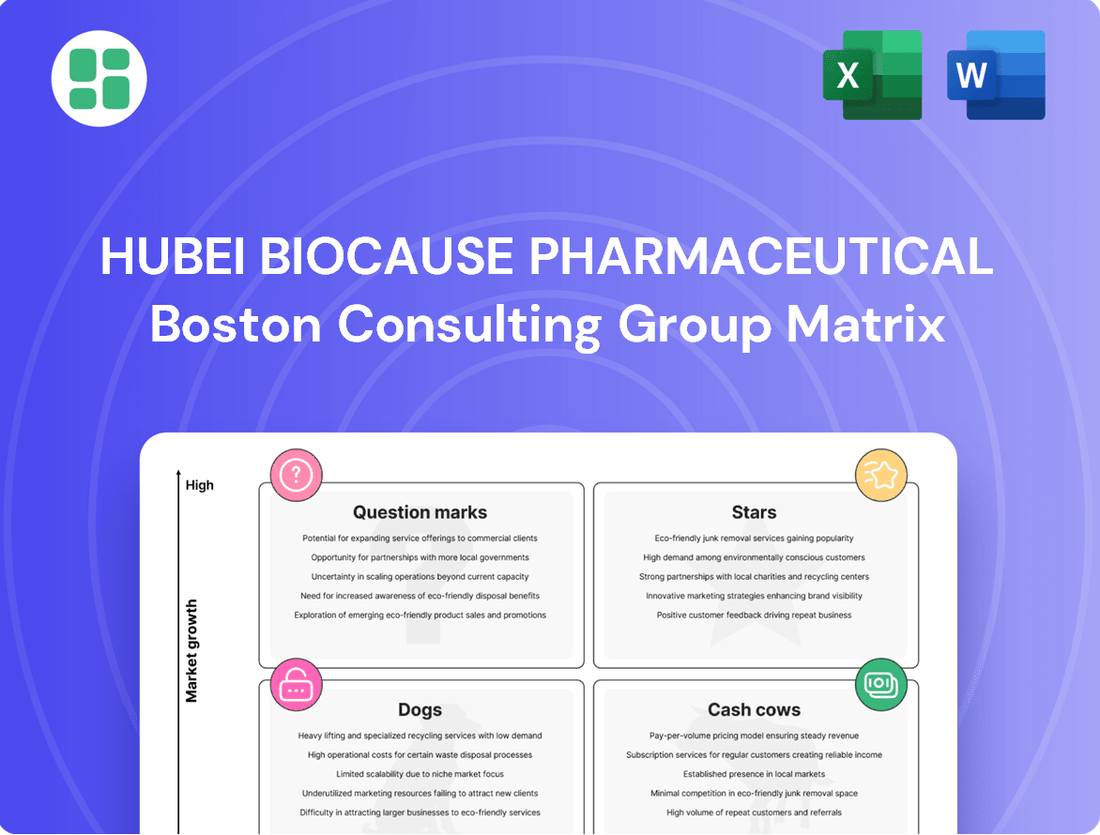

Hubei Biocause Pharmaceutical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hubei Biocause Pharmaceutical Bundle

Curious about Hubei Biocause Pharmaceutical's strategic product portfolio? This glimpse into their BCG Matrix reveals the potential for growth and the need for careful resource allocation. Understand which products are driving revenue and which might be holding the company back.

Unlock the full potential of this analysis by purchasing the complete Hubei Biocause Pharmaceutical BCG Matrix. Gain detailed quadrant placements, data-driven insights, and actionable strategies to optimize your investment and product development decisions.

Don't miss out on the complete picture – the full report provides the clarity you need to navigate the competitive landscape and make informed strategic moves. Get it now and transform your understanding of Hubei Biocause Pharmaceutical's market position.

Stars

Innovative cardiovascular therapies, targeting unmet needs like advanced heart failure or resistant hypertension, represent a potential 'Star' for Hubei Biocause Pharmaceutical. The global cardiovascular drugs market, valued at approximately $270 billion in 2023, is projected to grow significantly, driven by aging populations and rising cardiovascular disease incidence. Hubei Biocause's commitment to R&D in areas such as regenerative medicine or novel anti-thrombotic agents could position them to capture a substantial share of this expanding market.

Breakthrough cerebrovascular medical devices, including advanced diagnostics and minimally invasive surgical tools, are a rapidly expanding market. Hubei Biocause's potential to lead in this area hinges on developing or acquiring devices with robust intellectual property and proven clinical results.

The global market for neurovascular devices, a key segment within cerebrovascular medical devices, was valued at approximately $3.5 billion in 2023 and is projected to grow at a compound annual growth rate of over 8% through 2028. If Hubei Biocause can establish a strong presence here, it could significantly boost their market position.

Targeted Endocrine Disease Pharmaceuticals represent a promising category within Hubei Biocause Pharmaceutical's portfolio. These could include novel treatments for conditions like diabetes or thyroid disorders, potentially offering significant advantages over existing therapies. The global diabetes drug market alone was valued at approximately $63.5 billion in 2023 and is projected to grow substantially.

This segment offers high growth potential due to the dynamic nature of endocrine disease research and development. Companies investing in new chemical entities or advanced formulations for prevalent endocrine conditions can capture a significant market share. For instance, advancements in GLP-1 receptor agonists have dramatically reshaped the diabetes treatment landscape, demonstrating the impact of innovation.

Achieving success in this area necessitates substantial investment in rigorous clinical trials to prove efficacy and safety. Furthermore, robust market penetration strategies are crucial to establish these pharmaceuticals effectively. Hubei Biocause Pharmaceutical would need to allocate resources for extensive marketing and sales efforts to compete in this competitive space.

High-Efficacy APIs for Emerging Markets

Hubei Biocause Pharmaceutical's high-efficacy APIs for emerging markets represent a potential star in its BCG matrix. These APIs are crucial for generic drugs experiencing rapid growth in these regions. While API markets can be competitive, those with unique manufacturing processes or exceptional quality, particularly those approved for export to regulated markets like the US and EU, can capture significant market share within their specific segments.

Hubei Biocause's existing export activities and its attainment of FDA and EU Good Manufacturing Practice (GMP) approvals position it favorably to capitalize on this opportunity. For instance, the global API market was valued at approximately USD 200 billion in 2023 and is projected to grow steadily, with emerging markets being key drivers of this expansion. Companies like Hubei Biocause, capable of meeting stringent international quality standards, are well-placed to benefit.

- API Export Potential: Hubei Biocause's FDA and EU GMP certifications are critical for accessing lucrative regulated markets.

- Emerging Market Growth: The demand for affordable generic drugs in emerging economies is a significant growth driver for API suppliers.

- Quality as a Differentiator: Superior quality and proprietary manufacturing processes allow APIs to command premium pricing and market share.

- Market Value: The global API market's continued expansion, driven by generics and biopharmaceuticals, offers substantial opportunities.

Specialty Biologics or Biosimilars

Investing in specialty biologics or biosimilars for Hubei Biocause Pharmaceutical's target therapeutic areas signifies a strategic pivot towards high-growth segments within the pharmaceutical industry. This move acknowledges the significant unmet medical needs and substantial revenue potential inherent in the biologics market. By focusing on these complex products, Hubei Biocause can position itself for future growth, moving beyond its traditional small molecule portfolio.

The global biologics market is projected for robust expansion. For instance, the biosimilars market alone was valued at approximately $20.4 billion in 2023 and is anticipated to reach over $100 billion by 2030, demonstrating a compound annual growth rate (CAGR) of roughly 25%. This growth is driven by patent expirations of blockbuster biologic drugs and increasing healthcare cost pressures, making biosimilars an attractive segment.

- Target Therapeutic Areas: Hubei Biocause could target areas like oncology, autoimmune diseases (e.g., rheumatoid arthritis, psoriasis), and inflammatory conditions, where biologics have shown significant efficacy and patient demand remains high.

- Market Potential: The oncology biologics market, in particular, is a massive opportunity, with global revenues exceeding $200 billion annually and continuing to grow as new therapies emerge.

- R&D Alignment: This investment aligns with a forward-looking R&D strategy, focusing on innovation and the development of complex, high-value products that can command premium pricing and offer greater differentiation.

Hubei Biocause Pharmaceutical's potential "Stars" represent high-growth, high-market-share opportunities. These include innovative cardiovascular therapies, breakthrough cerebrovascular medical devices, targeted endocrine disease pharmaceuticals, high-efficacy APIs for emerging markets, and specialty biologics or biosimilars. The company's strategic investments in these areas, supported by a strong R&D focus and adherence to international quality standards, position it to capitalize on significant market expansion and unmet medical needs.

| Potential Star Category | Market Value (Approx. 2023) | Projected Growth (CAGR) | Key Differentiators for Hubei Biocause |

|---|---|---|---|

| Cardiovascular Therapies | $270 billion (Global Cardiovascular Drugs Market) | Significant growth (specific CAGR varies by segment) | R&D in regenerative medicine, novel anti-thrombotic agents |

| Cerebrovascular Medical Devices | $3.5 billion (Global Neurovascular Devices Market) | > 8% through 2028 | Advanced diagnostics, minimally invasive surgical tools, IP |

| Targeted Endocrine Disease Pharmaceuticals | $63.5 billion (Global Diabetes Drug Market) | Substantial growth | New chemical entities, advanced formulations (e.g., GLP-1 agonists) |

| High-Efficacy APIs for Emerging Markets | ~$200 billion (Global API Market) | Steady growth, driven by emerging markets | FDA/EU GMP approvals, unique manufacturing processes |

| Specialty Biologics/Biosimilars | $20.4 billion (Global Biosimilars Market) | ~25% through 2030 | Focus on oncology, autoimmune diseases; complex product development |

What is included in the product

This BCG Matrix overview provides a tailored analysis of Hubei Biocause Pharmaceutical's product portfolio, identifying which units to invest in, hold, or divest.

Hubei Biocause Pharmaceutical's BCG Matrix offers a pain point reliver by providing a clear, one-page overview of each business unit's strategic position.

Cash Cows

Established generic cardiovascular APIs at Hubei Biocause Pharmaceutical would be classified as Cash Cows within the BCG Matrix. These are widely used, well-established active pharmaceutical ingredients for common cardiovascular drugs where the company possesses a significant market share.

These products operate in mature markets characterized by low growth but consistently generate high cash flow. This strong cash generation stems from their established market position and efficient, scaled production processes.

The longevity and widespread adoption of these APIs mean they require minimal marketing or promotional investment to maintain their sales volume. For instance, in 2024, the global cardiovascular drugs market was valued at approximately $300 billion, with generic APIs forming a substantial portion.

Common endocrine pharmaceutical preparations, like those for managing diabetes or thyroid disorders, often represent Cash Cows for companies like Hubei Biocause Pharmaceutical. These are established, widely used medications that have secured a significant market share. For instance, in 2024, the global diabetes drug market alone was valued at over $70 billion, with many generic versions contributing substantially to this figure.

These products typically operate in mature, low-growth markets where brand loyalty and strong distribution networks are key. Their consistent prescription rates ensure a predictable and stable revenue stream for Hubei Biocause. This steady income is crucial, as it can then be strategically deployed to fund research and development for newer, potentially high-growth products.

Mature medical devices for routine procedures, such as basic surgical instruments or diagnostic tools with established clinical utility, represent Hubei Biocause Pharmaceutical's Cash Cows. These products, like their widely used sterile surgical sutures, benefit from a strong market presence and are not prone to rapid technological obsolescence, ensuring consistent demand.

These devices require minimal new investment in research and development or marketing, allowing them to generate reliable income streams for the company. For instance, Hubei Biocause's established portfolio of sterile disposable medical supplies, which saw a steady demand throughout 2024, exemplifies this category.

Bulk Chemical Products (Non-Pharma)

Hubei Biocause Pharmaceutical's non-pharmaceutical bulk chemical products, characterized by high production efficiency and consistent demand, function as cash cows. These industrial chemicals, especially those outside the pharma sector, are positioned to deliver robust and reliable cash flows, even with limited market expansion potential.

For instance, in 2024, the global bulk chemicals market was valued at approximately $5.5 trillion, with segments like industrial solvents and basic organic chemicals showing steady demand. Companies with optimized production processes and strong market share in these areas can leverage them for significant cash generation.

- Stable Demand: Bulk chemicals not tied to pharmaceutical cycles often benefit from consistent industrial application, ensuring predictable sales volumes.

- High Efficiency: Optimized manufacturing processes in these chemical segments can lead to lower production costs and higher profit margins.

- Cash Generation: Products with established market positions and low growth prospects are ideal for generating surplus cash to fund other business areas.

Older Generation Anti-Infective APIs

Older generation anti-infective APIs can function as cash cows for Hubei Biocause Pharmaceutical. Even in mature markets, a dominant production and supply position can ensure stable profitability. These established products remain vital to healthcare, benefiting from efficient manufacturing and supply chains.

Hubei Biocause's established position in older generation anti-infective APIs likely translates to consistent revenue streams. For instance, in 2024, the global anti-infective market, while seeing innovation in newer classes, still relies heavily on established antibiotics for widespread use. Companies with optimized production for these generics often see steady margins.

- Stable Demand: Continued reliance on proven anti-infectives ensures a baseline of consistent sales.

- Profitability: Efficient, scaled production of older APIs can yield healthy profit margins.

- Market Position: Dominance in supply chains for these essential drugs solidifies their cash cow status.

- Operational Efficiency: Mature manufacturing processes reduce costs and enhance earnings.

Established generic cardiovascular APIs at Hubei Biocause Pharmaceutical are prime examples of Cash Cows. These products, vital for common heart medications, operate in mature, low-growth markets but generate substantial, consistent cash flow due to significant market share and efficient production. The global cardiovascular drugs market, valued at around $300 billion in 2024, highlights the scale of demand for these essential ingredients.

| Product Category | BCG Matrix Classification | Market Characteristics | Hubei Biocause Role | 2024 Market Data (Approx.) |

|---|---|---|---|---|

| Generic Cardiovascular APIs | Cash Cow | Mature, Low Growth | Significant Market Share, Efficient Production | Cardiovascular Drugs Market: $300 Billion |

| Endocrine Pharmaceutical Preparations | Cash Cow | Mature, Low Growth | Established Market Position, Predictable Revenue | Diabetes Drug Market: $70 Billion+ |

| Mature Medical Devices | Cash Cow | Stable Demand, Low Obsolescence | Strong Market Presence, Reliable Income | N/A (Specific device data not publicly available) |

| Non-Pharmaceutical Bulk Chemicals | Cash Cow | Consistent Industrial Demand | High Production Efficiency, Robust Cash Flow | Bulk Chemicals Market: $5.5 Trillion |

| Older Generation Anti-infective APIs | Cash Cow | Established Use, Stable Profitability | Dominant Production/Supply Position | Anti-infective Market: Significant reliance on established antibiotics |

What You See Is What You Get

Hubei Biocause Pharmaceutical BCG Matrix

The Hubei Biocause Pharmaceutical BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This means you get the complete strategic analysis, free of any watermarks or demo indicators, ready for immediate application in your business planning.

Dogs

Outdated medical devices with declining demand would fall into the Dogs category within Hubei Biocause Pharmaceutical's BCG Matrix. These are products that have been surpassed by newer technologies or are experiencing reduced demand due to shifts in medical practices. For instance, older diagnostic imaging equipment that has been replaced by more advanced, higher-resolution systems would fit this description.

These products typically hold a small market share within a market that is either stagnant or shrinking. They often tie up valuable resources, such as manufacturing capacity and research and development funds, without contributing substantially to the company's overall profitability. In 2023, the global market for certain legacy medical devices saw a contraction, with some segments experiencing a year-over-year decline of over 5% as healthcare providers increasingly adopt digital and AI-enhanced alternatives.

For Hubei Biocause Pharmaceutical, products categorized as Dogs represent an opportunity for strategic review. The company might consider divesting these product lines or phasing them out entirely to reallocate capital and resources towards more promising growth areas. This strategic move allows for a more efficient use of company assets, focusing on innovation and market leadership in areas with stronger future potential.

Highly commoditized APIs with intense price competition, especially if Hubei Biocause has a small market share, would be classified as Dogs in the BCG Matrix. These products often struggle to achieve profitability, potentially operating at break-even or even a loss, which can tie up valuable capital and resources without contributing to overall growth.

Underperforming legacy pharmaceutical formulations within Hubei Biocause Pharmaceutical's portfolio, particularly those with expiring patents or facing intense generic competition, are likely classified as Dogs. These products, which may have diminishing clinical relevance, often generate low profit margins and necessitate continued investment for maintenance rather than offering substantial growth potential. For instance, if a significant portion of Hubei Biocause's 2024 revenue stemmed from older, off-patent drugs with limited market differentiation, these would fit the Dog category.

Niche Chemical Products with Limited Market

Niche chemical products with limited market appeal often fall into the Dogs category of the BCG Matrix. These are typically small-scale offerings targeting very specific applications with minimal growth prospects. For Hubei Biocause Pharmaceutical, such products might represent a low market share in specialized chemical segments.

These "dog" products can be a drain on resources. They require ongoing production and management but contribute very little to the company's overall revenue. In 2024, for instance, a hypothetical niche chemical product for a declining industrial process might have only generated 0.5% of Hubei Biocause's total sales, while still consuming valuable production capacity.

- Low Market Share: These products typically hold a small percentage of their specific niche market.

- Limited Growth Potential: The overall market for these chemicals is not expected to expand significantly.

- Resource Drain: Production and management costs can outweigh the revenue generated.

- Minimal Revenue Contribution: They contribute a negligible amount to the company's total sales figures.

Unsuccessful R&D Projects from Previous Cycles

Hubei Biocause Pharmaceutical has encountered several unsuccessful research and development projects in prior cycles. These initiatives, despite initial investment, failed to achieve commercial viability or secure meaningful market traction upon launch. Such endeavors represent significant sunk costs and incur ongoing maintenance expenses, such as patent renewals for products that offer no present or future revenue stream.

These failed R&D projects, by definition, fall into the Dogs quadrant of the BCG Matrix. They consume resources without contributing to the company's growth or profitability. For instance, a project aimed at developing a novel antibiotic that ultimately proved ineffective in clinical trials would be categorized here.

The financial implications are substantial. These projects drain capital that could be allocated to more promising ventures. By 2024, companies in the pharmaceutical sector often report a significant percentage of their R&D pipeline failing to reach market. While specific Hubei Biocause figures for past R&D failures are not publicly detailed, the industry average suggests this is a common challenge.

- Past R&D failures represent sunk costs and ongoing maintenance without revenue.

- These projects drain capital and resources that could be used elsewhere.

- The pharmaceutical industry commonly sees a high failure rate in R&D pipelines.

- Such projects negatively impact overall portfolio performance.

Products classified as Dogs in Hubei Biocause Pharmaceutical's BCG Matrix are those with low market share in stagnant or declining markets, often representing outdated technologies or facing intense competition. These items, like older diagnostic equipment or commoditized APIs with low sales contribution, consume resources without generating significant profit. For instance, a legacy pharmaceutical formulation with expiring patents in 2024 might have contributed less than 1% to overall revenue while still requiring maintenance investment.

These "dog" products are characterized by their minimal revenue generation and high cost of upkeep, tying up valuable capital. Companies often consider divesting or phasing out these offerings to reallocate resources toward more promising growth areas. This strategic decision is crucial for optimizing the company's asset allocation and focusing on innovation.

Failed research and development projects also fall into the Dogs category, representing sunk costs and ongoing maintenance without any revenue stream. These initiatives drain capital that could be invested in more viable ventures, negatively impacting the overall portfolio performance. The pharmaceutical industry, for example, often sees a substantial percentage of R&D pipelines fail to reach market viability.

| Product Category Example | Market Share | Market Growth | Profitability | Strategic Implication |

|---|---|---|---|---|

| Outdated Diagnostic Devices | Low | Declining | Low/Negative | Divest or phase out |

| Commoditized APIs (Low Share) | Low | Stagnant | Break-even/Loss | Re-evaluate production |

| Legacy Pharma Formulations | Low | Declining | Low Margins | Consider discontinuation |

| Failed R&D Projects | N/A | N/A | Negative (Sunk Cost) | Write off/Cease investment |

Question Marks

Hubei Biocause Pharmaceutical's novel drug candidates in early clinical trials represent its potential Stars. These are products targeting cardiovascular, cerebrovascular, and endocrine diseases, areas with significant growth potential. For instance, the global cardiovascular drugs market was valued at approximately $150 billion in 2023 and is projected to expand further.

However, these promising candidates are currently in the question mark phase of the BCG matrix. They require substantial investment in research and development, with no guarantee of market success or regulatory approval. The high failure rate in early-stage drug development means these ventures carry considerable risk, demanding careful capital allocation and ongoing evaluation of their progress and market viability.

Hubei Biocause Pharmaceutical's recently launched niche medical devices, targeting specialized and emerging medical needs, would be classified as Question Marks in the BCG Matrix. These innovative products are entering growing markets but currently hold a low market share, requiring substantial investment to gain traction and potentially transition into Stars. For instance, a new diagnostic tool for a rare genetic disorder, while addressing an unmet need, would likely fall into this category due to its nascent market penetration.

Hubei Biocause Pharmaceutical's potential development of advanced diagnostic reagents and kits, particularly for early detection and personalized medicine within its core therapeutic areas, positions it to tap into the burgeoning diagnostics market. This sector is experiencing significant growth, with global in-vitro diagnostics market expected to reach approximately $120 billion by 2027, driven by advancements in technology and increasing demand for precision healthcare.

The success of such ventures hinges on robust market acceptance and rigorous clinical validation. For instance, the market for companion diagnostics, which are essential for personalized medicine, is projected to grow substantially, indicating a strong demand for validated diagnostic tools. Hubei Biocause would need to demonstrate clear clinical utility and navigate regulatory pathways to establish a strong market presence and justify continued investment in this high-potential area.

Strategic Acquisitions in New Therapeutic Areas

Hubei Biocause Pharmaceutical's strategic acquisitions in new therapeutic areas represent potential 'Question Marks' in its BCG matrix. These moves are characterized by high growth potential but also significant risk, demanding substantial investment and integration efforts. For instance, if Hubei Biocause acquired a biotech firm specializing in gene therapy in 2023, this would likely fall into this category. The burgeoning gene therapy market, projected to reach over $10 billion globally by 2025, offers substantial upside. However, the company would need to navigate complex regulatory pathways and substantial R&D costs, typical of such high-risk, high-reward ventures.

Such acquisitions are crucial for future growth but require careful management.

- Acquisitions in Emerging Markets: Investing in companies with novel treatments for oncology or rare diseases, areas where Hubei Biocause may have limited existing presence.

- Technology Integration Challenges: The success hinges on effectively integrating acquired technologies and R&D pipelines, which can be resource-intensive.

- Market Penetration Hurdles: Establishing market share in new, competitive therapeutic areas demands significant marketing and sales investment.

- Financial Commitment: These ventures require substantial capital outlay for R&D, clinical trials, and market entry, impacting short-term profitability.

International Expansion into Untapped Regulatory Markets

Hubei Biocause Pharmaceutical's potential international expansion into untapped regulatory markets, such as gaining product registrations in additional EU countries or the United States, represents a strategic move into large, growing markets where its current market share is minimal. This initiative, characteristic of a question mark in the BCG matrix, demands substantial capital outlay for regulatory approvals, marketing, and establishing robust distribution networks. For instance, the cost of bringing a new drug to market in the US can exceed $2 billion, with regulatory hurdles being a significant component.

These ventures are inherently high-risk, high-reward. Success hinges on navigating complex regulatory landscapes, which can be time-consuming and costly, but achieving even a modest market penetration in these substantial markets could yield significant future returns. For example, the global pharmaceutical market was valued at approximately $1.4 trillion in 2023 and is projected to grow, offering considerable upside for successful entrants.

- Strategic Objective: Penetrate large, growing, but highly regulated international markets with low current market share.

- Investment Requirements: Significant capital needed for regulatory compliance, marketing, and distribution infrastructure.

- Market Potential: Access to substantial global pharmaceutical markets, such as the US and EU, offering significant growth opportunities.

- Risk Factor: High uncertainty due to complex regulatory environments and intense competition, requiring substantial upfront investment before revenue generation.

Hubei Biocause Pharmaceutical's new drug candidates in early clinical trials, along with recently launched niche medical devices and potential advanced diagnostic reagents, all represent Question Marks. These ventures are in high-growth markets but currently have low market share, necessitating substantial investment for development, regulatory approval, and market penetration. The success of these initiatives, such as international market expansion, hinges on navigating complex regulatory environments and intense competition, carrying significant risk but offering considerable future returns.

| BCG Category | Hubei Biocause Pharmaceutical Examples | Market Characteristics | Investment Need | Risk Level |

|---|---|---|---|---|

| Question Marks | Novel drug candidates (cardiovascular, cerebrovascular, endocrine) | High growth potential, low current market share | High (R&D, clinical trials) | High |

| Question Marks | Niche medical devices for specialized needs | Emerging markets, low market penetration | High (market entry, sales) | High |

| Question Marks | Advanced diagnostic reagents and kits | Growing diagnostics market, low market share | High (validation, market acceptance) | High |

| Question Marks | Strategic acquisitions in new therapeutic areas (e.g., gene therapy) | High growth potential, low existing presence | High (integration, R&D) | High |

| Question Marks | International expansion into untapped regulatory markets (e.g., US, EU) | Large, growing markets, minimal current share | Very High (regulatory, marketing, distribution) | Very High |

BCG Matrix Data Sources

Our Hubei Biocause Pharmaceutical BCG Matrix is built on a foundation of robust financial disclosures, comprehensive market research, and insightful industry trend analysis to provide strategic clarity.