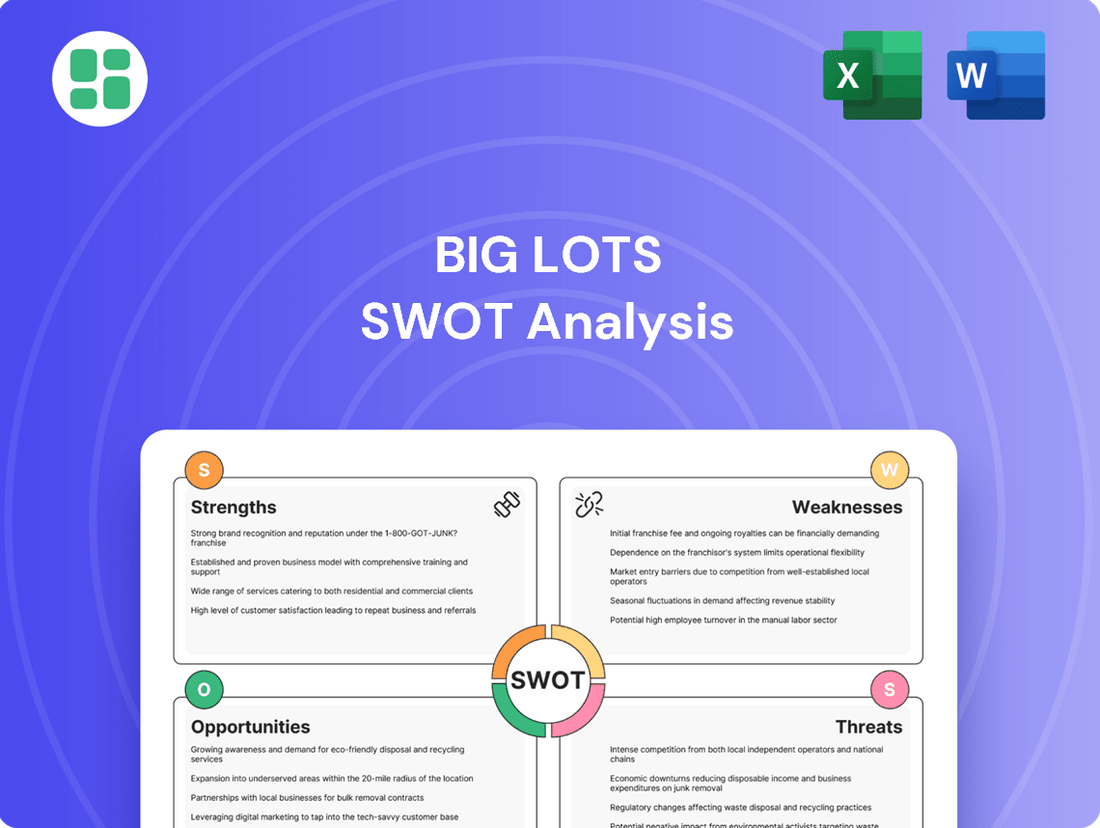

Big Lots SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Big Lots Bundle

Big Lots leverages its unique treasure-hunt shopping experience and broad product assortment to attract value-conscious consumers. However, it faces intense competition from online retailers and dollar stores, while navigating supply chain complexities and evolving consumer preferences.

Want the full story behind Big Lots' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Big Lots' unique closeout sourcing model is a significant strength, enabling them to procure merchandise at deeply discounted prices through closeouts, overstocks, and direct imports. This strategy allows them to offer compelling value to customers, setting them apart from traditional retailers. For instance, during the first quarter of 2024, Big Lots reported a 11.1% decrease in net sales, highlighting the ongoing challenges in the retail environment, yet their sourcing strategy remains a core differentiator in attracting price-sensitive consumers.

Big Lots boasts a diverse product assortment, ranging from furniture and home décor to food and seasonal items. This wide variety, constantly refreshed, makes it a compelling destination for shoppers looking for value across multiple categories. For instance, in fiscal year 2023, Big Lots continued to emphasize its assortment strategy, aiming to capture a broad consumer base seeking discounted goods for various household needs.

Big Lots benefits from significant brand recognition, a valuable asset honed over decades of operation as a discount home goods retailer. This established presence across the United States means many consumers are already familiar with the Big Lots name and its value proposition.

Even amidst recent financial headwinds, this brand familiarity remains a core strength. It provides a foundation that could be instrumental in any future strategic shifts, such as restructuring or rebranding initiatives. A recognized brand, even one facing challenges, can still connect with a consumer base accustomed to seeking out deals.

Focus on Value Proposition

Big Lots' core strength lies in its unwavering focus on delivering unmistakable value, a strategy that resonates strongly with consumers, especially in uncertain economic times. The company actively seeks to enhance its 'bargain penetration,' solidifying its reputation as a go-to source for significant savings.

This dedication to affordability is a key differentiator, attracting and retaining a loyal customer base that prioritizes price. For instance, in fiscal year 2023, Big Lots reported a net sales figure of $4.5 billion, reflecting the ongoing demand for value-oriented retail options.

- Focus on 'Unmistakable Value': Appeals to budget-conscious consumers.

- Increased 'Bargain Penetration': Reinforces brand identity as a savings destination.

- Customer Loyalty: Attracts and retains shoppers prioritizing affordability.

- Resilience in Economic Downturns: Value proposition becomes more attractive during economic strain.

Strategic Supply Chain Modernization

Big Lots' strategic supply chain modernization, including the establishment of international buying offices, is a significant strength. This initiative is designed to streamline the procurement of closeout and bargain merchandise, directly supporting their core business model. By enhancing efficiency, Big Lots can better manage its assortment and ensure a consistent influx of new, attractively priced products.

This modernization is critical for maintaining customer interest and competitiveness. For instance, in fiscal year 2023, Big Lots focused on improving inventory management and supply chain efficiency as part of its turnaround efforts. While specific numbers on the impact of international buying offices are not publicly detailed, the company's ongoing investment in supply chain technology and infrastructure underscores its commitment to this area.

- Enhanced Procurement Efficiency: International buying offices allow for direct sourcing and better negotiation power, crucial for securing closeout deals.

- Optimized Assortment Flow: Modernization aims to ensure a continuous and varied supply of new products, keeping the offering fresh for bargain hunters.

- Cost Management: A more efficient supply chain can lead to reduced logistics costs, directly benefiting the company's margin on low-priced goods.

Big Lots' ability to source merchandise through closeouts and overstocks is a core strength, allowing them to offer compelling value. This strategy is vital for attracting price-sensitive consumers, especially during economic uncertainty. For example, in fiscal year 2023, Big Lots reported net sales of $4.5 billion, demonstrating continued consumer demand for value-oriented retail.

The company's extensive and varied product assortment, from furniture to food, keeps its offerings fresh and appeals to a broad customer base. This wide selection, combined with their value proposition, solidifies their position as a go-to destination for discounts across multiple categories.

Big Lots benefits from significant brand recognition built over many years. This established presence provides a foundation for customer loyalty and potential future strategic initiatives, even amidst current market challenges.

Their focus on 'unmistakable value' and increased 'bargain penetration' directly appeals to budget-conscious shoppers, fostering customer loyalty. This emphasis on affordability makes Big Lots resilient, particularly during economic downturns when consumers prioritize savings.

What is included in the product

Delivers a strategic overview of Big Lots’s internal and external business factors, highlighting its value proposition and market positioning.

Offers a clear framework to identify Big Lots' competitive advantages and areas for improvement, easing the burden of complex strategic analysis.

Weaknesses

Big Lots' severe financial distress culminated in a Chapter 11 bankruptcy filing in September 2024. This move underscored a critical state of financial instability, marked by significant net losses and persistently negative cash flow throughout the preceding periods. The company's stock was subsequently delisted, and explicit warnings were issued that common shareholders faced a high probability of a total loss on their holdings.

Big Lots has faced persistent sales declines, with net sales falling by 10.1% to $4.56 billion in fiscal year 2023, and comparable store sales dropping 11.6%. This trend continued into early 2024, highlighting a significant challenge in attracting and retaining customers, especially in key discretionary categories.

Big Lots' reliance on a closeout sourcing model, while a strength, directly translates into a significant weakness: inconsistent inventory levels. This unpredictability makes it difficult to maintain reliable stock, frustrating customers looking for specific products and potentially pushing them towards competitors with more dependable inventory.

The 'treasure hunt' appeal, a core part of Big Lots' experience, can backfire when customers can't find what they need. This inconsistency impacts customer loyalty and can lead to lost sales opportunities, especially as Big Lots aims to attract a broader customer base beyond its core shoppers.

Underdeveloped E-commerce Capabilities

Big Lots has historically struggled to develop strong e-commerce capabilities, a significant weakness in today's retail environment. This underdevelopment limits its reach and competitiveness against digitally savvy rivals.

- Lagging Digital Presence: Big Lots has not kept pace with competitors in building a robust online shopping platform.

- Limited Customer Reach: The underdeveloped e-commerce hinders its ability to attract and serve a broader online customer base.

- Competitive Disadvantage: This deficiency makes it difficult to compete effectively with retailers that offer seamless digital experiences.

The company's ongoing challenges with digital transformation have directly impacted its financial performance, as evidenced by its financial difficulties in recent years. For instance, during the fiscal year ending February 3, 2024, Big Lots reported a net sales decrease of 8.9% compared to the prior year, highlighting the impact of its inability to fully capitalize on the online channel.

Negative Brand Perception and Store Closures

Big Lots faces a significant challenge with its negative brand perception, largely stemming from widely publicized financial struggles. The company's bankruptcy filing and numerous store closures have eroded consumer trust, creating an image of instability. This perception directly impacts customer willingness to engage with the brand, making it harder to attract and retain shoppers.

The ongoing closure of hundreds of Big Lots stores, a trend that continued into 2024, has amplified this negative sentiment. For instance, by the end of fiscal year 2023, Big Lots had closed approximately 200 stores, a substantial reduction in its retail footprint. This contraction signals financial distress to consumers, fostering a perception of unreliability and potentially driving customers to more stable competitors.

- Damaged Brand Image: Publicized bankruptcy and store closures have severely impacted consumer trust.

- Perception of Instability: Customers may view the company as unreliable due to its financial difficulties.

- Deterrent to Shoppers: Negative perceptions can discourage both existing and new customers from patronizing Big Lots.

- Uphill Battle for Rebuilding: Restoring a positive brand image and customer confidence will require substantial effort and time.

Big Lots' inability to consistently offer desired products due to its closeout model creates a significant weakness. This inventory unpredictability frustrates customers seeking specific items, driving them to competitors with more reliable stock. The 'treasure hunt' appeal falters when desired goods are absent, impacting customer loyalty and leading to lost sales, particularly as the company attempts to broaden its customer base.

The company's lagging digital presence is a critical weakness in today's retail landscape. Its underdeveloped e-commerce capabilities limit its reach and competitiveness against digitally savvy rivals, hindering its ability to attract and serve a broader online customer base. This deficiency makes it difficult to compete effectively with retailers offering seamless digital experiences.

Big Lots suffers from a damaged brand image, exacerbated by its widely publicized financial struggles and bankruptcy filing in September 2024. This perception of instability erodes consumer trust, making it harder to attract and retain shoppers. The ongoing closure of hundreds of stores, with approximately 200 closed by the end of fiscal year 2023, further amplifies this negative sentiment, signaling financial distress and potentially driving customers to more stable competitors.

The company's financial distress is a major weakness, evidenced by its Chapter 11 bankruptcy filing in September 2024. Significant net losses and persistently negative cash flow have marked its recent performance. This instability led to its stock being delisted, with explicit warnings of a high probability of total loss for common shareholders.

| Weakness | Description | Impact |

| Inventory Inconsistency | Reliance on closeout sourcing leads to unpredictable stock levels. | Frustrates customers, reduces loyalty, leads to lost sales. |

| Lagging Digital Presence | Underdeveloped e-commerce capabilities. | Limits customer reach, hinders competitiveness against online rivals. |

| Damaged Brand Image | Publicized financial struggles and bankruptcy filing. | Erodes consumer trust, discourages shoppers, creates perception of instability. |

| Financial Distress | Chapter 11 bankruptcy, net losses, negative cash flow. | Undermines stability, leads to delisting, high risk for shareholders. |

Preview the Actual Deliverable

Big Lots SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and allows you to assess the quality and depth of our Big Lots SWOT analysis before committing.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive breakdown of Big Lots' strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Big Lots SWOT analysis, ready for your strategic planning.

Opportunities

The agreement for Variety Wholesalers to acquire and operate a significant number of Big Lots stores offers a critical opportunity for a strategic reset. This move could inject much-needed capital and streamline operations, paving the way for a revitalized business emerging from bankruptcy with a more sustainable model.

The discount retail sector is booming, with consumers actively seeking value due to persistent inflation and economic unease. In 2024, discount retailers saw continued growth as shoppers stretched their budgets further. For example, dollar stores, a key segment of discount retail, reported strong sales figures throughout the year, indicating a sustained consumer preference for lower price points.

Big Lots, if its restructuring efforts prove successful, is ideally positioned to capture a significant share of this expanding market. By focusing on affordability and value, the company can attract a larger base of budget-conscious shoppers who are actively seeking deals. This alignment with consumer sentiment presents a substantial opportunity for Big Lots to regain market traction and drive sales.

The overall market trend towards discount shopping provides a powerful tailwind for Big Lots' recovery. As economic pressures continue, consumers are expected to remain focused on price, making discount retailers like Big Lots increasingly attractive. This favorable market dynamic offers a clear path for the company to capitalize on consumer behavior and achieve a turnaround.

Big Lots' ongoing store footprint optimization, which involves closing underperforming locations, is a strategic move to right-size its physical presence. This allows the company to concentrate resources on its more profitable and higher-traffic stores.

This strategic pruning is expected to boost operational efficiency and slash overhead expenses. By focusing on prime locations, Big Lots aims to increase profitability per square foot across its remaining store base.

For the fiscal year 2023, Big Lots reported closing approximately 20 stores, a continuation of its strategy to streamline its retail network. This leaner store portfolio is anticipated to bolster overall financial performance and enhance capital allocation.

Enhancing Omnichannel Experience

Big Lots has a clear chance to significantly upgrade its online and mobile shopping platforms, making sure the digital and physical store experiences work together smoothly. This is crucial as consumer habits continue to shift towards integrated shopping journeys.

The company has acknowledged this by launching a new app designed to boost customer loyalty through rewards and special offers. This initiative is a step towards bridging the gap between online engagement and in-store purchasing.

By strengthening its omnichannel capabilities, Big Lots can better cater to modern shopper expectations and potentially attract a wider customer base. For example, a well-executed app can drive foot traffic and increase average transaction values by offering personalized deals.

- Digital Investment: Continued investment in user-friendly website and app development is key.

- Seamless Integration: Focus on features like buy-online-pickup-in-store (BOPIS) and real-time inventory visibility across channels.

- Personalization: Leveraging data to offer tailored promotions and product recommendations through the app.

- Customer Loyalty: Enhancing the rewards program to drive repeat business and engagement across all touchpoints.

Strengthening Private Label and Extreme Bargain Offerings

Expanding private label offerings and emphasizing extreme bargains represent significant opportunities for Big Lots. This approach directly addresses a key consumer driver: value. By offering a wider array of proprietary brands, Big Lots can better control product quality and pricing, thereby enhancing its competitive edge and potentially improving gross margins. In 2024, retailers focusing on private label saw continued strength; for instance, private label penetration in the US grocery sector reached approximately 25% by the end of 2023, a trend expected to persist.

This strategy allows Big Lots to differentiate itself in a crowded retail landscape. By curating and promoting 'extreme bargain' selections, the company can reinforce its core value proposition and attract price-sensitive shoppers. This focus can lead to increased foot traffic and sales volume, particularly during economic periods where consumers are more budget-conscious. For example, during the initial phases of 2024, discount retailers generally outperformed the broader market, signaling continued consumer appetite for deals.

- Enhance Brand Loyalty: Developing unique private label products fosters brand recognition and encourages repeat purchases.

- Improve Profitability: Private label goods often carry higher gross margins compared to national brands.

- Control Product Assortment: Big Lots can tailor its private label offerings to meet specific customer demands and market trends.

- Strengthen Value Proposition: 'Extreme bargains' directly appeal to budget-conscious consumers, reinforcing Big Lots' core identity.

The acquisition of a significant number of Big Lots stores by Variety Wholesalers presents a pivotal opportunity for a strategic revitalization. This transition can inject essential capital and streamline operations, enabling a leaner, more sustainable business model post-bankruptcy. The discount retail sector continues to thrive, driven by consumer demand for value amidst ongoing inflation; in 2024, this trend persisted with dollar stores, a key segment, reporting robust sales, underscoring a sustained preference for lower price points.

Big Lots, through successful restructuring, is well-positioned to capitalize on this expanding market by emphasizing affordability and value. This strategic alignment with consumer spending habits offers a substantial avenue for market share recovery and sales growth. The company's ongoing optimization of its store footprint, including the closure of underperforming locations, allows for resource concentration on more profitable stores, aiming to boost operational efficiency and reduce overhead. For fiscal year 2023, Big Lots closed approximately 20 stores, a move designed to enhance financial performance through a leaner retail network.

Enhancing digital platforms and ensuring seamless integration between online and physical experiences represent a significant opportunity for Big Lots. The company's launch of a new app, focused on customer loyalty through rewards and special offers, aims to bridge the gap between digital engagement and in-store purchases. By strengthening omnichannel capabilities, Big Lots can better meet modern shopper expectations, potentially attracting a wider customer base; for instance, a well-executed app can drive foot traffic and increase average transaction values through personalized deals.

Expanding private label offerings and highlighting extreme bargains directly addresses consumer demand for value, a key driver in the current retail environment. In 2024, retailers focusing on private label saw continued strength, with US grocery sector private label penetration reaching approximately 25% by the end of 2023. This strategy allows Big Lots to differentiate itself, control product quality and pricing, and potentially improve gross margins. By curating 'extreme bargain' selections, the company reinforces its core value proposition, attracting price-sensitive shoppers and driving sales volume, especially during economically challenging periods where discount retailers generally outperformed the broader market in early 2024.

Threats

Big Lots confronts intense and expanding competition from giants like Walmart and Target, alongside nimble dollar stores and robust online players. Many of these rivals are aggressively broadening their reach, both in brick-and-mortar locations and e-commerce, creating a challenging environment for Big Lots to grow its market presence.

For instance, in 2023, Walmart reported over $648 billion in revenue, showcasing its immense scale and competitive pricing power. Similarly, Target's digital sales saw significant growth, demonstrating the increasing importance of online channels where Big Lots also faces pressure from Amazon and other dedicated e-commerce platforms.

Persistently high inflation and rising interest rates are significant headwinds for Big Lots. These conditions directly impact consumer purchasing power, leading to a noticeable pullback in discretionary spending, particularly on items like furniture and home décor which are staples for Big Lots. For example, in Q1 2024, the U.S. inflation rate remained elevated, impacting household budgets.

The company's core customer demographic is particularly sensitive to these economic shifts, forcing them to prioritize essential goods over non-essential purchases. This trend directly translates to reduced sales volumes and potentially lower profit margins for Big Lots as they may need to offer more aggressive promotions to move inventory.

These adverse macroeconomic factors are largely outside of Big Lots' direct control, presenting a substantial threat to its revenue streams and overall financial performance. The Federal Reserve's continued stance on interest rates in 2024, aimed at curbing inflation, further exacerbates this challenge.

Big Lots' brand has suffered significantly due to its Chapter 11 bankruptcy filing in early 2024, coupled with the collapse of a prior acquisition attempt. This has led to widespread store closures, with the company closing hundreds of locations in recent years, impacting its physical presence and customer accessibility. These events foster a perception of instability, making it difficult to retain existing customers and attract new ones.

Supply Chain Instability and Cost Pressures

Big Lots faces ongoing threats from supply chain instability and rising costs. Despite strategies to improve sourcing, the company remains susceptible to global disruptions, volatile shipping expenses, and the difficulty of consistently acquiring appealing closeout inventory. These issues can cause unexpected inventory shortages, higher operating expenses, and diminished profits, hindering their ability to offer competitive value.

For instance, during the first quarter of 2024, Big Lots reported a net sales decrease of 5.6% year-over-year, partly attributed to inventory challenges and promotional activity aimed at managing stock levels amidst these pressures. The company's reliance on closeout merchandise, while a core part of its model, inherently creates vulnerability to availability and quality fluctuations.

- Global Supply Chain Vulnerabilities: Continued disruptions in international shipping and manufacturing can lead to stockouts and increased lead times for key products.

- Freight Cost Volatility: Fluctuations in fuel prices and shipping container availability directly impact transportation expenses, squeezing profit margins.

- Closeout Merchandise Sourcing Challenges: The unpredictable nature of acquiring desirable closeout deals can affect inventory depth and product assortment, impacting sales potential.

Risk of Complete Shareholder Loss

A significant threat facing Big Lots is the substantial risk of complete shareholder loss. Recent financial disclosures have explicitly warned common shareholders that their investment could be entirely wiped out due to ongoing bankruptcy proceedings. This underscores the extreme financial distress and the uncertain future viability of the company, painting a grim picture for existing equity holders.

The precarious financial state of Big Lots means that recovery for common shareholders is highly improbable. As of the first quarter of 2024, the company reported a net loss of $21.4 million, a stark indicator of its ongoing struggles. This situation amplifies the threat of complete equity value erosion.

- Complete Loss of Investment: Common shareholders face a high likelihood of total loss on their investment.

- Bankruptcy Proceedings: The ongoing bankruptcy process significantly diminishes the prospects for equity recovery.

- Severe Financial Distress: The company's financial health is critically impaired, increasing investment risk.

- Uncertain Future Viability: Big Lots' long-term operational and financial stability remains in serious doubt.

Big Lots faces a significant threat from its precarious financial situation, highlighted by its Chapter 11 bankruptcy filing in early 2024. This event, coupled with a failed acquisition attempt, has led to widespread store closures, impacting its market presence and customer accessibility. The company's brand perception has suffered, making customer retention and acquisition increasingly challenging.

The company's reliance on closeout merchandise exposes it to sourcing challenges and inventory fluctuations, directly impacting its ability to offer competitive value. For example, in Q1 2024, Big Lots reported a net sales decrease of 5.6% year-over-year, partly due to inventory management issues amidst these pressures.

Shareholders face a substantial risk of complete investment loss, as recent financial disclosures have explicitly warned common shareholders about this possibility due to ongoing bankruptcy proceedings. The company's reported net loss of $21.4 million in Q1 2024 further amplifies the threat of equity value erosion.

| Threat Category | Specific Threat | Impact | Supporting Data (as of Q1 2024) |

|---|---|---|---|

| Financial Instability | Bankruptcy Proceedings | High likelihood of shareholder loss, diminished operational capacity | Net loss of $21.4 million |

| Competitive Landscape | Intensified Competition | Market share erosion, pressure on pricing | Walmart revenue exceeding $648 billion (2023) |

| Macroeconomic Factors | Inflation and Interest Rates | Reduced consumer discretionary spending, impacting key product categories | Elevated U.S. inflation rates |

| Operational Challenges | Supply Chain Disruptions | Inventory shortages, increased operating costs | 5.6% year-over-year net sales decrease |

SWOT Analysis Data Sources

This Big Lots SWOT analysis is built upon a foundation of robust data, including publicly available financial statements, comprehensive market research reports, and expert industry commentary to provide a well-rounded strategic perspective.