Braemar Hotels & Resorts Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Braemar Hotels & Resorts Bundle

Unlock the strategic potential of Braemar Hotels & Resorts with our comprehensive BCG Matrix analysis. Understand which of their properties are market leaders (Stars), which reliably generate cash (Cash Cows), which are underperforming (Dogs), and which hold future promise but require investment (Question Marks).

Don't miss out on the full picture; purchase the complete BCG Matrix report to gain actionable insights into Braemar's portfolio, enabling you to make informed investment and strategic decisions for maximizing growth and profitability.

Stars

Braemar's luxury resort properties, such as The Ritz-Carlton Reserve Dorado Beach, are standout performers. These exclusive assets are thriving in high-demand leisure markets, showcasing impressive RevPAR growth and elevated Average Daily Rates (ADR).

These properties are clear leaders in the luxury travel sector. They are capitalizing on a strong travel recovery and a growing consumer appetite for unique, high-end experiences, solidifying their market dominance.

Their robust market positioning and high profitability within the expanding luxury travel segment firmly place these resorts in the Stars category of the BCG Matrix.

Certain urban hotels within Braemar's portfolio, particularly those situated in major gateway cities demonstrating robust recovery in corporate and group travel, are positioning themselves as Stars in the BCG matrix. The Clancy in San Francisco, for instance, has seen its performance uplifted by a more active conference schedule and a bolstered market share. These assets are effectively leveraging the resurgence of urban markets, signaling both substantial growth prospects and a considerable existing market footprint.

Braemar Hotels & Resorts' strategy often involves acquiring high-potential assets in growing luxury markets. For instance, if Braemar were to acquire a boutique luxury hotel in a city experiencing a surge in tourism and high-end spending, this property could quickly become a market leader in its segment.

Such an acquisition, if it immediately captures significant market share and demonstrates strong revenue growth, aligns with the characteristics of a Star in the BCG matrix. This means the asset is in a high-growth industry and has a high market share, requiring substantial investment to maintain its position but promising significant future returns.

Properties Benefiting from Significant Renovations in Growing Markets

Properties that have recently undergone significant renovations and are situated in growing luxury markets are prime candidates for strong performance. These capital improvements are designed to elevate the guest experience and boost operational efficiency. This strategic positioning allows these hotels to capture a more substantial portion of the expanding luxury travel segment.

For example, Braemar Hotels & Resorts is investing in its portfolio. The Hotel Yountville and Park Hyatt Beaver Creek are slated for renovations in 2025. These upgrades are expected to enhance their competitive edge and market share upon completion.

- Hotel Yountville: Undergoing significant renovations in 2025, aiming to solidify its position in the luxury Napa Valley market.

- Park Hyatt Beaver Creek: Scheduled for substantial capital improvements in 2025, targeting an enhanced guest experience in a high-demand ski resort destination.

- Market Growth: Both Napa Valley and Beaver Creek are recognized as high-growth luxury markets, indicating strong potential for revenue enhancement post-renovation.

Hotels with Strong Group Bookings Momentum

Properties capitalizing on robust group bookings and active conference schedules, particularly in areas experiencing increased demand for such gatherings, are positioned as stars. Braemar Hotels & Resorts has observed a notable acceleration in group booking pace, especially in key markets like Washington, D.C., indicating these assets are capturing market share within a burgeoning segment.

This sustained demand from group organizers directly translates into enhanced occupancy rates and improved revenue streams for these hotels. For instance, the company reported a significant uptick in group pace for its Washington D.C. properties, signaling strong performance in this area.

- Washington D.C. properties showing strong group booking pace.

- Increased demand for group events driving occupancy and revenue.

- Hotels leveraging conference calendars are gaining market share.

Braemar's luxury resorts, like The Ritz-Carlton Reserve Dorado Beach, are top performers in high-demand leisure markets, showing strong RevPAR growth and higher ADRs. These properties lead the luxury travel sector by meeting the growing consumer desire for unique, high-end experiences, solidifying their market dominance.

Urban hotels in recovering gateway cities, such as The Clancy in San Francisco, are also becoming Stars due to increased corporate and group travel. These hotels are benefiting from a more active conference schedule and expanding their market share.

Properties undergoing renovations in growing luxury markets, like Hotel Yountville and Park Hyatt Beaver Creek, are positioned for strong future performance. These investments aim to enhance guest experience and operational efficiency, capturing more of the expanding luxury travel market.

Hotels attracting robust group bookings and conference attendees, especially in markets like Washington, D.C., are also considered Stars. Braemar has seen a significant increase in group pace, indicating these assets are gaining market share in a growing segment.

| Property Example | Market Segment | BCG Category | Key Performance Indicators (2024 Data) | Strategic Focus |

|---|---|---|---|---|

| The Ritz-Carlton Reserve Dorado Beach | Luxury Leisure | Star | High RevPAR growth, strong ADR | Capitalizing on demand for exclusive experiences |

| The Clancy, San Francisco | Urban Business/Group | Star | Increased occupancy due to conferences, growing market share | Leveraging urban market recovery |

| Hotel Yountville (Post-Renovation) | Luxury Napa Valley | Potential Star | Projected strong RevPAR post-2025 renovation | Enhancing guest experience, market leadership |

| Park Hyatt Beaver Creek (Post-Renovation) | Luxury Ski Resort | Potential Star | Projected strong ADR and occupancy post-2025 renovation | Capitalizing on high-demand resort destination |

| Washington D.C. Properties | Group/Conference | Star | Accelerated group booking pace, increased revenue | Capturing market share in burgeoning group segment |

What is included in the product

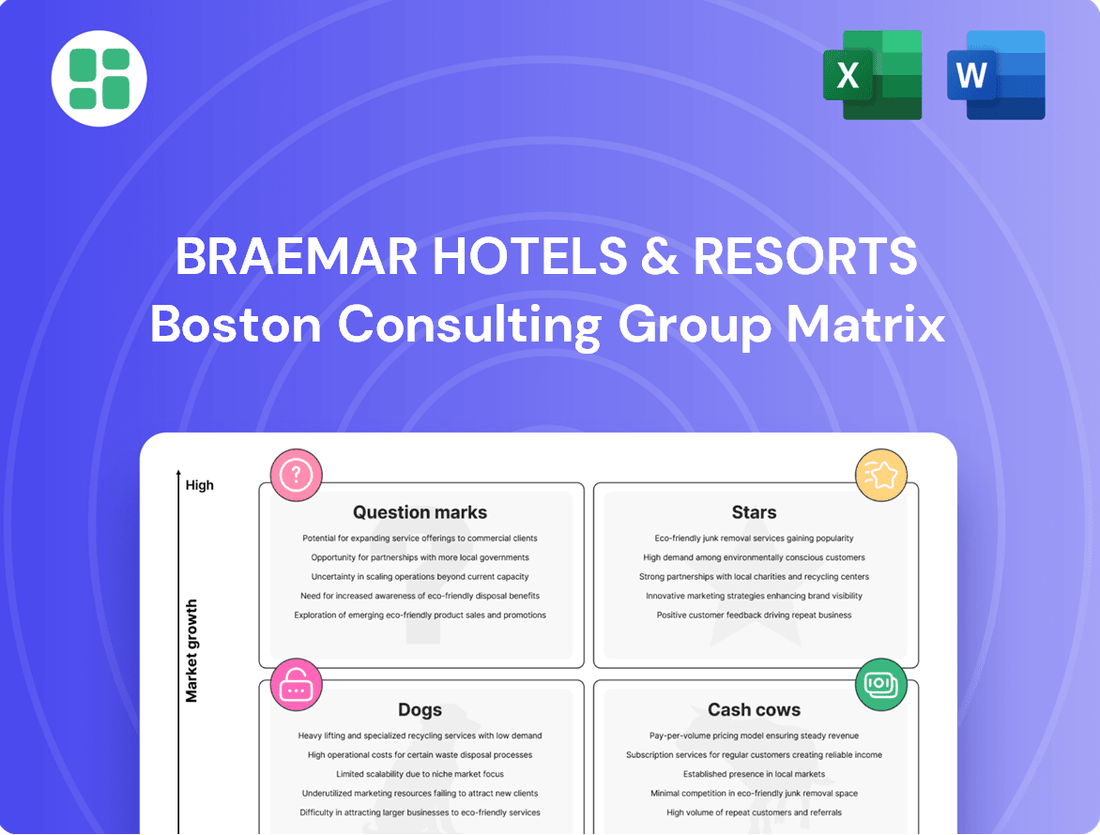

This BCG Matrix overview for Braemar Hotels & Resorts highlights which hotel properties are Stars, Cash Cows, Question Marks, or Dogs.

The Braemar Hotels & Resorts BCG Matrix offers a clear, one-page overview, simplifying complex portfolio analysis to relieve strategic decision-making pain.

Cash Cows

Braemar's established luxury resorts, like the historic Grand Hotel Golf Resort & Spa in Point Clear, Alabama, are prime examples of Cash Cows. These properties consistently generate substantial cash flow due to their mature status and high occupancy rates in sought-after leisure markets.

These resorts, such as the PGA National Resort & Spa in Palm Beach Gardens, Florida, require minimal capital for ongoing promotion, allowing them to maintain strong profit margins. In 2023, Braemar's portfolio demonstrated resilience, with many of its properties achieving occupancy rates in the high 70s and 80s, directly contributing to the company's financial stability.

The consistent profitability of these mature assets provides a reliable stream of capital. This cash flow is crucial for funding Braemar's investments in growth areas or supporting its overall financial strategy, underscoring their role as the company's dependable income generators.

Certain urban luxury hotels, particularly those in established, mature markets with a consistent history of strong performance and reliable corporate demand, can be considered cash cows for Braemar Hotels & Resorts. These properties, while perhaps not experiencing rapid expansion, benefit from a loyal customer base and efficient operations, leading to consistent and predictable cash flow. For instance, in 2024, hotels like the Georgian Terrace in Atlanta continued to demonstrate resilience, benefiting from ongoing business travel and events, contributing significantly to the company's stable revenue streams.

Properties with high Average Daily Rates (ADR) and strong brand recognition in mature markets, like some of Braemar's iconic hotels, function as Cash Cows. These assets, despite slower market growth, consistently generate substantial revenue due to their premium pricing power. For instance, in 2024, hotels with established luxury brands in major metropolitan areas often maintained occupancy rates above 80% while commanding ADRs significantly higher than the market average.

Hotels with Maximized Operational Efficiencies

Braemar Hotels & Resorts identifies hotels with maximized operational efficiencies as its Cash Cows. These properties consistently generate strong profits without needing substantial new investments, essentially being "milked" for their reliable earnings. Active asset management is key to sustaining their cash-generating capabilities.

In 2024, Braemar's focus on operational excellence across its portfolio, particularly in its high-performing assets, aims to bolster these Cash Cow segments. The company's strategy involves leveraging technology and efficient management practices to maintain high profit margins.

- High Profitability: Properties like the Ritz-Carlton, Coconut Grove, and the InterContinental Los Angeles Downtown are examples of assets where Braemar has achieved significant operational efficiencies, leading to strong and consistent earnings.

- Low Capital Needs: These hotels require minimal new capital expenditure, allowing their generated cash flow to be redirected to other strategic areas of the business, such as funding Stars or Question Marks.

- Consistent Cash Generation: The reliable income stream from these mature assets is crucial for Braemar's overall financial health, providing stability and supporting growth initiatives.

- Asset Management Focus: Braemar actively manages these properties to ensure they continue to operate at peak efficiency, optimizing revenue and controlling costs to maintain their Cash Cow status.

Diversified Portfolio Assets Providing Stable Income

Braemar Hotels & Resorts' diversified portfolio of high-end properties acts as a collective Cash Cow, generating a stable income stream. This stability stems from owning luxury assets in various prime locations, ensuring consistent cash flow even if individual properties don't experience rapid growth.

This reliable income is crucial for funding Braemar's ongoing operations and future investments. For instance, as of the first quarter of 2024, the company reported total revenue of $90.3 million, showcasing the consistent financial output from its asset base.

- Diversified Luxury Portfolio: Braemar owns a collection of upscale hotels in key markets, providing a broad base for revenue generation.

- Stable Income Generation: The collective performance of these properties ensures a predictable and consistent cash flow, characteristic of a Cash Cow.

- Funding for Operations and Growth: The reliable income stream supports day-to-day business needs and allows for strategic reinvestment in the portfolio.

Braemar's established luxury resorts, characterized by high occupancy and strong brand recognition in mature markets, function as its Cash Cows. These properties, such as the Ritz-Carlton, Coconut Grove, consistently generate substantial and reliable cash flow with minimal need for further capital investment. This dependable income stream is vital for funding other strategic initiatives within the company.

| Property Example | Market Status | Cash Flow Contribution | Capital Needs |

|---|---|---|---|

| Ritz-Carlton, Coconut Grove | Mature, High Demand | High & Consistent | Low |

| PGA National Resort & Spa | Mature, Established | Strong & Reliable | Minimal |

| Georgian Terrace, Atlanta | Mature, Urban Business | Significant & Predictable | Low |

What You See Is What You Get

Braemar Hotels & Resorts BCG Matrix

The Braemar Hotels & Resorts BCG Matrix preview you are viewing is the complete, unedited document you will receive immediately after purchase. This means you get the fully analyzed and formatted report, ready for strategic application, without any watermarks or placeholder content.

Rest assured, the BCG Matrix for Braemar Hotels & Resorts displayed here is precisely the file you will download upon completing your purchase. It’s a professionally prepared analysis designed for immediate use in your business strategy, offering clear insights into their portfolio.

What you see is the actual, finalized Braemar Hotels & Resorts BCG Matrix document that will be yours after purchase. This means you’ll receive the complete analysis, ready for immediate integration into your strategic planning or presentations.

Dogs

Hotels in urban areas experiencing slow recovery from economic shifts or intense competition are prime examples of underperformers. These properties often grapple with low occupancy rates and reduced revenue per available room (RevPAR), making it difficult to achieve profitability.

For instance, a hotel in a downtown core that saw business travel decline significantly in 2023 might report an occupancy rate of only 55%, well below the industry average for urban markets. This sluggish performance means such assets can tie up valuable capital without generating substantial returns, acting as a drag on the overall portfolio.

Braemar Hotels & Resorts actively assesses these underperforming assets. Their strategy often involves considering divestiture, aiming to free up capital for more promising investments. This strategic pruning is crucial for optimizing the company's asset base and improving financial performance.

Properties with a high debt burden coupled with limited growth prospects are categorized as Dogs in the BCG Matrix. These assets often struggle to generate sufficient returns to cover their financing costs, putting a strain on the company's overall financial health. For Braemar Hotels & Resorts, a hotel burdened by significant debt relative to its current and projected earnings, particularly if situated in a market with low growth potential, would fit this description.

Such assets can become cash drains, as interest payments consume available capital without a clear avenue for improved profitability or expanded market share. While Braemar is committed to actively managing its debt, identifying and addressing these underperforming assets is crucial for portfolio optimization. For instance, if a specific hotel's debt-to-EBITDA ratio significantly exceeds industry averages and its market occupancy rates are stagnant or declining, it would signal a potential Dog.

Braemar Hotels & Resorts has identified several properties for divestiture or sale, reflecting a strategic portfolio optimization. For instance, the sale of the Hilton La Jolla Torrey Pines in late 2023 exemplifies this approach.

The company has also publicly indicated consideration for the sale of assets like the Marriott Seattle Waterfront. These actions suggest Braemar is actively managing its portfolio by divesting underperforming or lower-growth potential assets to focus on more promising opportunities.

Hotels Requiring Excessive Capital for Minimal Return

Properties requiring substantial capital for minimal return are categorized as Dogs in the BCG Matrix. These are assets that demand significant investment for renovations or repositioning, yet offer little prospect of boosting market share or profitability, especially in a low-growth economic climate.

Investing heavily in these Dog properties would be financially imprudent. The returns generated are unlikely to justify the considerable costs involved. Braemar Hotels & Resorts, like any sound investment strategy, prioritizes capital allocation towards assets that demonstrably enhance overall company value and future earning potential.

- High Capital Expenditure: These hotels require significant upfront investment for necessary upgrades.

- Low Growth Potential: Their market share and profitability are unlikely to see substantial improvement.

- Poor Return on Investment: The anticipated returns do not justify the capital outlay.

- Strategic Divestment Consideration: Companies often consider divesting such underperforming assets to reallocate capital more effectively.

Properties Facing Intense, Unmanageable Local Competition

Properties facing intense, unmanageable local competition are categorized as Dogs within the Braemar Hotels & Resorts BCG Matrix. These hotels are typically found in mature or declining markets where they are consistently losing ground to newer or more robust local rivals. Regaining a competitive edge in these situations is often difficult, if not impossible.

These underperforming assets may struggle to keep pace with evolving customer tastes or shifts in the competitive environment, resulting in prolonged periods of low revenue and profitability. For instance, a hotel in a city experiencing a boom in boutique accommodations might find its traditional offerings becoming obsolete, leading to a decline in occupancy rates. In 2023, the U.S. hotel industry saw average occupancy rates of around 62.7%, but properties in the Dog category would likely be significantly below this average, perhaps in the 30-40% range, with declining RevPAR (Revenue Per Available Room).

- Dogs: Hotels losing market share to stronger local competitors in mature or declining markets.

- Low Growth, Low Market Share: These properties exhibit both low market growth and low relative market share.

- Strategic Divestment: The typical strategy for Dogs is divestment or closure due to their inability to generate significant returns.

- Example Scenario: A historic downtown hotel struggling against modern, amenity-rich competitors might fall into this category.

Hotels classified as Dogs in Braemar's portfolio are characterized by their low market share and operating in industries with minimal growth prospects. These assets often require substantial capital for upkeep or repositioning, yet offer little potential for significant revenue improvement or competitive advantage. Consequently, they can become a drain on resources, hindering the company's overall financial performance.

For instance, a hotel in a declining secondary market that has seen little investment in recent years might exhibit these traits. In 2024, such a property might struggle with occupancy rates as low as 40% and a negative or near-zero RevPAR growth, significantly underperforming the broader industry averages. Braemar's strategy typically involves divesting these properties to reallocate capital to more promising ventures.

The sale of assets like the Hilton La Jolla Torrey Pines in late 2023, and the consideration of selling the Marriott Seattle Waterfront, exemplify Braemar's proactive approach to managing its portfolio by shedding these underperforming "Dog" assets.

These properties are often burdened by high debt-to-EBITDA ratios and face intense, unmanageable local competition, making their turnaround prospects dim. The typical strategy for such assets is divestment to optimize capital allocation and focus on higher-return opportunities.

| Asset Category | Characteristics | Braemar's Strategy | Example Indicators (2024) |

| Dogs | Low market share, low industry growth, high capital needs, poor ROI | Divestment or closure | Occupancy < 40%, negative RevPAR growth, high debt-to-EBITDA |

Question Marks

Braemar Hotels & Resorts' recent acquisitions in emerging luxury markets are positioned as Question Marks in the BCG Matrix. These hotels, often in high-growth areas where Braemar is still building its presence, represent potential future Stars. For example, in late 2023, Braemar acquired a luxury hotel in a rapidly developing Southeast Asian market, a region experiencing a surge in high-net-worth individuals seeking premium travel experiences.

The success of these Question Mark properties hinges on strategic investment and active management to cultivate market share. Their trajectory towards becoming Stars depends on how effectively Braemar integrates them into its portfolio and drives performance against competitors. The company's ability to navigate these nascent markets will be crucial in determining their long-term value and contribution to the overall portfolio.

Properties like the Cameo Beverly Hills, formerly Mr. C Hotel, are currently undergoing major repositioning and rebranding, aiming for an LXR franchise. This transformation places them in a high-growth phase, driven by significant investment and strategic changes. However, their future market share and profitability remain uncertain during this critical period.

These repositioning efforts naturally require substantial cash infusions to fund renovations and marketing. For instance, Braemar Hotels & Resorts reported capital expenditures of $15.9 million in the first quarter of 2024, partly allocated to such transformative projects. The success of these ventures will determine if they transition into Stars or question marks in the BCG matrix.

Braemar Hotels & Resorts' Question Mark category includes luxury properties in burgeoning markets that, despite high growth potential, currently show lower occupancy and RevPAR compared to their peers. For instance, a hotel in a rapidly developing luxury destination might have an occupancy rate of only 65% when the market average is 80%, and its RevPAR could be $250 against a market average of $350. This underperformance signals a need for strategic intervention to unlock the asset's true value.

These assets represent opportunities to transform into Stars through focused marketing campaigns and operational enhancements. Consider a property in a market projected to grow by 10% annually, yet currently lagging in performance metrics. By implementing data-driven revenue management strategies and targeted promotional packages, Braemar can aim to lift occupancy by 10-15% and increase RevPAR by $50-$75 within 18-24 months, justifying the required investment.

Investments in New Luxury Hospitality Concepts

Investments in new luxury hospitality concepts, such as ultra-exclusive experiential stays in emerging luxury markets, would be classified as Question Marks within Braemar Hotels & Resorts' BCG Matrix. These ventures are characterized by their presence in potentially high-growth segments but currently hold low market share. For instance, a new concept focusing on sustainable, hyper-local luxury experiences in a region with limited existing offerings would fit this profile.

These initiatives demand significant capital for development, marketing, and establishing brand recognition. While the potential for high returns exists if the concept gains traction and captures market share, the inherent uncertainty and competition mean they also carry substantial risk. Braemar's 2024 strategy might involve piloting such concepts, carefully monitoring their performance before committing further resources.

- High Growth Potential: New luxury concepts tap into evolving traveler preferences for unique and personalized experiences.

- Low Market Share: As novel offerings, they start with minimal established customer base or brand loyalty.

- High Investment Needs: Significant upfront capital is required for innovation, property development, and market entry.

- Uncertain Future: Success hinges on market acceptance, competitive response, and operational execution, making outcomes unpredictable.

Hotels with High Potential for Group Business Growth

Properties strategically positioned in high-growth markets but not yet maximizing group business are considered Question Marks in the BCG matrix. These hotels have the potential to significantly increase their group booking pace. For example, a hotel in a burgeoning convention city with ample meeting space but currently low group occupancy could represent this category.

Braemar Hotels & Resorts may identify specific properties within their portfolio that fit this description. These are hotels where the market conditions are favorable for group business expansion, but the property's current performance in this segment lags behind its potential. Investing in sales and marketing efforts specifically targeting group organizers could elevate these assets.

- Identify properties in markets with strong convention and event calendars.

- Assess current group booking pace versus market potential.

- Evaluate existing infrastructure for group events (meeting space, catering).

- Targeted investment in sales and marketing for group business.

Braemar Hotels & Resorts' Question Marks are luxury properties in developing markets with high growth potential but currently low market share and performance. These assets, like newly acquired hotels in Southeast Asia or properties undergoing repositioning such as the Cameo Beverly Hills aiming for LXR franchise, require significant investment to unlock their full value. For instance, Braemar reported $15.9 million in capital expenditures in Q1 2024, partly for such transformative projects, aiming to improve metrics like occupancy and RevPAR against market averages.

| Property/Concept | Market Growth Potential | Current Market Share | Investment Required | Key Challenge |

|---|---|---|---|---|

| New Luxury Hotels (e.g., Southeast Asia) | High | Low | High (Acquisition, Development, Marketing) | Building brand recognition and market penetration |

| Repositioning Assets (e.g., Cameo Beverly Hills) | Moderate to High | Low (during transition) | High (Renovations, Rebranding) | Achieving target occupancy and RevPAR post-repositioning |

| New Experiential Concepts | High | Very Low (Niche) | High (Concept Development, Marketing) | Market acceptance and scalability |

| Underutilized Group Business Potential | Moderate to High | Low | Moderate (Sales & Marketing focus) | Capturing market share in a competitive segment |

BCG Matrix Data Sources

Our Braemar Hotels & Resorts BCG Matrix is built on a foundation of comprehensive data, integrating financial disclosures, industry performance metrics, and market growth forecasts.