BigBear.ai Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BigBear.ai Bundle

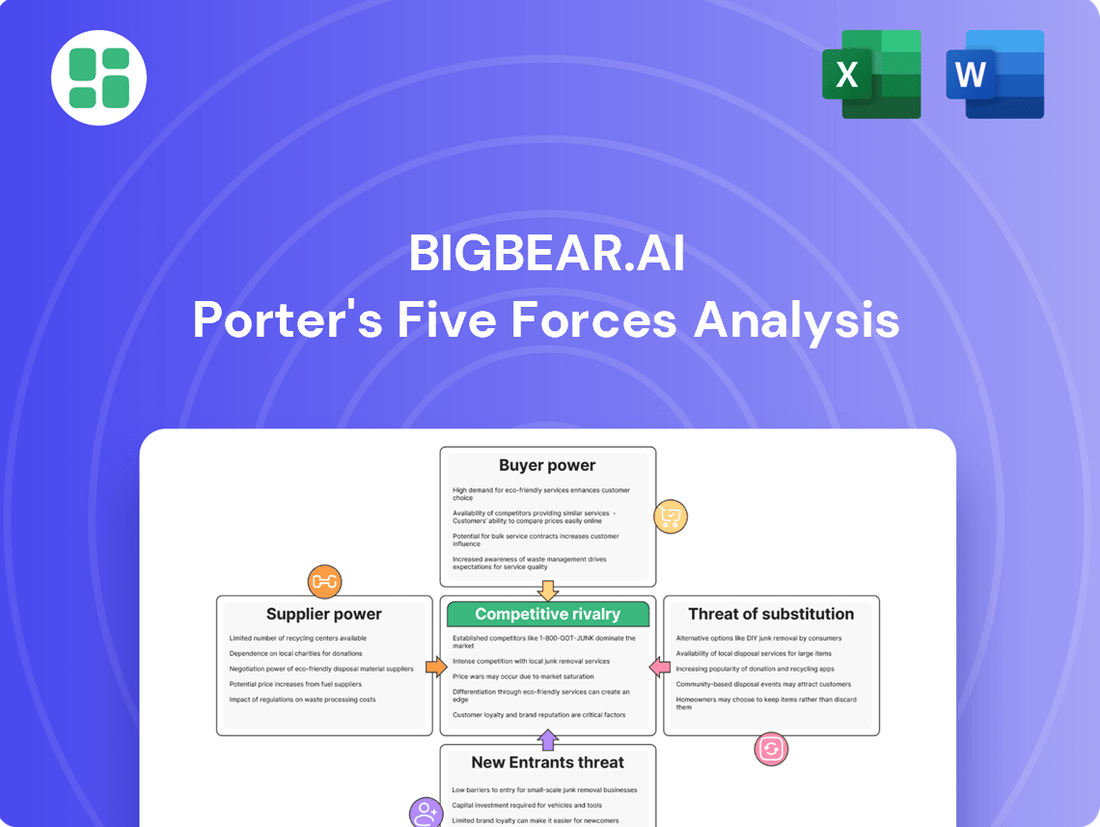

BigBear.ai operates in a dynamic market, facing significant pressures from buyer power and the threat of new entrants. Understanding these forces is crucial for navigating its competitive landscape. The full analysis reveals the strength and intensity of each market force affecting BigBear.ai, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

BigBear.ai's dependence on specialized AI talent, including data scientists and engineers, presents a significant factor in supplier bargaining power. The intense competition for these professionals, who are crucial for developing and implementing AI solutions, means their skills are highly valued.

The scarcity of top-tier AI talent can translate into increased labor costs for BigBear.ai. For instance, in 2023, the average salary for a senior data scientist in the US was reported to be around $150,000 to $180,000, a figure that can escalate with specialized skills and experience, directly impacting operational expenses.

This high demand necessitates competitive compensation packages and a robust company culture to attract and retain these vital employees. Failure to do so can lead to talent attrition, hindering BigBear.ai's ability to innovate and deliver on its AI-driven projects, thereby increasing the bargaining power of individual specialists.

BigBear.ai's reliance on proprietary data sources significantly impacts supplier bargaining power. Companies possessing unique, high-quality datasets, particularly exclusive government or industry-specific information vital for predictive analytics, can command higher prices. For instance, in 2024, the demand for specialized government intelligence data remained robust, with only a limited number of providers.

The bargaining power of suppliers is further amplified by the need for specialized AI algorithms and foundational models. Vendors offering unique, non-replicable AI capabilities can influence BigBear.ai's development costs and strategic direction. The market for cutting-edge AI models in 2024 saw a concentration of key developers, giving them considerable leverage over companies like BigBear.ai seeking to integrate advanced AI into their decision intelligence platforms.

BigBear.ai's reliance on advanced hardware and cloud infrastructure means providers like NVIDIA for GPUs and major cloud platforms such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud hold considerable sway. In 2024, the demand for AI-specific chips, like NVIDIA's H100 GPUs, continued to outstrip supply, leading to premium pricing. Similarly, cloud service costs are a significant operational expense, with these providers able to influence pricing based on demand and their own infrastructure investments.

Niche Technology and Software Vendors

BigBear.ai's reliance on niche technology and software vendors can create significant supplier bargaining power. If these vendors offer unique or patented components essential for BigBear.ai's core functionalities, they can dictate terms and pricing. For instance, a specialized AI algorithm provider or a unique data analytics platform vendor could leverage its proprietary technology to negotiate higher licensing fees or impose stricter usage conditions, directly affecting BigBear.ai's operational costs and development roadmap.

The impact of such dependencies is amplified when there are few alternative suppliers. In 2024, the market for highly specialized AI development tools and platforms remains concentrated, with a limited number of providers dominating specific technological niches. This scarcity allows these vendors to exert considerable influence over pricing and contract terms. For BigBear.ai, this means that the cost of integrating or maintaining these critical components could rise, potentially impacting profitability and the speed of innovation if significant investment is required to secure or develop alternatives.

- Vendor Concentration: The market for specialized AI software often features a few dominant players, increasing their leverage.

- Proprietary Technology: Unique, patented, or difficult-to-replicate software components grant suppliers greater bargaining power.

- Integration Costs: High costs associated with switching or replacing integrated niche software can lock BigBear.ai into existing vendor relationships.

- Impact on Innovation: Restrictive licensing or high costs from these vendors can slow down BigBear.ai's ability to adapt and innovate with new technologies.

Strategic Partnership Dependency

Strategic partnerships, while crucial for BigBear.ai's expansion and technological advancement, can also foster significant supplier dependency. For instance, collaborations with entities like DEFCON AI or Analogic, which provide specialized AI capabilities or hardware integration, position these partners as critical suppliers.

If a partner's offering is deeply embedded and difficult to substitute, BigBear.ai's flexibility in pricing and product development can be constrained by the partner's terms. In 2024, the increasing demand for specialized AI solutions across defense and commercial sectors amplifies the leverage of key technology providers.

- Supplier Leverage: Partnerships that offer unique, integrated components or exclusive market access grant substantial bargaining power to suppliers.

- Dependency Risk: Over-reliance on a single or few strategic partners for critical functionalities can expose BigBear.ai to unfavorable contract negotiations.

- Mitigation Strategy: Proactive management of these supplier relationships, including exploring alternative solutions and maintaining strong communication, is vital to balance power.

BigBear.ai faces considerable supplier bargaining power due to its reliance on scarce, specialized AI talent. The intense competition for data scientists and engineers, whose average salaries in 2023 ranged from $150,000 to $180,000, means these professionals can command premium compensation, directly impacting BigBear.ai's operational costs and innovation capacity.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to BigBear.ai's position in the AI and analytics sector.

Quickly identify and neutralize competitive threats with a dynamic visualization of all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

BigBear.ai's reliance on a concentrated customer base, particularly within the U.S. government sector, significantly amplifies customer bargaining power. In 2024, a substantial 52% of its revenue stemmed from just four clients, highlighting the considerable leverage these entities hold.

This concentration means that the loss or even a reduction in spending from any of these major government contracts could have a profound negative impact on BigBear.ai's financial stability. The inherent nature of government procurement, often characterized by lengthy bidding processes, intense competition, and unpredictable budget cycles, further solidifies the bargaining strength of these powerful clients.

For deeply integrated AI-powered decision intelligence solutions, customers face significant hurdles when considering a switch away from BigBear.ai. These high switching costs are a direct result of how deeply the company's systems become embedded within a client's operational framework.

The complexity involved in migrating vast amounts of data, the necessity of retraining personnel on new platforms, and the extensive reconfiguring of established workflows all contribute to a powerful lock-in effect. This makes it increasingly difficult and costly for customers to change providers, thereby diminishing their bargaining power over time.

For example, a recent survey of enterprise software adoption indicated that for complex, mission-critical systems, the average cost of switching vendors can range from 20% to 50% of the annual contract value, a substantial deterrent. This reality underscores the critical importance of securing initial sales and ensuring successful, seamless integration for BigBear.ai to foster enduring customer relationships and maintain its competitive edge.

BigBear.ai's customers, especially large commercial and government entities, are increasingly focused on tangible results. They expect clear evidence of return on investment (ROI) from the AI solutions they procure. This demand for proven value gives them significant bargaining power, as they can push for performance guarantees and pricing structures tied to demonstrable outcomes.

Furthermore, clients often require highly customized solutions tailored to their unique operational challenges. This need for personalization means BigBear.ai must be agile and adaptable, investing resources to modify its platforms. The ability of customers to seek out or demand bespoke features directly influences BigBear.ai's product development and service delivery, allowing them to negotiate terms that reflect the effort involved in customization.

Budgetary Constraints and Economic Conditions

Budgetary constraints significantly impact customer bargaining power, especially concerning investments in new technologies like artificial intelligence. During 2024, many governments and corporations faced tighter budgets due to inflation and geopolitical uncertainties, leading to a more cautious approach to spending on advanced solutions.

This economic climate often forces customers to scrutinize expenditures, making them more sensitive to price and demanding greater value from technology providers. For instance, a slowdown in global GDP growth, projected to be around 2.7% for 2024 by the IMF, can directly translate to reduced IT budgets for many businesses.

- Reduced Demand: Economic downturns and fiscal austerity measures can lead to a general decrease in demand for new technologies.

- Price Sensitivity: Customers facing budgetary pressures become more focused on cost-effectiveness and may negotiate harder on pricing.

- Delayed Adoption: Companies might postpone or scale back adoption plans for AI and other advanced technologies until economic conditions improve.

- Increased Competition: With fewer customers willing or able to spend, existing providers often face intensified competition for a smaller pool of business.

Customer Sophistication and In-House Capabilities

BigBear.ai's customer base, particularly within defense and large enterprise sectors, often comprises highly informed buyers who understand the nuances of artificial intelligence. These sophisticated clients are aware of the potential and limitations of AI solutions, which naturally elevates their negotiation stance.

Furthermore, some of BigBear.ai's larger clients may possess their own internal AI development teams or actively explore the possibility of creating proprietary solutions. This internal capability acts as a significant alternative to relying solely on external vendors like BigBear.ai.

- Sophisticated Buyers: Defense and enterprise clients possess deep knowledge of AI, enabling informed decision-making and negotiation.

- In-House AI Development: Larger clients may have internal teams capable of developing AI solutions, reducing reliance on external providers.

- Alternative Solutions: The potential for clients to build their own AI capabilities or leverage other vendor options increases their bargaining power.

BigBear.ai faces considerable customer bargaining power due to its concentrated client base, with over half its 2024 revenue coming from just four clients. This leverage is amplified by the lengthy, competitive, and budget-sensitive nature of government procurement. While high switching costs due to deep system integration can mitigate this, sophisticated buyers demanding proven ROI and customized solutions still hold significant sway. Economic pressures in 2024, with tighter budgets and a projected 2.7% global GDP growth, further embolden customers to negotiate harder on price and value, especially as some explore in-house AI capabilities.

| Factor | Impact on BigBear.ai | 2024 Context |

|---|---|---|

| Customer Concentration | High leverage for major clients | 52% of revenue from 4 clients |

| Switching Costs | Mitigates power due to integration | High for complex, mission-critical systems |

| Demand for ROI & Customization | Customers negotiate for proven value | Clients seek tailored, results-driven solutions |

| Budgetary Constraints | Increases price sensitivity and negotiation | Tighter budgets due to inflation/uncertainty |

| Customer Sophistication & Alternatives | Informed buyers, potential for in-house AI | Clients understand AI, may develop own solutions |

Full Version Awaits

BigBear.ai Porter's Five Forces Analysis

This preview showcases the complete BigBear.ai Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency. You'll gain immediate access to this comprehensive report, ready for immediate use and strategic application, without any hidden placeholders or sample content.

Rivalry Among Competitors

The AI landscape is intensely competitive, marked by the significant presence of major, diversified technology corporations like Google, Microsoft, IBM, and Palantir. These industry titans leverage substantial financial reserves, advanced research and development infrastructure, and expansive customer networks to deliver comprehensive AI solutions and aggressively pursue lucrative contracts.

These large players can offer integrated AI ecosystems and often have existing relationships with major enterprises, giving them an advantage in securing large-scale projects. For instance, Microsoft's Azure AI services and Google Cloud's AI platforms are widely adopted across industries, creating a high barrier to entry for smaller, specialized firms.

BigBear.ai, while focusing on specific areas like AI-driven decision intelligence, finds itself in direct competition with these dominant forces. The sheer scale and breadth of offerings from these tech giants mean they can often bundle AI capabilities with other services, presenting a formidable challenge for BigBear.ai to win market share.

BigBear.ai contends with a multitude of agile AI startups and specialized companies targeting specific sectors such as cybersecurity, logistics, and defense. These smaller players can craft highly focused solutions, attracting niche customer bases with tailored offerings.

This market fragmentation amplifies competitive rivalry, presenting customers with a wider array of specialized alternatives. For instance, the cybersecurity AI market alone saw significant investment in 2024, with numerous startups securing funding rounds to develop advanced threat detection and response platforms.

BigBear.ai faces significant competition from traditional defense contractors like Lockheed Martin, Northrop Grumman, and Raytheon Technologies. These giants are actively integrating artificial intelligence into their existing offerings and are also acquiring AI startups to bolster their capabilities. For instance, in 2023, the U.S. Department of Defense awarded billions in contracts for AI-enabled systems, a market where established players already hold considerable sway.

These established contractors benefit from decades of experience and deeply entrenched relationships with government agencies, often holding prime positions on major defense programs. This long-standing domain expertise and established trust can make it difficult for newer entrants like BigBear.ai to displace them, particularly when seeking multi-year, high-value contracts. Their sheer size and existing infrastructure provide a substantial advantage in securing and executing large-scale government projects.

Rapid Pace of Technological Innovation

The artificial intelligence sector, a core area for companies like BigBear.ai, experiences fierce competition driven by relentless technological innovation. New algorithms, sophisticated models, and novel applications emerge at an astonishing rate, forcing all players to constantly adapt.

This dynamic environment necessitates significant and ongoing investment in research and development. Companies that fail to keep pace with these rapid advancements risk becoming obsolete, seeing their market share and competitive edge diminish quickly. For instance, the global AI market size was valued at approximately $200 billion in 2023 and is projected to grow substantially, highlighting the intense race to capture this expanding market.

- Constant R&D Investment: Companies must allocate substantial resources to R&D to develop cutting-edge AI solutions.

- Emergence of New Technologies: The rapid introduction of new AI models and applications intensifies rivalry.

- Risk of Obsolescence: Failing to innovate can lead to a rapid decline in market position.

- Talent Wars: Competition for skilled AI professionals further fuels the pace of innovation.

Price Sensitivity in Government and Commercial Bidding

BigBear.ai operates in sectors where price is often a critical determinant in securing contracts, particularly within government and commercial bidding. This means that even with specialized offerings, the company must contend with rivals who may undercut on price to win business.

The pressure to deliver innovative solutions while remaining cost-competitive directly impacts BigBear.ai's profit margins. For instance, in the government sector, large-scale contracts are frequently awarded based on a combination of technical merit and the lowest bid.

- Government contracts often emphasize cost-effectiveness, impacting BigBear.ai's pricing strategies.

- Commercial bidding processes also frequently prioritize price, intensifying rivalry.

- Balancing innovation with affordability is a constant challenge, squeezing profit margins.

- The need to win large-scale contracts, where price sensitivity is highest, fuels competitive intensity.

Competitive rivalry for BigBear.ai is intense, stemming from both established tech giants and agile AI startups. Major players like Google and Microsoft offer broad AI ecosystems, creating high barriers to entry. Traditional defense contractors such as Lockheed Martin and Northrop Grumman leverage existing government relationships and domain expertise, making it challenging for newer companies to secure large contracts. The rapid pace of AI innovation necessitates continuous R&D investment, with companies risking obsolescence if they cannot keep up. For instance, the global AI market was valued at approximately $200 billion in 2023, indicating a fierce race for market share.

| Competitor Type | Key Characteristics | Impact on BigBear.ai |

|---|---|---|

| Tech Giants (e.g., Google, Microsoft) | Vast financial resources, extensive R&D, broad AI ecosystems, existing customer networks | High barrier to entry, ability to bundle services, challenging to win large integrated projects |

| Agile AI Startups | Niche specialization, tailored solutions, rapid innovation | Market fragmentation, increased choice for customers, potential for focused competition in specific sectors |

| Traditional Defense Contractors (e.g., Lockheed Martin) | Deep government relationships, long-standing domain expertise, established infrastructure | Difficulty displacing incumbents, advantage in securing multi-year government contracts |

| General Market Dynamics | Rapid technological advancements, constant need for R&D investment, price sensitivity in bidding | Risk of obsolescence, pressure on profit margins, need for cost-competitive solutions |

SSubstitutes Threaten

Traditional business intelligence and analytics tools, while less sophisticated than AI-driven platforms, can still act as substitutes for some of BigBear.ai's capabilities. Many organizations may choose these established, often more budget-friendly, options for their fundamental data analysis and reporting needs. This poses a threat when the perceived benefits of advanced AI don't justify the expense and complexity for specific applications.

Manual processes and human expertise represent a significant threat of substitutes for BigBear.ai's offerings. Many organizations, especially those with tighter budgets or less immediate need for advanced analytics, continue to rely on seasoned human analysts and consultants for decision-making. For instance, a 2024 survey indicated that over 60% of small to medium-sized businesses still primarily use internal teams or external consultants for strategic planning, bypassing the need for AI-powered solutions.

The rise of powerful open-source AI frameworks, such as TensorFlow and PyTorch, presents a notable threat of substitution for companies like BigBear.ai. These platforms empower technically adept organizations to build custom AI solutions internally, potentially bypassing the need for third-party providers. For instance, a significant portion of AI development in 2024 is leveraging these open-source tools, with companies investing heavily in internal data science teams.

This trend is particularly pronounced among large enterprises that possess the financial resources and in-house expertise to develop bespoke AI systems. The ability to tailor solutions precisely to their unique operational needs makes in-house development an attractive alternative. BigBear.ai’s strategy must therefore focus on highlighting its unique value proposition, which includes specialized domain knowledge, seamless integration services, and demonstrable performance advantages that are challenging for clients to replicate independently.

Generic Enterprise Software with Integrated AI Features

The threat of substitutes for BigBear.ai's specialized AI solutions is growing as major enterprise software providers embed AI features into their existing platforms. For instance, giants like SAP and Oracle are enhancing their ERP, SCM, and CRM offerings with machine learning capabilities. These integrated AI functionalities, while perhaps less sophisticated than BigBear.ai's bespoke offerings, can satisfy clients looking for a more consolidated, single-vendor approach or those with less demanding AI requirements.

This trend means that businesses might opt for these broader software suites if the built-in AI meets their immediate needs, potentially bypassing the need for a dedicated AI specialist like BigBear.ai. For example, a company might choose an updated SAP S/4HANA with its new AI-powered forecasting tools over a separate, specialized demand forecasting solution. This is particularly true for organizations prioritizing ease of integration and a unified IT infrastructure.

- Growing AI Integration in ERP/SCM/CRM: Major enterprise software vendors are increasingly incorporating AI and machine learning into their core products.

- Single-Vendor Appeal: Clients may prefer these integrated solutions for simplicity and a unified vendor relationship.

- Basic AI Functionality Sufficiency: For less complex AI needs, these embedded features can serve as viable substitutes.

- Market Share Impact: The adoption of AI by large software suites could divert potential customers from specialized AI providers.

Consulting Services and Advisory Firms

Organizations may choose to engage strategic consulting services or advisory firms as an alternative to directly implementing AI platforms. These external experts offer data-driven insights and strategic guidance, which can fulfill a client's need for improved decision-making without the substantial upfront investment in AI software. This approach presents a viable substitute for BigBear.ai's direct solution offerings, particularly for clients who favor outsourced strategic advice.

The market for management consulting services is substantial and growing. In 2023, the global management consulting market was valued at approximately $300 billion, with projections indicating continued growth. For instance, reports suggest the market could reach over $450 billion by 2028, demonstrating a strong demand for advisory services that can substitute for direct technology adoption.

- Consulting firms offer expertise in data analysis and strategic planning.

- These services provide a lower initial capital outlay compared to AI platform implementation.

- Clients seeking outsourced strategic advice may prefer consulting engagements over direct AI solutions.

The threat of substitutes for BigBear.ai is multifaceted, encompassing both traditional and emerging alternatives. Established business intelligence tools, manual processes, and the growing availability of open-source AI frameworks all present viable options for organizations. Furthermore, major enterprise software providers are increasingly embedding AI capabilities into their existing platforms, offering a consolidated approach that may appeal to some clients.

Strategic consulting services also serve as a significant substitute, providing data-driven insights and strategic guidance without the need for direct AI platform implementation. This is particularly attractive to businesses seeking outsourced expertise and a lower initial capital outlay. The substantial and growing market for management consulting underscores this trend, with global valuations indicating strong demand for advisory services that can fulfill similar decision-making needs.

| Substitute Category | Description | Example/Data Point (2024) |

|---|---|---|

| Traditional BI Tools | Less sophisticated but often more budget-friendly data analysis solutions. | Many SMEs still rely on these for fundamental reporting. |

| Manual Processes/Human Expertise | Internal teams or external consultants performing analysis. | Over 60% of SMEs in a 2024 survey used internal teams for strategic planning. |

| Open-Source AI Frameworks | Platforms like TensorFlow and PyTorch enabling in-house AI development. | Significant AI development in 2024 leveraged these tools. |

| Embedded AI in Enterprise Software | AI features integrated into ERP, SCM, CRM systems. | SAP and Oracle enhancing their offerings with ML capabilities. |

| Strategic Consulting Services | External advisory firms offering data-driven insights. | Global management consulting market valued around $300 billion in 2023. |

Entrants Threaten

Developing advanced AI solutions, particularly for sectors like national security and complex supply chains, demands significant capital for research and development. New companies need substantial funding to acquire top talent, build robust technology infrastructure, and gather essential datasets to even approach the capabilities of established firms like BigBear.ai.

BigBear.ai’s focus on defense, national security, and critical infrastructure means new entrants need more than just AI prowess. They must also demonstrate profound knowledge of these complex sectors.

Building the necessary trust with government agencies and major commercial clients is a significant hurdle. This trust is earned through lengthy vetting, obtaining security clearances, and a history of successful, reliable performance, making it difficult for newcomers to compete.

The threat of new entrants is somewhat mitigated by the long sales cycles and complex procurement processes inherent in the AI and data analytics sector, especially when dealing with government contracts. Securing these deals requires substantial upfront investment in time and resources, with no certainty of success. For instance, a typical federal IT contract can take 18-24 months from initial solicitation to award.

BigBear.ai leverages its established relationships and existing contract vehicles, such as the General Services Administration's OASIS+ Indefinite Delivery, Indefinite Quantity (IDIQ) contract, to its advantage. These established channels provide a significant barrier to entry for newcomers, as replicating the trust and familiarity required to navigate these complex procurement pathways takes considerable time and effort.

Brand Reputation and Established Track Record

BigBear.ai's strong brand reputation and established track record are significant barriers to new entrants. In mission-critical sectors, clients place a premium on reliability, security, and proven performance, areas where BigBear.ai has consistently delivered. This history of success makes it difficult for newcomers to gain traction, especially when competing for substantial, high-value contracts that demand a demonstrable portfolio of successful implementations.

New entrants often struggle to overcome the trust deficit associated with unproven capabilities. BigBear.ai's long-standing relationships with government agencies and large enterprises, built on years of successful project execution, provide a competitive moat. For instance, securing contracts with defense organizations requires extensive vetting and a history of dependable performance, a hurdle that nascent companies find exceptionally challenging to surmount.

- Brand Trust: Customers in high-stakes industries prioritize vendors with a proven history of success and reliability.

- Track Record: BigBear.ai's extensive portfolio of successfully deployed solutions for demanding clients acts as a significant deterrent to new market entrants.

- Credibility Gap: New competitors lack the established credibility and past performance data necessary to win large-scale, high-value contracts against incumbents.

- Contract Acquisition: Winning contracts in sectors like defense and intelligence requires a demonstrable track record, a barrier that new entrants find difficult to overcome.

Proprietary Technology and Data Moats

BigBear.ai's proprietary technology and data represent a significant barrier to new entrants. Their advanced AI platforms and unique algorithms are not easily replicated, requiring substantial investment in research and development for competitors to match. This technological advantage, coupled with the accumulation of specialized datasets, creates a durable moat, making it challenging for newcomers to compete effectively.

The company’s ability to leverage vast, specialized datasets and continuously refine predictive models provides a competitive edge that transcends generic AI capabilities. For instance, in 2023, BigBear.ai reported a significant increase in its data analytics capabilities, enabling more precise and actionable insights for its clients across various sectors.

- Proprietary AI Platforms: BigBear.ai possesses unique AI platforms that are difficult and costly for new companies to develop.

- Data Accumulation and Specialization: The company's access to and expertise in handling specialized datasets creates a significant advantage.

- Refined Predictive Models: Continuous improvement of algorithms allows for superior predictive accuracy, a key differentiator.

- High R&D Investment Required: New entrants would need to invest heavily in research and development to even approach BigBear.ai's current technological standing.

The threat of new entrants for BigBear.ai is relatively low, primarily due to the immense capital, specialized knowledge, and established trust required in its target markets. Developing advanced AI for sectors like national security demands substantial R&D investment, specialized talent, and robust infrastructure, creating significant upfront barriers.

Newcomers must also navigate complex procurement processes and build credibility with government agencies and major commercial clients, a lengthy and arduous journey. BigBear.ai's existing relationships, contract vehicles like OASIS+, and strong brand reputation further solidify its position, making it difficult for new players to gain traction.

Proprietary AI platforms and specialized datasets also act as significant deterrents, requiring new entrants to invest heavily in R&D to match BigBear.ai's technological capabilities and data-driven insights. For instance, in 2023, BigBear.ai reported enhanced data analytics capabilities, underscoring the high bar for competitors.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High R&D, talent acquisition, and infrastructure costs. | Significant financial hurdle for new companies. |

| Specialized Knowledge | Expertise in defense, national security, and complex supply chains. | Requires deep domain understanding beyond general AI. |

| Customer Trust & Relationships | Long vetting, security clearances, proven performance history. | Difficult to replicate established credibility and access. |

| Procurement Processes | Long sales cycles, complex government contracts (e.g., 18-24 months). | Demands substantial upfront investment and time commitment. |

| Proprietary Technology | Unique AI platforms, algorithms, and specialized datasets. | Costly and time-consuming for competitors to develop comparable solutions. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a robust combination of primary and secondary data, including company financial statements, industry-specific market research reports, and expert interviews. This approach ensures a comprehensive understanding of competitive intensity and market dynamics.