Bio-Techne PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bio-Techne Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Bio-Techne's trajectory. This comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Don't guess your next move; download the full version for a data-driven advantage.

Political factors

Government funding, especially from the National Institutes of Health (NIH), is a critical driver for the life sciences sector, directly benefiting companies like Bio-Techne whose products support foundational research. The NIH's budget has seen consistent growth, with proposed budgets for fiscal year 2024 and 2025 aiming for continued increases, reflecting a commitment to scientific advancement.

However, potential shifts in research priorities or budget allocations by new administrations could introduce uncertainty. For instance, a change in political leadership might lead to a reallocation of funds away from certain research areas or a general tightening of government spending, impacting the academic and government research markets that are significant customers for Bio-Techne.

The regulatory environment for biotechnology is constantly shifting, with potential changes in the US and globally directly impacting Bio-Techne's ability to bring new products to market and access those markets. For instance, the Inflation Reduction Act (IRA) of 2022, which allows Medicare to negotiate drug prices, introduces a layer of uncertainty for the entire biopharma ecosystem.

Further complicating matters, proposed legislation like the BIOSECURE Act, which aims to limit certain partnerships with foreign entities, could disrupt supply chains and collaborations within the industry. These legislative actions can indirectly affect the demand for Bio-Techne's essential tools and reagents, as they shape the broader biopharma landscape and its R&D investment strategies.

Geopolitical uncertainties and evolving trade policies present significant challenges for Bio-Techne. For example, the ongoing trade tensions between the United States and China, coupled with potential tariff adjustments, could disrupt Bio-Techne's global supply chains and impact the cost of raw materials and finished goods. This necessitates careful monitoring of international trade agreements and potential retaliatory measures that could affect market access.

The recent focus on national security in biotechnology, exemplified by discussions around legislation like the BIOSECURE Act, directly influences international collaborations and market dynamics. Such developments could lead to increased scrutiny of cross-border partnerships and R&D activities, potentially requiring Bio-Techne to re-evaluate its global strategy and diversify its operational footprint to mitigate risks associated with specific geopolitical alignments.

Intellectual Property Protection

Government policies, particularly regarding intellectual property (IP) protection, play a pivotal role in fostering innovation within the biotechnology sector. The Bayh-Dole Act, for instance, has been instrumental in encouraging the commercialization of federally funded research by allowing universities and small businesses to retain title to inventions. This legislative framework directly impacts companies like Bio-Techne by providing a mechanism to secure patents for novel discoveries.

The landscape surrounding IP protection is constantly evolving, presenting both opportunities and challenges. Ongoing debates concerning 'march-in rights,' which allow the government to compel patent holders to license their inventions under certain circumstances, and potential shifts in practices at the United States Patent and Trademark Office (USPTO) can influence how patents are granted and enforced. Furthermore, high-profile patent disputes, such as those involving CRISPR technology, underscore the litigious nature of the biotech industry and the critical importance of robust IP strategies for companies like Bio-Techne to safeguard their innovations.

- Patent Filings: In 2023, the USPTO saw a significant increase in patent applications across various technology sectors, with biotechnology remaining a key area of focus, reflecting continued investment in R&D.

- CRISPR Patent Landscape: As of early 2024, the ongoing legal battles over CRISPR gene-editing patents continue to shape the competitive environment, potentially impacting licensing agreements and future product development for companies in this space.

- Bayh-Dole Act Impact: Studies indicate that the Bayh-Dole Act has facilitated thousands of new technologies and products reaching the market since its inception, highlighting its sustained importance for biotech innovation.

International Collaboration and Market Access

Bio-Techne's international growth is significantly shaped by the political climate surrounding global collaborations. Policies impacting market access, especially in crucial regions like China, present both opportunities and challenges. Navigating these diverse regulatory environments is key for expansion.

The biotech sector, including Bio-Techne, is increasingly reliant on international partnerships for research and development, as well as market penetration. For instance, in 2024, the global biotechnology market was valued at approximately $1.3 trillion, highlighting the immense scale and interconnectedness of the industry. Despite geopolitical tensions that may lead to scrutiny of certain cross-border collaborations, the inherent need for shared expertise and market reach continues to drive licensing and partnership activities.

- Geopolitical Influence: Political decisions in major economies can directly affect Bio-Techne's ability to conduct business and form alliances in those markets.

- Regulatory Navigation: The company must adapt to varying national regulations concerning intellectual property, data sharing, and product approvals.

- Market Access Dynamics: Trade agreements and protectionist policies can either facilitate or hinder Bio-Techne's access to key international customer bases.

- Strategic Partnerships: Despite potential political headwinds, the strategic imperative for global collaboration in biotech remains strong, driving continued licensing deals.

Government funding remains a cornerstone for biotech innovation, with agencies like the NIH continuing to allocate substantial resources to life sciences research. For fiscal year 2025, proposed NIH budgets aim to sustain or increase funding levels, directly supporting the foundational research that underpins Bio-Techne's product demand.

However, political shifts can alter research priorities and funding allocations. New administrations may redirect funds, potentially impacting academic and government research markets that are key customers for Bio-Techne's reagents and instruments.

Regulatory frameworks, including the Inflation Reduction Act's drug price negotiation provisions and proposed legislation like the BIOSECURE Act, introduce complexities. These policies can influence R&D investment strategies across the biopharma sector, indirectly affecting demand for Bio-Techne's offerings by shaping the broader market landscape.

| Policy Area | 2024/2025 Impact on Bio-Techne | Key Legislation/Development |

|---|---|---|

| Government Funding | Continued robust NIH funding supports research demand. | Proposed NIH budgets for FY2024 and FY2025 |

| Regulatory Environment | Potential shifts in drug pricing and supply chain policies create uncertainty. | Inflation Reduction Act (IRA), BIOSECURE Act |

| Intellectual Property | Strong IP protection fosters innovation but ongoing disputes highlight risks. | Bayh-Dole Act, USPTO practices, CRISPR patent litigation |

| Geopolitics & Trade | Trade tensions and national security focus impact global collaborations and supply chains. | US-China trade relations, BIOSECURE Act discussions |

What is included in the product

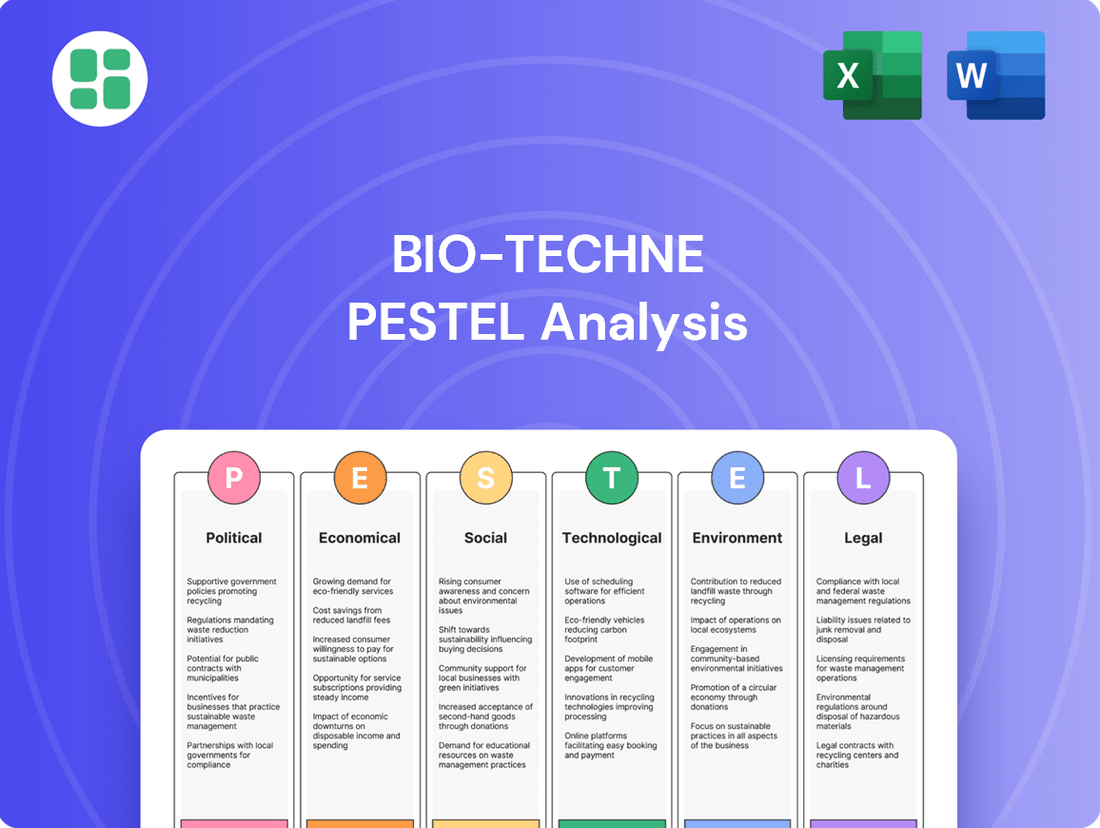

This Bio-Techne PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

It provides a comprehensive understanding of the external forces shaping Bio-Techne's market, enabling informed decision-making and proactive strategy development.

Provides a clear, actionable roadmap by identifying external opportunities and threats, enabling Bio-Techne to proactively address market shifts and mitigate potential risks.

Economic factors

The global economic climate significantly influences Bio-Techne's customer base, particularly pharmaceutical companies and academic research institutions, as their R&D budgets are directly tied to overall economic health. When economies are robust, these entities tend to increase their investment in research and development, which translates into higher demand for Bio-Techne's specialized tools and services.

Looking ahead to 2025, projections for a stronger global economic expansion are expected to bolster demand for life sciences products, including those offered by Bio-Techne. For instance, if advanced economies see GDP growth in the range of 2-3% in 2025, this would likely translate into increased R&D budgets for key Bio-Techne clients.

However, it's crucial to acknowledge that economic volatility, such as unexpected inflation spikes or geopolitical instability, can still present headwinds. Such uncertainties might lead to budget reallocations or delays in R&D projects, potentially impacting Bio-Techne's revenue streams despite overall growth expectations.

The flow of venture capital into the life sciences sector directly impacts the expansion of nascent biotech companies, which are key clients. Despite some headwinds in 2024, projections for 2025 indicate a rebound in mergers and acquisitions, alongside targeted initial public offerings. This trend suggests a more stable financial environment and potentially greater capital access for biotechnology businesses.

Inflationary pressures and interest rate fluctuations directly influence Bio-Techne's cost of capital and operational expenses. While some life sciences executives noted a decline in inflation concerns in early 2024, the persistent higher interest rate environment, with the Federal Reserve maintaining rates above 5% through mid-2024, can still limit capital access for smaller biotechs, potentially impacting their R&D spending and Bio-Techne's customer base.

Supply Chain Costs and Efficiency

Global supply chain dynamics, including the cost of raw materials and logistics, directly impact Bio-Techne's manufacturing and distribution expenses. For instance, in early 2024, disruptions in shipping lanes and increased fuel costs continued to put upward pressure on logistics expenses for many companies, including those in the biotech sector.

Geopolitical uncertainties and evolving trade policies can introduce significant volatility in these costs. Companies like Bio-Techne must therefore prioritize supply chain resilience and operational efficiency to maintain profitability. This involves strategies such as diversifying suppliers and optimizing inventory management to mitigate the impact of external shocks.

- Increased Logistics Costs: Global shipping rates saw fluctuations throughout 2023 and into 2024, with the average cost of shipping a 40-foot container remaining elevated compared to pre-pandemic levels.

- Raw Material Volatility: Prices for key chemical reagents and specialized components used in biotech manufacturing experienced variability, influenced by energy prices and geopolitical events.

- Focus on Resilience: Companies are investing in dual-sourcing strategies and regionalizing parts of their supply chains to reduce reliance on single points of failure.

- Operational Efficiency: Bio-Techne's focus on streamlining production processes and improving inventory turnover helps to offset rising input costs and maintain competitive pricing.

Bio-Techne's Financial Performance and Market Position

Bio-Techne's financial health is currently robust, as evidenced by its fiscal 2025 quarterly performance. The company achieved notable organic revenue growth, particularly within its Protein Sciences and Diagnostics & Spatial Biology segments, signaling strong demand for its products and services.

Strategic decisions, such as the divestiture of its Exosome Diagnostics business, are actively reshaping Bio-Techne's operational landscape. This move is designed to enhance the company's overall financial foundation and improve operating margins, thereby positioning it for sustained expansion within its key market areas.

- Fiscal 2025 Q1 Organic Revenue Growth: Protein Sciences up 10%, Diagnostics & Spatial Biology up 13%.

- Strategic Divestiture: Exosome Diagnostics business sold to focus on core competencies.

- Margin Improvement: Divestitures are expected to contribute to higher operating margins in the coming fiscal years.

- Market Position: Continued investment in R&D supports Bio-Techne's competitive standing in the life sciences sector.

Economic growth directly fuels Bio-Techne's revenue by increasing R&D budgets for its clients. Projections for 2025 suggest a global economic expansion, potentially boosting demand for life science tools. However, economic volatility, like inflation, can still create challenges by impacting client spending and Bio-Techne's operational costs.

The life sciences sector's access to capital, influenced by interest rates and venture funding, directly affects Bio-Techne's customer base. While higher interest rates persisted through mid-2024, a projected rebound in M&A and IPOs for 2025 suggests improved capital availability for biotech firms.

Supply chain disruptions and raw material costs remain key economic factors for Bio-Techne. Elevated shipping costs and raw material price volatility were observed in 2023-2024. Bio-Techne is focusing on supply chain resilience and operational efficiency to mitigate these impacts.

| Economic Factor | Impact on Bio-Techne | 2024/2025 Data/Projections |

|---|---|---|

| Global Economic Growth | Increased R&D spending by clients | Projected 2-3% GDP growth in advanced economies for 2025 |

| Inflation & Interest Rates | Higher operational costs, potential impact on client R&D budgets | Federal Reserve rates above 5% through mid-2024; ongoing cost pressures |

| Venture Capital & M&A | Capital availability for biotech clients | Projected rebound in M&A and IPOs for 2025 |

| Supply Chain Costs | Manufacturing and distribution expenses | Elevated shipping costs and raw material volatility observed in 2023-2024 |

What You See Is What You Get

Bio-Techne PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bio-Techne PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable strategic insights.

Sociological factors

The world's population is getting older, with projections indicating that by 2050, one in six people globally will be 65 or older, a significant jump from one in 11 in 2015. This demographic shift directly fuels demand for advanced diagnostics and treatments for age-related conditions, a core market for Bio-Techne's life science tools and reagents. For instance, the global market for diagnostics for Alzheimer's disease alone is expected to reach $10.5 billion by 2027, highlighting the substantial opportunity.

This aging trend also intensifies the disease burden, increasing the need for sophisticated research into conditions like cancer, cardiovascular disease, and neurodegenerative disorders. Bio-Techne's commitment to providing high-quality reagents and instruments for cellular and molecular analysis positions them to capitalize on this sustained demand for innovation in understanding and combating these prevalent diseases.

Societal shifts are increasingly favoring personalized medicine, a direct result of breakthroughs in genomics and molecular diagnostics. This trend is fundamentally altering how healthcare is delivered, moving towards treatments tailored to an individual's unique biological makeup.

Bio-Techne's product offerings are strategically aligned with this growing demand. Their tools empower researchers and medical professionals to create customized therapies and enhance diagnostic precision by analyzing individual patient data, a key driver for growth in the biotech sector.

For instance, the global personalized medicine market was valued at approximately $500 billion in 2023 and is projected to reach over $900 billion by 2030, showcasing a significant compound annual growth rate. This expansion directly benefits companies like Bio-Techne, whose technologies are integral to this burgeoning field.

Heightened public health awareness, significantly amplified by recent global health events, is driving increased investment in disease understanding, prevention, and diagnostics. This societal shift directly fuels demand for the tools and technologies Bio-Techne provides, as research into biological processes and disease mechanisms becomes a priority. For instance, the global diagnostics market, including areas like molecular diagnostics and immunoassay, was valued at approximately $80 billion in 2023 and is projected to grow substantially, underscoring the impact of this trend.

Ethical Considerations of Biotechnology

Public sentiment regarding biotechnologies, particularly gene editing like CRISPR and AI in healthcare, significantly impacts research investment and regulatory pathways. For instance, a 2024 Pew Research Center study indicated that while 56% of Americans supported using CRISPR to treat inherited diseases, only 29% favored using it for enhancing human traits, highlighting the nuanced ethical landscape.

Bio-Techne, as a key enabler of these advancements, must actively engage with these societal conversations to foster trust and ensure responsible development. Navigating these ethical debates is crucial for Bio-Techne's long-term success, influencing everything from product adoption to its corporate reputation.

The company's commitment to ethical practices can be a differentiator. For example, Bio-Techne's focus on providing tools for therapeutic applications, rather than purely enhancement technologies, aligns with public concerns. This careful positioning is vital as public perception shifts, potentially affecting Bio-Techne's market access and partnerships.

- Public Opinion on Gene Editing: A 2024 survey revealed varying public acceptance levels for different gene editing applications, impacting market potential for related technologies.

- AI in Healthcare Trust: Growing reliance on AI in diagnostics and treatment requires addressing public trust issues, which can influence the adoption of AI-powered biotech solutions.

- Corporate Responsibility: Bio-Techne's proactive stance on ethical innovation is essential for maintaining a positive brand image and securing future funding and regulatory approvals.

Workforce Dynamics and Talent Availability

The life sciences sector, including Bio-Techne's operational base, relies heavily on a skilled workforce. In early 2024, the U.S. life sciences sector reported record high employment, signaling a strong talent pool. However, the demand for highly specialized skills, particularly in emerging fields like artificial intelligence and gene therapy, continues to outpace supply, creating intense competition for top talent.

This dynamic directly impacts Bio-Techne's ability to innovate and scale, as well as its customers' capacity to leverage advanced biotechnologies. For instance, the growth in biopharmaceutical employment in 2024 underscores the need for continuous upskilling and strategic talent acquisition to maintain a competitive edge.

- Skilled Workforce Demand: High demand for life science professionals, especially in specialized areas.

- Talent Pool Strength: Record employment in the U.S. life sciences sector indicates a robust, though competitive, talent pool.

- Emerging Skill Gaps: Competition for expertise in AI, gene therapy, and other cutting-edge fields is a significant factor for industry growth.

- Impact on Bio-Techne: Workforce availability directly affects Bio-Techne's innovation capacity and its customers' adoption of new technologies.

Societal preferences are increasingly leaning towards preventative healthcare and wellness, a trend that boosts demand for diagnostic tools and research reagents. This shift, coupled with a growing global population, particularly in emerging economies, creates a larger addressable market for Bio-Techne's offerings.

The increasing acceptance of biotechnological advancements, such as gene editing and AI in drug discovery, is a significant societal factor. Public perception and ethical considerations surrounding these technologies directly influence investment and regulatory landscapes, impacting Bio-Techne's innovation pipeline and market adoption.

Awareness of health disparities and a desire for equitable access to advanced medical treatments are also shaping societal expectations. Bio-Techne's role in providing foundational research tools can contribute to addressing these disparities by enabling research into a wider range of diseases and populations.

The demand for transparency and ethical conduct in scientific research and development is paramount. Bio-Techne's commitment to rigorous quality control and ethical practices is crucial for building and maintaining public trust, which is essential for sustained growth.

Technological factors

The integration of Artificial Intelligence and Machine Learning (AI/ML) is profoundly transforming drug discovery, diagnostics, and clinical development processes within the life sciences. This evolution is creating a significant demand for Bio-Techne's advanced reagents and instruments as customers increasingly leverage AI-powered tools.

Bio-Techne's customers are utilizing AI to predict drug efficacy and analyze complex biological data, driving a need for high-quality, compatible tools. For example, AI platforms are accelerating the identification of novel drug targets, a process that historically took years, now potentially reduced to months.

The demand for AI-compatible reagents and instruments is growing as companies like Bio-Techne support these advanced analytical workflows. This trend is expected to continue, with the global AI in drug discovery market projected to reach billions by 2028, showcasing the immense impact on the biotech sector.

Advancements in gene editing, particularly CRISPR-Cas9, are revolutionizing medicine. These tools are fundamental for developing novel treatments. The market for gene and cell therapies is projected to reach $30 billion by 2026, highlighting the immense growth potential.

Bio-Techne's portfolio, encompassing reagents for cell biology and genomics, directly supports research in these cutting-edge areas. Their offerings are critical for the development of therapies like CAR-T cell treatments, which saw a significant increase in clinical trials in 2024. The company's role is pivotal in enabling the scientific community to push the boundaries of personalized medicine.

The advancement of spatial biology and multi-omics technologies is revolutionizing our understanding of biological systems, offering unprecedented detail at the cellular and molecular levels. These sophisticated analytical approaches are driving significant growth in the life sciences sector.

Bio-Techne's strategic focus on its Diagnostics and Spatial Biology segment positions it advantageously to meet the escalating demand for tools supporting these intricate analyses. The company's portfolio is designed to empower researchers with the capabilities needed to explore complex biological questions.

The market for spatial biology solutions is projected to expand considerably. For instance, the spatial biology market was valued at approximately $1.7 billion in 2023 and is anticipated to reach around $4.5 billion by 2028, demonstrating a compound annual growth rate of over 20%. This growth underscores the increasing adoption and importance of these technologies.

Increased Lab Automation and Robotics

The life sciences sector is seeing a significant push towards lab automation and robotics, with collaborative robots, or cobots, becoming increasingly common. This trend is all about boosting efficiency, accuracy, and the ability to scale up research and production. For instance, the global laboratory automation market was valued at approximately $6.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 8% through 2030, indicating strong adoption.

Bio-Techne's success hinges on its ability to ensure its instruments and reagents work harmoniously within these automated systems. The industry's demand for quicker, more reliable results means that seamless integration is no longer a nice-to-have but a necessity. Companies that can easily fit into automated workflows are better positioned to capture market share.

- Market Growth: The global laboratory automation market is expanding rapidly, with projections suggesting continued strong growth in the coming years.

- Efficiency Gains: Automation and robotics in labs directly translate to higher throughput and reduced manual errors.

- Integration is Key: Bio-Techne's product development must prioritize compatibility with automated laboratory environments.

- Reproducibility: The drive for reproducible scientific results is a major catalyst for increased automation adoption.

Digital Transformation and Data Management in Labs

The life sciences sector is undergoing a significant digital transformation, with cloud computing and advanced data analytics becoming integral. This shift is driven by the need for more efficient data management and secure exchange. For instance, the global life sciences analytics market was valued at approximately $10.5 billion in 2023 and is projected to reach $25.8 billion by 2030, growing at a CAGR of 13.7%.

Bio-Techne's success hinges on its capacity to offer digital solutions and data management support that complement its physical products. Customers are increasingly looking for integrated platforms that provide unified clinical and business insights, leading to optimized workflows. This integration is paramount as organizations aim to streamline operations and derive greater value from their data.

Key technological factors enabling this include:

- Cloud Computing: Facilitates scalable data storage and accessibility, crucial for large biological datasets.

- Advanced Data Analytics: Enables deeper insights into research, clinical trials, and operational efficiency.

- Secure Data Exchange: Essential for collaboration and compliance in a highly regulated industry.

- AI and Machine Learning: Increasingly used for pattern recognition, predictive modeling, and drug discovery acceleration.

The increasing adoption of AI in drug discovery and diagnostics is a major technological driver, with platforms accelerating target identification. Bio-Techne's reagents are essential for these AI-driven workflows, supporting the growing demand for high-quality biological data.

Advancements in gene editing, such as CRISPR, are revolutionizing therapeutic development, with the gene and cell therapy market projected to reach $30 billion by 2026. Bio-Techne's genomics and cell biology tools directly support this burgeoning field, enabling personalized medicine research.

Spatial biology and multi-omics are transforming biological understanding, with the spatial biology market expected to grow from $1.7 billion in 2023 to $4.5 billion by 2028. Bio-Techne's focus on these areas positions it to capitalize on this significant expansion.

Lab automation and robotics are boosting efficiency and reproducibility, with the global market valued at $6.5 billion in 2023 and projected to grow at over 8% CAGR through 2030. Bio-Techne's products must integrate seamlessly into these automated systems to meet industry needs.

| Technology Trend | Market Size (2023) | Projected Growth | Bio-Techne Relevance |

| AI in Drug Discovery | Billions (est.) | Significant | Reagents for AI workflows |

| Gene & Cell Therapy | $20+ Billion (est.) | $30 Billion by 2026 | Genomics & cell biology tools |

| Spatial Biology | $1.7 Billion | $4.5 Billion by 2028 (20%+ CAGR) | Tools for spatial analysis |

| Lab Automation | $6.5 Billion | 8%+ CAGR through 2030 | Seamless integration of products |

Legal factors

Bio-Techne's success hinges on robust intellectual property protection, especially patents, which are crucial for recouping substantial R&D investments in the biotech sector. The company actively manages a portfolio of patents covering its diagnostic and research tools, aiming to maintain a competitive edge.

Legal battles, like the ongoing disputes surrounding CRISPR-Cas9 gene-editing technology, highlight the dynamic nature of patent law in biotech and can reshape market access and competitive positioning for companies like Bio-Techne. Changes in patent office fees and examination policies, which saw increases in certain USPTO fees in early 2025, also directly affect the cost and strategy of patent asset management.

Bio-Techne operates under stringent data privacy and security regulations. In the US, the Health Insurance Portability and Accountability Act (HIPAA) dictates how protected health information is handled, a crucial aspect for Bio-Techne's diagnostics and clinical tools. Similarly, the upcoming EU AI Act will impose significant requirements on the use of AI in healthcare, directly impacting Bio-Techne's innovative diagnostic solutions and research platforms.

Compliance with these evolving legal frameworks is paramount. Failure to adhere to regulations like HIPAA can result in substantial fines, with HIPAA violations costing organizations an average of $10,000 per violation, and potentially much higher for widespread breaches. Maintaining customer trust, especially as AI becomes more integrated into diagnostic processes, hinges on robust data protection measures.

The U.S. Food and Drug Administration (FDA) oversees rigorous clinical trial and product approval processes, significantly impacting the market entry timeline and commercial success of Bio-Techne's innovative diagnostics and therapeutics. For instance, the FDA's accelerated approval pathways, which saw a notable increase in approvals for novel drugs in 2023, can expedite access to new treatments.

Shifts in regulatory landscapes, such as the ongoing movement towards reducing or eliminating animal testing for certain medical products, present both opportunities and potential hurdles for Bio-Techne's diverse product offerings. Companies that can adapt their research and development strategies to align with these evolving ethical and scientific standards are better positioned for future growth.

Product Liability and Quality Standards

Bio-Techne, as a key player in biotechnology, faces significant legal scrutiny regarding product liability and quality. The company must adhere to stringent regulations governing the safety and efficacy of its diagnostic tools and research reagents. Failure to meet these standards can lead to costly lawsuits and damage its standing in a highly regulated industry.

Maintaining robust quality control is paramount for Bio-Techne. This involves adhering to Good Manufacturing Practices (GMP) and ISO certifications, such as ISO 13485 for medical devices. In 2023, the FDA reported a rise in recalls for medical devices due to quality issues, underscoring the critical nature of compliance. Bio-Techne's commitment to quality directly impacts its ability to operate and grow.

The company's legal exposure extends to international markets, requiring compliance with varying regulatory frameworks like the EU's In Vitro Diagnostic Regulation (IVDR). The IVDR, implemented fully in May 2022, imposes stricter requirements on manufacturers, increasing the burden of proof for product safety and performance. Bio-Techne's proactive approach to these evolving global standards is crucial for market access and risk mitigation.

Key considerations for Bio-Techne include:

- Robust post-market surveillance systems to identify and address potential product issues promptly.

- Comprehensive internal quality management systems that align with global regulatory expectations.

- Proactive engagement with regulatory bodies to stay abreast of changing legal requirements.

- Thorough documentation and traceability for all products, from raw materials to finished goods.

Anti-Trust and Merger & Acquisition Regulations

Anti-trust and merger & acquisition regulations significantly shape Bio-Techne's inorganic growth strategy. Increased regulatory scrutiny, particularly from bodies like the Federal Trade Commission (FTC) in the US and the European Commission, can impact deal timelines and approvals. For instance, the FTC's focus on competition in the healthcare sector means that larger acquisitions by Bio-Techne might face more rigorous review, potentially delaying or even blocking deals that could be seen as reducing market competition.

The life sciences industry anticipates a rise in M&A activity through 2025, but these regulations act as a key gatekeeper. Bio-Techne must navigate these complexities, ensuring that proposed acquisitions align with competition laws. Failure to do so can result in significant penalties or the forced divestiture of assets, impacting the intended synergies and strategic benefits of any merger or acquisition.

- Increased regulatory scrutiny on healthcare M&A

- Potential delays and challenges in deal approvals

- Impact on Bio-Techne's inorganic growth strategy

- Need for compliance with anti-trust laws

Bio-Techne's legal landscape is heavily influenced by intellectual property law, particularly patents, which are vital for protecting its significant R&D investments in diagnostic and research tools. The company actively manages its patent portfolio to maintain a competitive edge, with patent office fee adjustments in early 2025 impacting asset management costs.

Stringent data privacy regulations like HIPAA in the US and the forthcoming EU AI Act directly affect Bio-Techne's handling of sensitive health information and the deployment of AI in its diagnostic solutions, with HIPAA violations potentially costing $10,000 per incident.

The company must navigate rigorous FDA approval processes for its products, similar to the accelerated approval pathways that saw increased novel drug approvals in 2023, while also adapting to evolving ethical standards like reduced animal testing.

Bio-Techne faces scrutiny over product liability and quality, adhering to GMP and ISO certifications like ISO 13485, especially as the FDA reported a rise in medical device recalls due to quality issues in 2023, underscoring the critical importance of compliance.

Environmental factors

The life sciences sector, including companies like Bio-Techne, faces growing demands for environmentally conscious manufacturing. This pressure stems from a global push to reduce the industry's impact on the planet.

Bio-Techne, as a key player in developing and producing life science tools, must prioritize reducing energy usage and streamlining its operations. A significant challenge is tackling plastic waste, particularly from disposable lab consumables, which are prevalent in research and diagnostics.

In 2024, the life sciences industry is seeing increased investment in green chemistry and circular economy principles. For instance, many companies are exploring biodegradable materials for labware, aiming to divert waste from landfills.

Effective waste management is a critical environmental consideration for Bio-Techne, especially concerning laboratory consumables and chemical byproducts. The biotech industry generates significant waste, and responsible handling is paramount.

By implementing robust strategies for waste reduction, recycling programs, and the adoption of biodegradable materials, Bio-Techne can significantly enhance its environmental footprint. This proactive approach also aligns with increasing global sustainability mandates and investor expectations.

For instance, the global waste management market was valued at approximately $1.1 trillion in 2023 and is projected to grow. Companies focusing on resource efficiency and circular economy principles, like those Bio-Techne can adopt, are increasingly favored.

Biopharmaceutical manufacturing, including Bio-Techne's operations, is inherently energy-intensive, contributing to a significant carbon footprint. For instance, the biopharma sector globally accounts for a notable portion of industrial energy use.

Bio-Techne's sustainability strategy will likely focus on transitioning to renewable energy sources and investing in energy-efficient equipment. This commitment aims to demonstrably reduce its greenhouse gas emissions, aligning with broader industry trends and regulatory pressures observed in 2024 and projected into 2025.

Ethical Sourcing and Supply Chain Sustainability

The pressure for ethical sourcing and sustainable supply chains is growing significantly. Bio-Techne's commitment to responsible procurement and partnering with suppliers who prioritize environmental care is crucial. This focus not only bolsters brand image but also aligns with the increasing demands from investors, customers, and regulators for corporate responsibility.

For instance, in 2024, a significant percentage of consumers indicated they would pay more for products from companies with strong sustainability practices. Bio-Techne's proactive approach to supply chain transparency and ethical sourcing, potentially showcased in their 2025 sustainability reports, will be a key differentiator.

- Growing Consumer Demand: Reports from late 2024 show over 60% of consumers consider sustainability when making purchasing decisions.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) factors are increasingly influencing investment strategies, with a notable rise in ESG-focused funds in 2024-2025.

- Regulatory Landscape: Emerging regulations in key markets are mandating greater supply chain transparency and ethical labor practices, impacting companies like Bio-Techne.

Green Biotechnology and Eco-Friendly Solutions

The increasing demand for eco-friendly solutions is driving the adoption of green biotechnology. This sector, which uses biological processes to create sustainable products, offers significant growth potential. For instance, the global bio-based materials market was valued at approximately $240 billion in 2023 and is projected to reach over $400 billion by 2030, indicating a strong upward trend.

Bio-Techne can capitalize on this shift by integrating green biotechnology into its product development and manufacturing. Innovations in bio-based materials and sustainable biomanufacturing processes are key areas where the company can contribute to ecological preservation while enhancing its market position. The biomanufacturing market, specifically, is expected to grow substantially, with some estimates placing its growth rate at over 15% annually in the coming years.

- Growing Market for Bio-Based Products: The global bio-based materials market is expanding rapidly, driven by environmental concerns and regulatory support.

- Sustainable Manufacturing Opportunities: Advancements in biomanufacturing offer cost-effective and environmentally sound alternatives to traditional chemical synthesis.

- Alignment with ESG Goals: Embracing green biotechnology aligns Bio-Techne with Environmental, Social, and Governance (ESG) initiatives, appealing to investors and consumers.

- Innovation in Bio-Materials: Development of novel bio-based polymers and composites presents opportunities for new product lines and applications.

Environmental factors are increasingly shaping the life sciences landscape, pushing companies like Bio-Techne towards more sustainable practices. Growing consumer and investor demand for eco-friendly products, with over 60% of consumers considering sustainability in 2024 purchasing decisions, highlights this trend. Furthermore, regulatory bodies are implementing stricter guidelines on waste management and carbon emissions, influencing operational strategies for the entire sector.

Bio-Techne must navigate the significant environmental footprint associated with biopharmaceutical manufacturing, which is energy-intensive. The company is exploring renewable energy sources and energy-efficient equipment to reduce its carbon emissions, a move that aligns with industry-wide sustainability goals for 2024-2025. Effective waste management, particularly concerning laboratory consumables and chemical byproducts, remains a critical focus, with the global waste management market projected for continued growth.

The rise of green biotechnology presents a substantial opportunity for Bio-Techne, as the global bio-based materials market is on a strong upward trajectory. By integrating sustainable biomanufacturing processes and developing bio-based materials, Bio-Techne can enhance its market position while contributing to ecological preservation. This strategic alignment with ESG principles is crucial for attracting investors and meeting evolving market expectations.

| Environmental Factor | Impact on Bio-Techne | 2024-2025 Data/Trend |

|---|---|---|

| Sustainability Demands | Increased pressure for eco-friendly operations and products. | 60%+ consumers prioritize sustainability in purchases (late 2024). |

| Carbon Footprint | Need to reduce energy consumption and emissions in manufacturing. | Biopharma sector is energy-intensive; transition to renewables is key. |

| Waste Management | Critical for handling lab consumables and chemical byproducts. | Global waste management market valued at ~$1.1 trillion (2023), projected growth. |

| Green Biotechnology | Opportunity for sustainable product development and manufacturing. | Global bio-based materials market ~$240 billion (2023), projected to exceed $400 billion by 2030. |

PESTLE Analysis Data Sources

Our Bio-Techne PESTLE Analysis is built on a robust foundation of data from leading scientific journals, industry-specific market research reports, and regulatory body publications. We meticulously gather insights on technological advancements, economic trends, and societal shifts impacting the biotechnology sector.