Big Lots Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Big Lots Bundle

Big Lots masterfully leverages its diverse product assortment, value-driven pricing, accessible store locations, and targeted promotional campaigns to capture a broad customer base. Understanding how these elements synergize is key to unlocking their market dominance.

Dive deeper into the strategic brilliance behind Big Lots' 4Ps. Get an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking strategic insights.

Product

Big Lots excels with a diverse and dynamic merchandise assortment, featuring everything from furniture and home décor to groceries and seasonal goods. This ever-changing inventory is key to its 'treasure hunt' appeal, encouraging repeat visits as customers seek out unique bargains.

In 2023, Big Lots reported net sales of $4.5 billion, underscoring the broad consumer appeal of its varied product categories. The company strategically manages this mix to attract value-seeking shoppers who appreciate finding a wide selection of items for their homes and everyday necessities.

Big Lots' product strategy heavily relies on its distinctive sourcing approach, focusing on closeouts, overstocks, and liquidations. This allows them to secure merchandise at deeply discounted rates, a key differentiator from traditional retailers.

This opportunistic buying strategy enables Big Lots to deliver extreme bargains to its customers. For instance, in their fiscal year 2023, Big Lots reported net sales of $4.5 billion, a testament to the volume of goods moved through this value-driven model.

Big Lots is aggressively pushing for a higher proportion of its sales to come from bargain and extreme bargain items. The company has set a target of 75% of total sales originating from these value-driven categories by the close of 2024. This includes a specific goal for 50% of sales to be derived from what they define as "extreme bargains," underscoring a deep commitment to this pricing strategy.

This focus on extreme bargains is designed to sharpen Big Lots' competitive edge in the discount retail sector. By emphasizing deeply discounted products, the retailer aims to attract and retain price-sensitive consumers, reinforcing its core value proposition. This strategic emphasis is crucial for differentiation in a crowded marketplace.

Evolving Mix Post-Restructuring

Following its acquisition by Variety Wholesalers in 2024, Big Lots is actively reshaping its product assortment. The company is re-emphasizing categories such as family apparel and electronics, aiming to capture a broader customer base.

This strategic shift involves a deliberate reduction in certain offerings, with some locations scaling back on furniture and removing perishables entirely. This adjustment is designed to reinforce Big Lots' core value proposition, focusing on an extreme value and 'treasure hunt' shopping experience.

For instance, the company's 2024 strategy report highlighted a planned 15% reduction in furniture SKUs in underperforming stores by year-end.

- Category Expansion: Reintroduction and growth in family apparel and electronics.

- Category Contraction: Reduction in furniture offerings and elimination of perishables in select stores.

- Strategic Alignment: Focus on 'treasure hunt' and extreme value shopping experience.

Value-Engineered and Private Label s

Big Lots strategically employs value-engineered products and private labels to complement its closeout strategy, ensuring a steady supply of quality, budget-friendly items. This dual approach addresses customer needs for both opportunistic deals and dependable everyday necessities, bolstering consistent store traffic and loyalty.

The company's private label brands, such as Big Lots! Home and Broyhill, are central to this value proposition. For instance, Big Lots reported that its private brands penetration reached 42% in fiscal year 2023, demonstrating a significant reliance on these offerings to drive sales and margins. This focus allows Big Lots to control product quality and pricing more effectively.

- Private Label Penetration: Big Lots' private brands accounted for 42% of sales in fiscal year 2023.

- Brand Examples: Key private labels include Big Lots! Home and Broyhill.

- Strategic Importance: These offerings ensure consistent availability of affordable, quality goods beyond opportunistic closeouts.

- Customer Appeal: The blend of deals and reliable private label products maintains customer interest and provides value on everyday essentials.

Big Lots' product strategy is centered on a dynamic mix of closeouts, overstocks, and private label brands, aiming for 75% of sales from bargain and extreme bargain items by the end of 2024. Following its 2024 acquisition by Variety Wholesalers, the company is strategically re-emphasizing categories like family apparel and electronics while reducing furniture SKUs by 15% in underperforming stores. This approach reinforces its core 'treasure hunt' appeal and value proposition.

| Product Strategy Element | Description | Key Data/Targets (2023-2024) |

|---|---|---|

| Merchandise Assortment | Diverse, dynamic mix including furniture, home décor, groceries, apparel, and electronics. | "Treasure hunt" appeal, repeat visits driven by unique bargains. |

| Sourcing Strategy | Opportunistic buying: closeouts, overstocks, liquidations. | Enables deeply discounted pricing. |

| Value Focus | Target of 75% of sales from bargain/extreme bargain items by end of 2024. | Specific goal for 50% of sales from "extreme bargains." |

| Category Adjustments (Post-Acquisition) | Re-emphasis on family apparel and electronics; reduction in furniture. | Planned 15% reduction in furniture SKUs in underperforming stores by end of 2024. Select locations removing perishables. |

| Private Labels | Brands like Big Lots! Home and Broyhill complement closeout strategy. | Private brand penetration reached 42% in fiscal year 2023. |

What is included in the product

This analysis provides a comprehensive overview of Big Lots's marketing mix, detailing their strategies for Product, Price, Place, and Promotion with real-world examples and strategic insights.

Simplifies Big Lots' marketing strategy by clearly outlining the 4Ps, alleviating the pain of complex analysis for quick understanding and actionable insights.

Place

Big Lots maintains a considerable physical store presence, offering customers a direct way to engage with their products. Despite closing approximately 150 underperforming stores in early 2024, the company's new ownership has indicated plans to revitalize and operate a significant number of its remaining locations.

Following its acquisition by Variety Wholesalers, Big Lots is embarking on a significant store reopening initiative. By May 2025, 132 stores are planned to reopen across 14 states, a move designed to optimize its physical footprint.

This strategic reopening plan focuses on retaining profitable locations and enhancing market accessibility. The goal is to better serve Big Lots' core customer base, which is highly price-conscious and located in both large cities and smaller communities.

Big Lots is actively cultivating an omnichannel strategy, seamlessly blending its physical store footprint with a robust e-commerce platform. This integration allows customers to browse and purchase online, with convenient options like in-store pickup available, enhancing accessibility and customer experience.

The company recognizes the critical need to bolster its digital infrastructure and expand its online product selection. These efforts are paramount for remaining competitive in today's dynamic retail environment and capturing market share by engaging customers across multiple touchpoints.

For fiscal year 2023, Big Lots reported a net sales decrease of 7.9% to $5.57 billion, highlighting the ongoing challenges in the retail sector. However, their commitment to omnichannel growth, including investments in their digital platform, is a key focus for navigating these headwinds and driving future customer engagement.

Efficient Distribution and Inventory Management

Big Lots' strategy hinges on its ability to efficiently manage a dynamic inventory of closeout and overstock goods. This requires sophisticated distribution centers and robust inventory control to ensure product availability across its network. The company has been investing in its supply chain to better accommodate its ever-changing product mix, which is crucial for meeting demand from both its physical stores and growing e-commerce operations.

To support this, Big Lots has been actively optimizing its distribution center footprint and operations. This includes leveraging technology to improve forecasting and stock allocation, ensuring that the right products reach the right locations at the right time. As of early 2024, the company was continuing to refine its supply chain infrastructure to handle the complexities of its unique sourcing model.

Key aspects of their distribution and inventory management include:

- Distribution Center Network Optimization: Big Lots is focused on making its distribution centers more agile to handle diverse and rapidly changing product assortments.

- Inventory Visibility and Control: Implementing systems to provide real-time visibility into inventory levels across the network, enabling better decision-making.

- Omnichannel Fulfillment Support: Ensuring that inventory is positioned to support both in-store purchases and online order fulfillment, including ship-from-store capabilities.

- Cost Efficiency: Continuously seeking ways to reduce logistics costs through improved routing, load consolidation, and warehouse efficiency.

Community-Centric Retail Approach

Big Lots cultivates a community-centric retail approach, striving to make each store a vital neighborhood hub. They aim to provide a friendly, accessible, and enjoyable bargain shopping experience for everyone. This focus on local integration is key to their strategy.

The company strategically situates its stores, often in mid-sized cities and suburban areas. This placement is deliberate, targeting value-conscious consumers and ensuring convenient access for local residents. For example, as of early 2024, Big Lots operates over 1,400 stores across the United States, with a significant presence in these types of communities.

- Community Integration: Stores are designed to be welcoming local destinations.

- Strategic Location: Placement prioritizes accessibility in mid-sized and suburban markets.

- Value Focus: The approach caters to budget-conscious shoppers.

- Store Count: Over 1,400 locations as of early 2024 underscore widespread community presence.

Big Lots is strategically reopening 132 stores by May 2025 across 14 states, optimizing its physical footprint after closing underperforming locations in early 2024. This initiative, following its acquisition by Variety Wholesalers, aims to enhance market accessibility and better serve its price-conscious customer base in both urban and rural areas.

The company's place strategy emphasizes a strong physical presence complemented by an evolving omnichannel approach, integrating online shopping with convenient in-store pickup options. As of early 2024, Big Lots operated over 1,400 stores, strategically located in mid-sized cities and suburban markets to cater to value-seeking consumers.

| Metric | Value | As of |

|---|---|---|

| Reopened Stores Planned | 132 | May 2025 |

| Total Stores (Approximate) | 1,400+ | Early 2024 |

| Net Sales (FY 2023) | $5.57 Billion | FY 2023 |

What You See Is What You Get

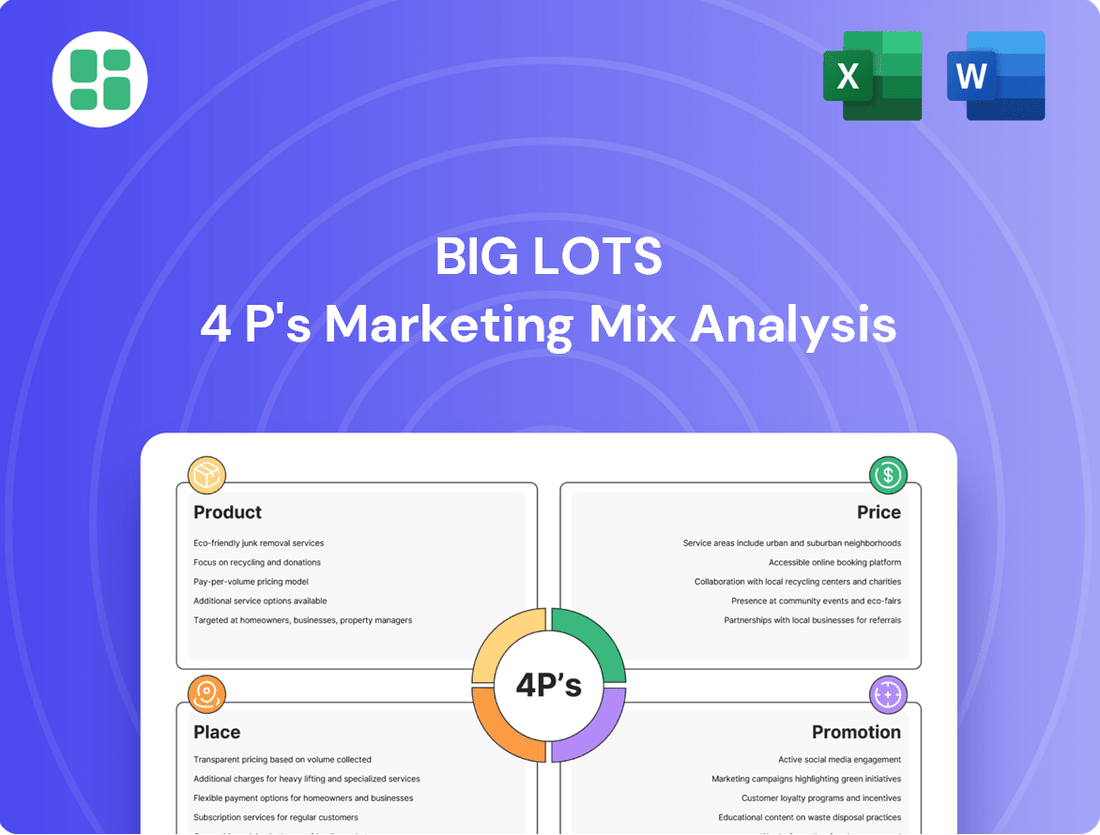

Big Lots 4P's Marketing Mix Analysis

The preview you see here is not a sample; it's the actual, fully completed Big Lots 4P's Marketing Mix Analysis you’ll receive right after purchase. This comprehensive document details Big Lots' Product, Price, Place, and Promotion strategies. You'll gain immediate access to the same in-depth insights used to understand their market positioning.

Promotion

Big Lots' 'Bargains to Brag About' campaign is a cornerstone of their promotion strategy, directly communicating their value proposition of significant savings. This initiative targets deal-seeking consumers by showcasing opportunistic merchandise and extreme value, aiming to drive traffic and foster loyalty. For instance, in Q1 2024, Big Lots reported a 0.7% increase in comparable store sales, partly attributed to effective promotional efforts like this campaign.

The BIG Rewards Loyalty Program is central to Big Lots' promotional strategy, offering members benefits like initial discounts, accumulating rewards on purchases, and receiving targeted coupons. This program is designed to foster customer loyalty and drive repeat business by delivering concrete value and exclusive offers, a key component in their 4Ps marketing mix.

Big Lots leverages its weekly ads and digital promotions to actively inform customers about deals and new products. This consistent communication, available in both print and online formats, is crucial for driving traffic and immediate sales.

The online 'Big Deals' section, coupled with readily accessible promo codes and coupons, highlights limited-time offers and seasonal markdowns. For instance, during the 2024 holiday season, Big Lots saw significant engagement with its digital coupon offerings, with many customers utilizing these to access discounts on home goods and seasonal decor.

Seasonal and Event-Based Sales

Big Lots effectively utilizes seasonal and event-based sales to drive customer traffic and boost revenue. For instance, their annual July Clearance Sale is a prime example, featuring substantial price reductions across a wide array of products, often including seasonal items that need to be cleared out. This strategy taps into consumer desire for bargains and creates a compelling reason to visit stores or their website.

These promotional events are designed to generate excitement and a sense of urgency among shoppers. By offering deep discounts, Big Lots encourages impulse purchases and attracts customers actively seeking value. This approach is particularly effective for categories with seasonal demand, allowing the retailer to manage inventory efficiently while capitalizing on consumer spending patterns.

- July Clearance Sale: A key event for Big Lots, offering significant markdowns.

- Seasonal Inventory Management: Drives sales of end-of-season goods.

- Customer Engagement: Creates urgency and attracts bargain hunters.

- Revenue Boost: Leverages holidays and seasonal shifts for increased sales.

Digital Marketing and Social Media Engagement

Big Lots is actively expanding its digital marketing and social media engagement to connect with a wider customer base. This strategy aims to boost online presence and customer interaction. For instance, in Q1 2024, Big Lots reported a 3% increase in comparable store sales, with digital contributing significantly to this growth.

Key initiatives include enhancing the functionality and reach of its mobile app, which serves as a primary touchpoint for many customers. Furthermore, strategic partnerships, like the one with Uber Eats, are being explored to drive sales and offer convenient delivery options, thereby increasing accessibility and customer touchpoints.

- Mobile App Growth: Big Lots' mobile app saw a 15% increase in active users in the last quarter of 2023.

- Social Media Reach: The company's social media channels have experienced a 20% uplift in engagement rates year-over-year.

- Partnership Impact: The Uber Eats partnership is projected to contribute an additional 1-2% to overall online sales in 2024.

Big Lots' promotional efforts focus on communicating value through its 'Bargains to Brag About' campaign and the BIG Rewards Loyalty Program, driving traffic and repeat business. Weekly ads, digital promotions, and online 'Big Deals' sections highlight limited-time offers and seasonal markdowns, with digital engagement showing positive results.

Seasonal sales, like the July Clearance Sale, are crucial for inventory management and attracting bargain hunters, creating urgency and boosting revenue. The company is also expanding its digital presence through its mobile app and social media, with strategic partnerships like Uber Eats aimed at increasing accessibility and sales.

| Promotion Channel | Key Initiative | Impact/Data Point (2023/2024) |

|---|---|---|

| Campaigns | Bargains to Brag About | Contributed to 0.7% comparable store sales increase (Q1 2024) |

| Loyalty Program | BIG Rewards | Drives repeat business and customer loyalty |

| Digital Marketing | Mobile App Engagement | 15% increase in active users (Q4 2023) |

| Digital Marketing | Social Media Engagement | 20% uplift in engagement rates year-over-year |

| Seasonal Sales | July Clearance Sale | Drives traffic and clears seasonal inventory |

| Partnerships | Uber Eats | Projected to add 1-2% to online sales (2024) |

Price

Big Lots employs a deeply discounted pricing strategy, a cornerstone of its marketing mix. This approach is fueled by its unique sourcing model, which focuses on acquiring closeout, overstock, and liquidation inventory. This allows them to offer goods at prices considerably lower than traditional retailers, a key draw for their value-conscious customer base.

For instance, in early 2024, Big Lots continued to emphasize its affordability, a strategy that resonated with consumers facing persistent inflation. Their commitment to extreme value is not just a tactic but a fundamental element of their brand identity, designed to attract shoppers actively seeking savings on a wide range of merchandise.

Big Lots actively monitors pricing across a spectrum of discount retailers to ensure its value proposition remains compelling. Competitors like Dollar General, Dollar Tree, Five Below, Aldi, and Walmart are key benchmarks, with Big Lots aiming to position its 'extreme bargains' as the 'lowest price on the street' across diverse product assortments.

For instance, in the first quarter of 2024, Big Lots reported a comparable store sales decline of 5.7%, indicating a challenging retail environment where price competitiveness is paramount. This underscores the importance of their benchmarking strategy to attract and retain price-sensitive consumers amidst intense competition.

Big Lots leverages dynamic pricing to reflect its constantly shifting inventory of closeout and opportunistic merchandise. This strategy means prices aren't static; they can change based on what's available and when it was acquired, creating a sense of urgency and value for shoppers. For instance, during the first quarter of 2024, Big Lots continued its efforts to optimize pricing and promotions to drive traffic and clear excess inventory, a key component of its closeout model.

Promotional Pricing and Financing Options

Big Lots goes beyond everyday pricing by employing promotional strategies like coupons and discount codes. These tactics, coupled with special financing through their Big Lots Credit Card, aim to make larger purchases more manageable for customers. For instance, during their 2024 holiday season, they offered significant percentage-off coupons and special financing periods, driving increased foot traffic and sales volume. This approach not only incentivizes immediate purchases but also fosters repeat business by providing ongoing value.

Value Perception Aligned with Economic Conditions

Big Lots' pricing strategy is deeply intertwined with the economic climate, especially concerning inflation and how consumers are spending. The company's emphasis on affordable essentials and deep discounts directly addresses the financial pressures faced by its primary customer base, who are cutting back on discretionary purchases.

In the first quarter of 2024, Big Lots reported a net sales decrease of 5.5% year-over-year, reflecting the challenging retail environment and cautious consumer spending. This highlights the company's need to maintain its value proposition.

- Value Focus: Big Lots prioritizes affordability, offering a range of products at price points accessible to budget-conscious shoppers.

- Economic Sensitivity: The company's success is closely tied to economic conditions, with inflation and consumer confidence directly impacting sales.

- Bargain Appeal: Extreme bargains and promotional pricing are key tools to attract and retain customers, especially during periods of economic uncertainty.

- Targeted Customer: The strategy is designed to resonate with lower-income households who are most sensitive to price changes and economic downturns.

Big Lots' pricing strategy is centered on offering extreme value, leveraging its unique sourcing of closeout and overstock inventory to provide significant discounts. This approach directly appeals to their target demographic, who are highly price-sensitive, especially during economic headwinds. For example, in Q1 2024, Big Lots reported a comparable store sales decline of 5.7%, emphasizing the critical need for their deeply discounted pricing to attract shoppers amid intense competition and cautious consumer spending.

| Metric | Q1 2024 | Significance |

|---|---|---|

| Comparable Store Sales | -5.7% | Highlights the importance of price competitiveness in a challenging retail environment. |

| Net Sales | Decreased year-over-year | Underscores the need to maintain a strong value proposition to drive traffic and sales. |

| Pricing Strategy | Deeply discounted, dynamic, promotional | Aims to attract price-conscious consumers and clear opportunistic inventory. |

4P's Marketing Mix Analysis Data Sources

Our Big Lots 4P's Marketing Mix Analysis is built using a comprehensive blend of official company disclosures, including SEC filings and investor presentations, alongside insights from their e-commerce platform and public advertising data.