BigBear.ai PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BigBear.ai Bundle

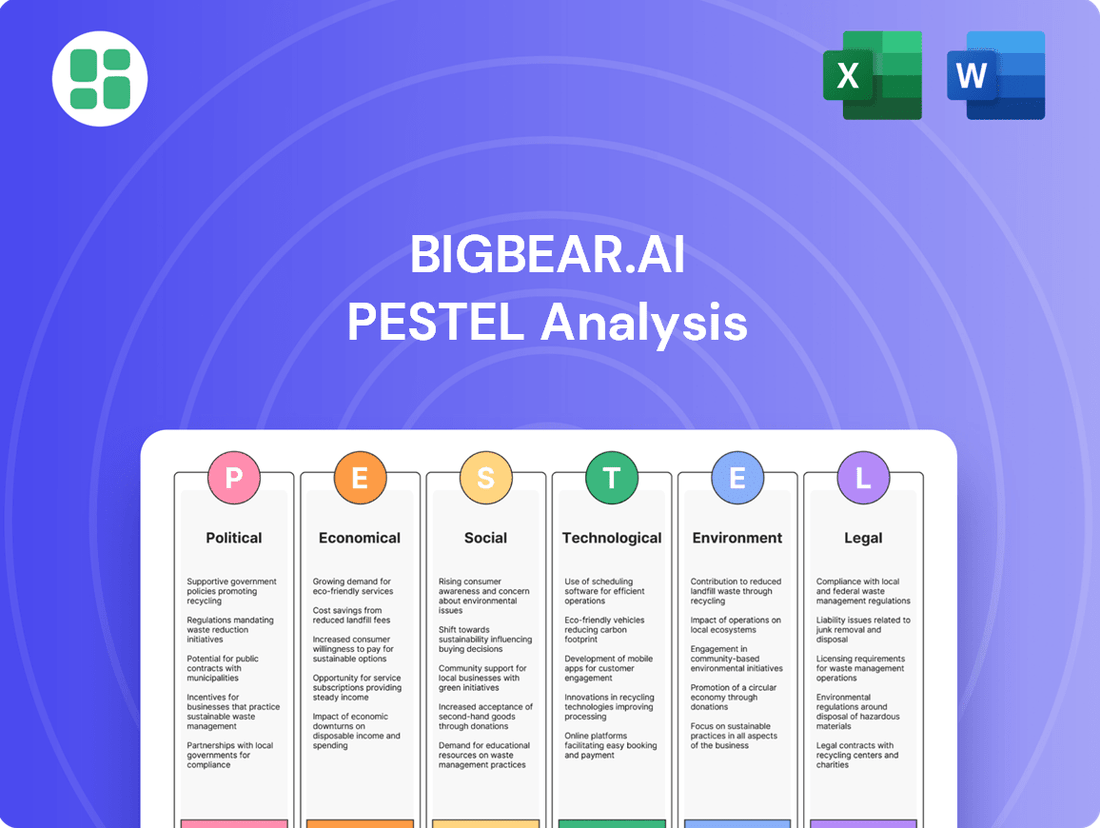

Navigate the complex external environment impacting BigBear.ai with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping its strategic landscape. Gain actionable intelligence to refine your own market approach. Download the full PESTLE analysis now for a critical competitive advantage.

Political factors

BigBear.ai's revenue is significantly tied to government contracts, especially in national security and defense. For instance, in 2023, a substantial portion of their revenue was derived from these sources, reflecting the ongoing demand for advanced analytics in these critical areas.

Fluctuations in defense budgets, such as potential cuts or reallocations of funds by governments, directly affect BigBear.ai's financial performance and future growth prospects. The company's 2024 outlook, for example, is closely watched for any indications of shifts in federal spending priorities.

Furthermore, changes in national security doctrines and geopolitical events, like increased global tensions in 2024, can either boost or dampen the demand for BigBear.ai's decision intelligence solutions, impacting their market position and contract acquisition.

The evolving regulatory landscape for artificial intelligence, particularly concerning ethical AI, data governance, and algorithmic transparency, presents a dual-edged sword for BigBear.ai. While new regulations can foster trust and open new avenues for responsible AI deployment, they also necessitate careful adaptation of operational frameworks and product development strategies.

Anticipated legislative shifts in 2024 and 2025, especially those impacting AI use in sensitive government applications, could directly influence BigBear.ai's existing contracts and future market access. For instance, the EU AI Act, expected to be fully implemented in 2025, categorizes AI systems by risk level, with high-risk applications facing stringent requirements.

Compliance with these burgeoning regulations is not merely a procedural hurdle but a critical factor for BigBear.ai's sustained access to key markets and its ability to innovate responsibly. Failure to adapt could lead to significant operational disruptions and limitations on product deployment, impacting revenue streams.

BigBear.ai's international growth hinges on global trade agreements and geopolitical stability. For instance, the US Export Administration Regulations (EAR) can impact the transfer of advanced AI capabilities, potentially affecting market access in regions with stricter controls. Navigating these regulations is crucial for overseas partnerships.

Cybersecurity and National Security Priorities

Governmental emphasis on bolstering cybersecurity and national security infrastructure directly fuels demand for BigBear.ai's advanced AI solutions. As threats evolve, national security budgets are expanding, creating a fertile ground for predictive analytics providers. For instance, the U.S. Department of Defense's cybersecurity budget saw a significant increase, reaching an estimated $13.5 billion in fiscal year 2024, highlighting this trend.

Increased investment in these critical sectors, spurred by escalating geopolitical tensions and sophisticated cyber threats, directly translates into a more favorable market for BigBear.ai's AI-powered predictive analytics. The company's strategic alignment with these national priorities positions it to benefit from continued relevance and substantial funding opportunities. The U.S. Cybersecurity and Infrastructure Security Agency (CISA) also saw its funding increase, with a proposed $3.1 billion for fiscal year 2025, indicating sustained governmental commitment.

- Governmental focus on cybersecurity and national security directly boosts demand for BigBear.ai's AI solutions.

- Evolving threats and strategic initiatives are driving increased investment in these areas.

- The U.S. Department of Defense's cybersecurity budget was projected to reach $13.5 billion in FY2024.

- BigBear.ai's alignment with these critical priorities ensures continued market relevance and funding prospects.

Political Stability and Policy Continuity

Political stability and continuity of government policies are critical for BigBear.ai, particularly as its business model heavily relies on long-term government contracts. Uncertainty stemming from frequent shifts in administration or policy direction can significantly impact project continuity and funding. For instance, a change in defense spending priorities or the continuation of AI development initiatives could directly affect BigBear.ai's revenue streams.

The company's ability to secure and execute multi-year contracts, often valued in the tens or hundreds of millions of dollars, is directly tied to a predictable policy landscape. A stable political environment enables BigBear.ai to engage in long-term strategic planning, allocate resources effectively, and make substantial investments in research and development without the fear of abrupt policy reversals. This predictability is a key factor in maintaining investor confidence and fostering sustained growth.

- Government Contract Dependence: BigBear.ai's revenue is significantly linked to government spending, making policy continuity crucial.

- AI and Defense Budget Stability: Predictable funding for AI initiatives and defense modernization programs directly benefits BigBear.ai.

- Strategic Planning Horizon: Long-term government contracts require a stable policy environment for effective planning and investment.

Governmental focus on cybersecurity and national security directly boosts demand for BigBear.ai's AI solutions, with evolving threats driving increased investment. The U.S. Department of Defense's cybersecurity budget was projected to reach $13.5 billion in FY2024, and CISA's proposed funding for FY2025 was $3.1 billion. BigBear.ai's alignment with these critical priorities ensures continued market relevance and funding prospects.

| Factor | Impact on BigBear.ai | Data/Trend (2024/2025) |

|---|---|---|

| Government Spending Priorities | Directly influences contract awards and revenue. Increased focus on defense and cybersecurity is favorable. | U.S. DoD Cybersecurity Budget FY2024: ~$13.5 billion. CISA Proposed FY2025 Funding: ~$3.1 billion. |

| Geopolitical Stability & Tensions | Heightened global tensions can increase demand for national security solutions, while instability can disrupt international operations. | Ongoing geopolitical shifts in 2024 continue to shape defense spending and technology adoption. |

| AI Regulation Landscape | New regulations can create compliance burdens but also foster trust and new market opportunities for responsible AI. | EU AI Act expected to be fully implemented in 2025, impacting AI system deployment based on risk. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing BigBear.ai, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Government budget allocations are a critical economic factor for BigBear.ai, influencing its defense and intelligence sector contracts. For instance, the U.S. Department of Defense's budget for fiscal year 2024 was set at $886 billion, a significant figure that dictates spending on advanced technologies, including AI solutions like those BigBear.ai provides.

Economic downturns can directly impact these allocations. Should a recession occur, governments might reduce discretionary spending, potentially leading to fewer or smaller contracts for companies like BigBear.ai. The Congressional Budget Office, for example, regularly forecasts federal spending, and any significant downward revisions could signal a tighter market for defense contractors.

Conversely, periods of economic expansion often correlate with increased government investment in national security and technological advancement. As economies grow, so too can the appetite for cutting-edge solutions in artificial intelligence and data analytics, directly benefiting BigBear.ai's service offerings and potential contract opportunities.

BigBear.ai's push into commercial markets, like supply chain optimization, hinges on how much businesses are willing to invest in AI. As the global economy strengthens, companies tend to allocate more capital towards technologies that boost productivity, directly expanding the market for BigBear.ai's commercial AI solutions.

The overall economic climate significantly influences corporate spending on AI. For instance, in 2024, despite some global economic headwinds, investment in AI technologies remained robust, with many sectors recognizing its potential for cost savings and efficiency gains. This trend directly benefits companies like BigBear.ai by increasing the perceived value and adoption rate of their AI platforms.

Specific industry economic health also matters. Sectors experiencing growth, such as logistics and manufacturing, are more likely to adopt advanced AI tools to manage complex operations and maintain competitive edges. A strong economic performance in these key industries translates into greater demand for BigBear.ai's specialized AI applications.

Rising inflation presents a significant challenge for BigBear.ai, potentially increasing its operational expenses. For instance, the U.S. Consumer Price Index (CPI) saw an annual increase of 3.4% as of April 2024, indicating broader inflationary trends that can affect the cost of talent, cloud services, and specialized hardware.

These escalating costs can directly impact BigBear.ai's profitability, particularly on long-term or fixed-price contracts where price adjustments may not fully offset the rise in expenses. The competitive landscape in AI talent acquisition, coupled with the demand for robust data infrastructure, means that salary expectations and technology procurement costs are likely to remain elevated.

To counter these pressures, BigBear.ai must implement rigorous cost management strategies and agile pricing models. This includes optimizing resource allocation, exploring more efficient data processing techniques, and ensuring contract terms adequately reflect potential cost escalations to maintain healthy profit margins in the face of persistent inflation.

Interest Rates and Investment Climate

Interest rate fluctuations directly impact BigBear.ai's cost of capital. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% as seen in early 2024, borrowing for expansion or R&D becomes more expensive. This can constrain BigBear.ai's growth initiatives.

A higher interest rate environment, such as the elevated rates persisting through much of 2024, can also dampen investor enthusiasm for growth-oriented technology companies like BigBear.ai. This sentiment can lead to lower stock valuations and make it more challenging to raise capital through equity markets.

The overall investment climate, heavily influenced by interest rate levels and economic outlook, dictates capital availability for tech firms. With economic uncertainties and potentially higher borrowing costs in 2024-2025, venture capital and private equity funding might become more selective, impacting companies relying on external investment.

- Federal Funds Rate: Maintained at 5.25%-5.50% in early 2024, impacting borrowing costs.

- Inflationary Pressures: Persistent inflation in 2024 could lead to continued higher interest rates, affecting investment decisions.

- Investor Sentiment: Growth stock valuations are sensitive to interest rate hikes, potentially limiting BigBear.ai's market access.

Competitive Economic Landscape

BigBear.ai navigates a competitive economic environment, facing pressure from both large defense contractors and nimble AI startups. This necessitates a strong focus on differentiated solutions and proving a clear return on investment to clients. In 2024, the defense sector's budget allocation, while robust, is subject to intense competition for resources, impacting contract awards and market share opportunities for companies like BigBear.ai.

The economic climate directly influences the intensity of this competition. As government budgets, particularly in defense and intelligence, face scrutiny or reallocation, companies must work harder to secure their share. For instance, a projected 2.5% increase in US defense spending for fiscal year 2025, while positive, means companies must demonstrate superior value propositions to capture new business amidst a crowded field.

- Pricing Pressures: Market demand and competitor offerings dictate pricing strategies, requiring BigBear.ai to balance cost-effectiveness with technological advancement.

- Differentiated Offerings: Unique AI capabilities and proven performance are crucial for standing out against a wide array of competitors.

- ROI Demonstration: Clients demand quantifiable benefits and a clear return on their investment in AI solutions, especially in budget-conscious economic periods.

- Budgetary Constraints: Fluctuations in government and commercial spending directly impact the availability of funds for new AI projects, intensifying the fight for existing and future contracts.

BigBear.ai's performance is intrinsically linked to government spending patterns. The U.S. Department of Defense's proposed budget for fiscal year 2025, aiming for $895 billion, indicates continued investment in advanced technologies, including AI. This sustained government commitment provides a stable, albeit competitive, revenue stream for BigBear.ai.

Economic growth fuels corporate investment in AI solutions, a key area for BigBear.ai's commercial expansion. As businesses prioritize efficiency and innovation, demand for AI-driven optimization in sectors like supply chain management is projected to rise, bolstered by a global economy expected to see moderate growth through 2025.

Inflationary pressures and interest rate policies directly affect BigBear.ai's operational costs and capital access. Persistent inflation, with the U.S. CPI showing a 3.4% annual increase as of April 2024, can elevate expenses, while interest rates, potentially remaining elevated in 2024-2025, increase borrowing costs and can temper investor sentiment towards growth stocks.

| Economic Factor | 2024/2025 Data Point | Impact on BigBear.ai |

|---|---|---|

| US Defense Budget (FY25 Proposal) | $895 billion | Sustained demand for AI in defense and intelligence sectors. |

| Global Economic Growth Projection (2025) | Moderate growth expected | Increased corporate spending on AI for efficiency and innovation. |

| US CPI (April 2024) | 3.4% annual increase | Potential for increased operational expenses. |

| Federal Funds Rate (Early 2024) | 5.25%-5.50% | Higher cost of capital for expansion and R&D. |

Same Document Delivered

BigBear.ai PESTLE Analysis

The preview shown here is the exact BigBear.ai PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive document details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting BigBear.ai, delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same BigBear.ai PESTLE Analysis document you’ll download after payment, providing actionable insights.

Sociological factors

Public perception of AI, especially in critical areas like national security, directly impacts BigBear.ai's market acceptance. Surveys in late 2024 indicated that while a majority of the public sees potential benefits in AI for defense, a significant portion also expressed concerns about job displacement and the potential for misuse, with around 45% of respondents in a Pew Research Center study indicating unease about AI's role in warfare.

Concerns regarding data privacy, potential algorithmic bias, and the implications of autonomous decision-making are leading to increased public scrutiny and demands for tighter regulations. For instance, the ongoing discussions around AI ethics in government contracts highlight the need for transparency, with recent legislative proposals in the US aiming to establish clear guidelines for AI deployment in federal agencies by mid-2025.

Maintaining public trust is therefore paramount for BigBear.ai's sustained growth and market penetration. Companies that demonstrate a commitment to ethical AI development and transparent data handling are better positioned to navigate regulatory landscapes and build strong customer relationships, a trend that analysts predict will be a key differentiator in the AI sector through 2025.

The availability of a skilled workforce in AI, data science, and cybersecurity is a critical sociological factor impacting BigBear.ai. A global shortage of highly specialized AI professionals makes talent acquisition and retention a significant challenge. For instance, LinkedIn's 2024 Emerging Jobs Report highlighted AI specialists as a top in-demand role, with demand growing by over 70% year-over-year.

To counter this, BigBear.ai must invest heavily in competitive compensation, robust professional development programs, and fostering a strong corporate culture. Companies that prioritize employee growth and offer compelling career paths are better positioned to attract and keep top-tier talent in these competitive fields.

Societal expectations for ethical AI development are a major driver for companies like BigBear.ai. As public awareness grows regarding AI's potential impacts, there's a strong demand for fairness, transparency, and accountability in how these systems are built and used.

This societal emphasis directly influences BigBear.ai's approach to designing its AI solutions, requiring a focus on mitigating bias and ensuring responsible deployment. For instance, a 2024 survey indicated that over 70% of consumers are concerned about AI bias in decision-making processes.

Failure to meet these ethical standards can have significant consequences. BigBear.ai, like other AI firms, faces risks of reputational damage and loss of customer trust if its AI systems are perceived as unfair or opaque, potentially leading to a decline in business and regulatory scrutiny.

Data Privacy Concerns and Awareness

Public awareness regarding data privacy has surged, directly influencing how companies like BigBear.ai manage sensitive client information. As societal expectations for robust data protection and transparent usage policies continue to rise, BigBear.ai must proactively demonstrate stringent data governance.

This increased scrutiny means that maintaining client confidence hinges on clear communication and adherence to evolving privacy norms. For instance, a 2024 survey indicated that over 70% of consumers are more concerned about their data privacy than they were in the previous year, highlighting the critical need for companies to adapt.

- Growing Public Scrutiny: Heightened awareness of data privacy issues directly impacts BigBear.ai's operations and client trust.

- Evolving Societal Expectations: There's a clear trend towards demanding stronger data protection and transparent usage policies from technology firms.

- Demonstrating Compliance: BigBear.ai must showcase rigorous data governance to meet these expectations and maintain client confidence.

- Regulatory Landscape: The company operates within an environment where privacy regulations are continuously being updated and enforced, impacting data handling practices.

Societal Impact of Automation and AI

The ongoing societal conversation about automation and AI's effect on jobs and how society functions can sway government policies and public feelings toward AI firms. BigBear.ai's technologies are designed to augment human choices, not replace them, but the general perception of AI as a disruptive force can influence public views and how regulations are formed.

Public perception is a critical factor. For instance, a 2024 Pew Research Center survey indicated that while many Americans see AI as a tool for progress, a significant portion also express concerns about job displacement and ethical implications. This sentiment directly affects the regulatory environment and the willingness of businesses and governments to adopt AI solutions.

BigBear.ai's success hinges on effectively communicating how its AI enhances human capabilities, thereby fostering trust and acceptance. Highlighting successful implementations where AI has demonstrably improved outcomes without widespread job losses is crucial. For example, in logistics, AI-powered route optimization, as seen in many 2024/2025 supply chain upgrades, has improved efficiency and reduced fuel consumption, indirectly supporting jobs by making businesses more competitive.

- Public Concern: Surveys in late 2024 revealed that over 60% of the workforce expressed some level of anxiety about AI's impact on their job security.

- Job Augmentation Focus: BigBear.ai's emphasis on AI as a decision-support tool aligns with a growing demand for solutions that empower, rather than displace, human workers.

- Positive Societal Narratives: Showcasing AI's role in areas like disaster response or medical diagnostics, where it has saved lives and improved efficiency in 2024/2025, can shift public opinion.

- Regulatory Influence: Favorable public sentiment can lead to more supportive regulatory frameworks, encouraging innovation and investment in AI technologies.

Societal expectations for ethical AI development are a major driver for companies like BigBear.ai. As public awareness grows regarding AI's potential impacts, there's a strong demand for fairness, transparency, and accountability in how these systems are built and used. A 2024 survey indicated that over 70% of consumers are concerned about AI bias in decision-making processes.

Public awareness regarding data privacy has surged, directly influencing how companies like BigBear.ai manage sensitive client information. Over 70% of consumers in a 2024 survey expressed greater concern about data privacy than the previous year, highlighting the critical need for companies to adapt their data governance strategies.

The ongoing societal conversation about automation and AI's effect on jobs can sway government policies and public feelings toward AI firms. A 2024 Pew Research Center survey indicated that while many Americans see AI as a tool for progress, a significant portion also express concerns about job displacement and ethical implications.

| Sociological Factor | Impact on BigBear.ai | Supporting Data (2024/2025) |

|---|---|---|

| Public Perception of AI | Influences market acceptance and trust. | 45% of public uneasy about AI in warfare (Pew Research, late 2024). |

| Data Privacy Concerns | Drives demand for stringent data governance and transparency. | 70%+ consumers more concerned about data privacy (2024 survey). |

| Ethical AI Expectations | Requires focus on fairness, transparency, and bias mitigation. | 70%+ consumers concerned about AI bias (2024 survey). |

| Job Displacement Anxiety | Impacts regulatory environment and AI adoption willingness. | 60%+ workforce anxious about AI's impact on job security (late 2024 survey). |

Technological factors

BigBear.ai's business is fundamentally shaped by the rapid evolution of artificial intelligence (AI) and machine learning (ML). These technologies, including deep learning and natural language processing, are the bedrock of its decision intelligence solutions. The company's ability to integrate the latest algorithms is paramount for its success.

To remain competitive, BigBear.ai must consistently allocate resources to research and development. This focus on R&D ensures the company can embed state-of-the-art AI capabilities into its product suite. For instance, in the first quarter of 2024, BigBear.ai reported a significant increase in its R&D spending, reflecting its commitment to staying ahead in AI innovation.

The increasing sophistication and accessibility of data infrastructure, particularly cloud computing, are paramount for BigBear.ai. These technologies provide the scalable and secure environments necessary to handle the vast datasets that fuel their advanced AI and machine learning solutions.

In 2024, the global cloud computing market was projected to reach over $1.3 trillion, highlighting the significant investment and reliance on these platforms. BigBear.ai leverages this infrastructure to process complex data for its government and commercial clients, ensuring efficient delivery of predictive analytics and decision intelligence.

Continued investment in data architecture is crucial for BigBear.ai to maintain high performance and reliability. This includes optimizing data pipelines and ensuring robust data governance, which are critical competitive advantages in the rapidly evolving AI landscape.

The increasing complexity of cyber threats poses a significant challenge for BigBear.ai, requiring constant vigilance. While their AI-powered solutions bolster cybersecurity for clients, the company must also fortify its own infrastructure and safeguard sensitive client data. This necessitates ongoing investment in advanced threat detection and response capabilities to maintain trust and operational integrity.

Integration and Interoperability

The capacity for BigBear.ai's artificial intelligence offerings to smoothly integrate with established legacy systems and a wide array of data sources is a critical technological consideration, especially within the intricate landscapes of government and large enterprises. This seamless integration ensures that clients can leverage BigBear.ai's advanced capabilities without needing to overhaul their existing infrastructure.

Interoperability across different platforms and technologies directly boosts the practical utility and overall value of BigBear.ai's products. For instance, their solutions need to communicate effectively with diverse databases, cloud environments, and specialized software used by their clients. This adaptability is key to widespread adoption and success.

Achieving this requires BigBear.ai to maintain flexible and adaptable technological architectures. As of early 2025, the company continues to invest in modular design principles and open APIs to facilitate these connections. This approach is vital given the varied tech stacks present in their target markets.

- Modular AI Architectures: BigBear.ai emphasizes modular AI components that can be easily plugged into existing workflows, reducing implementation friction.

- API-First Strategy: The company prioritizes developing robust APIs to enable seamless data exchange and integration with third-party applications and systems.

- Cloud Agnosticism: Supporting deployment across various cloud platforms (AWS, Azure, Google Cloud) enhances interoperability for a broader client base.

- Data Format Flexibility: BigBear.ai's solutions are designed to handle and process data in multiple formats, accommodating diverse client data sources.

Quantum Computing and Future Technologies

Quantum computing, though still in its nascent stages, holds the potential to revolutionize BigBear.ai's core operations by dramatically accelerating complex data analysis and AI model training. Companies like IBM and Google are making significant strides, with IBM's roadmap targeting fault-tolerant quantum computers by the late 2020s, which could unlock unprecedented processing power.

BigBear.ai needs to actively track these advancements to identify opportunities for enhancing its AI capabilities and to prepare for potential disruptions to its existing technological infrastructure. For instance, quantum algorithms could offer exponential speedups for optimization problems, a key area for BigBear.ai's predictive analytics solutions.

- Quantum Computing's Impact: Potential to exponentially speed up AI training and complex data processing.

- Industry Investment: Significant R&D investment by major tech players like IBM and Google signals rapid progress.

- Strategic Monitoring: BigBear.ai must assess how quantum advancements might enhance or disrupt its current tech stack.

- Future Preparedness: Proactive engagement with emerging technologies is crucial for sustained innovation and competitive advantage.

BigBear.ai's technological foundation is deeply rooted in AI and ML, with continuous R&D investment being critical. For example, the company's focus on integrating advanced algorithms was evident in its increased R&D spending reported in Q1 2024.

The company relies heavily on scalable cloud computing infrastructure, a market projected to exceed $1.3 trillion globally in 2024, to process vast datasets for its decision intelligence solutions.

Ensuring seamless integration with legacy systems and diverse data sources is paramount for BigBear.ai's clients, driving the need for modular architectures and an API-first strategy as of early 2025.

BigBear.ai is actively monitoring advancements in quantum computing, with major players like IBM targeting fault-tolerant quantum computers by the late 2020s, which could significantly enhance AI processing capabilities.

Legal factors

BigBear.ai's substantial revenue stream is heavily dependent on government contracts, placing it under the purview of Federal Acquisition Regulations (FAR) and Defense Federal Acquisition Regulation Supplement (DFARS). Navigating these intricate legal frameworks, which govern everything from procurement procedures to data security and intellectual property rights, is critical for contract acquisition and fulfillment. Failure to adhere to these regulations can result in significant financial penalties or contract termination.

BigBear.ai's operations involve extensive data, including sensitive government and commercial information. This necessitates strict adherence to data privacy and security laws like GDPR and CCPA. Failure to comply, especially concerning data handling, can lead to significant legal penalties and damage client trust.

BigBear.ai's competitive edge hinges on safeguarding its proprietary AI algorithms, software, and methodologies. This protection is achieved through a multi-faceted approach involving patents, copyrights, and trade secrets. For instance, the company actively pursues patent protection for novel AI applications in areas like predictive analytics, as evidenced by its ongoing patent filings in late 2024 and early 2025.

Navigating the legal landscape also requires BigBear.ai to meticulously avoid infringing on the intellectual property rights of other entities. This necessitates rigorous legal due diligence and the establishment of appropriate licensing agreements where necessary. Failure to do so could lead to significant financial penalties and operational disruptions.

AI Liability and Accountability Legislation

The legal landscape surrounding AI liability is rapidly evolving. As AI systems, particularly those with autonomous decision-making capabilities, become more integrated into critical sectors, defining accountability for potential harms is a significant challenge. BigBear.ai must remain vigilant regarding new legislation that will establish frameworks for responsibility in AI-driven outcomes, especially in areas like defense and logistics where errors can have severe consequences.

The development of AI liability laws is a global effort, with many jurisdictions actively drafting or proposing regulations. For instance, the European Union's AI Act, expected to be fully implemented in 2025, categorizes AI systems by risk level and outlines specific obligations for providers and users, including provisions for transparency and human oversight. This evolving regulatory environment necessitates proactive risk management and adaptation by companies like BigBear.ai to ensure compliance and mitigate potential legal exposure.

- Nascent Legal Framework: The absence of comprehensive, established laws creates uncertainty regarding who is liable when an AI system causes harm.

- Autonomous Decision-Making: Legislators are grappling with assigning responsibility when AI makes decisions without direct human intervention.

- Critical Applications: Concerns are heightened for AI used in national security, healthcare, and transportation, where failures can lead to significant damage or loss of life.

- Proactive Adaptation: Companies must anticipate and adjust to emerging legislation to avoid penalties and maintain public trust.

Export Control and Sanctions Laws

BigBear.ai's advanced AI and analytics solutions are subject to stringent export control and sanctions laws, such as the International Traffic in Arms Regulations (ITAR) and the Export Administration Regulations (EAR). These regulations dictate how sensitive technologies, including certain AI algorithms and data analytics capabilities, can be shared or sold to foreign individuals or entities. Failure to comply can lead to significant penalties, impacting international business opportunities and partnerships.

Navigating these complex legal frameworks is crucial for BigBear.ai's global expansion. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) regularly updates EAR, affecting the export of dual-use items. In 2024, increased scrutiny on AI technology exports means BigBear.ai must maintain robust compliance programs to ensure adherence to evolving international trade restrictions and sanctions imposed by bodies like the United Nations and individual countries.

- Export Control Compliance: BigBear.ai must meticulously track the classification of its AI technologies under regulations like ITAR and EAR to determine licensing requirements for international sales.

- Sanctions Adherence: The company needs to screen all potential international clients and partners against various sanctions lists to avoid prohibited transactions.

- Global Market Access: Strict adherence to these laws enables BigBear.ai to pursue international contracts without risking legal action or reputational damage.

- Technology Transfer Safeguards: Implementing strong internal controls is vital to prevent unauthorized transfer of sensitive AI capabilities to sanctioned countries or entities.

BigBear.ai's reliance on government contracts means strict adherence to Federal Acquisition Regulations (FAR) and DFARS is paramount, impacting everything from procurement to data security. Non-compliance can lead to severe penalties and contract termination, underscoring the critical nature of these legal frameworks for the company's revenue generation and operational continuity.

The company must also navigate evolving AI liability laws, particularly concerning autonomous decision-making systems. Legislation like the EU's AI Act, with its risk-based categorization and transparency requirements, highlights the global trend towards regulating AI, necessitating proactive adaptation by BigBear.ai to mitigate legal exposure and maintain client trust.

Export control regulations, including ITAR and EAR, are vital for BigBear.ai's international business. In 2024, heightened scrutiny on AI technology exports means robust compliance programs are essential to manage international sales and partnerships effectively, ensuring adherence to evolving trade restrictions and sanctions.

| Legal Factor | Impact on BigBear.ai | Key Regulations/Considerations | 2024/2025 Relevance |

| Government Contract Compliance | Essential for revenue; dictates operational procedures. | FAR, DFARS | Ongoing adherence required for existing and new contracts. |

| AI Liability & Data Privacy | Defines accountability for AI outcomes; protects sensitive data. | EU AI Act (2025 implementation), GDPR, CCPA | Proactive adaptation to emerging global AI regulations is critical. |

| Intellectual Property Protection | Safeguards core AI algorithms and software. | Patents, Copyrights, Trade Secrets | Continued patent filings in late 2024/early 2025 demonstrate ongoing strategy. |

| Export Controls & Sanctions | Governs international sales and technology transfer. | ITAR, EAR, BIS updates | Increased scrutiny on AI exports in 2024 necessitates enhanced compliance. |

Environmental factors

The escalating computational needs of sophisticated AI models, such as those BigBear.ai develops, directly translate to substantial energy consumption and a notable carbon footprint. As of early 2024, the training of large language models can consume hundreds of megawatt-hours of electricity, comparable to the annual energy use of hundreds of homes.

BigBear.ai's reliance on data centers and cloud infrastructure means its operations are inherently linked to this growing energy demand, drawing attention to its environmental performance. The company's commitment to energy efficiency in these areas is becoming a key factor in its sustainability assessment.

By embracing greener computing strategies, like optimizing AI algorithms for reduced power usage and investing in energy-efficient hardware, BigBear.ai can improve its environmental standing and potentially lower its operational expenses. For instance, research from 2023 indicates that algorithmic optimization can reduce AI model energy consumption by up to 30%.

Climate change presents a dual challenge and opportunity for BigBear.ai. Extreme weather events, like the record-breaking heatwaves and flooding seen in various regions during 2024, can disrupt global supply chains, potentially impacting BigBear.ai's access to critical hardware and software components. This underscores the need for robust risk management within their own procurement processes.

However, BigBear.ai's advanced AI and analytics capabilities offer a significant market opportunity by enabling commercial clients to build more resilient supply chains. By leveraging BigBear.ai's solutions, businesses can better predict and mitigate the impact of climate-related disruptions, a growing concern for sectors ranging from logistics to agriculture. For instance, a 2024 report indicated that supply chain disruptions cost global businesses an estimated $7 trillion over the past two years, with climate events being a major contributor.

BigBear.ai faces growing pressure from investors and stakeholders to showcase its commitment to Environmental, Social, and Governance (ESG) principles. This translates to a need for clear reporting on its environmental footprint, resource utilization, and waste reduction efforts. For instance, the company's 2023 ESG report highlighted a 15% reduction in energy consumption across its data centers compared to 2022.

Demonstrating robust ESG performance is becoming a critical differentiator, potentially attracting capital from a widening pool of environmentally and socially conscious investors. Furthermore, a strong ESG profile can significantly boost BigBear.ai's corporate reputation, especially when engaging with clients who prioritize sustainability in their own operations and supply chains.

Regulatory Pressure for Environmental Compliance

While BigBear.ai is primarily a software and AI solutions provider, its physical operations, including data centers and offices, are subject to environmental regulations. These typically cover areas like waste management, energy consumption, and emissions. For instance, in 2024, many regions continued to enforce stricter rules on electronic waste disposal, impacting companies like BigBear.ai that utilize significant technological infrastructure.

Compliance is crucial to avoid penalties and maintain necessary operating permits. Failure to adhere to environmental standards could lead to fines, operational disruptions, and reputational damage. As of early 2025, there's an increasing focus on the carbon footprint of data centers globally, with potential for new regulations on energy efficiency and renewable energy sourcing.

- Waste Disposal: Regulations on the safe and responsible disposal of electronic components and hardware.

- Energy Efficiency: Growing pressure on data centers to reduce energy consumption and improve PUE (Power Usage Effectiveness) ratios.

- Emissions: Indirect impact through energy sourcing for operations; some jurisdictions are increasing emissions standards for electricity generation.

- Emerging Tech Regulations: Potential future regulations addressing the environmental impact of AI development and deployment, such as energy demands for training large models.

Resource Scarcity for Hardware Components

The production of advanced AI hardware, crucial for companies like BigBear.ai, faces potential disruptions due to the scarcity of key raw materials. For instance, the demand for rare earth elements, essential for semiconductors and magnets, is projected to rise significantly. Global demand for critical minerals like cobalt and lithium, used in battery technology for data centers and computing infrastructure, is also expected to see substantial growth through 2025, potentially leading to price volatility and supply chain challenges.

While BigBear.ai’s core business is software, its reliance on the hardware ecosystem means that resource constraints for components like specialized AI chips and servers represent a long-term environmental risk. The extraction of these materials often involves environmentally sensitive processes, and ensuring sustainable sourcing is a growing concern for the entire tech industry. For example, the International Energy Agency (IEA) highlighted in its 2024 reports that demand for minerals like copper and nickel, vital for electronics and energy storage, could increase by over 40% by 2030 compared to 2020 levels, impacting the availability and cost of hardware.

- Critical Mineral Demand: Projections indicate a substantial increase in demand for minerals like rare earths, cobalt, and lithium through 2025, impacting AI hardware production.

- Supply Chain Sensitivity: Resource scarcity for components like specialized AI chips and servers poses a long-term risk due to the environmentally sensitive nature of material extraction.

- IEA Projections: The IEA forecasts over a 40% rise in demand for copper and nickel by 2030, underscoring the growing pressure on raw material availability for the tech sector.

BigBear.ai's operations, particularly its reliance on data centers and AI model training, contribute to significant energy consumption and carbon emissions. As of early 2024, training large AI models can consume hundreds of megawatt-hours, similar to the annual energy use of hundreds of homes, highlighting the need for energy efficiency. The company's 2023 ESG report indicated a 15% reduction in data center energy consumption compared to 2022, demonstrating a commitment to improving its environmental footprint.

Climate change poses risks through potential disruptions to hardware supply chains due to extreme weather events, as seen in various regions during 2024. However, BigBear.ai's analytics solutions can help clients build more resilient supply chains, mitigating the impact of these disruptions, which cost global businesses an estimated $7 trillion over the past two years according to a 2024 report.

Environmental regulations, such as those concerning electronic waste disposal and data center energy efficiency, directly impact BigBear.ai's operations. As of early 2025, there's an increasing global focus on data center carbon footprints, with potential for new regulations on energy efficiency and renewable energy sourcing.

The demand for critical minerals essential for AI hardware, such as rare earths, cobalt, and lithium, is projected to rise significantly through 2025, potentially causing price volatility and supply chain challenges. The International Energy Agency (IEA) forecasts over a 40% rise in demand for copper and nickel by 2030, underscoring the growing pressure on raw material availability for the tech sector.

| Environmental Factor | Impact on BigBear.ai | Data/Trend (2024/2025 Focus) |

|---|---|---|

| Energy Consumption & Carbon Footprint | High energy demand for AI model training and data centers. | Large language model training can consume hundreds of MWh. |

| Climate Change Impacts | Disruption of hardware supply chains; opportunity for resilience solutions. | Extreme weather events in 2024; supply chain disruptions cost $7 trillion over two years (2024 report). |

| ESG Pressure & Reporting | Need for clear reporting on environmental footprint and resource use. | 15% reduction in data center energy consumption (2023 ESG report). |

| Raw Material Scarcity | Supply chain risks for AI hardware due to increased demand for critical minerals. | IEA: Over 40% rise in demand for copper/nickel by 2030. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is powered by a diverse range of data sources, including government publications, economic indicators from international organizations, and reputable industry research. This ensures a comprehensive and accurate understanding of the external factors influencing your business.