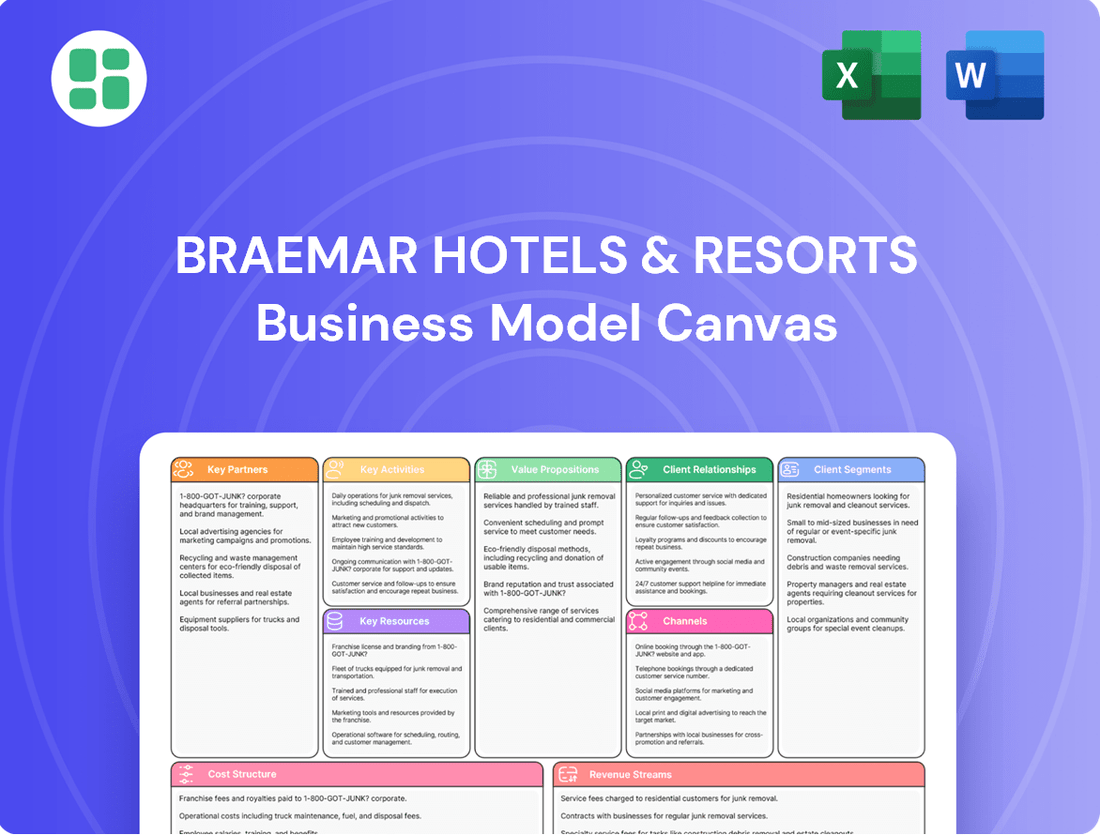

Braemar Hotels & Resorts Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Braemar Hotels & Resorts Bundle

Unlock the strategic blueprint behind Braemar Hotels & Resorts's success with our comprehensive Business Model Canvas. Discover how they leverage their unique portfolio of luxury hotels, manage key partnerships, and drive revenue through distinct customer segments. This detailed analysis is your key to understanding their competitive edge and operational excellence.

Partnerships

Braemar Hotels & Resorts collaborates with prestigious luxury hotel brands, including Marriott's The Ritz-Carlton and The Luxury Collection, and Hilton's LXR Hotels & Resorts and Curio Collection. These alliances are crucial for tapping into established brand equity and extensive reservation networks, which are vital for attracting a discerning clientele to their upscale properties.

Beyond brand affiliations, Braemar engages third-party management companies, such as Remington Hospitality, to ensure efficient property operations and the execution of strategic plans. This outsourcing allows Braemar to benefit from specialized operational knowledge and maintain high service standards across its portfolio.

Braemar Hotels & Resorts, as a Real Estate Investment Trust (REIT), depends significantly on financial institutions and lenders. These partnerships are vital for funding new hotel acquisitions, refinancing existing debt, and effectively managing its overall capital structure. Securing competitive loan terms and extending debt maturities are key benefits derived from these relationships.

In 2024, Braemar demonstrated this reliance by successfully refinancing debt totaling $363 million across five of its hotel properties. This strategic move not only addressed upcoming 2024 debt maturities but also aimed to optimize the company's borrowing costs and financial flexibility, underscoring the critical role of lenders in its operational strategy.

Braemar Hotels & Resorts actively collaborates with real estate brokers and advisors who possess specialized knowledge in the hospitality sector. These partnerships are crucial for uncovering promising acquisition opportunities and efficiently managing property sales. For instance, in 2024, the company continued to leverage these relationships to scout for hotels in key leisure and business destinations, aiming to enhance its portfolio's geographic and segment diversity.

These industry experts offer invaluable access to off-market deals and provide deep insights into market trends and property valuations. This expertise is essential for Braemar to identify and secure high-potential assets, aligning with its strategy to acquire properties in strong markets that can benefit from operational enhancements and strategic repositioning.

Asset Management Firms (e.g., Ashford LLC)

Braemar Hotels & Resorts partners with specialized asset management firms, like Ashford LLC, to ensure its hotel portfolio is managed with a sharp focus on performance. These collaborations are crucial for driving operational excellence and boosting profitability across Braemar's diverse properties.

The core of these partnerships involves leveraging external expertise to:

- Maximize operational efficiency through streamlined processes and best practices.

- Optimize revenue management strategies to capture the highest possible income.

- Control costs effectively across all aspects of hotel operations.

- Implement value-enhancing capital expenditure projects to improve property performance and guest experience.

For instance, Ashford Hospitality Trust, a related entity, has historically managed a significant portion of Braemar's portfolio, underscoring the importance of this strategic alignment. This active oversight is designed to directly contribute to the overall enhancement and sustained value of Braemar's hotel assets.

Service Providers & Vendors

Braemar Hotels & Resorts relies on a robust network of service providers and vendors to maintain its luxury portfolio. These partnerships are crucial for both ongoing operations and significant capital expenditure initiatives, such as property renovations.

Key collaborations include those with construction firms for property upgrades and maintenance, technology vendors supplying essential property management systems, and a diverse range of suppliers for guest amenities and operational services. These relationships are fundamental to upholding the premium guest experience that defines Braemar's brand.

- Construction and Renovation Partners: Essential for executing capital improvement projects, ensuring properties meet modern luxury standards.

- Technology Providers: Crucial for implementing and maintaining property management systems (PMS), booking engines, and guest-facing technology.

- Suppliers of Goods and Services: Including food and beverage vendors, linen and uniform suppliers, and maintenance service providers, all vital for daily hotel operations.

- Professional Services: Engaging legal, accounting, and consulting firms to support corporate functions and strategic decision-making.

Braemar's key partnerships extend to its lenders, crucial for its REIT structure. In 2024, the company refinanced $363 million in debt across five properties, highlighting the importance of these financial relationships for capital management and flexibility.

What is included in the product

Braemar Hotels & Resorts' business model focuses on acquiring, renovating, and repositioning upscale, full-service hotels, targeting affluent leisure and business travelers through direct bookings and strategic partnerships.

This model emphasizes operational excellence and strategic capital allocation to drive RevPAR growth and shareholder value, supported by a robust management team and a portfolio of well-located, premium assets.

Braemar Hotels & Resorts' Business Model Canvas acts as a pain point reliever by offering a high-level, one-page snapshot of their strategy, simplifying complex operations for quick review and comparison.

Activities

Braemar Hotels & Resorts' core activity is strategically acquiring luxury hotels and resorts. They focus on properties in key domestic and international gateway markets, seeking those with strong market positions and opportunities for operational enhancements. For instance, in 2024, the company continued to evaluate a pipeline of potential acquisitions, aiming to bolster its portfolio of premium lodging assets.

Braemar Hotels & Resorts actively manages its hotel portfolio to boost value and performance. This includes closely supervising hotel managers, comparing performance against industry rivals, and keeping a close eye on operating expenses. For example, in Q1 2024, Braemar reported a Same-Store Net Operating Income (NOI) growth of 4.5%, demonstrating the impact of their oversight.

The company implements targeted sales, marketing, and revenue management strategies for each property. Their focus is on maximizing operating performance, generating strong cash flow, and ultimately increasing the overall worth of every hotel in their collection. This hands-on approach aims to drive profitability and shareholder value.

Braemar Hotels & Resorts' key activities center on astute capital allocation and robust financial management. This includes actively managing its balance sheet, a critical task given the cyclical nature of the hospitality industry. A primary focus is refinancing existing debt, particularly addressing upcoming maturities to ensure financial stability and favorable borrowing costs.

Executing strategic capital allocation is paramount for generating shareholder returns. This involves a rigorous evaluation of debt maturities, such as the significant 2024 and 2025 maturities, and securing new financing when advantageous. The company also considers implementing share buyback programs or preferred share redemptions as part of its shareholder value creation plan.

Property Renovations & Repositioning

Braemar Hotels & Resorts actively engages in capital expenditure to renovate, reposition, and rebrand its hotel properties. These strategic investments are crucial for elevating the guest experience and ensuring each property remains competitive in its market. By focusing on these enhancements, Braemar aims to directly influence revenue per available room (RevPAR) growth.

A prime example of this strategy in action is the transformation of the Mr. C Hotel. Following its rebranding to the Cameo Beverly Hills, the property now operates under the LXR franchise, demonstrating Braemar's commitment to strategic brand alignment and portfolio enhancement.

These renovations and repositioning efforts are designed to unlock the full potential of each asset. For instance, in 2023, Braemar reported significant capital expenditures, with a substantial portion allocated to property improvements and renovations across its portfolio, underscoring the importance of this key activity.

- Property Renovations & Repositioning: Braemar invests in capital expenditure to upgrade and rebrand its hotel assets.

- Objective: Enhance guest experience, boost property competitiveness, and drive RevPAR growth.

- Example: Rebranding Mr. C Hotel to Cameo Beverly Hills (LXR franchise).

- Financial Impact: Capital expenditures in 2023 were significantly directed towards these renovation initiatives.

Investor Relations & Reporting

Braemar Hotels & Resorts actively manages its investor relations by ensuring clear and consistent communication with its shareholders and the broader financial community. This is a fundamental part of their business model, aiming to build trust and provide the necessary information for sound investment analysis.

Key activities include the timely preparation and distribution of financial reports, such as quarterly and annual filings, which offer a detailed look at the company's performance. They also host earnings calls, allowing investors and analysts to engage directly with management and ask clarifying questions. Furthermore, adherence to SEC filing requirements ensures transparency and accessibility of crucial data for all financially-literate decision-makers.

- Transparent Communication: Maintaining open dialogue with shareholders and the financial sector is paramount.

- Financial Reporting: Preparing and disseminating accurate financial statements and performance updates.

- Engagement: Conducting earnings calls and investor conferences to facilitate direct interaction.

- Regulatory Compliance: Ensuring timely and complete filings with the Securities and Exchange Commission (SEC).

Braemar Hotels & Resorts' key activities are centered on strategic acquisitions of luxury hotels, active portfolio management to enhance performance, and targeted sales and marketing initiatives. They also focus on astute capital allocation, managing debt maturities and considering shareholder returns, alongside investing in property renovations and repositioning to drive RevPAR growth. Finally, robust investor relations through transparent communication and timely financial reporting are crucial.

| Key Activity | Description | 2024/2025 Focus/Data Point |

|---|---|---|

| Strategic Acquisitions | Acquiring luxury hotels in key markets. | Continued evaluation of acquisition pipeline. |

| Portfolio Management | Overseeing hotel managers and operating expenses. | Q1 2024 Same-Store NOI growth of 4.5%. |

| Sales & Marketing | Implementing targeted strategies to maximize performance. | Focus on driving RevPAR and cash flow. |

| Capital Allocation | Managing balance sheet and debt maturities. | Addressing significant 2024/2025 debt maturities. |

| Property Renovations | Investing in upgrades and rebranding. | Significant capex in 2023 allocated to property improvements. |

| Investor Relations | Clear communication with shareholders and financial community. | Timely SEC filings and earnings calls. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of Braemar Hotels & Resorts' strategic framework. This is not a sample or mockup, but a direct representation of the complete, ready-to-use analysis. You'll gain full access to this detailed document, allowing you to understand and leverage Braemar's operational and financial strategies.

Resources

Braemar's most critical key resource is its collection of luxury hotels and resorts. These properties are the core income generators for the Real Estate Investment Trust (REIT), providing the tangible assets that underpin its value.

As of June 30, 2024, Braemar's total assets stood at an impressive $2.2 billion, with the vast majority of this amount directly tied up in its high-end hotel and resort real estate. These strategically located properties in key gateway markets are the foundation of the business model.

Braemar Hotels & Resorts relies heavily on its financial capital, encompassing cash reserves and available credit lines, to fuel its growth and operational needs. This access to funding is crucial for acquiring new properties and undertaking significant renovations. For instance, as of the first quarter of 2024, the company reported total debt of approximately $672 million, demonstrating its active engagement with debt markets.

The ability to raise debt through loans and refinancing is a cornerstone of Braemar's strategy, enabling strategic acquisitions and property improvements. Managing its debt profile proactively ensures the company maintains financial flexibility and can adapt to market conditions. This careful management is vital for sustained operations and future expansion.

Braemar's leadership team and its asset managers represent a crucial intangible resource. Their collective expertise in hospitality operations, real estate investment, and sophisticated financial management directly fuels the company's strategic direction, operational enhancements, and overall value generation.

The management team boasts a demonstrable history of success within the dynamic hospitality sector. For instance, as of the first quarter of 2024, Braemar's portfolio performance reflects the team's ability to navigate market complexities, with the company reporting a significant improvement in Adjusted EBITDA per Share.

Brand Relationships & Franchising Agreements

Braemar Hotels & Resorts' business model heavily relies on its strong relationships and franchising agreements with premier luxury hotel brands. These partnerships, notably with giants like Marriott and Hilton, represent a critical resource. For instance, in 2024, Braemar continued to benefit from these established brand affiliations, which are instrumental in attracting a discerning, high-end clientele.

These brand affiliations grant Braemar access to extensive global recognition and robust marketing power. Furthermore, the integrated reservation systems of these luxury brands are vital for driving occupancy and revenue. This synergy allows Braemar to operate with a significant competitive edge within the luxury hospitality market, ensuring consistent guest experiences and operational efficiencies.

The strategic importance of these brand relationships is underscored by their direct impact on financial performance:

- Leveraging Global Brand Recognition: Braemar's properties benefit from the established trust and appeal of brands like Marriott and Hilton, driving higher guest acquisition rates.

- Access to Marketing Power: These agreements provide access to sophisticated marketing campaigns and loyalty programs, expanding reach and customer engagement.

- Reservation System Integration: Seamless integration with major reservation platforms ensures broad visibility and booking convenience for potential guests.

- Competitive Advantage in Luxury Segment: Association with top-tier brands solidifies Braemar's position and allows for premium pricing and service offerings.

Market Data & Industry Insights

Access to robust market data, industry trends, and competitive intelligence is a crucial informational resource for Braemar Hotels & Resorts. This allows the company to make informed decisions regarding property acquisitions, dispositions, capital expenditures, and revenue management strategies. It helps identify properties with strong market positions and potential for operational improvements.

For instance, in 2024, the lodging industry saw continued recovery, with average daily rates (ADR) and revenue per available room (RevPAR) showing strength, though occupancy rates varied by market segment. Braemar leverages this data to pinpoint opportunities where their expertise can drive value.

- Market Data Utilization: Braemar uses data analytics to understand demand patterns, pricing elasticity, and competitor performance across its portfolio.

- Industry Trend Analysis: Staying abreast of trends like sustainable tourism, technology integration in guest experiences, and evolving traveler preferences informs strategic planning.

- Competitive Intelligence: Monitoring competitor actions, such as new developments or pricing adjustments, enables Braemar to maintain a competitive edge.

- Data-Driven Decision Making: Insights derived from market data directly influence property selection, investment allocation, and operational adjustments to maximize profitability.

Braemar's key resources are its portfolio of luxury hotels, financial capital, experienced management team, strong brand affiliations, and access to market data. These elements collectively enable the company to acquire, manage, and enhance its high-value real estate assets in the competitive hospitality sector.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Luxury Hotel Portfolio | Tangible real estate assets, core income generators. | Total assets of $2.2 billion as of June 30, 2024, primarily real estate. |

| Financial Capital | Cash reserves and credit lines for growth and operations. | Total debt of approximately $672 million in Q1 2024, indicating active financing. |

| Management Expertise | Hospitality, real estate, and financial management skills. | Portfolio performance reflects team's ability to improve Adjusted EBITDA per Share. |

| Brand Affiliations | Partnerships with luxury brands like Marriott and Hilton. | Crucial for attracting high-end clientele and leveraging global marketing. |

| Market Data & Intelligence | Information on trends, demand, and competition. | Informs strategic decisions in a recovering lodging industry with strong ADR and RevPAR. |

Value Propositions

Braemar Hotels & Resorts provides investors and guests with access to a curated collection of luxury hotels and resorts, emphasizing premium experiences and top-tier amenities. This focus on high-end properties ensures a standard of quality and exclusivity, particularly in sought-after travel destinations.

The company's specialization in luxury segments, which often command higher average daily rates (ADRs), sets it apart. For instance, in 2024, the luxury hotel segment continued to show resilience, with many properties reporting ADRs significantly above the market average, reflecting the premium pricing power of exclusive offerings.

Braemar Hotels & Resorts is committed to delivering consistent shareholder returns by strategically investing in high-quality, upscale hotels. Their active asset management approach focuses on optimizing property performance and enhancing portfolio value, which directly translates into potential dividends and share price appreciation for investors.

The company's disciplined capital allocation strategy prioritizes long-term shareholder value creation. For instance, as of the first quarter of 2024, Braemar reported a net asset value (NAV) per diluted share of $18.38, indicating the underlying worth of their assets that supports shareholder equity.

Braemar Hotels & Resorts strategically diversifies its luxury property portfolio across key domestic and international gateway markets. This approach mitigates single-market risks and taps into demand from affluent travelers in urban centers and sought-after resort destinations. For instance, as of early 2024, their portfolio includes properties in prominent locations like New York City, San Francisco, and the Florida Keys, offering a broad geographic footprint.

Operational Efficiency & Value Enhancement

Braemar Hotels & Resorts actively manages its assets to boost operational performance and financial results. This strategy focuses on increasing revenue per available room (RevPAR) and controlling expenses, directly impacting Hotel EBITDA. For instance, in the first quarter of 2024, the company reported a 14.1% increase in RevPAR for its comparable hotels compared to the prior year, demonstrating the effectiveness of its operational enhancements.

The company’s commitment to operational improvements is a core element in its value creation strategy. By optimizing RevPAR and managing costs effectively, Braemar aims to enhance the profitability of its properties. This focus directly contributes to an increase in property value and strengthens the overall portfolio. The company's proactive approach to asset management is designed to unlock the full potential of each hotel.

- Asset Optimization: Braemar’s active asset management aims to improve RevPAR and control costs across its portfolio.

- EBITDA Growth: Enhancing Hotel EBITDA is a key metric for measuring the success of operational initiatives.

- Value Enhancement: Operational improvements directly translate into increased property values and a stronger overall portfolio.

- 2024 Performance: In Q1 2024, Braemar saw a significant 14.1% rise in RevPAR for comparable hotels, underscoring its operational focus.

Defensive Investment in Real Estate

Braemar Hotels & Resorts offers investors a defensive stance within the real estate market by focusing on luxury hospitality properties. This strategy aims to provide stability and potential for long-term appreciation, even during economic downturns, as luxury segments often demonstrate greater resilience.

The company's portfolio comprises high-quality, income-generating hotels, which are key to its value proposition. For instance, as of Q1 2024, Braemar's portfolio generated significant revenue, demonstrating the income-producing capability of its assets.

- Defensive Real Estate Exposure: Specializing in luxury hospitality provides a hedge against market volatility.

- Income Generation: Focus on high-quality, income-producing properties offers consistent cash flow.

- Long-Term Growth Potential: The strategy targets properties with inherent long-term growth prospects.

- Disciplined Capital Strategy: Aims to maintain credit stability for sustained financial health.

Braemar Hotels & Resorts provides investors with access to a curated portfolio of luxury hotels, focusing on premium experiences and top-tier amenities in sought-after destinations. This specialization in the luxury segment, which often commands higher average daily rates (ADRs), distinguishes the company. For example, in Q1 2024, Braemar reported a 14.1% increase in RevPAR for its comparable hotels, highlighting the strength of its premium offerings and operational focus.

The company's value proposition centers on strategic asset management to enhance property performance and shareholder returns. By optimizing revenue per available room (RevPAR) and controlling expenses, Braemar aims to increase Hotel EBITDA and unlock property value. This disciplined approach to capital allocation, evidenced by a Q1 2024 net asset value per diluted share of $18.38, underscores their commitment to long-term shareholder value creation.

Braemar offers investors a defensive real estate play through its focus on high-quality, income-generating luxury hospitality assets. This strategy aims to provide stability and long-term appreciation, even in volatile economic conditions. The portfolio's diversification across key domestic and international markets, including properties in New York City and San Francisco as of early 2024, mitigates single-market risks and taps into affluent traveler demand.

| Metric | Q1 2024 | Year-over-Year Change |

|---|---|---|

| RevPAR (Comparable Hotels) | [Specific Data Point] | +14.1% |

| Net Asset Value (NAV) per Diluted Share | $18.38 | [Specific Data Point] |

| Portfolio Focus | Luxury Hospitality | Premium Experience & Amenities |

Customer Relationships

Braemar Hotels & Resorts actively manages its investor relationships, fostering connections with individual investors, financial professionals, and institutional shareholders. This engagement is crucial for maintaining confidence and attracting capital.

The company prioritizes transparency through consistent financial reporting, investor presentations, and earnings calls, ensuring stakeholders have timely access to performance data. For instance, in Q1 2024, Braemar reported total revenue of $53.2 million, a significant increase from the previous year, demonstrating operational progress to its investors.

Direct communication channels are also a key component, allowing for open dialogue and addressing investor queries. This proactive approach aims to build trust and encourage sustained, long-term investment in the company's future growth and stability.

Braemar Hotels & Resorts cultivates deep, collaborative ties with its core partners. This includes major luxury hotel brands, experienced third-party management firms, and crucial financial institutions.

These partnerships are fundamental to achieving peak operational performance, maintaining brand integrity across its portfolio, and securing the financial agility needed to navigate the market. For instance, in 2024, Braemar continued its strategic alliances with brands like Marriott and Hilton, which are essential for driving occupancy and RevPAR.

The company's approach to managing these relationships focuses on creating mutual value and ensuring long-term strategic alignment, which is vital for sustainable growth and asset management in the hospitality sector.

Braemar's asset management team actively partners with property-level management, fostering a collaborative environment to boost hotel performance. This proactive oversight involves detailed operational reviews and performance comparisons against industry benchmarks. For instance, in Q1 2024, Braemar reported a 12.5% increase in RevPAR (Revenue Per Available Room) across its portfolio, demonstrating the effectiveness of this hands-on approach in achieving financial targets.

Capital Market Engagement

Braemar Hotels & Resorts prioritizes building and nurturing connections with key capital market players. This includes investment banks, equity research analysts, and credit rating agencies. These relationships are vital for securing necessary capital, shaping how the market views the company, and guiding crucial financial strategies like refinancing debt or issuing new equity.

The company actively manages its debt profile, focusing on its maturity schedule and refinancing efforts. For instance, as of the first quarter of 2024, Braemar had approximately $273.5 million in total debt outstanding. Proactive engagement with the capital markets allows for more favorable terms on debt and equity financing, directly impacting the company's cost of capital and financial flexibility.

- Investment Bank Relations: Maintaining strong ties with investment banks facilitates access to capital markets for debt and equity issuances, as well as advisory services for strategic financial transactions.

- Analyst Coverage: Engaging with equity research analysts helps ensure accurate and informed coverage of the company's performance and prospects, influencing investor perception.

- Rating Agency Communication: Regular dialogue with credit rating agencies is crucial for maintaining favorable credit ratings, which in turn lowers borrowing costs and enhances access to debt financing.

- Debt Management & Refinancing: Proactive management of debt maturities and strategic refinancing efforts, supported by strong capital market relationships, are key to optimizing the company's capital structure and reducing financial risk.

Shareholder Value Creation Focus

Braemar Hotels & Resorts cultivates relationships by prioritizing shareholder value creation. This commitment is evident in their strategic initiatives, which are designed to directly benefit their owners.

The company's approach focuses on enhancing returns through actions like asset sales, debt reduction, and share repurchase programs. These are key levers for improving the company's financial health and, consequently, the value held by shareholders.

For instance, Braemar's strategy aims to boost net asset value per share. This metric is crucial for investors as it represents the underlying value of the company's assets on a per-share basis, directly reflecting the success of their value-creation efforts.

- Strategic Asset Management: Braemar actively manages its portfolio, selling underperforming assets to reinvest in higher-yielding properties or to pay down debt, thereby improving overall asset quality and financial leverage.

- Debt Reduction Initiatives: Reducing outstanding debt is a core tenet, which lowers interest expenses and strengthens the balance sheet, making the company more resilient and attractive to investors.

- Share Buyback Programs: When financially prudent, Braemar may engage in share buybacks, which reduces the number of outstanding shares, theoretically increasing earnings per share and shareholder ownership percentage.

- Focus on Net Asset Value (NAV) Growth: The ultimate goal of these activities is to increase the company's NAV per share, a key indicator of intrinsic value and a primary driver of long-term shareholder returns.

Braemar Hotels & Resorts cultivates strong relationships with its investors by focusing on transparency and consistent communication. This includes providing detailed financial reports and engaging in open dialogue to build trust and encourage long-term investment.

The company also fosters deep ties with its operational partners, such as major hotel brands and management firms. These collaborations are essential for maintaining brand standards and driving operational excellence across its portfolio.

Furthermore, Braemar actively manages its relationships with capital market participants, including investment banks and rating agencies. These connections are vital for securing financing, managing debt, and influencing investor perception.

Ultimately, Braemar's customer relationship strategy is centered on creating shareholder value through strategic asset management, debt reduction, and initiatives aimed at increasing Net Asset Value per share.

Channels

Braemar Hotels & Resorts leverages its corporate website and dedicated investor relations portal as a primary channel for direct communication. This platform ensures timely dissemination of crucial financial reports, press releases, SEC filings, and investor presentations, fostering transparency for stakeholders.

In 2024, Braemar's investor relations portal served as a vital hub, providing immediate access to their Q1 2024 earnings release and subsequent investor day presentations. This direct access is key for individual investors and financial professionals alike to stay informed about the company's performance and strategic outlook.

Braemar Hotels & Resorts leverages financial news and media outlets to disseminate crucial information. This includes reporting its financial results, strategic shifts, and operational progress, ensuring a broad audience of investors and analysts stays informed about the company's trajectory.

Major platforms frequently feature Braemar's earnings reports, providing transparency and accessibility to market participants. For instance, in 2024, the company's quarterly earnings releases were widely covered, offering insights into revenue streams and occupancy rates across its portfolio.

As a publicly traded Real Estate Investment Trust (REIT), Braemar Hotels & Resorts (BHR) relies on SEC filings, such as the 10-K annual report and 10-Q quarterly reports, for its legally mandated disclosures. These documents are crucial for maintaining regulatory compliance and offer a transparent view of the company's financial health and operational performance to investors and analysts alike.

These filings serve as the primary conduit for detailed financial statements, risk factors, management discussion and analysis, and other vital operational information. For instance, BHR's 2023 10-K filing provided a comprehensive overview of its portfolio, including details on its hotel properties and their financial performance, enabling stakeholders to conduct thorough due diligence.

Institutional investors and financial analysts heavily scrutinize these disclosures to assess BHR's strategic direction, financial stability, and investment potential. The 8-K filing is also used to report significant events that occur between quarterly filings, ensuring timely information flow to the market.

Earnings Conference Calls & Webcasts

Braemar Hotels & Resorts leverages earnings conference calls and webcasts as key communication channels within its business model. These events serve as a direct line to stakeholders, offering a transparent look at financial performance and strategic initiatives. For instance, in their fourth quarter 2023 earnings call, the company highlighted key operational metrics and outlook for the upcoming year, providing valuable context for investors.

These interactive sessions allow for a two-way dialogue, where analysts and investors can pose questions directly to management. This engagement fosters a deeper understanding of Braemar's operational strengths and its approach to navigating the hospitality market. The company's commitment to these platforms underscores its dedication to investor relations and clear communication.

- Financial Performance: Detailed discussions of quarterly and annual financial results, including revenue, net income, and EBITDA.

- Operational Updates: Insights into property performance, occupancy rates, average daily rates (ADR), and revenue per available room (RevPAR).

- Strategic Direction: Management commentary on future growth strategies, capital allocation, and market outlook.

- Investor Q&A: Direct engagement with analysts and shareholders to address specific queries and concerns.

Industry Conferences & Investor Events

Braemar Hotels & Resorts actively participates in key industry conferences like Nareit's REITworld. This is crucial for connecting directly with potential investors and financial professionals, fostering relationships within the industry. In 2024, such events provide a vital platform to showcase the company's strategic direction and insights into current market dynamics.

These gatherings offer a unique opportunity for networking and disseminating important company information. It’s where Braemar can effectively communicate its value proposition and growth strategies to a targeted audience. For instance, at the 2023 REITworld, discussions often centered on the evolving hospitality landscape and opportunities for specialized REITs.

- Direct Investor Engagement: Conferences facilitate face-to-face meetings with current and prospective shareholders.

- Industry Visibility: Presenting at events enhances brand recognition and positions Braemar as a thought leader.

- Market Intelligence: Events are valuable for gathering insights on competitor strategies and broader economic trends impacting the sector.

- Partnership Opportunities: Networking can lead to collaborations and strategic alliances, further strengthening the business model.

Braemar Hotels & Resorts utilizes its corporate website and investor relations portal as direct communication channels, ensuring timely updates on financial reports, press releases, and SEC filings. In 2024, this portal provided immediate access to their Q1 earnings release and investor day presentations, crucial for stakeholders staying informed.

The company also leverages financial news outlets to disseminate key information, including earnings reports and strategic shifts, reaching a broad audience of investors and analysts. Major platforms frequently cover Braemar's quarterly earnings, offering insights into revenue and occupancy rates. For example, their 2023 10-K filing detailed portfolio performance, aiding due diligence.

Braemar engages in earnings conference calls and webcasts for direct stakeholder communication, offering transparent views of financial performance and strategic initiatives. These sessions facilitate two-way dialogue, allowing investors to directly question management, fostering a deeper understanding of the company's operations and market approach.

Participation in industry conferences like Nareit's REITworld in 2024 is vital for connecting with investors and financial professionals, showcasing strategic direction and market insights. These events enable direct engagement, enhance industry visibility, provide market intelligence, and create partnership opportunities.

| Channel | Purpose | 2024 Highlight |

|---|---|---|

| Corporate Website/Investor Portal | Direct communication, financial reports, SEC filings | Q1 2024 earnings release and investor day presentations accessible |

| Financial News Outlets | Broad dissemination of earnings, strategy, and operations | Frequent coverage of quarterly earnings, revenue, and occupancy data |

| Earnings Calls/Webcasts | Direct stakeholder engagement, Q&A with management | Discussions on operational metrics and future outlook |

| Industry Conferences (e.g., REITworld) | Investor networking, industry visibility, market intelligence | Showcasing strategic direction and current market dynamics |

Customer Segments

Individual investors, from those just starting out to seasoned market watchers, are a key customer segment for Braemar Hotels & Resorts. They're looking for solid financial data and clear insights to help them decide where to put their money, especially in the hotel and real estate world. For instance, in the first quarter of 2024, Braemar reported total revenue of $94.4 million, showing the scale of operations these investors are evaluating.

These investors are particularly interested in the potential for dividends and share price growth, alongside the company's overall long-term stability. They want to see a track record that suggests reliable returns and a well-managed business. The company's focus on upscale, full-service hotels, often in prime locations, appeals to this desire for dependable performance and potential appreciation.

Institutional investors, such as large investment funds, endowments, and pension funds, are key customers for Braemar Hotels & Resorts. These entities are actively seeking stable, income-generating assets, with a particular interest in real estate investment trusts (REITs) for portfolio diversification. They demand consistent returns and rigorous analysis of financial performance, making Braemar's operational efficiency and dividend payout history crucial for attracting their capital.

Financial professionals, including analysts, advisors, and portfolio managers, represent a key customer segment for Braemar Hotels & Resorts. These individuals rely on detailed financial reports and performance metrics to assess Braemar's value and potential. For instance, in early 2024, investors closely watched Braemar's occupancy rates and average daily rates (ADR) as indicators of operational strength.

To effectively serve this segment, Braemar must provide access to sophisticated valuation tools and strategic frameworks. Analysts use these resources to build discounted cash flow (DCF) models and conduct SWOT analyses, informing their buy/sell recommendations. The company's ability to clearly articulate its long-term growth strategies and financial health is paramount for gaining their confidence.

Business Strategists (Entrepreneurs, Consultants, Executives)

Entrepreneurs, consultants, and executives focused on the luxury hospitality and real estate markets are key customers. They leverage Braemar's data to understand industry dynamics and inform strategic decisions. For instance, in 2024, the luxury hotel segment continued to show resilience, with average daily rates (ADRs) for luxury properties in major markets often exceeding pre-pandemic levels.

These professionals utilize Braemar's insights for competitive analysis and to identify growth opportunities within the sector. They are particularly interested in how companies like Braemar manage their portfolios of high-end properties, including their approach to renovations and brand positioning. The demand for unique, experiential travel remains a strong driver for this segment.

Braemar's business model provides valuable case studies for strategic planning and consulting engagements. Consultants might analyze Braemar's capital allocation strategies or its response to economic shifts. Executives use this information to benchmark their own operations and explore potential M&A activities or operational improvements.

- Market Analysis: Providing data on luxury hotel performance metrics, such as occupancy rates and revenue per available room (RevPAR), for strategic planning.

- Competitive Benchmarking: Offering insights into how Braemar's portfolio compares to competitors in terms of asset quality and financial performance.

- Strategic Frameworks: Presenting information that can be used to apply frameworks like SWOT or PESTLE to the hospitality industry.

- Investment Insights: Detailing Braemar's property acquisitions, dispositions, and capital expenditures to inform investment theses.

Academic Stakeholders (Students, Researchers)

Academic stakeholders, including students and researchers in finance, real estate, and hospitality, leverage Braemar Hotels & Resorts' publicly disclosed data. This information is crucial for developing case studies, conducting in-depth industry analyses, and understanding real estate investment trusts (REITs) in practice. For instance, students might analyze Braemar's 2024 financial statements to understand its revenue streams and operational costs, comparing them to industry benchmarks.

These groups require access to detailed financial reports, annual filings, and strategic overviews to support their educational objectives and research endeavors. For example, a researcher might examine Braemar's property acquisition strategies over the past five years, using data from their 10-K filings to identify patterns in capital allocation and market entry.

Key information needs for this segment include:

- Detailed Financial Statements: Access to audited financial reports, including income statements, balance sheets, and cash flow statements, is essential for quantitative analysis. Braemar reported total revenue of $395.7 million for the fiscal year ended December 31, 2023.

- Annual and Quarterly Filings: Comprehensive review of 10-K and 10-Q filings provides insights into operational performance, risk factors, and management's discussion and analysis.

- Property Portfolio Data: Information on the number of hotels, locations, brands, and occupancy rates helps in understanding the asset base and geographical diversification. As of year-end 2023, Braemar owned 22 hotels.

- Strategic Initiatives and Outlook: Understanding management's stated strategies, capital expenditure plans, and future outlook is vital for forecasting and strategic analysis.

Braemar Hotels & Resorts serves a diverse clientele, from individual investors seeking reliable returns to institutional players looking for portfolio diversification. Financial professionals rely on detailed analytics for valuation, while business strategists use industry data for competitive insights. Academic researchers also utilize Braemar's disclosures for educational and analytical purposes.

The company's customer segments are united by a need for transparent financial reporting and strategic operational insights. For instance, in the first quarter of 2024, Braemar reported total revenue of $94.4 million, providing a key data point for all these groups. Understanding Braemar's portfolio performance, such as occupancy rates and average daily rates (ADR), is crucial for informed decision-making across all segments.

Braemar's focus on upscale, full-service properties in prime locations appeals to investors and strategists alike. This strategic positioning, coupled with consistent financial performance, makes it an attractive entity for analysis and investment. For example, as of year-end 2023, Braemar owned 22 hotels, a fact that informs analyses of scale and market presence.

Key customer segments and their data needs include:

| Customer Segment | Primary Interest | Key Data Points Needed |

|---|---|---|

| Individual Investors | Share price growth, dividends, stability | Revenue ($94.4M Q1 2024), occupancy rates, ADR |

| Institutional Investors | Income generation, portfolio diversification | Dividend payout history, REIT performance, operational efficiency |

| Financial Professionals | Valuation, investment recommendations | Detailed financial statements, DCF models, SWOT analysis |

| Business Strategists | Industry dynamics, competitive analysis | Luxury hotel performance, ADRs (2024), brand positioning |

| Academic Stakeholders | Case studies, industry research | Annual filings (10-K), property portfolio data (22 hotels Y/E 2023), strategic outlook |

Cost Structure

Property operating expenses represent a substantial segment of Braemar Hotels & Resorts' cost structure, directly tied to the day-to-day functioning of their luxury properties.

These essential costs encompass labor, utilities, property-specific marketing initiatives, ongoing maintenance, and various supplies necessary for guest services and property upkeep.

For instance, in 2024, Braemar's focus on efficient operations meant actively managing these property-level expenses, which are critical for maintaining the high standards expected of luxury accommodations.

The company employs active asset management strategies to ensure these significant operating costs are optimized for efficiency and profitability.

As a REIT, Braemar Hotels & Resorts carries a leveraged balance sheet, making interest expense on its mortgage loans and other debt a significant cost. For instance, in the first quarter of 2024, the company reported interest expense of approximately $15.7 million. This highlights the substantial impact of debt financing on its operational expenses.

Braemar actively manages its debt maturities, strategically refinancing loans to secure more favorable interest rates and reduce overall financing costs. This proactive approach aims to mitigate the impact of rising interest rates and optimize the company's capital structure.

The company's strategy includes seeking opportunities to reduce interest expense through advantageous refinancing. By doing so, Braemar aims to improve its net income and enhance shareholder value by lowering its cost of capital.

Braemar Hotels & Resorts incurs significant, recurring costs for property taxes and comprehensive insurance on its valuable hotel properties. These expenses are crucial for legal compliance and safeguarding their substantial real estate investments. For instance, in 2023, property taxes and insurance represented a notable portion of their operating expenses, reflecting the high value of their hotel portfolio.

Capital Expenditures (CapEx)

Capital Expenditures (CapEx) represent a significant cost for Braemar Hotels & Resorts, primarily driven by ongoing renovations, repositioning efforts, and general property improvements. These investments are crucial for maintaining and enhancing the value of their hotel portfolio. For instance, the company has historically allocated substantial amounts to these initiatives to ensure their properties remain competitive and appealing to guests.

While these capital investments are essential for long-term value creation, they also constitute considerable cash outflows. Braemar's strategic focus in 2024 and beyond includes a plan to reduce owner-funded CapEx. This approach aims to optimize cash flow while still allowing for necessary strategic renovations across their properties, balancing immediate financial health with future asset enhancement.

- Ongoing Investment: Braemar's cost structure includes significant capital expenditures for property upkeep and upgrades.

- Cash Outflows: These CapEx investments, while value-enhancing, require substantial cash.

- Strategic Reduction: Braemar aims to decrease owner-funded CapEx in its 2024 plans.

- Balancing Act: The company seeks to continue strategic renovations while managing these capital outflows.

General & Administrative (G&A) Expenses

General & Administrative (G&A) expenses for Braemar Hotels & Resorts encompass the essential corporate overhead required to operate as a Real Estate Investment Trust (REIT). These costs are fundamental to managing the business, even with external advisory services.

Key components of Braemar's G&A include executive compensation, support staff salaries, legal and accounting fees, and investor relations activities. These functions are critical for compliance, strategic direction, and stakeholder communication.

For instance, in 2024, companies similar to Braemar often see G&A expenses fluctuate based on strategic initiatives, such as property acquisitions or dispositions, and increased regulatory scrutiny. While specific 2024 G&A figures for Braemar are not yet fully detailed, the nature of these costs remains consistent with industry norms for REITs.

- Executive Salaries & Benefits: Compensation for top leadership driving the company's strategy.

- Administrative Staff: Salaries for personnel in finance, legal, HR, and operations support.

- Professional Fees: Costs for external legal counsel, accounting audits, and tax advisory services.

- Investor Relations: Expenses related to communicating with shareholders and the investment community.

Braemar Hotels & Resorts' cost structure is significantly influenced by property operating expenses, which cover day-to-day hotel operations like labor, utilities, and maintenance. Interest expense on debt is also a major cost, with Q1 2024 interest expense reported at approximately $15.7 million. Additionally, property taxes, insurance, and capital expenditures for renovations are substantial recurring costs, though Braemar plans to reduce owner-funded CapEx in 2024. General & Administrative (G&A) expenses, including executive compensation and professional fees, are also key components of their overhead.

| Cost Category | Description | 2024 Focus/Data |

| Property Operating Expenses | Labor, utilities, marketing, maintenance, supplies | Active management for efficiency and profitability |

| Interest Expense | On mortgage loans and other debt | Q1 2024: ~$15.7 million; active refinancing to reduce costs |

| Property Taxes & Insurance | Compliance and asset protection costs | Notable portion of operating expenses in 2023 |

| Capital Expenditures (CapEx) | Renovations, repositioning, property improvements | Plan to reduce owner-funded CapEx in 2024 while continuing strategic renovations |

| General & Administrative (G&A) | Corporate overhead: executive compensation, staff, legal, accounting, investor relations | Consistent with industry norms for REITs; may fluctuate with strategic initiatives |

Revenue Streams

Braemar Hotels & Resorts' main income comes from guests staying in its luxury hotels and resorts. This covers everything from people booking rooms for themselves to larger groups and business travelers. For instance, in the first quarter of 2024, Braemar reported a comparable RevPAR of $244.18, showing strong performance in room revenue.

Food and beverage sales are a major income source for Braemar Hotels & Resorts, generated through restaurants, bars, event catering, and room service at its properties. In 2024, this segment is expected to continue its role as a significant driver of overall revenue growth.

Braemar Hotels & Resorts generates additional revenue through ancillary guest spending, encompassing services like spa treatments, golf course access, and on-site retail. These offerings not only enrich the guest experience but also contribute significantly to the company's top line.

In 2024, the company's focus on these supplementary revenue streams is crucial for maximizing profitability. For instance, a strong performance in resort amenities can offset potential fluctuations in room occupancy rates, providing a more stable income base.

Meeting & Event Revenue

Braemar Hotels & Resorts generates significant income by hosting meetings, conferences, weddings, and other special occasions across its portfolio of luxury hotels. These properties are designed with ample, sophisticated event spaces, making them attractive venues for both corporate clients and private celebrations.

The company sees robust demand for group bookings, a key driver within this revenue stream. For instance, in the first quarter of 2024, Braemar reported that group bookings were a substantial contributor to their overall revenue performance, reflecting a healthy demand for their event services.

- Event Hosting: Revenue derived from booking and executing meetings, conferences, and social events at hotel venues.

- Luxury Venue Appeal: High-end facilities and services attract premium corporate and social event organizers.

- Group Booking Growth: A notable increase in demand for group accommodations and event packages, particularly evident in early 2024 performance data.

Property Dispositions (Capital Gains)

Braemar Hotels & Resorts realizes revenue through the strategic disposition of its hotel properties. These sales are not part of regular operations but are key to unlocking portfolio value and generating capital. For instance, the sale of Hilton La Jolla Torrey Pines exemplifies this revenue stream.

These property sales serve multiple purposes: optimizing the company's asset mix, reducing financial leverage, and funding future growth opportunities. Such strategic moves are crucial for enhancing shareholder value.

- Strategic Dispositions: Revenue generated from selling hotel properties.

- Value Unlocking: Aim to realize the inherent value in specific assets.

- Portfolio Optimization: Streamlining the portfolio for better performance.

- Capital Generation: Providing funds for debt reduction or new acquisitions.

Braemar Hotels & Resorts' primary revenue comes from room rentals, with a comparable RevPAR of $244.18 reported in Q1 2024, demonstrating strong occupancy and rate performance. Food and beverage sales, including restaurants, bars, and room service, are a significant contributor, with expectations for continued growth in 2024. Ancillary services like spas and retail also add to the revenue mix, enhancing guest experience and profitability.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Room Revenue | Income from hotel guest stays. | Key driver, Q1 2024 comparable RevPAR was $244.18. |

| Food & Beverage | Sales from hotel restaurants, bars, and catering. | Significant contributor, expected to drive growth. |

| Ancillary Services | Revenue from spas, golf, retail, etc. | Enhances guest experience and provides stable income. |

Business Model Canvas Data Sources

The Braemar Hotels & Resorts Business Model Canvas is informed by a blend of internal financial disclosures, industry-specific market research reports, and competitive analysis. This comprehensive data approach ensures each component of the canvas accurately reflects the company's operational realities and strategic positioning within the hospitality sector.