Big Lots Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Big Lots Bundle

Big Lots faces significant competitive rivalry, with numerous players vying for market share in the discount retail sector. Understanding the bargaining power of both buyers and suppliers is crucial for their operational success.

The threat of substitutes looms large, as consumers have many alternative channels for purchasing household goods and apparel. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Big Lots’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Big Lots' business model, heavily reliant on closeouts and overstocks, inherently creates a fragmented supplier base. This means the company isn't dependent on a few major manufacturers, but rather sources from a wide array of distressed inventory sellers.

This fragmentation significantly weakens the bargaining power of individual suppliers. With numerous options available, Big Lots can easily switch between sellers if pricing or terms become unfavorable, thereby maintaining a strong negotiating stance.

In 2024, the retail sector continued to see significant inventory overhangs from various industries, providing Big Lots with a consistent flow of liquidation opportunities. This abundance of distressed merchandise strengthens Big Lots' ability to secure deeply discounted pricing, a key element in its competitive strategy.

Big Lots' reliance on opportunistic buying significantly weakens supplier power. By actively seeking out and purchasing excess or distressed inventory, the company creates demand for suppliers needing to clear stock quickly. This dynamic allows Big Lots to negotiate favorable terms, as suppliers are often eager to make a sale rather than hold onto unsold goods.

The company's strategic goal to increase its 'bargains penetration' to 75% of sales, which includes extreme bargains, further solidifies this advantage. This aggressive pursuit of discounted merchandise means suppliers who can offer these deals are more likely to find a willing buyer in Big Lots, thus diminishing their ability to dictate terms.

Big Lots cultivates direct import relationships, fostering more structured ties with manufacturers. Despite this, the company's substantial import volume, around 25,000 containers annually, empowers it to negotiate for value-engineered products and competitive pricing, thereby mitigating supplier leverage.

Importance of Big Lots as an Outlet

Big Lots plays a significant role as an outlet for suppliers dealing with excess or liquidated inventory. This is especially true for distressed retailers and vendors who need to offload merchandise quickly. For these suppliers, Big Lots offers a reliable channel to move large volumes, often at a discount, rather than incurring the costs of holding onto unsellable stock.

This dynamic grants Big Lots a degree of bargaining power. Suppliers may prioritize selling to Big Lots, even if it means accepting lower profit margins, to avoid the financial drain of unsold goods. In 2023, the retail sector experienced significant inventory challenges, with many businesses seeking efficient liquidation solutions, further enhancing Big Lots' position.

- Suppliers' Need for Liquidation: Big Lots provides a vital outlet for suppliers facing overstock or liquidation.

- Big Lots' Bargaining Advantage: The need to move inventory quickly gives Big Lots leverage in negotiations.

- Industry Context: In 2023, widespread inventory issues in retail amplified the importance of liquidation channels like Big Lots.

Supplier Compliance Requirements

Big Lots maintains robust vendor compliance requirements, which suppliers must meet. This establishes a degree of control, influencing the bargaining power of suppliers. For instance, non-compliance can lead to financial penalties like deductions, reinforcing Big Lots' leverage in setting terms.

The company actively encourages new vendors, but for those exceeding 25 shipments annually, Electronic Data Interchange (EDI) setup is mandatory. This requirement streamlines operations and further solidifies Big Lots' ability to manage its supplier network effectively, potentially mitigating supplier power.

- Vendor Compliance: Big Lots has clear guidelines that suppliers must follow.

- Consequences of Non-Compliance: Deductions can be imposed for failing to meet standards.

- New Vendor Onboarding: Encouraged, with specific technical requirements for high-volume suppliers.

- EDI Requirement: Mandatory for vendors with over 25 shipments per year, indicating operational integration.

Big Lots' reliance on opportunistic buying, particularly distressed and closeout merchandise, significantly diminishes supplier bargaining power. The company's ability to absorb large volumes of excess inventory from a fragmented supplier base means it can dictate terms, as suppliers often prioritize liquidation over holding unsold goods.

In 2024, the retail landscape continued to present ample opportunities for Big Lots to secure deeply discounted inventory, reinforcing its negotiating advantage. This strategic focus on maximizing 'bargains penetration' to 75% of sales further solidifies its position, as suppliers eager to offload stock find a willing buyer.

Big Lots' operational scale, including its substantial direct import volume, allows it to negotiate favorable pricing and value-engineered products, effectively counteracting supplier leverage. Furthermore, its stringent vendor compliance requirements and mandatory EDI for high-volume suppliers streamline operations and reinforce Big Lots' control over its supply chain.

| Factor | Impact on Big Lots' Supplier Bargaining Power | Supporting Data/Context (2023-2024) |

|---|---|---|

| Supplier Fragmentation | Weakens supplier power | Big Lots sources from a wide array of distressed inventory sellers. |

| Opportunistic Buying Strategy | Weakens supplier power | Abundance of distressed merchandise in 2024 retail sector provides consistent liquidation opportunities. |

| Vendor Compliance & EDI | Weakens supplier power | Mandatory EDI for over 25 shipments annually streamlines operations and enhances Big Lots' control. |

| Direct Import Volume | Weakens supplier power | Approximately 25,000 containers annually allow negotiation for value-engineered products and competitive pricing. |

What is included in the product

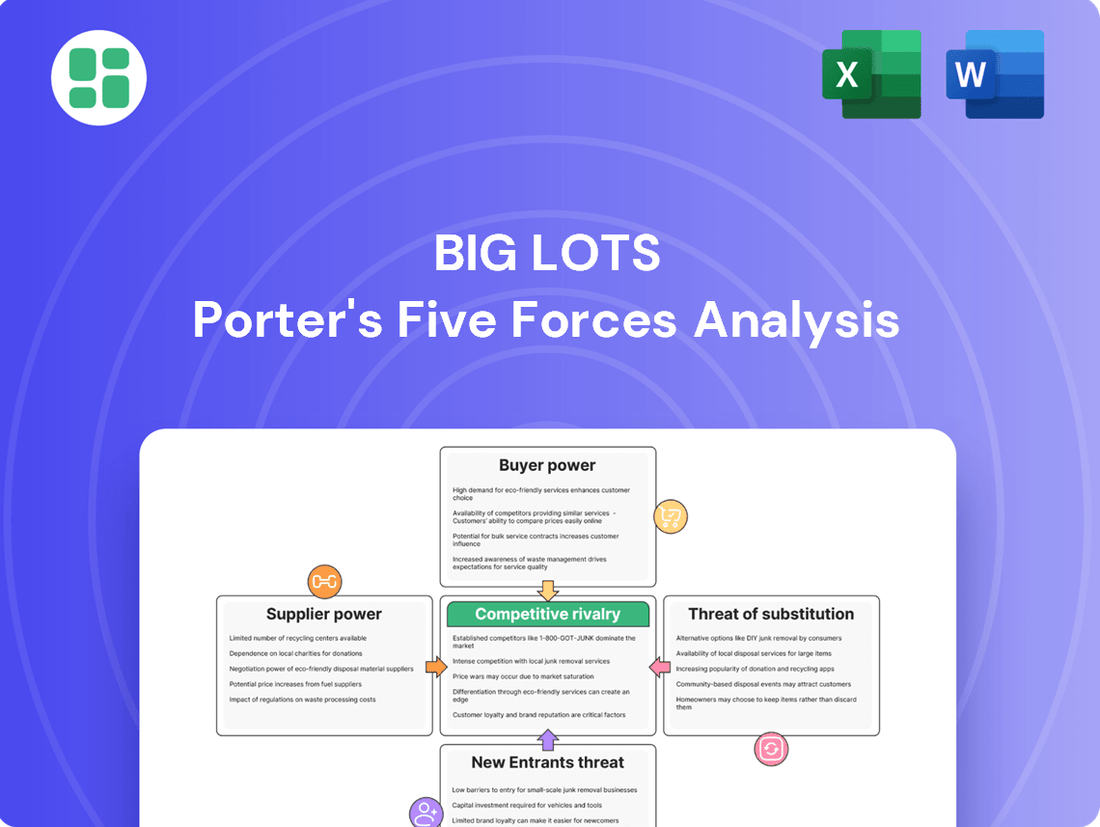

Tailored exclusively for Big Lots, analyzing its position within its competitive landscape by examining supplier power, buyer bargaining, new entrant threats, substitute products, and existing rivalry.

Instantly understand competitive pressures with a clear, visual representation of Big Lots' Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

Big Lots' customer base is notably price-sensitive, a characteristic amplified by ongoing economic uncertainties and inflationary pressures. This means customers are quick to compare prices and will readily switch to competitors offering better deals, thereby strengthening their leverage.

In 2024, with persistent inflation impacting household budgets, consumers are actively prioritizing value. This heightened focus on cost-effectiveness means Big Lots' customers are more inclined to seek out discounts and promotions, directly influencing the company's pricing strategies and margins.

Customers at Big Lots face a significant number of alternative options. Retailers like Dollar General, Dollar Tree, Five Below, TJ Maxx, and Ross, along with online giants such as Amazon and Walmart, offer similar product categories. This abundance of choices means customers can easily switch if they find better prices or product selections elsewhere, thereby increasing their bargaining power.

The ease of switching between these numerous competitors significantly lowers the cost for customers to find alternative solutions. This directly translates to increased leverage for consumers, who can more readily demand lower prices or improved value propositions from Big Lots. The discount and dollar store sector, in particular, has experienced robust growth, with many of these alternatives expanding their reach and offerings throughout 2024 and into early 2025.

Big Lots' product assortment, while varied, often features items in categories like home décor and everyday consumables that aren't significantly different from what competitors offer. This makes it simpler for shoppers to find comparable goods at other retailers, which naturally increases their leverage.

The company's historical financial performance, including its struggles with consistent profitability, as highlighted by a net sales decline in fiscal year 2023, further underscores this point. When a business faces challenges in maintaining profitability and adapting to evolving consumer tastes, customers gain more bargaining power because they have less reason to be loyal to a specific brand or retailer.

Impact of E-commerce and Omnichannel Shopping

The growth of e-commerce and the demand for seamless omnichannel shopping significantly enhance customer bargaining power. With a few clicks, consumers can readily compare prices, product features, and reviews across numerous retailers, putting pressure on companies to offer competitive value. This digital shift means customers can easily switch to alternatives if their expectations for convenience and price aren't met.

Big Lots has faced challenges in fully leveraging its e-commerce and omnichannel strategies. For instance, in fiscal year 2023, while the company reported net sales of $5.1 billion, its digital sales penetration remained a key area for development. This lag in online capabilities can empower customers to seek out competitors offering a more robust and user-friendly digital experience, thereby increasing their leverage.

- Price Transparency: Online platforms allow for effortless price comparison, forcing retailers to remain competitive.

- Convenience Factor: Omnichannel offerings, like buy-online-pickup-in-store, are now expected by consumers.

- Switching Costs: Low switching costs in retail empower customers to easily move to other providers offering better deals or experiences.

Declining Discretionary Spending

Recent economic conditions, marked by persistent inflation and higher interest rates, have significantly impacted consumer behavior. This has resulted in a noticeable decline in discretionary spending, especially for non-essential goods like furniture. For instance, in the first quarter of 2024, retail sales of furniture and home furnishings saw a contraction compared to the previous year, reflecting this trend.

This shift forces consumers to become more discerning about their purchases. They are actively seeking out deals and prioritizing value, which inherently amplifies their bargaining power. When consumers have fewer options they can afford or feel less urgency to buy, they can negotiate harder or simply choose not to buy, putting pressure on retailers.

- Reduced Consumer Spending: High inflation and interest rates have curtailed discretionary budgets.

- Demand for Value: Consumers are prioritizing extreme value and lower prices.

- Increased Selectivity: Shoppers are more cautious and deliberate in their purchasing decisions.

- Amplified Bargaining Position: Consumers gain leverage when their spending power is diminished.

Big Lots customers wield significant bargaining power due to the highly competitive retail landscape and their own price sensitivity, especially in the current economic climate of 2024. With numerous alternatives readily available and low switching costs, consumers can easily shift their spending to retailers offering better value, directly impacting Big Lots' pricing and profitability.

The company's historical financial performance, including a net sales decline in fiscal year 2023, indicates that customers may not perceive a strong unique value proposition, further empowering them to seek better options. In 2024, with inflation impacting discretionary spending, particularly on items like furniture, consumers are more inclined to prioritize deals, amplifying their leverage over retailers like Big Lots.

The increasing prevalence of e-commerce and omnichannel shopping further enhances customer bargaining power by facilitating easy price and product comparisons. Big Lots' lagging digital sales penetration in fiscal year 2023 suggests customers can readily find more convenient and competitively priced alternatives online.

| Factor | Impact on Big Lots' Customer Bargaining Power | 2024 Context |

|---|---|---|

| Competition | High number of alternatives (e.g., Dollar General, Walmart, Amazon) | Continued expansion and aggressive pricing from competitors |

| Price Sensitivity | Customers prioritize value and seek discounts | Inflationary pressures heighten focus on affordability |

| Switching Costs | Low; easy to move between retailers | Digital platforms facilitate quick comparisons and switches |

| Product Differentiation | Many products are comparable to competitors' offerings | Lack of unique selling points strengthens customer leverage |

Preview Before You Purchase

Big Lots Porter's Five Forces Analysis

This preview displays the exact Big Lots Porter's Five Forces Analysis you will receive upon purchase, offering a comprehensive examination of competitive forces within the discount retail sector. You'll gain insights into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes. This professionally formatted document is ready for immediate download and use, ensuring you get the complete analysis without any discrepancies.

Rivalry Among Competitors

The discount retail landscape is fiercely competitive, with Big Lots facing formidable rivals. Established giants like Dollar General and Dollar Tree, alongside specialized players such as Five Below, are constantly vying for market share. Additionally, off-price retailers like TJ Maxx, Ross, and Burlington are expanding their store counts and diversifying their product offerings, intensifying the pressure on Big Lots' sales and profit margins.

Big Lots operates in a highly competitive retail environment where price wars are a frequent occurrence, directly impacting profitability and putting significant pressure on profit margins. The company's strategy of offering extreme bargains, while appealing to its price-sensitive customer base, necessitates highly efficient sourcing and supply chain management to remain profitable when competitors engage in aggressive pricing tactics.

In 2023, Big Lots reported a net sales decline, with total net sales for the fiscal year reaching $4.5 billion, a decrease from $5.2 billion in the prior year. This trend underscores the ongoing challenges the company faces in a market where rivals can often undercut prices, forcing Big Lots to constantly re-evaluate its cost structure to maintain any semblance of healthy margins.

Big Lots faces intense competition from traditional discounters and e-commerce titans like Amazon and Walmart, who boast superior digital infrastructure and seamless omnichannel offerings. In 2023, Big Lots reported a net sales decline, underscoring its struggle to keep pace with rivals who have invested heavily in online platforms and integrated customer experiences.

The company's delayed digital transformation has been a significant handicap, leaving it less equipped to meet evolving consumer demands for convenient online shopping and flexible fulfillment options. This lag in adapting to digital trends has made its predominantly brick-and-mortar model increasingly less competitive against more agile, digitally-native or digitally-enhanced retailers.

Market Saturation and Store Expansion

The discount retail landscape is intensely competitive, with significant market saturation in many regions due to aggressive expansion by rivals. While Big Lots has strategically closed underperforming stores, competitors like Dollar General, Dollar Tree, and Five Below have been actively opening new locations throughout 2024, intensifying the fight for customers.

This expansion directly impacts Big Lots by increasing the number of competing outlets vying for the same consumer base. The growth in store count for these rivals translates to a more crowded market, making it harder for any single retailer to capture significant market share without a differentiated offering or strong customer loyalty.

- Aggressive Competitor Expansion: Chains like Dollar General, Dollar Tree, and Five Below are actively increasing their store count.

- Market Saturation: This expansion leads to a crowded retail environment in many geographic areas.

- Shifting Foot Traffic: Increased competition makes it more challenging for Big Lots to attract and retain customer visits.

- 2024 Traffic Growth: Key competitors, including Dollar General, Dollar Tree, and Five Below, reported year-over-year traffic growth in 2024, indicating their expanding reach and customer engagement.

Product Assortment and Differentiation

Big Lots faces intense rivalry due to its product assortment. While they cultivate a unique 'treasure hunt' appeal with ever-changing inventory, many competitors provide more extensive selections or a reliable stock of essential everyday goods. This differentiation strategy can be a double-edged sword, as Big Lots' heavy reliance on discretionary items makes it vulnerable during economic slowdowns when consumers tighten their belts and focus on necessities.

The company's historical underinvestment in the grocery category further exacerbates this competitive pressure. In 2023, the grocery sector continued to be a significant driver of retail traffic and consumer spending, with major players like Walmart and Kroger reporting strong sales. Big Lots' slower entry and development in this essential category meant missing out on consistent customer engagement and revenue streams that competitors leveraged effectively.

- Product Mix Vulnerability: Big Lots' focus on a changing assortment of discretionary items contrasts with competitors offering more consistent availability of everyday essentials, impacting sales during economic downturns.

- Grocery Category Lag: The company's delayed investment in the grocery sector put it at a disadvantage compared to rivals who have established strong footholds in this essential retail segment.

- Competitive Landscape: Retailers like Target and Walmart offer a wider, more consistent range of products, including groceries, directly challenging Big Lots' unique value proposition.

Big Lots contends with intense competitive rivalry, marked by aggressive expansion from discounters like Dollar General and Dollar Tree, who are actively increasing their store counts throughout 2024. This leads to market saturation, intensifying the fight for customer traffic and making it harder for Big Lots to retain its customer base. For instance, Dollar General reported a 2.7% increase in same-store sales for Q1 2024, demonstrating their continued customer draw.

| Competitor | 2024 Store Count (Approx.) | 2024 Growth Strategy | Key Competitive Advantage |

| Dollar General | 19,000+ | Continued store expansion, focus on consumables | Extensive store network, everyday essentials |

| Dollar Tree | 17,000+ | Expanding store footprint, introducing higher price points | Value proposition, broad product categories |

| Five Below | 1,500+ | Aggressive new store openings, targeting younger demographics | Unique product assortment for teens and pre-teens |

SSubstitutes Threaten

The most potent substitutes for Big Lots are online retailers and marketplaces like Amazon, Walmart.com, and Wayfair. These platforms provide an extensive product range, often at more competitive prices, and the sheer convenience of home delivery directly challenges the traditional brick-and-mortar model. In 2023, e-commerce sales in the U.S. reached over $1.1 trillion, highlighting the significant shift in consumer behavior towards online shopping.

Consumers can easily switch from Big Lots to other discount and off-price retailers such as TJ Maxx, Marshalls, Ross, Burlington, Dollar General, and Dollar Tree. These competitors offer comparable value and a similar range of products, presenting direct alternatives for budget-conscious shoppers.

The discount department stores sector is substantial, with its market size projected to reach $464.53 billion in 2024. This significant market size indicates a highly competitive landscape where consumers have numerous readily available substitutes for Big Lots.

The rise of second-hand markets and DIY projects presents a significant threat of substitution for Big Lots. For instance, platforms like Facebook Marketplace and eBay saw robust activity in 2024, with millions of transactions for used furniture and home goods, often at prices considerably lower than Big Lots' offerings. Consumers seeking unique or personalized items can also turn to DIY, a trend that gained further traction with readily available online tutorials and affordable craft supplies.

Conventional Retailers' Sales and Promotions

Conventional retailers, even those not typically considered direct competitors, can become significant substitutes for Big Lots. This is particularly true when these traditional stores engage in aggressive sales, clearance events, or offer compelling loyalty programs. For instance, a major department store running a 50% off sale on home goods or apparel can easily divert shoppers who might otherwise consider Big Lots for similar items. The perceived value or quality difference can be a deciding factor, prompting consumers to postpone purchases at Big Lots in anticipation of better deals elsewhere.

The threat is amplified by the widespread availability of these sales. In 2024, many traditional retailers continued to leverage promotional strategies to drive foot traffic and clear inventory. Data from industry reports indicated that promotional intensity remained high across various retail sectors, with average discount rates often reaching 20-30% during key sales periods. This competitive pricing environment means consumers have ample opportunity to find comparable or even superior products at comparable or lower prices from conventional retailers, directly impacting Big Lots' customer base.

- Promotional Intensity: In 2024, many traditional retailers maintained high levels of promotional activity, with average discounts frequently reaching 20-30% during peak sales periods.

- Value Perception: Consumers may delay purchases from Big Lots if they believe they can find better quality or greater value through sales events at conventional retail stores.

- Loyalty Programs: The allure of loyalty points, exclusive discounts, and rewards offered by established retailers can sway consumer choices away from off-price or discount chains like Big Lots.

- Broad Product Categories: Conventional retailers often carry a wide array of goods, including home furnishings, apparel, and seasonal items, directly mirroring many of Big Lots' product categories, thus increasing the substitutability.

Consumers Opting for Fewer Discretionary Purchases

In tough economic climates, consumers often cut back on non-essential spending, like home furnishings and decor, rather than actively seeking alternatives. This trend directly impacts retailers like Big Lots, as customers may simply postpone or skip purchases entirely. For instance, during periods of economic uncertainty, discretionary spending often sees a significant dip.

The threat of substitutes for Big Lots is amplified when consumers shift their behavior from seeking alternatives to simply reducing consumption. Instead of buying a cheaper brand of furniture, a customer might decide to keep their existing items longer or forgo the purchase altogether. This behavioral change is a significant factor for retailers in the discount sector.

- Reduced Discretionary Spending: Consumers prioritize essential goods over non-essential items during economic downturns, directly impacting sales of home decor and furniture.

- Purchase Deferral: Shoppers may delay buying new items, opting to make do with existing possessions, thus reducing demand for Big Lots' product categories.

- Impact on Retailers: This consumer behavior poses a substantial threat to businesses like Big Lots, as it directly reduces the overall market size for their offerings.

The threat of substitutes for Big Lots is substantial, encompassing online giants, other discount retailers, and even the growing second-hand market. Consumers can easily pivot to platforms like Amazon or Wayfair for convenience and price, or to competitors like TJ Maxx and Dollar General for similar value propositions. The sheer size of the discount department store sector, projected at $464.53 billion in 2024, underscores the abundance of readily available alternatives.

| Substitute Category | Key Players | Consumer Appeal | 2024 Market Relevance |

|---|---|---|---|

| Online Retailers | Amazon, Walmart.com, Wayfair | Convenience, vast selection, competitive pricing | U.S. e-commerce sales exceeded $1.1 trillion in 2023, indicating strong consumer preference. |

| Off-Price Retailers | TJ Maxx, Marshalls, Ross, Burlington | Similar value, comparable product range | Direct competitors offering similar goods to budget-conscious shoppers. |

| Dollar Stores | Dollar General, Dollar Tree | Extreme value, essential items | Significant market presence and accessibility for everyday needs. |

| Second-Hand Markets | Facebook Marketplace, eBay | Low prices, unique finds, sustainability | Millions of transactions in 2024 for used home goods, often at lower price points. |

Entrants Threaten

Entering the discount retail sector at a scale comparable to Big Lots demands considerable capital. This includes funding for prime retail locations, extensive inventory, robust supply chain networks, and widespread marketing campaigns. For instance, the discount retail market is anticipated to grow at a compound annual growth rate of 10.5% between 2025 and 2033, indicating a competitive landscape where significant upfront investment is crucial for any new player aiming for substantial market share.

Big Lots benefits from deeply entrenched sourcing networks that are critical to its closeout and overstock business model. These established relationships allow the company to consistently acquire diverse inventory from distressed retailers and vendors.

Developing comparable sourcing capabilities, especially for unique, distressed merchandise, presents a substantial hurdle for potential new entrants. This intricate web of vendor relationships, built over years, creates a significant barrier to entry.

While Big Lots has navigated a challenging retail environment, it retains a degree of brand recognition, particularly among consumers seeking value. New entrants would face a significant hurdle in replicating this established presence, requiring substantial investment in marketing and customer acquisition to build comparable brand awareness and loyalty.

The retail sector is already saturated with established discount players. For instance, in 2024, competitors like Dollar General and Family Dollar continued their aggressive expansion strategies, adding hundreds of new stores. This expanding footprint and increasingly diverse product offerings from existing players present a formidable barrier for any newcomer aiming to capture market share.

Regulatory Hurdles and Compliance

New entrants face significant regulatory hurdles. Navigating zoning laws, labor regulations, and product safety standards requires substantial investment and expertise. For instance, in 2024, the cost of complying with new environmental regulations for retail operations saw an average increase of 8% across the sector, impacting smaller players disproportionately.

- Zoning Laws: Retailers must secure permits and adhere to local land-use regulations, which can vary significantly by municipality.

- Labor Laws: Compliance with minimum wage, overtime, and worker safety standards adds to operational costs and complexity.

- Product Safety: Especially for a diverse product range like Big Lots, ensuring all items meet safety certifications (e.g., CPSC in the US) is a continuous and costly process.

Market Saturation and Competitive Response

The discount retail sector, where Big Lots operates, is already highly saturated and intensely competitive. Established giants like Dollar General and Dollar Tree are not only expanding their store footprints but also enhancing their private label offerings, making it difficult for newcomers to gain traction. For instance, Dollar General announced plans to open approximately 800 new stores in fiscal year 2024, further intensifying the competitive landscape.

Any new entrant would face significant hurdles in carving out a meaningful market share. Existing players possess strong brand recognition, established supply chains, and economies of scale that new entrants would struggle to match. These incumbents are also likely to engage in aggressive pricing strategies or promotional activities to deter new competition, increasing the cost and risk for any aspiring entrant.

Despite the challenges, opportunities exist for retailers that can effectively leverage available retail space and manage inventory efficiently. The ongoing economic climate may create openings for discounters that can offer compelling value propositions, potentially attracting consumers seeking savings. However, the capital investment required to establish a competitive presence remains substantial.

- Market Saturation: The discount retail sector is crowded with dominant players.

- Competitive Response: Existing retailers like Dollar General and Dollar Tree are poised to react aggressively to new entrants.

- Barriers to Entry: High capital requirements, established supply chains, and brand loyalty present significant challenges for newcomers.

- Potential Openings: Savvy retailers might find opportunities by capitalizing on available real estate and efficient inventory management.

The threat of new entrants in the discount retail sector, where Big Lots operates, is moderate but presents significant challenges. High capital requirements for inventory, prime locations, and marketing are substantial barriers. For instance, establishing a national discount chain in 2024 would likely require hundreds of millions of dollars in initial investment.

Established sourcing networks, particularly for unique closeout merchandise, are difficult for newcomers to replicate. This gives Big Lots an advantage in securing diverse inventory at competitive prices.

The market is already saturated with strong competitors like Dollar General and Family Dollar, which are actively expanding. In 2024, Dollar General alone planned to open around 800 new stores, intensifying competition and making it harder for new players to gain a foothold.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Significant investment needed for inventory, real estate, and marketing. | High barrier; requires substantial funding. |

| Sourcing Networks | Established relationships for acquiring distressed merchandise. | High barrier; difficult to replicate unique inventory access. |

| Market Saturation | Presence of dominant, expanding competitors. | High barrier; intense competition for market share. |

| Brand Recognition | Existing customer loyalty and awareness. | Moderate barrier; requires significant marketing spend to build. |

Porter's Five Forces Analysis Data Sources

Our Big Lots Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, investor presentations, and SEC filings, complemented by industry-specific market research reports from firms like IBISWorld and Statista.