Bio-Techne SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bio-Techne Bundle

Bio-Techne's innovative product pipeline and strong market presence are key strengths, but understanding potential regulatory hurdles and competitive pressures is crucial for strategic planning. Our comprehensive SWOT analysis dives deep into these factors, offering actionable insights to navigate the dynamic biotech landscape.

Want the full story behind Bio-Techne's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bio-Techne boasts a remarkably diverse and comprehensive product portfolio, encompassing reagents, instruments, and custom services. This breadth spans critical areas like cell biology, protein analysis, genomics, and diagnostics, catering to a wide array of research and clinical needs.

This extensive product offering translates into multiple, stable revenue streams for the company, significantly mitigating the risk associated with over-reliance on any single product or market segment. For instance, in fiscal year 2023, Bio-Techne's consolidated net sales reached $1.16 billion, showcasing the strength derived from its varied offerings.

Bio-Techne's strategic positioning within burgeoning sectors like biopharma and cell and gene therapy is a significant strength. The company is capitalizing on robust demand for its specialized offerings, including Good Manufacturing Practice (GMP) reagents and essential cell therapy tools.

This focus is clearly reflected in its financial performance, with the Protein Sciences segment, a key revenue driver, experiencing 7% organic growth in the third quarter of fiscal year 2025. This growth is directly attributable to the strong market reception of these high-demand products.

Bio-Techne demonstrates a robust commitment to innovation, consistently bringing advanced solutions to market. Recent successful product introductions include the Leo system, RNAscope assays integrated with the COMET platform, and the Bio-Marker Pathfinder kit, showcasing their ability to deliver cutting-edge tools.

Solid Financial Health and Shareholder Returns

Bio-Techne demonstrates robust financial health, evidenced by a strong current ratio of 3.71, indicating excellent liquidity. This financial stability allows for consistent shareholder returns, with the company having maintained dividend payments for 17 consecutive years.

Further underscoring its commitment to shareholder value, Bio-Techne launched a $500 million stock repurchase program. This initiative reflects management's confidence in the company's underlying worth and its dedication to enhancing shareholder returns through strategic capital allocation.

- Strong Liquidity: Current ratio of 3.71 as of the latest reporting period.

- Consistent Dividends: 17 consecutive years of dividend payments.

- Shareholder Return Program: $500 million stock repurchase authorization.

- Management Confidence: Repurchase program signals belief in intrinsic value.

Strategic Partnerships and Acquisitions

Bio-Techne's strategic approach to growth is significantly bolstered by its proactive engagement in partnerships and targeted acquisitions. These moves are designed to broaden its technological portfolio and solidify its standing in key market segments. For instance, a notable 19.9% investment was made in Wilson Wolf Manufacturing, a move aimed at enhancing its cell culture device offerings. This aligns with the company's strategy to expand its capabilities in critical areas of biotechnology.

Further demonstrating this strategy, Bio-Techne established a strategic partnership with Spear Bio. This collaboration focuses on advancing immunoassay technology, a vital area for diagnostics and research. Such alliances are crucial for Bio-Techne to integrate cutting-edge innovations and maintain a competitive edge in the rapidly evolving biotech landscape.

- Wilson Wolf Manufacturing Investment: Bio-Techne secured a 19.9% stake, enhancing its cell culture device capabilities.

- Spear Bio Partnership: This collaboration targets advancements in immunoassay technology, a key growth area.

- Market Position Enhancement: These strategic moves are designed to strengthen Bio-Techne's competitive standing and expand its technological reach.

Bio-Techne's diverse product catalog, covering everything from reagents to instruments, provides multiple stable income streams. This broad offering, which includes specialized tools for cell and gene therapy, is a significant advantage. The company's Protein Sciences segment, a key contributor, saw 7% organic growth in Q3 FY2025, highlighting the market's strong demand for these essential products.

Innovation is a core strength, with recent successful product launches like the Leo system and RNAscope assays demonstrating Bio-Techne's ability to bring advanced solutions to market. This commitment to R&D ensures they remain at the forefront of biotechnology advancements.

Strategic partnerships and acquisitions further bolster Bio-Techne's growth. Their 19.9% investment in Wilson Wolf Manufacturing enhances cell culture capabilities, while a partnership with Spear Bio aims to advance immunoassay technology, solidifying their position in critical biotech areas.

| Metric | Value | Reporting Period |

|---|---|---|

| Consolidated Net Sales | $1.16 billion | Fiscal Year 2023 |

| Protein Sciences Organic Growth | 7% | Q3 Fiscal Year 2025 |

| Current Ratio | 3.71 | Latest Reporting Period |

| Consecutive Dividend Years | 17 | Ongoing |

| Stock Repurchase Authorization | $500 million | Announced |

What is included in the product

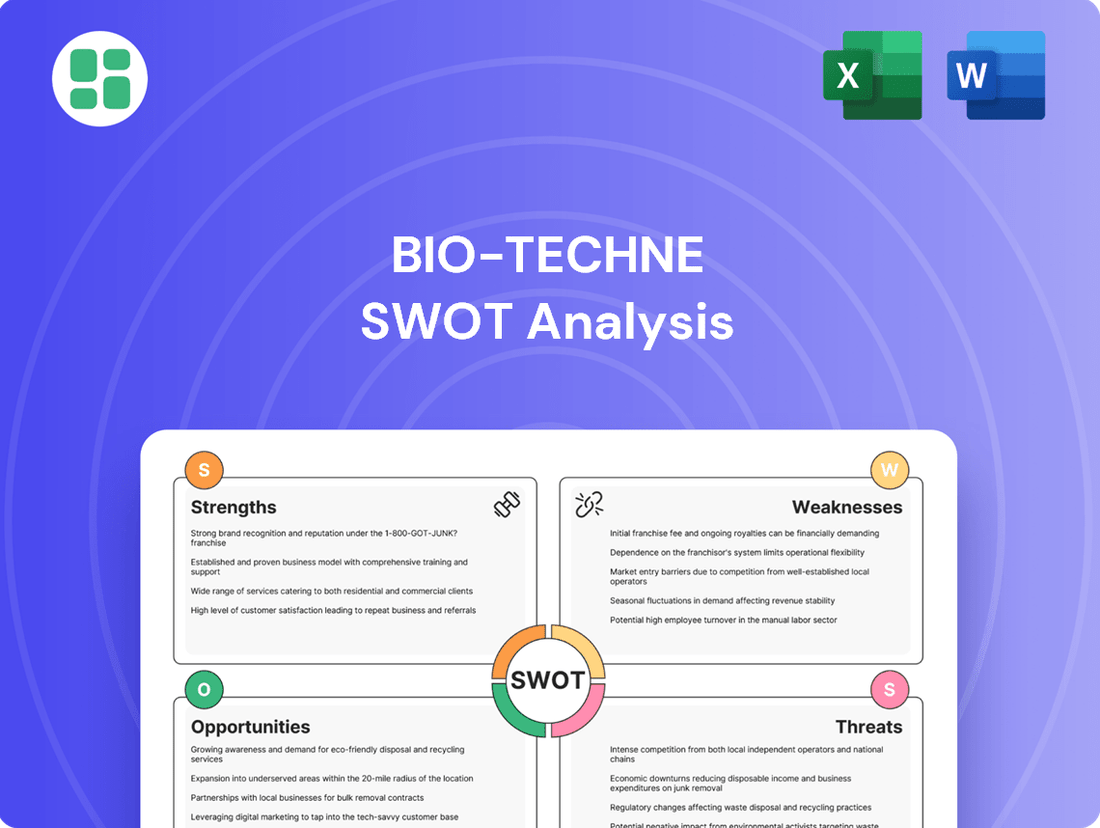

Delivers a strategic overview of Bio-Techne’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges within the biotech sector.

Weaknesses

Bio-Techne's reliance on external research funding presents a notable weakness. Approximately 12% of its revenue is directly linked to grants from institutions like the NIH, exposing the company to the inherent volatility of academic research budgets. This dependency means that shifts in government funding priorities or outright cuts could significantly impact Bio-Techne's financial performance.

Furthermore, potential changes in how indirect costs are reimbursed could create headwinds. If caps are implemented, it might lead to delays in academic institutions purchasing expensive equipment and reagents from Bio-Techne, thereby affecting short-term sales and revenue streams.

Bio-Techne faces a crowded landscape with over 375 active competitors, a significant hurdle in its path to market dominance. Major players like Illumina, for instance, are formidable rivals, especially in areas where products become more standardized.

This intense rivalry, particularly in commoditized segments such as immunoassays within its Diagnostics and Spatial Biology division, can significantly impact Bio-Techne's ability to maintain favorable pricing and secure a larger slice of the market share.

Bio-Techne is susceptible to geopolitical tensions and trade policies, particularly U.S.-China tariffs. These tariffs have historically presented a financial headwind, with an estimated annual impact of around $20 million.

While the company is actively working on strategies, including pricing adjustments and production efficiencies, to offset these costs by 2026, the ongoing nature of these risks poses a near-term challenge to profitability and operational stability.

Lower Operating Margins in Diagnostics Segment

Bio-Techne's Diagnostics and Spatial Biology segment is currently showing lower operating margins compared to its more established Protein Sciences division. For instance, in the third quarter of fiscal year 2025, the Diagnostics and Spatial Biology segment reported operating margins of 9.4%. This contrasts sharply with the Protein Sciences segment, which achieved a robust 45.6% operating margin during the same period.

This significant difference highlights potential challenges within the Diagnostics and Spatial Biology segment, suggesting areas where cost efficiencies might be lacking or where competitive pressures are more intense.

- Lower Profitability in Diagnostics: The Diagnostics and Spatial Biology segment's 9.4% operating margin in Q3 2025 trails the Protein Sciences segment's 45.6%.

- Cost Pressures: The margin disparity points to potential cost management issues or higher operational expenses in the diagnostics area.

- Room for Improvement: Bio-Techne has an opportunity to enhance profitability within its diagnostics offerings.

Potential for Product Obsolescence

The fast-paced nature of biotechnology means Bio-Techne faces a significant risk of its products becoming outdated quickly. Continuous innovation is crucial to stay competitive, as new technologies can swiftly render existing offerings obsolete. This necessitates substantial and ongoing investment in research and development to ensure Bio-Techne's products remain relevant and cutting-edge in the scientific community.

- R&D Investment: Bio-Techne's commitment to R&D is paramount. In fiscal year 2023, the company reported $203.3 million in R&D expenses, representing approximately 12.6% of its total revenue.

- Innovation Pipeline: Maintaining a robust pipeline of new products and technologies is essential to counteract obsolescence.

- Market Dynamics: The biotech sector's rapid evolution demands agile product development and strategic foresight.

Bio-Techne's reliance on external research funding, with about 12% of revenue tied to grants, exposes it to the volatility of academic budgets and potential cuts. This dependency, coupled with the risk of changes in indirect cost reimbursement policies, could negatively impact sales of its specialized products.

The company operates in a highly competitive environment with over 375 rivals, including giants like Illumina. This intense rivalry, particularly in commoditized areas such as immunoassays, challenges Bio-Techne's pricing power and market share growth.

Geopolitical tensions and trade policies, like U.S.-China tariffs, have historically cost Bio-Techne an estimated $20 million annually, posing a near-term challenge to profitability despite ongoing mitigation efforts.

The Diagnostics and Spatial Biology segment exhibits lower operating margins (9.4% in Q3 FY25) compared to the Protein Sciences segment (45.6% in Q3 FY25), indicating potential inefficiencies or higher competitive pressures in this division.

Full Version Awaits

Bio-Techne SWOT Analysis

This is the actual Bio-Techne SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive evaluation of Bio-Techne's strategic position.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Bio-Techne's strengths, weaknesses, opportunities, and threats.

This is a real excerpt from the complete Bio-Techne SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a complete strategic overview.

Opportunities

The cell and gene therapy market is experiencing robust expansion, with projections indicating a compound annual growth rate (CAGR) of 24% from 2024 to 2034. This significant growth trend provides a strong tailwind for Bio-Techne.

Bio-Techne's established expertise in developing and manufacturing specialized proteins, along with its comprehensive cell therapy workflow solutions, strategically positions the company to effectively capitalize on this burgeoning market.

The growing trend towards personalized treatments and the critical need for precise clinical diagnoses present significant avenues for Bio-Techne's precision diagnostics and spatial biology solutions. These advancements directly align with the company's expertise, offering a strong growth trajectory.

Bio-Techne's strategic retention of its exosome-based technology, even after selling off a diagnostics unit, positions it well for future development of diagnostic kits. This access to key technology is a crucial enabler for expanding its footprint in this lucrative market segment.

Bio-Techne is strategically positioned to capitalize on the burgeoning field of AI in biotech research. Its existing work with AI-modified designer proteins and its strong foothold in spatial biology are key advantages. This integration allows for more sophisticated data analysis, promising to accelerate discovery and innovation.

Strategic Acquisitions and Partnerships

Bio-Techne's robust financial position, characterized by strong cash flow and minimal debt, positions it favorably for strategic growth. This financial health not only makes it an appealing acquisition target for larger entities but also empowers Bio-Techne to proactively seek out and integrate complementary businesses or technologies. For instance, its ability to invest in its own R&D and market expansion is a key strength.

The company actively pursues partnerships to enhance its technological capabilities and market presence. A prime example of this strategy is the collaboration with Spear Bio, aimed at advancing its innovative product offerings.

- Financial Strength: Bio-Techne's strong cash flow generation provides the capital necessary for strategic acquisitions and R&D investment.

- Acquisition Potential: The company's low leverage makes it an attractive target for larger players, while also enabling it to acquire smaller, innovative firms.

- Partnership Strategy: Collaborations like the one with Spear Bio demonstrate a commitment to expanding its technological portfolio and market reach.

Market Shift Towards Organoid Solutions

The shift away from animal testing, particularly by regulatory bodies like the FDA for monoclonal antibody therapies, is a significant tailwind for Bio-Techne. This move is creating a strong demand for advanced alternatives, and organoid toxicity testing is at the forefront of this innovation. Bio-Techne is well-positioned to capitalize on this trend, with its extensive range of organoid-related products.

The organoid market itself is projected for substantial growth, with annual increases expected to exceed 20%. This robust expansion rate underscores the increasing adoption and importance of these complex biological models in research and development. Bio-Techne's comprehensive portfolio directly addresses this burgeoning market need.

- FDA's Stance: The FDA's initiative to phase out animal testing for monoclonal antibody therapies is a key driver for organoid adoption.

- Market Growth Projection: The organoid market is anticipated to grow by over 20% annually, indicating strong future demand.

- Bio-Techne's Portfolio: The company offers a comprehensive suite of products supporting organoid development and utilization.

The cell and gene therapy market is projected to grow at a 24% CAGR from 2024 to 2034, presenting a substantial opportunity for Bio-Techne, given its expertise in cell therapy workflow solutions and specialized proteins.

Bio-Techne's precision diagnostics and spatial biology offerings are well-aligned with the growing demand for personalized treatments and accurate clinical diagnoses, further bolstering its growth prospects.

The company's strategic retention of its exosome-based technology, coupled with its strong financial position and active partnership strategy, including collaborations like the one with Spear Bio, positions it for continued innovation and market expansion.

The increasing move away from animal testing, particularly for monoclonal antibody therapies, is driving demand for advanced alternatives like organoid toxicity testing, a sector where Bio-Techne's comprehensive organoid product portfolio provides a significant advantage.

Threats

The biotechnology research product sector is experiencing a significant increase in the number of companies offering similar goods, leading to heightened price competition. This dynamic could potentially squeeze Bio-Techne's profit margins as it navigates a market where customers have more choices and are increasingly sensitive to cost. For instance, in 2024, the global life science research tools market, a key area for Bio-Techne, was projected to grow, but this growth is accompanied by intensified competition across various product categories.

To stay ahead, Bio-Techne must consistently innovate and clearly articulate the unique value its products bring to researchers. In a crowded marketplace, simply offering a product isn't enough; demonstrating superior quality, performance, or novel applications is crucial for retaining and expanding market share. This means investing in research and development to maintain a competitive edge and ensuring its product portfolio addresses unmet needs in the scientific community.

Economic downturns pose a significant threat by potentially shrinking research budgets across academic and biopharmaceutical sectors. A slowdown in the broader economy often translates to reduced R&D investments, directly impacting the demand for Bio-Techne's specialized reagents and instruments. For instance, during periods of economic contraction, organizations may prioritize essential operational spending, leading to cutbacks in discretionary research expenditures.

Bio-Techne faces significant threats from evolving regulatory landscapes, particularly concerning product approvals and clinical testing. For instance, the U.S. Food and Drug Administration (FDA) continues to refine its guidelines for diagnostic tests and biopharmaceuticals, potentially increasing the scrutiny and time required for Bio-Techne's innovative products to reach the market. Navigating these complex, often country-specific regulations is paramount for maintaining market access and ensuring product viability, adding a substantial compliance burden.

Intellectual Property Infringement Risks

Bio-Techne, as a leader in biotechnology, faces significant risks from intellectual property infringement. Protecting its extensive patent portfolio, which underpins its innovative product lines in areas like cell and gene therapy reagents, is crucial for sustained market leadership. The company's ability to defend its intellectual property directly impacts its revenue streams and competitive positioning.

The threat of infringement can manifest through competitors attempting to replicate Bio-Techne's proprietary technologies or develop similar products without proper licensing. This risk is heightened in the fast-evolving biotech landscape where rapid innovation can lead to overlapping research and development efforts. For instance, in 2023, the biotechnology sector saw a notable increase in patent litigation, underscoring the importance of robust IP protection strategies for companies like Bio-Techne.

- Patent Defense Costs: Litigation to protect patents can be expensive, diverting resources from R&D and operations.

- Market Share Erosion: Infringement can lead to the introduction of lower-cost imitations, potentially capturing market share.

- Reputational Damage: Failure to effectively protect IP could impact investor confidence and brand reputation.

- Loss of Exclusivity: Unauthorized use of patented technologies can undermine Bio-Techne's exclusive market rights.

Supply Chain Disruptions and Input Cost Volatility

The biotechnology sector, including companies like Bio-Techne, is particularly vulnerable to disruptions in its intricate global supply chains. Geopolitical tensions, like the ongoing conflicts in Eastern Europe, and the lingering effects of the COVID-19 pandemic continue to pose risks to the timely sourcing of critical raw materials and specialized components. This can directly impact manufacturing schedules and the ability to meet customer demand.

Input cost volatility presents another significant threat. For instance, the price of specialized reagents, enzymes, and even basic laboratory consumables can fluctuate based on global supply and demand dynamics, energy costs, and trade policies. Bio-Techne, like its peers, must navigate these unpredictable cost increases, which can squeeze profit margins if not effectively managed through pricing strategies or cost-containment measures. For example, reports from early 2024 indicated sustained increases in the cost of certain rare earth elements crucial for some diagnostic assays, a trend that could continue.

- Supply Chain Vulnerability: Reliance on global suppliers for specialized reagents and manufacturing components exposes Bio-Techne to potential delays and shortages stemming from geopolitical instability or natural disasters.

- Input Cost Fluctuations: Volatile pricing for raw materials, including chemicals and biological materials, can directly impact Bio-Techne's cost of goods sold and overall profitability.

- Logistical Challenges: Maintaining the integrity of temperature-sensitive biological products throughout the supply chain adds another layer of complexity and potential for disruption.

Intensifying competition within the biotechnology research product sector presents a significant threat, as an increasing number of companies offer similar goods, leading to heightened price competition and potentially squeezing Bio-Techne's profit margins. Economic downturns can also shrink research budgets, directly impacting demand for specialized reagents and instruments. Furthermore, evolving regulatory landscapes, particularly concerning product approvals and clinical testing, can increase scrutiny and delay market entry.

SWOT Analysis Data Sources

This Bio-Techne SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry evaluations. This multi-faceted approach ensures a thorough understanding of the company's internal capabilities and external environment.