Bio-Techne Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bio-Techne Bundle

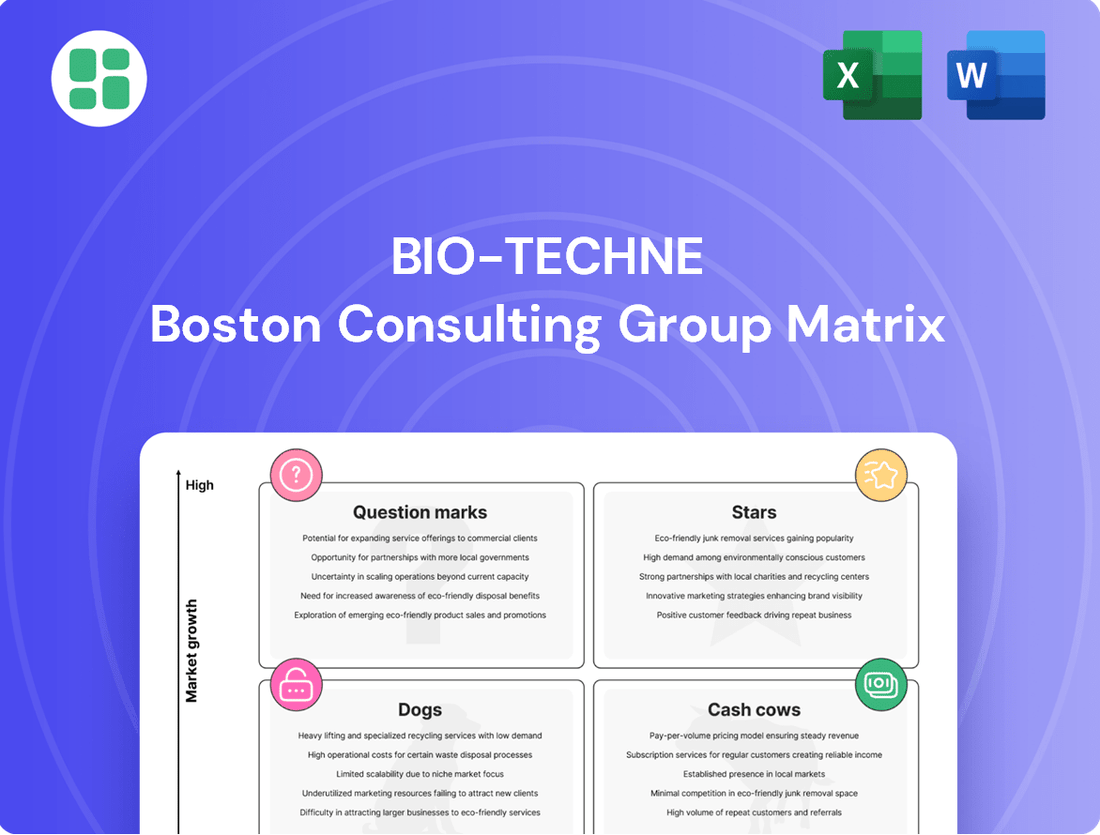

Unlock the strategic potential of Bio-Techne's product portfolio with this insightful BCG Matrix preview. Understand where their innovations sit as Stars, Cash Cows, Dogs, or Question Marks in the dynamic biotech landscape. Don't miss out on the complete picture; purchase the full BCG Matrix for actionable insights and a clear roadmap to optimize Bio-Techne's market performance and investment decisions.

Stars

Bio-Techne's cell and gene therapy workflow solutions are strategically placed within a booming market. Their comprehensive offering, including GMP reagents and essential tools, addresses a critical need in this rapidly evolving field.

The market for cell and gene therapy is experiencing significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 24% expected between 2024 and 2034. This robust growth trajectory highlights the immense potential and increasing demand for specialized solutions like those provided by Bio-Techne.

The company has witnessed a strong adoption and consistent utilization of its cell and gene therapy workflow solutions. This widespread acceptance solidifies Bio-Techne's position as a key player and leader within this high-growth market segment.

Bio-Techne's Diagnostics and Spatial Biology segment, featuring offerings like RNAscope and the COMET System, experienced a strong 14% organic growth in the first quarter of fiscal year 2025. This segment is a critical driver for future expansion, poised to capitalize on innovations such as organoid modeling and single-cell sequencing within the biotechnology sector.

The COMET System's dual capability to support both RNA and protein detection using RNAscope technology significantly enhances its market competitiveness. This integrated approach makes it a more attractive solution for researchers and diagnostic developers.

Organoid Solutions within Bio-Techne's portfolio are positioned for substantial expansion, with projections indicating an annual market growth exceeding 20%. This upward trend is significantly influenced by the FDA's April 2025 directive to phase out animal testing for monoclonal antibody therapies, thereby promoting alternative methods like organoid toxicity assessments.

Bio-Techne's robust offering encompasses a full spectrum of organoid-related products, including essential proteins, targeted small molecules, and specialized growth media. This comprehensive suite supports researchers in advancing organoid technology for drug development and toxicity screening.

AI-Engineered Designer Proteins

Bio-Techne's AI-Engineered Designer Proteins represent a significant advancement in the biotechnology sector, specifically targeting the cell and gene therapy market. Launched in January 2025, these novel recombinant proteins utilize artificial intelligence to achieve superior cell culture performance and improved cell expansion rates. This innovation is particularly impactful for applications in cellular therapy and regenerative medicine, areas experiencing substantial growth and investment.

The company's strategic focus on AI-driven protein design places it in a strong position within a high-value segment of the biotech industry. For instance, the global cell and gene therapy market was valued at approximately $10.5 billion in 2023 and is projected to reach over $40 billion by 2030, indicating a compound annual growth rate (CAGR) exceeding 20%. Bio-Techne's new offerings, such as the IL-2 Heat Stable Agonist and FGF basic Heat Stable, are designed to meet the escalating demand for reliable and efficient tools in these advanced therapeutic fields.

- Market Entry: January 2025 launch of AI-engineered designer proteins.

- Key Products: IL-2 Heat Stable Agonist and FGF basic Heat Stable.

- Target Applications: Cellular therapy and regenerative medicine.

- Market Context: Global cell and gene therapy market projected to exceed $40 billion by 2030.

Ultrasensitive Immunoassays for Neurology

Bio-Techne's ultrasensitive immunoassays for neurology, bolstered by a July 2025 partnership with Spear Bio, are positioned to capture a significant share of the growing neurodegenerative disease market. This strategic move allows Bio-Techne to offer advanced diagnostic tools for detecting low-abundance biomarkers, crucial for early disease detection. The company's investment in Spear Bio's 2024 Series A funding highlights its commitment to this high-potential sector.

The collaboration specifically addresses the urgent need for improved diagnostics in conditions like Alzheimer's disease. The global Alzheimer's disease diagnostics market was valued at approximately $3.8 billion in 2023 and is projected to reach over $7.5 billion by 2030, demonstrating substantial growth. Bio-Techne's entry into this space with Spear Bio's technology aims to leverage this expansion.

- Market Focus: Neurodegenerative diseases, including Alzheimer's, with significant unmet diagnostic needs.

- Technological Advancement: Distribution of next-generation ultrasensitive immunoassays for low-abundance biomarker detection.

- Strategic Investment: Bio-Techne's participation in Spear Bio's 2024 Series A funding round.

- Growth Potential: Tapping into a rapidly expanding diagnostics market driven by aging populations and increased disease awareness.

Bio-Techne's AI-Engineered Designer Proteins are a prime example of a Star product. Launched in January 2025, these proteins, including the IL-2 Heat Stable Agonist and FGF basic Heat Stable, are designed for high-growth areas like cellular therapy and regenerative medicine. The cell and gene therapy market is projected to exceed $40 billion by 2030, with a CAGR over 20%, indicating strong future potential for these innovative offerings.

What is included in the product

The Bio-Techne BCG Matrix offers a strategic overview of its product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

It provides actionable insights on investment, divestment, and management strategies for each product category.

Streamlined BCG Matrix analysis for Bio-Techne's portfolio, simplifying strategic decisions.

Cash Cows

Bio-Techne's Core Protein Sciences Reagents are the undisputed cash cows in their BCG Matrix, driving an impressive 70-75% of the company's overall revenue. This segment's dominance is further underscored by its contribution to approximately 95% of consolidated operating income, showcasing its exceptional profitability.

The segment, encompassing vital products like cytokines, growth factors, and antibodies, consistently delivers robust financial performance. In Q3 2025, it achieved remarkable gross margins of around 75% and operating margins of 45.6%, highlighting its efficient operations and strong market positioning.

These essential reagents are foundational to numerous research applications, creating a predictable and recurring revenue stream from consumables. This consistent demand and high margin profile solidify their status as a core cash-generating engine for Bio-Techne.

ProteinSimple instruments and consumables, including the popular Simple Western Leo System, are well-established cornerstones in protein analysis, boasting significant market adoption. This product line delivers dependable revenue streams, with instruments facilitating efficient high-throughput workflows and consumables driving consistent recurring sales.

While not experiencing explosive growth, ProteinSimple's robust market position and proven reliability are crucial drivers of Bio-Techne's overall cash flow. For instance, in fiscal year 2023, Bio-Techne reported that its Protein Sciences segment, which includes ProteinSimple, saw a 7% increase in revenue, highlighting the sustained demand for these solutions.

Bio-Techne's bulk and custom reagents for the in vitro diagnostic (IVD) market are a cornerstone of their business, fitting squarely into the Cash Cows quadrant of the BCG matrix. This segment benefits from a mature yet consistently stable demand, as these reagents are critical components in a vast array of clinical tests and diagnostic procedures. The reliability of these products translates into predictable and substantial revenue streams.

The IVD market, while not experiencing explosive growth, offers a dependable revenue base. In 2024, the global IVD market was valued at approximately $100 billion, with reagent sales forming a significant portion of this. Bio-Techne's established position and broad customer adoption ensure that these offerings continue to generate consistent cash flow, supporting other, more growth-oriented ventures within the company.

Established Immunoassays

Bio-Techne’s established immunoassay portfolio represents a significant cash cow within its operations. These widely adopted and mature products, while perhaps not as flashy as newer ultrasensitive assays, consistently generate substantial and predictable revenue streams for the company.

These established immunoassays benefit from deep-rooted customer relationships and a stable, ongoing demand within the diagnostics market. This stability allows them to contribute reliably to Bio-Techne's cash reserves.

- Mature Market Position: These products hold established positions in a stable market, ensuring consistent sales.

- Revenue Generation: They are key contributors to Bio-Techne's overall revenue, acting as a reliable income source.

- Customer Loyalty: Existing customer bases for these assays foster continued demand and reduce customer acquisition costs.

General Research-Use-Only (RUO) Reagents

Bio-Techne's General Research-Use-Only (RUO) Reagents, encompassing thousands of proteins and antibodies, are foundational tools for academic and biopharma researchers. This segment generates highly recurring revenue due to the constant demand for these essential scientific consumables. Their strong reputation for quality solidifies a significant market share in this mature but vital research market.

The RUO reagents segment represents a significant portion of Bio-Techne's business, contributing to its stable revenue streams. In fiscal year 2023, Bio-Techne reported total revenue of $1.16 billion, with their protein and reagents segment playing a crucial role. The recurring nature of consumable sales, driven by ongoing research projects, makes this a predictable income source.

- Recurring Revenue: Researchers continuously require RUO reagents for experiments, ensuring repeat purchases.

- Market Share: Bio-Techne's commitment to quality has secured a strong position in the competitive research consumables market.

- Foundational Products: These reagents are critical for a wide array of scientific investigations, underpinning many research workflows.

- Fiscal Year 2023 Performance: Bio-Techne's protein and reagents segment was a key contributor to their overall financial success.

Bio-Techne's Core Protein Sciences Reagents are the undisputed cash cows in their BCG Matrix, driving an impressive 70-75% of the company's overall revenue. This segment's dominance is further underscored by its contribution to approximately 95% of consolidated operating income, showcasing its exceptional profitability.

The segment, encompassing vital products like cytokines, growth factors, and antibodies, consistently delivers robust financial performance. In Q3 2025, it achieved remarkable gross margins of around 75% and operating margins of 45.6%, highlighting its efficient operations and strong market positioning.

These essential reagents are foundational to numerous research applications, creating a predictable and recurring revenue stream from consumables. This consistent demand and high margin profile solidify their status as a core cash-generating engine for Bio-Techne.

ProteinSimple instruments and consumables, including the popular Simple Western Leo System, are well-established cornerstones in protein analysis, boasting significant market adoption. This product line delivers dependable revenue streams, with instruments facilitating efficient high-throughput workflows and consumables driving consistent recurring sales.

While not experiencing explosive growth, ProteinSimple's robust market position and proven reliability are crucial drivers of Bio-Techne's overall cash flow. For instance, in fiscal year 2023, Bio-Techne reported that its Protein Sciences segment, which includes ProteinSimple, saw a 7% increase in revenue, highlighting the sustained demand for these solutions.

Bio-Techne's bulk and custom reagents for the in vitro diagnostic (IVD) market are a cornerstone of their business, fitting squarely into the Cash Cows quadrant of the BCG matrix. This segment benefits from a mature yet consistently stable demand, as these reagents are critical components in a vast array of clinical tests and diagnostic procedures. The reliability of these products translates into predictable and substantial revenue streams.

The IVD market, while not experiencing explosive growth, offers a dependable revenue base. In 2024, the global IVD market was valued at approximately $100 billion, with reagent sales forming a significant portion of this. Bio-Techne's established position and broad customer adoption ensure that these offerings continue to generate consistent cash flow, supporting other, more growth-oriented ventures within the company.

Bio-Techne’s established immunoassay portfolio represents a significant cash cow within its operations. These widely adopted and mature products, while perhaps not as flashy as newer ultrasensitive assays, consistently generate substantial and predictable revenue streams for the company.

These established immunoassays benefit from deep-rooted customer relationships and a stable, ongoing demand within the diagnostics market. This stability allows them to contribute reliably to Bio-Techne's cash reserves.

- Mature Market Position: These products hold established positions in a stable market, ensuring consistent sales.

- Revenue Generation: They are key contributors to Bio-Techne's overall revenue, acting as a reliable income source.

- Customer Loyalty: Existing customer bases for these assays foster continued demand and reduce customer acquisition costs.

Bio-Techne's General Research-Use-Only (RUO) Reagents, encompassing thousands of proteins and antibodies, are foundational tools for academic and biopharma researchers. This segment generates highly recurring revenue due to the constant demand for these essential scientific consumables. Their strong reputation for quality solidifies a significant market share in this mature but vital research market.

The RUO reagents segment represents a significant portion of Bio-Techne's business, contributing to its stable revenue streams. In fiscal year 2023, Bio-Techne reported total revenue of $1.16 billion, with their protein and reagents segment playing a crucial role. The recurring nature of consumable sales, driven by ongoing research projects, makes this a predictable income source.

- Recurring Revenue: Researchers continuously require RUO reagents for experiments, ensuring repeat purchases.

- Market Share: Bio-Techne's commitment to quality has secured a strong position in the competitive research consumables market.

- Foundational Products: These reagents are critical for a wide array of scientific investigations, underpinning many research workflows.

- Fiscal Year 2023 Performance: Bio-Techne's protein and reagents segment was a key contributor to their overall financial success.

| Product Segment | BCG Category | Key Characteristics | FY 2023 Revenue Contribution (Est.) | Profitability |

| Core Protein Sciences Reagents | Cash Cow | High revenue, high operating income, stable demand, recurring consumables | 70-75% of total revenue | Gross Margins ~75%, Operating Margins ~45.6% (Q3 2025) |

| ProteinSimple Instruments & Consumables | Cash Cow | Established market, reliable revenue, high-throughput workflows | Significant contributor to Protein Sciences segment | Dependable revenue streams |

| Bulk & Custom Reagents (IVD) | Cash Cow | Mature, stable demand, critical for clinical tests, predictable revenue | Significant portion of IVD market revenue | Consistent cash flow generation |

| Established Immunoassays | Cash Cow | Deep customer relationships, stable demand, predictable revenue | Key contributor to overall revenue | Reliable contribution to cash reserves |

| General RUO Reagents | Cash Cow | Foundational research tools, recurring revenue, strong quality reputation | Key contributor to Protein & Reagents segment | Predictable income source |

Preview = Final Product

Bio-Techne BCG Matrix

The Bio-Techne BCG Matrix preview you are currently viewing is the identical, fully unlocked document you will receive immediately after purchase. This means no watermarks or sample data, but rather the complete, professionally formatted strategic tool ready for your immediate analysis and business planning needs.

Dogs

Bio-Techne's Exosome Diagnostics business, featuring the ExoDx Prostate (EPI) test, was divested to Mdxhealth SA in August 2025. This strategic decision aimed to sharpen Bio-Techne's focus on its core, high-margin product lines, thereby enhancing its overall operating margin.

While the ExoDx Prostate test showed some prior growth, its divestiture suggests it was not aligned with Bio-Techne's long-term vision for high-profit expansion. This move is characteristic of a company repositioning its portfolio, potentially moving an asset that was growing but not at the pace or profitability desired for its future strategic direction.

Certain legacy diagnostic products, particularly older immunoassay offerings, likely fall into the Dogs category within Bio-Techne's BCG Matrix. These products operate in highly competitive, commoditized market segments where their market share is consequently low.

These older diagnostics face limited growth prospects, especially when juxtaposed with Bio-Techne's more advanced and innovative spatial biology solutions. Their continued presence may divert valuable resources that could be better allocated to high-growth areas, impacting overall portfolio efficiency and profitability.

While acquisitions are vital for Bio-Techne's growth, some integrated assets may initially underperform. For example, the Lunaphore acquisition in fiscal 2024 led to a temporary dip in the Diagnostics & Genomics segment's operating margin due to necessary strategic growth investments.

If certain product lines stemming from these acquisitions struggle to gain market traction or achieve profitability, they could become cash drains. These underperforming assets might consume valuable resources without generating sufficient returns, potentially impacting overall financial performance if not managed effectively.

Products Highly Dependent on Fluctuating Academic Funding

Segments heavily reliant on U.S. academic funding, especially those susceptible to National Institutes of Health (NIH) budget fluctuations, are facing significant challenges. For instance, research reagents and specialized assays catering primarily to university labs could experience dampened demand if federal research grants are reduced. This dependency creates a vulnerability to external economic and policy shifts.

Bio-Techne is actively working to mitigate these risks by diversifying its customer base and product applications. However, products that are almost exclusively sold to academic institutions, without strong ties to commercial or clinical diagnostics, are particularly exposed. These offerings might see a decline in market share and overall sales if the academic funding landscape tightens.

- Academic Funding Dependency: Products targeting U.S. academic research are vulnerable to potential NIH budget cuts, impacting demand.

- Growth Headwinds: Segments reliant on this funding may face low or negative growth prospects due to reduced grant availability.

- Diversification Imperative: Companies with products lacking diversified revenue streams outside academia are at higher risk.

- Market Share Vulnerability: Over-reliance on shrinking academic markets can lead to declining demand and market share erosion for specific product lines.

Instruments with Significant China Tariff Exposure

Certain proteomic analytical instruments, particularly those shipped directly from the U.S. to China, are subject to significant tariff impacts. In 2024, these tariffs are estimated to affect operating profits by approximately $20 million.

While Bio-Techne is implementing strategies to lessen these effects, products with high tariff exposure that cannot adequately adjust pricing or optimize production may see their profitability and market standing diminish. These instruments could be categorized as question marks if their competitive edge erodes and market share begins to decline due to these trade policies.

- Tariff Impact: An estimated $20 million impact on operating profits for U.S.-to-China direct shipments of proteomic analytical instruments.

- Mitigation Efforts: Ongoing strategies are in place to reduce the financial effects of these tariffs.

- Risk Factors: Products unable to adjust pricing or optimize production due to tariffs face reduced profitability and market competitiveness.

- BCG Classification: High-exposure products that lose market share could be classified as question marks.

Products classified as Dogs in Bio-Techne's portfolio are those with low market share in slow-growing or declining industries. These often include older diagnostic kits or reagents that face intense competition and have limited innovation potential. Their contribution to overall revenue and profit is minimal, and they typically consume resources without generating significant returns, hindering the company's ability to invest in more promising areas.

These "Dogs" are characterized by their inability to capture substantial market share, often due to commoditization or the emergence of superior technologies. For instance, legacy immunoassay products might fall into this category, struggling to compete with newer, more advanced platforms. Their continued existence can dilute focus and capital allocation, making their management critical for portfolio optimization.

The divestiture of the Exosome Diagnostics business in August 2025, for example, suggests that even previously growing assets might be reclassified if they don't meet Bio-Techne's evolving profitability and strategic growth targets. This proactive portfolio management aims to shed underperforming or misaligned assets, freeing up resources for high-potential ventures.

Managing these "Dog" segments involves strategic decisions like divestiture, discontinuation, or a minimal investment approach to harvest any remaining value. The goal is to prevent them from becoming a drag on the company's financial performance and to redeploy capital into areas with greater growth and profitability potential.

Question Marks

Following the divestiture of its Exosome Diagnostics business, Bio-Techne is strategically leveraging its retained exosome-based technology for new kit development within its precision diagnostics segment. This move positions them to capitalize on high-growth potential in emerging precision diagnostics markets.

These new initiatives, while promising, currently hold nascent market share. This reflects their early stages of development or initial commercialization efforts, indicating significant future growth potential as these products mature in the market.

Bio-Techne's acquisition of Lunaphore in early fiscal year 2024 introduced innovative spatial biology solutions. While spatial biology is a rapidly expanding field, the initial integration of these early-stage Lunaphore products has impacted the Diagnostics and Genomics segment's operating margin, leading to a decrease. This is common for new technologies entering the market, as they often require significant investment for scaling and market penetration.

These new offerings, though holding substantial future growth potential, currently represent a smaller market share within Bio-Techne's broader portfolio. The focus in this early stage is on establishing their presence, refining the technology, and building out the necessary infrastructure for wider adoption. This strategic investment is crucial for realizing their long-term market potential.

Bio-Techne's strategic investments, like its 19.9% stake in Wilson Wolf Manufacturing, a cell culture device maker, and its participation in Spear Bio's Series A funding round, are classic examples of 'Question Marks' in the BCG Matrix. These ventures are positioned in high-growth potential markets, aiming to capture future market share.

While these investments, such as the Spear Bio funding which closed in early 2024, signal Bio-Techne's commitment to innovation and potential market leadership, their ultimate success and return on investment are still uncertain. They require continued capital infusion and strategic development to determine if they will become 'Stars' or revert to 'Dogs'.

Cutting-edge AI-driven Research Tools in Nascent Applications

Bio-Techne's cutting-edge AI-driven research tools are pushing into highly innovative, nascent application areas, positioning them for potential disruption. These emerging markets, while offering significant growth opportunities, are characterized by early-stage adoption and require substantial, ongoing investment to cultivate market share.

These AI-powered platforms are being developed for applications such as personalized medicine diagnostics and novel therapeutic discovery, fields where the potential impact is immense but market penetration is still minimal. For instance, in 2024, the global AI in healthcare market was valued at approximately $15.4 billion, with significant growth projected in specialized diagnostic and drug discovery segments.

- AI-driven protein engineering for novel therapeutic development.

- Predictive analytics for early disease detection and personalized treatment plans.

- Automated data analysis in genomics and proteomics for accelerated research.

- Development of AI-powered platforms for novel drug discovery pipelines.

Expansion into Novel Therapeutic Modalities

Bio-Techne is actively investing in novel therapeutic modalities, a strategic move into emerging high-growth sectors. For instance, the gene editing tools market, a key area of expansion, is projected to grow at a compound annual growth rate of 10.2% between 2024 and 2029. This indicates significant future potential.

While these advanced niches represent substantial growth opportunities, Bio-Techne's current market share within these nascent and highly specialized segments may be limited. Building a strong foothold requires considerable upfront investment to establish leadership and capture market share.

- Market Expansion: Bio-Techne is broadening its portfolio to include cutting-edge therapeutic areas.

- Gene Editing Growth: The gene editing tools market is a prime example, expected to expand at a 10.2% CAGR from 2024 to 2029.

- Market Share Dynamics: In these new, specialized markets, Bio-Techne's current market share may still be developing.

- Investment Focus: Significant investment is crucial for Bio-Techne to gain substantial traction and leadership in these forward-looking therapeutic modalities.

Bio-Techne's investments in areas like spatial biology through the Lunaphore acquisition and its stake in Wilson Wolf exemplify 'Question Marks'. These ventures are in high-growth potential markets but currently have limited market share.

The company's AI-driven research tools and expansion into novel therapeutic modalities, such as gene editing, also fall into this category. These emerging fields, while promising, require substantial investment to establish market presence.

For instance, the global AI in healthcare market was valued at approximately $15.4 billion in 2024, with significant growth expected in specialized diagnostic and drug discovery segments where Bio-Techne is active.

The gene editing tools market is projected to grow at a 10.2% CAGR between 2024 and 2029, highlighting the potential for these 'Question Mark' investments to become future 'Stars'.

| BCG Category | Bio-Techne Examples | Market Growth Potential | Current Market Share | Strategic Outlook |

|---|---|---|---|---|

| Question Marks | Lunaphore (Spatial Biology), Wilson Wolf (Cell Culture), Spear Bio (Series A), AI Research Tools, Gene Editing Tools | High | Low to Moderate | Requires significant investment to grow into Stars or may become Dogs |

BCG Matrix Data Sources

Our Bio-Techne BCG Matrix is constructed using comprehensive market data, including sales figures, R&D investments, and competitive landscape analysis from industry reports and financial disclosures.