Bechtle Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bechtle Bundle

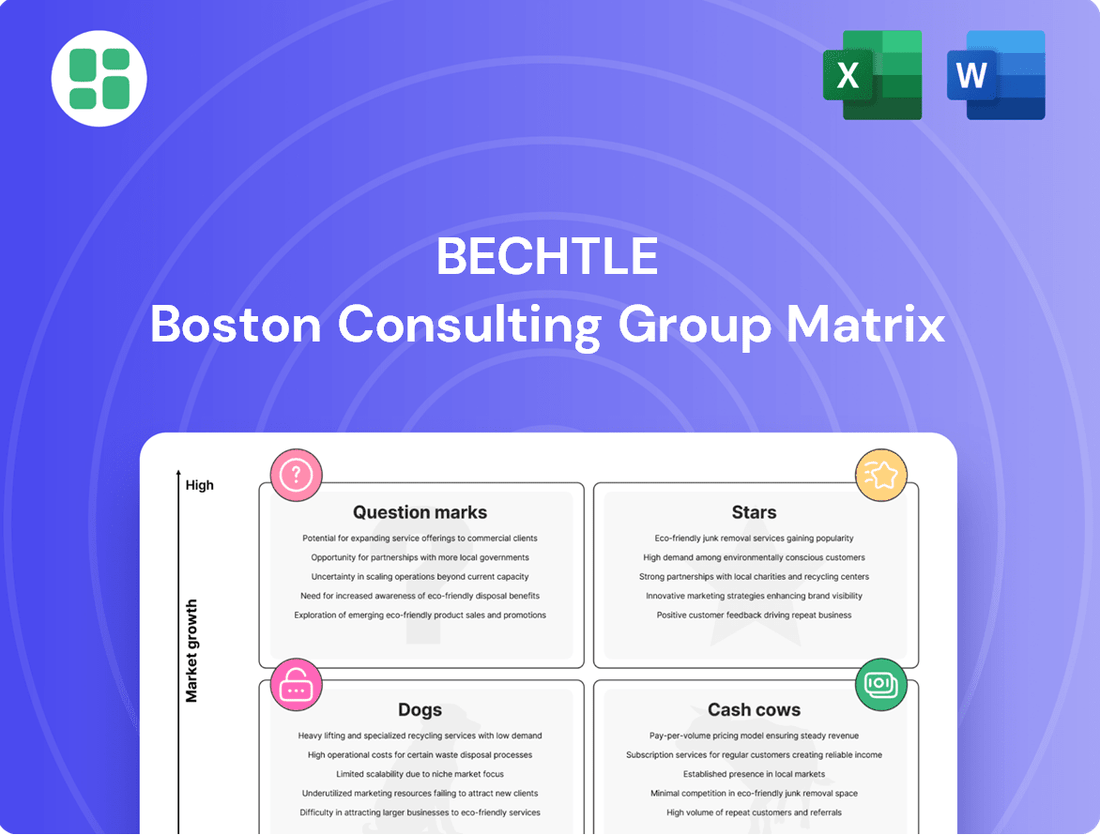

Understanding a company's product portfolio is crucial for strategic growth, and the BCG Matrix provides a powerful framework. This glimpse shows you how products are categorized by market share and growth, but the real advantage lies in the detailed analysis.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Bechtle is strategically investing in AI integration services, viewing it as a significant growth area. By leveraging platforms like Azure AI and Microsoft Copilot, they are developing solutions for tasks such as automating HR processes and summarizing patient data, demonstrating a practical application of AI for efficiency. This focus is underscored by their expansion into the Innovation Park Artificial Intelligence, signaling a strong commitment to capturing value in the expanding AI market.

Advanced Cybersecurity Solutions represent a critical and rapidly expanding sector within Bechtle's portfolio. The company's robust market presence, particularly in IT security services and securing framework agreements with public sector entities, underscores its significant market share in this high-growth area. This segment is a primary engine for Bechtle's expansion, vital for safeguarding sensitive information and maintaining operational resilience for its wide range of customers.

Bechtle is seeing significant growth in its multi-cloud architecture services, driven by large enterprises and public sector organizations. This surge in demand highlights a clear market trend towards hybrid and multi-cloud adoption for enhanced agility and robustness. Their capability in navigating these complex deployments is a key differentiator.

The company's ability to design, implement, and manage these sophisticated environments positions Bechtle favorably. In 2024, the global multi-cloud market was valued at an estimated $16.9 billion, with projections indicating continued strong growth, underscoring the strategic importance of Bechtle's offerings in this expanding sector.

Digital Transformation Consulting

Digital Transformation Consulting positions Bechtle as a Stars player within the BCG matrix, reflecting its strong market growth and leading position. As a significant IT service provider, Bechtle is instrumental in helping companies navigate the complexities of digitalization, a key driver of modern business success.

Bechtle's consulting services are designed to modernize IT infrastructures and boost operational efficiency. This strategic focus directly addresses the ongoing digital shift across industries. In 2024, the global digital transformation market was valued at over $1.8 trillion, underscoring the immense demand for such expertise.

- Market Leadership: Bechtle's comprehensive, vendor-neutral approach allows it to guide clients effectively through technology adoption.

- Revenue Growth: The company's commitment to digital transformation consulting is a key factor in its sustained revenue growth, with Bechtle reporting a 13.5% increase in revenue for the first nine months of 2024 compared to the same period in 2023.

- Future-Proofing: By enabling businesses to embrace new technologies and processes, Bechtle ensures clients develop resilient and forward-looking IT architectures.

- Client Success: Bechtle's success in this segment is evidenced by its ability to secure major digital transformation projects, contributing to its strong market share.

Modern Workplace Solutions

The shift towards remote and hybrid work models has dramatically reshaped how businesses operate, fueling a substantial market expansion for modern workplace solutions. Bechtle is well-positioned to capture this growth with its comprehensive suite of cloud-based communication tools and virtual desktop infrastructure, designed to enhance collaboration and maintain productivity regardless of location.

These solutions are critical for businesses adapting to the new normal, directly addressing the demand for flexible and efficient work environments. For instance, the global market for unified communications and collaboration (UCC) solutions was projected to reach over $100 billion in 2024, highlighting the significant opportunity.

- Market Growth: The increasing adoption of hybrid work models is a primary driver for modern workplace solutions.

- Bechtle's Offerings: Cloud-based communication and virtual desktop infrastructure are key components of Bechtle's strategy.

- Customer Relevance: These solutions directly address the evolving needs of Bechtle's customer base for flexible work.

- Market Opportunity: The UCC market alone represents a multi-billion dollar opportunity, with strong growth forecasts.

Stars, in the context of the Bechtle BCG Matrix, represent business areas with high market growth and a strong competitive position for the company. These segments are characterized by significant ongoing demand and Bechtle's ability to lead or capture substantial market share.

These are the growth engines, requiring continued investment to maintain their momentum and capitalize on future opportunities. Their performance is crucial for the overall health and expansion of Bechtle's business portfolio.

Bechtle's AI integration services, advanced cybersecurity, multi-cloud architecture, digital transformation consulting, and modern workplace solutions are all prime examples of its Stars. These areas demonstrate robust market expansion and Bechtle's strong standing within them.

The company's strategic focus and investment in these sectors are designed to leverage current market trends and secure long-term competitive advantages.

| Bechtle's Star Segments | Market Growth | Bechtle's Position | Key Drivers | 2024 Market Data Example |

|---|---|---|---|---|

| AI Integration Services | High | Leading | Digitalization, Automation | AI market projected to grow significantly |

| Advanced Cybersecurity | High | Strong Market Share | Increasing cyber threats, regulatory compliance | Global cybersecurity market valued in hundreds of billions |

| Multi-Cloud Architecture | High | Key Player | Enterprise cloud adoption, hybrid strategies | Global multi-cloud market ~$16.9 billion in 2024 |

| Digital Transformation Consulting | High | Significant Provider | Business modernization, IT infrastructure upgrade | Global digital transformation market over $1.8 trillion in 2024 |

| Modern Workplace Solutions | High | Well-Positioned | Remote/hybrid work, collaboration tools | Unified Communications & Collaboration market over $100 billion in 2024 |

What is included in the product

The Bechtle BCG Matrix categorizes business units by market share and growth rate, guiding strategic decisions for investment and resource allocation.

The Bechtle BCG Matrix provides a clear, visual overview of your portfolio, easing the pain of complex strategic analysis.

Cash Cows

Bechtle's traditional IT infrastructure sales, encompassing hardware, software, and related components, represent a core and enduring revenue generator. This segment, while mature, benefits from a vast, established customer base and predictable replacement cycles, ensuring a steady and reliable cash flow for the company.

In 2023, Bechtle reported a significant portion of its revenue stemming from these foundational IT sales, underscoring its role as a consistent cash cow. This mature business area, despite potentially slower growth compared to newer technological offerings, provides the financial stability necessary to invest in future growth areas.

Bechtle's standard software licensing and management, often through its Comsoft brand, represents a significant, high-volume revenue generator. This area thrives in a mature market where demand for software and its management is consistent, leading to dependable income.

The predictable nature of software license renewals and ongoing asset management contracts underpins the steady profitability of this segment. This stability means Bechtle can rely on consistent earnings with minimal need for substantial investment in expanding into new markets.

For the fiscal year 2023, Bechtle reported a substantial portion of its revenue stemming from software, highlighting its importance. While specific figures for the "Standard Software Licensing & Management" segment aren't broken out separately in all reports, the overall IT system house and managed services revenue, which heavily includes software, reached €6.1 billion in 2023, demonstrating the scale of this business.

Bechtle's established managed IT services, covering the operation and upkeep of IT systems, are a significant cash generator. These offerings typically secure long-term agreements with public sector entities, mid-sized companies, and major corporations, ensuring consistent, recurring income streams.

With a substantial market position in this mature service sector, Bechtle benefits from operational efficiencies and robust profit margins. For instance, in 2024, Bechtle reported a revenue of €6.0 billion from its IT System House & Managed Services segment, highlighting the segment's maturity and cash-generating capacity.

IT E-Commerce Platform Sales

The IT E-Commerce Platform Sales, encompassing brands like Bechtle direct and ARP, represent a significant Cash Cow for Bechtle. This segment has shown sustained revenue growth, a testament to its strong market share in online IT product and software distribution.

This efficient online sales channel effectively reaches a broad customer base, solidifying its position as a key revenue driver. The established infrastructure and existing customer loyalty are crucial factors contributing to the segment's substantial business volume.

- Consistent Revenue Growth: Demonstrates a high-performing segment with a strong market presence.

- Efficient Distribution Channel: Leverages online platforms for broad reach of IT products and software.

- Customer Loyalty and Established Platforms: Key drivers of significant business volume and profitability.

- Contribution to Overall Business: A reliable and profitable component of Bechtle's diversified portfolio.

General IT Consulting for Mature Systems

Bechtle's general IT consulting for mature systems exemplifies a classic Cash Cow. This involves providing ongoing support and strategic advice for established IT infrastructures, ensuring stability and incremental enhancements for long-term clients.

This segment generates predictable revenue streams, reflecting the consistent demand for maintaining and optimizing existing systems rather than pursuing disruptive innovation. For instance, Bechtle's focus on customer retention means a significant portion of their revenue comes from existing partnerships, often involving these mature system services.

- Stable Revenue: Services for mature systems offer a reliable income source due to the ongoing need for maintenance and support.

- Customer Loyalty: Long-term client relationships in this area foster consistent business.

- Incremental Growth: While not high-growth, these services allow for steady, predictable revenue expansion through ongoing client engagement.

- Cash Generation: The consistent demand and lower investment needs compared to growth areas make this a strong cash generator for Bechtle.

Bechtle's traditional IT infrastructure sales, including hardware and software, are a prime example of a Cash Cow. This segment benefits from a large, established customer base and regular replacement cycles, ensuring a consistent inflow of cash. For 2023, Bechtle's IT System House & Managed Services segment, which heavily includes these foundational sales, generated €6.0 billion in revenue, underscoring its mature and reliable nature.

The company's standard software licensing and management, particularly through brands like Comsoft, also functions as a strong Cash Cow. Demand in this mature market is steady, supported by predictable renewal cycles and ongoing asset management contracts. This stability allows for consistent earnings with minimal need for extensive new investment.

Bechtle's established managed IT services, which involve the operation and maintenance of IT systems, are another significant cash generator. Long-term agreements with various business sizes provide recurring income streams. The company's strong market position in this mature service sector contributes to robust profit margins, making it a dependable source of cash.

The IT E-Commerce Platform Sales, represented by Bechtle direct and ARP, are a key Cash Cow due to their sustained revenue growth and strong market share in online IT distribution. This efficient channel effectively reaches a wide customer base, driving substantial business volume and profitability through customer loyalty and established platforms.

| Segment | 2023 Revenue (EUR Billion) | Key Characteristics |

|---|---|---|

| IT System House & Managed Services | 6.0 | Mature, established customer base, predictable replacement cycles, recurring revenue from managed services. |

| Software Licensing & Management | Included in IT System House & Managed Services | Steady demand, predictable renewals, ongoing asset management contracts. |

| IT E-Commerce Platform Sales | Significant contributor (specific breakout not always detailed) | Sustained growth, strong market share, efficient online distribution, customer loyalty. |

Delivered as Shown

Bechtle BCG Matrix

The Bechtle BCG Matrix preview you're seeing is the complete, unwatermarked document you'll receive immediately after purchase, ready for immediate integration into your strategic planning. This isn't a sample; it's the final, professionally formatted report designed to offer clear insights into your product portfolio's market position. You can confidently use this preview as a direct representation of the valuable, analysis-ready file that will be yours to edit and present. Invest in this comprehensive Bechtle BCG Matrix to gain actionable intelligence for optimizing your business strategy.

Dogs

Sales of outdated on-premise hardware, like older server models and networking gear, are definitely seeing less interest. Businesses are increasingly moving to cloud services and newer systems, making these legacy products less desirable.

Bechtle might still offer some of these older items, but their share in this shrinking market is likely quite small. These products typically don't bring in much profit and can also tie up valuable inventory space.

Niche legacy software support often falls into the 'dog' quadrant of the BCG matrix. This is because the demand for these highly specialized, older applications is typically declining, with a shrinking user base. For instance, in 2024, many companies still rely on custom-built or industry-specific software from the early 2000s, but the market for new licenses or extensive upgrades is minimal.

The challenge with these 'dogs' is the significant investment needed to maintain the necessary expertise and infrastructure for support. This often includes specialized training for IT staff or reliance on external consultants who command high fees. The limited revenue generated from these legacy systems rarely justifies the ongoing costs, turning them into cash traps that drain resources.

Consider the example of a company providing support for a niche accounting software used by a handful of manufacturing firms. While the revenue from these few clients might be stable, the cost of keeping up with evolving compliance regulations and maintaining the specific skill set for that software can easily exceed the income. In 2024, the trend is for businesses to migrate away from such systems, further diminishing the revenue potential.

In the realm of commoditized low-margin IT reselling, Bechtle likely faces intense competition where products are largely indistinguishable, and price dictates customer choice. This segment often yields razor-thin profit margins, making it challenging to achieve substantial returns on investment. The strategic value derived from these basic IT product sales is minimal, demanding considerable operational effort for modest financial gains.

Basic Break-Fix IT Support (Non-Contracted)

Ad-hoc, non-contracted break-fix IT support, while meeting immediate needs, often presents challenges for companies like Bechtle. These services, characterized by their reactive nature and lack of long-term commitment, typically yield lower profit margins compared to proactive, managed service agreements. The operational overhead associated with dispatching technicians for one-off issues can also be substantial, impacting overall efficiency.

If Bechtle continues to rely heavily on these uncontracted, reactive services, they could be categorized as 'dogs' within the BCG framework. This classification stems from their potential for low profitability and limited scalability. In 2024, the IT services market continued to see a strong shift towards recurring revenue models, making uncontracted break-fix less attractive.

- Low Profitability: Break-fix services often have thinner margins due to the unpredictable nature of the work and the cost of reactive support.

- Scalability Issues: It's difficult to scale break-fix operations efficiently, as it relies on immediate resource allocation for each incident.

- Operational Overhead: Managing a large volume of non-contracted, reactive support can lead to higher administrative and logistical costs.

- Market Trend: The industry focus in 2024 remained on managed services and subscription-based models for predictable revenue and better resource planning.

Highly Localized, Non-Scalable IT Solutions

Highly Localized, Non-Scalable IT Solutions represent a segment of Bechtle's offerings characterized by their extreme specificity and limited reach. These are often custom-built IT projects tailored for a single client's unique needs or for a very small, geographically confined market. Their bespoke nature means they are not easily replicated or scaled across Bechtle's broader European operations, potentially leading to inefficient resource allocation.

While these solutions might satisfy immediate client demands, they can become a drain on resources without contributing substantially to Bechtle's overall growth trajectory or market share expansion. For instance, a project costing €200,000 to develop for a single regional client might not yield the same return on investment as a standardized solution deployed across multiple markets.

- Limited Replicability: Solutions designed for niche regional requirements often lack the universal appeal or technical adaptability for wider deployment.

- Resource Intensity: Developing highly customized IT solutions can be time-consuming and expensive, consuming disproportionate amounts of engineering and support staff time.

- Low Scalability: The very nature of these projects prevents them from benefiting from economies of scale, making them less profitable in the long run.

- Impact on Growth: While serving specific needs, these solutions typically do not drive significant top-line growth or enhance Bechtle's competitive positioning in key markets.

Products or services in the 'dog' quadrant of the BCG matrix, like outdated on-premise hardware or niche legacy software support, typically have low market share and low growth potential. Bechtle's involvement in these areas is likely minimal, with these offerings providing little profit and consuming valuable resources. The trend in 2024 continues to be a move away from such legacy IT, making these 'dogs' a strategic challenge.

These 'dogs' often require significant investment to maintain expertise and infrastructure, with limited revenue rarely justifying ongoing costs. For instance, supporting niche accounting software from the early 2000s, while stable for a few clients, incurs costs for compliance and skill maintenance that can outweigh income. The market in 2024 is actively migrating away from these systems.

Commoditized, low-margin IT reselling and ad-hoc, uncontracted break-fix support also fall into the 'dog' category. These segments face intense price competition and have lower profit margins compared to managed services. In 2024, the IT services market strongly favored recurring revenue models, making reactive support less attractive due to its limited scalability and higher overhead.

Highly localized, non-scalable IT solutions, often custom-built for single clients or small markets, also represent 'dogs'. Their bespoke nature prevents easy replication or scaling, leading to inefficient resource use. A €200,000 project for one regional client, for example, may not offer the same ROI as a standardized solution deployed across multiple markets, impacting Bechtle's growth trajectory.

| BCG Category | Characteristics | Bechtle Examples (Likely) | Market Trend (2024) | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Outdated Hardware, Niche Legacy Software Support, Commoditized Reselling, Uncontracted Break-Fix, Highly Localized Solutions | Shift towards cloud, managed services, and recurring revenue models | Divest, harvest, or minimize investment; focus on transitioning customers to growth areas |

Question Marks

Specialized AI Development & Custom Solutions for Bechtle would fall into the Question Marks category of the BCG Matrix. While Bechtle is significantly investing in AI, these highly specialized projects, targeting niche industry challenges or integrating advanced technologies like quantum computing, represent a burgeoning market where their current market share is still developing.

These initiatives demand substantial R&D investment and highly specialized talent to achieve significant market penetration. For instance, the global AI market was projected to reach $1.8 trillion by 2030, with specialized AI solutions, particularly in areas like industrial automation and healthcare, showing rapid growth. Bechtle's strategic focus here aims to capture a share of this expanding segment, acknowledging the high potential but also the current early stage of their involvement.

Bechtle's exploration into emerging IoT solutions for niche verticals, such as precision agriculture or specialized healthcare monitoring, positions them in a high-growth potential quadrant. These advanced applications, while requiring significant upfront investment in R&D and specialized talent, could unlock substantial market share in underserved segments.

For instance, the global IoT in agriculture market was projected to reach $33.4 billion by 2026, indicating a strong demand for tailored solutions. Bechtle's strategic focus here mirrors a potential "Question Mark" in the BCG matrix, where high investment is needed to capture a nascent but promising market.

Blockchain consulting and implementation is a burgeoning sector, with global market size projected to reach USD 39.1 billion by 2025, indicating substantial growth. Bechtle, while a significant IT player, is likely in the early stages of developing its blockchain offerings, placing it in the question mark quadrant due to its nascent market share in this specialized, high-growth area.

To move into a star position, Bechtle would need to significantly invest in building deep technical expertise, developing proven use cases, and securing early client wins to establish credibility and a competitive edge in this rapidly evolving technology landscape.

Advanced Data & Analytics Platforms

Bechtle's focus on advanced data and analytics platforms aims to elevate business intelligence into predictive and prescriptive insights. This strategic direction addresses the increasing market demand for sophisticated data utilization, moving beyond historical reporting to forecasting future outcomes and recommending optimal actions.

While the market for advanced analytics is growing rapidly, Bechtle may face challenges in establishing a significant market share against established competitors specializing in highly customized solutions. This necessitates substantial investment in research, development, and talent to build a differentiated offering.

- Market Growth: The global big data and business analytics market was projected to reach over $300 billion in 2024, indicating substantial opportunity.

- Investment Needs: Developing proprietary advanced analytics algorithms and platforms can require significant capital outlay, estimated to be in the tens of millions for cutting-edge capabilities.

- Competitive Landscape: Bechtle competes with firms that have a long history in AI and machine learning, requiring a clear value proposition to gain traction.

- Talent Acquisition: Securing skilled data scientists and AI engineers is crucial, with demand far outstripping supply, driving up compensation costs.

Sustainable/Circular IT Business Models

Developing and scaling comprehensive circular IT business models is a key focus, encompassing areas like extensive IT asset remarketing and refurbishment-as-a-service. These models integrate sustainability directly into IT-as-a-Service offerings, aligning with growing environmental concerns and the demand for responsible technology lifecycles.

While Bechtle is actively investing in these innovative, long-term approaches, their market share in these nascent segments is still evolving. Significant strategic investment is required to capture leadership in this growing trend.

- IT Asset Remarketing: Focuses on maximizing value from used IT equipment through refurbishment and resale, contributing to a circular economy.

- Refurbishment-as-a-Service: Offers businesses access to refurbished IT equipment as a service, reducing waste and upfront costs.

- IT-as-a-Service with Sustainability: Integrates environmental considerations into ongoing IT services, promoting resource efficiency and reduced carbon footprint.

- Market Growth: The global IT asset disposition market, a key component of circular IT, was valued at approximately $20 billion in 2023 and is projected to grow significantly in the coming years.

Question Marks represent areas where Bechtle is investing in high-growth, emerging markets but currently holds a small market share. These ventures require substantial investment to gain traction and establish a strong competitive position.

Success in these areas depends on effectively navigating evolving technologies and market demands, potentially transforming them into future Stars. The key challenge is to allocate resources strategically to foster growth and market penetration.

Several of Bechtle's initiatives, such as specialized AI development, advanced data analytics, and circular IT models, fit this description. These are characterized by significant market potential but require Bechtle to build expertise and capture market share.

For instance, the global AI market's projected growth to $1.8 trillion by 2030 highlights the potential, while Bechtle's current market share in niche AI solutions is still developing, making it a classic Question Mark.

BCG Matrix Data Sources

Our Bechtle BCG Matrix leverages comprehensive market data, including Bechtle's financial reports, industry growth rates, and competitor analysis, to accurately position each business unit.