases | Global type 2 diabetes to reach 643M adults by 2030 | Sustained demand for related pharmaceutical products. |

| Patient Trust in Domestic Pharma | 98% compliance rate in Hubei Biocause audits (2024) | Enhanced market acceptance and brand reputation. |

Technological factors

Continuous advancements in drug discovery technologies, such as AI-driven molecular design and CRISPR gene editing, are rapidly reshaping the pharmaceutical industry. These innovations promise to accelerate the identification of novel drug candidates and personalize treatment approaches.

Hubei Biocause Pharmaceutical needs to actively invest in research and development, potentially through strategic partnerships, to harness these cutting-edge technologies. This will enable the company to develop new Active Pharmaceutical Ingredients (APIs) and create innovative drug formulations, staying competitive in a rapidly evolving market.

For instance, the global biotechnology market was valued at approximately USD 1.3 trillion in 2023 and is projected to grow significantly. Companies that effectively integrate these advanced technologies, like Hubei Biocause, are better positioned for future success.

The pharmaceutical sector's embrace of manufacturing automation and smart factory concepts is a significant technological trend. These advancements are crucial for boosting production efficiency, cutting operational expenses, and ensuring a higher, more consistent standard of product quality. Hubei Biocause Pharmaceutical can leverage these innovations to solidify its market position.

By integrating cutting-edge manufacturing technologies and digital solutions, Hubei Biocause Pharmaceutical can achieve a notable competitive advantage. For instance, the global market for industrial automation in pharmaceuticals was projected to reach approximately $15.6 billion in 2023 and is expected to grow substantially, indicating a strong industry-wide shift toward these smart production methods.

The increasing adoption of digital health and telemedicine is fundamentally reshaping healthcare. In 2024, the global telemedicine market was valued at approximately $115 billion, with projections indicating continued robust growth, driven by convenience and accessibility. This trend allows for enhanced patient monitoring and remote consultations, offering new avenues for pharmaceutical companies.

Hubei Biocause Pharmaceutical can capitalize on this by developing digital therapeutics or using online platforms to boost patient engagement and improve medication adherence. For instance, by 2025, it's estimated that over 75% of all healthcare consultations could be delivered remotely, presenting a significant opportunity for Biocause to integrate its products and services into these digital ecosystems.

Data Analytics and AI in R&D

The integration of data analytics and AI is revolutionizing pharmaceutical R&D. For Hubei Biocause Pharmaceutical, this means faster drug discovery and more efficient clinical trials. By leveraging these technologies, the company can pinpoint novel therapeutic targets and enhance patient outcomes, a critical advantage in the competitive healthcare landscape.

AI's role in drug development is becoming increasingly vital. In 2024, it's estimated that AI can reduce the time it takes to bring a new drug to market by as much as 25%. Hubei Biocause can capitalize on this by:

- Accelerating target identification: AI algorithms can sift through vast biological datasets to uncover promising drug targets more rapidly than traditional methods.

- Optimizing clinical trial design: Predictive analytics can improve patient selection and trial protocols, leading to higher success rates and reduced costs.

- Advancing personalized medicine: AI can analyze individual patient data to tailor treatments, improving efficacy and minimizing side effects.

Biologics and Biosimilars Development

The pharmaceutical landscape is increasingly defined by the rise of biologics and biosimilars, a technological evolution that Hubei Biocause Pharmaceutical must closely track. This trend signifies a move towards more complex, protein-based therapies, which require different manufacturing processes and raw materials compared to traditional small-molecule drugs. As of early 2025, the global biosimilars market is projected to reach over $100 billion by 2030, demonstrating substantial growth potential.

Hubei Biocause Pharmaceutical's core business in Active Pharmaceutical Ingredients (APIs) and preparations positions it to potentially adapt by supplying advanced intermediates or exploring partnerships in the biologics supply chain. For instance, companies specializing in cell culture media or purification resins are seeing increased demand. The company should assess how its existing capabilities can be leveraged or expanded to cater to the specific needs of biologic drug development and manufacturing.

- Biologics Market Growth: The global biologics market is expected to exceed $600 billion by 2028, driven by advancements in biotechnology.

- Biosimilar Adoption: Biosimilar sales are projected to capture a significant share of the originator biologic market, with an estimated 15-20% annual growth rate in key regions.

- Manufacturing Complexity: Biologics production involves intricate cell culture, purification, and formulation processes, creating opportunities for specialized API and intermediate suppliers.

- Investment Trends: Venture capital funding in biotech startups focused on novel biologics and biosimilar development reached new highs in 2024, indicating strong investor confidence.

Technological advancements, particularly in AI-driven drug discovery and gene editing, are transforming pharmaceutical R&D, promising faster development and personalized treatments. Hubei Biocause Pharmaceutical must invest in these areas to remain competitive, leveraging innovations to create new APIs and formulations.

The company can also benefit from manufacturing automation and smart factory concepts, which boost efficiency and product quality. The global market for industrial automation in pharmaceuticals is growing significantly, highlighting this trend.

Digital health and telemedicine are also reshaping the sector, with telemedicine markets projected for robust growth. Hubei Biocause can integrate its offerings into these digital ecosystems to enhance patient engagement and medication adherence.

AI's impact on drug development is substantial, potentially reducing time-to-market by 25% by 2024. This includes accelerating target identification, optimizing clinical trials, and advancing personalized medicine.

The rise of biologics and biosimilars presents another key technological shift. The biosimilars market is expected to exceed $100 billion by 2030, requiring Hubei Biocause to adapt its API and intermediate supply capabilities.

| Technology Trend | Market Projection/Impact | Hubei Biocause Opportunity |

|---|---|---|

| AI in Drug Discovery | Reduces time-to-market by up to 25% (2024 estimate) | Accelerate target identification, optimize trials |

| Manufacturing Automation | Global market projected to grow substantially (>$15.6 billion in 2023) | Boost efficiency, cut costs, ensure quality |

| Digital Health/Telemedicine | Telemedicine market valued at $115 billion (2024) | Develop digital therapeutics, enhance patient engagement |

| Biologics & Biosimilars | Biosimilars market >$100 billion by 2030 | Supply advanced intermediates, explore partnerships |

Legal factors

Hubei Biocause Pharmaceutical navigates a complex legal landscape shaped by China's rigorous drug administration laws. The National Medical Products Administration (NMPA) is the primary enforcer, setting strict standards for drug development, manufacturing, and marketing.

Significant regulatory reforms are anticipated for 2024-2025, focusing on enhanced oversight throughout a drug's lifecycle. These changes aim to streamline approval processes while simultaneously tightening controls on product quality and safety, impacting everything from clinical trials to post-market surveillance.

The NMPA's evolving framework is designed to foster innovation while prioritizing patient well-being, meaning Hubei Biocause must remain agile in adapting to new compliance requirements and quality assurance protocols.

China's intellectual property framework is increasingly robust, with significant updates to patent laws in recent years aimed at bolstering enforcement. For Hubei Biocause Pharmaceutical, this means enhanced protection for its novel drug formulations and manufacturing processes, safeguarding its research and development expenditures. In 2023, China's Supreme People's Court reported a substantial increase in patent infringement cases handled, signaling a more serious approach to IP protection.

The strengthening of patent protection directly influences Hubei Biocause Pharmaceutical's strategic decisions, particularly concerning market exclusivity for its innovative products. This legal environment also shapes the company's approach to developing generic versions of drugs and its production of Active Pharmaceutical Ingredients (APIs), ensuring competitive positioning within a regulated landscape.

Pharmaceutical manufacturing in China, including Hubei Biocause Pharmaceutical, faces stringent environmental protection laws. These regulations focus heavily on waste disposal, emissions control, and overall pollution management, reflecting a national drive towards greener industrial practices. For instance, China's Ministry of Ecology and Environment has been progressively tightening standards for wastewater discharge and air pollutants from chemical and pharmaceutical plants.

Hubei Biocause Pharmaceutical must diligently adhere to these evolving environmental mandates. Non-compliance can result in significant penalties, operational disruptions, and even the revocation of operating licenses, directly impacting its ability to manufacture and sell its products. In 2023, environmental inspections across China led to the shutdown or significant fines for numerous industrial facilities, highlighting the enforcement rigor.

Anti-Corruption and Compliance Regulations

China's intensified focus on anti-corruption within the pharmaceutical sector, particularly evident in 2024, means companies like Hubei Biocause Pharmaceutical must prioritize stringent compliance. Recent crackdowns have targeted commercial bribery and unethical sales practices, leading to significant penalties for non-compliant firms.

To navigate this evolving regulatory landscape, Hubei Biocause Pharmaceutical is implementing enhanced internal compliance programs. These initiatives are crucial for maintaining operational integrity and safeguarding the company's reputation amidst stricter enforcement measures from authorities.

- Increased Scrutiny: Chinese regulators are actively investigating pharmaceutical companies for violations related to marketing and sales practices.

- Focus on Ethics: The government's push aims to foster a more ethical business environment, impacting how drugs are promoted and sold.

- Reputational Risk: Non-compliance can lead to substantial fines, operational disruptions, and significant damage to brand image.

Product Liability and Consumer Protection Laws

As a pharmaceutical manufacturer, Hubei Biocause Pharmaceutical is subject to stringent product liability and consumer protection laws. These regulations hold companies accountable for ensuring the safety, efficacy, and quality of their products, with potential penalties for non-compliance. For instance, the China Food and Drug Administration (now the National Medical Products Administration) has progressively tightened oversight, with fines for violations in product quality and marketing practices becoming more significant. In 2024, regulatory bodies continued to emphasize post-market surveillance and adverse event reporting, making transparent operations and robust quality control essential for mitigating legal risks.

Adhering to high-quality standards and transparent reporting is crucial for Hubei Biocause Pharmaceutical to build consumer trust and avoid costly litigation. The company must ensure its manufacturing processes meet Good Manufacturing Practices (GMP) and that all product claims are substantiated. Failure to do so can lead to recalls, damage to brand reputation, and substantial financial penalties. Consumer protection laws in China, such as the Consumer Rights Protection Law, empower individuals to seek redress for defective or misrepresented products, underscoring the importance of proactive compliance.

Key considerations for Hubei Biocause Pharmaceutical regarding product liability and consumer protection include:

- Ensuring rigorous quality control at every stage of production to minimize product defects.

- Maintaining transparent and accurate labeling and marketing materials to avoid misleading consumers.

- Establishing a robust system for handling consumer complaints and adverse event reporting.

- Staying updated on evolving pharmaceutical regulations and consumer protection legislation in China and international markets.

China's evolving legal framework for pharmaceuticals, overseen by the NMPA, demands strict adherence to quality and safety standards. Anticipated reforms for 2024-2025 will further tighten controls, impacting Hubei Biocause's development and manufacturing processes.

The company benefits from strengthened intellectual property laws, with a reported increase in patent infringement cases handled by China's Supreme People's Court in 2023, offering better protection for its innovations.

Stringent environmental laws require Hubei Biocause to manage waste and emissions meticulously, as evidenced by the Ministry of Ecology and Environment's tightening standards for industrial facilities.

Heightened anti-corruption efforts in China's pharmaceutical sector, particularly in 2024, necessitate robust internal compliance programs for Hubei Biocause to avoid penalties and reputational damage.

Environmental factors

The pharmaceutical sector is under mounting pressure to address its environmental footprint, especially regarding wastewater discharge, air pollutants, and solid waste generated during production. Hubei Biocause Pharmaceutical, a key player in API and finished dosage forms, faces stringent environmental regulations that necessitate significant investment in sophisticated pollution abatement systems and robust waste handling protocols to ensure compliance and minimize ecological impact.

There's a significant global push towards sustainable manufacturing, impacting companies like Hubei Biocause Pharmaceutical. This includes a focus on energy efficiency, water conservation, and employing greener chemical processes. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes green development, setting targets for reduced energy consumption per unit of GDP and lower carbon emissions, which directly influences manufacturing standards.

Implementing these sustainable practices can lead to tangible benefits for Hubei Biocause Pharmaceutical. Reduced energy and water usage directly translate to lower operational costs. Furthermore, a strong commitment to environmental responsibility can significantly enhance the company's corporate image and meet the increasing expectations of investors, consumers, and regulatory bodies for ethical and sustainable operations.

Climate change presents significant risks to Hubei Biocause Pharmaceutical's supply chain, potentially impacting the sourcing of natural raw materials. Extreme weather events, such as floods or droughts, could disrupt agricultural yields, affecting the availability and cost of botanical inputs crucial for certain pharmaceutical production.

Furthermore, these weather disruptions can severely hamper logistics and transportation networks. In 2024, regions globally experienced increased frequency and intensity of extreme weather, leading to significant delays and increased shipping costs for many industries, a trend likely to continue. Hubei Biocause must proactively assess these vulnerabilities and implement robust, resilient supply chain strategies to maintain uninterrupted production and delivery of its products.

Corporate Social Responsibility (CSR)

Public and investor scrutiny regarding environmental impact is intensifying, pushing companies like Hubei Biocause Pharmaceutical to actively pursue robust Corporate Social Responsibility (CSR) programs. This heightened awareness means that demonstrating genuine commitment to environmental stewardship is no longer optional but a critical component of corporate strategy.

Hubei Biocause Pharmaceutical's proactive engagement in CSR can significantly enhance its brand image and appeal. By showcasing a dedication to sustainability, the company can attract a growing segment of environmentally conscious investors and top-tier talent who prioritize ethical and responsible business practices. For instance, in 2024, ESG (Environmental, Social, and Governance) investing continued its upward trajectory, with global ESG assets projected to reach $50 trillion by 2025, highlighting the financial imperative of strong CSR.

- Enhanced Brand Reputation: Demonstrating a commitment to environmental protection can build trust and loyalty among consumers and stakeholders.

- Investor Attraction: Companies with strong CSR profiles are increasingly favored by investors seeking sustainable and ethical investments, a trend evident in the significant growth of ESG funds.

- Talent Acquisition: A positive CSR image helps attract and retain employees who are motivated by working for socially responsible organizations.

- Risk Mitigation: Proactive environmental management can reduce the risk of regulatory fines, operational disruptions, and reputational damage.

Resource Scarcity and Raw Material Sourcing

The pharmaceutical industry, including Hubei Biocause Pharmaceutical, faces increasing pressure from resource scarcity. Water, a critical input for manufacturing and purification processes, is becoming a significant concern in many regions, potentially driving up operational costs. For instance, by 2025, global water stress is projected to affect over two-thirds of the world's population, impacting industrial water availability.

Furthermore, the sourcing of specific chemical precursors, essential for active pharmaceutical ingredients (APIs), presents its own set of challenges. Geopolitical factors and concentrated supply chains can lead to price volatility and availability issues. In 2024, the global chemical industry experienced supply chain disruptions due to regional conflicts, leading to an average 15% increase in raw material costs for certain intermediates.

To navigate these environmental factors, Hubei Biocause Pharmaceutical should proactively implement strategies focused on sustainability. This includes:

- Diversifying raw material suppliers: Reducing reliance on single sources can mitigate risks associated with localized scarcity or geopolitical instability.

- Investing in water-efficient technologies: Implementing advanced water recycling and conservation methods can significantly lower water consumption and associated costs.

- Exploring circular economy principles: Investigating the potential for recycling and repurposing chemical byproducts can create a more sustainable sourcing model and reduce waste.

- Developing strategic partnerships: Collaborating with upstream suppliers to ensure long-term, stable access to critical precursors is vital for maintaining production continuity.

Hubei Biocause Pharmaceutical operates within an evolving environmental landscape, marked by increasingly stringent regulations and a global shift towards greener manufacturing practices. China's 14th Five-Year Plan (2021-2025) underscores this, emphasizing reduced energy consumption and lower carbon emissions, directly impacting production standards and requiring substantial investment in pollution control. The company must also contend with the growing risks of climate change, which can disrupt the supply of natural raw materials and impact logistics, as seen with the increased frequency of extreme weather events in 2024. Consequently, a strong commitment to environmental stewardship, including water conservation and sustainable sourcing, is crucial not only for compliance but also for enhancing brand reputation and attracting ESG-focused investors, a market projected to reach $50 trillion by 2025.

| Environmental Factor | Impact on Hubei Biocause Pharmaceutical | Data/Trend (2024/2025) | Strategic Implication |

|---|---|---|---|

| Regulatory Compliance | Need for investment in pollution abatement and waste handling. | China's 14th Five-Year Plan (2021-2025) targets green development, increasing compliance costs. | Ensure ongoing investment in environmental technologies. |

| Climate Change & Supply Chain | Risk of raw material scarcity and logistics disruptions due to extreme weather. | Global increase in extreme weather events in 2024, impacting transportation costs. | Diversify suppliers and build supply chain resilience. |

| Resource Scarcity (Water) | Potential for increased operational costs due to water stress. | Global water stress projected to affect over two-thirds of the world's population by 2025. | Invest in water-efficient technologies and recycling. |

| Sustainability & Investor Relations | Growing demand for CSR and ESG practices. | ESG investing projected to reach $50 trillion by 2025; strong CSR enhances brand image. | Proactively integrate and communicate CSR initiatives. |

PESTLE Analysis Data Sources

Our Hubei Biocause Pharmaceutical PESTLE analysis is grounded in official Chinese government publications, international health organization reports, and leading pharmaceutical industry market research. We incorporate data on regulatory changes, economic indicators, and technological advancements to provide a comprehensive overview.