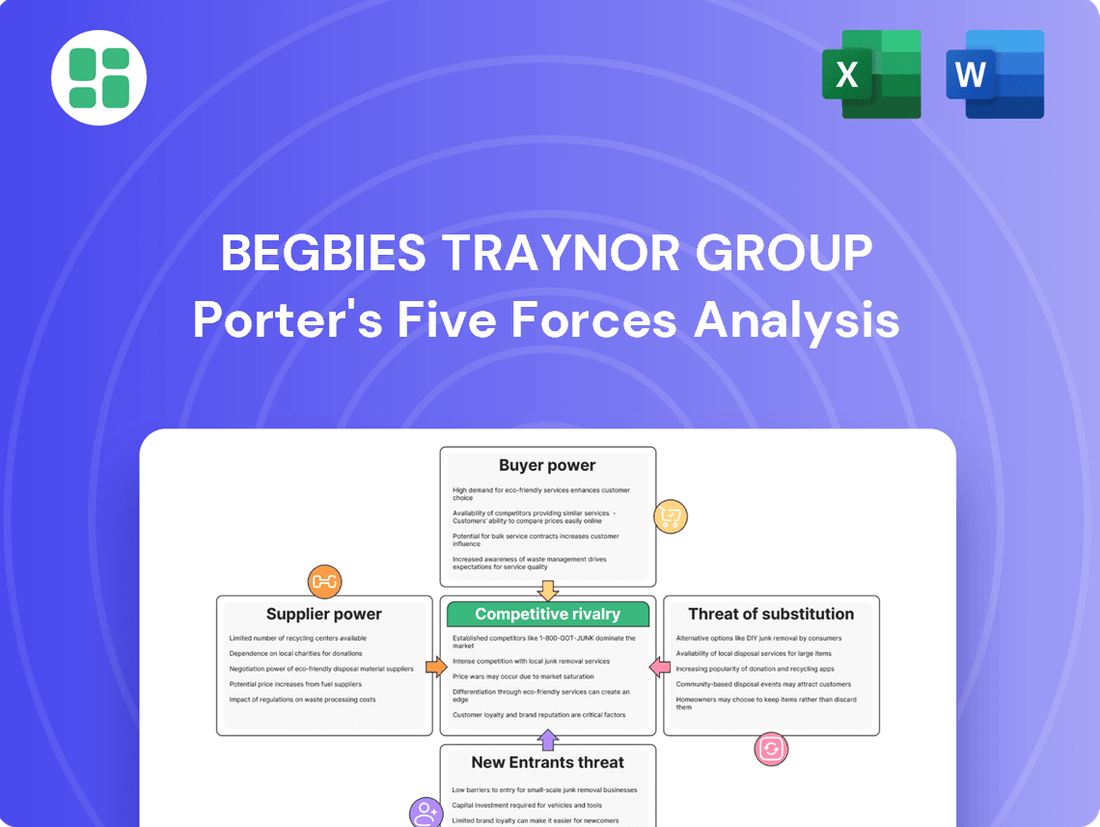

Begbies Traynor Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Begbies Traynor Group Bundle

Understanding the competitive landscape for Begbies Traynor Group through Porter's Five Forces reveals the intense rivalry and the significant bargaining power of clients within the insolvency and restructuring sector. The threat of new entrants is moderate, but the availability of substitutes for their core services presents a notable challenge.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Begbies Traynor Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Begbies Traynor Group's reliance on specialized professional talent, such as insolvency practitioners and chartered surveyors, is a key factor in supplier bargaining power. The scarcity of these highly qualified individuals means they can command better terms, influencing recruitment and retention costs for the group.

With over 1,300 colleagues across the UK, Begbies Traynor Group faces a significant demand for this specialized expertise. This substantial workforce requirement amplifies the bargaining power of any individual or firm possessing these sought-after skills, potentially leading to higher salary demands or specialized service fees.

Technology and data providers hold significant bargaining power over firms like Begbies Traynor Group, especially those offering specialized software, legal databases, and financial analytics. Begbies Traynor’s 2024 strategy emphasizes continued investment in technology, indicating a dependence on these suppliers for efficient valuations and case management. If these providers' solutions are unique or if switching to alternatives incurs substantial costs, their leverage increases.

The insolvency and restructuring sector, where Begbies Traynor Group operates, is heavily regulated, making specialized legal and compliance expertise a crucial input. External legal counsels and regulatory advisors, especially those with deep knowledge of UK insolvency law and upcoming reforms, represent powerful suppliers.

Their specialized insights into a constantly shifting legal framework, such as the potential impacts of the Insolvency and Economic Recovery Act 2020 or anticipated future legislative changes, can significantly amplify their bargaining power. For instance, a firm needing to navigate complex cross-border insolvency proceedings would rely heavily on counsel with that specific, scarce expertise.

Property Market Data and Platforms

Begbies Traynor's reliance on property market data and online auction platforms means suppliers of these critical inputs can wield significant bargaining power. Companies offering comprehensive, up-to-date databases or dominant auction platforms, especially those with proprietary data or advanced analytics, can command higher prices or dictate terms. This is particularly true as the property advisory sector, including Begbies Traynor's services like valuations and auctions, continues to grow, increasing demand for such data and platforms.

The increasing digitization of the property market, with platforms like Rightmove and Zoopla becoming central hubs for listings and data, exemplifies this. For instance, in 2024, the UK property market saw continued activity, with online portals playing an ever-larger role in transaction visibility. Suppliers who control access to vast amounts of this data, or who operate the most popular and efficient online auction environments, are well-positioned to exert influence.

- Data Providers: Companies with extensive, verified property transaction histories and market trend analytics can charge premium rates for access, given the direct impact on valuation accuracy and advisory services.

- Online Auction Platforms: Key platforms that attract a large buyer and seller base, offering seamless transaction processes and robust marketing, can leverage their network effects to negotiate favorable terms with service providers like Begbies Traynor.

- Technological Innovators: Suppliers of advanced data analytics, AI-driven valuation tools, or sophisticated virtual viewing technologies can also exert power by offering unique capabilities that competitors lack.

- Market Consolidation: If the market for property data or auction platforms consolidates, the remaining few dominant players will naturally gain increased bargaining power.

Office Space and Infrastructure

Begbies Traynor Group, with its extensive network of over 50 UK offices, has significant demand for office space, IT infrastructure, and administrative support. This large operational footprint means substantial purchasing power for these services. However, landlords in highly sought-after prime locations or specialized IT service providers could still wield some influence, especially in tight markets.

The bargaining power of suppliers in the office space and infrastructure sector for Begbies Traynor is influenced by several factors. While the group's scale provides leverage, the concentration of prime office locations and essential IT service providers can shift power towards suppliers. For instance, in 2024, commercial property rental prices in major UK cities remained elevated, potentially increasing the bargaining power of landlords in these areas.

- Scale of Operations: Begbies Traynor's requirement for office space across more than 50 locations grants it considerable negotiating leverage with many property providers.

- Market Conditions: The strength of the commercial real estate market and the availability of IT services in specific regions can impact supplier power.

- Supplier Concentration: A limited number of high-quality office providers or specialized IT firms in key locations can enhance supplier bargaining power.

- Contractual Terms: Long-term leases and service agreements can lock in terms, but also create dependencies that suppliers can exploit.

The bargaining power of suppliers for Begbies Traynor Group is notably strong in areas requiring specialized expertise and technology. Highly skilled insolvency practitioners and chartered surveyors are in demand, allowing them to negotiate favorable terms, directly impacting recruitment and retention costs. Similarly, providers of essential technology like specialized software and financial analytics hold significant leverage, especially when their solutions are unique or difficult to replace, as highlighted by Begbies Traynor's continued investment in technology in 2024.

The group’s reliance on property market data and online auction platforms also empowers suppliers in these sectors. Dominant platforms and those with proprietary data can command higher prices, particularly as the property advisory sector grows. This is evident in the 2024 UK property market where online portals played a crucial role, giving data and platform providers increased influence.

| Supplier Type | Bargaining Power Factors | Impact on Begbies Traynor |

|---|---|---|

| Specialized Professionals (e.g., Insolvency Practitioners) | Scarcity of highly qualified individuals, high demand | Increased recruitment and retention costs, potential for higher service fees |

| Technology & Data Providers | Unique solutions, high switching costs, strategic importance for operations | Potential for premium pricing on software, analytics, and databases |

| Property Data & Online Auction Platforms | Network effects, proprietary data, market dominance | Higher costs for data access and platform usage, influence on transaction terms |

| Legal & Compliance Advisors | Deep knowledge of complex regulations, scarcity of specialized expertise | Increased fees for navigating intricate legal frameworks and upcoming reforms |

What is included in the product

This analysis leverages Porter's Five Forces to dissect the competitive landscape for Begbies Traynor Group, assessing the intensity of rivalry, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitutes.

Identify and quantify competitive threats with a structured framework, enabling proactive strategy development.

Gain actionable insights into market dynamics, empowering informed decisions to navigate industry pressures effectively.

Customers Bargaining Power

Customers of Begbies Traynor, often businesses and individuals in financial distress, are inherently vulnerable. This distress, while highlighting their urgent need for specialized insolvency and restructuring advice, can temper their immediate bargaining power on service necessity.

However, these clients, facing significant financial challenges, are still highly motivated to secure the most effective and reputable solutions available. Their focus remains on achieving the best possible outcome for their complex situations, influencing their selection of service providers and potentially their negotiation stance on fees for critical services.

Begbies Traynor's business recovery and advisory division is seeing significant growth fueled by larger, more complex cases. This trend highlights a shift towards higher-value engagements.

Sophisticated clients, including major financial institutions and large distressed corporations, wield substantial bargaining power. Their ability to award substantial, recurring mandates and their access to a broader selection of leading professional service firms means they can negotiate more favorable terms.

For instance, in the fiscal year ending April 30, 2024, Begbies Traynor reported a 12% increase in revenue to £128.1 million, with advisory services showing particularly strong performance, indicating the growing importance of these larger client relationships.

Even when businesses face financial distress and need specialized insolvency or restructuring advice, they aren't without options. Clients can choose from a variety of insolvency practitioners and restructuring advisors, which naturally shifts power towards them.

The market for these services is quite competitive, with many firms, including major accounting practices and smaller specialist consultancies, vying for clients. This abundance of choice means clients can shop around, comparing fees, the specific expertise offered, and the overall reputation of different firms before making a decision.

For instance, in 2024, the UK insolvency market saw a significant number of licensed insolvency practitioners, with the Insolvency Service reporting over 1,500 individuals holding licenses. This sheer number underscores the availability of alternatives and empowers clients to negotiate terms more effectively.

Creditor Influence and Mandates

Creditors, especially banks and HMRC, hold significant sway in corporate insolvency, often influencing the appointment of insolvency practitioners. Their considerable financial stakes mean they can dictate terms, favoring firms with pre-existing relationships. This creditor influence is a key aspect of understanding the bargaining power of customers within the broader Porter's Five Forces framework.

In 2024, HMRC's increasingly assertive approach to tax debt recovery has further amplified its role. For instance, by mid-2024, HMRC had issued a notable increase in winding-up petitions compared to the previous year, directly impacting the insolvency market and the choices available to distressed companies.

This creditor power translates into a direct challenge for businesses facing financial distress. The ability of major creditors to steer the restructuring process can limit a company's options and potentially lead to less favorable outcomes if their interests are prioritized over other stakeholders.

- Creditor Influence: Financial institutions and HMRC often dictate the appointment of insolvency practitioners in distress scenarios.

- HMRC's Aggressive Stance: In 2024, HMRC intensified its efforts to recover tax debts, increasing winding-up petitions.

- Impact on Choices: Creditors' preferences can limit a distressed company's options for restructuring and insolvency services.

- Bargaining Power: This creditor leverage represents a significant form of bargaining power within the customer segment of Porter's Five Forces.

Service Customization and Outcome Dependency

Customers within the financial services sector, including those seeking corporate finance or property management, often demand highly customized solutions. This tailoring is crucial because their specific financial circumstances require bespoke strategies rather than one-size-fits-all approaches.

The success of engagements with firms like Begbies Traynor Group is intrinsically linked to the tangible outcomes delivered, whether that's a successful company restructuring or the efficient recovery of assets. Clients are investing in results, not just services.

This significant dependency on achieving desired outcomes grants customers considerable bargaining power. They can leverage this by insisting on demonstrable expertise, proven track records, and guaranteed results, often influencing pricing and service level agreements.

- Outcome Dependency: Clients prioritize firms that can demonstrably achieve specific financial goals, such as increasing asset value or reducing liabilities.

- Customization Needs: The unique nature of corporate financial challenges means off-the-shelf solutions are rarely sufficient, empowering clients who articulate specific requirements.

- Demand for Proven Results: In 2024, businesses are scrutinizing service providers' past successes more than ever, seeking evidence of effective strategy implementation and measurable impact.

While distressed clients may seem vulnerable, their need for specialized advice grants them leverage. The availability of numerous insolvency practitioners and restructuring advisors means clients can compare offerings, influencing fee negotiations. In 2024, the UK insolvency market featured over 1,500 licensed practitioners, highlighting this competitive landscape and client choice.

Sophisticated clients, including large corporations and financial institutions, possess significant bargaining power due to the substantial value of their mandates. These clients can negotiate favorable terms, a trend reflected in Begbies Traynor's FY24 revenue growth of 12% to £128.1 million, driven by larger advisory engagements.

Creditors, particularly banks and HMRC, exert considerable influence by often dictating the choice of insolvency practitioners. HMRC's intensified tax debt recovery efforts in 2024, marked by a notable increase in winding-up petitions, further amplifies their power to shape restructuring outcomes.

Clients demand customized solutions and demonstrable results, which empowers them to negotiate pricing and service levels based on expected outcomes. Their dependency on successful restructuring or asset recovery means they scrutinize providers' track records for tangible impact.

| Customer Type | Bargaining Power Factors | 2024 Data/Observation |

|---|---|---|

| Distressed Businesses | Availability of alternatives, need for specialized advice | Over 1,500 licensed insolvency practitioners in the UK market |

| Large Corporations & Financial Institutions | High mandate value, recurring business potential | Begbies Traynor FY24 revenue up 12% to £128.1M, driven by larger cases |

| Creditors (Banks, HMRC) | Financial stakes, influence on practitioner appointment | Increased HMRC winding-up petitions in 2024 |

| All Clients | Demand for customized solutions, proven results | Increased scrutiny of provider track records for measurable impact |

Preview Before You Purchase

Begbies Traynor Group Porter's Five Forces Analysis

This preview displays the comprehensive Porter's Five Forces analysis of the Begbies Traynor Group, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is precisely the same professionally formatted analysis you will receive instantly after completing your purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The UK insolvency and financial advisory market presents a dual nature, featuring both large, multi-service firms and a substantial number of smaller, niche players. This fragmentation means Begbies Traynor, despite being the leader in corporate insolvency appointments, faces competition from various sources.

Major accounting firms, with their broader service offerings and extensive client bases, also vie for restructuring and advisory mandates. Alongside these giants, numerous specialized consultancies focus on specific areas of distress, adding another layer of rivalry.

This competitive mosaic intensifies the battle for high-profile and lucrative engagements, pushing firms to differentiate themselves through expertise, service quality, and pricing strategies to capture market share.

Begbies Traynor Group thrives by differentiating itself through specialized expertise and a comprehensive service portfolio, particularly in business recovery and financial advisory. Their strategy centers on multi-disciplinary teams, allowing them to offer a wide spectrum of solutions under one roof, a key factor in attracting clients seeking integrated support.

The competitive landscape in this sector is intense, with firms frequently investing in senior talent and broadening their service offerings to gain an advantage. For instance, in the fiscal year ending April 2024, Begbies Traynor Group reported a revenue of £118.5 million, demonstrating their market presence and ability to attract business through their established reputation and diverse service lines.

Begbies Traynor Group, like many in professional services, thrives on its established reputation and a history of successful engagements. In the realm of financial distress, where trust and expertise are critical, a firm's track record significantly influences its ability to secure new business. For instance, in 2024, firms with a demonstrable history of navigating complex insolvency cases are consistently preferred by creditors and stakeholders.

This emphasis on a proven track record creates a substantial barrier for newer entrants. Potential clients, particularly those facing high-stakes financial challenges, are more likely to engage with established firms that have a documented history of positive outcomes, client testimonials, and industry accolades. This competitive advantage is hard-won and difficult to replicate quickly.

Pricing Pressures

Begbies Traynor Group operates in a market where pricing pressures are a significant factor, even within its specialized insolvency and restructuring services. Clients in financial distress are inherently cost-conscious, driving competition on fees. This is particularly evident in the market for smaller businesses, where price sensitivity can be quite high.

While larger, more complex cases can command higher fees, the overall competitive landscape necessitates a careful balancing act. Firms must offer high-quality services while remaining competitively priced to attract and retain clients. For instance, in the UK, the insolvency market saw a notable increase in appointments in 2023, with company insolvencies reaching 25,130, a 14% increase from 2022, indicating a larger pool of potential clients but also heightened competition.

- Price Sensitivity: Clients facing financial difficulties often have limited budgets, making fee structures a critical decision factor.

- Market Segmentation: While high-value cases offer better margins, the volume of smaller cases means competitive pricing is essential for market share.

- Service Quality vs. Cost: Firms must demonstrate value and expertise to justify their fees, especially when competing against lower-cost alternatives.

- Economic Impact: Broader economic conditions, such as rising interest rates and inflation impacting 2024, can further exacerbate client cost constraints and intensify pricing pressures.

Economic Conditions and Insolvency Levels

The prevailing economic climate directly impacts how intensely companies compete. When businesses face financial difficulties, it creates more opportunities for service providers, but it also means more players are vying for those same opportunities. This heightened competition can lead to price wars or more aggressive marketing tactics.

In the UK, business insolvencies have been notably high. For instance, in the first quarter of 2024, there were 27,757 registered company insolvencies, a significant increase compared to previous periods. This trend is expected to persist, with forecasts indicating continued elevated levels through 2025.

- UK registered company insolvencies in Q1 2024: 27,757

- Forecasted trend: Continued high levels into 2025

- Impact on rivalry: Increased opportunities and aggressive competition

Begbies Traynor Group faces intense competition from a mix of large accounting firms and specialized boutiques, all vying for restructuring and advisory mandates. The firm's strategy of offering integrated, multi-disciplinary services helps it stand out, but the market remains highly competitive.

The firm's revenue of £118.5 million for the fiscal year ending April 2024 highlights its significant market presence, achieved through a strong reputation and a broad service portfolio. This reputation is crucial, as clients in financial distress often prioritize established firms with a proven track record, creating a barrier for newer entrants.

Pricing is a key competitive factor, especially for smaller businesses, as clients facing financial hardship are budget-conscious. The UK insolvency market saw a 14% increase in company insolvencies in 2023, reaching 25,130, which, while increasing opportunities, also intensifies competition on fees.

| Competitor Type | Key Differentiators | Impact on Begbies Traynor |

|---|---|---|

| Major Accounting Firms | Broad service offerings, extensive client bases | Compete for large mandates, require strong value proposition |

| Specialized Consultancies | Niche expertise, focused service areas | Fragment market, challenge for specific engagements |

| Established Reputation | Proven track record, client trust | Significant advantage, barrier to entry for new firms |

| Pricing Strategies | Cost-consciousness of distressed clients | Pressure on fees, especially for smaller cases |

SSubstitutes Threaten

Larger corporations may leverage in-house finance or legal departments for certain restructuring tasks, acting as a substitute for external advisory firms. This internal capability is generally confined to less complex financial distress scenarios.

However, the intricate legal framework and licensing requirements for formal insolvency proceedings mean that specialized external practitioners remain essential for most significant restructurings. For instance, the UK Insolvency Service reported 24,616 company insolvencies in 2023, a substantial increase from previous years, highlighting the need for expert intervention.

Businesses in distress might try to cut deals directly with those they owe money to, like suppliers or employees, to avoid formal insolvency. This can seem faster, but it doesn't offer the same legal safety net as working with insolvency experts. For example, during 2024, many small businesses explored these informal routes to manage cash flow issues, with some success in deferring payments.

However, the effectiveness of these informal agreements is increasingly challenged. The UK's HMRC, for instance, has been noted for its proactive approach in pursuing tax debts, making it harder for companies to rely solely on informal negotiations. In early 2024, HMRC reported a significant increase in debt recovery actions, impacting businesses that hadn't secured formal arrangements.

Distressed businesses facing financial difficulties often explore alternative funding or refinancing options rather than immediate restructuring or insolvency. These can include emergency loans, private equity injections, or asset sales to manage immediate cash flow pressures. For instance, in 2024, the market for distressed debt advisory saw continued activity as businesses sought to avoid formal insolvency proceedings.

Independent finance brokers and private equity firms represent significant substitutes to firms like Begbies Traynor Group, which offers its own corporate finance and debt advisory services. These external entities can provide similar financial solutions, potentially at competitive terms, thereby diverting business that might otherwise come to Begbies Traynor.

DIY Advisory Resources

The rise of readily available online DIY advisory resources, such as templates and general business advice platforms, presents a potential substitute for professional insolvency services. For smaller businesses or individuals facing minor financial challenges, these self-help options might seem appealing as a cost-saving measure. However, the intricate and highly regulated landscape of corporate rescue and recovery means these DIY approaches are often inadequate and carry substantial risks.

While DIY resources can offer basic guidance, they typically lack the specialized knowledge and legal expertise required for complex insolvency situations. For instance, navigating the Insolvency and Bankruptcy Code in India, which underwent significant amendments in 2020 and continues to see evolving case law, demands a nuanced understanding that generic templates cannot provide. The potential for missteps in areas like asset valuation, creditor negotiations, or compliance with statutory deadlines can lead to severe financial penalties or even the complete loss of assets for the business.

- DIY resources are insufficient for complex insolvency matters.

- Navigating regulated areas like corporate rescue requires specialized expertise.

- Missteps in DIY approaches can lead to significant financial and legal repercussions.

- The complexity of insolvency law, such as recent amendments in various jurisdictions, underscores the need for professional guidance.

Non-Specialist Legal or Accounting Advice

Businesses facing financial distress might first seek help from their regular legal counsel or accounting firms. These professionals can provide initial advice, but often lack the specific licenses and hands-on experience needed for formal insolvency proceedings or complex turnarounds.

While generalists can offer preliminary guidance, they typically do not hold the necessary insolvency practitioner licenses or possess the deep, practical knowledge required for formal restructuring. This limitation means they cannot fully substitute the specialized services offered by firms like Begbies Traynor Group.

The threat from non-specialist advice is moderate. For instance, in 2024, the Insolvency Service reported a significant increase in company insolvencies, highlighting the need for specialized expertise. General advisors may not be equipped to navigate the intricate legal and financial frameworks involved in these situations.

- Limited Licensing: Non-specialists generally lack the formal licenses required to act as insolvency practitioners or administrators.

- Lack of Specialized Experience: They may not have the practical, day-to-day experience in handling complex restructurings or formal insolvency appointments.

- Regulatory Constraints: General legal and accounting advice operates under different regulatory frameworks than formal insolvency services.

- Inability for Formal Appointments: They cannot be appointed as liquidators, administrators, or receivers, which are core services provided by specialist firms.

The threat of substitutes for insolvency practitioners like Begbies Traynor Group comes from various sources, including in-house capabilities, informal arrangements, alternative funding, and DIY resources. While these substitutes might seem appealing, they often fall short in addressing the complexities and legal requirements of formal insolvency and restructuring. For instance, while businesses may attempt informal deals with creditors, the increasing assertiveness of tax authorities like HMRC in pursuing debts, as seen in their reported rise in debt recovery actions in early 2024, makes these informal routes riskier.

Independent finance brokers and private equity firms also pose a threat by offering similar financial solutions. Furthermore, the proliferation of online DIY advisory resources, while potentially useful for minor issues, is inadequate for the intricate legal and regulatory landscape of corporate rescue. Navigating complex legislation, such as the Insolvency and Bankruptcy Code in India, which saw significant amendments in 2020, requires specialized expertise that generic platforms cannot provide, leading to potential financial and legal repercussions.

General legal and accounting firms can offer initial advice but lack the specific licenses and hands-on experience for formal insolvency proceedings. They cannot be appointed as liquidators or administrators, core services provided by specialist firms. The increasing number of company insolvencies, with the UK's Insolvency Service reporting a substantial rise in 2023, underscores the critical need for specialized expertise in navigating these challenging financial situations.

| Substitute Type | Description | Limitations | 2024 Relevance |

|---|---|---|---|

| In-house Finance/Legal | Internal departments handling restructuring tasks. | Generally limited to less complex scenarios; lacks specialized licensing for formal proceedings. | Continued reliance for basic internal financial management. |

| Informal Creditor Agreements | Direct deals with suppliers or employees to defer payments. | No legal safety net; effectiveness challenged by proactive debt recovery by authorities. | Increased exploration by small businesses for cash flow issues, but with growing risks. |

| Alternative Funding/Refinancing | Emergency loans, private equity, asset sales. | May not address underlying insolvency issues; can be costly or dilutive. | Active market for distressed debt advisory as businesses seek to avoid formal insolvency. |

| DIY Advisory Resources | Online templates and general business advice platforms. | Inadequate for complex, regulated insolvency matters; significant risk of legal and financial penalties. | Appealing for minor issues but insufficient for navigating evolving insolvency laws. |

| Non-Specialist Advisors (Lawyers/Accountants) | Generalist legal and accounting advice. | Lack insolvency practitioner licenses and specialized practical experience; cannot hold formal appointments. | Provide preliminary guidance but cannot substitute specialist insolvency services. |

Entrants Threaten

The corporate rescue and recovery sector presents substantial hurdles for newcomers due to stringent regulatory frameworks. Aspiring insolvency practitioners must possess specific professional qualifications and obtain licenses, a process that can be both time-consuming and costly. For example, the Insolvency Qualification Board (IQB) oversees the examinations for insolvency practitioners, ensuring a high standard of expertise.

These rigorous entry requirements, coupled with the ongoing need to adhere to complex compliance obligations, act as a significant deterrent to potential new entrants. The UK government's commitment to reforming the regulation of insolvency practitioners, as indicated by ongoing consultations and potential legislative changes, further adds to this complexity, making the path to market entry even more challenging.

The services Begbies Traynor Group provides require a high level of specialized knowledge in areas like insolvency law, corporate finance, and property valuation. New entrants would need to invest heavily in recruiting and training individuals with these diverse skill sets. For instance, a firm entering the UK insolvency market would need to demonstrate compliance with stringent regulations set by bodies like the Insolvency Practitioners Association, a process that itself requires significant commitment and proven capability.

Establishing a strong reputation for trustworthiness and successful case management is equally crucial in this sector. This isn't built overnight; it takes years of consistent performance and positive client outcomes. New firms face the challenge of overcoming the established credibility of firms like Begbies Traynor, which has a long track record. In 2024, industry reports highlighted that client retention and referral rates are significantly higher for established insolvency practitioners with a proven history of navigating complex cases.

The threat of new entrants for a firm like Begbies Traynor Group is significantly mitigated by the high capital and network requirements inherent in the insolvency and restructuring sector. Establishing a national presence, which includes a network of physical offices, demands considerable upfront investment. For instance, setting up and maintaining even a modest regional office can easily run into hundreds of thousands of pounds, covering rent, staff, and operational costs.

Beyond physical infrastructure, substantial investment in technology is crucial for efficient case management and data analysis. Attracting and retaining experienced, senior fee earners, who are essential for handling complex insolvency cases, also requires competitive remuneration packages, adding to the initial capital outlay. In 2024, the cost of acquiring top talent in specialized financial services continues to be a major barrier.

Furthermore, success in this industry is heavily dependent on established relationships with key stakeholders. This includes strong ties with financial institutions, legal firms, and a broad base of professional referrers who are vital for generating new business. A new entrant would find it exceptionally difficult and time-consuming to replicate the extensive and deep-rooted network that Begbies Traynor has cultivated over many years, making market penetration a formidable challenge.

Brand Recognition and Client Trust

In the realm of business rescue and recovery, brand recognition and client trust are paramount, especially when companies face financial distress. Begbies Traynor Group has cultivated a formidable reputation as the UK's leading provider in this sector. New entrants would struggle immensely to replicate this established trust and visibility, which is essential for attracting substantial client engagements.

The threat of new entrants is significantly mitigated by the deep-seated brand recognition and client trust that Begbies Traynor Group has meticulously built over years of successful operations. In critical times, businesses actively seek advisors with a proven track record and a strong reputation for reliability. For instance, in 2024, the demand for insolvency practitioners remained robust, with the Insolvency Service reporting a notable increase in company insolvencies. Newcomers would face a substantial hurdle in convincing clients, particularly those with complex financial situations, to entrust them with their business rescue needs over an established leader.

- Established Reputation: Begbies Traynor is widely recognized as the UK's market leader in business rescue and recovery.

- Client Trust: In times of financial difficulty, businesses prioritize advisors with a proven history and strong client confidence.

- High Barrier to Entry: New entrants would need significant investment and time to build comparable brand recognition and trust to secure high-value mandates.

Acquisition as a Growth Strategy

The threat of new entrants for Begbies Traynor Group is somewhat mitigated by the industry's ongoing consolidation. Established firms, including Begbies Traynor itself, are actively engaging in strategic acquisitions to bolster their service offerings and expand their geographical footprint. This trend of consolidation, where larger entities absorb potential competitors, erects significant barriers for smaller, nascent businesses seeking to enter and grow organically within the insolvency and restructuring sector.

For instance, Begbies Traynor Group has consistently demonstrated its commitment to growth through acquisition. In the fiscal year ending April 30, 2024, the group announced several strategic acquisitions, further solidifying its market position. These moves not only integrate new capabilities but also absorb market share, making it increasingly challenging for new entrants to gain traction against well-capitalized and established players.

- Industry Consolidation: Established players like Begbies Traynor are actively acquiring smaller firms.

- Barriers to Entry: This consolidation makes organic growth and competition harder for new, smaller entrants.

- Talent Acquisition: Larger firms absorb key talent, further limiting new entrants' resources.

- Market Share Absorption: Acquisitions by incumbents reduce the available market share for new businesses.

The threat of new entrants into the corporate rescue and recovery sector is considerably low for Begbies Traynor Group. This is due to the high barriers to entry, including stringent regulatory requirements, the need for specialized expertise, substantial capital investment for infrastructure and technology, and the critical importance of established reputation and client trust. Industry consolidation further exacerbates these challenges for potential newcomers.

In 2024, the UK insolvency market continued to see steady activity. For example, the Insolvency Service reported a 15% increase in company insolvencies in the first quarter of 2024 compared to the same period in 2023, indicating a sustained demand for the services Begbies Traynor provides. This environment, while active, is dominated by established players who have built the necessary credentials and networks.

| Factor | Impact on New Entrants | Begbies Traynor's Advantage |

|---|---|---|

| Regulatory Hurdles | High (licensing, qualifications) | Established compliance and expertise |

| Capital Investment | Significant (offices, technology) | Existing infrastructure and financial capacity |

| Reputation & Trust | Difficult to build | Long-standing market leader with proven track record |

| Industry Consolidation | Challenging (acquisition of market share) | Ability to acquire and integrate smaller competitors |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive suite of data sources, including Begbies Traynor Group's internal financial data, publicly available company filings, and reputable industry research reports. This multi-faceted approach ensures a robust understanding of competitive dynamics.