BigBear.ai Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BigBear.ai Bundle

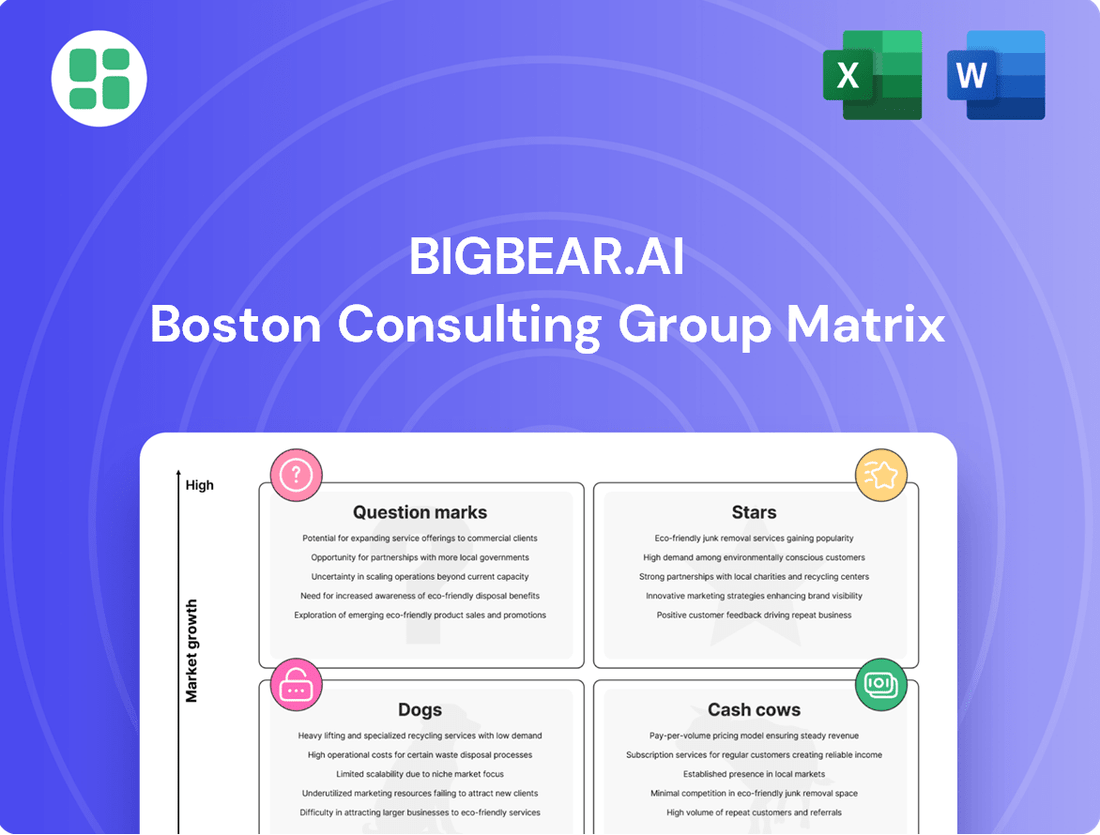

Curious about BigBear.ai's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio's potential. Discover which areas are poised for growth and which might require a closer look.

Unlock the full strategic picture by purchasing the complete BigBear.ai BCG Matrix. Gain detailed quadrant placements, understand market share dynamics, and receive actionable insights to guide your investment decisions.

Don't miss out on the opportunity to leverage this powerful analytical tool. Get the full report and equip yourself with the knowledge to navigate BigBear.ai's market landscape with confidence and foresight.

Stars

BigBear.ai's U.S. Army Global Force Information Management (GFIM-OE) initiative firmly plants it in the Stars quadrant of the BCG Matrix. This is driven by a substantial five-year, $165.15 million sole-source prime contract awarded in October 2024.

This contract signifies BigBear.ai's dominant position in a high-growth market: AI for national security. The GFIM-OE project underscores the strategic necessity of their AI-powered decision intelligence for the U.S. Army's operational readiness.

BigBear.ai's AI-powered aviation security solutions are positioned as a significant growth driver, likely falling into the Stars category of the BCG Matrix. The company's strategic acquisitions, such as Pangiam, and collaborations, like the one with Analogic, are directly targeting the multi-billion dollar global aviation security market. This aggressive expansion leverages their AI-driven threat detection capabilities, which are being integrated into critical airport infrastructure like CT scanners to improve both security and passenger throughput.

BigBear.ai's Joint Staff J-35 ORION Decision Support Platform (DSP) Modernization project positions it as a strong contender in the defense sector. In March 2025, the company secured a $13.2 million contract, spanning 3.5 years, to enhance this critical platform.

This sole-source award highlights BigBear.ai's established expertise in delivering advanced AI solutions for defense force management and planning. The ongoing demand for sophisticated decision intelligence within national security initiatives fuels the growth and importance of such platforms.

National Security AI & Predictive Analytics

BigBear.ai's National Security AI & Predictive Analytics segment, a key component of its BCG Matrix positioning, capitalizes on substantial U.S. government defense and intelligence sector investments. This focus area is experiencing robust growth, driven by the critical need for advanced AI solutions in safeguarding national interests.

The company's established proficiency in predictive analytics and delivering actionable data insights for complex national security operations firmly places it as a frontrunner in this domain. This expertise is particularly valuable in an era of evolving global threats.

The current geopolitical landscape, marked by heightened international tensions, directly translates into increased defense spending proposals. For instance, the U.S. Department of Defense's budget requests for fiscal year 2024 included significant allocations for artificial intelligence and advanced technologies, underscoring the demand for BigBear.ai's core capabilities.

- Revenue Driver: Over 80% of BigBear.ai's revenue is generated from U.S. government defense and intelligence agencies.

- Market Leadership: Proven expertise in predictive analytics for national security missions.

- Growth Fuel: Increased defense spending, with U.S. defense budget requests consistently rising.

- Demand Signal: Geopolitical instability directly correlates with higher demand for AI-driven security solutions.

AI for Supply Chain Management & Logistics Optimization

BigBear.ai's AI-powered solutions are revolutionizing supply chain management and logistics, especially within the defense industry. These advanced tools focus on enhancing operational efficiency and building resilience. The company's expertise is particularly valuable in sectors demanding predictive capabilities and robust supply chain networks.

The demand for BigBear.ai's offerings spans both government and commercial clients. This broad appeal stems from the increasing need for smarter, more agile logistics in a complex global environment. For instance, in 2024, the global supply chain management market was projected to reach over $32 billion, highlighting the significant growth potential.

BigBear.ai has a proven history of delivering results in these critical areas. Their established market presence is a testament to their ability to meet the evolving needs of clients seeking to optimize their operations. The company's AI platforms are designed to provide actionable insights, enabling better decision-making and improved performance.

- Foundational AI for Supply Chain: BigBear.ai's core AI technology addresses inefficiencies in supply chain and logistics.

- Defense Sector Strength: Significant focus and success within the defense sector for critical operational improvements.

- High Demand Across Sectors: Strong market pull from both government and commercial entities seeking enhanced resilience and predictive analytics.

- Growing Market: Operating within a continually expanding market, with the global supply chain management market showing robust growth.

BigBear.ai's AI-driven decision intelligence for national security, exemplified by its GFIM-OE initiative and the ORION DSP Modernization, firmly positions it as a Star. The company's substantial sole-source contract for GFIM-OE, valued at $165.15 million starting October 2024, highlights its dominance in a high-growth sector.

Its AI aviation security solutions, bolstered by acquisitions like Pangiam and collaborations with Analogic, target a multi-billion dollar market, integrating AI into critical airport infrastructure. This strategic expansion leverages advanced threat detection, solidifying its Star status.

The company's National Security AI & Predictive Analytics segment benefits from significant U.S. government defense investments, driven by evolving global threats and increased defense spending, such as the substantial allocations for AI in the FY2024 budget requests.

BigBear.ai's AI capabilities are also revolutionizing defense supply chain and logistics, addressing inefficiencies and enhancing resilience across government and commercial sectors. The global supply chain management market's projected over $32 billion valuation in 2024 underscores the significant growth potential for these solutions.

| BigBear.ai's Star Positioning | Key Initiatives/Segments | Supporting Data/Contracts | Market Context |

|---|---|---|---|

| National Security AI | GFIM-OE Initiative | $165.15M sole-source prime contract (Oct 2024) | High-growth market for AI in national security |

| Aviation Security | AI-powered threat detection | Acquisitions (Pangiam), collaborations (Analogic) | Multi-billion dollar global aviation security market |

| Defense Force Management | ORION Decision Support Platform Modernization | $13.2M contract (March 2025) for 3.5 years | Critical defense sector demand for AI solutions |

| Supply Chain & Logistics | AI for operational efficiency and resilience | Global SCM market projected >$32B (2024) | High demand across government and commercial sectors |

What is included in the product

The BigBear.ai BCG Matrix provides a strategic overview of its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

BigBear.ai's BCG Matrix offers a clear, visual representation of your portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

BigBear.ai's established government intelligence analytics contracts are definitive cash cows within its BCG matrix. These long-standing agreements with U.S. defense and intelligence agencies provide a bedrock of stable, predictable revenue, minimizing the need for substantial new investment in marketing or product enhancement.

These mature contracts are the company's foundational revenue generators, consistently producing reliable cash flow. For instance, in the first quarter of 2024, BigBear.ai reported a significant portion of its revenue stemming from its core analytics and AI solutions, underscoring the cash-generating power of these established government partnerships.

Digital Identity and Biometrics Maintenance Services, while not at the forefront of cutting-edge innovation, represent a stable Cash Cow for BigBear.ai. These services provide essential ongoing support and upkeep for existing digital identity solutions deployed with government clients. This reliability stems from high renewal rates, ensuring a consistent and predictable revenue stream.

The steady cash flow generated by these maintenance services is crucial, as they require minimal additional investment for market penetration. In 2024, BigBear.ai continued to leverage these established contracts, which are vital for funding more speculative, high-growth ventures within the company's portfolio. This segment acts as a foundational element, providing the financial stability needed for the company's broader strategic initiatives.

BigBear.ai's foundational data engineering and cloud-based analytics services are the bedrock of its offerings, focusing on data ingestion, enrichment, and processing. These capabilities are crucial for clients needing to make sense of vast datasets.

These essential infrastructure services generate recurring revenue through ongoing service agreements and platform usage fees, providing a stable income stream. For instance, in 2023, BigBear.ai reported that its recurring revenue represented a significant portion of its total revenue, underscoring the stability of these offerings.

The company enjoys a high market share within its established customer base for these core services, indicating strong client retention and deep integration into their operations. This dominance in its existing markets positions these services as classic cash cows.

Long-Term Federal Aviation Administration (FAA) Subcontract

BigBear.ai's position as a subcontractor on a 10-year, $2.4 billion Federal Aviation Administration (FAA) contract for IT services and emerging technologies firmly places this engagement in the Cash Cow category of the BCG Matrix. This substantial, long-term government contract provides a highly stable and predictable revenue stream for BigBear.ai, ensuring consistent income over a decade.

- Stable Revenue: The 10-year duration of the FAA contract guarantees a predictable and ongoing revenue source for BigBear.ai.

- Significant Value: With a ceiling of $2.4 billion, this contract represents a major, reliable income channel.

- Low Growth Potential: While substantial, government IT contracts often have defined scopes, limiting rapid, explosive growth compared to high-growth market segments.

- Market Position: This established government relationship highlights BigBear.ai's capability in a mature, albeit essential, market segment.

Maintenance and Operations for Deployed DoD Platforms

BigBear.ai's maintenance and operations for deployed Department of Defense (DoD) platforms, such as the ORION Decision Support Platform, represent a significant cash cow. These services ensure the continued functionality and effectiveness of critical defense systems, generating stable, high-margin revenue long after initial deployment.

These ongoing support contracts are vital for mission readiness and provide a predictable income stream. For example, in 2024, BigBear.ai continued to secure and execute long-term contracts for sustainment and operational support, reflecting the enduring need for their expertise in maintaining complex defense technologies.

- Recurring Revenue: Post-deployment maintenance and operational services provide consistent, high-margin income.

- Mission Criticality: These services are essential for the continuous operation of DoD platforms, ensuring high demand.

- Contract Stability: Long-term contracts in this segment offer predictable revenue visibility.

- High Profitability: Specialized technical support and maintenance often command higher profit margins compared to initial development.

BigBear.ai's established government intelligence analytics contracts are definitive cash cows within its BCG matrix. These long-standing agreements with U.S. defense and intelligence agencies provide a bedrock of stable, predictable revenue, minimizing the need for substantial new investment in marketing or product enhancement. These mature contracts are the company's foundational revenue generators, consistently producing reliable cash flow. For instance, in the first quarter of 2024, BigBear.ai reported a significant portion of its revenue stemming from its core analytics and AI solutions, underscoring the cash-generating power of these established government partnerships.

Digital Identity and Biometrics Maintenance Services, while not at the forefront of cutting-edge innovation, represent a stable Cash Cow for BigBear.ai. These services provide essential ongoing support and upkeep for existing digital identity solutions deployed with government clients. This reliability stems from high renewal rates, ensuring a consistent and predictable revenue stream. The steady cash flow generated by these maintenance services is crucial, as they require minimal additional investment for market penetration. In 2024, BigBear.ai continued to leverage these established contracts, which are vital for funding more speculative, high-growth ventures within the company's portfolio. This segment acts as a foundational element, providing the financial stability needed for the company's broader strategic initiatives.

BigBear.ai's foundational data engineering and cloud-based analytics services are the bedrock of its offerings, focusing on data ingestion, enrichment, and processing. These capabilities are crucial for clients needing to make sense of vast datasets. These essential infrastructure services generate recurring revenue through ongoing service agreements and platform usage fees, providing a stable income stream. For instance, in 2023, BigBear.ai reported that its recurring revenue represented a significant portion of its total revenue, underscoring the stability of these offerings. The company enjoys a high market share within its established customer base for these core services, indicating strong client retention and deep integration into their operations. This dominance in its existing markets positions these services as classic cash cows.

BigBear.ai's position as a subcontractor on a 10-year, $2.4 billion Federal Aviation Administration (FAA) contract for IT services and emerging technologies firmly places this engagement in the Cash Cow category of the BCG Matrix. This substantial, long-term government contract provides a highly stable and predictable revenue stream for BigBear.ai, ensuring consistent income over a decade.

BigBear.ai's maintenance and operations for deployed Department of Defense (DoD) platforms, such as the ORION Decision Support Platform, represent a significant cash cow. These services ensure the continued functionality and effectiveness of critical defense systems, generating stable, high-margin revenue long after initial deployment. These ongoing support contracts are vital for mission readiness and provide a predictable income stream. For example, in 2024, BigBear.ai continued to secure and execute long-term contracts for sustainment and operational support, reflecting the enduring need for their expertise in maintaining complex defense technologies.

| Category | Key Characteristics | BigBear.ai Examples | Financial Impact | Strategic Role |

| Cash Cow | Stable revenue, low investment needed, high market share in mature markets | Govt. Intelligence Analytics, Digital Identity Maintenance, Data Engineering Services, FAA Contract Subcontract, DoD Platform Maintenance | Generates consistent, predictable cash flow, funds other ventures | Provides financial stability, supports growth initiatives |

Delivered as Shown

BigBear.ai BCG Matrix

The BigBear.ai BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no hidden surprises—just a comprehensive, analysis-ready report designed for strategic decision-making.

Rest assured, the BigBear.ai BCG Matrix you see here is the exact file that will be delivered to you upon completion of your purchase. It's a professionally crafted document, ready for immediate integration into your business strategy, offering clear insights into BigBear.ai's product portfolio.

What you are previewing is the definitive BigBear.ai BCG Matrix report that you will own after purchase. This means you get the complete, unedited analysis, allowing you to leverage its strategic value for your planning and presentations without any further modifications needed.

Dogs

Prior to its strategic pivot, BigBear.ai likely had legacy commercial offerings that were not performing well. These ventures might have shown minimal revenue growth and struggled to capture significant market share, acting as drains on resources rather than drivers of profit. For instance, if a particular data analytics service launched in 2022 generated only $500,000 in revenue in 2023 with a projected growth rate of 2%, it would clearly fall into this category.

The 15 legacy U.S. Army systems BigBear.ai is modernizing fall into the 'dog' category within the BCG matrix. These systems, while slated for transformation into the GFIM-OE platform, are currently characterized by inefficiency and high maintenance costs. Their strategic value is minimal in their current state, consuming resources without delivering significant returns until the modernization is complete.

Highly commoditized IT services offered by BigBear.ai, those not directly tied to its core AI or decision intelligence, are likely categorized as Dogs. These services operate in a fiercely competitive market, often characterized by price wars and slim profit margins. For instance, basic cloud migration or managed IT support, if offered without a unique AI-driven advantage, would fall into this group, offering little strategic growth potential.

Past Unsuccessful R&D Initiatives

BigBear.ai, like many forward-thinking technology firms, has undoubtedly poured resources into various research and development endeavors. These initiatives, while crucial for staying competitive and exploring new frontiers, may not always translate into market success or widespread adoption. When these R&D projects fail to gain traction or scale effectively, they can become a drain on resources, fitting the description of 'dogs' within a strategic portfolio analysis.

For instance, BigBear.ai might have explored advanced AI algorithms for niche industrial applications that, despite technical merit, faced significant adoption hurdles due to high implementation costs or a lack of readily available data from potential clients. Such projects, requiring substantial upfront investment in talent and infrastructure without generating commensurate returns, represent classic 'dog' characteristics in terms of their contribution to overall growth and profitability.

- Past R&D Failures: BigBear.ai has likely encountered projects that did not achieve market viability or scalability.

- Resource Allocation Impact: Unsuccessful R&D can tie up capital and talent, hindering investment in more promising areas.

- Example Scenario: An AI solution for a specific industrial problem might have been technically sound but too costly for widespread adoption.

- Strategic Re-evaluation: Identifying these 'dogs' is vital for efficient resource allocation and focusing on high-potential ventures.

Costs Associated with Government Funding Delays

The carrying cost of excess resource capacity due to government funding delays significantly impacts BigBear.ai, placing it in the 'dog' quadrant of the BCG matrix. These are essentially operational expenses that continue to accrue without any offsetting revenue. For instance, in 2024, BigBear.ai reported that extended government contract timelines led to increased overhead, impacting profitability.

- Carrying Costs: These are direct operational expenses like salaries for idle personnel or maintaining unused infrastructure.

- Revenue Lag: Delays mean revenue generation is pushed back, creating a cash flow vacuum.

- Resource Underutilization: Capacity built for anticipated projects sits idle, representing a sunk cost.

- Impact on Profitability: These costs directly reduce net income and can strain working capital.

BigBear.ai's legacy U.S. Army system modernization efforts, specifically those focused on 15 older platforms, are currently classified as Dogs. These systems, while targeted for transformation into the GFIM-OE platform, are characterized by inefficiency and substantial maintenance costs in their current state. Their strategic value is limited, consuming resources without generating significant returns until the modernization is complete.

Highly commoditized IT services that BigBear.ai offers, separate from its core AI or decision intelligence capabilities, also fall into the Dog category. These services compete in a crowded market, often marked by price competition and narrow profit margins. Basic cloud migration or standard managed IT support, without a distinct AI-driven advantage, would fit this description, offering minimal potential for strategic growth.

The carrying cost of excess resource capacity, often a result of government funding or contract delays, significantly impacts BigBear.ai, placing these assets in the Dog quadrant. These represent ongoing operational expenses without corresponding revenue. For instance, extended government contract timelines in 2024 contributed to increased overhead for BigBear.ai, negatively affecting profitability.

| Category | Description | BigBear.ai Example | Financial Implication | 2024 Data Point |

|---|---|---|---|---|

| Dogs | Low market share, low growth potential | Legacy U.S. Army systems modernization | Resource drain, high maintenance costs | Extended government contract timelines increased overhead. |

| Dogs | Low market share, low growth potential | Commoditized IT services | Price wars, slim profit margins | N/A (specific data not publicly available for commoditized services) |

| Dogs | Low market share, low growth potential | Unsuccessful R&D projects | Capital and talent tied up | N/A (specific R&D project failures not publicly disclosed) |

Question Marks

BigBear.ai's Virtual Anticipation Network (VANE) prototype, a key component within its broader strategic offerings, is positioned as a potential star in the BCG matrix. The Department of Defense Chief Digital and Artificial Intelligence Office (CDAO) recognized its promise, awarding a contract in February 2025 to further develop this AI model for geopolitical risk analysis.

While VANE shows significant promise in a critical defense sector, its current prototype status places it firmly in the question mark category. This means it has high growth potential but also requires substantial investment to transition from development to widespread operational deployment and capture significant market share.

BigBear.ai's strategic pivot towards integrating generative AI with edge computing, a significant R&D focus for 2025, positions it on a high-growth, innovative frontier. This move, while promising, places the initiative squarely in the Question Mark category of the BCG Matrix.

The company is investing heavily in this nascent technology, recognizing its potential to create new revenue streams. However, its current market share is minimal, reflecting the early stage of development and the significant effort required to achieve widespread market adoption and establish a dominant position.

BigBear.ai's strategic partnership with DEFCON AI, announced in early 2024, positions it to capitalize on the burgeoning defense technology market. This collaboration focuses on co-developing advanced modeling and simulation solutions tailored for military logistics and readiness. The defense sector, particularly in areas requiring sophisticated AI-driven insights, represents a significant growth opportunity.

While the partnership targets a high-growth segment, it's crucial to recognize that this initiative is in its nascent stages. Successful market penetration will hinge on substantial joint investment and the effective delivery of integrated solutions. BigBear.ai's investment in such strategic alliances underscores its commitment to expanding its capabilities in critical defense applications.

Expansion into New Commercial Verticals (Healthcare, Manufacturing, Life Sciences)

BigBear.ai's expansion into commercial verticals like healthcare, manufacturing, and life sciences represents a strategic pivot towards areas with significant AI adoption potential. These sectors, particularly healthcare, are projected for robust growth; for instance, the global healthcare AI market was valued at approximately $15.4 billion in 2023 and is expected to reach $175.7 billion by 2030, growing at a CAGR of 41.5%.

While BigBear.ai has articulated its ambition to serve these markets, its current market share outside of its traditional defense and aviation security focus is likely in its early stages. Establishing a strong competitive foothold in these diverse and complex commercial sectors will necessitate considerable strategic investment in sales, marketing, and product development tailored to specific industry needs.

The company's success in these new verticals will hinge on its ability to demonstrate tangible value propositions and build trust within industries that may have longer sales cycles and require specialized domain expertise. Key considerations for BigBear.ai include:

- Market Penetration Strategy: Developing targeted go-to-market plans for each vertical, addressing unique pain points with AI-driven solutions.

- Investment in R&D: Allocating resources to adapt existing AI platforms or develop new ones that meet the specific regulatory and operational demands of healthcare, manufacturing, and life sciences.

- Partnership Development: Collaborating with established players or industry associations to accelerate market entry and build credibility.

- Demonstrating ROI: Clearly articulating the return on investment for AI solutions, crucial for adoption in cost-sensitive commercial environments.

Commercial Applications of Palantir Partnership

BigBear.ai's partnership with Palantir to embed its AI solutions within Palantir's Foundry platform targets commercial sectors like retail and energy. This integration aims to unlock new revenue streams by offering advanced analytics and decision intelligence to these industries.

The success of this commercial application hinges on BigBear.ai's ability to penetrate these new markets. As of early 2024, market penetration in these specific commercial verticals remains nascent, necessitating significant capital allocation for product development, sales force expansion, and marketing initiatives to establish a foothold and capture market share.

- Growth Opportunity: Integration into Palantir Foundry for retail and energy verticals.

- Market Penetration: Currently low in these new commercial applications.

- Investment Required: Substantial funds needed for product integration, sales, and marketing.

- Strategic Aim: To gain significant market share in commercial sectors.

BigBear.ai's efforts in commercial verticals like healthcare and manufacturing, alongside its Palantir partnership for retail and energy, represent significant growth opportunities. However, these initiatives are in their early stages, requiring substantial investment to build market share and demonstrate clear ROI.

The company's strategic pivot towards integrating generative AI with edge computing also falls into the Question Mark category. While promising for future revenue, it demands considerable R&D and market development to establish a dominant position.

The Virtual Anticipation Network (VANE) prototype, despite its defense sector potential, remains a Question Mark due to its current developmental status, needing further investment to transition to widespread deployment.

| Initiative | BCG Category | Market Growth | Market Share | Investment Needs |

|---|---|---|---|---|

| VANE Prototype | Question Mark | High (Defense AI) | Low (Prototype) | High |

| Gen AI & Edge Computing | Question Mark | High (Emerging Tech) | Low (Nascent) | High |

| Commercial Verticals (Healthcare, Mfg.) | Question Mark | High (e.g., Healthcare AI CAGR ~41.5%) | Low (New Entrant) | High |

| Palantir Partnership (Retail, Energy) | Question Mark | Moderate to High | Low (New Application) | High |

BCG Matrix Data Sources

Our BCG Matrix is powered by comprehensive market data, including financial reports, industry growth rates, and competitive landscape analysis, to provide actionable strategic guidance.