Bechtle SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bechtle Bundle

Bechtle's robust IT infrastructure services and strong European market presence are key strengths, but the company faces challenges from intense competition and evolving technology landscapes. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Bechtle’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bechtle AG stands as a dominant force in the European IT landscape, holding the distinction of being Germany's largest IT system house. Their extensive IT portfolio covers everything from infrastructure solutions to software and a wide range of services, making them a one-stop shop for many businesses.

This comprehensive offering is a significant strength, allowing Bechtle to serve a broad spectrum of clients, from public sector entities to large enterprises and mid-sized companies. Their market leadership is further solidified by a robust network of IT system houses and efficient e-commerce platforms, enabling them to deliver integrated IT solutions.

In 2023, Bechtle reported revenue of €6.4 billion, underscoring their substantial market presence and the demand for their end-to-end IT services, which span consulting, implementation, and ongoing operational support.

Bechtle benefits from consistently high-value framework agreements with public sector clients, ensuring a dependable revenue source. For instance, in 2024, these agreements represented a substantial portion of their forward-looking revenue pipeline.

While early 2025 saw some public sector investment hesitancy, the establishment of a new government is anticipated to boost planning security. This stability is expected to drive the conversion of these framework agreements into concrete orders, especially from the latter half of 2025 onwards.

This established presence within the public sector offers Bechtle a robust and resilient demand for its IT services and solutions, underpinning its market position.

Bechtle's strategic investments in AI and cloud computing are a significant strength, aligning it with the ongoing digital transformation. By integrating technologies like BechtleGPT and Microsoft Copilot, the company is enhancing its service portfolio and internal efficiency, positioning itself for future growth in a rapidly evolving IT landscape.

Proven M&A Growth Strategy

Bechtle's proven M&A growth strategy, often termed 'buy-and-build', has been a cornerstone of its success, with the company completing over 100 acquisitions since its founding. This consistent acquisition activity fuels expansion across European markets and broadens its service offerings, driving sustained growth. The company's robust cash generation capacity directly supports these strategic acquisitions, delivering value to shareholders through targeted expansion.

Key aspects of this strategy include:

- Strategic Acquisitions: Over 100 acquisitions completed, demonstrating a consistent and effective M&A approach.

- Geographic Expansion: The 'buy-and-build' model facilitates entry and consolidation within new European territories.

- Portfolio Diversification: Acquisitions allow Bechtle to broaden its IT service and product portfolio, catering to a wider client base.

- Value Creation: High cash generation supports these strategic moves, enhancing investor returns through calculated expansion.

Skilled and Growing Workforce

Bechtle views its employees as the bedrock of its achievements, placing substantial importance on its human capital. The company actively nurtures future talent through dedicated vocational training programs.

Bechtle's workforce has experienced growth, partly fueled by strategic acquisitions, underscoring its expansion and integration capabilities. This focus on developing and retaining skilled IT professionals is vital for maintaining superior expertise and service quality in the dynamic IT services sector.

- Skilled Workforce: Bechtle's commitment to employee development ensures a high caliber of IT professionals.

- Growth Trajectory: The company's workforce has expanded, partly due to successful acquisitions.

- Talent Investment: Significant investment in vocational training prepares the next generation of IT experts.

Bechtle's broad IT portfolio, encompassing infrastructure, software, and services, positions it as a comprehensive IT partner for a diverse client base. This extensive offering, coupled with a strong e-commerce presence and a vast network of IT system houses, solidifies its market leadership across Europe.

The company's strategic focus on AI and cloud computing, evidenced by integrations like BechtleGPT, ensures it remains at the forefront of digital transformation trends. Bechtle's consistent M&A strategy, with over 100 acquisitions completed, fuels geographic expansion and portfolio diversification, supported by strong cash generation.

Bechtle's deep relationships with public sector clients, secured through high-value framework agreements, provide a stable revenue foundation. The anticipation of increased public sector investment in 2025, following government stability, is expected to convert these agreements into significant orders.

The company's investment in its human capital, including robust vocational training programs, cultivates a skilled workforce essential for delivering high-quality IT services and maintaining its competitive edge.

| Metric | 2023 Value (€ Billion) | 2024 Outlook (General Trend) | 2025 Outlook (General Trend) |

|---|---|---|---|

| Revenue | 6.4 | Growth expected | Continued growth anticipated |

| Acquisitions Completed (Cumulative) | >100 | Ongoing | Ongoing |

| Public Sector Framework Agreements | Significant portion of pipeline | Stable, conversion expected | Conversion anticipated to increase |

What is included in the product

Delivers a strategic overview of Bechtle’s internal and external business factors, highlighting its strengths in market presence and opportunities in digital transformation, while also acknowledging weaknesses in integration and threats from competition.

Offers a clear, actionable framework to identify and address internal weaknesses and external threats, transforming strategic challenges into opportunities.

Weaknesses

Bechtle's significant concentration in the German market presents a notable weakness. This reliance exposes the company to the risks associated with the German economy, which has shown signs of slowing. For instance, Germany's IT spending contracted recently, directly impacting Bechtle's performance.

This over-dependence makes Bechtle vulnerable to economic downturns and hesitant investment within its primary market. The company reported a 5.8% year-on-year revenue decline in Germany during the first quarter of 2025, highlighting this vulnerability. Such headwinds in the German economy can significantly hinder Bechtle's overall growth trajectory.

Bechtle has experienced a notable downturn in its financial performance, with Earnings Before Taxes (EBT) dropping by a significant 32.5% in the first quarter of 2025 when compared to the same period in the prior year. This sharp decline highlights a considerable challenge in maintaining profitability amidst current market conditions.

The company's EBIT margin has also compressed, indicating that for every euro of sales, Bechtle is retaining less profit. This pressure is evident across both its IT System House & Managed Services and its IT E-Commerce segments, suggesting a widespread issue rather than a problem confined to a single business area.

Bechtle has faced significant headwinds from rising operational costs, notably higher personnel expenses stemming from wage inflation and increased non-wage labor costs. For instance, in the first half of 2024, personnel expenses rose by 11.3% year-on-year. This surge in labor costs, coupled with a decrease in bonus payments from manufacturing partners and the discontinuation of certain marketing allowances, has directly impacted the company's profitability.

These cost pressures are not expected to abate soon, with projections indicating their persistence throughout 2025. This ongoing challenge presents a structural impediment to Bechtle's financial performance, requiring strategic cost management to mitigate the impact on earnings.

Slow IT Spending and Investment Reluctance

Challenging macroeconomic conditions have continued to dampen client investment, particularly within the Small and Medium-sized Enterprise (SME) and public sectors through the first half of 2025. This hesitancy directly impacts Bechtle, leading to postponed IT projects and a noticeable slowdown in business volume growth. For instance, Bechtle reported that its IT system house and managed services segment saw only a modest increase in demand during early 2025, a stark contrast to earlier periods.

This subdued demand environment directly affects Bechtle's revenue streams and overall financial performance, as clients adopt a more cautious approach to IT spending. The company anticipates a market recovery, with projections largely pointing towards the second half of 2025 for a significant uptick in investment activity.

- Delayed Project Starts: Many clients are deferring new IT initiatives, impacting Bechtle's order pipeline.

- Reduced IT Budgets: The SME and public sectors, key Bechtle markets, have exhibited a pronounced reluctance to commit to substantial IT investments in H1 2025.

- Slower Growth Trajectory: The cautious spending environment has directly contributed to a slower pace of business volume growth for Bechtle in the early part of the year.

Conservative Full-Year Outlook

Bechtle's conservative full-year outlook presents a notable weakness. Following a mixed and underwhelming start to 2025, marked by a significant earnings decline, the company has issued cautious guidance.

The projected modest business volume growth, coupled with a potential decline or only slight increase in revenue and EBT, highlights an uncertain near-term financial trajectory. This cautious forecast underscores the ongoing challenges Bechtle faces and the critical need for a strong second-half recovery to meet its own expectations.

- Cautious Guidance: Bechtle's full-year outlook for 2025 is conservative, signaling potential headwinds.

- Mixed Start to 2025: The company experienced a mixed and underwhelming beginning to the year, including a significant earnings decline.

- Revenue and EBT Uncertainty: Projections indicate modest business volume growth but a potential decline or slight increase in revenue and EBT.

- Dependence on H2 Recovery: Achieving full-year targets hinges on a strong performance in the latter half of 2025.

Bechtle's heavy reliance on the German market, which experienced a recent IT spending contraction, poses a significant risk. This concentration makes the company particularly susceptible to economic slowdowns in its primary region, as evidenced by a 5.8% year-on-year revenue decline in Germany during Q1 2025.

Rising operational costs, especially personnel expenses which grew by 11.3% in H1 2024 due to wage inflation, are squeezing profitability. These increased costs are expected to persist through 2025, impacting margins across both key business segments.

The company faces subdued demand from its SME and public sector clients, leading to delayed IT projects and slower business volume growth in early 2025. This cautious spending environment directly affects Bechtle's revenue, with a market recovery anticipated only in the latter half of the year.

Bechtle's conservative full-year outlook for 2025 reflects a mixed start to the year, including a substantial earnings decline. Projections for modest business volume growth alongside potential revenue and EBT stagnation highlight ongoing challenges and a dependence on a strong second-half performance.

| Financial Metric | Q1 2025 vs Q1 2024 | H1 2024 vs H1 2023 |

| German Revenue Growth | -5.8% | N/A |

| EBT Change | -32.5% | N/A |

| Personnel Expense Growth | N/A | +11.3% |

| Business Volume Growth (Early 2025) | Modest Increase | N/A |

Preview the Actual Deliverable

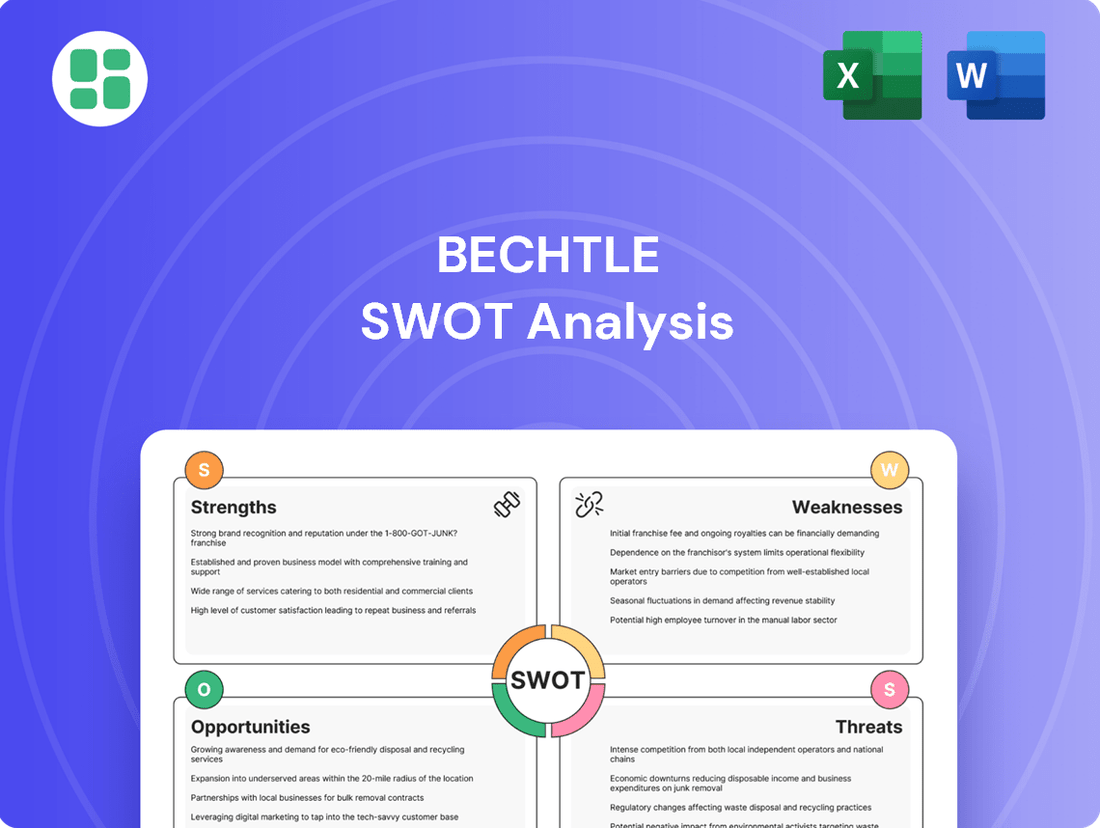

Bechtle SWOT Analysis

This is the actual Bechtle SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full Bechtle SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic considerations for the IT service provider.

Opportunities

Germany's recent political stabilization and the establishment of a new government are poised to boost planning certainty for public sector clients. This renewed confidence is expected to translate into substantial investments, particularly in the latter half of 2025.

Bechtle's substantial backlog of framework agreements, valued at €7.7 billion as of the first quarter of 2024, is well-positioned to benefit from this anticipated spending increase. This could see a significant portion of these agreements convert into tangible incoming orders, reigniting growth within this crucial customer segment.

The approaching end of support for Microsoft Windows 10 in autumn 2025 creates a significant migration wave, offering a prime opportunity for Bechtle. This event historically drives demand for hardware refreshes, software updates, and comprehensive migration and support services as businesses transition to newer operating systems like Windows 11.

This anticipated surge in IT infrastructure renewal is expected to directly benefit Bechtle's system house operations. We foresee a substantial uplift in sales of new devices and a corresponding increase in demand for Bechtle's expert IT consulting, implementation, and ongoing support services, thereby boosting overall revenue streams.

The accelerating integration of Artificial Intelligence (AI) and cloud computing across diverse business sectors presents a substantial opportunity for Bechtle. Bechtle's proactive investments in AI solutions and multi-cloud strategies, including specialized AI applications, are well-aligned to capitalize on this expanding market. The ongoing digital transformation trend guarantees a persistent demand for these sophisticated IT services, with the global AI market projected to reach over $1.5 trillion by 2030, and cloud computing adoption continuing its upward trajectory.

Potential for International Market Expansion

While the German market presents some challenges, Bechtle is seeing positive traction in international arenas. The company has noted modest growth in key markets like the UK and France, bolstered by strategic acquisitions in Belgium and the Netherlands. This trend highlights a significant opportunity to broaden its revenue base and lessen dependence on its home market by deepening its presence across other European nations.

Further investment in international expansion could unlock substantial growth. For instance, Bechtle's 2023 annual report indicated a revenue increase in its international segments, suggesting a receptive market for its IT services and solutions. This diversification strategy is crucial for mitigating risks associated with regional economic downturns.

- UK and France Growth: Bechtle has experienced positive revenue contributions from its UK and French operations, indicating market acceptance.

- Acquisition Strategy: Recent acquisitions in Belgium and the Netherlands are already contributing to international revenue, demonstrating successful integration.

- Diversification Benefits: Expanding into new European territories can reduce Bechtle's exposure to the German market's specific economic cycles.

- Market Penetration: There is scope to increase market share in existing international locations and explore new, underserved European markets.

Leveraging Digital Transformation Trends

The relentless push towards digitalization across all industries presents a significant opportunity for Bechtle. Businesses and public sector organizations are consistently investing in modernizing their IT infrastructure to remain competitive and efficient. This ongoing need for digital transformation, encompassing everything from cloud migration to advanced cybersecurity, directly benefits Bechtle's comprehensive IT service offerings.

Bechtle is strategically positioned to capitalize on this trend, acting as a key partner for entities navigating their digital journeys. The company's ability to provide end-to-end IT solutions, including consulting, implementation, and managed services, aligns perfectly with the market's demand. For instance, in 2024, IT spending on digital transformation initiatives was projected to reach over $2.3 trillion globally, highlighting the immense market potential.

- Growing Demand for Cloud Services: The shift to cloud computing continues to accelerate, with global public cloud spending expected to grow by 20.4% in 2024 to $679 billion, according to Gartner. Bechtle's expertise in cloud solutions is a direct advantage.

- Increased Cybersecurity Investments: As digital footprints expand, so do cyber threats. Businesses are prioritizing cybersecurity, with global spending on security and risk management expected to reach $272 billion in 2024, a 14.5% increase from 2023. Bechtle's security services are crucial here.

- Managed Services for Efficiency: Companies are increasingly outsourcing IT management to focus on core business functions. The global managed services market is projected to reach $362 billion by 2025, indicating strong demand for Bechtle's managed IT services.

The ongoing digital transformation across all industries presents a significant opportunity for Bechtle, as businesses and public sector organizations invest in modernizing their IT infrastructure. This consistent need for digital upgrades, from cloud adoption to advanced cybersecurity, directly benefits Bechtle's comprehensive IT service offerings.

Bechtle is well-positioned to assist entities in their digital journeys, offering end-to-end IT solutions. The global IT spending on digital transformation initiatives was projected to exceed $2.3 trillion in 2024, underscoring the vast market potential Bechtle can tap into.

The accelerating integration of Artificial Intelligence (AI) and cloud computing across various business sectors offers a substantial growth avenue. Bechtle's investments in AI solutions and multi-cloud strategies align perfectly with this expanding market, with the global AI market anticipated to surpass $1.5 trillion by 2030.

The impending end of support for Microsoft Windows 10 in late 2025 is expected to trigger a significant wave of IT hardware and software upgrades, driving demand for Bechtle's migration and support services.

Threats

Persistent macroeconomic uncertainty remains a significant threat to Bechtle. Economic slowdowns and persistent inflation across Europe, a key market for Bechtle, directly impact customer IT budgets. For instance, in Q1 2024, Bechtle reported a 3.5% revenue increase, a slowdown from previous periods, partly attributable to cautious customer spending amidst ongoing economic volatility.

The IT services market is a crowded space, with major competitors like SoftwareONE Group, Cancom, Kontron, Insight, and CDW vying for market share. This intense rivalry puts pressure on pricing and can squeeze profit margins.

To stand out, Bechtle needs to constantly innovate and prove its unique value proposition. For instance, in 2023, Bechtle's revenue grew by 11.4% to €6.4 billion, demonstrating its ability to compete effectively, but maintaining this growth requires ongoing differentiation against these established players.

Bechtle's strategic investments in areas like AI, cloud, and cybersecurity, while promising, carry significant execution risks. Successfully integrating these complex technologies and developing profitable solutions is a major hurdle. For instance, if Bechtle fails to achieve its projected return on investment for its new AI platform, it could lead to resource strain, particularly with the ongoing inflationary pressures impacting IT spending, which saw growth moderate in early 2024.

Pressure from Supplier Relationships and Rebates

Bechtle faces a significant threat from declining bonus payments from manufacturing partners, as evidenced by a Q1 2025 observation. This trend can directly squeeze gross profit margins and negatively impact overall profitability. For instance, a 5% reduction in partner rebates could translate to millions in lost earnings for a company of Bechtle's scale.

Maintaining strong, collaborative relationships with key technology suppliers is paramount to counter this pressure. The ability to negotiate favorable terms and secure continued support through these partnerships is critical for Bechtle's financial health.

- Declining Partner Bonuses: A observed drop in Q1 2025 bonus payments signals potential shifts in supplier power.

- Profitability Impact: Reduced rebates directly threaten Bechtle's gross profit and overall financial performance.

- Strategic Importance: Cultivating and preserving strong ties with core technology manufacturers is essential for mitigating this threat.

Talent Shortages and Wage Inflation

The IT sector continues to struggle with finding and keeping qualified workers, a problem that directly affects companies like Bechtle. This persistent talent shortage means that competition for skilled professionals is fierce, driving up labor costs.

In the first quarter of 2025, Bechtle experienced a significant impact on its earnings due to rising personnel expenses. These costs encompass not only higher wages but also increased non-wage benefits and recruitment expenses, all contributing to a tougher financial environment.

The ongoing demand for IT expertise, coupled with these escalating labor costs, presents a clear threat to Bechtle's future profitability. If this trend continues, it could hinder the company's ability to expand its operations or maintain the efficiency of its service delivery, potentially impacting client satisfaction and market share.

- Talent Gap: The global IT talent shortage is projected to worsen, with estimates suggesting millions of unfilled roles by 2025.

- Wage Inflation: Average IT salaries saw an increase of 8-12% in 2024, with further upward pressure expected in 2025.

- Increased Overhead: Non-wage labor costs, such as benefits and training, have also risen by an estimated 5-7% in the past year.

- Operational Strain: Companies may face challenges in scaling operations to meet demand without adequate staffing, leading to potential service delays or quality issues.

Intensifying competition from established players and emerging IT solution providers poses a significant threat, potentially eroding Bechtle's market share and pricing power. For instance, competitors like SoftwareONE and CDW have been actively expanding their service portfolios and geographical reach in 2024, intensifying the pressure on Bechtle.

The ongoing macroeconomic uncertainty, particularly in key European markets, continues to dampen customer IT spending. Bechtle's Q1 2025 results showed a moderation in revenue growth to 3.5%, reflecting this cautious spending environment driven by inflation and economic slowdown fears.

Bechtle's strategic investments in advanced technologies like AI and cloud carry inherent execution risks, with the potential for misallocation of resources if market adoption or profitability targets are not met. The company's ability to successfully integrate these complex solutions and demonstrate clear ROI is crucial, especially given the increased cost of capital in 2025.

| Threat Category | Specific Concern | Impact on Bechtle | 2024/2025 Data Point |

| Competition | Market Saturation & Aggressive Competitors | Pressure on pricing, reduced market share | Competitor expansion in 2024 |

| Macroeconomic Factors | Economic Slowdown & Inflation | Reduced IT budgets, cautious spending | Q1 2025 revenue growth of 3.5% |

| Execution Risk | Integration of New Technologies (AI, Cloud) | Resource strain, potential ROI miss | Increased R&D investment in 2024 |

SWOT Analysis Data Sources

This Bechtle SWOT analysis is built upon a robust foundation of data, including Bechtle's official financial reports, comprehensive market intelligence from reputable industry analysts, and expert opinions from seasoned IT sector professionals. These sources collectively provide a well-rounded and accurate view of the company's strategic position.