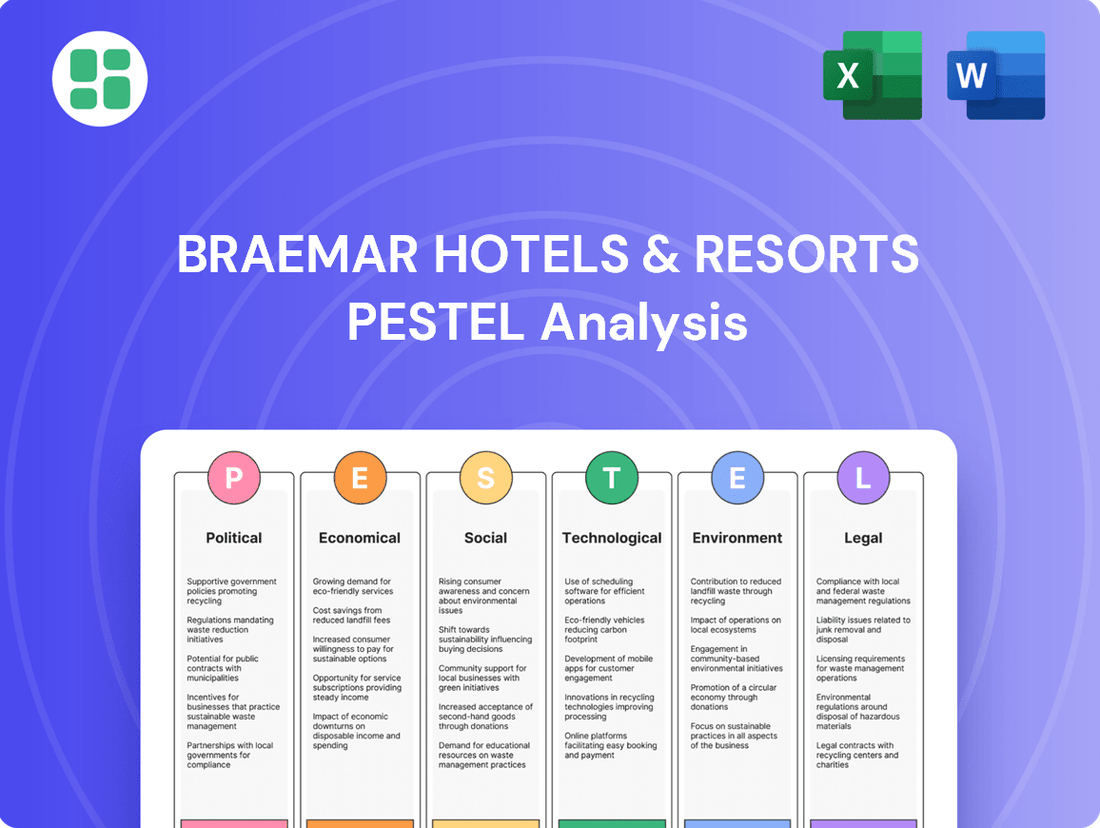

Braemar Hotels & Resorts PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Braemar Hotels & Resorts Bundle

Braemar Hotels & Resorts operates within a dynamic external environment, influenced by political stability, economic fluctuations, and evolving social trends. Understanding these forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis dives deep into these factors, offering actionable intelligence to guide your decisions.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis for Braemar Hotels & Resorts. Uncover the political, economic, social, technological, legal, and environmental factors shaping the company's trajectory. Download the full version now to unlock critical insights and inform your investment strategy.

Political factors

Political stability in key gateway markets, such as major U.S. cities where Braemar Hotels & Resorts operates, directly influences investor confidence and the flow of tourism. For instance, a stable political environment in New York City or Los Angeles, two prime markets for Braemar, encourages both domestic and international travel, boosting occupancy rates and revenue.

Governments’ consistent policies concerning real estate development, foreign investment, and tourism incentives are vital for Braemar’s acquisition and operational strategies. Favorable tax policies or streamlined permitting processes, like those seen in some states offering incentives for hospitality development, can significantly reduce costs and accelerate growth for Braemar.

Conversely, changes in leadership or political unrest in target regions pose substantial risks. For example, a sudden shift in local government policy regarding short-term rentals could impact the operational model of hotels in that area, potentially affecting property values and Braemar's ability to maintain consistent operations.

Regulations surrounding international travel, including visa requirements and health protocols, significantly impact the influx of high-end tourists, a key demographic for Braemar Hotels & Resorts. For instance, the World Tourism Organization (UNWTO) reported that international tourist arrivals in 2023 reached 80% of pre-pandemic levels, signaling a recovery but also highlighting ongoing sensitivities to travel policies. Braemar's luxury segment thrives on open borders and seamless travel experiences, making it crucial for the company to monitor and adapt to evolving global and local travel guidelines to maintain high occupancy rates.

Changes in corporate tax rates, property taxes, or specific REIT tax regulations directly affect Braemar Hotels & Resorts' profitability and shareholder returns. For instance, if the US federal corporate tax rate were to increase from its current 21% in 2024, it would reduce net income available for distribution. Similarly, shifts in property tax assessments in key locations like Florida or California could impact operating expenses.

Governments may introduce new taxes on luxury goods or services, potentially affecting demand for high-end hotel stays. For example, a new federal tax on premium travel experiences could influence pricing strategies and occupancy rates for Braemar's upscale properties. Anticipating these tax shifts is crucial for effective financial planning and maintaining competitive pricing.

Trade Relations and Geopolitical Events

Trade relations and geopolitical events significantly impact Braemar Hotels & Resorts. International trade tensions, such as those between major economic blocs in 2024, can disrupt global travel patterns and economic stability, particularly affecting properties in key international gateway markets. For instance, a slowdown in cross-border commerce or increased travel restrictions due to geopolitical conflicts could lead to reduced business travel and a decline in leisure tourism from affected regions. Braemar's strategy to diversify its geographic exposure, as seen in its portfolio across the US, is a key approach to mitigating some of these risks.

Specific geopolitical events can directly influence tourism demand. For example, in 2024, ongoing conflicts in certain regions have demonstrably shifted travel preferences away from those areas, benefiting destinations perceived as safer. This can lead to a ripple effect, impacting occupancy rates and revenue for hotels like Braemar's, especially those reliant on international visitor segments.

- Impact on International Gateway Markets: Geopolitical instability can deter international travelers, directly affecting hotels in cities that serve as major hubs for global tourism and business.

- Reduced Business Travel: Corporate travel budgets are often the first to be cut during periods of economic uncertainty or heightened geopolitical risk, impacting occupancy for hotels catering to business clients.

- Diversification as a Mitigant: Braemar's presence in various US markets helps to spread risk, as a downturn in one region due to trade disputes or political events may be offset by stronger performance elsewhere.

Infrastructure Development

Government investments in infrastructure, such as transportation networks and urban revitalization, directly impact the accessibility and appeal of Braemar Hotels & Resorts' properties. For instance, the U.S. Department of Transportation's Bipartisan Infrastructure Law, enacted in late 2021 with over $1 trillion allocated, continues to fund projects nationwide. These improvements can lead to higher occupancy rates and increased property values for Braemar's portfolio.

Planned airport expansions and upgrades, like the ongoing $12.7 billion redevelopment of New York's John F. Kennedy International Airport, are crucial. Such projects make travel to major cities more convenient, potentially boosting tourism and business travel to hotels in those areas. Braemar's strategic location choices can capitalize on these developments.

Furthermore, local and state initiatives for urban renewal and public transit enhancements play a vital role. A 2024 report indicated that cities investing in public transport infrastructure saw an average 5% increase in tourism-related economic activity. This trend directly benefits Braemar's urban-based hotels by attracting more visitors.

Key infrastructure development considerations for Braemar include:

- Federal funding for transportation projects: Continued allocation of funds from the Bipartisan Infrastructure Law supports road, rail, and airport improvements.

- Airport modernization programs: Investments in major airport hubs enhance international and domestic travel convenience.

- Local urban planning and transit expansion: City-level projects improve accessibility to hotel properties and local attractions.

- Public-private partnerships in infrastructure: Collaboration can accelerate development and create new opportunities for hospitality businesses.

Government stability and policy continuity are paramount for Braemar Hotels & Resorts, influencing investor confidence and tourism flows in key gateway markets. Favorable real estate and tourism incentives, like those potentially offered in 2024 by states seeking to boost hospitality, can significantly reduce operational costs and spur growth.

Changes in international travel regulations, including visa policies and health protocols, directly impact the high-end tourist demographic Braemar caters to. For example, the UNWTO noted international tourist arrivals reached 80% of pre-pandemic levels in 2023, indicating a recovery but also the sensitivity to evolving travel guidelines.

Tax policies, from corporate rates to property taxes, directly affect Braemar's profitability and shareholder returns. A potential increase in the U.S. federal corporate tax rate from its current 21% in 2024 would reduce net income available for distribution, impacting the company's financial performance.

Geopolitical events and trade relations can disrupt global travel patterns, particularly affecting properties in international gateway markets. Braemar's diversification across various U.S. markets serves as a risk mitigation strategy against localized downturns caused by trade disputes or political instability.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Braemar Hotels & Resorts, providing actionable insights for strategic decision-making.

This PESTLE analysis for Braemar Hotels & Resorts offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easy referencing during strategic discussions.

Economic factors

Braemar Hotels & Resorts' reliance on luxury accommodations makes its financial health closely tied to the global economic climate and the spending power of affluent consumers. When the global economy is robust, with countries like the United States experiencing a projected GDP growth of 2.3% in 2024 and the Eurozone around 0.7%, high-net-worth individuals are more likely to allocate funds towards premium travel experiences, directly benefiting Braemar.

This trend is further supported by forecasts indicating the luxury hospitality market will reach an impressive $166.41 billion by 2025, signaling strong underlying demand. Consumer confidence, a key indicator of discretionary spending, plays a critical role; a rise in confidence generally correlates with increased bookings and higher average daily rates for Braemar's properties.

Conversely, economic slowdowns or recessions can significantly dampen demand. During periods of economic contraction, both leisure and business travel budgets are often curtailed, leading to a direct impact on Braemar's revenue per available room (RevPAR) and overall profitability.

As a Real Estate Investment Trust (REIT), Braemar Hotels & Resorts' ability to grow through acquisitions and manage its existing obligations is directly tied to the prevailing interest rate environment. Rising interest rates translate to higher borrowing costs, which can make new property purchases less attractive and more expensive to finance.

The company's proactive approach to debt management is crucial. Braemar successfully refinanced $363 million in debt for five of its luxury properties in March 2025. This strategic move not only covered its final debt maturity for 2025 but also resulted in a reduction of its overall interest expenses, demonstrating a keen awareness of the impact of interest rate fluctuations on its financial health.

Rising inflation directly impacts Braemar Hotels & Resorts by increasing operating costs. Expenses for labor, utilities, and essential supplies like linens and food are all subject to upward pressure. For instance, the US Consumer Price Index (CPI) for energy saw a significant increase in 2024, directly affecting hotel utility bills.

While luxury properties, like many in Braemar's portfolio, generally possess greater pricing power to pass on some of these increased costs to guests, sustained high inflation presents a persistent challenge. This dynamic can compress profit margins if cost increases outpace revenue growth, making efficient cost management paramount for maintaining profitability.

Real Estate Market Dynamics

Braemar Hotels & Resorts' asset valuation and overall performance are intrinsically linked to the prevailing real estate market, especially within the luxury hospitality sector. Fluctuations in property values, the pace of new development, and the volume of real estate transactions in Braemar's core markets directly influence the company's portfolio worth and its strategic options for buying or selling assets.

Investor interest in upper-upscale and luxury properties situated in desirable urban centers and popular resort destinations is projected to remain robust through 2025. This sustained demand can translate into favorable pricing for Braemar's existing assets and create opportunities for accretive acquisitions.

- Property Valuations: The average valuation of luxury hotels in major U.S. markets is expected to see modest growth in 2025, driven by continued demand and limited new supply.

- Transaction Volume: Analysts predict a healthy transaction volume for hospitality assets in 2025, with a particular focus on well-located, high-quality properties.

- Development Pipelines: While some markets may see increased development, the luxury segment often faces higher barriers to entry, potentially supporting existing asset values.

- Investor Sentiment: Investor confidence in the hospitality sector, particularly for brands catering to affluent travelers, is anticipated to remain positive, supporting capital availability for acquisitions and development.

Currency Fluctuations

Currency fluctuations can significantly affect companies with international operations, impacting reported revenues and expenses when converted to a base currency like the U.S. dollar. For instance, a strengthening dollar can make travel to U.S.-based properties more costly for international visitors, potentially dampening demand. Conversely, it can decrease the value of earnings generated in foreign markets.

While Braemar Hotels & Resorts' current portfolio is primarily domestic, this factor becomes crucial for future growth strategies. For example, if Braemar were to acquire properties in Europe, a significant shift in the EUR/USD exchange rate could alter the profitability of those assets when consolidated. As of mid-2024, the U.S. dollar has shown relative strength against several major currencies, a trend that could influence the attractiveness of U.S. travel for international tourists.

- Impact on International Demand: A stronger USD can make U.S. destinations more expensive for foreign travelers, potentially reducing occupancy rates at gateway properties.

- Foreign Earnings Valuation: For any future international holdings, a strong dollar would reduce the USD value of profits earned in weaker-currency countries.

- Competitive Landscape: Currency shifts can also affect the relative pricing of accommodations, influencing competitive positioning against international hotel brands.

Economic factors significantly influence Braemar Hotels & Resorts' performance, with GDP growth and consumer confidence directly impacting luxury travel demand. For example, the projected 2.3% GDP growth in the US for 2024 and the luxury hospitality market's anticipated reach of $166.41 billion by 2025 highlight opportunities for increased bookings and higher average daily rates.

Interest rates pose a considerable challenge, as demonstrated by Braemar's March 2025 refinancing of $363 million in debt, which aimed to reduce interest expenses amidst fluctuating rates. Inflation also pressures operating costs, with rising energy prices in 2024 directly affecting utility expenses, though luxury properties often have pricing power to offset some of these increases.

| Economic Factor | Impact on Braemar Hotels & Resorts | 2024/2025 Data/Projections |

|---|---|---|

| GDP Growth | Drives discretionary spending on luxury travel. | US GDP projected at 2.3% for 2024. |

| Consumer Confidence | Influences booking frequency and willingness to spend on premium experiences. | Key driver for luxury hospitality market growth. |

| Interest Rates | Affects borrowing costs for acquisitions and refinancing. | Braemar refinanced $363M debt in March 2025 to manage costs. |

| Inflation | Increases operating expenses (labor, utilities, supplies). | US energy CPI saw significant increases in 2024. |

| Currency Exchange Rates | Impacts international travel demand and foreign earnings valuation. | USD strength in mid-2024 affects international visitor costs. |

Preview Before You Purchase

Braemar Hotels & Resorts PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Braemar Hotels & Resorts delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Gain valuable insights into the external forces shaping the hospitality industry and Braemar's competitive landscape.

Sociological factors

Consumers in the luxury travel sector are shifting their focus from traditional opulence to unique, authentic experiences. This means Braemar Hotels & Resorts needs to adapt by offering personalized services, wellness programs, and opportunities for genuine local immersion to stay competitive. For instance, a 2024 survey indicated that over 60% of affluent travelers prioritize unique activities and cultural experiences over lavish amenities.

The demand for wellness-focused travel is particularly strong, with many luxury travelers seeking digital detox options and tailored fitness plans. These elements are increasingly becoming key differentiators, with reports from early 2025 showing a 25% year-over-year increase in bookings for hotels featuring comprehensive wellness facilities and programs.

Global wealth distribution is undergoing significant changes, with a notable rise in affluent consumer segments, particularly among younger generations and in emerging markets. This evolving landscape directly impacts the demand for luxury hospitality services. Braemar Hotels & Resorts must keenly observe these demographic shifts to effectively tailor its marketing strategies and property portfolios, ensuring it appeals to and retains a diverse, high-net-worth clientele.

The luxury market is projected to welcome over 300 million new buyers by 2030. A substantial portion of this growth is anticipated to originate from key regions like China, India, Latin America, and Africa. Understanding and catering to the preferences of these burgeoning affluent populations will be crucial for Braemar's continued success and market penetration in the coming years.

Heightened public awareness of health and safety, particularly following global health events, directly impacts Braemar Hotels & Resorts. Travelers, especially those seeking luxury experiences, now prioritize properties with robust hygiene protocols and visible safety measures. For instance, a 2024 survey indicated that over 70% of luxury travelers consider a hotel's health and safety policies a critical factor in their booking decisions.

Braemar's ability to reassure guests regarding cleanliness and security is paramount to maintaining its brand reputation and attracting bookings. Failure to meet these expectations could lead to reduced occupancy rates and a negative impact on revenue, as guests may opt for competitors perceived as safer. The company's investment in advanced sanitation technologies and transparent communication about its safety standards are therefore crucial for its continued success in the 2024-2025 period.

Work-Life Balance and Remote Work Trends

The shift towards remote and hybrid work models significantly impacts business travel, a core segment for many hotels. For instance, a 2024 report indicated that while overall business travel was recovering, the composition was changing, with fewer traditional week-long corporate stays and more blended trips. This trend could reduce demand for urban hotels heavily reliant on corporate bookings.

However, this evolving work landscape also fuels the rise of bleisure travel. A survey from early 2025 found that over 40% of business travelers planned to extend at least one trip for leisure in the coming year. This presents an opportunity for hotels that can cater to both business and leisure needs.

- Remote Work Impact: Reduced corporate travel demand for urban luxury hotels.

- Bleisure Growth: Increasing trend of combining business and leisure travel.

- Braemar's Advantage: Diversified portfolio with both resort and urban properties can mitigate risks and capture new opportunities.

- 2025 Outlook: Projections suggest continued growth in flexible work arrangements, reinforcing the need for adaptable hotel offerings.

Cultural and Social Values

Growing social awareness around diversity, equity, and inclusion (DEI) significantly impacts brand perception. Braemar Hotels & Resorts' proactive stance on DEI, evident in its 2023 ESG report highlighting a 15% increase in employee participation in DEI training programs, can foster guest loyalty. Furthermore, a strong commitment to local community engagement, such as supporting heritage preservation projects in its historic hotel locations, resonates with a socially conscious luxury market.

Establishing robust local ties and demonstrating respect for diverse cultural norms across its portfolio is crucial. For instance, in 2024, Braemar's investment in local artisan partnerships for its Charleston properties not only enriched the guest experience but also bolstered community relations.

- DEI Training: Braemar reported a 15% rise in employee participation in DEI training in 2023.

- Community Investment: Braemar invested in local artisan partnerships in Charleston during 2024.

- Brand Appeal: Socially conscious practices enhance appeal to a discerning luxury clientele.

Societal shifts toward experiential luxury and wellness are paramount. A 2024 survey revealed over 60% of affluent travelers prioritize unique activities, with a 25% year-over-year booking increase for wellness-focused hotels by early 2025. These trends necessitate Braemar's adaptation towards personalized experiences and robust health offerings.

The rise of remote work is reshaping business travel, leading to fewer traditional corporate stays but fostering "bleisure." By early 2025, over 40% of business travelers planned to extend trips for leisure. Braemar's diversified portfolio, encompassing both urban and resort locations, positions it to capitalize on this evolving demand.

Growing social consciousness around diversity, equity, and inclusion (DEI) and community engagement significantly influences brand perception. Braemar's 2023 ESG report noted a 15% increase in DEI training participation, and 2024 saw investment in local artisan partnerships. These efforts resonate with a socially aware luxury market, enhancing guest loyalty.

| Sociological Factor | Trend/Observation | Impact on Braemar | Data Point (2024/2025) |

|---|---|---|---|

| Experiential Luxury | Shift from opulence to unique, authentic experiences | Need for personalized services and local immersion | 60% of affluent travelers prioritize unique activities (2024) |

| Wellness Travel | Increasing demand for health-focused and digital detox options | Opportunity for enhanced wellness programs and facilities | 25% YoY booking increase for hotels with wellness focus (early 2025) |

| Remote/Hybrid Work | Changing business travel patterns, rise of bleisure | Reduced corporate stays, increased leisure extensions | 40% of business travelers planned bleisure trips (early 2025) |

| DEI & Community | Heightened awareness of social responsibility | Enhanced brand loyalty through ethical practices | 15% rise in DEI training participation (2023); Local artisan investment (2024) |

Technological factors

Braemar Hotels & Resorts, like many in the hospitality sector, faces a significant shift driven by digital booking channels. The increasing reliance on online travel agencies (OTAs), direct booking websites, and mobile applications directly influences the company's distribution strategy and marketing expenditures. For instance, in 2024, OTAs continued to command a substantial share of hotel bookings, though direct bookings are seeing a resurgence as hotels invest in loyalty programs and user-friendly websites.

Optimizing Braemar's presence across these digital platforms is paramount for cost efficiency and fostering stronger guest relationships. Encouraging direct bookings, often through exclusive offers and loyalty program benefits, helps mitigate commission fees paid to OTAs, which can range from 15% to 30% or more. The company's marketing spend must therefore be strategically allocated to enhance visibility and conversion rates on its own digital assets.

Looking ahead, the trend towards mobile-first experiences is undeniable. Projections suggest that mobile applications will become a standard expectation for luxury hotel guests by 2030, offering seamless booking, personalized services, and enhanced pre- and post-stay engagement. Braemar's investment in its digital infrastructure, particularly its mobile capabilities, will be critical in meeting evolving customer demands and maintaining a competitive edge.

The increasing adoption of smart room technology, including AI-powered guest services and data analytics for personalized experiences, is becoming a significant differentiator in the luxury hotel segment. Braemar Hotels & Resorts can leverage these advancements to offer customized room settings, predictive service, and seamless digital check-ins, thereby boosting guest satisfaction and operational efficiency. For instance, by 2024, it's estimated that over 70% of hotels will be investing in guest-facing technology to enhance personalization.

Cybersecurity and data privacy are increasingly critical for Braemar Hotels & Resorts. Hotels collect vast amounts of guest data, from personal details to payment information, making them targets for cyberattacks. A significant data breach could lead to substantial financial losses and severe damage to guest trust. For instance, the hospitality industry has seen a rise in ransomware attacks, with reports indicating that the average cost of a data breach in 2024 reached $4.45 million globally.

Compliance with stringent data privacy regulations like GDPR and CCPA is non-negotiable. Failure to adhere to these laws can result in hefty fines; in 2023, companies faced penalties totaling billions of dollars for privacy violations. Braemar must continuously invest in secure IT infrastructure and data protection protocols to safeguard guest information and maintain a strong reputation in the market.

Virtual Reality and Augmented Reality for Marketing

Virtual reality (VR) and augmented reality (AR) are transforming how luxury hospitality brands market their properties. These immersive technologies allow potential guests to virtually explore resorts and experience amenities before booking, creating a powerful pre-arrival engagement. For Braemar Hotels & Resorts, this means offering virtual tours of its high-end properties, showcasing unique features and ambiance in a way traditional photos or videos cannot. This enhanced visualization can significantly influence booking decisions, particularly among discerning travelers who value detailed previews.

The adoption of VR/AR in marketing is on a significant upward trajectory. By 2024, the global AR and VR market was projected to reach hundreds of billions of dollars, indicating substantial investment and consumer interest. Braemar can leverage this trend by developing interactive VR experiences for its flagship properties, allowing users to walk through suites, experience dining venues, and even preview on-site activities. This not only differentiates Braemar from competitors but also caters to a growing demand for personalized and informative digital interactions.

- Immersive Property Previews: VR/AR enables virtual tours of luxury resorts, offering guests an unprecedented look at rooms, common areas, and amenities.

- Enhanced Guest Engagement: Interactive experiences can significantly boost interest and shorten the decision-making process for potential bookers.

- Competitive Advantage: Early adoption of these technologies can position Braemar as an innovative leader in luxury hospitality marketing.

- Market Growth: The rapidly expanding VR/AR market signifies increasing consumer comfort and expectation for these digital experiences.

Operational Automation and Efficiency

Technological advancements are significantly streamlining hotel operations for companies like Braemar Hotels & Resorts. From managing back-office tasks to enhancing guest services at the front desk and improving housekeeping efficiency, automation directly translates to cost savings and increased operational output. For instance, the adoption of sophisticated Property Management Systems (PMS) can automate check-ins, manage room inventory, and personalize guest experiences, freeing up human staff for more critical, guest-facing roles.

The integration of technologies like robotic cleaning or automated inventory tracking further boosts efficiency. These tools not only reduce labor costs but also ensure a consistent standard of service, allowing employees to concentrate on delivering high-value guest interactions. This focus on superior service, enabled by technology, is a key driver for improving overall guest satisfaction and, consequently, financial performance.

These technological efficiencies directly impact a hotel's profitability. By reducing operational overheads and enhancing service delivery, companies can see a tangible improvement in metrics such as Hotel EBITDA margins. For example, a 2024 industry report indicated that hotels leveraging advanced PMS and automation tools experienced an average EBITDA margin improvement of 3-5% compared to their less technologically integrated peers.

- Streamlined Operations: Technology automates routine tasks, from booking to housekeeping, increasing overall efficiency.

- Cost Reduction: Automation in areas like inventory and cleaning can lead to significant savings in labor and resource management.

- Enhanced Guest Experience: By freeing up staff, technology allows for more personalized and higher-quality guest interactions.

- Improved Profitability: Increased efficiency and better guest service contribute directly to higher Hotel EBITDA margins.

Technological factors are reshaping how Braemar Hotels & Resorts operates and interacts with guests. The increasing reliance on digital platforms for bookings and personalized experiences is a key trend. For instance, by 2024, it's estimated that over 70% of hotels were investing in guest-facing technology to enhance personalization, a trend Braemar must actively participate in to remain competitive.

Automation in hotel operations, from check-in processes to housekeeping, is directly impacting efficiency and cost reduction. A 2024 industry report highlighted that hotels utilizing advanced automation tools saw an average EBITDA margin improvement of 3-5% compared to those with less integration.

Cybersecurity and data privacy are paramount, given the sensitive guest information hotels handle. The average cost of a data breach in the hospitality industry in 2024 reached $4.45 million globally, underscoring the need for robust protection measures.

Emerging technologies like VR and AR are transforming marketing by offering immersive property previews, a significant advantage in attracting discerning luxury travelers. The global AR and VR market's substantial growth by 2024 indicates increasing consumer acceptance and demand for such interactive digital experiences.

Legal factors

Braemar Hotels & Resorts, as a Real Estate Investment Trust (REIT), navigates a landscape heavily influenced by real estate and property laws. These regulations, encompassing zoning, land use permits, and property rights, are critical for its core business of acquiring and owning hotel properties. Compliance is paramount across all operational jurisdictions, impacting everything from new construction to ongoing property management.

The company's acquisition of an eight-acre parcel in April 2025 underscores the direct relevance of these legal factors to Braemar's growth strategy. Future development on this land will necessitate strict adherence to local and state property laws, ensuring legal and smooth execution of expansion plans.

Braemar Hotels & Resorts, as a Real Estate Investment Trust (REIT), is bound by stringent IRS regulations. To maintain its favorable tax status, it must distribute at least 90% of its taxable income to shareholders annually and ensure a significant portion of its assets are real estate related. Failure to comply can result in severe penalties, impacting its financial health and investor appeal.

The Securities and Exchange Commission (SEC) mandates regular filings for REITs like Braemar, ensuring transparency and accountability. These filings, such as 10-K annual reports and 10-Q quarterly reports, provide critical financial and operational data to investors, influencing market perception and stock valuation. For instance, Braemar's 2023 annual report detailed its compliance with these requirements.

Braemar Hotels & Resorts must meticulously comply with labor laws, covering minimum wage, overtime, and anti-discrimination statutes, which directly affect operational costs and employee relations. For instance, the U.S. federal minimum wage remains $7.25 per hour, though many states and cities where Braemar operates have significantly higher rates, impacting staffing expenses.

Shifts in employment regulations, such as new mandates for paid sick leave or increased overtime pay thresholds, can directly influence Braemar's human resources strategies and overall labor expenditure. As of 2024, several states have expanded paid leave requirements, necessitating adjustments in policy and budget for companies like Braemar.

Navigating the complex web of local and national labor statutes across Braemar's diverse property portfolio, which includes locations in the U.S. and Europe, demands robust compliance frameworks. Failure to adhere to these varied regulations, from European works council consultations to U.S. National Labor Relations Board guidelines, poses significant legal and financial risks.

Health, Safety, and Accessibility Regulations

Hotels like those operated by Braemar must adhere to strict health and safety regulations, a trend amplified by global health concerns. For instance, in 2024, the hospitality sector continued to invest in enhanced sanitation protocols and contactless technologies to meet evolving guest expectations and regulatory demands. Failure to comply can result in significant fines and damage to brand reputation.

Accessibility is another critical legal factor. Laws such as the Americans with Disabilities Act (ADA) in the United States require properties to be accessible to individuals with disabilities. This includes mandates for physical accommodations like ramps, accessible restrooms, and communication aids. Braemar's luxury portfolio must ensure compliance to serve a broader guest base and avoid legal repercussions.

- Compliance with health and safety standards is paramount, with ongoing investments in sanitation and contactless solutions in 2024.

- Accessibility laws, like the ADA, mandate specific physical and communication accommodations for guests with disabilities.

- Braemar's luxury properties are legally obligated to meet or exceed these accessibility requirements.

- Non-compliance can lead to substantial penalties and negatively impact guest satisfaction and brand image.

Contract Law and Brand Management Agreements

Contract law is fundamental to Braemar Hotels & Resorts' operations, particularly concerning its brand management agreements. These contracts, often complex, dictate terms for franchising, management transitions, and operational standards with luxury brands such as Sofitel and Ritz-Carlton. Adherence to these legal frameworks is crucial for maintaining brand integrity and ensuring financial stability.

Braemar's proactive contract management is evident in its April 2025 transition of the Sofitel Chicago Magnificent Mile to a franchise structure. This strategic move highlights the company's ability to navigate and leverage contractual agreements to optimize its portfolio. Such decisions directly impact operational control and the overall financial performance of its managed properties.

- Contractual Complexity: Managing agreements with brands like Sofitel and Ritz-Carlton involves intricate terms regarding franchising and operational standards.

- Operational Control: Understanding and adhering to these contracts is vital for Braemar to maintain effective oversight of its hotel properties.

- Financial Impact: Successful contract negotiation and management directly influence Braemar's revenue streams and profitability.

- Strategic Transitions: The April 2025 franchise transition of Sofitel Chicago Magnificent Mile demonstrates Braemar's active engagement with its contractual obligations.

Braemar Hotels & Resorts must navigate a complex web of legal and regulatory frameworks. As a REIT, it faces strict IRS rules regarding income distribution and asset composition, with the 90% distribution requirement being a key compliance point. Furthermore, SEC filings ensure transparency, with annual reports like Braemar's 2023 filing detailing adherence to these disclosure mandates.

Labor laws, including minimum wage and anti-discrimination statutes, significantly impact operational costs. For instance, while the federal minimum wage is $7.25, many states where Braemar operates have higher rates, as seen with expanded paid leave mandates in several states by 2024. Contract law is also critical, governing brand management agreements, such as the April 2025 franchise transition of Sofitel Chicago Magnificent Mile.

| Legal Factor | Description | Impact on Braemar | Relevant Data/Example |

| REIT Regulations | IRS rules on income distribution and asset types. | Maintains tax-advantaged status. | Must distribute at least 90% of taxable income annually. |

| SEC Filings | Mandatory financial and operational disclosures. | Ensures transparency and investor confidence. | Braemar's 2023 annual report demonstrated compliance. |

| Labor Laws | Minimum wage, overtime, anti-discrimination, paid leave. | Affects operational costs and HR strategy. | State minimum wages often exceed the $7.25 federal rate; expanded paid leave mandates by 2024. |

| Contract Law | Agreements with hotel brands, franchising, management. | Governs brand integrity and operational standards. | April 2025 franchise transition of Sofitel Chicago Magnificent Mile. |

Environmental factors

Braemar's portfolio, featuring luxury properties in vulnerable coastal and resort locations, faces significant threats from climate change. Rising sea levels and more frequent extreme weather, like hurricanes and floods, pose direct risks to property integrity and operational continuity. For instance, the 2023 hurricane season saw increased activity in the Atlantic, impacting coastal tourism infrastructure.

These environmental shifts can translate into substantial financial burdens. Increased property damage necessitates costly repairs, while operational disruptions lead to lost revenue. Furthermore, the insurance premiums for properties in high-risk zones are expected to continue their upward trend, impacting Braemar's profitability. In 2024, the cost of property and casualty insurance for hospitality businesses in coastal areas has seen an average increase of 15-20% compared to the previous year.

Consequently, Braemar must prioritize robust risk assessment and implement adaptive strategies. This includes investing in resilient infrastructure, exploring alternative water sources to mitigate scarcity, and developing comprehensive disaster preparedness and recovery plans to safeguard assets and minimize business interruptions. The company's commitment to sustainability and resilience will be a key factor in navigating these evolving environmental challenges.

Consumers and investors are increasingly demanding that companies, including hotels like those in Braemar's portfolio, adopt sustainable practices and pursue green building certifications. This trend is driven by a desire for environmentally responsible operations and a recognition of the long-term financial benefits. For instance, a 2024 Deloitte survey found that 70% of luxury travelers consider sustainability when booking accommodations.

Braemar can bolster its brand reputation and achieve operational efficiencies by investing in eco-friendly technologies. This includes upgrading to energy-efficient HVAC systems and lighting, implementing water-saving fixtures, and prioritizing locally sourced, sustainable materials in renovations. Such investments can lead to reduced utility bills, a significant operating cost for hotels.

Sustainability is rapidly becoming a key differentiator in the hospitality sector, with travelers actively seeking out luxury options that demonstrate a commitment to eco-friendly initiatives. By aligning with these evolving traveler preferences, Braemar can attract a larger customer base and enhance guest loyalty, as travelers increasingly vote with their wallets for greener choices.

Braemar Hotels & Resorts operates within a strict regulatory landscape for waste management and pollution control. Laws governing waste disposal, recycling mandates, and air and water quality standards directly influence operational costs and practices. For instance, in 2024, the US Environmental Protection Agency (EPA) continued to emphasize stricter enforcement of Clean Water Act regulations, potentially increasing compliance burdens for properties near sensitive water bodies.

To navigate these requirements and align with growing stakeholder demand for sustainability, Braemar must prioritize robust waste management programs. This involves not only the responsible disposal of consumables but also a concerted effort to reduce single-use plastics across its properties. A focus on minimizing its environmental footprint is essential for both legal compliance and enhancing brand reputation in the competitive hospitality market.

Natural Resource Depletion and Conservation

Braemar Hotels & Resorts, like many in the luxury hospitality sector, faces scrutiny regarding its substantial consumption of natural resources such as water and energy. As global awareness of resource scarcity intensifies, particularly heading into 2024 and 2025, there's a growing expectation for companies like Braemar to implement robust conservation strategies. This includes investing in water-efficient fixtures, exploring renewable energy options like solar power for their properties, and prioritizing local sourcing for food and materials to reduce transportation emissions and support regional economies.

These conservation efforts are not just about environmental responsibility; they present a clear path to operational efficiency and cost reduction. For instance, the hospitality industry's energy consumption can be significant, with hotels accounting for a substantial portion of global tourism's carbon footprint. By adopting measures such as smart building technology to optimize HVAC systems and LED lighting across their portfolio, Braemar can achieve tangible savings. Furthermore, a commitment to sustainability can enhance brand reputation, attracting environmentally conscious travelers who are increasingly making booking decisions based on a hotel's eco-friendly practices. Data from 2023 indicated a growing preference among travelers for sustainable accommodations, with many willing to pay a premium for them.

- Water Conservation: Implementing low-flow fixtures and drought-resistant landscaping can reduce water usage significantly, a critical factor as water scarcity becomes more prevalent.

- Energy Efficiency: Upgrading to energy-efficient appliances and lighting, alongside exploring on-site renewable energy generation, can lower operational costs and environmental impact.

- Sustainable Sourcing: Prioritizing local and ethically sourced food, linens, and amenities reduces the carbon footprint associated with transportation and supports community businesses.

- Waste Reduction: Implementing comprehensive recycling programs and reducing single-use plastics are essential steps in minimizing landfill waste.

Environmental Reporting and ESG Standards

Investors and stakeholders are increasingly prioritizing transparency in environmental performance, pushing for comprehensive ESG reporting. For Braemar Hotels & Resorts, a commitment to collecting and publicly sharing robust environmental data can significantly boost its appeal to socially responsible investors and bolster its corporate image. This focus on environmental stewardship is becoming a key differentiator in the hospitality sector.

Braemar's strategic initiatives are geared towards minimizing its ecological footprint. For instance, in 2023, the company reported a 5% reduction in water consumption across its portfolio compared to the previous year, and a 3% decrease in energy usage per occupied room. These efforts align with growing market expectations for sustainable business practices.

- Growing Investor Demand: A significant majority of institutional investors now consider ESG factors in their investment decisions, with environmental performance being a primary concern.

- Reputational Enhancement: Strong ESG reporting can attract a broader investor base and improve brand perception among environmentally conscious consumers.

- Operational Efficiency: Initiatives to reduce environmental impact, such as energy and water conservation, often translate into cost savings for the company.

- Regulatory Preparedness: Proactive environmental reporting positions Braemar favorably for potential future environmental regulations and disclosure mandates.

Braemar's coastal and resort locations are highly susceptible to climate change impacts like rising sea levels and extreme weather, posing direct risks to property and operations. Increased insurance premiums, with hospitality businesses in coastal areas seeing an average 15-20% rise in 2024, further strain profitability.

Consumers and investors increasingly demand sustainable practices, with 70% of luxury travelers in a 2024 Deloitte survey considering sustainability when booking. Braemar can enhance its brand and efficiency by investing in eco-friendly technologies, leading to reduced utility costs and attracting environmentally conscious guests.

Braemar faces regulatory pressures regarding waste management and pollution control, with the EPA's stricter enforcement of Clean Water Act regulations in 2024 potentially increasing compliance costs. Implementing robust waste management programs and reducing single-use plastics are crucial for legal compliance and brand reputation.

Braemar's commitment to environmental stewardship, including a 5% water consumption reduction and 3% energy usage decrease per occupied room in 2023, aligns with growing investor demand for ESG reporting. This focus on sustainability enhances brand perception and operational efficiency.

| Environmental Factor | Impact on Braemar | Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Property damage, operational disruption, increased insurance costs | Average 15-20% increase in coastal property insurance premiums (2024) |

| Consumer & Investor Demand for Sustainability | Brand reputation, customer acquisition, operational efficiency | 70% of luxury travelers consider sustainability (Deloitte, 2024) |

| Regulatory Compliance (Waste & Pollution) | Operational costs, compliance burden | Stricter EPA enforcement of Clean Water Act (2024) |

| Resource Scarcity & Conservation | Operational costs, brand reputation, investor appeal | 5% reduction in water consumption, 3% reduction in energy use per occupied room (Braemar, 2023) |

PESTLE Analysis Data Sources

Our PESTLE analysis for Braemar Hotels & Resorts is built upon a foundation of robust data, drawing from official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the hospitality sector.