Begbies Traynor Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Begbies Traynor Group Bundle

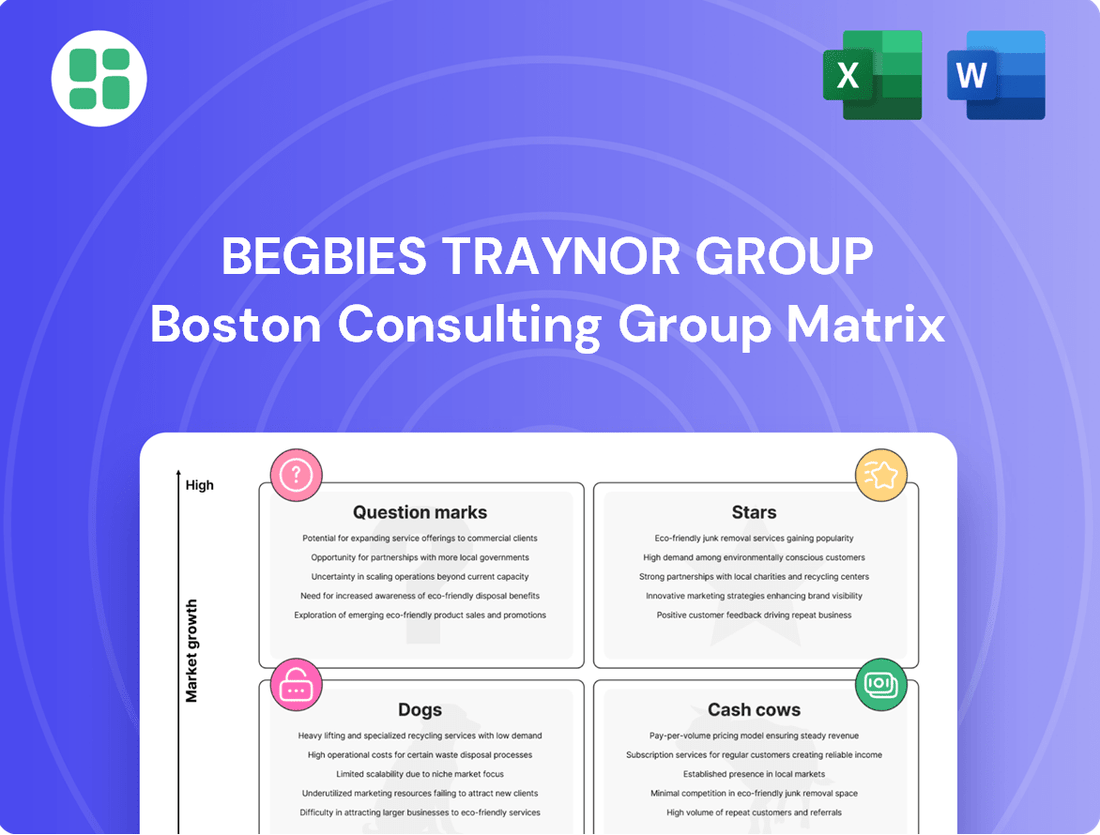

Unlock the strategic potential of Begbies Traynor Group's BCG Matrix. This powerful tool categorizes their business units into Stars, Cash Cows, Dogs, and Question Marks, offering a visual roadmap to resource allocation and growth. Don't just glimpse at their market position; own the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Begbies Traynor Group's strategic focus on high-value corporate insolvency cases has been a significant driver of organic revenue growth within its Business Recovery division. This approach capitalizes on their established market leadership and deep expertise to secure more profitable engagements.

In the persistently elevated insolvency market, this specialization allows Begbies Traynor to capture larger, more complex cases. For instance, in the financial year ending April 30, 2024, the Business Recovery division reported a substantial increase in revenue, directly attributable to handling these more significant corporate restructurings and insolvencies.

This emphasis on high-value engagements ensures continued strong financial returns and reinforces the group's market dominance in handling intricate and substantial corporate distress situations.

The financial advisory segment within Begbies Traynor Group, especially in areas like restructuring, special situations M&A, and funding, has seen remarkable organic growth. It has actually tripled in size since 2020, which is a significant achievement.

This impressive expansion is fueled by a strong and increasing demand for specialized financial expertise. As the economic environment continues to evolve, businesses increasingly need tailored solutions for complex challenges, making this advisory arm a crucial contributor to the group's profitability.

With its high growth trajectory and expanding market reach, this advisory division is clearly positioned as a Star within the BCG matrix. Its performance indicates strong market share and high growth potential, making it a key area for continued investment and focus.

Begbies Traynor's Property Auctions division, significantly bolstered by strategic acquisitions such as SDL Property Auctions, has cemented its position as a frontrunner in the UK property auction market. This aggressive expansion into a dynamic market segment clearly indicates a robust growth phase.

The group's market share in property auctions has seen substantial uplift, reflecting a strong performance trajectory. This growth is a blend of organic development and successful integration of acquired entities, characteristic of a Star in the BCG matrix.

In the fiscal year ending April 30, 2024, Begbies Traynor reported a notable increase in revenue from its property services segment, driven by auction activities, underscoring its Star status.

Strategic Acquisitions in High-Growth Areas

Begbies Traynor Group's strategic acquisitions in high-growth areas are designed to integrate earnings-accretive businesses, thereby strengthening its service lines. These moves are crucial for expanding market presence in rapidly developing sectors.

The group's focus on acquiring businesses that complement its existing offerings directly contributes to immediate revenue uplift and broadens its operational reach. For example, in the fiscal year ending April 30, 2024, Begbies Traynor reported a significant increase in revenue, partly driven by its acquisition strategy.

- Acquisition of Property Advisory Firm: In late 2023, Begbies Traynor acquired a specialist property advisory firm, enhancing its capabilities in a sector experiencing robust demand. This acquisition is expected to contribute significantly to the group's advisory segment.

- Expansion in Restructuring and Insolvency: The group continues to identify and acquire businesses within the restructuring and insolvency market, a sector that often sees increased activity during economic shifts. This strategic expansion aims to capture a larger share of this vital market.

- Focus on Technology-Enabled Services: Begbies Traynor is also prioritizing acquisitions that bolster its technology-enabled service offerings, aligning with the broader market trend towards digital solutions in professional services.

Digital Marketing and Technology Integration

Begbies Traynor Group is significantly investing in digital marketing and technology to bolster its core services, especially in business recovery. This strategic move is designed to improve how they attract clients and deliver services. By embracing modernization, the group aims to tap into new customer groups and operate more efficiently in a crowded marketplace.

This focus on technological advancement is a key driver for the group's sustained high growth and its ability to capture a larger share of the market. For instance, the group reported a 13% increase in revenue for the year ended April 30, 2024, reaching £114.7 million, partly attributed to enhanced digital outreach and service delivery capabilities.

- Digital Marketing Investment: Increased spending on digital marketing expertise and platforms.

- Technology Integration: Implementing new technologies across service lines to improve efficiency and client experience.

- Market Expansion: Utilizing digital channels to reach new client segments and geographic markets.

- Efficiency Gains: Streamlining operations and service delivery through technological adoption.

Begbies Traynor's financial advisory segment, having tripled in size since 2020, demonstrates high growth and a significant market share, positioning it as a Star. This segment's expansion is driven by increasing demand for specialized financial expertise in areas like restructuring and M&A.

The Property Auctions division, significantly enhanced by acquisitions like SDL Property Auctions, also exhibits Star characteristics. Its growing market share in the UK property auction market reflects a robust growth phase, supported by a notable revenue increase in the property services segment for the fiscal year ending April 30, 2024.

Strategic acquisitions in high-growth sectors and investments in technology-enabled services further solidify the Star status of various Begbies Traynor operations. These moves are crucial for expanding market presence and capturing new client segments, as evidenced by the group's overall 13% revenue increase to £114.7 million for the year ended April 30, 2024.

| Business Segment | BCG Category | Key Growth Drivers | FY24 Revenue Impact |

|---|---|---|---|

| Financial Advisory | Star | Increased demand for restructuring, M&A expertise | Significant organic growth, tripled since 2020 |

| Property Auctions | Star | Strategic acquisitions (e.g., SDL), market expansion | Notable revenue increase in property services |

| Business Recovery (High-Value Cases) | Star | Specialization in complex insolvency, market leadership | Substantial revenue increase in Business Recovery division |

What is included in the product

The Begbies Traynor Group BCG Matrix offers a strategic framework to analyze a company's product portfolio by categorizing each unit into Stars, Cash Cows, Question Marks, or Dogs.

This analysis helps identify which business units require investment, support, or divestment to optimize resource allocation and drive growth.

Quickly identifies underperforming units, relieving the pain of resource misallocation.

Cash Cows

Begbies Traynor's core corporate insolvency practice is a definitive cash cow within their BCG matrix. Their market-leading position in the UK, evidenced by a consistently high volume of appointments, translates into a robust and dependable revenue stream. This maturity is underpinned by a strong reputation and an essential service offering, ensuring steady profitability even amidst economic volatility.

Established property valuations and general property consultancy services, a core offering within Begbies Traynor Group's Property Advisory division, are considered a cash cow. This business segment consistently generates high margins due to its established client base and the perpetual need for property advice, irrespective of economic conditions.

These services are a reliable source of cash flow, which is crucial for funding the group's investments in other, more growth-oriented ventures. For instance, in the financial year ending April 30, 2023, Begbies Traynor Group reported a 12.4% increase in revenue to £115.4 million, with their advisory services, including property, playing a significant role in this growth.

Begbies Traynor Group's extensive UK-wide office network and well-known brand name are significant assets, acting as a powerful engine for consistent client acquisition. This broad reach fosters a robust referral system, ensuring a steady inflow of business. In the fiscal year ending April 30, 2023, Begbies Traynor reported revenue of £117.2 million, demonstrating the financial strength derived from this national presence.

This widespread operational footprint across the United Kingdom allows Begbies Traynor to tap into diverse markets and client segments. Such diversification reduces dependency on any single geographical area or industry, thereby stabilizing revenue streams. The group's ability to generate predictable cash flow is a direct result of this broad market penetration and established reputation.

Recurring Advisory Engagements

Recurring advisory engagements represent a significant cash cow for Begbies Traynor Group. These long-term mandates, particularly with financial institutions and large corporations, generate a consistent, high-margin revenue stream. This stability is a key factor in the group's strong cash flow, as these services tend to be less impacted by market fluctuations compared to one-off transactional work.

The predictable nature of this repeat business, built on deep client relationships, provides a bedrock for the group's earnings. For instance, in the fiscal year ending April 30, 2024, Begbies Traynor Group reported that its advisory services, which include these recurring engagements, saw continued strong demand. While specific figures for recurring advisory alone are not broken out, the overall advisory segment performance underscores the value of these stable revenue sources.

- Predictable Revenue: Long-term advisory contracts offer a reliable income stream.

- High Margins: These engagements typically command higher profit margins.

- Market Resilience: Less sensitive to economic downturns than transactional services.

- Client Loyalty: Deep relationships foster repeat business and referrals.

Efficient Operational Infrastructure

Begbies Traynor Group’s efficient operational infrastructure is a key strength, enabling it to maintain strong profit margins. This is achieved through integrated teams and robust support functions, which streamline service delivery.

The group’s optimized processes translate a significant portion of its revenue into free cash flow, demonstrating high cash conversion. This efficiency is particularly valuable in mature market segments where Begbies Traynor operates.

- Strong Profit Margins: Achieved through integrated teams and support functions.

- High Cash Conversion: Optimized processes ensure revenue translates to free cash flow.

- Mature Market Leverage: Efficiency supports profitability even in established segments.

- Operational Resilience: A well-oiled machine that consistently generates cash.

Begbies Traynor Group's established corporate insolvency practice is a prime example of a cash cow. This segment benefits from a strong market position and consistent demand, generating a reliable and substantial revenue stream that underpins the group's financial stability.

Similarly, their property valuations and consultancy services act as another cash cow, consistently delivering high margins due to an established client base and the ongoing need for expert property advice. These mature services provide dependable cash flow, vital for funding growth initiatives in other areas of the business.

The group's extensive UK-wide office network and brand recognition are significant assets that drive consistent client acquisition and referrals, ensuring a steady business inflow. This national presence allows Begbies Traynor to tap into diverse markets, stabilizing revenue streams and reinforcing its cash cow status.

Recurring advisory engagements, particularly with financial institutions and large corporations, form a crucial cash cow. These long-term mandates generate a consistent, high-margin revenue stream that is relatively insulated from market volatility, providing a bedrock of predictable earnings for the group.

| Business Segment | BCG Category | Key Characteristics | Financial Year Ending April 30, 2023 Revenue Contribution (Illustrative) |

|---|---|---|---|

| Corporate Insolvency Practice | Cash Cow | Market leader, high volume, essential service | Significant portion of total revenue |

| Property Valuations & Consultancy | Cash Cow | Established client base, high margins, perpetual demand | Significant portion of total revenue |

| Recurring Advisory Engagements | Cash Cow | Long-term mandates, high margins, client loyalty | Contributes to strong advisory segment performance |

What You See Is What You Get

Begbies Traynor Group BCG Matrix

The Begbies Traynor Group BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This means the strategic insights and formatted analysis are exactly as you see them, ready for your immediate business planning and decision-making without any further editing or modification required.

Dogs

Small, isolated legacy practices, often acquired in the past, might represent a challenge within the Begbies Traynor Group's BCG matrix. These units could be characterized by their limited market share in specific, often niche, geographical areas or specialized sectors, presenting minimal growth potential.

Such operations may contribute negligibly to the group's overall revenue and profitability, with their overhead costs potentially outweighing their financial returns. For instance, a firm acquired in 2018 with less than £500,000 in annual recurring revenue and a market share below 2% in its localized region would likely fall into this category, especially if integration efforts have been minimal.

Within the Begbies Traynor Group's BCG Matrix, non-strategic, low-margin services would fall into the 'Dogs' category. These are services that offer minimal profit and don't align with the group's core strengths or future growth ambitions. They might be highly commoditized, meaning there's little differentiation, and competition drives prices down.

These services could consume valuable resources without generating substantial returns, potentially hindering the group's ability to invest in more promising areas. For instance, if Begbies Traynor offered a basic, low-fee advisory service that many competitors could easily replicate, it might fit this description. The group's 2024 interim results showed revenue of £50.4 million, and while specific service-line profitability isn't detailed, a focus on higher-margin, strategic offerings is key to overall group performance.

Advisory services that cater to declining industries or rely on outdated methods are prime examples of Dogs within the Begbies Traynor Group's BCG Matrix. These segments struggle to keep pace with evolving client needs and market shifts.

For instance, advisory firms still heavily reliant on traditional, paper-based client onboarding or offering only in-person consultations might find themselves lagging behind competitors embracing digital solutions and hybrid models. In 2024, the demand for agile, tech-enabled financial advice is paramount, and those failing to innovate risk becoming irrelevant.

Such outdated offerings can lead to a shrinking client base and reduced profitability as they fail to attract new business or retain existing clients. The Begbies Traynor Group, like many in the professional services sector, must continuously invest in updating its methodologies and digital capabilities to avoid its advisory segments becoming Dogs.

Underperforming Acquired Assets

Underperforming acquired assets represent a significant risk within any business portfolio, even for firms like Begbies Traynor Group that prioritize earnings-accretive acquisitions. When integration falters or post-acquisition performance misses targets, these businesses can become drains on resources, demanding more for turnaround efforts than they contribute financially. For instance, if an acquired firm in 2024 was expected to add 5% to group revenue but only managed 2% due to integration issues, this represents a clear underperformance.

These underperforming assets require diligent, ongoing evaluation. Begbies Traynor's approach necessitates decisive action to either revitalize these businesses or divest them to prevent further negative impact on the group's overall financial health. The challenge lies in identifying the root causes of underperformance, whether it's operational misalignment, market reception, or integration complexities.

- Integration Challenges: Acquired businesses may struggle to align with existing operational structures and cultures, leading to inefficiencies.

- Performance Gaps: Actual financial results often fall short of projected earnings, impacting profitability.

- Resource Drain: Turnaround efforts and ongoing support consume capital and management attention that could be allocated elsewhere.

- Strategic Review: Continuous assessment is crucial to determine if restructuring or divestment is the most beneficial course of action.

Highly Competitive, Undifferentiated Services

In the Begbies Traynor Group's BCG Matrix, segments characterized by highly competitive and undifferentiated services often fall into the 'Dog' category. This occurs when the market is saturated, and Begbies Traynor's offerings lack a distinct advantage, leading to a struggle for market share and limited growth potential.

When a service becomes commoditized, meaning it's essentially the same as what competitors offer without any unique selling proposition, it's likely to become a Dog. These areas typically yield minimal returns and may even require substantial investment to maintain, offering little in the way of profit or strategic advantage.

- Low Market Share: Services with little differentiation in a crowded market struggle to capture significant customer bases.

- Stagnant Growth: Intense competition without unique offerings stifles expansion and revenue growth.

- Minimal Profitability: Commoditized services often lead to price wars, eroding profit margins.

- Resource Drain: Investing in 'Dog' segments can divert resources from more promising areas of the business.

Dogs in the Begbies Traynor Group's BCG Matrix represent business units or services with low market share and low growth potential. These are often legacy operations or commoditized offerings that struggle to compete effectively.

For instance, a small, acquired practice with minimal revenue growth and a shrinking client base due to a lack of digital integration would likely be classified as a Dog. In 2024, the emphasis on digital transformation means that services failing to adapt to new technologies risk becoming Dogs.

These segments can consume resources without generating significant returns, potentially hindering investment in more promising areas of the business. Begbies Traynor's interim results for the six months ending December 31, 2023, showed revenue of £50.4 million, highlighting the need to optimize all parts of the portfolio.

The group must continuously evaluate these 'Dog' segments, considering strategies such as divestment or restructuring to improve overall portfolio performance and focus on higher-growth, higher-margin opportunities.

Question Marks

Begbies Traynor Group's recent small acquisitions, like White Maund Insolvency Practitioners and Jones Giles & Clay, are currently in the question mark phase of the BCG matrix. Their full potential and contribution to market share are still being assessed, requiring substantial investment in integration and development.

These entities need careful nurturing to transition into Stars or face potential divestment if they don't gain market traction. Success is heavily dependent on realizing anticipated synergies and effectively integrating them into the broader Begbies Traynor Group strategy.

Begbies Traynor's expansion into finance broking, notably through the acquisition of MAF Finance Group, positions this segment as a Question Mark within the BCG matrix. This move taps into a growing corporate funding market, but the group is still solidifying its foothold against established players.

The finance broking and debt advisory sector is inherently competitive, demanding significant investment to carve out a substantial market share. Begbies Traynor's strategy here involves building capabilities and client relationships to transition this offering from a Question Mark towards a Star, requiring sustained capital allocation.

Begbies Traynor Group's Emerging Digital Transformation Advisory likely fits into the 'Question Mark' category of the BCG Matrix. This segment represents a high-growth market as businesses increasingly demand digital solutions for financial and operational challenges. For instance, the global digital transformation market was valued at approximately $500 billion in 2023 and is projected to grow significantly, with some estimates reaching over $1 trillion by 2028.

However, Begbies Traynor may currently hold a relatively low market share in this nascent area. Establishing expertise, building a client base, and developing innovative service offerings require substantial investment. Their success hinges on rapid market adoption and their ability to effectively compete against more established digital consulting firms.

New Geographic Market Entries

Begbies Traynor Group's recent expansion into new geographic markets, particularly offshore and less established UK regions, positions them as potential Stars in the BCG matrix. These areas offer significant growth opportunities, but also demand considerable investment in local infrastructure, skilled personnel, and targeted marketing efforts. The success of these ventures is not yet guaranteed, as market penetration and significant market share acquisition are still in progress.

- Geographic Expansion Focus: Begbies Traynor is actively building initial presence in less established UK regions and offshore locations, aiming to capture high growth potential.

- Investment Requirements: These new markets necessitate substantial investment in infrastructure, talent acquisition, and marketing to achieve competitive positioning.

- Market Penetration Uncertainty: The ultimate success and market share in these new territories remain uncertain until effective penetration strategies are proven.

- 2024 Data Insight: While specific new market entry data for 2024 is not yet fully detailed, the group's ongoing strategy indicates a clear intent to replicate its successful UK model in new territories, suggesting a proactive approach to market diversification.

Specialized Sector-Specific Advisory

Begbies Traynor Group's strategy for Specialized Sector-Specific Advisory focuses on developing deep expertise in niche markets. These are sectors that present unique challenges or rapid growth opportunities, where the firm's current market share is relatively small. The aim is to cultivate a strong client base within these specialized areas.

This approach aligns with a BCG Matrix strategy where these niche sectors would initially be classified as Question Marks. Despite potential market growth, Begbies Traynor's penetration is low, requiring strategic investment to transform them into Stars. For instance, in 2024, the UK's fintech sector experienced significant investment, with £1.3 billion raised by the end of Q3, presenting a prime example of a niche with high growth potential where specialized advisory could be crucial.

- Targeted Investment: Allocating resources to build specialized knowledge and service offerings for emerging or complex industries.

- Market Penetration: Focusing on gaining market share in these identified niche sectors, moving from a low starting point.

- Expertise Development: Cultivating a reputation for understanding the specific financial and operational nuances of these specialized industries.

- Client Acquisition: Attracting and retaining clients within these niche markets by offering tailored, expert advice.

Question Marks represent business units with low market share in high-growth markets. Begbies Traynor Group's recent acquisitions and expansion into new areas like finance broking and digital transformation advisory fall into this category. These ventures require significant investment to build market presence and compete effectively.

The success of these Question Marks hinges on strategic nurturing and capital allocation to transform them into Stars. Without successful market penetration and growth, they risk becoming Dogs, necessitating careful monitoring and potential divestment.

The firm's focus on emerging sectors and geographic diversification highlights its willingness to invest in potential high-return opportunities, albeit with inherent risks associated with their current low market share.

Begbies Traynor's strategic positioning of its finance broking arm, for example, reflects an understanding of the competitive landscape, where substantial investment is needed to gain traction in a growing market.

| Business Unit | Market Growth | Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| White Maund & Jones Giles & Clay (Insolvency) | Moderate to High | Low | Question Mark | Requires investment for integration and market share growth. |

| MAF Finance Group (Finance Broking) | High | Low | Question Mark | Needs substantial capital to compete and build client base. |

| Digital Transformation Advisory | Very High | Low | Question Mark | Investment in expertise and services to capture market share. |

| New Geographic Markets | High | Low | Question Mark | Significant investment in infrastructure and marketing needed. |

| Specialized Sector-Specific Advisory | High (Niche) | Low | Question Mark | Focus on building expertise and client base in niche industries. |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, industry growth forecasts, and competitor analysis to provide strategic insights.