Bechtle Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bechtle Bundle

Bechtle operates within a dynamic IT sector, facing intense competition, significant buyer power, and a constant threat from new entrants and substitutes. Understanding these forces is crucial for navigating its market landscape effectively.

The complete report reveals the real forces shaping Bechtle’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a significant factor for Bechtle, a major IT system house. The company's reliance on a few dominant global IT hardware and software vendors, such as Microsoft, HP, and Dell, means these suppliers hold considerable power. This concentration limits Bechtle's ability to negotiate favorable pricing and terms for crucial components and software licenses, directly impacting Bechtle's cost structure and profitability.

Bechtle's reliance on established vendor partnerships, while beneficial for expertise, creates substantial switching costs. Transitioning to entirely new core suppliers would necessitate significant investment in staff retraining, solution re-certification, and the potential for service disruptions, thereby bolstering the bargaining power of these existing suppliers.

The uniqueness of IT components and software solutions from Bechtle's key suppliers significantly bolsters their bargaining power. Many of these offerings are highly specialized or proprietary, meaning Bechtle has limited alternatives. For instance, in 2024, the global market for specialized enterprise software continued to see consolidation, with fewer vendors offering niche solutions, thereby concentrating power. This lack of readily available substitutes forces Bechtle to accept supplier terms, potentially impacting cost structures and product availability.

Threat of Forward Integration by Suppliers

Large hardware and software manufacturers, such as Microsoft or Dell, possess the capability to directly offer IT services to end-users. This potential for forward integration by suppliers can diminish the bargaining power of IT system houses like Bechtle. For instance, if a major cloud provider were to offer end-to-end managed services that directly compete with a system integrator's offerings, it would exert pressure on pricing and service margins.

While comprehensive integration projects are less susceptible to this threat, the underlying potential remains a factor. This means suppliers can leverage their brand recognition and existing customer relationships to potentially bypass intermediaries. For example, in 2024, major tech firms continued to expand their direct-to-customer service portfolios, indicating a persistent, albeit often latent, competitive pressure.

- Supplier Capability: Major tech vendors can leverage existing infrastructure and customer bases to offer IT services directly.

- Impact on System Houses: This capability can reduce the reliance on intermediaries like Bechtle, potentially impacting their market share and pricing power.

- Project Scope: The threat is more pronounced for standardized services rather than complex, customized integration projects.

- Market Trend: The ongoing expansion of direct-to-customer service offerings by large tech companies in 2024 highlights this evolving dynamic.

Importance of Bechtle to Suppliers

Bechtle's substantial market share as a premier IT service provider across Europe positions it as a vital sales conduit for numerous technology suppliers. This significant presence grants Bechtle considerable bargaining power, as many suppliers rely on the company for access to a broad customer base and efficient market penetration.

Suppliers recognize Bechtle's role in driving their sales volumes and expanding their market reach. For instance, in 2023, Bechtle reported revenue of €6.4 billion, demonstrating its extensive network and influence within the IT ecosystem. This reliance means suppliers often need to offer favorable terms to secure or maintain their partnership with Bechtle.

- Bechtle's European Market Leadership: As a leading IT service provider, Bechtle commands a significant portion of the European market, making it an indispensable partner for many technology manufacturers.

- Supplier Dependence on Bechtle: Suppliers depend on Bechtle for substantial sales volume and access to a wide array of clients, which strengthens Bechtle's negotiating position.

- Leverage through Market Access: Bechtle's extensive customer network provides suppliers with crucial market access and customer acquisition opportunities, a key factor in supplier relationships.

- Impact on Supplier Terms: The importance of Bechtle to suppliers means they are often willing to negotiate better pricing and terms to maintain this valuable sales channel.

The bargaining power of suppliers for Bechtle is influenced by several key factors, including supplier concentration, switching costs, and the uniqueness of their offerings. Bechtle's reliance on a few major IT vendors like Microsoft and Dell means these suppliers have significant leverage due to limited alternatives for Bechtle. This dynamic was evident in 2024 as the IT market continued to see consolidation among specialized software providers, further concentrating power in the hands of fewer suppliers.

| Factor | Bechtle's Position | Supplier Power Level |

|---|---|---|

| Supplier Concentration | High reliance on few dominant vendors (e.g., Microsoft, HP, Dell) | High |

| Switching Costs | Significant investment required for retraining and re-certification | High |

| Uniqueness of Offerings | Proprietary and specialized IT components and software | High |

| Potential for Forward Integration | Suppliers can offer direct IT services, bypassing intermediaries | Moderate to High |

| Bechtle's Market Influence | Significant European market share, vital sales conduit | Low to Moderate |

What is included in the product

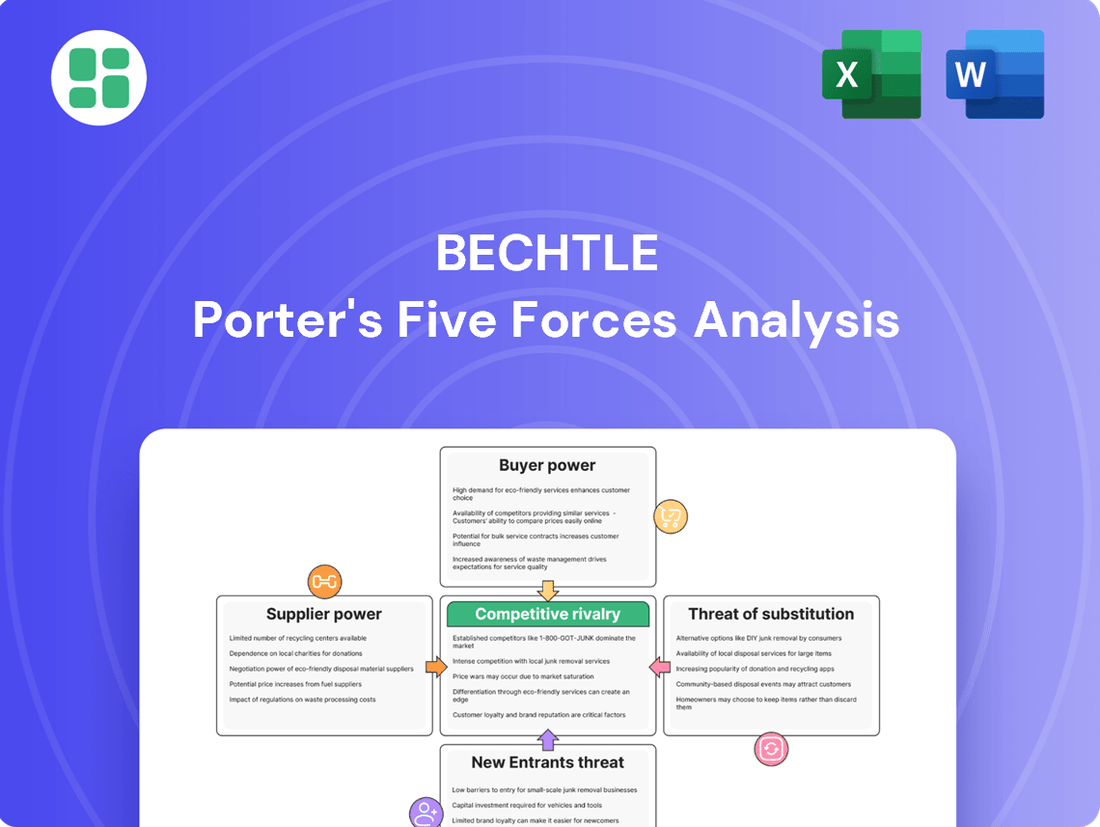

Analyzes the competitive intensity and profitability potential for Bechtle by examining supplier power, buyer power, threat of new entrants, threat of substitutes, and rivalry among existing competitors.

Instantly visualize competitive intensity with a dynamic spider chart, highlighting key pressures and strategic vulnerabilities.

Customers Bargaining Power

Bechtle's diverse customer base, ranging from public sector entities to large corporations, significantly influences its bargaining power of customers. Public sector clients, often bound by strict budgetary limitations, exhibit a pronounced price sensitivity. This can lead to intense competition focused on price, impacting Bechtle's margins.

For instance, in 2024, IT procurement within many European public sectors saw increased scrutiny on cost-effectiveness. This trend forces Bechtle to carefully balance competitive pricing with the value and service quality it offers, particularly when bidding for large public contracts where price is a primary determinant.

Customers today have a wealth of choices when it comes to IT services. They can turn to other major IT providers, niche specialists, or even manage their IT needs internally. This wide array of options significantly boosts their negotiation leverage.

For instance, in 2024, the IT services market is highly fragmented, with numerous players competing for business. Companies looking for cloud solutions, cybersecurity, or managed IT services can easily compare offerings from giants like Accenture and IBM, as well as smaller, agile firms, impacting pricing and service level agreements.

For businesses relying on integrated IT environments, the prospect of switching service providers presents significant hurdles. These often involve substantial costs related to migrating complex data, retraining staff on new systems, and the potential for operational disruptions during the transition. For instance, a 2024 survey indicated that over 60% of IT decision-makers cited data migration as a primary concern when considering a new provider.

These embedded systems and the associated migration complexities directly increase customer switching costs. This elevated cost somewhat diminishes the bargaining power of customers, as the financial and operational implications of changing providers become a significant deterrent.

Customer Size and Concentration

Bechtle AG benefits from a diverse customer base, which generally dilutes the bargaining power of any single customer. This broad reach means that the loss of one client, while impactful, is unlikely to cripple the company. However, a significant portion of Bechtle's revenue is generated from large corporate and public sector clients.

These larger entities, due to their substantial purchasing volume and strategic importance, inherently possess greater individual bargaining power. They can leverage their size to negotiate more favorable terms, pricing, and service level agreements. For instance, in 2024, Bechtle's top customers, while not individually named, represent a concentrated revenue stream that allows them to exert considerable influence on contract negotiations.

- Diverse Customer Base: Bechtle's broad customer portfolio mitigates the risk associated with any single client's demands.

- Concentration Risk: A notable percentage of Bechtle's revenue comes from large corporate and public sector clients.

- Bargaining Power of Large Clients: These major clients can leverage their size to negotiate better pricing and terms.

- 2024 Revenue Impact: The significant revenue contribution from these key accounts underscores their influence in negotiations.

Customer Information Asymmetry

Customers, particularly those making substantial purchases, increasingly possess detailed knowledge of prevailing market prices and the array of available solutions. This diminished information asymmetry empowers them to negotiate more forcefully, directly impacting Bechtle's potential profit margins.

For instance, in the IT solutions sector, large enterprise clients often conduct extensive market research, comparing offerings from multiple vendors. This proactive approach means they enter negotiations with a clear understanding of competitive pricing, leaving less room for Bechtle to command premium prices.

- Informed Negotiation: Customers armed with market data can leverage this knowledge to secure better terms.

- Margin Pressure: Increased customer awareness directly translates to downward pressure on Bechtle's pricing power.

- Competitive Landscape: The readily available information in the IT sector intensifies this customer bargaining power.

The bargaining power of Bechtle's customers is a significant factor, amplified by the fragmented nature of the IT services market and the increasing availability of information. While Bechtle's diverse client base offers some insulation, large corporate and public sector clients, representing a substantial revenue stream, wield considerable influence. In 2024, the emphasis on cost-effectiveness, particularly in public sector IT procurement, further heightened customer negotiation leverage, compelling Bechtle to balance competitive pricing with service value.

| Customer Segment | Influence on Bargaining Power | 2024 Market Trend Impact |

|---|---|---|

| Public Sector | High due to budget constraints and price sensitivity. | Increased scrutiny on cost-effectiveness, driving competitive pricing. |

| Large Corporations | High due to significant purchasing volume and strategic importance. | Leverage size for favorable terms, pricing, and SLAs. |

| General Customer Base | Diluted overall power due to diversity. | N/A (focus on larger segments for significant impact). |

Full Version Awaits

Bechtle Porter's Five Forces Analysis

This preview showcases the complete Bechtle Porter's Five Forces Analysis, offering a thorough examination of competitive pressures within the IT sector. You are viewing the exact, professionally formatted document that will be instantly available for download upon purchase, ensuring no surprises or hidden content. This comprehensive analysis will equip you with a deep understanding of Bechtle's strategic landscape.

Rivalry Among Competitors

The IT service and systems house market, especially in Europe, is quite crowded. It features a wide array of companies, from massive global players like Dell Technologies, IBM, and Accenture, to many smaller, local IT firms. This sheer number and variety of competitors significantly ramp up the competitive rivalry within the sector.

The IT market is experiencing robust growth, fueled by widespread digital transformation initiatives, increasing cloud adoption, and the critical need for enhanced cybersecurity and artificial intelligence solutions. This upward trend is a significant driver for companies like Bechtle.

However, recent economic headwinds have introduced a more challenging landscape, leading to a noticeable slowdown in IT spending. This economic pressure intensifies competition among IT providers as they vie for a smaller pool of available projects, making market share gains harder to achieve.

For instance, in 2024, global IT spending was projected to reach $5.1 trillion, a 6.8% increase from 2023, according to Gartner. Despite this overall growth, specific sectors might see more cautious investment, directly impacting the intensity of rivalry for Bechtle and its competitors.

Operating IT systems houses and data centers involves substantial fixed costs, including infrastructure, power, and cooling. For instance, building a new data center can easily cost tens of millions of dollars. Companies must achieve high utilization rates to cover these significant overheads, which fuels aggressive price competition as players vie for market share to keep their facilities running efficiently.

Differentiation Among Competitors

Bechtle stands out in the IT services landscape by offering a broad spectrum of solutions, from hardware and software to cloud services and consulting. This comprehensive approach, coupled with specialized expertise in areas like cybersecurity and digital transformation, allows them to move beyond simple product resale and create value-added partnerships. For instance, Bechtle reported a significant increase in its digital workspace solutions in 2024, indicating a successful push into higher-value service offerings.

The company cultivates deep, long-term relationships with its clients, particularly within the small and medium-sized enterprise (SME) and public sector segments. This focus allows for a nuanced understanding of specific customer needs, fostering loyalty and reducing the likelihood of customers switching based solely on price. Bechtle's consistent growth in recurring revenue streams, which comprised a substantial portion of their 2023 revenue, underscores the strength of these customer bonds.

- Comprehensive Portfolio: Bechtle offers end-to-end IT solutions, reducing the need for customers to manage multiple vendors.

- Deep Expertise: Specialized knowledge in areas like cloud migration and data analytics differentiates them from generalist providers.

- Customer Relationships: A strong focus on building lasting partnerships, especially with SMEs and the public sector, fosters loyalty.

- Segment Focus: Tailoring services to specific market needs, such as digital transformation for public administrations, creates a competitive edge.

Exit Barriers

High exit barriers significantly influence competitive rivalry. For instance, companies like Bechtle, heavily invested in specialized IT infrastructure and skilled personnel, face substantial costs if they decide to leave the market. This capital intensity, coupled with long-term service agreements common in the IT sector, discourages quick exits, forcing competitors to persevere even in challenging economic conditions.

These entrenched positions mean that even when market demand softens, companies are often compelled to stay put due to the difficulty and expense of divesting assets or unwinding contracts. This persistence fuels ongoing competition, as firms fight to maintain market share and profitability, rather than seeking an easier exit.

Consider the IT services industry, where Bechtle operates. In 2023, global IT spending was projected to reach over $4.7 trillion, with a significant portion dedicated to services and infrastructure. Companies within this space have made substantial investments in data centers, cloud solutions, and highly trained technical staff. For example, Bechtle's own infrastructure and workforce represent significant sunk costs. The need to recoup these investments, along with contractual obligations to clients, acts as a powerful deterrent to leaving the market.

- High Capital Investment: Significant upfront costs in IT infrastructure, such as data centers and specialized hardware, make exiting the market financially prohibitive.

- Specialized Human Capital: The reliance on highly skilled IT professionals, whose expertise may not be easily transferable to other industries, creates a barrier to workforce reallocation.

- Long-Term Customer Contracts: Service level agreements and multi-year contracts lock companies into ongoing operations, making early termination costly and complex.

- Brand Reputation and Relationships: Established customer relationships and brand loyalty, built over years, are difficult to divest or abandon without substantial loss.

The IT service and systems house market is characterized by intense competition. This is driven by a large number of players, including global giants and numerous smaller, specialized firms, all vying for market share. The high fixed costs associated with IT infrastructure, such as data centers, necessitate high utilization rates, leading to aggressive pricing strategies.

Companies like Bechtle differentiate themselves through comprehensive service portfolios, deep technical expertise, and strong customer relationships, particularly in the SME and public sectors. Despite overall market growth, economic slowdowns in 2024 have intensified rivalry as companies compete for a more constrained IT spending budget.

High exit barriers, stemming from substantial investments in specialized infrastructure and skilled personnel, along with long-term contracts, further fuel this rivalry. These factors compel companies to remain in the market and compete aggressively, even during periods of reduced demand.

| Key Competitive Factors | Impact on Rivalry | Bechtle's Position |

|---|---|---|

| Number of Competitors | High rivalry due to many global and local players. | Operates in a crowded market but has a strong European presence. |

| Market Growth & Economic Climate | Growth fuels competition; economic headwinds intensify it. | Benefiting from digital transformation but facing spending slowdowns. |

| Fixed Costs & Utilization | High fixed costs drive price competition to maintain utilization. | Focuses on value-added services to mitigate pure price competition. |

| Differentiation & Customer Loyalty | Strong differentiation and loyalty reduce price sensitivity. | Offers comprehensive solutions and builds deep client relationships. |

| Exit Barriers | High capital investment and contracts keep firms competing. | Significant investment in infrastructure and talent creates high exit barriers. |

SSubstitutes Threaten

Large corporations and public sector organizations often possess substantial in-house IT departments. These internal teams can manage a wide range of IT infrastructure, software development, and ongoing services, directly competing with Bechtle's core business. For instance, in 2024, many Fortune 500 companies continued to invest heavily in their internal IT capabilities, viewing them as strategic assets rather than outsourcing opportunities.

The rise of cloud-native solutions and Software-as-a-Service (SaaS) presents a significant threat by diminishing the reliance on traditional IT infrastructure and integration services. Companies are increasingly opting for direct consumption of services from cloud providers like AWS, Microsoft Azure, and Google Cloud.

This shift directly substitutes the need for many of Bechtle's core offerings, particularly in on-premise hardware and complex system integration. For instance, the global cloud computing market was valued at approximately $592 billion in 2023 and is projected to reach over $1.3 trillion by 2028, indicating a substantial move away from traditional IT models.

Customers increasingly have the option to bypass IT systems houses like Bechtle and purchase hardware, software, and even fundamental cloud services directly from major vendors. Companies like Microsoft, Amazon Web Services (AWS), and Google Cloud are making it easier for businesses to procure these solutions independently.

This direct engagement poses a significant threat of substitution, as customers might see it as a more cost-effective or streamlined approach. For example, AWS reported a revenue of $24.2 billion in the first quarter of 2024, highlighting the scale of direct cloud service offerings available to businesses.

Bechtle mitigates this threat through its strong, established partnerships with these very vendors. By offering integrated solutions, expert support, and tailored services that go beyond what a direct vendor purchase might provide, Bechtle aims to retain its customer base.

Managed Services from Hyperscalers

Hyperscale cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are expanding their managed service offerings. These services directly compete with Bechtle's core managed IT operations, potentially drawing customers away. For instance, AWS offers a wide array of managed services covering databases, analytics, and machine learning, aiming to provide an end-to-end solution.

This increasing comprehensiveness means customers could consolidate their IT needs with a single hyperscaler. This consolidation trend poses a significant threat as it reduces the need for specialized third-party managed service providers like Bechtle. In 2024, the global managed services market continued its robust growth, with cloud-based managed services being a key driver, indicating the increasing customer preference for integrated, provider-managed solutions.

- Increased Competition: Hyperscalers offer integrated managed IT operations, directly challenging Bechtle's business model.

- Customer Consolidation: The trend towards single-provider IT stacks limits opportunities for diversified managed service providers.

- Market Growth: The managed services market, particularly cloud-centric offerings, saw significant expansion in 2024, highlighting the competitive landscape.

Open-Source Alternatives

The increasing maturity and widespread adoption of open-source software present a significant threat of substitutes for Bechtle. These alternatives often offer substantial cost savings, a crucial factor for price-sensitive customers.

For instance, in 2024, the global open-source software market was valued at over $30 billion, demonstrating its substantial reach and economic impact. Many businesses are now leveraging open-source solutions for operating systems, databases, and even cloud infrastructure, directly challenging Bechtle's proprietary offerings.

This trend means clients can bypass traditional software vendors and their associated licensing fees, opting for flexible and often community-supported solutions. The ability to customize and integrate open-source components further enhances their appeal as viable substitutes.

- Cost-Effectiveness: Open-source software often eliminates licensing fees, reducing total cost of ownership for clients.

- Flexibility and Customization: Clients can modify open-source solutions to meet specific business needs, unlike many proprietary systems.

- Growing Ecosystem: The robust development and support communities surrounding popular open-source projects enhance their reliability and feature sets.

- Market Penetration: Significant portions of the IT infrastructure globally, including cloud platforms and web servers, run on open-source technologies, indicating strong market acceptance.

The increasing prevalence of direct purchasing from major technology vendors like Microsoft and AWS presents a significant substitute. Businesses can bypass intermediaries and acquire hardware, software, and cloud services directly, potentially reducing costs and streamlining procurement processes.

For example, AWS reported revenues of $24.2 billion in Q1 2024, illustrating the massive scale of direct cloud service offerings available. This trend allows customers to consolidate their IT needs with a single provider, diminishing the necessity for specialized third-party managed service providers.

Entrants Threaten

High capital requirements act as a formidable barrier to entry for new players looking to establish themselves as IT service providers and systems houses. Building the necessary physical infrastructure, including state-of-the-art data centers and robust network capabilities, demands significant upfront investment. For instance, setting up a Tier III data center can easily cost tens of millions of dollars, a sum that many potential entrants simply cannot afford.

Beyond physical assets, a broad service portfolio, encompassing everything from hardware and software sales to complex managed services and cybersecurity solutions, requires substantial investment in skilled personnel, research and development, and marketing. Companies like Bechtle, with their extensive reach and integrated offerings, have built this infrastructure over years, making it difficult for newcomers to compete on scale and scope without immense financial backing. This high initial outlay effectively deters many aspiring competitors.

The IT services sector requires deep technical knowledge, industry-specific certifications, and proven experience in areas like cloud computing, data analytics, and cybersecurity. New companies struggle to find and keep these skilled professionals, as established players often offer more competitive compensation and career development opportunities. For instance, in 2024, the global IT services market faced a significant talent shortage, with reports indicating that over 70% of IT leaders found it challenging to recruit qualified personnel, driving up labor costs for new entrants.

Bechtle has cultivated deep, long-standing relationships with over 70,000 customers, a significant portion of which are in the critical public sector. This extensive network is built on years of reliable service and proven trust, making it a formidable barrier for any new competitor attempting to enter the market.

New entrants face a substantial challenge in replicating Bechtle's established trust and customer loyalty. Without a comparable track record and demonstrable history of successful partnerships, it is difficult for them to gain significant market share, especially when dealing with entities that prioritize stability and proven reliability.

Economies of Scale and Scope

Bechtle leverages significant economies of scale across its operations. Its vast network of system houses and robust e-commerce platforms enable bulk purchasing and streamlined logistics, translating into cost advantages. For instance, in 2023, Bechtle reported revenues of €6.7 billion, underscoring the scale of its operations.

New entrants face a substantial barrier in replicating Bechtle's cost efficiencies. Achieving comparable purchasing power and operational overheads would require immense upfront investment and time to build a similar infrastructure and customer base. This makes it challenging for smaller or newer companies to compete on price or service delivery speed.

- Economies of Scale: Bechtle's large operational footprint allows for lower per-unit costs in procurement and service delivery.

- Network Effect: The extensive system house network provides a competitive edge in reach and local support that is difficult for new entrants to match.

- E-commerce Efficiency: Bechtle's established e-commerce platforms benefit from high transaction volumes, reducing per-transaction costs.

- Capital Investment Barrier: Reaching Bechtle's scale necessitates significant capital, deterring potential new competitors.

Regulatory Hurdles and Compliance

For companies like Bechtle, operating within the IT sector, particularly when serving public sector and large corporate clients, the threat of new entrants is significantly shaped by stringent regulatory hurdles and compliance demands. New players must invest heavily in understanding and adhering to frameworks such as the General Data Protection Regulation (GDPR) and the upcoming NIS2 Directive, which mandates enhanced cybersecurity measures across the EU. This compliance burden acts as a substantial barrier to entry, requiring specialized expertise and resources that nascent companies may lack.

The IT industry, especially in Europe, is increasingly governed by data privacy and security regulations. For instance, the GDPR, implemented in 2018, imposes strict rules on how personal data is collected, processed, and stored, with significant penalties for non-compliance. The NIS2 Directive, expected to come into full effect in late 2024, further raises the bar for cybersecurity resilience, impacting a broader range of essential organizations and their suppliers. These evolving legal landscapes demand continuous adaptation and investment, making it challenging for new entrants to establish a foothold without significant upfront commitment.

- GDPR fines can reach up to €20 million or 4% of annual global turnover.

- The NIS2 Directive expands the scope of cybersecurity requirements to approximately 160,000 entities across the EU.

- Compliance with IT security standards often requires specific certifications, which take time and resources to obtain.

- New entrants face the challenge of building trust with clients regarding data security and regulatory adherence from the outset.

The threat of new entrants for Bechtle is significantly mitigated by high capital requirements, the need for extensive technical expertise, and established customer relationships. Building the necessary infrastructure and acquiring skilled talent represents a substantial financial and operational hurdle. For instance, the global IT services market in 2024 faced persistent talent shortages, with many firms reporting difficulties in hiring qualified personnel, driving up labor costs for newcomers.

Bechtle's established network of over 70,000 customers, particularly its strong presence in the public sector, creates a formidable barrier. New entrants struggle to replicate the trust and loyalty built over years of reliable service. Furthermore, Bechtle's economies of scale, evidenced by its €6.7 billion revenue in 2023, allow for cost advantages in procurement and operations that are difficult for smaller, newer companies to match.

Regulatory compliance, such as GDPR and the upcoming NIS2 Directive, adds another layer of complexity and cost for potential new entrants in the IT services sector. Navigating these stringent data privacy and cybersecurity demands requires specialized knowledge and investment, further limiting the ease of market entry.

| Barrier to Entry | Description | Impact on New Entrants | Example Data (2024/2023) |

|---|---|---|---|

| Capital Requirements | Significant investment needed for infrastructure, R&D, and talent. | Deters companies lacking substantial funding. | Setting up a Tier III data center can cost tens of millions of dollars. |

| Technical Expertise & Talent | Demand for specialized skills in cloud, cybersecurity, etc. | Challenges in recruiting and retaining skilled professionals due to shortages. | Over 70% of IT leaders found it challenging to recruit qualified personnel in 2024. |

| Customer Relationships & Trust | Long-standing partnerships, especially in the public sector. | Difficulty in gaining market share without a proven track record. | Bechtle serves over 70,000 customers, many in critical public sector roles. |

| Economies of Scale | Cost advantages from large-scale operations and purchasing power. | New entrants cannot compete on price or operational efficiency. | Bechtle reported revenues of €6.7 billion in 2023. |

| Regulatory Compliance | Adherence to data privacy (GDPR) and cybersecurity (NIS2) regulations. | Requires significant investment in expertise and ongoing adaptation. | NIS2 Directive impacts ~160,000 EU entities, increasing compliance burdens. |

Porter's Five Forces Analysis Data Sources

Our Bechtle Porter's Five Forces analysis is built on a foundation of industry-specific market research reports, financial disclosures from publicly traded companies, and data from reputable business intelligence platforms. This combination ensures a comprehensive understanding of competitive intensity, supplier and buyer power, and the threat of new entrants and substitutes.