Braemar Hotels & Resorts Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Braemar Hotels & Resorts Bundle

Braemar Hotels & Resorts faces a complex competitive landscape, with significant pressure from substitute lodging options and the bargaining power of its guests. Understanding the intensity of rivalry among existing players and the influence of suppliers is crucial for navigating this market.

The complete report reveals the real forces shaping Braemar Hotels & Resorts’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Braemar Hotels & Resorts' reliance on major luxury hotel brands like Marriott, Hilton, and Hyatt as suppliers means these management companies hold considerable bargaining power. Their global brand recognition and vast reservation networks are critical for attracting guests to Braemar's properties, giving them leverage in negotiating management agreements.

The operational expertise these suppliers bring to the luxury segment further solidifies their strong position. For instance, the shift of Sofitel Chicago Magnificent Mile to a franchise model managed by Remington Hospitality highlights Braemar's strategy to potentially gain more control, but the fundamental need for established, high-performing brands persists.

Braemar Hotels & Resorts, as a luxury hotel REIT, faces suppliers of specialized renovation and construction services who can exert some bargaining power. This is particularly true for unique design elements and high-quality materials needed to maintain its luxury brand positioning. In 2024, the construction industry continued to grapple with labor shortages and material cost volatility, impacting project budgets and timelines for companies like Braemar.

Braemar Hotels & Resorts, as a real estate investment trust, relies heavily on debt and equity capital providers, including financial institutions, banks, and broader capital markets. This dependence means the bargaining power of these suppliers can significantly influence Braemar's ability to fund acquisitions, manage existing debt, and invest in property improvements. Favorable terms from lenders are crucial for executing growth strategies and maintaining profitability.

The cost and accessibility of capital directly affect Braemar's financial flexibility. For instance, in 2024, the company continued to focus on optimizing its debt structure. This involved efforts to refinance existing loans, aiming to extend maturity dates and lower interest expenses, thereby demonstrating the direct impact of supplier terms on its financial health and strategic execution.

Real Estate Brokers and Property Sellers

When Braemar Hotels & Resorts looks to acquire new luxury hotels, the sellers of these valuable properties wield significant influence. The limited availability of prime luxury real estate in key markets means sellers can often dictate higher prices and more advantageous terms. For instance, in 2024, the average transaction value for luxury hotels in major US gateway cities remained robust, reflecting this scarcity. Braemar's focus on acquiring assets with established market strength further concentrates this power among a smaller group of sellers.

The bargaining power of suppliers, in this case, property sellers, is amplified by several factors:

- Scarcity of Prime Assets: The limited supply of high-quality luxury hotels in desirable locations gives sellers considerable leverage.

- High Transaction Values: In 2024, the median sale price for luxury hotels continued to be substantial, underscoring the value sellers bring to the table.

- Braemar's Acquisition Strategy: Braemar's targeted approach, seeking properties with strong market positions, narrows the field of potential sellers, increasing their individual bargaining power.

Technology and Operational Service Providers

Suppliers providing specialized technology for hotel operations, such as property management systems and revenue management software, can hold a degree of influence. For instance, a robust property management system (PMS) can be critical for efficient operations, and switching costs can be substantial, giving established providers some leverage. Braemar Hotels & Resorts' commitment to guest experience means reliance on these systems.

Essential operational service providers, including cleaning, security, and food and beverage suppliers, generally possess moderate bargaining power. This power is amplified when these suppliers cater to luxury standards or offer highly specialized services with limited alternatives. For example, a unique gourmet food supplier for a high-end restaurant within a Braemar property might command more favorable terms than a general catering service.

- Technology Suppliers: Specialized hotel technology providers can exert influence due to high switching costs and the critical nature of their systems for operational efficiency and guest satisfaction.

- Operational Service Providers: Suppliers of essential services like cleaning, security, and F&B have moderate power, especially when meeting luxury standards or offering unique, hard-to-replace inputs.

- Braemar's Dependence: Braemar's focus on premium guest experiences inherently ties its operational quality to the performance and reliability of these key suppliers.

Braemar Hotels & Resorts faces significant supplier bargaining power from major luxury hotel brands, which are critical for guest acquisition and operational expertise. The company's reliance on these established brands, like Marriott and Hilton, means these management companies hold considerable leverage in negotiations, impacting Braemar's ability to attract guests and maintain its luxury positioning.

The bargaining power of suppliers for Braemar Hotels & Resorts is notably strong with hotel management companies and capital providers. In 2024, the luxury hotel market continued to see high demand for prime assets, giving property sellers considerable leverage. Furthermore, the specialized nature of luxury hotel operations means that providers of unique renovation materials and high-end technology systems can also command stronger terms.

The bargaining power of suppliers for Braemar Hotels & Resorts is influenced by the scarcity of prime luxury assets and the specialized nature of services required. In 2024, the limited availability of high-quality hotels in key markets empowered sellers. Additionally, providers of critical technology and unique renovation materials could exert more influence due to high switching costs and the need to maintain luxury brand standards.

What is included in the product

This analysis details the competitive forces impacting Braemar Hotels & Resorts, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the luxury hotel sector.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each force, allowing for focused strategic adjustments.

Customers Bargaining Power

Individual luxury travelers, while often lacking direct power to negotiate room rates, represent a significant force through their collective demand. Their willingness to pay for premium experiences directly underpins Braemar Hotels & Resorts' revenue streams. For instance, the luxury travel sector saw continued robust growth through 2024, with many high-end properties reporting occupancy rates above 80% and average daily rates increasing by 5-10% year-over-year.

Braemar Hotels & Resorts benefits from robust demand for group and corporate bookings, essential for events and business travel. These significant clients, however, possess considerable bargaining power, enabling them to negotiate preferential pricing and service packages.

For instance, in 2024, the hospitality sector saw continued pressure on corporate travel budgets, making volume discounts a key negotiation point for larger entities. Braemar's strategic focus on growing its group segment, particularly during off-peak periods, aims to boost ancillary revenue streams and offset potential market volatility.

Online Travel Agencies (OTAs) like Expedia and Booking.com act as powerful intermediaries, connecting hotels with a vast customer base. While this broadens reach, it also means hotels often pay significant commissions, impacting their net revenue. In 2023, commissions paid by hotels to OTAs could range from 15% to 30% or even higher, depending on the platform and negotiated terms.

The sheer volume of bookings processed through OTAs grants them considerable leverage. This power allows them to influence pricing, dictate visibility within their platforms, and set terms that can impact a hotel's direct booking strategies. Hotels must carefully balance the benefits of OTA exposure against the costs and potential erosion of direct customer relationships.

Economic Sensitivity of Luxury Spending

The luxury hotel sector, while generally resilient, is still influenced by overall economic health and how much consumers feel they can spend on non-essentials. When the economy slows down or inflation is high, even wealthy individuals might become more cautious about their spending, potentially delaying trips or choosing less expensive luxury options. This shift in behavior can give customers more leverage, as reduced demand for top-tier services puts pressure on hotels to maintain pricing.

This increased price sensitivity among affluent travelers can directly impact key performance indicators for companies like Braemar Hotels & Resorts. For instance, a significant economic slowdown could lead to a noticeable dip in Revenue Per Available Room (RevPAR) and occupancy rates, as fewer guests are willing to pay premium prices. This economic sensitivity highlights a crucial aspect of the bargaining power of customers in the luxury segment.

- Economic Downturn Impact: During periods of economic contraction, discretionary spending on luxury travel typically declines, increasing customer bargaining power.

- Inflationary Pressures: High inflation can erode purchasing power, even for affluent consumers, making them more sensitive to hotel pricing and enhancing their ability to negotiate.

- Demand Reduction: A collective decision by affluent customers to reduce the frequency or scale of their luxury travel directly weakens the pricing power of hotels.

- RevPAR and Occupancy Sensitivity: These shifts in consumer behavior can translate into lower RevPAR and occupancy, indicating a tangible increase in customer bargaining power.

Hotel Brand Loyalty and Alternatives

Customers often display significant loyalty to established luxury hotel brands, like those managed by Braemar Hotels & Resorts, which can limit their inclination to switch brands. This loyalty means that if Braemar's managed properties don't offer a compelling reason to choose them over a preferred brand, guests have considerable power. For instance, a 2024 report indicated that over 60% of luxury travelers cite brand reputation as a primary factor in their booking decisions, underscoring the influence of brand affinity.

While Braemar Hotels & Resorts owns the physical assets, the success of these hotels is intrinsically linked to the brands they operate under. The ability of these brands to attract and retain guests directly affects Braemar's revenue and asset performance. This creates a dynamic where guest preferences for specific brands indirectly grant them leverage, as their willingness to book is tied to the perceived value and reputation of the brand, not just the underlying real estate.

- Brand Loyalty Impact: High customer loyalty to luxury brands can reduce price sensitivity and increase switching costs for guests, strengthening the bargaining power of customers.

- Indirect Influence on Braemar: Although Braemar owns the real estate, the brand's appeal directly influences occupancy and RevPAR (Revenue Per Available Room), giving brand-loyal customers leverage.

- Value Proposition is Key: To counter this, Braemar's managed properties must consistently deliver superior guest experiences and value to mitigate the bargaining power derived from brand preference.

The bargaining power of customers for Braemar Hotels & Resorts is multifaceted, encompassing individual luxury travelers, corporate clients, and the influence of Online Travel Agencies (OTAs). While individual luxury travelers may lack direct negotiation power, their collective demand and willingness to pay for premium experiences are foundational. However, economic conditions and brand loyalty can shift this dynamic, granting customers more leverage if hotels fail to deliver consistent value or if economic downturns increase price sensitivity.

| Customer Segment | Bargaining Power Factors | Impact on Braemar Hotels & Resorts |

|---|---|---|

| Individual Luxury Travelers | Collective demand, brand loyalty, price sensitivity during economic downturns | Influences occupancy and RevPAR; loyalty can reduce price elasticity but economic shifts increase leverage. In 2024, luxury travel demand remained strong, with many properties reporting over 80% occupancy. |

| Group & Corporate Bookings | Volume of bookings, negotiation of preferential pricing and packages | Significant leverage to negotiate discounts; crucial for driving revenue, especially during off-peak times. Corporate budgets in 2024 often focused on volume discounts. |

| Online Travel Agencies (OTAs) | Vast customer reach, influence on pricing and visibility, commission rates | Provide broad exposure but at a cost of significant commissions (15-30% in 2023); can dictate terms affecting direct booking strategies. |

What You See Is What You Get

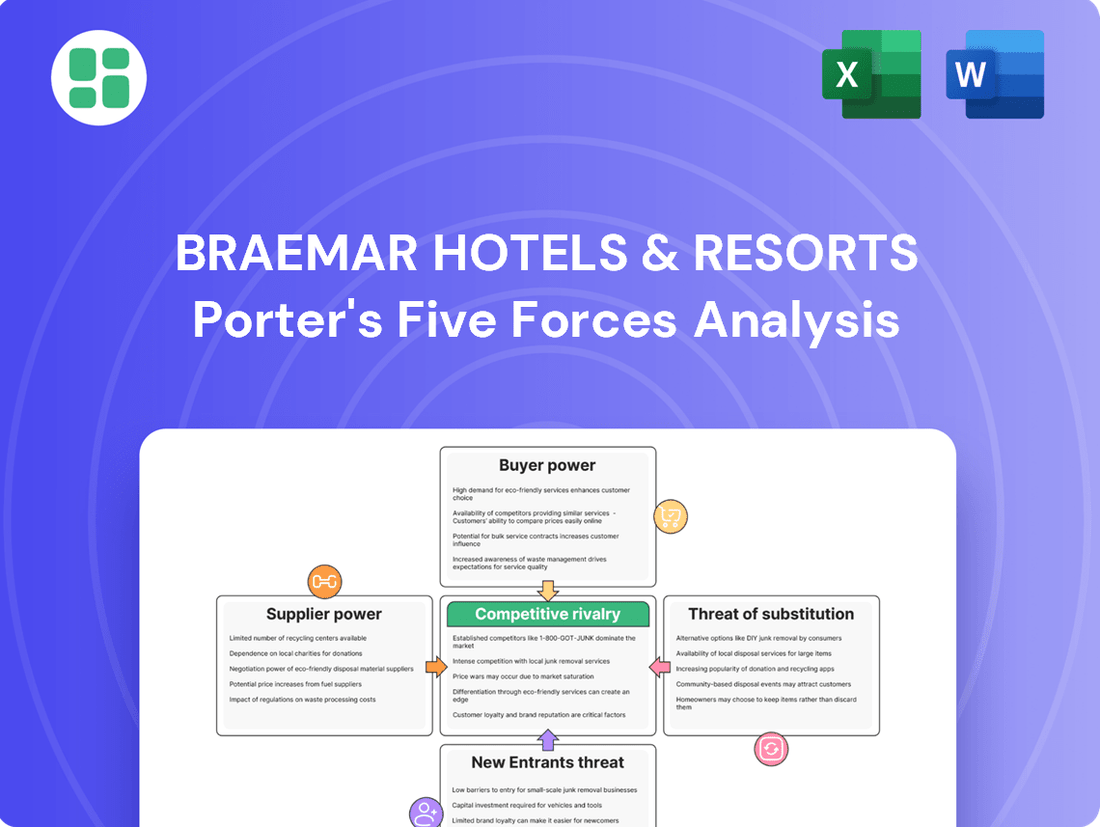

Braemar Hotels & Resorts Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Braemar Hotels & Resorts, detailing the competitive landscape and strategic positioning of the company within the hospitality sector. The exact document you see here, complete with in-depth insights into industry rivalry, buyer and supplier power, threats of new entrants, and substitutes, is precisely what you will receive immediately after purchase. This professionally formatted analysis is ready for your immediate use, offering a clear understanding of the forces shaping Braemar's operating environment.

Rivalry Among Competitors

Braemar Hotels & Resorts faces significant rivalry from other luxury hotel Real Estate Investment Trusts (REITs). Competitors like Host Hotels & Resorts, Park Hotels & Resorts, and DiamondRock Hospitality also target premium properties, creating direct competition for acquisition opportunities and investor attention. For instance, in 2024, Host Hotels & Resorts reported a portfolio of 73 hotels, demonstrating its substantial presence in the luxury segment.

Beyond publicly traded REITs, private equity firms, sovereign wealth funds, and other large institutional investors represent a significant competitive threat to Braemar Hotels & Resorts. These entities possess considerable capital and frequently engage in aggressive bidding for high-quality hotel properties. This activity can escalate acquisition costs and narrow the range of available investment opportunities for Braemar.

The appetite for hotel assets among private investors remained robust throughout 2024. This sustained demand intensifies competition, as these well-capitalized players can often outbid public companies, particularly for prime luxury assets. For instance, reports indicated a notable increase in private capital deployment into the hospitality sector in the first half of 2024, with a particular focus on premium-branded and experiential properties.

Global hotel giants like Marriott, Hilton, and Hyatt, with their extensive portfolios of luxury properties, present a formidable competitive force. These brands not only vie for the same discerning guests but also act as potential acquirers, influencing market consolidation. In 2024, Marriott's luxury segment alone boasted over 500 properties worldwide, highlighting their significant market presence.

Beyond the major brands, independent luxury hotels and bespoke boutique operators carve out their own space by offering distinctive, personalized experiences. These establishments cater to niche markets seeking unique stays, contributing to a fragmented luxury hospitality landscape. For instance, many independent luxury hotels saw occupancy rates rebound strongly in 2024, often exceeding 70% in prime urban and resort locations, demonstrating their appeal.

Geographic and Segment-Specific Market Dynamics

The intensity of competition for Braemar Hotels & Resorts varies considerably based on location and the specific luxury segment. For instance, urban markets might see different competitive pressures compared to popular resort destinations.

Braemar's diverse portfolio includes properties in both urban settings and resort areas, with a notable trend showing luxury resort properties often demonstrating stronger performance metrics. This suggests a dynamic competitive landscape where different property types face unique challenges and opportunities.

Competition remains particularly fierce in highly sought-after markets with significant barriers to entry, such as prime urban centers or exclusive resort locales. This intensity is fueled by the limited availability of premier locations and consistently high demand from affluent travelers.

- Urban vs. Resort Competition: Competition intensity differs between urban and resort markets. For example, in 2024, luxury urban hotels might face higher operational costs and a more saturated market, while luxury resorts in high-demand destinations could experience robust occupancy rates despite intense competition for prime beachfront or scenic locations.

- Segment-Specific Performance: Luxury resort properties within Braemar's portfolio have frequently outperformed their urban counterparts in terms of RevPAR (Revenue Per Available Room) and occupancy in 2024, indicating a stronger demand in leisure-focused segments.

- High-Barrier Market Dynamics: In markets like Manhattan or exclusive Caribbean islands, competition is fierce due to limited new supply and sustained high demand, driving up acquisition costs and operational expenses for all players.

Strategic Asset Management and Capital Investment

Competitive rivalry within strategic asset management and capital investment is intense. Companies like Braemar Hotels & Resorts are constantly investing to improve their properties. This focus on enhancing property value and guest experience is crucial for maintaining market share. For instance, Braemar's planned capital expenditures for 2025 highlight this ongoing commitment to staying competitive through property upgrades.

Competitors are actively engaged in renovating, upgrading, and repositioning their assets. This strategy aims to attract a higher-spending clientele and secure a stronger market position. The continuous cycle of investment means that failing to keep pace with these enhancements can lead to a loss of competitive advantage.

- Property Enhancements: Competitors are actively renovating and upgrading their hotel assets to improve guest experience and attract high-spending customers.

- Market Share Defense: Continuous capital investment is essential for companies like Braemar Hotels & Resorts to defend their market share against rivals.

- Strategic Repositioning: Competitors are also repositioning their properties to target different market segments or appeal to evolving consumer preferences.

- 2025 Capital Expenditures: Braemar's planned capital expenditures for 2025 underscore the industry's ongoing need for significant investment in property improvements to remain competitive.

Braemar Hotels & Resorts operates in a highly competitive luxury hotel market, facing rivals like Host Hotels & Resorts and Park Hotels & Resorts, both of which possess substantial portfolios. Private equity, sovereign wealth funds, and other institutional investors also aggressively pursue prime hotel assets, often outbidding public companies. Global hotel giants such as Marriott and Hilton, with their vast luxury brands and extensive property networks, further intensify this rivalry by competing for guests and potential acquisitions.

The competitive landscape is further fragmented by independent luxury and boutique hotels that appeal to niche markets seeking unique experiences. This dynamic means Braemar must continuously invest in property enhancements and strategic repositioning to maintain its market share. For example, Braemar's planned capital expenditures for 2025 demonstrate this ongoing commitment to staying competitive through property upgrades, a strategy mirrored by its rivals who are also actively renovating and upgrading their assets.

| Competitor Type | Key Characteristics | 2024 Data/Trends |

|---|---|---|

| Publicly Traded REITs | Large portfolios, focus on premium properties | Host Hotels & Resorts: 73 hotels in portfolio. |

| Private Equity/Institutional Investors | Significant capital, aggressive bidding | Increased private capital deployment in hospitality sector, focus on premium/experiential properties. |

| Global Hotel Brands | Extensive luxury portfolios, brand loyalty | Marriott's luxury segment: Over 500 properties globally. |

| Independent/Boutique Hotels | Niche markets, personalized experiences | Strong occupancy rebound in 2024, often exceeding 70% in prime locations. |

SSubstitutes Threaten

The growing popularity of high-end short-term rentals and private villas presents a significant threat of substitution for luxury hotels like those in Braemar Hotels & Resorts' portfolio. Platforms such as Airbnb Luxe and specialized agencies are making it easier for travelers to access unique, private accommodations that can offer more space and a personalized touch compared to traditional hotel rooms.

These luxury rentals often appeal to families or groups seeking a more integrated and private vacation experience. For instance, in 2024, the luxury vacation rental market continued its robust growth, with many travelers prioritizing privacy and unique amenities. This trend directly competes with the traditional hotel model, potentially capturing a share of the luxury travel segment that values these alternative offerings.

The threat of substitutes for Braemar Hotels & Resorts is significant, as affluent consumers have a growing array of luxury travel alternatives. These include luxury cruises, private jet tours, and exclusive experiential travel packages, all competing for the same discretionary spending. For instance, the luxury cruise market saw robust recovery post-pandemic, with companies like Royal Caribbean reporting strong booking trends in 2024, indicating a healthy demand for premium travel experiences outside traditional hotels.

High-end wellness retreats also present a compelling substitute, catering to a desire for unique and rejuvenating experiences. These offerings, often all-inclusive and focused on personalized well-being, directly compete for the attention and budget of high-net-worth individuals. The global wellness tourism market, projected to reach over $1.3 trillion by 2025, highlights the substantial and growing appeal of these alternative luxury travel segments.

Economic downturns significantly amplify the threat of substitutes for luxury hospitality providers like Braemar Hotels & Resorts. During periods of financial strain, consumers who previously indulged in premium accommodations may shift to more budget-friendly alternatives, a phenomenon known as down-trading. This can involve opting for upper-upscale or even upscale hotels, or forgoing luxury travel altogether in favor of domestic or less expensive leisure activities.

Other Real Estate Investment Opportunities

For investors looking at Braemar Hotels & Resorts (BHR), other real estate investment trusts (REITs) and alternative assets represent significant substitutes. For instance, industrial REITs offered a strong performance in 2024, with some sectors seeing double-digit growth in net asset value due to robust demand for logistics and warehousing. Similarly, residential REITs have maintained steady rental income streams, making them attractive for their stability.

The appeal of hotel REITs like Braemar can shift based on their perceived risk and dividend yields when compared to these other options. In early 2024, the bond market, particularly U.S. Treasuries, provided attractive yields, drawing capital away from riskier equity investments, including some REIT sectors. Private equity, while less liquid, also presents an alternative for investors seeking diversification beyond publicly traded securities.

The competitive landscape means that Braemar Hotels & Resorts must continually assess its value proposition against these substitutes. Factors such as economic outlook, interest rate movements, and sector-specific performance directly influence investor allocation decisions. For example, a rising interest rate environment can make dividend yields from REITs less competitive against fixed-income alternatives.

- Industrial REITs: Demonstrated strong NAV growth in 2024, driven by e-commerce logistics.

- Residential REITs: Provided stable rental income, appealing to risk-averse investors.

- Bonds: Offered competitive yields in early 2024, attracting capital from equity markets.

- Private Equity: Remains a substitute for investors seeking diversification and potentially higher returns, albeit with lower liquidity.

Emergence of Niche or Experiential Travel Models

The rise of personalized and immersive travel experiences presents a significant threat of substitutes for traditional luxury hotels like those in Braemar Hotels & Resorts' portfolio. Niche models such as glamping, eco-lodges, and remote luxury retreats are gaining traction, offering unique value propositions that appeal to affluent travelers seeking something beyond the conventional. For instance, the global glamping market was valued at approximately $2.7 billion in 2023 and is projected to grow substantially, indicating a clear shift in consumer preferences.

These alternative accommodations often emphasize sustainability and unique local experiences, directly challenging the established luxury hotel format. By bypassing traditional hotel infrastructure, these substitutes can offer more intimate and tailored experiences, potentially drawing away specific high-end demographics. This trend is particularly relevant as consumer demand for authentic and eco-conscious travel continues to surge, with studies showing a significant portion of travelers willing to pay a premium for sustainable options.

- Growing Demand for Unique Experiences: Travelers increasingly seek authentic, immersive, and personalized travel, moving beyond standard hotel offerings.

- Rise of Niche Accommodations: Glamping, eco-lodges, and remote retreats are emerging as direct substitutes, offering distinct value propositions.

- Sustainability as a Differentiator: Eco-conscious travel is a growing segment, with consumers willing to opt for sustainable alternatives to traditional luxury.

- Market Growth in Alternatives: The glamping market alone was valued at around $2.7 billion in 2023, highlighting the significant appeal of these substitute models.

The threat of substitutes for Braemar Hotels & Resorts is substantial, encompassing both alternative travel experiences and investment options. Luxury short-term rentals, private villas, and high-end cruises offer personalized and unique experiences that directly compete with traditional hotel stays. For investors, other REIT sectors like industrial and residential, along with less liquid assets like private equity, serve as viable substitutes, especially when considering risk-adjusted returns and market performance. In 2024, the industrial REIT sector showed notable growth, while bonds offered competitive yields, influencing capital allocation decisions away from hospitality.

| Substitute Category | Examples | Key Appeal | 2024 Market Trend Relevance |

| Alternative Accommodations | Luxury Rentals, Glamping, Eco-lodges | Privacy, unique experiences, personalization | Continued growth in unique travel, with glamping market valued at ~$2.7 billion in 2023. |

| Experiential Travel | Luxury Cruises, Private Jet Tours, Wellness Retreats | Immersive experiences, exclusivity, well-being | Luxury cruise market saw strong bookings in 2024; wellness tourism projected over $1.3 trillion by 2025. |

| Investment Alternatives | Industrial REITs, Residential REITs, Bonds, Private Equity | Diversification, stability, yield | Industrial REITs showed strong NAV growth in 2024; bonds offered attractive yields in early 2024. |

Entrants Threaten

The luxury hotel Real Estate Investment Trust (REIT) sector presents a formidable barrier to entry due to extraordinarily high capital requirements. Acquiring and developing prime, high-end hotel properties demands investments that can easily run into the hundreds of millions, if not billions, of dollars. For instance, Braemar Hotels & Resorts' portfolio, as of early 2024, boasts assets valued in the billions, a scale that effectively prices out most aspiring competitors.

Securing prime real estate in desirable locations presents a significant hurdle for new luxury hotel operators. These coveted spots, often in major cities or exclusive resort areas, are not only scarce but also come with substantial acquisition costs and complex zoning laws. For instance, in 2024, the average price per key for luxury hotel development in gateway cities like New York or London continued to be exceptionally high, often exceeding $500,000, effectively pricing out many potential new players.

New entrants face a significant hurdle in replicating Braemar Hotels & Resorts' established relationships with top luxury hotel brands and seasoned management teams. These long-standing partnerships, cultivated over years, provide access to critical operational expertise and powerful brand recognition essential for high-end property management.

Operational Complexity and Niche Expertise

Operating luxury hotels presents a formidable barrier to entry due to its inherent operational complexity. This includes intricate revenue management systems, the delivery of exceptionally high-touch guest services, and meticulous long-term capital expenditure planning for premium assets. Newcomers must either cultivate or procure this specialized expertise, a significant challenge, especially when aiming to manage a varied collection of high-end properties.

The need for niche expertise in luxury hospitality, particularly in areas like bespoke guest experiences and sophisticated property maintenance, acts as a deterrent. For instance, in 2024, the average RevPAR (Revenue Per Available Room) for luxury hotels in major urban centers often exceeded $350, a figure that requires highly optimized operations to achieve and sustain. New entrants would struggle to replicate the established operational efficiencies and brand recognition that drive such performance.

- High Capital Requirements: Significant upfront investment is needed for acquiring or developing prime real estate, coupled with substantial ongoing refurbishment costs to maintain luxury standards.

- Specialized Management Skills: Expertise in luxury brand management, personalized service delivery, and complex operational logistics is crucial and difficult to acquire quickly.

- Established Brand Loyalty: Existing luxury hotel brands benefit from strong customer loyalty built over years, making it challenging for new entrants to attract and retain a discerning clientele.

- Regulatory and Licensing Hurdles: Navigating complex zoning laws, hospitality licenses, and health and safety regulations can be time-consuming and costly for new operators.

Market Saturation in Specific Luxury Segments

While the broader luxury travel sector shows resilience, specific niches within it can become quite crowded. For instance, by early 2024, certain ultra-luxury urban hotels in prime global cities might see an oversupply, making it challenging for a new player to carve out a profitable space. This saturation in particular segments acts as a deterrent to new entrants.

Newcomers would need to either pinpoint underdeveloped luxury markets or prepare for significant investment to challenge well-established brands. The cost of acquiring prime real estate, developing unique guest experiences, and building brand recognition in already saturated luxury sub-segments can be substantial, potentially limiting the threat from new entrants in those specific areas.

- Market Saturation: Over-saturation in specific luxury hotel segments, like ultra-luxury urban properties, can deter new entrants.

- High Entry Costs: Significant investment is required for prime real estate, unique experiences, and brand building in competitive luxury markets.

- Niche Identification: New entrants must find underserved luxury niches or face intense competition with established players.

The threat of new entrants into the luxury hotel sector, particularly for a REIT like Braemar Hotels & Resorts, remains relatively low. The sheer scale of capital required to acquire or develop prime luxury properties, often in the hundreds of millions or even billions, acts as a significant deterrent. For example, as of early 2024, Braemar's portfolio assets were valued in the billions, a benchmark few new players can meet.

Beyond capital, new entrants face substantial hurdles in securing prime real estate in desirable locations and navigating complex zoning laws. In 2024, the cost per key for luxury hotel development in gateway cities frequently surpassed $500,000, effectively pricing out many potential competitors.

Furthermore, replicating the established operational expertise, brand relationships, and loyalty enjoyed by existing luxury operators like Braemar is a lengthy and costly endeavor. The need for specialized management skills in delivering high-touch guest experiences and maintaining premium assets, coupled with the difficulty of achieving economies of scale, further limits the threat.

| Barrier to Entry | Description | Example Data (Early 2024) |

|---|---|---|

| Capital Requirements | Extremely high investment for prime property acquisition and development. | Braemar's portfolio valued in billions; Luxury hotel development cost per key > $500,000 in gateway cities. |

| Real Estate Scarcity | Limited availability of prime locations in sought-after luxury markets. | High acquisition costs and complex zoning laws in major cities and exclusive resorts. |

| Brand & Relationships | Established luxury brands and management teams offer competitive advantages. | Long-standing partnerships with top brands and experienced operational teams. |

| Operational Complexity | Requires specialized expertise in luxury service, revenue management, and capital planning. | Average luxury hotel RevPAR > $350 in urban centers, requiring optimized operations. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Braemar Hotels & Resorts is built upon data from their SEC filings, including 10-K and 10-Q reports, alongside industry-specific market research from firms like STR and CBRE Hotels. We also incorporate insights from financial news outlets and analyst reports to provide a comprehensive view of the competitive landscape.