Bio-Techne Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bio-Techne Bundle

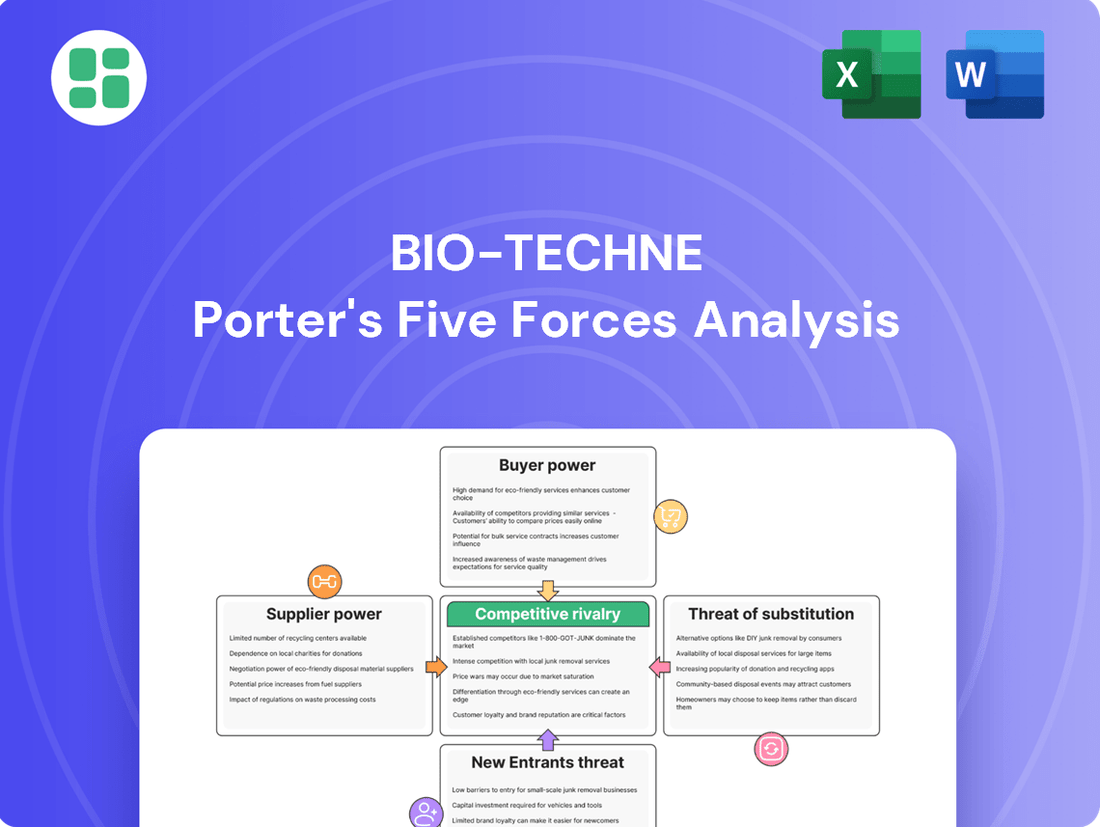

Bio-Techne's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the constant threat of new entrants disrupting the market. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this dynamic industry.

This preview is just the beginning. Dive into a complete, consultant-grade breakdown of Bio-Techne’s industry competitiveness—ready for immediate use.

Suppliers Bargaining Power

Bio-Techne depends on specialized suppliers for critical raw materials, chemicals, and biological reagents vital to its extensive product lines. The unique or restricted availability of some of these inputs gives these specialized suppliers considerable leverage.

This supplier power can translate into increased prices or less favorable contract terms for Bio-Techne, directly affecting its cost of goods sold and overall profitability. For instance, in 2024, the life sciences sector experienced continued supply chain pressures for certain high-purity reagents, potentially impacting companies like Bio-Techne.

Bio-Techne's reliance on suppliers possessing proprietary technologies or unique intellectual property can significantly bolster supplier bargaining power. For instance, if a critical component for a diagnostic assay is only available from a single licensed developer, Bio-Techne faces increased leverage from that supplier. This dependence can translate into higher costs for licensing or component acquisition, potentially impacting Bio-Techne's profit margins and product pricing strategies.

The production of high-quality biotechnology instruments and precision diagnostics hinges on advanced manufacturing equipment and specialized components. This reliance creates a significant bargaining power for suppliers in this niche market.

The market for such sophisticated machinery is often concentrated, meaning only a select few vendors possess the requisite expertise and production capabilities. For instance, in 2024, the global market for semiconductor manufacturing equipment, a parallel to advanced biotech machinery, was valued at approximately $100 billion, with a significant portion dominated by a handful of key players.

This concentration empowers these equipment suppliers to influence terms, delivery schedules, and pricing. Consequently, Bio-Techne, like other companies in the sector, faces potential impacts on its operational efficiency and capital expenditures due to the leverage held by these specialized equipment providers.

Skilled Scientific and Technical Talent

The availability of highly skilled scientific, engineering, and manufacturing talent is a critical factor for Bio-Techne, akin to a supplier's influence. A scarcity of specialized life sciences professionals can empower these individuals, leading to increased labor costs through higher compensation packages.

This dynamic directly affects Bio-Techne's operational expenses and its capacity for rapid innovation and expansion. For instance, in 2024, the demand for bioinformaticians and geneticists saw significant upticks, with some roles experiencing salary increases of 10-15% year-over-year, according to industry surveys.

- Talent as a Supplier: Skilled personnel are essential for Bio-Techne's R&D and production.

- Impact of Shortages: Limited availability of talent can drive up wages and benefits.

- Financial Ramifications: Increased labor costs can affect Bio-Techne's profitability and growth potential.

- Industry Trends: Specific scientific disciplines, like bioinformatics, experienced notable salary growth in 2024.

Regulatory Compliant and Certified Inputs

Suppliers who can provide materials, components, or services that meet strict regulatory standards, such as Good Manufacturing Practices (GMP) or ISO certifications, gain significant bargaining power. Bio-Techne's need to ensure its supply chain meets these rigorous quality and regulatory requirements narrows its supplier options.

- Regulatory Compliance as a Barrier: Suppliers holding necessary certifications like FDA approval for critical reagents or GMP for manufacturing processes effectively limit the competitive landscape for Bio-Techne.

- Increased Supplier Leverage: This limitation in the supplier pool directly translates to increased leverage for those few entities that can consistently meet Bio-Techne's stringent compliance demands.

- Impact on Cost and Availability: The reliance on certified suppliers can influence both the cost of goods and the availability of essential inputs for Bio-Techne's operations.

Bio-Techne faces considerable bargaining power from its suppliers, particularly those providing specialized raw materials, chemicals, and biological reagents essential for its product development and manufacturing. The concentration within certain niche supplier markets, such as advanced manufacturing equipment, further amplifies this leverage.

In 2024, supply chain pressures persisted for high-purity reagents, impacting companies like Bio-Techne and highlighting the power of suppliers in critical input markets. For example, the global market for semiconductor manufacturing equipment, a sector with parallels to advanced biotech machinery, was valued around $100 billion in 2024, with a few dominant players dictating terms.

Furthermore, the scarcity of highly skilled scientific talent, such as bioinformaticians and geneticists, drove up labor costs in 2024, with some roles seeing 10-15% salary increases. This talent scarcity effectively positions skilled personnel as powerful suppliers, influencing Bio-Techne's operational expenses and innovation capacity.

| Supplier Characteristic | Impact on Bio-Techne | Supporting Data/Example (2024) |

|---|---|---|

| Specialized Reagents/Materials | Increased costs, potential supply disruptions | Continued supply chain pressures for high-purity reagents |

| Proprietary Technology/IP | Higher licensing or component acquisition costs | Single-source availability for critical diagnostic assay components |

| Advanced Manufacturing Equipment | Influence on delivery schedules, pricing, operational efficiency | Concentrated market for biotech machinery, similar to $100B semiconductor equipment market |

| Scarcity of Skilled Talent | Increased labor costs, impact on R&D and expansion | 10-15% salary growth for bioinformaticians and geneticists |

| Regulatory Compliance (GMP, ISO) | Limited supplier options, increased leverage for certified suppliers | Reliance on FDA-approved or GMP-certified suppliers affects cost and availability |

What is included in the product

This analysis details Bio-Techne's competitive environment by examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly identify competitive pressures and strategic opportunities within the biotech landscape, streamlining complex market analysis.

Gain actionable insights into industry dynamics, empowering informed decisions to navigate and capitalize on market shifts.

Customers Bargaining Power

Bio-Techne's diverse customer base, encompassing academic research, biopharma, diagnostics, and hospitals, significantly limits individual customer bargaining power. This fragmentation means no single buyer typically represents a substantial portion of Bio-Techne's overall sales, preventing any one entity from dictating terms.

Customers often face substantial switching costs when considering a change from Bio-Techne's specialized reagents, instruments, and custom services. These costs can include the time and expense of validating new protocols, retraining personnel, recalibrating equipment, and potential disruptions to ongoing research or clinical trials. For instance, in the life sciences sector, the validation of new assay kits can take months and cost tens of thousands of dollars, making a switch from a trusted supplier like Bio-Techne a significant undertaking.

High switching costs directly limit the bargaining power of customers. When it is difficult and expensive to switch, customers are less likely to demand lower prices or better terms from Bio-Techne, as the cost of seeking alternatives outweighs the potential benefits. This sticky customer base provides Bio-Techne with a degree of pricing power and stability.

Bio-Techne's portfolio, encompassing reagents for cell biology, protein analysis, and genomics, is fundamental to cutting-edge scientific research, drug development, and diagnostics. The critical nature of these tools means that researchers and developers depend on their consistent high performance and accuracy.

Given that product failure can derail years of research or compromise diagnostic results, customers place a premium on reliability and precision. This inherent criticality significantly diminishes their leverage to negotiate aggressively on price, as the potential costs of an unreliable product far outweigh minor price concessions.

Product Differentiation and Proprietary Offerings

Bio-Techne’s diverse portfolio, featuring highly differentiated and often proprietary products like recombinant proteins and specialized instruments, significantly reduces customer bargaining power. The unique features and superior performance of these offerings foster strong customer loyalty, making it difficult for buyers to demand price concessions due to a scarcity of equally effective alternatives.

For instance, in 2023, Bio-Techne reported a robust product pipeline with several key innovations, contributing to its market position. This differentiation limits customers' ability to switch to competitors without sacrificing performance or reliability, thereby strengthening Bio-Techne's pricing power.

- Proprietary Innovations: Bio-Techne's focus on unique, often patented, recombinant proteins and antibodies creates a competitive moat.

- Performance Advantages: The superior quality and reliability of their products, evidenced by consistent R&D investment, reduce customer sensitivity to price.

- Limited Substitutability: The scarcity of direct, equally effective alternatives for many of Bio-Techne's specialized offerings diminishes customers' leverage.

Budgetary Constraints and Grant Funding Cycles

While major biopharmaceutical companies often possess considerable budgets, academic and government research institutions, a crucial customer base for Bio-Techne, frequently operate under strict grant funding timelines and predetermined financial allocations. This dynamic can foster price sensitivity, particularly for more standardized or less specialized product offerings.

For instance, the reliance on specific grant cycles means that institutions might delay purchases or seek more cost-effective alternatives if funding is uncertain or has been allocated elsewhere. This can impact the bargaining power of these customers, especially for products where Bio-Techne faces competition from lower-priced suppliers.

- Grant-Dependent Purchasing: Many academic and government research labs rely on external grants, which have specific funding periods and allowable expenses.

- Budgetary Rigidity: Unlike commercial entities, these institutions often have less flexibility to reallocate funds, making them sensitive to price changes on essential supplies.

- Price Sensitivity for Commoditized Products: For less differentiated items, customers may leverage their budgetary constraints to negotiate lower prices or seek out cheaper alternatives.

- Funding as a Purchase Driver: Conversely, the availability of dedicated research grants can empower customers to prioritize innovative or unique solutions, with funding availability often outweighing minor price differences for cutting-edge technologies.

Bio-Techne's diverse customer base, ranging from large biopharma to smaller academic labs, means no single buyer holds significant sway. This fragmentation, coupled with high switching costs for specialized reagents and instruments, substantially limits individual customer bargaining power. For example, the validation of new assay kits can cost tens of thousands of dollars and take months, making customers hesitant to switch from reliable suppliers like Bio-Techne.

The critical nature of Bio-Techne's products in research and diagnostics means customers prioritize reliability over price. Failure can derail years of work, so customers are less likely to push for lower prices when performance is paramount. This dependence on quality diminishes their leverage to negotiate aggressively.

Bio-Techne's proprietary and differentiated product portfolio, including unique recombinant proteins and advanced instruments, further reduces customer bargaining power. The scarcity of equally effective alternatives fosters loyalty and limits customers' ability to demand price concessions. In 2023, Bio-Techne's continued investment in R&D, leading to innovative product launches, reinforced this market advantage.

While large biopharma firms may have substantial budgets, academic and government institutions often face stricter grant funding and budgetary constraints. This can lead to price sensitivity for less specialized products, potentially increasing their bargaining power for those specific items.

| Customer Segment | Typical Budgetary Constraints | Impact on Bargaining Power |

| Large Biopharma | High budgets, flexible allocation | Lower for specialized, high-performance products; moderate for commoditized items |

| Academic & Government Research | Grant-dependent, fixed allocations | Higher for commoditized products due to price sensitivity; lower for cutting-edge, unique solutions |

| Diagnostic Labs | Reimbursement rates, operational efficiency | Moderate, influenced by regulatory approvals and workflow integration |

Full Version Awaits

Bio-Techne Porter's Five Forces Analysis

This preview showcases the complete Bio-Techne Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of existing rivalry. The document you are viewing is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises or placeholders. This comprehensive report is ready for immediate download and use, providing actionable insights into Bio-Techne's strategic positioning.

Rivalry Among Competitors

The biotechnology products and instruments market is a hotbed of innovation, demanding substantial investment in research and development. Bio-Techne navigates this landscape where both giant, diversified life science corporations and agile, niche players are continuously launching cutting-edge technologies, refining current offerings, and pioneering new uses. This relentless pursuit of advancement fuels a vigorous competition for market dominance and customer loyalty.

Bio-Techne faces significant competitive pressure from large, diversified players such as Thermo Fisher Scientific, Danaher Corporation, Agilent Technologies, Merck Group, and Bio-Rad Laboratories. These giants possess substantial financial resources and broad product lines that span numerous market segments, giving them a considerable advantage.

The sheer scale and extensive product portfolios of these competitors intensify rivalry across Bio-Techne's offerings, including reagents, instruments, and services. For instance, Thermo Fisher Scientific reported over $40 billion in revenue for 2023, highlighting its immense market presence and ability to invest heavily in R&D and market expansion, directly impacting Bio-Techne's competitive landscape.

Competitive rivalry in the biotechnology sector is fierce and global, with companies like Bio-Techne actively competing for market share across key regions such as North America, Europe, and Asia. This necessitates navigating a landscape where rivals possess deep regional understanding and localized market approaches.

Bio-Techne faces established players and emerging competitors, each with distinct strengths. For instance, while North America remains a significant market, the Asia Pacific region is projected for substantial growth, indicating a future where competition will likely intensify as companies adapt their strategies to capture this expanding opportunity.

Pricing Pressures and Value Proposition

Bio-Techne faces significant pricing pressures, especially for its more standardized reagents and less unique instruments. While specialized products can indeed fetch higher prices, the broader market often sees competitors vying on cost. For instance, in 2024, the life sciences tools market experienced intense competition, with companies frequently adjusting pricing strategies to capture market share.

The competitive landscape isn't solely about price; it's also about the comprehensive value proposition. This includes not only product quality but also the caliber of customer service, the responsiveness of technical support, and how seamlessly products integrate into existing laboratory workflows. Bio-Techne must therefore consistently refine its cost efficiencies and clearly articulate its superior value to customers.

- Price Sensitivity: While Bio-Techne offers high-value specialized products, a portion of its portfolio faces pressure from competitors offering lower-priced alternatives.

- Value-Based Competition: Beyond price, Bio-Techne differentiates itself through product reliability, expert technical support, and integrated workflow solutions, as evidenced by its continued investment in customer success initiatives throughout 2024.

- Cost Optimization: The need to remain competitive necessitates ongoing efforts to optimize Bio-Techne's internal cost structures, impacting manufacturing and supply chain operations.

- Market Dynamics: The life sciences industry in 2024 continued to show a trend where innovation drives premium pricing, but commoditization quickly erodes it, forcing companies like Bio-Techne to balance R&D investment with cost management.

Strategic Partnerships and Acquisitions

The biotechnology sector is characterized by intense rivalry, often fueled by strategic partnerships and acquisitions. Companies actively pursue collaborations and mergers to bolster their technological expertise, broaden their market presence, and enhance their product portfolios. These strategic maneuvers are crucial for staying competitive.

Bio-Techne, for instance, has been actively involved in such strategic activities. As of early 2024, the company announced its intention to acquire the remaining stake in Wilson Wolf, a move aimed at strengthening its cell and gene therapy offerings. Simultaneously, Bio-Techne divested Exosome Diagnostics, a strategic decision to streamline its operations and focus on core areas. These actions directly influence the competitive landscape by consolidating capabilities and shifting market focus.

- Strategic Alliances: Companies forge partnerships to share R&D costs, access new markets, and combine complementary technologies.

- Mergers & Acquisitions (M&A): The biotech industry saw significant M&A activity in 2023, with deals valued in the billions, as larger firms acquire innovative smaller companies to accelerate growth and pipeline development.

- Impact on Competition: These transactions can consolidate market share, create new dominant players, or lead to the emergence of specialized niche competitors.

- Bio-Techne's Strategy: The planned acquisition of Wilson Wolf and the divestiture of Exosome Diagnostics illustrate Bio-Techne's proactive approach to managing its competitive positioning.

Competitive rivalry in the biotech sector is intense, with Bio-Techne facing formidable competition from large, diversified life science corporations and agile niche players. These rivals, such as Thermo Fisher Scientific, with over $40 billion in 2023 revenue, possess substantial resources that fuel aggressive R&D and market expansion, directly impacting Bio-Techne's market share and pricing strategies.

The market demands constant innovation, forcing companies to balance premium pricing for specialized products with cost-competitiveness for more commoditized offerings. In 2024, this dynamic led to significant pricing adjustments across the life sciences tools market as companies vied for dominance, emphasizing the need for Bio-Techne to optimize costs and clearly communicate its value proposition.

Strategic alliances and mergers and acquisitions (M&A) are key competitive maneuvers. The biotech industry saw billions in M&A deals in 2023, consolidating market share and creating new dominant players. Bio-Techne's own strategic moves, like the planned acquisition of Wilson Wolf in early 2024, underscore the importance of these actions in shaping the competitive landscape.

| Competitor | 2023 Revenue (Approx.) | Key Strengths |

|---|---|---|

| Thermo Fisher Scientific | $40+ billion | Financial resources, broad product lines, extensive R&D |

| Danaher Corporation | $23+ billion | Diversified portfolio, strong market presence |

| Agilent Technologies | $6.5+ billion | Analytical instruments, diagnostics |

| Merck Group | $60+ billion (Life Science Segment) | Global reach, strong R&D pipeline |

| Bio-Rad Laboratories | $2.8+ billion | Life science research and clinical diagnostics |

SSubstitutes Threaten

The threat of substitutes in the biotech research space is significant. Alternative scientific methodologies, such as advanced computational biology and AI-driven drug discovery platforms, can offer similar research outcomes. For example, the global AI in drug discovery market was valued at approximately $1.2 billion in 2023 and is projected to grow substantially, potentially reducing the demand for certain traditional lab-based assays that Bio-Techne's products support.

Large pharmaceutical companies and major academic research centers possess the financial muscle and scientific talent to develop critical reagents and assays internally. For instance, in 2024, leading biopharmaceutical firms continued to invest heavily in R&D, with some dedicating over $10 billion annually to internal innovation, potentially including custom assay development, which can reduce reliance on external suppliers like Bio-Techne for specific, high-volume needs.

This in-house capability acts as a direct substitute, especially when proprietary applications demand unique solutions or when cost-effectiveness at scale is paramount. By building internal capacity, these entities can bypass the need to purchase off-the-shelf products or custom services, thereby mitigating the threat of substitutes for Bio-Techne.

The rise of open-source tools and do-it-yourself (DIY) biotechnology presents a notable threat of substitutes for Bio-Techne, particularly within academic research and early-stage development. These alternatives offer significantly lower costs, appealing to budget-conscious entities. For instance, in 2024, the global open-source software market continued its expansion, with many platforms offering free or low-cost bioinformatics and data analysis tools that can be leveraged in lieu of specialized commercial software.

While these DIY solutions might not match the rigorous validation, scalability, or comprehensive support of Bio-Techne's established product lines, they are gaining traction for specific, less demanding applications. This trend is fueled by the increasing availability of publicly accessible research protocols and affordable lab equipment, allowing researchers to perform certain experiments without relying on premium commercial reagents or instruments. This can impact Bio-Techne's market share in segments where cost is a primary driver and the need for highly specialized, validated solutions is less critical.

Evolution of Diagnostic Paradigms

The threat of substitutes for diagnostic applications, particularly those relying on specific biomarkers, is significant. Entirely new diagnostic approaches or technologies can emerge, potentially making current biomarker-based tests less critical. For instance, advancements in sophisticated imaging modalities or the development of liquid biopsies targeting different molecular markers could reduce the reliance on established immunoassays or certain molecular diagnostic methods.

Consider the impact of evolving technologies. In 2024, the global diagnostic imaging market was valued at approximately $35 billion, showcasing the scale of alternative diagnostic avenues. Furthermore, the liquid biopsy market, a prime example of a substitute technology, is projected to reach over $15 billion by 2028, indicating a substantial shift in diagnostic preferences.

- Imaging Technologies: Advanced MRI, CT, and PET scans offer non-invasive ways to detect and monitor disease, sometimes bypassing the need for specific biomarker assays.

- Liquid Biopsies: These tests analyze circulating tumor DNA (ctDNA), RNA, or proteins in blood or other bodily fluids, providing a less invasive alternative to tissue biopsies for cancer detection and monitoring.

- Point-of-Care (POC) Devices: Novel POC diagnostic platforms are emerging that offer rapid results, potentially reducing the need for centralized laboratory testing that often relies on traditional biomarker detection methods.

- Genomic and Proteomic Profiling: Broader genetic or protein analysis can provide comprehensive disease insights, potentially overshadowing tests focused on single biomarkers.

Shifting Focus in Therapeutic Development

The threat of substitutes for Bio-Techne is influenced by fundamental shifts in therapeutic development. For example, a significant move towards preventative gene editing or cell therapies for certain diseases could reduce the demand for traditional research tools used in mechanistic studies. This macro-level change in how diseases are managed could directly impact the market for Bio-Techne's diagnostic and research reagents.

Consider the burgeoning field of preventative medicine. In 2024, investments in gene therapy and cell therapy research continued to climb, with the global gene therapy market projected to reach over $15 billion by 2026, indicating a strong trend toward these novel approaches. If these therapies become widely adopted as preventative measures, the need for certain types of diagnostic assays and protein-based research tools that Bio-Techne provides might see a proportional decline.

This evolving therapeutic landscape presents a tangible substitute threat.

- Therapeutic Paradigm Shift: A move towards preventative treatments like gene editing could lessen reliance on traditional disease research tools.

- Market Impact: Reduced demand for mechanistic studies could affect Bio-Techne's product portfolio.

- Investment Trends: Significant 2024 investments in gene and cell therapies highlight this potential shift.

The threat of substitutes for Bio-Techne is substantial, driven by emerging technologies and internal capabilities within larger organizations. Advanced computational biology and AI-driven drug discovery platforms offer alternative research pathways, potentially reducing demand for traditional lab assays. For instance, the global AI in drug discovery market was valued at approximately $1.2 billion in 2023 and is expected to grow significantly.

Major pharmaceutical companies and research centers can develop critical reagents and assays in-house, especially for proprietary applications or cost-sensitive, high-volume needs. In 2024, leading biopharma firms continued substantial R&D investments, with some allocating over $10 billion annually to internal innovation, which can include custom assay development, lessening reliance on external suppliers.

The rise of open-source tools and DIY biotechnology also presents a cost-effective substitute, particularly for academic research and early-stage development. While these may lack the validation and support of commercial products, their accessibility is growing. The global open-source software market continued its expansion in 2024, offering free or low-cost bioinformatics tools.

Furthermore, new diagnostic approaches, like advanced imaging modalities and liquid biopsies, pose a threat to biomarker-based tests. The global diagnostic imaging market was valued at around $35 billion in 2024, and the liquid biopsy market is projected to exceed $15 billion by 2028, indicating a shift in diagnostic preferences.

| Substitute Type | Description | 2023/2024 Data Point | Potential Impact on Bio-Techne |

| Computational Biology/AI | AI-driven platforms for drug discovery | AI in drug discovery market ~$1.2B (2023) | Reduced demand for traditional assays |

| In-house R&D | Large organizations developing own reagents | Biopharma R&D spend >$10B/year (leading firms, 2024) | Decreased reliance on external suppliers |

| Open-Source/DIY Bio | Low-cost, accessible research tools | Growth in open-source software market (2024) | Impact on segments where cost is primary |

| Advanced Diagnostics | Imaging, liquid biopsies | Diagnostic imaging market ~$35B (2024); Liquid biopsy market projected >$15B by 2028 | Reduced need for certain biomarker tests |

Entrants Threaten

Entering the biotechnology products and instruments market requires immense upfront capital. Companies need to invest heavily in cutting-edge research and development facilities, sophisticated manufacturing plants, and robust sales and distribution channels. For instance, establishing a new gene sequencing platform can easily cost tens of millions of dollars.

The significant financial outlay needed to develop innovative products and scale up production presents a major hurdle for potential new competitors. This high barrier to entry limits the number of firms that can realistically challenge established players like Bio-Techne.

The biotechnology sector, where Bio-Techne operates, demands immense scientific acumen. Success is built on deep expertise in fields such as cell biology, genomics, and proteomics, supported by substantial research and development investments. New companies entering this space must assemble highly specialized scientific teams and meticulously navigate a complex web of existing intellectual property and patents.

The life sciences and diagnostics sector is a minefield of regulations, especially for anything used in clinical settings. For instance, in 2024, the FDA continued to process a significant volume of medical device submissions, with timelines often stretching over many months, if not years, creating a substantial hurdle for newcomers.

New companies must meticulously navigate these intricate approval pathways, which include rigorous testing and documentation for agencies like the FDA and equivalent international bodies. This complexity alone acts as a significant barrier, deterring many potential entrants who lack the resources or expertise to manage such demanding processes.

Established Brand Reputation and Customer Loyalty

Established brand reputation and customer loyalty act as significant barriers to entry in the biotechnology sector, particularly for companies like Bio-Techne. These incumbents have spent years, often decades, building trust and demonstrating reliable performance and technical support to their clientele. For instance, Bio-Techne’s long-standing presence has allowed them to cultivate deep relationships with researchers and clinicians who rely on their consistent quality and innovative solutions.

Newcomers face a steep challenge in replicating this level of trust and loyalty. Customers in the biotech field, especially those in critical research and diagnostic applications, often have high switching costs associated with changing suppliers. These costs can include the need for extensive re-validation of new products, retraining of personnel, and potential disruptions to ongoing research projects. This makes it difficult for new entrants to gain traction against the proven track record of established players.

- Brand Equity: Companies like Bio-Techne benefit from decades of investment in building a strong brand identity synonymous with quality and innovation.

- Customer Loyalty: Existing customer bases are often deeply entrenched due to satisfaction with product performance, reliability, and support services.

- Switching Costs: High costs associated with changing suppliers, including validation and retraining, deter customers from adopting new entrants' products.

- Market Penetration Difficulty: New entrants struggle to displace established relationships and must offer a demonstrably superior value proposition to attract significant market share.

Access to Distribution Channels and Supply Chains

The biotechnology sector presents significant hurdles for new entrants concerning access to established distribution channels and supply chains. Building a robust global sales and distribution network for highly specialized biotech products is both capital-intensive and a lengthy process.

New players must either make substantial investments in their own infrastructure or forge critical partnerships with existing distributors, a path often dominated by established firms. For instance, Bio-Techne itself has cultivated extensive global distribution networks over decades, reaching researchers and clinicians worldwide. In 2023, the global life sciences tools market, which includes many of Bio-Techne's product categories, was valued at approximately $100 billion, highlighting the scale of investment required to compete effectively.

Furthermore, securing reliable and high-quality supply chains for specialized raw materials and reagents is a considerable challenge. This can involve navigating complex regulatory environments and ensuring consistent product integrity, which can significantly impede new market penetration.

- High Capital Investment: Establishing global distribution for biotech products requires substantial financial resources, often in the tens of millions of dollars, to build or acquire the necessary infrastructure.

- Partnership Dependence: New entrants frequently rely on existing distributors, who often have exclusive agreements with established companies like Bio-Techne, limiting market access.

- Supply Chain Complexity: Sourcing specialized biological materials and reagents demands stringent quality control and regulatory compliance, making it difficult for newcomers to secure consistent and reliable supplies.

The threat of new entrants into Bio-Techne's market is generally low due to several significant barriers. These include the substantial capital required for research, development, and manufacturing, alongside the need for specialized scientific expertise and the navigation of complex regulatory landscapes. Established brand loyalty and high customer switching costs further solidify the position of incumbents.

New companies must overcome these challenges, which often involve securing extensive funding, building specialized teams, and obtaining regulatory approvals, a process that can take years. For example, the cost of developing a new diagnostic assay can easily run into millions of dollars, a significant deterrent for smaller or less-funded entities.

The market’s reliance on established distribution channels and complex supply chains also presents a formidable obstacle. Bio-Techne, like its peers, has invested heavily in global networks. In 2023, the global life sciences tools market, a key segment for Bio-Techne, was valued around $100 billion, indicating the scale of infrastructure and reach required to compete effectively.

| Barrier Type | Description | Example/Impact |

|---|---|---|

| Capital Requirements | High upfront investment in R&D, manufacturing, and distribution. | Establishing a new gene sequencing platform can cost tens of millions of dollars. |

| Scientific Expertise | Need for deep knowledge in specialized fields like genomics and proteomics. | Requires assembling highly skilled scientific teams and navigating intellectual property. |

| Regulatory Hurdles | Complex approval processes for products, especially those used clinically. | FDA submissions in 2024 often experienced lengthy review periods, delaying market entry. |

| Brand Reputation & Loyalty | Established trust and reliability built over years of operation. | High switching costs for customers due to re-validation and retraining needs. |

| Distribution & Supply Chains | Access to established global sales networks and reliable sourcing of specialized materials. | New entrants may depend on distributors with exclusive agreements with incumbents. |

Porter's Five Forces Analysis Data Sources

Our Bio-Techne Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Bio-Techne's annual reports, SEC filings, and investor presentations. We supplement this with industry-specific market research reports and data from reputable financial databases to provide a thorough assessment of the competitive landscape.