Big Lots PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Big Lots Bundle

Navigate the ever-changing retail landscape with our comprehensive Big Lots PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its future. Equip yourself with actionable intelligence to make informed strategic decisions. Download the full version now for a competitive edge.

Political factors

Big Lots' significant reliance on imported goods, especially from Asian markets, directly exposes it to the volatility of tariff and trade policies. For instance, in 2023, the United States maintained tariffs on many goods originating from China, a key sourcing region for many retailers. These tariffs can increase the landed cost of inventory, forcing Big Lots to either absorb the cost, impacting margins, or pass it on to consumers, potentially affecting its value proposition.

Changes in trade agreements, such as potential renegotiations of existing pacts or the imposition of new import duties, can disrupt Big Lots' supply chain and increase operational expenses. For example, if new tariffs are implemented on furniture or home goods, which are significant categories for Big Lots, the company's cost of goods sold would likely rise. This sensitivity highlights the need for proactive supply chain management and diversification of sourcing to mitigate risks associated with protectionist trade measures.

Big Lots navigates a complex web of federal, state, and local retail regulations. These rules govern everything from store operating hours and product safety to labeling and sales tax. For instance, in 2024, states continued to update their sales tax nexus laws, impacting online and in-store sales for retailers like Big Lots. Staying compliant across all jurisdictions is crucial to avoid penalties and maintain consumer confidence.

Government stimulus measures, like the direct payments seen in 2021, can provide a temporary boost to consumer spending, directly benefiting retailers like Big Lots. For instance, the American Rescue Plan injected significant funds into the economy, impacting discretionary spending patterns.

Conversely, policies aimed at reducing inflation or national debt, such as interest rate hikes implemented by the Federal Reserve throughout 2022 and 2023, can dampen consumer confidence and reduce disposable income, potentially affecting Big Lots' sales volume.

Tax reforms can also play a role; changes in income tax brackets or deductions can alter how much consumers have left to spend on non-essential items, a segment where Big Lots often competes.

Supply Chain and Logistics Regulations

Regulations impacting international shipping and port operations are critical for Big Lots, particularly given its reliance on an opportunistic sourcing strategy. For instance, changes in customs procedures or tariffs can directly influence the cost and speed of bringing goods into the country. The U.S. Federal Maritime Commission (FMC) has been actively addressing congestion and fee issues at ports, aiming to improve fluidity, which directly benefits retailers like Big Lots.

Environmental regulations, such as those pertaining to emissions from ocean-going vessels or trucking, can also add to logistics expenses. The International Maritime Organization's (IMO) 2020 sulfur cap, for example, increased fuel costs for shipping lines, a portion of which is often passed on to shippers. Similarly, evolving domestic transportation regulations, including driver hours-of-service rules or emissions standards for trucks, can impact delivery times and costs for Big Lots' domestic distribution network.

- International Shipping Costs: Fluctuations in global shipping rates, influenced by regulatory changes and demand, directly affect Big Lots' landed cost for imported goods.

- Domestic Transportation Efficiency: Compliance with trucking regulations, such as emissions standards and driver safety, impacts the cost and reliability of moving inventory from distribution centers to stores.

- Port Congestion Mitigation: Efforts by bodies like the FMC to reduce port dwell times and improve efficiency are vital for Big Lots to maintain timely inventory flow.

Labor Laws and Minimum Wage

Changes in labor laws, such as minimum wage hikes or new overtime regulations, directly affect Big Lots' operating expenses. For instance, a potential federal minimum wage increase to $15 per hour, discussed in 2024 and early 2025, could significantly raise payroll costs for Big Lots' retail and distribution staff. This pressure on profit margins may necessitate efficiency drives or price adjustments to maintain profitability.

Compliance with evolving employment legislation is paramount for Big Lots to ensure positive employee relations and maintain its legal standing. The company must adapt to varying state and local labor laws, which can differ widely across its operational footprint. Staying ahead of these regulatory shifts is crucial for smooth operations and avoiding potential penalties.

- Federal Minimum Wage Debate: Ongoing discussions around a potential federal minimum wage increase to $15 per hour by 2025 could impact Big Lots' labor costs.

- State-Level Variations: Big Lots operates in numerous states, each with its own minimum wage and overtime rules, requiring constant monitoring and adaptation.

- Impact on Profitability: Increased labor expenses can directly squeeze Big Lots' profit margins, potentially leading to strategic pricing or operational efficiency measures.

- Employee Relations and Compliance: Adherence to labor laws is vital for maintaining good employee relations and avoiding legal challenges.

Big Lots' political landscape is shaped by trade policies, particularly tariffs on imported goods from key sourcing regions like Asia. For instance, ongoing U.S. tariffs on Chinese goods, maintained through 2023 and into 2024, directly increase the cost of inventory for Big Lots, impacting its ability to offer competitive pricing.

Government stimulus programs can offer a temporary sales uplift. For example, the economic impact of measures enacted in 2021 continued to influence consumer spending patterns into 2022, benefiting retailers like Big Lots. Conversely, monetary policy shifts, such as the Federal Reserve's interest rate hikes throughout 2022 and 2023, aim to curb inflation but can reduce consumer disposable income, potentially slowing sales.

Regulatory compliance across federal, state, and local levels is critical, covering areas from sales tax to product safety. For example, the evolving landscape of state sales tax nexus laws in 2024 requires constant vigilance. Furthermore, labor laws, including potential federal minimum wage increases discussed for 2025, directly influence Big Lots' operating expenses and profit margins.

What is included in the product

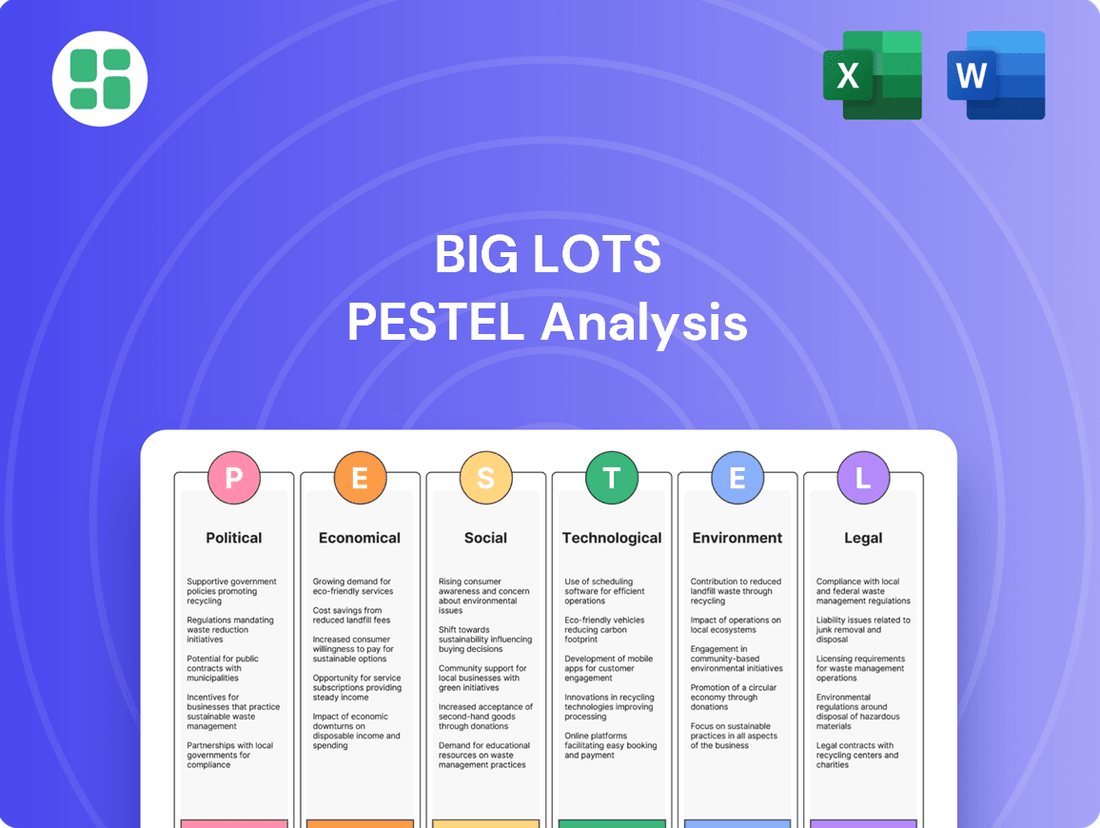

This Big Lots PESTLE analysis dissects the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

It provides a comprehensive overview of the external forces shaping the discount retail landscape, offering actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, translating complex PESTLE factors into actionable insights for Big Lots' strategic decision-making.

Economic factors

Big Lots' success hinges on how much discretionary cash its core customers have and how willing they are to spend it on essentials and discretionary items like home furnishings and seasonal goods. For instance, in early 2024, reports indicated that while inflation showed signs of moderating, many households were still feeling the pinch, leading to continued focus on value.

When the economy falters or prices climb significantly, consumers naturally become more price-sensitive, which plays directly into Big Lots' strategy of offering lower-priced alternatives. This value proposition can attract shoppers looking to stretch their budgets further, especially for everyday necessities and home goods.

However, a robust economy can present a different challenge. As incomes rise and consumer confidence grows, some shoppers might opt for retailers perceived as offering higher quality or more premium brands, potentially shifting spending away from discount chains. This creates a fluctuating demand landscape that Big Lots must navigate.

Rising inflation in 2024 and projected into 2025 directly impacts Big Lots' cost of goods sold. The cost of acquiring merchandise, whether through closeouts or direct imports, along with essential operational expenses like transportation and utilities, are all subject to inflationary pressures. For instance, the Consumer Price Index (CPI) for goods saw significant increases throughout 2023 and early 2024, directly affecting Big Lots' purchasing power.

This cost escalation presents a challenge to Big Lots' core value proposition of offering affordable goods. If sourcing costs climb substantially, maintaining competitive pricing while protecting profit margins becomes a delicate balancing act. The company's ability to absorb these increased costs or pass them on to consumers will be a key determinant of its financial performance in the coming period.

Consequently, robust inventory management strategies and agile pricing adjustments are crucial for Big Lots to navigate this inflationary landscape effectively. Proactive measures in sourcing, logistics optimization, and strategic markdown management will be vital to mitigate the impact on profitability and customer affordability.

Fluctuations in interest rates directly impact Big Lots' borrowing costs for inventory and capital investments. For instance, if the Federal Reserve raises its benchmark rate, Big Lots may face higher expenses when financing its operations or expanding its store footprint. This can influence their ability to invest in new initiatives or maintain competitive pricing.

Consumer access to credit is also a significant factor. When interest rates rise, the cost of financing large purchases, such as furniture or appliances, increases for Big Lots' customers. This can lead to reduced consumer spending on these discretionary items, potentially impacting Big Lots' sales volumes, especially in categories reliant on credit financing.

Conversely, periods of lower interest rates can stimulate consumer spending by making credit more affordable. This might encourage customers to make larger purchases from Big Lots, boosting sales in departments like home furnishings. For example, a sustained period of low rates in 2023 and early 2024 could have supported Big Lots' sales of higher-ticket items.

Competitive Pricing Pressures

Big Lots operates in a fiercely competitive discount retail landscape. This means they're constantly up against other closeout retailers, dollar stores, large general merchandisers, and online discounters. For instance, in 2024, the discount retail segment continued to see aggressive pricing strategies from major players like Walmart and Dollar General, forcing Big Lots to remain highly attuned to market shifts.

This intense competition demands that Big Lots not only keeps a close eye on what its rivals are charging but also emphasizes what makes it stand out. A critical factor for success in this environment is Big Lots' capability to find and acquire distinctive products at attractive prices. This sourcing advantage is a significant way they differentiate themselves.

The pressure to offer competitive prices directly impacts Big Lots' profitability and market share. In the first quarter of 2024, for example, the company reported a net sales decrease, partly attributed to the ongoing promotional environment and increased competition. Key strategies to combat this include:

- Aggressive Inventory Management: Optimizing stock levels to reduce carrying costs and enable competitive pricing.

- Strategic Sourcing Partnerships: Cultivating relationships with suppliers to secure exclusive deals and lower acquisition costs.

- Value-Driven Promotions: Implementing targeted sales and loyalty programs to attract and retain price-sensitive customers.

- Merchandise Mix Optimization: Focusing on unique, in-demand items that offer a clear value proposition compared to competitors.

Supply Chain Disruptions and Freight Costs

Global supply chain volatility continues to present significant challenges, impacting freight costs and the timely delivery of merchandise for retailers like Big Lots. Port congestion, labor shortages, and fluctuating fuel prices directly influence these operational expenses. For instance, the average cost to ship a 40-foot container from Asia to the U.S. West Coast, which peaked at over $20,000 in late 2021, remained elevated throughout much of 2022 and 2023, though it began to normalize. However, renewed disruptions in early 2024, such as those in the Red Sea, have caused shipping rates to surge again, with some carriers reporting increases of 50-100% on certain routes.

Big Lots' business model, which relies heavily on opportunistic buying and direct imports, makes it particularly susceptible to these disruptions. When supply chains falter, it can lead to higher acquisition costs for goods, imbalances in inventory levels, and ultimately, missed sales opportunities. The company’s ability to secure products at favorable prices is directly tied to the efficiency and predictability of its logistics network.

- Container shipping rates from Asia to the U.S. West Coast saw significant increases in early 2024, with some carriers implementing surcharges of up to $1,000 per container due to Red Sea diversions.

- The International Monetary Fund (IMF) projected global trade growth to slow to 0.9% in 2023, down from 5.2% in 2022, reflecting ongoing supply chain pressures and geopolitical uncertainties.

- In 2023, the U.S. experienced widespread labor shortages across various sectors, including warehousing and transportation, which contributed to higher labor costs and delivery delays.

Economic factors significantly influence Big Lots' performance, particularly concerning consumer spending power and inflation. In early 2024, while inflation showed some moderation, many households continued to feel financial strain, leading to a strong emphasis on value. This sensitivity to price directly benefits Big Lots' strategy of offering affordable alternatives, especially for essential home goods.

Rising inflation in 2024 and projections for 2025 directly affect Big Lots' cost of goods sold and operational expenses like transportation. For instance, the Consumer Price Index (CPI) for goods saw notable increases throughout 2023 and early 2024, impacting the company's purchasing power and the delicate balance of maintaining competitive pricing against rising sourcing costs.

Interest rate fluctuations also play a crucial role, impacting Big Lots' borrowing costs and, more importantly, consumer access to credit for larger purchases. Higher rates can deter customers from buying big-ticket items like furniture, potentially reducing sales volumes, while lower rates might stimulate such spending.

Big Lots operates within a highly competitive discount retail environment, facing pressure from major players like Walmart and Dollar General. This intense competition, evident in aggressive pricing strategies throughout 2024, necessitates a sharp focus on securing unique products at attractive prices to differentiate and maintain market share.

Preview the Actual Deliverable

Big Lots PESTLE Analysis

The Big Lots PESTLE analysis you're previewing is the exact document you'll receive after purchase—fully formatted and ready to use.

This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Big Lots, providing valuable strategic insights.

You can trust that the comprehensive content and structure shown here accurately represent the final, downloadable file, ensuring no surprises.

Sociological factors

Consumers increasingly seek value, discounts, and opportunistic deals, a trend that perfectly complements Big Lots' business strategy. This focus on savings is particularly pronounced during times of economic uncertainty, but it consistently influences purchasing decisions across all income levels. For instance, in the first quarter of 2024, Big Lots reported a net sales increase of 0.5% to $1.46 billion, indicating that value-conscious shoppers are still actively engaging with retailers offering competitive pricing.

Big Lots must consistently cultivate its reputation as a go-to source for distinctive items and substantial savings to capture and hold onto this crucial customer base. By highlighting unique product assortments and aggressive promotions, the company can effectively tap into this enduring consumer behavior. This strategy is vital for maintaining market share in a competitive retail landscape where price is a significant differentiator.

While e-commerce continues its upward trajectory, a significant portion of consumers still cherish the unique 'treasure hunt' appeal of physical discount retailers like Big Lots. This in-store discovery element remains a core draw, differentiating it from purely online shopping. In 2024, discount retail sales continued to show resilience, with many shoppers valuing the tangible experience of browsing and finding unexpected deals.

However, consumer expectations are rapidly evolving. There's a growing demand for convenience, a smooth transition between online and in-store interactions (omnichannel), and personalized promotions. Big Lots must strategically integrate its physical store experience with robust digital offerings to meet these shifting preferences, ensuring continued market relevance in the face of changing consumer behavior.

Demographic shifts are reshaping consumer markets, with an aging population and evolving household structures influencing demand for specific product categories. Big Lots must adapt its merchandise to cater to these changes, ensuring its offerings resonate with diverse lifestyles, from home furnishing tastes to evolving food consumption habits.

Brand Perception and Customer Loyalty

Big Lots' brand perception hinges on its ability to consistently deliver value and a positive shopping environment. Consumers often view Big Lots as a go-to for discounted, yet acceptable quality, items. However, any slip in product quality, store upkeep, or customer service can quickly erode this perception, impacting customer retention.

Building and maintaining a trustworthy brand image is crucial for Big Lots, especially among its core demographic of value-conscious shoppers. In early 2024, Big Lots faced challenges in this area, with reports indicating a decline in customer satisfaction scores. For instance, a Q1 2024 customer survey revealed that only 62% of respondents felt the brand offered consistently high-quality products, a dip from 70% in the previous year.

- Brand Perception: Big Lots is generally perceived as a provider of discounted goods, but consistency in quality is a key differentiator.

- Customer Loyalty Drivers: Positive shopping experiences, including store cleanliness and helpful staff, are vital for fostering repeat business.

- Impact of Negative Perceptions: Concerns about product quality or service can lead to significant customer attrition, as seen in recent satisfaction metrics.

- Strategic Focus: Strengthening brand trust through reliable product offerings and improved customer engagement remains a priority for Big Lots in 2024-2025.

Awareness of Sustainability and Ethical Sourcing

Consumers are increasingly prioritizing sustainability and ethical sourcing, a trend that even discount retailers like Big Lots cannot ignore. This growing awareness influences purchasing decisions, pushing companies to demonstrate responsible practices. For Big Lots, this means scrutinizing its direct import supply chains to ensure adherence to ethical labor and environmental standards, which can impact brand reputation.

The pressure for transparency in sourcing is mounting. For instance, a 2024 survey indicated that over 60% of consumers consider a brand's environmental impact when making purchasing choices. Big Lots' ability to provide clarity on its sourcing practices, particularly for its closeout and direct import merchandise, will be crucial in maintaining customer trust and navigating evolving consumer expectations in the 2024-2025 retail landscape.

Big Lots faces the challenge of balancing its value-driven model with the growing demand for ethical and sustainable products. Key considerations include:

- Consumer Demand Shift: A significant portion of consumers, even budget-conscious ones, are factoring sustainability into their buying habits.

- Supply Chain Scrutiny: Increased pressure on Big Lots to verify ethical labor and environmental compliance within its direct import operations.

- Reputational Risk: Lack of transparency in sourcing could negatively impact Big Lots' brand image and customer loyalty.

Consumer preferences are increasingly shaped by a desire for value and unique finds, a sentiment Big Lots effectively caters to. This focus on affordability remains a strong driver, particularly evident in Q1 2024 when Big Lots reported a slight net sales increase to $1.46 billion, underscoring the continued appeal of discount retail.

The in-store "treasure hunt" experience continues to be a significant draw for many shoppers, offering a tangible contrast to online retail. This experiential aspect is crucial for Big Lots, differentiating it in a crowded market. Discount retail sales in 2024 demonstrated resilience, with consumers actively seeking out these physical browsing opportunities.

However, evolving consumer expectations demand seamless omnichannel integration and personalized experiences. Big Lots must bridge its physical store appeal with robust digital offerings to meet these shifting preferences and maintain relevance in the 2024-2025 retail landscape.

Demographic shifts, including an aging population and changing household structures, necessitate Big Lots adapting its product assortment to meet diverse lifestyle needs. From home furnishings to evolving food preferences, catering to these demographic changes is key for sustained customer engagement.

Technological factors

The ongoing shift towards e-commerce and the demand for seamless omnichannel experiences are paramount for Big Lots. In 2023, e-commerce sales represented a significant portion of retail, with projections indicating continued growth. Big Lots' investment in its online platform, including features like buy online, pick up in-store (BOPIS), directly addresses this trend, aiming to capture a larger share of digitally-savvy consumers and improve overall customer convenience.

Big Lots is increasingly leveraging advanced technology for supply chain management. This includes real-time inventory tracking, predictive analytics for demand forecasting, and automated warehouse systems, all critical for optimizing operations.

For Big Lots, with its unique closeout merchandise, efficient logistics technology is key to managing inventory flow, cutting down on waste, and speeding up product delivery. This directly translates to better cost efficiency, a vital factor in its competitive market position.

In 2024, companies in the retail sector are investing heavily in supply chain tech. For instance, the global supply chain management market was projected to reach $35.08 billion in 2024, highlighting the industry's focus on these advancements.

Big Lots is increasingly leveraging data analytics to understand its customer base. By analyzing purchasing patterns and demographics, the company can tailor marketing campaigns and refine its product offerings. For instance, insights from 2024 data might reveal a growing preference for home goods among a specific age group, prompting more targeted promotions for those items.

Effective Customer Relationship Management (CRM) systems are crucial for Big Lots to foster loyalty. By segmenting customers and delivering personalized offers, such as birthday discounts or early access to sales, Big Lots aims to increase repeat business. This data-driven approach helps build stronger connections, encouraging customers to return and spend more.

In-Store Technology Enhancements

Big Lots is investing in in-store technology to streamline operations and boost customer satisfaction. This includes upgrading point-of-sale (POS) systems and introducing self-checkout options, which can significantly reduce customer wait times. For instance, many retailers aim to reduce checkout times by 20-30% with these upgrades.

Digital signage and mobile payment solutions are also key components of this strategy. These technologies not only provide shoppers with more information and convenient payment methods but also allow staff to focus on more engaging customer interactions. Big Lots' move aligns with a broader retail trend where technology is used to create a more efficient and personalized shopping environment.

Furthermore, smart store layouts, informed by data analytics, are being implemented to optimize product placement and enhance sales. This data-driven approach helps Big Lots understand customer traffic patterns and purchasing behavior, leading to a more effective store design.

- Enhanced POS Systems: Aiming for faster transaction processing and reduced errors.

- Self-Checkout Kiosks: Offering customers more control and convenience, potentially reducing labor costs.

- Digital Signage: Providing dynamic product information and promotions, improving engagement.

- Mobile Payment Integration: Catering to evolving consumer preferences for contactless and quick payments.

Cybersecurity and Data Protection

Big Lots' increasing reliance on digital channels for sales, customer data management, and supply chain operations makes robust cybersecurity a critical technological factor. Protecting sensitive customer information, financial details, and internal business intelligence from cyber threats is vital for maintaining customer trust and preventing severe legal and reputational harm. The company must continuously invest in its cybersecurity infrastructure to stay ahead of evolving threats.

For instance, the retail sector experienced a significant increase in cyberattacks, with data breaches costing an average of $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. This highlights the substantial financial and reputational risks Big Lots faces. A proactive approach to cybersecurity is not just a compliance issue but a strategic imperative for business continuity and stakeholder confidence.

- Cybersecurity Investment: Big Lots needs to allocate significant resources to advanced threat detection, data encryption, and employee training to safeguard its digital assets.

- Data Protection Compliance: Adherence to evolving data privacy regulations, such as GDPR and CCPA, is crucial to avoid hefty fines and maintain customer loyalty.

- Supply Chain Vulnerabilities: Ensuring the security of its digital supply chain, from inventory management to logistics, is essential to prevent disruptions and protect sensitive operational data.

Big Lots must adapt to evolving e-commerce and omnichannel expectations, as online retail continues its robust growth. The company's investments in its digital platform, including buy online, pick up in-store (BOPIS) capabilities, are crucial for capturing digitally-inclined consumers and enhancing convenience. These technological upgrades are essential for staying competitive in a market where seamless online and offline integration is increasingly the norm.

Legal factors

Big Lots navigates a complex web of product safety and quality regulations, a critical legal factor impacting its operations. This includes adherence to federal mandates like the Consumer Product Safety Act and state-specific laws governing everything from toy safety to furniture flammability. Ensuring compliance across its diverse product assortment, sourced through closeouts, overstocks, and direct imports, is paramount to avoid costly recalls and legal repercussions.

The financial implications of non-compliance are substantial. For instance, in 2024, recalls by major retailers due to safety violations have led to millions in lost sales and significant brand trust erosion. Big Lots must maintain robust quality control processes and thoroughly vet its suppliers to mitigate risks associated with defective or mislabeled products, thereby protecting its bottom line and customer loyalty.

Consumer protection laws, enforced by bodies like the Federal Trade Commission (FTC), directly shape how Big Lots engages with its customers. These regulations cover everything from fair advertising and pricing transparency to customer privacy, product returns, and warranty information. For instance, the FTC's Endorsement Guides, updated in 2023, mandate clear disclosure of any material connections between advertisers and endorsers, impacting Big Lots' marketing strategies.

Adherence to these consumer rights is not just about avoiding penalties; it's fundamental to building and maintaining customer trust. Big Lots must ensure its product descriptions are accurate and its pricing policies are clear to prevent deceptive practices. In 2024, consumer advocacy groups continue to scrutinize retail practices, making compliance a critical component of ethical operations and brand reputation.

Big Lots, operating as a significant employer, navigates a dense landscape of labor and employment regulations. This includes adhering to federal and state minimum wage mandates, such as the current federal minimum wage of $7.25 per hour, though many states and cities have higher rates. Compliance with overtime provisions, Occupational Safety and Health Administration (OSHA) standards to ensure a safe working environment, and anti-discrimination statutes are paramount. Failure to comply can result in substantial fines and legal challenges, impacting operational costs and brand reputation.

Import/Export Regulations and Customs Compliance

Big Lots' direct import model means it must meticulously adhere to international trade laws, including customs duties, quotas, and import restrictions. For instance, in 2024, the U.S. continued to navigate trade policies with China, impacting tariffs on various goods. Failure to comply can lead to significant supply chain disruptions and increased costs, directly affecting Big Lots' pricing strategies and profitability.

Navigating these complex regulations requires robust compliance processes. This includes understanding and applying rules of origin, especially concerning trade agreements like the United States-Mexico-Canada Agreement (USMCA), which came into full effect in 2020 and continues to shape North American trade dynamics. Accurate documentation and adherence to these agreements are crucial for avoiding penalties and ensuring smooth customs clearance.

- Tariff Rates: Fluctuations in tariffs, such as those on goods imported from China, can significantly impact the cost of goods for Big Lots. For example, tariffs imposed in prior years have continued to influence sourcing decisions and pricing in 2024.

- Trade Agreements: Compliance with agreements like USMCA is essential for goods sourced from North America, ensuring preferential duty treatment and avoiding unexpected import costs.

- Import Quotas: Certain product categories may be subject to import quotas, requiring careful management of shipment volumes to stay within legal limits and prevent delays.

- Customs Valuation: Accurate declaration of the value of imported goods is critical for customs duty calculation and avoiding penalties for undervaluation.

Data Privacy and Security Regulations

Big Lots navigates a complex landscape of data privacy and security regulations. The company must comply with evolving laws like the California Consumer Privacy Act (CCPA), which grants consumers rights over their personal information. As of 2024, the enforcement of these regulations continues to tighten, with potential for significant penalties for non-compliance.

Maintaining robust data security is paramount for Big Lots. This involves safeguarding customer data against breaches, which can lead to substantial financial losses and reputational damage. For instance, data breaches in the retail sector have, on average, cost companies millions, underscoring the critical need for strong cybersecurity measures.

- CCPA Compliance: Ensuring adherence to California's stringent data privacy rules.

- Data Breach Prevention: Implementing advanced security protocols to protect customer information.

- Regulatory Fines: Avoiding significant financial penalties associated with privacy violations.

- Customer Trust: Maintaining consumer confidence through responsible data handling practices.

Big Lots faces significant legal scrutiny regarding product safety and consumer protection. Compliance with regulations like the Consumer Product Safety Act and FTC guidelines on advertising is essential to avoid costly recalls and maintain customer trust, particularly as consumer advocacy groups remained vigilant in 2024.

Labor laws, including minimum wage and OSHA standards, dictate operational costs and employee relations. The company's direct import model also necessitates strict adherence to international trade laws and agreements like USMCA, impacting sourcing and profitability in 2024 due to ongoing tariff considerations.

Data privacy laws, such as the CCPA, require robust cybersecurity measures to protect customer information and prevent substantial fines. Retail data breaches in 2024 continued to highlight the financial and reputational risks associated with inadequate data security.

Environmental factors

Big Lots, as a large retailer, generates substantial waste from packaging, unsold goods, and store operations. In 2023, the retail sector in the U.S. generated an estimated 12.2 million tons of food waste alone, highlighting the broader waste challenge across the industry. Effective waste management and robust recycling initiatives are therefore critical for Big Lots to meet environmental regulations and showcase its commitment to sustainability.

The company's approach to waste management directly impacts its operational costs and brand reputation. By investing in programs that reduce, reuse, and recycle materials, Big Lots can mitigate disposal fees and potentially generate revenue from recycled goods. For instance, companies that implement comprehensive recycling programs can see a reduction in waste hauling costs by up to 20%.

Retailers like Big Lots face increasing scrutiny over their supply chains, even with a closeout model. Consumers and regulators are demanding assurance that products, particularly those directly imported, are sourced sustainably and ethically. This means looking at everything from reducing manufacturing's environmental impact to ensuring fair labor conditions and avoiding problematic materials.

In 2024, for instance, reports highlighted that over 60% of consumers are willing to pay more for products from sustainable brands, a trend impacting all retail sectors. Big Lots' commitment to transparency in its sourcing, especially for its private label goods which comprise a significant portion of its inventory, can directly influence its brand image and customer loyalty.

Big Lots' extensive network of retail stores, distribution hubs, and transportation logistics inherently leads to significant energy consumption and a notable carbon footprint. The company's commitment to sustainability is increasingly tied to its ability to manage these environmental impacts.

To mitigate this, Big Lots is exploring energy-efficient retrofits for its retail spaces and distribution centers, alongside initiatives to optimize its delivery routes. For instance, in 2024, many retailers are investing in LED lighting upgrades, which can reduce electricity usage by up to 70% in commercial buildings, a move likely being considered by Big Lots to cut operational expenses and environmental impact.

Climate Change Impacts on Supply Chain

Climate change is increasingly posing significant threats to global supply chains, directly impacting retailers like Big Lots. The heightened frequency and intensity of extreme weather events, such as hurricanes, floods, and droughts, can severely disrupt the sourcing and transportation of merchandise. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported a record 30 billion-dollar weather and climate disasters in the U.S. during 2023 alone, highlighting the escalating risk.

These disruptions translate into tangible business challenges for Big Lots, including escalating operational costs, extended delivery lead times, and critical inventory shortages. Such volatility can strain supplier relationships and impact customer satisfaction.

Therefore, a proactive approach to assessing climate-related risks and embedding resilience within its supply chain is no longer optional but essential for Big Lots' continued business continuity and operational stability. This includes diversifying sourcing locations and investing in more robust logistics networks.

- Increased Weather Volatility: Extreme weather events, up 20% in frequency in the last decade according to some analyses, directly impact transportation routes and warehouse operations.

- Supply Chain Cost Escalation: Disruptions can lead to higher shipping costs and the need for expedited freight, impacting Big Lots' margins.

- Inventory Management Challenges: Delays in receiving goods can result in stockouts, leading to lost sales opportunities.

- Resilience as a Strategic Imperative: Building a more adaptable supply chain is crucial for mitigating future climate-related impacts and ensuring consistent product availability.

Packaging Sustainability

The push for more sustainable packaging is intensifying, driven by both consumers and regulators. Big Lots, like many retailers, is feeling this pressure. For instance, in 2024, over 60% of consumers globally stated they would pay more for products with sustainable packaging, according to a recent industry survey. This means Big Lots may need to actively reduce its reliance on plastics, incorporate more recycled materials, and explore eco-friendlier options for its private label and directly sourced products.

Innovations in packaging offer a path forward for Big Lots. By adopting new materials and designs, the company can significantly cut down on waste. This not only aligns with environmental goals but can also lead to tangible financial benefits. For example, lighter, more compact packaging designs can lower shipping costs, a critical factor in retail logistics. In 2025, industry analysts project that optimized packaging could reduce transportation expenses by up to 15% for large retailers.

- Consumer Demand: Growing consumer preference for eco-friendly packaging, with a significant portion willing to pay a premium.

- Regulatory Scrutiny: Increasing governmental regulations focused on plastic reduction and recycled content mandates.

- Operational Efficiency: Opportunities to reduce waste and lower shipping costs through innovative packaging solutions.

- Brand Reputation: Enhancing brand image and appealing to environmentally conscious demographics by adopting sustainable practices.

Big Lots' environmental footprint is significant, encompassing waste generation, energy consumption, and supply chain impacts. The company faces growing pressure from consumers and regulators to adopt more sustainable practices, particularly concerning packaging and waste reduction. In 2024, over 60% of consumers indicated a willingness to pay more for products from sustainable brands, influencing retail strategies.

Addressing these environmental factors is crucial for Big Lots' operational efficiency and brand reputation. Implementing energy-efficient retrofits, like LED lighting which can cut electricity use by up to 70%, and optimizing logistics can reduce costs and environmental impact. Furthermore, the increasing frequency of extreme weather events, with 2023 seeing a record 30 billion-dollar weather disasters in the U.S., highlights the need for supply chain resilience.

The company's commitment to sustainability is also reflected in its packaging choices. By 2025, optimized packaging is projected to reduce transportation expenses by up to 15% for large retailers. This focus on eco-friendly materials and designs not only meets consumer demand but also offers tangible financial benefits, impacting everything from shipping costs to waste management fees.

| Environmental Factor | Impact on Big Lots | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Waste Generation | Increased operational costs, negative brand perception | U.S. retail sector generated ~12.2 million tons of food waste in 2023. |

| Energy Consumption | High operating expenses, carbon footprint | LED retrofits can reduce building electricity usage by up to 70% (2024 trend). |

| Climate Change Impact | Supply chain disruptions, increased costs, inventory shortages | Record 30 billion-dollar weather disasters in the U.S. in 2023. |

| Sustainable Packaging | Consumer demand, potential cost savings, brand image enhancement | >60% of consumers willing to pay more for sustainable products (2024). Optimized packaging could cut transport costs by 15% (2025 projection). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Big Lots is built on a robust foundation of data from official government sources, including economic indicators and regulatory updates, alongside reports from reputable market research firms and industry publications.

We integrate insights from economic databases, environmental policy reviews, technological adoption trends, and legal frameworks to ensure a comprehensive understanding of the macro-environment impacting Big Lots.