BigBear.ai SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BigBear.ai Bundle

BigBear.ai possesses unique strengths in its AI-powered decision intelligence, but also faces significant challenges in market adoption and competitive pressures. Understanding these dynamics is crucial for anyone looking to invest or strategize within this evolving sector.

Want the full story behind BigBear.ai's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BigBear.ai's profound understanding of government AI needs is a significant strength, positioning it as a key player in defense and national security sectors. This specialization has led to securing crucial contracts like the U.S. Army's Global Force Information Management, demonstrating their capability in high-stakes environments.

BigBear.ai boasts a substantial and rapidly growing backlog, a significant strength. As of December 31, 2024, the company reported a backlog of $418 million, a remarkable 148% increase from the previous year. This momentum continued into 2025, with the backlog standing at $385 million by March 31, 2025.

This expanding order book clearly signals robust demand for BigBear.ai's advanced analytics and AI solutions. It provides a strong foundation and a predictable revenue stream for the company's future performance, indicating a healthy pipeline of secured business.

The key to unlocking further growth lies in the effective conversion of this substantial backlog into realized revenue. This conversion is a critical driver that will directly impact BigBear.ai's financial trajectory and operational success in the coming periods.

BigBear.ai's strategic acquisitions and partnerships are significant strengths, bolstering its market position and technological capabilities. The acquisition of Pangiam in February 2024, for instance, was instrumental in expanding its backlog and diversifying into critical sectors like aviation security, adding approximately $100 million to its backlog at the time of the announcement.

Further strengthening its offerings, BigBear.ai has forged key partnerships. Collaborations with Analogic for advanced airport threat detection and DEFCON AI for enhanced military readiness demonstrate its commitment to innovation. A notable strategic alliance with Palantir significantly broadens its product integration and market penetration capabilities.

Advanced and Specialized AI Technology

BigBear.ai's strength lies in its advanced and specialized AI technology, focusing on decision intelligence solutions. These solutions leverage predictive analytics and real-time data to offer actionable insights, crucial for complex operational scenarios.

The company's proprietary technologies are tailored for demanding, mission-critical environments. For instance, its Pangiam® Threat Detection platform enhances aviation security by improving threat identification accuracy.

Furthermore, the Virtual Anticipation Network (VANE) provides sophisticated geopolitical risk analysis. This specialized AI capability allows for more informed strategic decision-making in high-stakes situations.

- Advanced AI Decision Intelligence: Develops sophisticated AI-powered solutions for predictive analytics and real-time data insights.

- Mission-Critical Applications: Technologies like Pangiam® and VANE are designed for complex, mission-based operating environments, enhancing threat identification and risk analysis.

- Enhanced Accuracy: The specialized AI enables improved accuracy in identifying threats and making strategic decisions in critical domains.

Improved Financial Position and Deleveraging

BigBear.ai has significantly improved its financial standing, a key strength as part of its ongoing strategic development. The company successfully reduced its net debt from $150 million to $27 million by the first quarter of 2025. This aggressive deleveraging effort has substantially strengthened its balance sheet.

The company’s debt-to-cash ratio also saw a remarkable improvement, dropping from 4.0 at the end of Q4 2024 to a much healthier 1.2 by Q1 2025. This deleveraging is a testament to effective financial management and positions BigBear.ai for more robust and stable growth throughout 2025 and into the future.

- Reduced Net Debt: Decreased from $150 million to $27 million by Q1 2025.

- Improved Debt-to-Cash Ratio: Fell from 4.0 (end of Q4 2024) to 1.2 (Q1 2025).

- Enhanced Financial Stability: The deleveraging strategy supports more sustainable future growth.

BigBear.ai's robust backlog is a significant strength, indicating strong market demand for its AI solutions. By March 31, 2025, the backlog stood at $385 million, a testament to its growing order book. This expanding pipeline provides a predictable revenue stream, crucial for sustained growth and operational stability.

| Metric | Q4 2023 | Q4 2024 | Q1 2025 |

|---|---|---|---|

| Backlog (Millions USD) | $168 | $418 | $385 |

| Backlog Growth YoY | N/A | 148% | N/A |

What is included in the product

Analyzes BigBear.ai’s competitive position through key internal and external factors, highlighting its strengths in AI solutions and market opportunities while acknowledging potential weaknesses and threats.

BigBear.ai's SWOT analysis provides a structured framework to identify and address critical business challenges, offering actionable insights for strategic decision-making.

Weaknesses

Despite securing new contracts, BigBear.ai has experienced sluggish revenue growth. In 2024, revenue saw only a 2% increase, reaching $158 million. This trend continued into Q1 2025, with a 5% year-over-year increase to $34.8 million, indicating a slow pace of top-line expansion.

The company continues to face challenges with profitability, consistently reporting significant net losses. BigBear.ai incurred a substantial $296 million loss in 2024, followed by a $62 million net loss in the first quarter of 2025. These figures highlight persistent operational deficits and a difficult journey toward achieving profitability.

BigBear.ai faces a significant challenge with high customer concentration. In 2024, a substantial 52% of its revenue stemmed from just four key clients, predominantly within the U.S. government sector. This heavy dependence on a small client base exposes the company to considerable risk, as losing or seeing reduced spending from any of these major customers could severely destabilize its financial performance and revenue generation.

BigBear.ai's gross margins present a notable weakness, especially when stacked against pure software companies. For instance, the company reported 37.4% in Q4 2024 and a further dip to 21.3% in Q1 2025. These figures are significantly lower than the industry standard for software, indicating a business model that leans heavily on services rather than scalable software products.

This service-heavy approach inherently means higher costs associated with delivering those services, which directly impacts profitability. Consequently, BigBear.ai's ability to achieve the same level of profit margins as its software-focused peers is constrained, limiting its overall financial performance potential within the broader tech landscape.

Execution Challenges and Government Funding Delays

BigBear.ai is grappling with significant execution challenges, particularly in transforming its substantial contract backlog into actual revenue. This operational friction directly impacts its financial performance, making consistent revenue recognition a key hurdle.

Delays in securing government funding and necessary approvals are exacerbating these issues. These postponements not only inflate selling, general, and administrative (SG&A) expenses but also lead to inefficient resource allocation, leaving valuable assets underutilized.

- Operational Inefficiencies: Difficulty in converting backlog to revenue.

- Funding Delays: Government funding and approval delays impact project timelines.

- Increased SG&A: Delays contribute to higher operational costs.

- Resource Underutilization: Projects stalled by funding issues lead to wasted resources.

Stock Volatility and Speculative Investment Profile

BigBear.ai's stock has shown significant price swings, often reacting more to the general excitement surrounding artificial intelligence than to the company's own financial results. This volatility makes it a speculative play, as its current market valuation might not be fully supported by its earnings or steady growth trajectory.

For investors who prefer stability, this high degree of unpredictability presents a notable risk. For instance, during periods of intense AI market enthusiasm, BigBear.ai's stock price might surge, only to decline sharply when sentiment shifts or if the company fails to meet elevated expectations. This speculative nature means the stock's value can be influenced by factors beyond its core business performance, making it less suitable for conservative portfolios.

- High Volatility: BigBear.ai's stock price has experienced substantial fluctuations, often driven by market sentiment around AI rather than concrete financial performance.

- Speculative Investment: The company's valuation may not be fully justified by current earnings or consistent growth, classifying it as a high-risk investment.

- Risk for Averse Investors: The unpredictable nature of the stock poses a significant challenge for investors who prioritize capital preservation and stable returns.

BigBear.ai faces significant challenges converting its substantial contract backlog into tangible revenue, a key operational hurdle impacting financial performance. Delays in securing government funding and necessary approvals further exacerbate these execution issues, leading to increased SG&A expenses and underutilized resources.

The company's gross margins, particularly in Q1 2025 at 21.3%, lag behind pure software companies, suggesting a service-heavy business model with higher associated costs. This limits its ability to achieve comparable profitability to software-focused peers.

Furthermore, BigBear.ai exhibits high customer concentration, with 52% of 2024 revenue coming from just four clients, primarily in the U.S. government sector. This dependence creates substantial risk if any of these major clients reduce spending.

The company's stock price is highly volatile, often driven by market sentiment around AI rather than its financial results, making it a speculative investment. This unpredictability poses a risk for investors seeking stability.

| Weakness | Description | Relevant Data |

|---|---|---|

| Revenue Growth | Sluggish top-line expansion despite new contracts. | 2% revenue increase in 2024 ($158M); 5% YoY increase in Q1 2025 ($34.8M). |

| Profitability | Consistent significant net losses. | $296M loss in 2024; $62M net loss in Q1 2025. |

| Customer Concentration | Heavy reliance on a small client base. | 52% of 2024 revenue from four key clients. |

| Gross Margins | Lower than industry standards for software companies. | 37.4% in Q4 2024; 21.3% in Q1 2025. |

| Execution & Funding Delays | Difficulty converting backlog to revenue; government funding delays. | Impacts project timelines, increases SG&A, leads to resource underutilization. |

| Stock Volatility | Price swings driven by AI market sentiment, not financial results. | Speculative investment; high risk for stability-focused investors. |

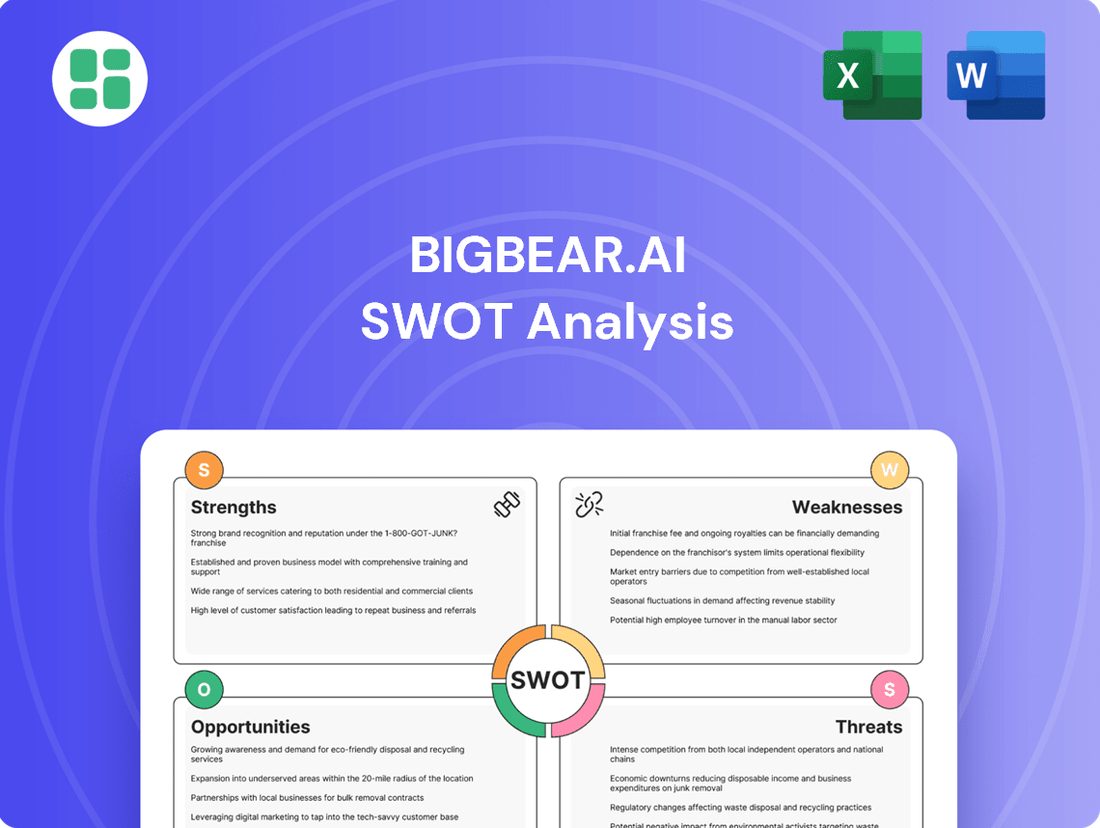

Preview the Actual Deliverable

BigBear.ai SWOT Analysis

This is the actual BigBear.ai SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic insights for BigBear.ai.

This is a real excerpt from the complete BigBear.ai SWOT analysis document. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

Opportunities

The U.S. government's commitment to artificial intelligence is substantial, with projections indicating over $20 billion in spending for AI initiatives in fiscal year 2025. This significant investment, particularly from the Department of Defense, underscores a strategic shift towards integrating AI across national defense operations.

This increasing allocation of resources creates a robust and growing market for companies like BigBear.ai, which specializes in decision intelligence solutions. The company's expertise directly aligns with the government's need for advanced AI capabilities in areas such as threat assessment and operational efficiency.

BigBear.ai is strategically positioned to capitalize on these sustained government investments. The company's ability to provide actionable intelligence through AI-driven platforms makes it a key potential beneficiary of this expanding defense technology sector.

BigBear.ai is strategically expanding beyond its core government contracts into promising commercial markets like aviation security, manufacturing, and logistics. This diversification is crucial for reducing reliance on a single client base and unlocking new growth avenues.

The company's international push, exemplified by its VANE deployment in the UAE for multinational military exercises, signals a clear intent to tap into global demand. These international ventures not only diversify revenue but also offer significant opportunities to scale its AI-powered solutions across different geopolitical and economic landscapes.

BigBear.ai's acquisition of Pangiam and its strategic collaborations, including those with Analogic, DEFCON AI, and Proof Labs, are creating significant synergistic opportunities. These moves are designed to bolster its capabilities in critical sectors like aviation security and defense.

These integrations are expected to expand BigBear.ai's product suite, offering enhanced airport threat detection and advanced military readiness solutions. This expansion is poised to drive new revenue streams and foster innovation across its diverse technology portfolio, leveraging the combined strengths of its acquired and partnered entities.

Leveraging Advanced AI for Emerging Threats

The evolving AI security landscape presents a significant opportunity for BigBear.ai. As new threats like agentic AI exploits and data poisoning emerge, there's a growing demand for robust, secure-by-design AI solutions. BigBear.ai can capitalize on this by continuously enhancing its offerings with specialized AI security measures, thereby strengthening its competitive edge.

This proactive approach allows BigBear.ai to address the most current and sophisticated cyber threats. For instance, the global AI cybersecurity market is projected to grow substantially, with some estimates suggesting it could reach over $40 billion by 2028, highlighting the market's readiness for advanced security capabilities. By integrating advanced AI security, BigBear.ai can solidify its position as a leader in providing resilient AI-powered decision intelligence.

- Evolving Threat Landscape: New vulnerabilities like agentic AI exploits and data poisoning necessitate advanced security frameworks.

- Market Demand: The AI cybersecurity market is experiencing rapid growth, indicating a strong need for specialized solutions.

- Value Proposition Enhancement: Incorporating AI security measures can significantly boost BigBear.ai's offerings and client appeal.

- Competitive Advantage: Staying ahead of emerging threats through continuous innovation secures BigBear.ai's market leadership.

Conversion of Large Contract Backlog

BigBear.ai's significant contract backlog, reported at $385 million as of March 2025, presents a prime opportunity for revenue conversion. Successfully executing these secured contracts is key to unlocking substantial financial growth and demonstrating operational capability.

This backlog translates directly into future revenue streams, offering a clear path to improved financial performance. The company's ability to efficiently deliver on these commitments will be crucial in capitalizing on these secured wins.

- Contract Backlog Value: $385 million (as of March 2025)

- Opportunity: Convert backlog into recognized revenue.

- Impact: Potential for accelerated revenue growth and improved financial performance.

- Key Factor: Efficient execution and timely project delivery.

BigBear.ai is well-positioned to leverage the substantial U.S. government investment in AI, projected to exceed $20 billion in fiscal year 2025, particularly within the defense sector. This focus on advanced AI capabilities for national defense creates a fertile ground for BigBear.ai's decision intelligence solutions.

The company is actively diversifying into commercial sectors such as aviation security, manufacturing, and logistics, reducing its reliance on government contracts and tapping into new growth avenues. International expansion, evidenced by its VANE deployment in the UAE, further broadens its market reach and revenue potential.

Strategic acquisitions, like that of Pangiam, and collaborations with entities such as Analogic and DEFCON AI, are enhancing BigBear.ai's capabilities in critical areas like airport threat detection and military readiness. This consolidation is expected to drive innovation and create new revenue streams by offering more comprehensive solutions.

The evolving AI security landscape, with emerging threats like agentic AI exploits and data poisoning, presents a significant opportunity for BigBear.ai to enhance its offerings with specialized AI security measures, thereby strengthening its competitive advantage in a market projected for substantial growth. The company's substantial contract backlog of $385 million as of March 2025 also provides a clear pathway for revenue conversion and financial growth through efficient project execution.

Threats

BigBear.ai faces intense competition from established AI giants like Palantir Technologies and C3.ai. These larger players often possess significantly greater financial resources and extensive client networks, enabling them to potentially undercut pricing and secure larger contracts. For instance, Palantir reported over $2.2 billion in revenue for 2023, demonstrating its scale advantage.

This competitive landscape presents a significant threat, as it can limit BigBear.ai's ability to expand market share and acquire new customers. The established market presence and brand recognition of these larger competitors can make it difficult for BigBear.ai to differentiate itself and win bids, especially for large-scale government or enterprise contracts.

BigBear.ai's significant reliance on U.S. government contracts, particularly from defense and intelligence agencies, presents a substantial threat. This dependence makes the company vulnerable to shifts in federal spending priorities, sequestration, and the unpredictable nature of government appropriations. For instance, in 2023, a notable portion of BigBear.ai's revenue was tied to government work, making any disruption in these funding streams a direct risk to its financial stability and growth projections.

BigBear.ai faces a considerable threat from the potential loss of key customers. In 2024, a significant 52% of its revenue was generated from only four major clients. This high concentration means that the discontinuation of a single contract could severely impact the company's financial health and stability, creating a substantial single-point-of-failure risk.

Rapid Technological Obsolescence and Cybersecurity Risks

The relentless pace of AI development presents a significant threat of technological obsolescence for BigBear.ai. If the company cannot consistently innovate and integrate cutting-edge advancements, its current offerings could quickly become outdated, impacting its competitive edge. For instance, the AI market is projected to grow substantially, with some estimates suggesting it could reach over $1.5 trillion by 2030, highlighting the speed at which new technologies emerge.

Cybersecurity risks are also escalating, particularly with the rise of sophisticated AI-driven threats. Vulnerabilities like agentic AI exploits, which involve autonomous AI agents acting maliciously, and data poisoning attacks, where malicious data is injected to corrupt AI models, demand constant vigilance and advanced defense mechanisms. In 2024, cybersecurity spending globally is expected to exceed $200 billion, underscoring the critical nature of these investments.

- Rapid AI advancements necessitate continuous R&D investment to avoid obsolescence.

- Emerging threats like agentic AI exploits and data poisoning require proactive cybersecurity strategies.

- Failure to adapt to technological shifts could lead to a loss of market share in the fast-evolving AI sector.

Operational and Regulatory Scrutiny

BigBear.ai continues to grapple with operational hurdles, notably its struggle to translate a substantial backlog into predictable profitability and manage increasing operating costs. For instance, the company reported a net loss of $41.5 million in the first quarter of 2024, highlighting ongoing profitability challenges.

The company faces significant threats from intensified operational and regulatory scrutiny. These challenges can impact its financial stability and market perception.

- Operational Efficiency: Difficulty in converting backlog into consistent profits and managing rising operating expenses, as seen in Q1 2024 results.

- Regulatory Investigations: Past legal probes concerning restated financials and internal control weaknesses can erode investor trust.

- Capital Access: Scrutiny can complicate the company's ability to secure necessary capital for growth and operations.

- Contract Acquisition: Weakened confidence and potential compliance issues may hinder the acquisition of new government contracts, a key revenue stream.

BigBear.ai faces significant threats from its dependence on a concentrated customer base, with over half its revenue in 2024 coming from just four major clients. This makes the company highly susceptible to the loss of any single contract, posing a substantial risk to its financial stability and future growth prospects. Furthermore, the company's ongoing struggles with operational efficiency, evidenced by a net loss of $41.5 million in Q1 2024, highlight challenges in converting its backlog into consistent profitability and managing escalating operating costs.

The dynamic nature of the AI sector presents a constant threat of technological obsolescence, requiring continuous innovation to maintain a competitive edge. Additionally, escalating cybersecurity risks, including advanced AI-driven threats like agentic AI exploits and data poisoning, demand robust and evolving defense strategies. The company also faces potential hurdles in accessing capital and acquiring new contracts due to past regulatory scrutiny concerning financial restatements and internal control weaknesses.

| Threat Category | Specific Risk | Impact | 2024/2025 Data Point |

| Customer Concentration | Loss of Key Clients | Severe financial impact due to reliance on few major clients. | 52% of revenue from 4 major clients in 2024. |

| Operational Challenges | Profitability and Cost Management | Difficulty converting backlog into profits, increasing operating expenses. | Net loss of $41.5 million in Q1 2024. |

| Technological Obsolescence | Pace of AI Advancement | Risk of current offerings becoming outdated without continuous innovation. | AI market projected to exceed $1.5 trillion by 2030. |

| Cybersecurity | Sophisticated AI Threats | Vulnerability to new exploits and data manipulation. | Global cybersecurity spending expected to exceed $200 billion in 2024. |

| Regulatory & Capital Access | Scrutiny and Trust Erosion | Complicated capital access and potential hindrance to new contract acquisition. | Past probes into restated financials and internal controls. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from BigBear.ai's official financial filings, comprehensive market intelligence reports, and expert industry analyses to provide a well-rounded strategic overview.