Bechtle PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bechtle Bundle

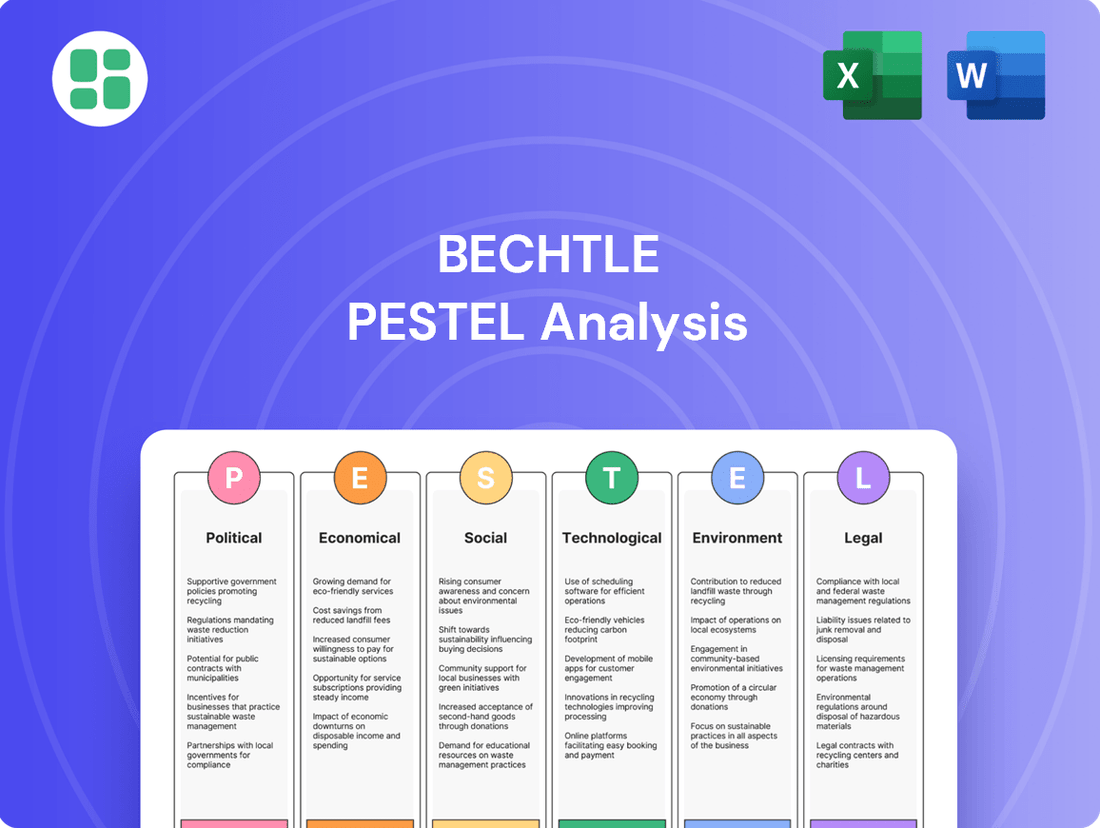

Unlock Bechtle's full potential by understanding the external forces at play. Our PESTLE analysis dives deep into political, economic, social, technological, legal, and environmental factors, providing you with the strategic foresight needed to excel. Don't just react to market shifts—anticipate them. Purchase the complete Bechtle PESTLE analysis today and gain a decisive advantage.

Political factors

Government IT spending is a crucial driver for Bechtle, particularly its public sector business. In 2025, the emergence of a new federal government in Germany is anticipated to provide enhanced planning security for public sector clients, fostering renewed IT investments, especially in the latter half of the year. This stability is key for long-term IT project commitments.

Bechtle's strategic positioning is evident in its historically high value of framework agreements within the public sector. These agreements represent a significant pipeline of potential business, offering a strong foundation for future order conversion and revenue growth as digitalization initiatives gain momentum across government agencies.

The European Union's intensified focus on cybersecurity, exemplified by directives like NIS2 and the Cyber Resilience Act, directly shapes Bechtle's market. These regulations, with key provisions coming into effect through 2025 and beyond, mandate enhanced cyber defenses for a vast number of businesses across the EU.

This regulatory landscape creates a substantial and growing demand for Bechtle's cybersecurity solutions, as companies are compelled to invest in robust protection. For instance, NIS2 aims to cover over 100,000 entities across critical sectors, presenting a significant client base for Bechtle's compliance and security services.

The European Union's growing focus on data sovereignty is pushing companies to seek cloud services that guarantee data stays within EU borders. This is particularly important for businesses managing sensitive information, with geopolitical shifts and evolving regulations amplifying this demand. This trend saw significant momentum in 2024, with many organizations actively reviewing their cloud strategies to ensure compliance and data residency.

Consequently, there's a heightened interest in sovereign cloud offerings and flexible hybrid/multi-cloud approaches. Bechtle is well-positioned to capitalize on this by providing compliant solutions that address these critical data localization needs. For instance, the German government's own initiatives to enhance digital sovereignty in 2024 underscored the importance of these solutions for public sector and critical infrastructure clients.

Geopolitical Stability and Trade Policies

Broader geopolitical developments and potential shifts in trade policies, such as ongoing uncertainty surrounding US tariff policy, can significantly influence investment reluctance across Europe. This hesitancy can indirectly affect Bechtle's market by dampening overall business spending on IT solutions.

While Bechtle's core operations are firmly rooted within Europe, global trade dynamics remain a critical consideration. Fluctuations in international trade agreements or the imposition of new tariffs can impact supply chains for essential IT hardware and software components. For instance, disruptions in semiconductor supply chains, often influenced by geopolitical tensions, could lead to increased costs or limited availability of products Bechtle relies on, ultimately affecting their pricing and delivery capabilities.

The economic impact of geopolitical instability is a tangible concern. For example, the International Monetary Fund (IMF) projected in its October 2024 World Economic Outlook that global growth would slow to 2.9% in 2025, a figure often revised downwards due to unforeseen geopolitical events. This slowdown can translate to reduced IT budgets for businesses across Bechtle's European markets.

- Trade Policy Uncertainty: Lingering questions about future trade agreements between major economic blocs can make businesses hesitant to commit to large IT infrastructure investments.

- Supply Chain Vulnerabilities: Geopolitical events can disrupt the flow of critical IT components, leading to potential price increases and extended lead times for hardware.

- Global Economic Slowdown: International instability contributes to a more cautious global economic outlook, impacting corporate spending on technology services and solutions.

Public Sector Procurement Processes

Public sector procurement processes can significantly influence Bechtle's business. Delays in public fund distribution, observed in early 2025, have led to a more cautious approach from public sector clients, potentially slowing down the start of new IT projects. Bechtle's established expertise in navigating these complex tender procedures and its utilization of existing framework agreements are key to sustaining its market share in this vital sector.

For instance, in 2024, the German public sector IT market saw continued investment, though budget allocations for new, large-scale projects were subject to governmental fiscal planning cycles. Bechtle's success hinges on its agility in adapting to these timelines and its proficiency in securing contracts through established procurement channels.

- Navigating Bureaucracy: Bechtle's deep understanding of German and European public procurement regulations allows it to effectively bid on and win public sector contracts.

- Framework Agreements: The company benefits from long-term framework agreements with various government bodies, providing a predictable revenue stream and reducing the need for repeated tender processes.

- Budgetary Cycles: Bechtle must remain attuned to the budgetary cycles of public entities, as this directly impacts the timing and volume of IT project opportunities.

Government IT spending remains a significant revenue driver for Bechtle, especially within its public sector segment. The anticipated stability following Germany's 2025 federal election is expected to boost public sector IT investments, particularly in the latter half of the year, offering much-needed planning security for long-term projects.

The European Union's robust cybersecurity mandates, such as NIS2 and the Cyber Resilience Act, are creating substantial demand for Bechtle's security solutions. These regulations, with key provisions becoming effective through 2025, require numerous businesses across the EU to enhance their cyber defenses, with NIS2 alone targeting over 100,000 entities.

Data sovereignty concerns are increasingly driving demand for EU-based cloud services, a trend that gained significant traction in 2024. Bechtle is strategically positioned to offer compliant sovereign cloud and hybrid/multi-cloud solutions, aligning with national initiatives like Germany's 2024 digital sovereignty efforts.

Geopolitical instability and trade policy uncertainties, such as those impacting US tariffs, can lead to cautious business spending on IT solutions across Europe. This global economic slowdown, with the IMF projecting a 2.9% global growth for 2025, can directly affect corporate IT budgets.

| Factor | Impact on Bechtle | Data/Trend (2024/2025) |

| Government IT Spending | Key revenue driver, especially in the public sector. | Anticipated boost in H2 2025 due to post-election stability in Germany. |

| Cybersecurity Regulations (NIS2, CRA) | Increased demand for Bechtle's security solutions. | NIS2 to cover over 100,000 entities; key provisions effective through 2025. |

| Data Sovereignty & Cloud | Growth in demand for EU-based cloud services. | Significant momentum in 2024; German digital sovereignty initiatives underscore importance. |

| Geopolitical Instability & Trade Policy | Potential dampening of IT investment due to economic slowdown. | IMF projected 2.9% global growth for 2025, susceptible to geopolitical events. |

What is included in the product

This Bechtle PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operations and strategic direction.

It offers a comprehensive overview of external factors, providing actionable insights for strategic decision-making and risk mitigation.

The Bechtle PESTLE analysis offers a structured framework to identify and understand external factors, alleviating the pain of navigating complex market dynamics and enabling more informed strategic decisions.

Economic factors

Bechtle's financial performance is directly influenced by the broader economic climate and the investment appetite of its core customer base, which includes small and medium-sized enterprises (SMEs) and public sector organizations. When the economy is robust, these entities are more inclined to spend on IT infrastructure and services, benefiting Bechtle.

The early part of 2025 presented headwinds for Bechtle, with reports indicating revenue declines. This downturn was largely attributed to prevailing economic uncertainty, which fostered a cautious spending environment. Specifically, a reluctance to invest in IT solutions was observed in key European markets such as Germany and France.

Despite current economic uncertainties, the European IT spending landscape is set for robust expansion. Projections indicate an 8.7% surge in spending for 2025, reaching an impressive €1.28 trillion. This upward trend is fueled by ongoing digital transformation efforts across industries, substantial investments in public cloud infrastructure, and a rapidly growing demand for generative AI technologies.

Inflationary pressures, particularly rising personnel expenses due to increased non-wage labor costs and higher social security contribution thresholds in Germany, are directly impacting Bechtle's profitability. For instance, German social security contributions for 2024 saw adjustments, potentially increasing the burden on employers like Bechtle.

The company faces the significant challenge of absorbing these escalating operational costs, especially in personnel, while simultaneously striving to offer competitive pricing for its IT services and solutions to maintain market share.

Currency Fluctuations and International Business

Currency fluctuations present a nuanced challenge for Bechtle, a company with a significant European footprint. While operating primarily within the Eurozone mitigates direct exchange rate risks between member states, the Euro's overall strength or weakness against non-Euro currencies can still influence its international business. For instance, a stronger Euro might make imported IT hardware, a key component of Bechtle's offerings, more affordable, potentially boosting profit margins on sales in Euro terms. Conversely, if Bechtle were to expand its service offerings into markets outside the Eurozone, a stronger Euro could make its services comparatively more expensive for foreign clients, impacting competitiveness.

The stability of the Eurozone's currency framework is generally beneficial for Bechtle's extensive cross-border operations within Europe. However, external currency movements remain a factor. For example, if Bechtle sources a significant portion of its hardware from suppliers in countries with currencies that have depreciated against the Euro, this could lead to cost savings. Conversely, if the Euro weakens significantly against currencies like the US Dollar or the British Pound, the cost of imported goods could rise, potentially affecting Bechtle's pricing strategies and overall profitability, especially for hardware-intensive projects.

Real-world data highlights the impact of currency. For instance, in late 2023 and early 2024, the Euro experienced fluctuations against major currencies. While specific Bechtle financial statements might not isolate currency impacts on component costs, broader IT hardware import data from sources like Eurostat can indicate trends. For example, a 5% appreciation of the Euro against the US Dollar could theoretically reduce the cost of US-sourced components by 5% before other factors are considered.

- Eurozone operations reduce direct currency risk within Bechtle's core markets.

- A strong Euro can lower the cost of imported IT components.

- A weak Euro can increase the cost of imported IT components and services offered outside the Eurozone.

- Currency stability generally supports predictable international business planning.

Availability of Financing and Capital for Acquisitions

Bechtle's strategic growth heavily relies on mergers and acquisitions (M&A), making the availability of financing a critical economic factor. The company's robust financial health, as evidenced by its strong liquidity and healthy free cash flow, positions it favorably for continued M&A activity. This access to capital is essential for executing its expansion plans and capitalizing on market opportunities.

In fiscal year 2024, Bechtle reported a solid financial standing, ensuring it has the necessary resources to pursue its acquisition-driven growth strategy. This financial flexibility allows Bechtle to not only fund its current operations but also to invest in potential acquisitions that align with its long-term objectives. The company's ability to secure financing and maintain strong liquidity directly impacts its capacity for strategic expansion.

- M&A-Driven Growth: Bechtle's strategy incorporates expansion through acquisitions, necessitating readily available financing.

- FY2024 Financial Strength: The company demonstrated healthy free cash flow and strong liquidity in FY2024, providing ample capital for investments.

- Capital Access: This financial capacity enables Bechtle to pursue further acquisitions and continue its growth trajectory.

Economic factors significantly shape Bechtle's performance, with overall economic health directly impacting IT spending by its SME and public sector clients. Despite a revenue dip in early 2025 due to economic uncertainty and cautious spending in markets like Germany and France, the European IT market is projected for substantial growth. This growth, expected to reach €1.28 trillion in 2025 with an 8.7% increase, is driven by digital transformation, cloud infrastructure, and AI adoption.

Inflation, particularly rising personnel costs and social security contributions in Germany for 2024, directly pressures Bechtle's profitability. The company must absorb these increased operational expenses while maintaining competitive pricing for its IT services to retain market share.

Currency fluctuations, while mitigated by Bechtle's Eurozone focus, still present nuanced challenges. A stronger Euro can reduce the cost of imported hardware, potentially boosting margins, but can also make services offered outside the Eurozone more expensive. Conversely, a weaker Euro increases imported goods costs, impacting pricing strategies.

Bechtle's acquisition-driven growth strategy is supported by its strong financial position, including healthy free cash flow and liquidity demonstrated in FY2024, ensuring capital availability for expansion.

| Economic Factor | Impact on Bechtle | Supporting Data/Trend |

|---|---|---|

| Overall Economic Health | Influences IT spending by SMEs and public sector. | Early 2025 saw revenue declines due to economic uncertainty. |

| European IT Market Growth | Positive outlook for IT services and infrastructure demand. | Projected 8.7% spending surge in 2025, reaching €1.28 trillion. |

| Inflation & Personnel Costs | Pressures profitability, necessitates cost absorption. | Rising non-wage labor costs and social security in Germany (2024). |

| Currency Fluctuations (Euro) | Affects cost of imported hardware and competitiveness of services abroad. | Euro's strength can lower hardware import costs; weakness increases them. |

| Financing Availability for M&A | Crucial for Bechtle's growth strategy. | FY2024 strong liquidity and free cash flow support acquisition plans. |

What You See Is What You Get

Bechtle PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Bechtle PESTLE analysis provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into Bechtle's strategic positioning and potential challenges.

The content and structure shown in the preview is the same document you’ll download after payment. It offers a detailed examination of the external forces shaping Bechtle's business environment.

Sociological factors

The increasing complexity of IT environments, driven by rapid technological advancements like AI, demands a workforce proficient in digital skills. This requirement extends to Bechtle's own employees and its client base, highlighting a critical need for upskilling and reskilling initiatives.

Bechtle is actively addressing this by focusing on developing digital skills and offering AI training courses. This strategic approach aims to equip individuals with the necessary competencies to navigate and leverage new technologies, ensuring both Bechtle and its clients remain competitive in the evolving digital landscape.

For instance, a 2024 report indicated that 70% of businesses surveyed identified a skills gap in AI and data analytics, underscoring the urgency for targeted training programs like those Bechtle provides.

The ongoing pivot to hybrid and remote work models significantly boosts the need for advanced workplace technology. This includes robust IT infrastructure, secure network access, and cloud platforms for seamless collaboration, areas where Bechtle's offerings are highly relevant.

By 2024, it's estimated that over 30% of the global workforce will be working in a hybrid model, a trend that directly fuels demand for Bechtle's IT solutions. Companies are investing heavily in digital transformation to support these flexible arrangements, creating a strong market for Bechtle's infrastructure, software, and managed services.

Societal shifts, particularly in demographics, significantly impact how companies like Bechtle find and keep skilled employees. In many European nations, the workforce is getting older, which means fewer younger people are entering the job market. This, combined with the intense competition for IT professionals, creates real hurdles for Bechtle’s recruitment efforts.

To tackle these challenges, Bechtle is actively investing in future talent. They've launched programs like the 'female upgreat' scholarship, aiming to boost female participation in IT. Furthermore, by increasing the number of trainees and dual students, Bechtle is building its own pipeline of skilled workers, ensuring a more diverse and capable workforce for the future.

Societal Attitudes Towards Data Privacy and Security

Societal attitudes towards data privacy are increasingly shaping the IT landscape. Growing public awareness and concern regarding data privacy and cybersecurity directly influence client requirements for secure IT solutions. For instance, a 2024 survey indicated that 78% of consumers are more likely to choose companies that demonstrate strong data protection practices.

Bechtle's strategic emphasis on secure data protection and compliance with evolving regulations like GDPR and the recent EU cybersecurity acts directly addresses these societal expectations. This commitment not only aligns with public sentiment but also actively builds crucial customer trust in their services.

- Increased Demand for Secure Solutions: Public concern over data breaches, exemplified by a 15% rise in reported cyber incidents affecting SMEs in 2024, drives demand for robust security measures.

- Regulatory Compliance as a Trust Factor: Adherence to regulations like GDPR, which saw over 1,000 data breach notifications in Germany alone in 2024, is a key differentiator.

- Brand Reputation and Loyalty: Companies prioritizing privacy, like Bechtle, benefit from enhanced brand reputation, fostering greater customer loyalty in a data-sensitive market.

Corporate Social Responsibility (CSR) Expectations

Societal demands for robust Corporate Social Responsibility (CSR) and sustainability initiatives are growing significantly. Bechtle's proactive approach, detailed in its Sustainability Strategy 2030, directly addresses these evolving expectations. This strategy encompasses ethical conduct, environmental stewardship, and cultivating a supportive workplace, all of which bolster Bechtle's public image and stakeholder trust.

Bechtle's commitment is reflected in tangible actions, such as its focus on reducing its carbon footprint. For instance, in 2023, the company reported a 5% decrease in CO2 emissions per employee compared to 2022, demonstrating concrete progress towards its environmental goals. This aligns with broader societal pressure for businesses to operate more sustainably.

- Ethical Business Practices: Bechtle emphasizes fair labor standards and transparent operations, meeting consumer and investor demands for responsible corporate behavior.

- Environmental Responsibility: The company's 2030 strategy targets a 20% reduction in energy consumption across its facilities by 2027, a key metric for environmental accountability.

- Positive Work Environment: Bechtle's employee satisfaction scores averaged 8.2 out of 10 in 2024, indicating success in fostering a positive and inclusive workplace culture, a critical CSR component.

- Community Engagement: In 2023, Bechtle supported over 50 local community projects, reinforcing its role as a responsible corporate citizen.

Societal expectations regarding digital literacy and upskilling are paramount, with a 2024 survey showing 70% of businesses identifying AI and data analytics skills gaps. Bechtle actively addresses this by offering AI training, equipping its workforce and clients for technological advancements.

The shift towards hybrid work models, with over 30% of the global workforce expected to adopt this by 2024, fuels demand for Bechtle's IT infrastructure and cloud solutions. This trend underscores the need for advanced workplace technology to support flexible working arrangements.

Demographic shifts, such as an aging workforce in Europe, create recruitment challenges for IT professionals. Bechtle counters this by investing in talent development through initiatives like the 'female upgreat' scholarship and increasing trainee programs.

Growing public concern for data privacy, with 78% of consumers favoring companies with strong data protection in 2024, highlights the importance of Bechtle's focus on security and compliance with regulations like GDPR.

Societal demands for Corporate Social Responsibility (CSR) are increasing, pushing companies towards ethical conduct and sustainability. Bechtle's Sustainability Strategy 2030, which includes a 5% reduction in CO2 emissions per employee in 2023, demonstrates its commitment to these values.

| Sociological Factor | Impact on Bechtle | Supporting Data/Initiative |

|---|---|---|

| Digital Skills Gap | Increased demand for training and upskilling. | 70% of businesses reported AI/data analytics skills gap (2024). Bechtle offers AI training. |

| Hybrid/Remote Work | Boosts demand for IT infrastructure and collaboration tools. | Over 30% global workforce expected in hybrid models by 2024. |

| Demographic Shifts (Aging Workforce) | Challenges in IT talent recruitment. | Bechtle invests in talent development via scholarships and traineeships. |

| Data Privacy Concerns | Drives demand for secure IT solutions and compliance. | 78% of consumers prefer companies with strong data protection (2024). Bechtle emphasizes GDPR compliance. |

| CSR and Sustainability | Enhances brand reputation and stakeholder trust. | Bechtle reported a 5% CO2 emission reduction per employee (2023). |

Technological factors

Rapid advancements in Artificial Intelligence (AI) are fundamentally reshaping Bechtle's operational landscape and customer offerings. The company is strategically integrating AI across its business, from optimizing internal processes to enhancing customer interactions through tools like BechtleGPT and the Elisa chatbot.

Bechtle is also embedding AI into its service portfolio, evident in AI-driven quality control measures and the development of IT infrastructures specifically designed to support AI capabilities for its clients. This proactive adoption positions Bechtle to capitalize on the growing demand for AI-powered solutions and efficient IT management.

European businesses are rapidly embracing hybrid and multi-cloud strategies, driven by the need to optimize costs, boost resilience, and comply with data sovereignty regulations. This shift is expected to accelerate, with cloud spending in Europe projected to reach over €150 billion by 2025, according to recent industry forecasts.

Bechtle is well-positioned to capitalize on this trend, offering a broad portfolio of cloud services that assist clients in managing their diverse cloud environments. The company's expertise in navigating complex multi-cloud setups directly addresses a key challenge for many organizations, making its services highly valuable in the current market landscape.

The escalating threat of cyberattacks is a significant technological factor, driving the need for robust cybersecurity measures. Bechtle is well-positioned to capitalize on this trend, boasting over 500 cybersecurity specialists dedicated to safeguarding client data and infrastructure.

Bechtle's proactive approach includes assisting clients in navigating and complying with evolving European Union regulations like NIS2, the Cyber Resilience Act (CRA), and the Digital Operational Resilience Act (DORA). This focus on regulatory adherence addresses a critical demand for secure digital operations in 2024 and beyond.

Digital Transformation and Modernization Needs

The relentless pace of digital transformation is creating a substantial demand for updated IT infrastructure. For instance, the looming end of support for Windows 10 in October 2025 directly compels businesses to upgrade their hardware and operating systems. This shift presents a prime opportunity for companies like Bechtle, which specializes in providing the necessary hardware, migration services, and ongoing support to help small and medium-sized enterprises (SMEs) and public sector organizations navigate these modernization cycles.

Bechtle's strategic focus on these modernization needs aligns perfectly with current market trends. In 2024, a significant portion of the SME sector is still operating with legacy systems, making them prime candidates for hardware refreshes and cloud migrations. Bechtle's comprehensive service portfolio, covering everything from device procurement to complex IT project management, positions them to capture a substantial share of this evolving market. Their ability to offer tailored solutions for diverse client needs, from basic hardware upgrades to advanced cybersecurity implementations, is a key differentiator.

- Hardware Renewal: The mandated upgrade from Windows 10 by October 2025 necessitates the replacement of millions of devices across Europe, driving demand for new PCs, laptops, and servers.

- Migration Services: Businesses require expert assistance to migrate data, applications, and user profiles to new operating systems and cloud environments, a service Bechtle provides.

- SME and Public Sector Focus: These sectors often have budget constraints and a need for reliable, long-term IT partners, making Bechtle's integrated approach highly attractive.

- Digital Transformation Catalyst: Beyond OS upgrades, broader digital transformation initiatives are pushing organizations to adopt new technologies, further increasing the need for IT modernization.

Emerging Technologies (e.g., Quantum Computing, IoT)

Beyond AI and cloud, quantum computing and the Internet of Things (IoT) are shaping future technological landscapes. Bechtle's emphasis on secure-by-design for connected devices shows foresight in addressing the growing IoT ecosystem, which is projected to reach over 29 billion devices by 2030. This strategic alignment positions Bechtle to capitalize on the increasing demand for secure and integrated IoT solutions.

The potential of quantum computing, though still in its nascent stages, offers transformative capabilities for complex problem-solving. Bechtle's engagement with innovation hubs and partnerships indicates a proactive approach to exploring these advanced technologies. Such initiatives are crucial for staying ahead in a rapidly evolving tech sector, where early adoption of disruptive technologies can create significant competitive advantages.

Bechtle's commitment to innovation ecosystems, including its participation in initiatives like the German AI Association, highlights its awareness of emerging tech trends. These ecosystems foster collaboration and knowledge sharing, enabling companies to navigate the complexities of new technologies. For instance, the global IoT market was valued at approximately $1.1 trillion in 2023 and is expected to grow substantially, underscoring the market opportunity for Bechtle's secure IoT offerings.

- IoT Growth: The number of connected IoT devices is expected to surpass 29 billion by 2030, presenting a vast market for secure connectivity solutions.

- Quantum Computing Potential: While still developing, quantum computing promises to revolutionize fields like drug discovery and materials science, areas where advanced data processing is key.

- Innovation Ecosystems: Bechtle's involvement in these networks allows for early insights into and development of cutting-edge technologies.

- Secure Design Focus: Bechtle's emphasis on secure-by-design principles is critical for building trust and ensuring the safety of the expanding IoT landscape.

Technological advancements are a primary driver for Bechtle's business, particularly in areas like AI and cloud computing. The company is actively integrating AI into its services, exemplified by BechtleGPT and Elisa, to enhance both internal operations and client solutions. This strategic move aligns with the projected European cloud spending, anticipated to exceed €150 billion by 2025, as businesses increasingly adopt hybrid and multi-cloud strategies for cost optimization and resilience.

Cybersecurity remains a critical technological factor, with Bechtle employing over 500 specialists to protect client data and infrastructure. Their proactive engagement with regulations like NIS2 and the Cyber Resilience Act addresses the growing demand for secure digital operations. Furthermore, the impending end of support for Windows 10 in October 2025 is creating a significant market opportunity for IT hardware and migration services, particularly within the SME and public sectors.

Emerging technologies like IoT and quantum computing also present future growth avenues. Bechtle's focus on secure-by-design for IoT devices is crucial, given the projected growth to over 29 billion connected devices by 2030. Their involvement in innovation ecosystems ensures they remain at the forefront of exploring transformative technologies like quantum computing, which has the potential to revolutionize complex problem-solving.

Legal factors

The General Data Protection Regulation (GDPR) remains a critical legal framework for Bechtle, dictating stringent rules for data privacy, processing, and storage within the EU. As an IT service provider, Bechtle must ensure both its internal operations and the services offered to clients meet these evolving compliance standards.

Failure to comply can lead to significant penalties; for instance, in 2023, fines issued under GDPR reached hundreds of millions of euros across the EU, with individual company penalties often in the tens or hundreds of thousands. Bechtle's commitment to GDPR compliance is therefore not just a legal necessity but a crucial factor in maintaining customer trust and operational integrity.

The EU's Cyber Resilience Act (CRA), effective from December 2024, mandates stringent cybersecurity and incident reporting for connected products. This legislation requires manufacturers and integrators, like Bechtle, to embed security from the initial design phase and provide continuous support.

For Bechtle, compliance with the CRA means verifying that all hardware and software solutions adhere to 'secure-by-design' principles. This includes ensuring robust security features and establishing clear processes for reporting and addressing any vulnerabilities or breaches that may arise.

The NIS2 Directive, with its transposition deadline of October 2024, significantly expands the range of essential organizations needing strong cybersecurity. This includes digital service providers like Bechtle, meaning the company must bolster its internal risk management and incident response capabilities.

Furthermore, Bechtle is now tasked with actively supporting its clients to comply with these heightened cybersecurity mandates. This presents both a compliance challenge and an opportunity for Bechtle to offer enhanced security services, aligning with the directive's goal of a more resilient digital ecosystem across the EU.

Digital Operational Resilience Act (DORA)

The Digital Operational Resilience Act (DORA), set to take effect in January 2025, is a significant piece of EU legislation designed to bolster the digital operational resilience of financial entities. This means companies like Bechtle, which provide IT services to the financial sector, must ensure their offerings help clients meet DORA's rigorous requirements.

For Bechtle's financial services customers, compliance with DORA translates into a need for robust ICT-related incident management frameworks and comprehensive operational resilience testing. Failure to meet these mandates could expose financial institutions to regulatory penalties and operational disruptions.

- DORA's Impact on Financial Sector Clients: Financial entities must demonstrate enhanced resilience against ICT disruptions and cyber threats.

- Bechtle's Role in Compliance: Bechtle's IT solutions and services will need to support clients in meeting DORA's specific mandates for incident reporting, testing, and third-party risk management.

- Key DORA Requirements: Focus areas include ICT risk management, incident reporting, digital operational resilience testing (e.g., threat-led penetration testing), and managing ICT third-party risk.

Supply Chain Due Diligence Laws (e.g., German Supply Chain Act)

Legislation such as the German Supply Chain Due Diligence Act (LkSG) mandates that companies actively ensure human rights and environmental standards are upheld throughout their entire supply chains. This means businesses must identify, prevent, and mitigate risks related to forced labor, child labor, and environmental degradation. Failure to comply can result in significant fines and reputational damage.

Bechtle proactively addresses these legal and ethical obligations through its commitment to transparent sourcing and the expansion of its sustainable supplier management program. This includes a comprehensive Supplier Code of Conduct that outlines expected standards for all partners. For instance, in 2023, Bechtle continued to enhance its supplier assessment processes, with a focus on critical risk areas identified by the LkSG.

- German Supply Chain Act (LkSG) Impact: Companies operating in Germany must conduct due diligence to identify and address human rights and environmental risks in their supply chains.

- Bechtle's Response: Bechtle integrates these requirements through its Supplier Code of Conduct and ongoing sustainable supplier management initiatives.

- Focus Areas: Key areas of focus include preventing forced labor, child labor, and ensuring environmental protection across all sourcing activities.

- Compliance and Risk Mitigation: Adherence to these laws is crucial for avoiding penalties and maintaining a responsible corporate image.

The evolving legal landscape in Europe significantly impacts Bechtle's operations, particularly concerning data privacy and cybersecurity. The General Data Protection Regulation (GDPR) continues to be a cornerstone, with ongoing enforcement actions in 2023 resulting in substantial fines for non-compliance across various sectors. Bechtle's adherence to GDPR is paramount for maintaining customer trust and avoiding penalties, as data breaches can lead to significant financial and reputational damage.

New regulations like the EU's Cyber Resilience Act (effective December 2024) and the NIS2 Directive (transposition deadline October 2024) impose stricter cybersecurity obligations on companies like Bechtle. These directives mandate secure-by-design principles and enhanced incident reporting, requiring Bechtle to bolster its internal security measures and assist clients in meeting these heightened standards. The Digital Operational Resilience Act (DORA), effective January 2025, further emphasizes the need for robust ICT risk management and resilience testing, especially for Bechtle's clients in the financial sector.

Beyond cybersecurity, legislation like the German Supply Chain Due Diligence Act (LkSG) requires Bechtle to ensure ethical and environmental standards throughout its supply chain. By maintaining a comprehensive Supplier Code of Conduct and enhancing supplier management, Bechtle addresses these legal requirements, mitigating risks associated with forced labor and environmental degradation. In 2023, Bechtle continued to refine its supplier assessment processes to align with these critical due diligence obligations.

Environmental factors

Bechtle's commitment to environmental sustainability is underscored by its Climate Protection Strategy 2030, targeting net-zero emissions by 2050 in line with the Paris Agreement. This strategy involves ambitious reductions in greenhouse gas emissions across its operations and value chain.

Specifically, Bechtle aims for a significant 54.4% reduction in absolute Scope 1 and 2 emissions by 2030. Furthermore, the company is focused on decreasing Scope 3 emissions, particularly those stemming from purchased goods and services, by 55% relative to value created by the same year.

Clients are increasingly pushing for IT solutions that are environmentally friendly, with a significant rise in demand for green cloud initiatives. This trend is fueled by corporate sustainability goals and a tightening regulatory landscape. For instance, a 2024 survey indicated that over 70% of businesses are prioritizing sustainability in their IT procurement decisions.

Bechtle's strategic focus on 'Circular IT' directly addresses this growing market need. By offering services that promote the reuse and responsible disposal of IT assets, they align with client demands for more sustainable operations. This also extends to Bechtle's internal enterprise architecture, which is being optimized for resource efficiency.

The escalating demand for cloud services and advanced AI applications is significantly boosting the energy requirements of data centers. For instance, global data center energy consumption was projected to reach around 1.5% of total global electricity consumption in 2024, a figure expected to climb as AI adoption accelerates.

As an IT service provider, Bechtle is directly affected by this trend, necessitating a focus on energy-efficient computing solutions and sustainable data center strategies. This influences Bechtle's infrastructure investments and the advice it offers clients seeking to reduce their environmental footprint and operational costs.

E-waste Management and Circular Economy Principles

The escalating global generation of electronic waste, or e-waste, presents a significant environmental challenge. In 2023, the United Nations reported that the world generated a record 62 million tonnes of e-waste, a 8% increase from 2022. This trend underscores the critical need for effective recycling and disposal strategies to mitigate environmental harm.

Bechtle's commitment to Circular IT principles directly addresses this issue by focusing on the entire lifecycle of IT equipment. This approach includes ensuring responsible end-of-life management for devices, thereby promoting resource efficiency and minimizing waste.

- E-waste Growth: Global e-waste is projected to reach 82 million tonnes by 2030, highlighting an urgent need for sustainable management.

- Circular Economy Focus: Bechtle's Circular IT services aim to extend product life and facilitate responsible disposal, aligning with circular economy goals.

- Resource Efficiency: By refurbishing and recycling IT assets, Bechtle contributes to conserving valuable raw materials and reducing the environmental footprint of technology.

- Regulatory Compliance: Adhering to strict e-waste regulations is crucial for companies like Bechtle to maintain operational integrity and environmental stewardship.

Corporate Environmental Responsibility Reporting

Environmental factors are increasingly shaping corporate strategies, with a growing demand for transparent reporting on ecological impact. Stakeholders, including investors and consumers, expect businesses to demonstrate a clear commitment to sustainability, driving the need for comprehensive environmental data. This trend is particularly relevant for technology service providers like Bechtle, where operational footprints and supply chain considerations carry significant environmental weight.

Bechtle actively addresses these environmental pressures through its consistent publication of sustainability reports. These reports detail the company's efforts to minimize its ecological footprint and contribute positively to environmental goals. For instance, in its 2023 sustainability report, Bechtle highlighted a reduction in CO2 emissions per employee compared to the previous year, demonstrating tangible progress in its environmental performance.

The integration of the United Nations Sustainable Development Goals (SDGs) into Bechtle's overarching strategy further underscores its dedication to environmental responsibility. This strategic alignment ensures that environmental considerations are not an afterthought but are woven into the fabric of the company's operations and decision-making processes. Specific initiatives often focus on areas like energy efficiency in data centers and promoting circular economy principles within their IT lifecycle management services.

- Regulatory Scrutiny: Expect stricter regulations on carbon emissions and waste management impacting IT service providers.

- Stakeholder Expectations: Investors and customers increasingly favor companies with strong environmental, social, and governance (ESG) performance, influencing Bechtle's reporting and operational choices.

- Resource Efficiency: Initiatives like energy-efficient hardware and optimized logistics are crucial for reducing Bechtle's environmental impact.

- Circular Economy: Bechtle's focus on IT asset disposition and refurbishment aligns with the growing demand for sustainable IT lifecycle management.

Environmental factors are increasingly driving demand for sustainable IT solutions, with clients prioritizing green cloud initiatives and responsible IT asset management. Bechtle's Climate Protection Strategy 2030, aiming for net-zero emissions by 2050 and significant Scope 1, 2, and 3 reductions by 2030, directly addresses these market shifts.

The growing volume of e-waste, projected to reach 82 million tonnes by 2030, necessitates Bechtle's focus on Circular IT principles. This strategy emphasizes extending product lifecycles and responsible end-of-life management, aligning with global sustainability goals and regulatory compliance.

Bechtle's commitment to environmental responsibility is further demonstrated through its sustainability reporting and integration of UN SDGs. For instance, in 2023, the company reported a reduction in CO2 emissions per employee, showcasing tangible progress in its environmental performance.

| Environmental Factor | Bechtle's Response/Impact | Supporting Data/Trend (2024/2025 Focus) |

| Climate Change & Emissions | Climate Protection Strategy 2030; Net-zero by 2050 | 54.4% reduction target for Scope 1 & 2 emissions by 2030; 55% relative reduction for Scope 3 |

| E-waste Management | Circular IT Services; Asset Refurbishment & Recycling | Global e-waste reached 62 million tonnes in 2023; projected 82 million tonnes by 2030 |

| Energy Consumption (Data Centers) | Focus on energy-efficient solutions; sustainable data center strategies | Global data center energy consumption ~1.5% of global electricity in 2024, rising with AI adoption |

| Stakeholder & Regulatory Pressure | Transparent Sustainability Reporting; ESG Integration | Over 70% of businesses prioritizing sustainability in IT procurement (2024 survey) |

PESTLE Analysis Data Sources

Our Bechtle PESTLE Analysis is meticulously crafted using a blend of official government publications, reputable market research firms, and leading economic and technological forecasting reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Bechtle.