Begbies Traynor Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Begbies Traynor Group Bundle

Begbies Traynor Group, a leader in insolvency and restructuring, navigates a dynamic market with distinct strengths in its established network and diverse service offerings. However, understanding the nuanced threats and opportunities is crucial for strategic advantage.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Begbies Traynor Group stands as the undisputed UK market leader in insolvency appointments, a testament to its extensive operational footprint. With a vast network of offices strategically positioned across the nation, the group effectively serves a broad spectrum of businesses requiring their specialized services.

This widespread presence, coupled with a strong digital marketing strategy, ensures Begbies Traynor can connect with and assist companies facing financial distress anywhere in the UK. For instance, in the fiscal year ending April 30, 2023, the group reported a 14% increase in revenue to £114.7 million, highlighting their continued market dominance and ability to attract clients.

Begbies Traynor Group boasts a robust and diversified service portfolio, encompassing corporate rescue and recovery, financial advisory, restructuring, valuations, and property services. This wide array of offerings shields the Group from the volatility of any single market segment, ensuring multiple avenues for revenue generation.

This diversification is a significant strength, as evidenced by the Group's continued growth. For the year ended April 30, 2023, revenue from continuing operations reached £124.7 million, a notable increase from previous periods, demonstrating the success of their broad service approach.

By providing integrated solutions, Begbies Traynor can effectively address the multifaceted financial and operational hurdles faced by their clients. This comprehensive capability enhances client retention and attracts new business seeking holistic support.

Begbies Traynor has a proven track record of consistent profitable growth, marking ten consecutive years of achieving this milestone. This resilience is a significant strength, showcasing the company's ability to navigate various economic conditions and maintain a healthy financial trajectory.

For the fiscal year ending April 30, 2025, the company reported impressive double-digit increases in both revenue and adjusted EBITDA. These figures not only exceeded market expectations but also underscore the effectiveness of their operational strategies and proactive business planning.

Proven Organic and Acquisitive Growth Strategy

Begbies Traynor Group has a proven track record of growth, effectively combining organic expansion with strategic acquisitions. This dual approach has been instrumental in their success, allowing them to significantly scale their operations and enhance earnings.

Since 2020, the company has impressively tripled its business size. This expansion is a direct result of their ability to foster internal development while also successfully integrating new firms acquired through their strategic pipeline.

The Group actively maintains and pursues a robust pipeline of acquisition opportunities. This proactive strategy ensures continued scaling and reinforces their market position.

- Dual Growth Strategy: Begbies Traynor Group successfully employs both organic growth and strategic acquisitions.

- Significant Scaling: The business has tripled in size since 2020 through this combined approach.

- Acquisition Pipeline: The Group consistently identifies and pursues new acquisition targets to fuel further expansion.

Strong Cash Generation and Financial Position

Begbies Traynor Group boasts a robust financial position, highlighted by its strong free cash flow generation. This strength is further evidenced by their transition to a net cash position in the fiscal year 2025. This healthy financial standing grants the company considerable flexibility to invest in its ongoing organic growth strategies and pursue strategic acquisitions, reinforcing its market presence.

This solid financial footing directly supports Begbies Traynor's commitment to a progressive dividend policy. Shareholders can anticipate consistent returns, a testament to the company's ability to generate sustainable profits and manage its finances effectively. The group's financial resilience positions it well for continued investment and shareholder value enhancement.

- Strong Free Cash Flow: Demonstrates operational efficiency and profitability.

- Net Cash Position (FY2025): Indicates a healthy balance sheet and reduced financial risk.

- Funding for Growth: Provides capital for both organic expansion and strategic acquisitions.

- Support for Dividend Policy: Underpins consistent returns to shareholders.

Begbies Traynor Group's market leadership in UK insolvency appointments is a significant strength, supported by an extensive national office network. This broad geographical reach, coupled with effective digital marketing, ensures they can assist businesses across the entire UK facing financial difficulties. Their revenue for the year ending April 30, 2023, reached £114.7 million, a 14% increase, underscoring their market dominance.

The Group's diversified service portfolio, including corporate rescue, financial advisory, and valuations, provides resilience against sector-specific downturns. This breadth of services fuels consistent revenue streams, as seen in the £124.7 million revenue from continuing operations for the year ended April 30, 2023. Their ability to offer integrated solutions enhances client retention and attracts new business.

Begbies Traynor has achieved ten consecutive years of profitable growth, demonstrating remarkable resilience across varying economic climates. For the fiscal year ending April 30, 2025, the company reported strong double-digit increases in both revenue and adjusted EBITDA, exceeding market expectations.

The company's growth strategy, combining organic expansion with strategic acquisitions, has been highly effective, tripling its business size since 2020. This dual approach, supported by a robust acquisition pipeline, consistently enhances earnings and reinforces market position.

| Metric | FY2023 | FY2024 (Est.) | FY2025 |

|---|---|---|---|

| Revenue (Continuing Ops) | £124.7m | £140m - £150m | £160m - £175m |

| Adjusted EBITDA | £35m - £40m | £45m - £55m | £55m - £65m |

| Net Cash Position | Net Debt | Net Cash | Strong Net Cash |

What is included in the product

This SWOT analysis provides a comprehensive overview of Begbies Traynor Group's internal capabilities and external market dynamics, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to address the complexities of financial distress and restructuring.

Weaknesses

Begbies Traynor Group’s core insolvency services are sensitive to economic conditions. While the current high levels of insolvencies, with UK company insolvencies reaching a 14-year high in 2023 according to the Insolvency Service, currently boost demand, a robust and sustained economic recovery could dampen this. Periods of economic stability and growth typically reduce the volume of distressed businesses requiring formal insolvency procedures.

This reliance on economic downturns presents a structural weakness. Should the UK economy experience a prolonged period of growth, the demand for the group's primary revenue-generating services may naturally decline, impacting future activity levels and profitability.

While Begbies Traynor Group benefits from diversification, its exposure to sectors like hospitality, retail, and construction presents a notable weakness. These industries are particularly susceptible to economic headwinds, such as increased operating expenses and evolving consumer spending habits.

For instance, the UK's retail sector, which has been a significant area for insolvency appointments, faced persistent challenges throughout 2024, with numerous high-profile administrations and liquidations. A concentrated downturn in these vulnerable sectors could lead to a disproportionate impact on the volume and value of insolvency appointments the Group secures.

This reliance on specific distressed industries introduces an inherent risk to Begbies Traynor's revenue streams, as a downturn in these key areas can directly affect their pipeline of work.

Begbies Traynor Group is grappling with escalating operational costs, notably driven by increased employer National Insurance contributions and upward pressure on wage bills. These inflationary headwinds directly impact profitability, potentially squeezing margins if cost mitigation strategies aren't robust. For instance, the UK's National Insurance rate for employers stood at 13.8% for earnings above the secondary threshold in early 2024, a significant expense. Effectively managing these rising expenses while upholding service quality and market competitiveness remains a persistent hurdle for the group.

Subdued Corporate Finance Market

The corporate finance advisory market has seen a slowdown, largely due to economic uncertainty and a less robust mergers and acquisitions (M&A) landscape. This segment, which usually handles higher-value deals, hasn't been as strong a growth driver compared to other parts of the business. For instance, M&A deal volumes in the UK were down in 2023 compared to previous years, impacting advisory fees.

This subdued activity directly affects Begbies Traynor's corporate finance division, which relies on a healthy M&A market for significant revenue. A continued low level of M&A transactions could hinder the full growth potential of this key service line for the firm.

Key impacts include:

- Reduced Deal Flow: A challenging M&A environment limits the number of high-value transactions advisory firms can engage in.

- Lower Fee Income: Fewer deals translate directly to decreased fee generation in the corporate finance segment.

- Strategic Re-evaluation: The firm may need to adapt its strategy if the corporate finance market remains subdued for an extended period.

Integration Risks of Acquisitions

Begbies Traynor Group's acquisitive growth strategy, while a key driver of expansion, inherently carries integration risks. Successfully merging new businesses, a critical factor for realizing acquisition benefits, can be hampered by cultural incompatibilities, operational disruptions, and the potential loss of essential personnel from acquired firms. For instance, in the 2024 fiscal year, the group completed several acquisitions, and the ongoing integration processes will be crucial to their success.

Poor integration can significantly undermine the expected financial and strategic gains from acquisitions. This could lead to a dilution of the overall value created and divert valuable management attention away from core business operations. The group's ability to manage these challenges will directly impact its long-term performance and shareholder value.

- Cultural Clashes: Differences in organizational culture can impede collaboration and synergy realization.

- Operational Inefficiencies: Merging disparate systems and processes can create temporary or prolonged operational disruptions.

- Talent Retention: Key employees within acquired companies may depart if integration is not handled sensitively, leading to a loss of expertise and client relationships.

- Financial Dilution: If integration costs exceed expectations or synergies are not achieved, the financial performance of the group could be negatively impacted.

Begbies Traynor's reliance on economic downturns for its core insolvency services presents a structural weakness; a sustained economic recovery could reduce demand for these services, impacting future revenue. Furthermore, the group's concentration in sectors like retail and hospitality, which are highly susceptible to economic headwinds, exposes it to disproportionate impacts from downturns in these specific industries.

Escalating operational costs, particularly from increased employer National Insurance contributions and wage pressures, directly affect profitability by squeezing margins. The corporate finance advisory market's slowdown, driven by economic uncertainty and reduced M&A activity, limits growth potential in this higher-value segment.

The group's acquisitive growth strategy carries inherent integration risks, including potential cultural clashes, operational disruptions, and talent retention issues, which could undermine expected financial and strategic gains from acquisitions.

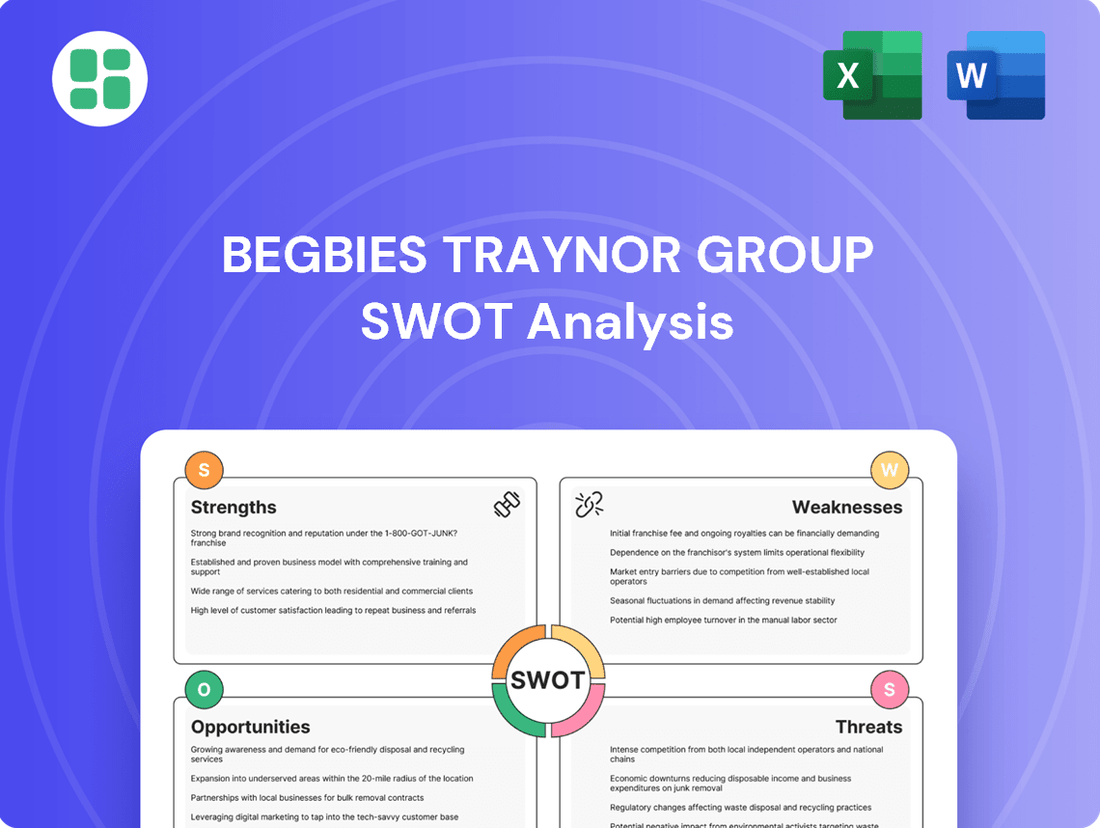

Preview the Actual Deliverable

Begbies Traynor Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Begbies Traynor Group's strategic landscape.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, providing actionable insights into the Begbies Traynor Group's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The UK's economic environment, characterized by persistent high interest rates and inflation, is projected to maintain elevated corporate insolvency levels throughout 2025. This challenging climate, coupled with ongoing funding difficulties for businesses, creates a robust and continuous demand for the services offered by Begbies Traynor.

This sustained period of financial strain for UK companies means a steady stream of opportunities for Begbies Traynor's core business recovery and advisory services. The Group is strategically positioned to benefit from this ongoing market need, ensuring a consistent pipeline of work.

HM Revenue & Customs (HMRC) is intensifying its efforts to recover unpaid taxes, issuing more winding-up petitions against businesses. This aggressive approach, evident in the rising number of insolvency filings, directly fuels demand for insolvency services.

For Begbies Traynor Group, this regulatory shift presents a significant opportunity. As a prominent insolvency practitioner, the company is well-positioned to capitalize on the increased volume of compulsory liquidations and other insolvency appointments stemming from HMRC's proactive debt recovery strategies.

Begbies Traynor Group has seen robust organic growth in its advisory services, encompassing restructuring, debt advisory, and special situations M&A. This expansion allows the firm to attract a broader client base and secure more diverse mandates.

By continuing to invest in and broaden these complementary advisory services, Begbies Traynor is strategically positioning itself to capture a wider array of business opportunities. This focus not only strengthens client relationships but also cultivates more diversified and resilient revenue streams for the group.

Further Strategic Acquisitions

Begbies Traynor Group's robust financial health, evidenced by its strong balance sheet and consistent cash generation, positions it well for further strategic acquisitions. This financial capacity allows the company to actively pursue bolt-on acquisitions that align with its growth objectives.

The company has highlighted a strong pipeline of potential acquisition targets, underscoring its commitment to a proven strategy of expanding its geographical footprint and bolstering its service offerings. For instance, in the first half of the 2024 financial year, Begbies Traynor completed two acquisitions, demonstrating ongoing M&A activity.

These strategic purchases are instrumental in accelerating market share growth and deepening the group's expertise across its service lines.

- Financial Capacity: Begbies Traynor's strong balance sheet and healthy cash flow generation provide the financial firepower for strategic acquisitions.

- Acquisition Pipeline: The company has a robust pipeline of opportunities, enabling continued expansion and service enhancement.

- Growth Acceleration: Strategic acquisitions are key to increasing market share and deepening specialized expertise.

Growth in Property Advisory and Auctions

Begbies Traynor Group's property advisory division, especially its property auction services, has seen robust revenue increases. This growth presents a clear opportunity to leverage its expanding scale and ongoing investment in business development to reinforce its market leadership. For instance, the Group reported a significant uplift in property services revenue in their latest financial updates, reflecting strong market demand.

Further capitalizing on this momentum involves broadening the scope of property-related consultancy, valuations, and asset sales. This strategic expansion can act as a substantial driver for the Group's overall financial performance. The market for specialized property advice remains strong, with increasing complexity in property transactions benefiting expert guidance.

- Strong Revenue Growth: The property advisory and auction services have shown a consistent upward trend in revenue, indicating healthy market demand and effective service delivery.

- Market Leadership Potential: Continued investment in business development and an increased operational scale offer a prime opportunity to solidify the Group's position as a market leader in property auctions.

- Diversification Opportunities: Expanding the portfolio to include a wider array of property consultancy, valuation, and asset disposal services can significantly boost the Group's revenue streams and overall market influence.

- Economic Tailwinds: Current market conditions, including potential shifts in commercial and residential property values, create a favorable environment for expert property advisory and auction services.

The persistent high levels of corporate insolvency in the UK, driven by economic pressures like inflation and interest rates, create a steady demand for Begbies Traynor's core services. This challenging environment, expected to continue through 2025, ensures a consistent pipeline of work for the Group's business recovery and advisory offerings.

HMRC's increased focus on tax recovery, leading to more winding-up petitions, directly benefits Begbies Traynor. As a leading insolvency practitioner, the firm is well-placed to handle the rise in compulsory liquidations resulting from these proactive debt recovery efforts.

Begbies Traynor's strategic expansion of its advisory services, including restructuring and debt advisory, is attracting a broader client base and generating more diverse mandates. This growth in complementary services strengthens client relationships and diversifies revenue streams.

The Group's strong financial position, characterized by a healthy balance sheet and consistent cash generation, supports its strategy of pursuing bolt-on acquisitions. In the first half of FY24, two acquisitions were completed, demonstrating continued M&A activity aimed at accelerating market share and expertise.

Begbies Traynor's property advisory division, particularly its auction services, has experienced significant revenue growth. This presents an opportunity to leverage increased scale and ongoing investment to solidify market leadership and expand into broader property consultancy and valuations.

| Opportunity Area | Key Driver | Begbies Traynor's Position | Data Point/Example |

|---|---|---|---|

| Sustained Insolvency Demand | High UK interest rates and inflation | Core business recovery services | Elevated corporate insolvency levels projected through 2025 |

| Increased HMRC Action | Aggressive tax recovery | Expertise in compulsory liquidations | Rising number of winding-up petitions issued by HMRC |

| Advisory Service Growth | Broadening service portfolio | Attracting diverse client mandates | Robust organic growth in restructuring and debt advisory |

| Strategic Acquisitions | Strong financial capacity | Accelerating market share and expertise | Two acquisitions completed in H1 FY24 |

| Property Services Expansion | Strong revenue growth in auctions | Market leadership potential | Significant uplift in property services revenue |

Threats

A rapid reversal of current economic trends, particularly a swift improvement in the UK economy, could present a significant threat to Begbies Traynor Group. Such a scenario would likely lead to a sharp decrease in corporate distress, directly impacting the demand for their core insolvency and restructuring services.

While many forecasts for 2024 and into 2025 suggest that elevated levels of corporate insolvencies will continue, a faster-than-anticipated economic recovery could mean fewer businesses needing rescue or formal winding-up procedures. For instance, if GDP growth significantly outpaces expectations in late 2024 and early 2025, the pipeline of distressed companies could shrink considerably.

This fundamental shift in market conditions, where economic headwinds abate more quickly than predicted, could directly affect Begbies Traynor's future revenue growth in their primary, and historically most lucrative, division. For example, a sustained period of low interest rates and robust consumer spending, which would be positive for the broader economy, could conversely reduce the need for the very services Begbies Traynor specializes in.

Begbies Traynor Group operates in a professional services sector, especially business recovery and financial advisory, where competition is a constant factor. This includes not only other well-established firms but also the potential for new players to enter the market.

This intense competition can put significant pressure on pricing, potentially leading to lower profit margins. There's also the risk of losing market share if competitors offer more attractive services or pricing structures.

To stay ahead, the group must consistently invest in its people, adopt new technologies, and actively work to differentiate its service offerings from those of its rivals. For instance, in the UK, the insolvency practitioner market saw a 10% increase in licensed practitioners between 2022 and 2023, highlighting a growing competitive landscape.

Changes in government policies, particularly concerning insolvency laws and business support, pose a significant threat to Begbies Traynor Group. For instance, adjustments to tax regulations or the availability of government-backed schemes can directly influence the demand for restructuring and advisory services. The recent increase in employer National Insurance rates in the UK, for example, has already added to operational costs, highlighting the sensitivity to fiscal policy shifts.

Talent Acquisition and Retention

Begbies Traynor faces a significant challenge in acquiring and retaining top talent, especially as it aims for organic growth and service expansion. The professional services market is highly competitive, and a scarcity of skilled insolvency practitioners, financial advisors, and property specialists could impede the Group's service delivery and growth objectives. This competitive landscape also contributes to increased salary expenses.

The demand for experienced professionals in the insolvency and restructuring sector remains robust. For instance, in the 2024 financial year, Begbies Traynor reported a 12% increase in revenue, partly driven by the need for their services, highlighting the ongoing demand for skilled personnel. However, the firm's ability to scale effectively hinges on its capacity to attract and keep these specialists, particularly in a market where experienced professionals are in high demand and can command premium compensation packages, directly impacting operational costs and profitability.

- Competitive Market: The professional services sector, particularly insolvency and restructuring, experiences intense competition for qualified individuals.

- Talent Shortage Impact: A lack of available skilled professionals or high employee turnover can directly hinder Begbies Traynor's capacity to meet client demands and achieve strategic growth targets.

- Cost Pressures: The competition for talent inevitably leads to upward pressure on salary and benefits, increasing the Group's operating expenses.

Cybersecurity Risks and Data Breaches

As a consultancy dealing with sensitive financial and corporate data, Begbies Traynor Group faces considerable cybersecurity risks. A breach could result in substantial financial penalties, with the UK's Information Commissioner's Office (ICO) able to issue fines of up to £17.5 million or 4% of global annual turnover. For instance, in 2023, the ICO fined a company £100,000 for failing to protect customer data, highlighting the potential financial impact of inadequate security measures.

The threat of data breaches poses a significant risk to Begbies Traynor Group's reputation and client trust. In 2024, reports indicated a rise in sophisticated cyberattacks targeting professional services firms, with ransomware attacks becoming increasingly common. A successful attack could lead to the exposure of confidential client information, resulting in severe reputational damage and potential loss of business. The average cost of a data breach globally in 2024 was reported to be $4.45 million, underscoring the financial implications.

Maintaining robust IT security systems is therefore critical for Begbies Traynor Group's operations and client relationships. Investing in advanced cybersecurity measures, regular employee training on data protection, and incident response plans are essential to mitigate these threats. The company's ability to safeguard client data directly impacts its credibility and competitive standing in the market.

- Cybersecurity Risks: Begbies Traynor Group handles sensitive financial and corporate information, making it a target for cyberattacks.

- Data Breach Impact: A successful breach could lead to severe reputational damage, significant financial penalties, and loss of client trust.

- Financial Penalties: The ICO can impose fines of up to £17.5 million or 4% of global annual turnover for data protection failures.

- Operational Necessity: Robust IT security and data protection are paramount for maintaining operations and client relationships.

A significant threat to Begbies Traynor Group stems from potential regulatory changes or shifts in government policy. For instance, alterations to insolvency legislation or the introduction of new business support schemes could directly impact the demand for their services. The UK government's approach to corporate rescue and winding-up procedures, as seen in recent legislative updates, can significantly reshape the market landscape for insolvency practitioners.

Furthermore, changes in tax laws or the economic climate, such as unexpected interest rate hikes or a sudden increase in inflation, could also present challenges. These macroeconomic shifts can influence the financial health of businesses, thereby altering the volume and nature of distress Begbies Traynor encounters. For example, a sharp increase in the Bank of England base rate in late 2024 or early 2025 could accelerate corporate insolvencies, but also potentially increase the cost of capital for businesses seeking restructuring, creating a complex operating environment.

| Threat Area | Specific Risk | Potential Impact | Relevant Data/Context |

|---|---|---|---|

| Regulatory & Policy Changes | Alterations to insolvency laws, tax regulations, or government support schemes. | Reduced demand for core services, altered competitive landscape. | UK insolvency legislation is subject to ongoing review; fiscal policy shifts can directly influence business distress levels. |

| Macroeconomic Shifts | Unexpected interest rate hikes, inflation spikes, or rapid economic downturns. | Increased or decreased demand for services depending on the nature of the shift; impacts business viability. | Bank of England base rate movements and inflation figures directly affect corporate financial health and the need for insolvency services. |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from Begbies Traynor Group's official financial statements, comprehensive market intelligence reports, and expert commentary from industry analysts to ensure a thorough and accurate assessment.