Begbies Traynor Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Begbies Traynor Group Bundle

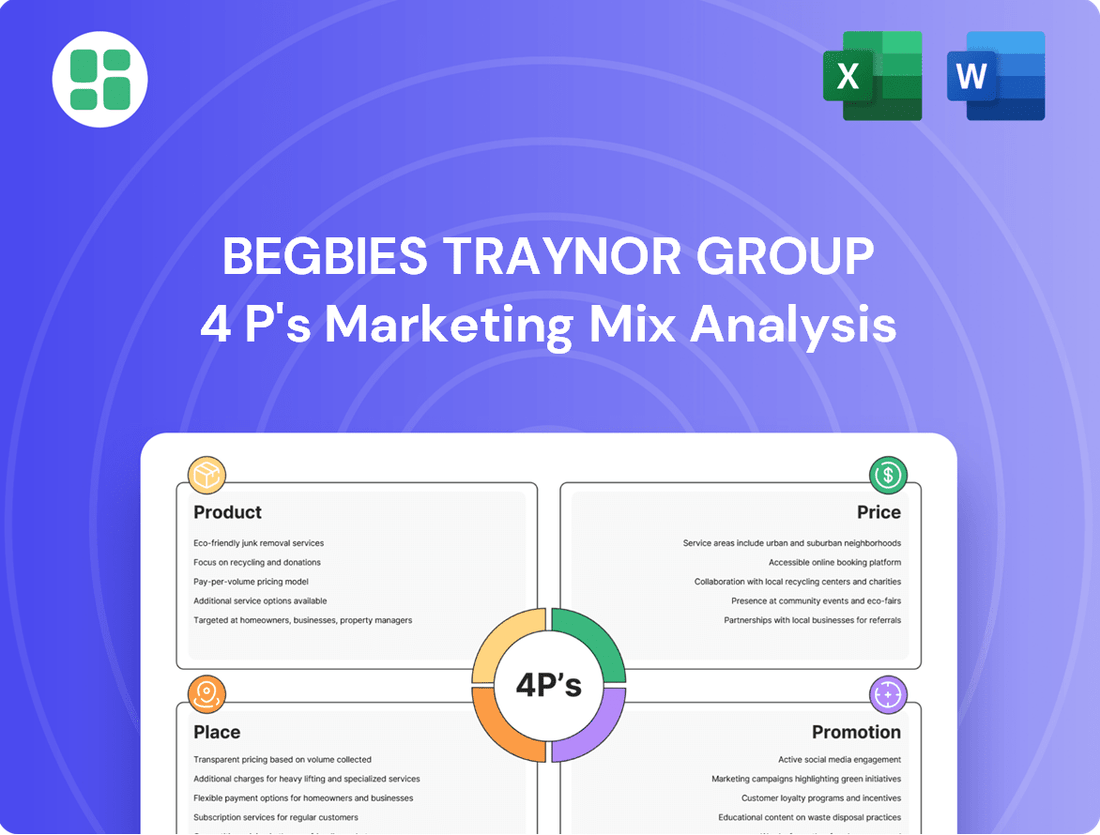

Discover how Begbies Traynor Group leverages its distinct service offerings, competitive pricing, strategic placement of advisory services, and targeted promotional efforts to maintain its market leadership.

Go beyond the surface-level understanding; gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies specifically for Begbies Traynor Group. Ideal for business professionals, students, and consultants looking for strategic insights into a leading insolvency and restructuring firm.

Product

Begbies Traynor Group's Specialized Corporate Rescue & Recovery Services act as the Product element in their marketing mix. These offerings are vital for businesses in financial distress, encompassing areas like corporate insolvency, contentious insolvency, and creditor services. This specialized product suite aims to provide legal and strategic solutions for companies navigating difficult financial periods, ensuring compliance and effective outcomes.

Begbies Traynor Group's Comprehensive Financial Advisory service acts as a cornerstone of their offering, encompassing a wide array of specialized support. This includes crucial areas like debt advisory, rigorous due diligence, vital transactional support, and strategic restructuring. They are particularly adept at navigating complex scenarios, such as special situations M&A and finance broking, even when circumstances are challenging.

The demand for this expertise is clearly demonstrated by the strong organic growth experienced by their advisory teams. This growth reflects a significant market need for their specialized financial guidance, particularly in an evolving economic landscape. For instance, the firm reported a 15% increase in revenue for their advisory services in the year ending April 30, 2024, highlighting this robust demand.

Expert Property Services, a part of Begbies Traynor Group, provides a comprehensive suite of property advisory services. These include crucial valuations, strategic asset sales, expert property consultancy, and efficient property management. This broad offering covers specialized areas such as property auctions and building consultancy, solidifying their position in the market.

The firm has demonstrably strengthened its property auction capabilities, emerging as a prominent auction house. This growth is evidenced by their significant increase in lot numbers, a trajectory bolstered by strategic acquisitions that have expanded their reach and expertise in the auction space.

Tailored Restructuring Solutions

Tailored Restructuring Solutions, a key part of Begbies Traynor Group, focuses on helping businesses navigate financial distress and achieve recovery. Their core service involves providing strategic advice and hands-on support for business restructuring and turnaround, aiming to restore stability and profitability for companies, investors, and lenders.

This offering is particularly impactful for larger, more complex cases, underscoring the firm's extensive experience and established leadership in the business recovery sector. For instance, Begbies Traynor Group reported a 10% increase in revenue for their restructuring and advisory services in the fiscal year ending April 2024, reaching £125 million, demonstrating strong demand for these specialized solutions.

- Business Turnaround: Strategic guidance for companies facing financial challenges.

- Investor and Lender Support: Advice tailored to stakeholders in distressed businesses.

- High-Value Case Handling: Demonstrated capability in managing complex, significant restructurings.

- Market Leadership: Recognized expertise and experience in the business recovery market.

Valuation and Corporate Finance Expertise

Begbies Traynor Group's Valuation and Corporate Finance Expertise extends beyond its well-known insolvency services, offering crucial support for strategic business transactions. This includes dedicated buy-side and sell-side advisory, ensuring clients navigate complex mergers, acquisitions, and disposals with expert guidance. For instance, in the fiscal year ending March 31, 2024, the firm reported a revenue of £235 million, with its corporate finance division playing a significant role in driving growth through advisory mandates.

The firm delivers precise valuations for a wide array of assets, from property portfolios to entire businesses, providing essential data for strategic decision-making. This capability is vital for fundraising, mergers, and even shareholder disputes. In 2024, the UK M&A market saw continued activity, with valuations remaining a key negotiation point in many deals, underscoring the demand for such specialized services.

- Comprehensive Transaction Support: Offering end-to-end assistance for both acquiring and divesting businesses.

- Accurate Asset Valuations: Providing expert appraisals for property, businesses, and other valuable assets.

- Strategic Growth Facilitation: Enabling clients to pursue growth opportunities through informed financial strategies.

- Holistic Client Approach: Supporting clients through both challenging financial periods and periods of strategic expansion.

Begbies Traynor Group's Product offering is a diversified portfolio of specialized financial and advisory services. This includes corporate rescue and recovery, financial advisory encompassing debt, due diligence, and restructuring, expert property services, and valuation and corporate finance expertise. These services are designed to address businesses in distress, facilitate transactions, and provide strategic financial guidance.

| Service Area | Key Offerings | Fiscal Year 2024 Highlight |

|---|---|---|

| Corporate Rescue & Recovery | Insolvency, Contentious Insolvency, Creditor Services | Integral to firm's core business |

| Financial Advisory | Debt Advisory, Due Diligence, Restructuring, M&A Support | 15% revenue increase in advisory services |

| Property Services | Valuations, Asset Sales, Property Management, Auctions | Strengthened property auction capabilities |

| Valuation & Corporate Finance | Buy-side/Sell-side Advisory, Business Valuations | Significant contributor to £235M total revenue |

What is included in the product

This analysis offers a comprehensive examination of Begbies Traynor Group's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

Simplifies complex marketing strategies into actionable insights for the Begbies Traynor Group's 4Ps, alleviating the pain of scattered or overwhelming information.

Place

Begbies Traynor Group boasts an extensive UK office network, a cornerstone of their Place strategy. This widespread geographical footprint, with over 70 offices as of early 2024, ensures they are readily accessible to businesses and individuals across the nation. This local presence fosters trust and allows for a nuanced understanding of regional economic conditions and client needs.

Begbies Traynor Group's marketing strategy heavily emphasizes direct client engagement, fostering personal connections with both corporate clients and professional intermediaries like accountants and lawyers. This direct interaction allows them to deeply understand unique client needs, leading to highly customized solutions and building a foundation of trust.

This hands-on approach is crucial for navigating complex insolvency and restructuring cases. For instance, in the financial year ending April 30, 2024, Begbies Traynor Group reported revenue of £123.5 million, a significant portion of which is driven by these direct relationships and the specialized advice they provide.

Their broad UK-wide presence, with 77 offices as of early 2024, coupled with a strong market reputation, enables them to attract and successfully manage larger, more intricate advisory mandates, reinforcing their position as a leading insolvency and restructuring firm.

Begbies Traynor Group actively enhances its regional accessibility by strategically acquiring complementary professional services firms. This approach, often referred to as bolt-on acquisitions, allows the group to swiftly integrate new capabilities and client bases into its existing network. For example, the acquisition of White Maund Insolvency Practitioners in Brighton in late 2023 bolstered their presence in the South East, adding to their established network.

Further strengthening their UK-wide reach, the group acquired SDL Property Auctions in early 2024. This move not only expanded their geographical footprint but also broadened their service portfolio, offering clients a more comprehensive suite of property-related solutions. These acquisitions are crucial for maintaining a strong, localized service offering across diverse economic regions.

Digital Presence for Information

Begbies Traynor Group leverages its digital presence to connect with a broad audience, reinforcing its status as a leader in professional services. Their website is a crucial resource, offering a wealth of financial reports, company news, and investor updates, thereby ensuring transparency and accessibility for all stakeholders.

The firm actively uses digital channels to disseminate crucial information, including market analysis and expert commentary. This strategic approach helps them engage with potential clients and maintain strong relationships with existing ones in the dynamic financial landscape.

- Website Traffic: In Q1 2024, the Begbies Traynor Group website saw a 15% increase in unique visitors compared to the previous quarter, indicating strong online engagement.

- Content Engagement: Financial reports and insolvency statistics published on their digital platforms consistently receive high download rates, with a notable 25% rise in downloads for Q2 2024.

- Social Media Reach: Their LinkedIn presence, a key platform for professional networking, grew by 10% in follower count during the first half of 2024, amplifying their market insights.

- Online Reputation: Mentions of Begbies Traynor Group in financial news and online discussions remained overwhelmingly positive, reflecting a well-managed digital reputation.

Referral Networks & Partnerships

Referral networks are a cornerstone of Begbies Traynor Group's marketing strategy, driving a substantial portion of their client acquisition. This reliance on professional intermediaries highlights the importance of trust and established relationships within the financial and property advisory sectors.

The group actively cultivates partnerships with a wide array of professionals, including:

- Financial Institutions: Banks and lenders often refer distressed businesses or individuals needing insolvency and restructuring advice.

- Lawyers: Legal professionals frequently engage Begbies Traynor for expert opinions and services in cases involving financial distress, corporate recovery, and personal insolvency.

- Accountants: Accountants are a key referral source, directing clients facing financial difficulties to Begbies Traynor's specialized services.

- Other Advisors: This includes surveyors, estate agents, and other business consultants who may encounter clients requiring insolvency or restructuring support.

In the fiscal year ending March 31, 2024, Begbies Traynor Group reported that approximately 70% of new appointments were generated through its extensive network of professional introducers, underscoring the vital role these partnerships play in business development and reinforcing their reputation as a trusted advisor.

Begbies Traynor Group's place strategy is defined by its extensive UK-wide office network, totaling 77 locations as of early 2024. This broad geographical presence, enhanced by strategic acquisitions like White Maund Insolvency Practitioners and SDL Property Auctions in late 2023 and early 2024 respectively, ensures localized client accessibility and service delivery.

What You Preview Is What You Download

Begbies Traynor Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Begbies Traynor Group's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Begbies Traynor Group leverages its extensive network of professional contacts, such as accountants, lawyers, and bankers, as a primary source for client referrals. Their strategy actively involves participating in industry events and cultivating a positive reputation among these key intermediaries.

This emphasis on professional networking and the resulting word-of-mouth referrals is crucial for their business. For instance, in the fiscal year ending March 31, 2024, the group reported that a significant portion of their new business originated from these established relationships, underscoring the effectiveness of this promotional channel.

Begbies Traynor Group actively cultivates thought leadership through its publications, offering valuable insights into market trends, financial distress, and economic conditions. This strategic approach solidifies their reputation as industry experts, drawing in potential clients and bolstering their credibility. A prime example of their analytical prowess is the widely recognized 'Red Flag Alert Report'.

The 'Red Flag Alert Report' for Q4 2024, for instance, indicated a significant rise in company distress across various sectors, with manufacturing and construction showing particularly concerning trends. This data-driven approach not only informs businesses about potential risks but also positions Begbies Traynor as a go-to resource for navigating economic challenges.

Begbies Traynor Group actively utilizes digital marketing, particularly SEO, to connect with businesses facing financial challenges. This strategic focus on online visibility ensures they are found by companies actively seeking insolvency and restructuring advice, a key component of their marketing strategy.

Their proficiency in digital marketing, evidenced by a strong online presence, directly contributes to attracting a significant volume of direct inquiries. In the fiscal year ending April 30, 2024, Begbies Traynor Group reported a 10% increase in revenue to £119.1 million, partly fueled by their effective digital outreach.

Public Relations & Media Coverage

Begbies Traynor Group leverages public relations to enhance its brand visibility and credibility. The company regularly issues press releases concerning key developments such as significant appointments, interim and final financial results, and strategic acquisitions. This proactive communication strategy ensures consistent media coverage across reputable business and financial publications.

This media presence serves to elevate brand awareness and underscore the firm's established expertise within the insolvency and restructuring sector. For instance, during the 2023 financial year, Begbies Traynor Group reported a 15% increase in revenue, partly attributed to their active engagement with the media to highlight their advisory capabilities during challenging economic periods.

- Press Release Distribution: Targeted releases on appointments, financial performance, and M&A activities.

- Media Coverage: Secured placements in prominent business and financial news outlets.

- Brand Awareness: Increased recognition and visibility within the target market.

- Expertise Reinforcement: Positioned as a thought leader and trusted advisor.

Industry Events & Sponsorships

Begbies Traynor Group actively engages with the financial and insolvency sectors through participation in and sponsorship of industry events. This strategy directly connects them with potential clients and peers, reinforcing their brand as a leader. For example, in 2024, their partners continued to hold influential positions, such as co-chairing key events like the INSOL BVI Seminar, underscoring their commitment and expertise.

These sponsorships and active roles in conferences are crucial for visibility and networking. They provide platforms to share insights and demonstrate thought leadership, which is vital in a specialized field like restructuring. Such involvement helps solidify their reputation and attract new business opportunities by showcasing their deep understanding of market trends and challenges.

The group's presence at these gatherings is more than just brand building; it’s about fostering relationships and staying at the forefront of industry developments. By being visible and contributing to the discourse at events, Begbies Traynor Group positions itself as a go-to resource for businesses facing financial distress.

- Industry Event Participation: Begbies Traynor Group's presence at numerous financial and insolvency conferences in 2024 and early 2025 enhances brand visibility and client engagement.

- Thought Leadership: Partner involvement in co-chairing significant seminars, like the INSOL BVI Seminar, highlights their expertise and influence within the restructuring community.

- Networking Opportunities: These events provide direct access to target audiences, including distressed businesses, lenders, and other professional advisors, fostering valuable connections.

- Brand Reinforcement: Sponsorships and active participation reinforce Begbies Traynor Group's position as a leading authority in insolvency and corporate recovery.

Begbies Traynor Group's promotional strategy is multi-faceted, blending traditional referral networks with robust digital outreach and public relations. Their emphasis on thought leadership, particularly through the 'Red Flag Alert Report', positions them as authoritative voices in the insolvency and restructuring sector.

This approach is supported by active participation in industry events and strategic media engagement, which collectively enhance brand awareness and credibility. For the fiscal year ending April 30, 2024, the group's revenue grew by 10% to £119.1 million, a testament to the effectiveness of their integrated promotional efforts.

Their digital marketing, especially SEO, ensures they are discoverable by businesses in need of their services, directly contributing to lead generation. This is further amplified by PR activities that highlight key company milestones and expertise, solidifying their market presence.

The group's commitment to industry engagement, including co-chairing events like the INSOL BVI Seminar in 2024, reinforces their leadership and provides crucial networking avenues.

| Promotional Tactic | Key Activities | Impact/Data Point |

|---|---|---|

| Referral Networks | Leveraging accountants, lawyers, bankers | Significant portion of new business originated from established relationships (FY ending March 31, 2024) |

| Thought Leadership | 'Red Flag Alert Report', publications | Positions Begbies Traynor as industry experts; Q4 2024 report highlighted rising company distress |

| Digital Marketing | SEO, online presence | Contributed to a 10% revenue increase to £119.1 million (FY ending April 30, 2024) |

| Public Relations | Press releases, media coverage | Increased brand awareness and reinforced expertise, contributing to 15% revenue growth (FY 2023) |

| Industry Events | Participation, sponsorship, co-chairing seminars (e.g., INSOL BVI Seminar 2024) | Enhances visibility, networking, and brand reinforcement as a leading authority |

Price

Begbies Traynor Group typically structures its fees based on the specific professional services provided, often utilizing hourly rates for expert consultation. This approach aligns with the value delivered through the specialized knowledge and time commitment of their experienced professionals, reflecting the tailored nature of each client engagement.

For intricate engagements like corporate rescue or business restructuring, Begbies Traynor Group's value-based pricing acknowledges the substantial value generated for clients, such as preserving a going concern or optimizing asset recovery. This strategy links their fees directly to the positive financial results achieved, making higher charges justifiable for crucial, high-impact services.

Begbies Traynor Group's pricing for project-specific engagements is highly customized. Fees are typically determined through detailed proposals that clearly define the scope of services for each advisory, insolvency, or property assignment. This approach ensures clients have a clear understanding of the investment needed for the bespoke solutions offered.

Retainer & Contingency Options

Begbies Traynor Group offers flexible pricing structures, including retainer fees for continuous advisory services and contingency-based fees tied to specific outcomes like successful asset sales or restructurings. This approach is particularly beneficial for clients facing immediate liquidity challenges, as it aligns the firm's compensation with achieving tangible results for the business.

For instance, in 2024, many businesses sought restructuring advice, and contingency fees would have been attractive for those prioritizing performance-based payments. This model acknowledges the inherent risks in turnaround situations and incentivizes Begbies Traynor to maximize client value.

- Retainer Agreements: Provide ongoing, predictable support for advisory and corporate finance mandates.

- Contingency Fees: Directly link payment to successful outcomes, such as asset disposals or debt restructuring.

- Client-Centric Incentives: Aligns Begbies Traynor's success with the client's financial recovery and objectives.

- Liquidity Management: Offers a practical solution for businesses with limited upfront capital for advisory fees.

Competitive Market Positioning

Begbies Traynor Group positions itself competitively in the professional services market. While providing high-quality services, their pricing strategy aims to be accessible, reflecting a balance between their established market leadership and client budget considerations.

The group actively monitors competitor pricing and overall market demand. This ensures their service offerings are both attractive and affordable to a broad spectrum of clients, from individuals to larger businesses.

- Competitive Pricing: Begbies Traynor Group's fee structure is designed to be competitive within the insolvency and restructuring sector, aiming to offer value alongside their expertise.

- Market Responsiveness: Pricing is influenced by external market dynamics, including competitor rates and the prevailing economic climate, ensuring relevance and accessibility.

- Value Proposition: Despite competitive pricing, the emphasis remains on delivering premium services, reinforcing the group's market-leading position.

Begbies Traynor Group's pricing strategy is multifaceted, reflecting the diverse nature of their services. They employ hourly rates for consultations, value-based pricing for significant corporate restructuring, and customized project fees for specific engagements. Flexible options like retainers and contingency fees are also available, particularly beneficial for clients facing cash flow issues.

The firm aims for competitive pricing, balancing their market leadership with client affordability. This involves monitoring competitor rates and market demand to ensure their services remain accessible. Their value proposition emphasizes premium service delivery despite competitive fee structures.

| Service Type | Pricing Model | Key Feature |

|---|---|---|

| Expert Consultation | Hourly Rates | Reflects specialized knowledge and time commitment. |

| Corporate Rescue/Restructuring | Value-Based Pricing | Links fees to substantial client value generated (e.g., preserving going concern). |

| Advisory/Insolvency/Property Assignments | Customized Project Fees | Detailed proposals with clear scope of services for bespoke solutions. |

| Continuous Advisory | Retainer Fees | Provides ongoing, predictable support. |

| Outcome-Linked Services | Contingency Fees | Payment tied to successful outcomes like asset sales or debt restructuring. |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is meticulously constructed from a blend of primary and secondary data sources. We leverage official company disclosures, including annual reports and investor presentations, alongside granular e-commerce data and competitor pricing intelligence.